Global Semiconductor Recycling & Sustainability Market Size, Share, Statistics Analysis Report By Material (Silicon Semiconductors, Compound Semiconductors, Other Semiconductor Materials), By Application (Consumer Electronics, Automotive, IT & Telecom, Industrial, Energy, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141780

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

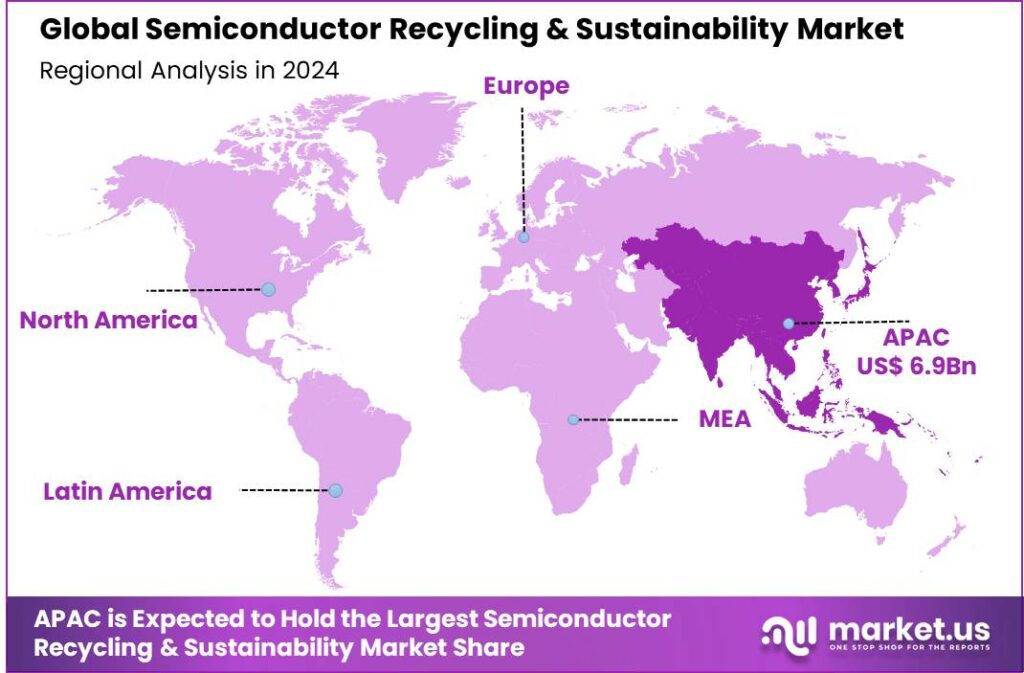

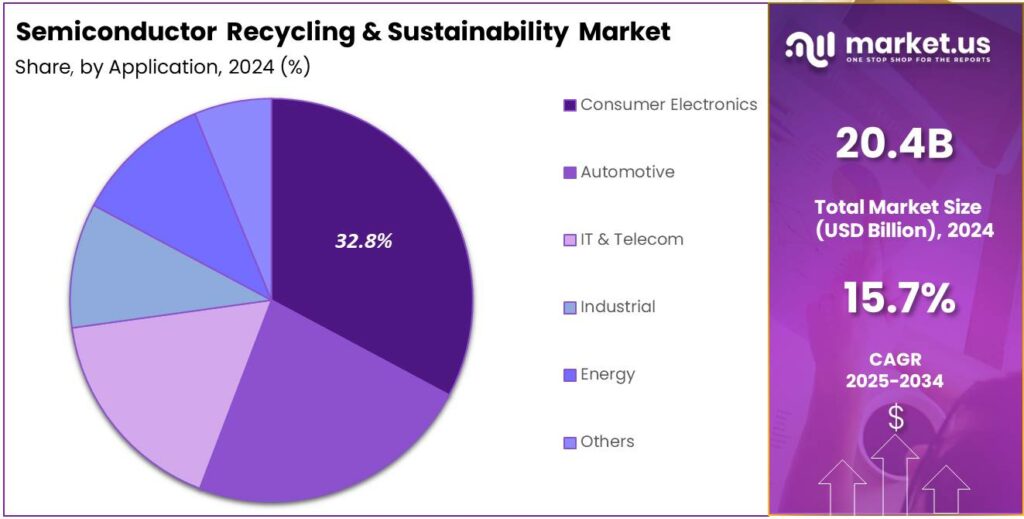

The Global Semiconductor Recycling & Sustainability Market size is expected to be worth around USD 87.7 Billion By 2034, from USD 20.4 Billion in 2024, growing at a CAGR of 15.70% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region dominated the semiconductor recycling and sustainability market with over a 34.1% share, generating USD 6.9 billion in revenue.

Semiconductor recycling and sustainability involve the processes and practices dedicated to responsibly reclaiming and repurposing materials from electronic devices and semiconductors. This practice is essential in reducing waste, conserving natural resources, and mitigating environmental impacts associated with semiconductor production.

The semiconductor recycling and sustainability market is gaining traction, driven by the need for more efficient waste management solutions as semiconductor production scales up. This growth is fueled by technological advancements in sectors like AI, IoT, and 5G, which require substantial semiconductor inputs. Companies are investing in sophisticated recycling and waste-to-energy technologies, aiming to improve efficiency and sustainability.

Key drivers of the semiconductor recycling market include the escalating production of semiconductors, leading to increased waste and the need for effective disposal and recycling solutions. The growing awareness and regulatory push towards environmental sustainability are compelling companies to adopt greener practices.

Rising consumer awareness of environmental issues is driving demand for sustainably produced electronics, encouraging manufacturers to prioritize recycling. Advancements in recycling technology make the recovery of valuable materials more efficient, making recycling both environmentally and financially beneficial. These trends are fueling the growth of the semiconductor recycling and sustainability market.

The semiconductor recycling and sustainability market is rising in popularity, driven by a broader shift toward environmental responsibility in the tech industry. As stakeholders recognize the environmental and cost benefits of recycling, the market gains visibility. Increasing ESG criteria among investors are boosting the market’s popularity, making it a key component of sustainable investment portfolios.

The market offers significant opportunities, including innovations in recycling technologies for more efficient material recovery. There’s potential for new business models that incorporate circular economy principles into semiconductor manufacturing. Additionally, partnerships between tech companies, recycling experts, and regulatory agencies could drive growth and sustainability in the industry.

The semiconductor recycling market is poised for rapid expansion, driven by technological advancements, growing demand for sustainable technologies, and the scaling of global recycling regulations. As the market matures, it may diversify in services and expand geographically, becoming a key component of the global push for a sustainable electronics supply chain.

Key Takeaways

- The Global Semiconductor Recycling & Sustainability Market size is expected to reach USD 87.7 Billion by 2034, up from USD 20.4 Billion in 2024, growing at a CAGR of 15.70% during the forecast period from 2025 to 2034.

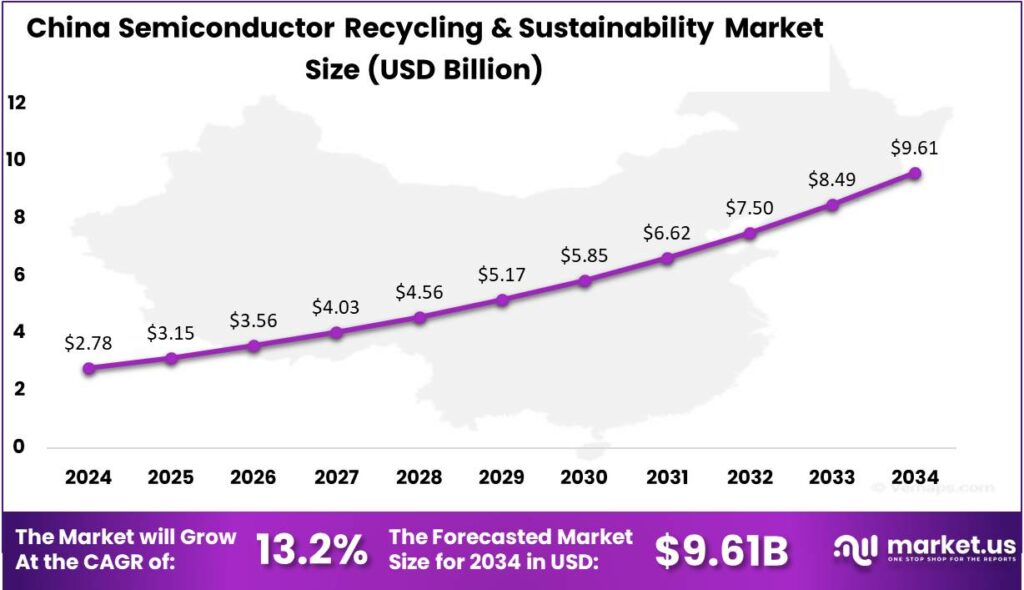

- In 2024, the market for semiconductor recycling and sustainability in China was valued at USD 2.78 billion. It is expected to grow at a CAGR of 13.2%.

- In 2024, the Asia-Pacific region held a dominant market position in the semiconductor recycling and sustainability market, capturing over 34.1% share. The region generated a revenue of USD 6.9 billion, driven by strong manufacturing capabilities and comprehensive environmental policies.

- In 2024, the Silicon Semiconductors segment dominated the semiconductor recycling and sustainability market, accounting for more than 48.7% share.

- In 2024, the Consumer Electronics segment held a leading position in the semiconductor recycling and sustainability market, capturing more than 32.8% share.

China Market Size

In 2024, the market for semiconductor recycling and sustainability in China was valued at USD 2.78 billion. It is projected to grow at a compound annual growth rate (CAGR) of 13.2%.

This growth can be attributed to several factors including increased regulatory focus on sustainable practices within the technology sector and heightened awareness about the environmental impact of semiconductor manufacturing waste. China’s strict environmental regulations are driving market growth by promoting recycling and reducing landfill waste.

Advancements in recycling technologies have made it easier to recover valuable materials from used semiconductors, conserving resources and lowering raw material costs for manufacturers. This has led to a surge in investment from both private and public sectors, eager to capitalize on the opportunities presented by sustainable and eco-friendly practices.

In 2024, Asia-Pacific held a dominant market position in the semiconductor recycling and sustainability market, capturing more than a 34.1% share. The region generated revenue of USD 6.9 billion, underpinned by robust manufacturing capabilities and comprehensive environmental policies.

The leadership of Asia-Pacific in this market is largely due to the concentration of semiconductor manufacturing facilities in the area, particularly in countries like China, South Korea, and Taiwan. These countries are not only leading producers of semiconductors but also pioneers in the adoption of recycling and sustainability practices within the industry.

The driving forces behind Asia-Pacific’s prominent role include aggressive governmental initiatives aimed at reducing electronic waste and promoting circular economy practices. China’s stringent e-waste recycling regulations mandate strict disposal and recycling standards, driving the growth of local recycling infrastructure.

Moreover, the rise in consumer electronics consumption in Asia-Pacific has led to an increase in semiconductor demand, thereby producing more waste and, consequently, more material for recycling. This volume of waste provides a large base for recycling operations, making it economically viable to invest in sophisticated recycling technologies.

Analysts’ Viewpoint

One of the primary objectives in the semiconductor recycling market is to significantly reduce the carbon footprint of semiconductor manufacturing and waste management. Companies are setting ambitious targets to achieve net-zero emissions and are investing in clean technologies to meet these goals.

Demand in the semiconductor recycling market is strongly influenced by the electronics industry’s growth, as semiconductors are essential components of all electronic devices. The demand for recycling services is particularly robust in regions with strict environmental compliance standards and high levels of electronic waste generation.

Asia Pacific leads in demand due to its substantial semiconductor manufacturing output, followed by North America and Europe, which are also significant players in the market due to their advanced waste management technologies.

There are substantial investment opportunities in developing innovative recycling technologies and expanding existing facilities to handle the growing volume of semiconductor waste. Investments are particularly promising in regions experiencing rapid industrial growth, such as Asia-Pacific, where manufacturing capacity is expanding.

Technological innovations are profoundly reshaping the semiconductor industry. Developments in materials science, like the use of silicon carbide and gallium nitride, enhance efficiency and performance. Additionally, breakthroughs in quantum computing and AI integration are setting new benchmarks for what semiconductors can achieve, creating further opportunities for growth and investment in the sector.

Material Analysis

In 2024, the Silicon Semiconductors segment held a dominant market position within the semiconductor recycling and sustainability market, capturing more than a 48.7% share. This segment’s leadership is primarily attributed to the widespread use of silicon in a vast array of electronic devices, from smartphones to computers and beyond.

Silicon’s fundamental role in semiconductor manufacturing, due to its superior electrical properties and abundance, makes it a critical focus for recycling efforts. As the cornerstone material in most electronic components, the recycling of silicon not only supports sustainability but also helps in meeting the continuous demand in the electronics market.

The dominance of the silicon semiconductor segment is strengthened by advances in recycling technologies tailored for silicon. These innovations enable efficient extraction and purification of silicon from electronic waste, making recycling economically viable. As manufacturers aim to cut raw material costs, recycled silicon provides a cost-effective, high-quality alternative to newly mined silicon.

Environmental regulations and sustainability goals are driving the growth of silicon semiconductor recycling. Mandates in regions like the EU, US, and Asia-Pacific focus on recycling electronic waste, with silicon as a key target. These regulations reduce environmental impact and boost the dominance of silicon recycling.

Application Analysis

In 2024, the Consumer Electronics segment held a dominant position in the semiconductor recycling and sustainability market, capturing more than a 32.8% share. This segment leads primarily due to the high volume of consumer electronic products that reach the end of their lifecycle each year.

Devices like smartphones, tablets, and laptops contain valuable semiconductors that need recycling to recover materials and prevent environmental harm. Rapid innovation and frequent upgrades in consumer electronics increase e-waste volume, driving the demand for efficient recycling technologies in this segment.

The robustness of the Consumer Electronics segment in the semiconductor recycling market is further supported by increasing consumer awareness regarding sustainable practices. As the public becomes more conscious of environmental issues, there is a growing demand for brands to adopt responsible recycling and manufacturing processes.

Regulatory pressures are key to the growth of the consumer electronics segment in semiconductor recycling. Stricter e-waste management laws worldwide ensure proper disposal and recycling, reducing environmental impact and reclaiming valuable resources to support the semiconductor industry’s sustainability goals.

Key Market Segments

By Material

- Silicon Semiconductors

- Compound Semiconductors

- Other Semiconductor Materials

By Application

- Consumer Electronics

- Automotive

- IT & Telecom

- Industrial

- Energy

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Regulatory Pressure and Environmental Policies

The semiconductor industry’s commitment to recycling and sustainability is significantly influenced by stringent environmental regulations and policies. Governments worldwide are enacting laws that mandate reductions in electronic waste and the adoption of eco-friendly manufacturing processes.

These regulations compel semiconductor manufacturers to implement recycling initiatives and sustainable practices to comply with legal standards and avoid penalties. For instance, the European Union’s Waste Electrical and Electronic Equipment (WEEE) Directive obligates producers to manage e-waste responsibly, promoting recycling and recovery of materials. Such regulatory frameworks drive the industry toward sustainable operations, ensuring environmental protection and resource conservation.

Restraint

High Energy Consumption in Recycling Processes

Recycling semiconductor materials is an energy-intensive endeavor, posing a significant challenge to sustainability efforts. Recycling electronic waste requires significant energy, often from non-renewable sources, increasing carbon emissions and potentially offsetting the environmental benefits, which reduces its appeal to manufacturers focused on lowering their carbon footprint.

The intricate design and material composition of semiconductor devices make recycling a complex and costly process. Semiconductors contain various hazardous chemicals and rare materials that require specialized handling and processing techniques.

Advanced technologies for safe and efficient recycling increase operational costs, discouraging investment in recycling. Additionally, rapid technological advancement and frequent product obsolescence create a constant influx of diverse e-waste, straining recycling systems.

Opportunity

Advancements in Green Chemistry and Sustainable Materials

The pursuit of green chemistry and the development of sustainable materials present a significant opportunity for enhancing recycling and sustainability in the semiconductor industry. By substituting hazardous substances with eco-friendly alternatives and designing materials that are easier to recycle, manufacturers can reduce environmental impact and improve resource efficiency.

Innovations in this area not only facilitate safer recycling processes but also lead to the creation of semiconductors that are inherently more sustainable throughout their lifecycle. This approach aligns with the principles of a circular economy, promoting the reuse and regeneration of materials and contributing to long-term environmental and economic benefits.

Challenge

Supply Chain Transparency and Ethical Sourcing

Achieving sustainability in semiconductor recycling is challenged by the complexity of supply chains and the difficulty in ensuring ethical sourcing of materials. Semiconductor production relies on rare and conflict-prone materials, raising concerns about environmental degradation and human rights violations in mining practices.

Ensuring that recycled materials are sourced ethically requires robust tracking systems and collaboration among stakeholders to uphold environmental and social standards. Implementing technologies such as blockchain for supply chain transparency can help address these challenges, but widespread adoption and standardization remain hurdles that the industry must overcome to achieve truly sustainable and ethical recycling practices.

Emerging Trends

The semiconductor industry is increasingly embracing sustainable practices to mitigate environmental impacts. A notable trend is the adoption of circular economy principles, emphasizing the recycling and reuse of materials to minimize waste and conserve resources. This approach reduces environmental impact and boosts resource efficiency.

Advancements in recycling technologies are pivotal in this shift. For example, recyclable vitrimer-based printed circuit boards (vPCBs) enable material recovery and reuse, supporting circular economy objectives. Packaging solutions made from recycled post-consumer waste are being used, further minimizing the environmental impact of semiconductor manufacturing.

The integration of artificial intelligence (AI) and machine learning (ML) is also emerging as a significant trend. These technologies enable precise control over manufacturing processes, optimize resource usage, and predict maintenance needs, thereby reducing waste and energy consumption.

Industry collaboration is driving sustainability, with companies uniting to develop and implement best practices for emissions reduction, waste management, and energy efficiency. This collective effort is crucial for realizing significant environmental benefits throughout the semiconductor value chain.

Business Benefits

Sustainable practices in semiconductor manufacturing offer significant business benefits, including cost reduction. Recycling initiatives like silicon wafer recycling lower raw material needs and production costs, while energy-efficient processes and waste reduction strategies drive operational savings.

Sustainability efforts boost brand reputation and competitiveness. Companies prioritizing environmental responsibility attract eco-conscious consumers and investors, strengthening their market position. Adopting green chemistry and eco-friendly materials helps firms stand out, appealing to sustainability-focused customers.

Regulatory compliance is a key benefit of sustainability efforts. As global environmental regulations tighten, companies with proactive initiatives are better equipped to comply, avoiding fines and disruptions. This ensures both protection and continued access to markets with strict environmental standards.

Employee engagement and retention are positively influenced by sustainable practices. A commitment to environmental responsibility fosters a sense of pride and purpose among employees, leading to higher job satisfaction and retention rates.

Key Player Analysis

Pure Wafer is a leading player in the semiconductor recycling industry. The company specializes in reclaiming silicon wafers, which are one of the most critical materials used in semiconductor manufacturing. Pure Wafer has developed advanced technology to efficiently recycle these wafers, recovering valuable materials while also reducing the environmental footprint.

Tes-Amm India Pvt. Ltd. is a significant player in the e-waste and semiconductor recycling market. Known for its strong presence in the Indian market, Tes-Amm focuses on providing eco-friendly and sustainable solutions for the recycling of semiconductors and electronic waste. Their advanced processes enable them to recover precious metals and reduce harmful waste.

Global Electronic Recycling is another major player in the semiconductor recycling market. They focus on providing comprehensive recycling services for a wide range of electronic waste, including semiconductors. The company has made significant strides in developing processes to recover precious metals and other reusable materials from discarded electronics.

Top Key Players in the Market

- Pure Wafer

- Tes-Amm India Pvt. Ltd.

- Global Electronic Recycling

- International Business Machines Corporation (IBM)

- Phoenix Silicon International Corporation

- Samsung

- Intel Corporation

- NVIDIA Corporation

- Veolia

- Others

Top Opportunities Awaiting for Players

In the evolving landscape of the semiconductor recycling and sustainability market, several key opportunities stand out for industry players to seize growth and innovation.

- Enhanced Recycling Technologies and Infrastructure: As the volume of semiconductor waste grows, there is a critical need for advanced recycling technologies that can manage this complex waste stream efficiently. Companies that develop and implement innovative recycling and recovery methods will find themselves well-positioned to lead the market.

- Zero-Waste Manufacturing: The Zero-Waste Semiconductor Fabrication Market is gaining traction, driven by a combination of technological advancements and stringent environmental regulations. Opportunities abound for companies that can integrate circular economy principles effectively into their operations, reducing waste at every stage of the semiconductor manufacturing process.

- Sustainable Material Use: There’s a significant shift towards the use of sustainable, recyclable, and biodegradable materials in semiconductor manufacturing. Companies exploring new materials and sustainable production processes are set to capture market share as industry standards evolve towards greener alternatives.

- Regulatory Compliance and Market Expansion: The semiconductor industry faces a complex regulatory landscape that varies by region. Companies that can navigate these requirements effectively and adapt their operations to comply with international standards will gain a competitive advantage. This compliance is not just about adhering to laws but also about leveraging these regulations to enter new markets and gain the trust of eco-conscious consumers.

- Consumer Demand for Eco-Friendly Electronics: There is a growing consumer demand for devices that are environmentally friendly. This trend is pushing semiconductor companies to prioritize sustainability in their product designs and manufacturing processes. Businesses that can meet these consumer expectations are likely to see increased loyalty and market share, especially among younger, more environmentally aware demographics.

Recent Developments

- In April 2024, Veolia provides innovative solutions to support the semiconductor industry’s sustainability goals, helping reduce environmental impact while ensuring efficient resource management. Their services enhance energy conservation, water treatment, and waste reduction, driving a greener future for semiconductor manufacturing.

- In June 2024, EFC’s cutting-edge Neon Gas Recycling System boosts sustainability in semiconductor manufacturing, potentially reducing over one million metric tons of CO2 emissions per fab over the next 20 years by offsetting the need for neon production.

- In November 2024, TSMC celebrated a major sustainability milestone with the opening of the Taichung Zero Waste Manufacturing Center, a cutting-edge facility focused on energy and resource recycling. As the semiconductor industry’s first circular economy demonstration hub, it sets a new global standard for sustainable manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 20.4 Bn Forecast Revenue (2034) USD 87.7 Bn CAGR (2025-2034) 15.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Silicon Semiconductors, Compound Semiconductors, Other Semiconductor Materials), By Application (Consumer Electronics, Automotive, IT & Telecom, Industrial, Energy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pure Wafer, Tes-Amm India Pvt. Ltd., Global Electronic Recycling, International Business Machines Corporation (IBM), Phoenix Silicon International Corporation, Samsung, Intel Corporation, NVIDIA Corporation, Veolia, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Semiconductor Recycling & Sustainability MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Recycling & Sustainability MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pure Wafer

- Tes-Amm India Pvt. Ltd.

- Global Electronic Recycling

- International Business Machines Corporation (IBM)

- Phoenix Silicon International Corporation

- Samsung

- Intel Corporation

- NVIDIA Corporation

- Veolia

- Others