Global Semiconductor Materials Market By Material Type (Silicon Carbide, Gallium Manganese Arsenide, Copper Indium Gallium Selenide, Molybdenum Disulfide, Bismuth Telluride), By Application (Fabrication, Packaging), By End-User (Consumer Electronics, Manufacturing, Automotive, Energy and Utility, Others), By End-User (Consumer Electronics, Manufacturing, Automotive, Energy and Utility, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120651

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

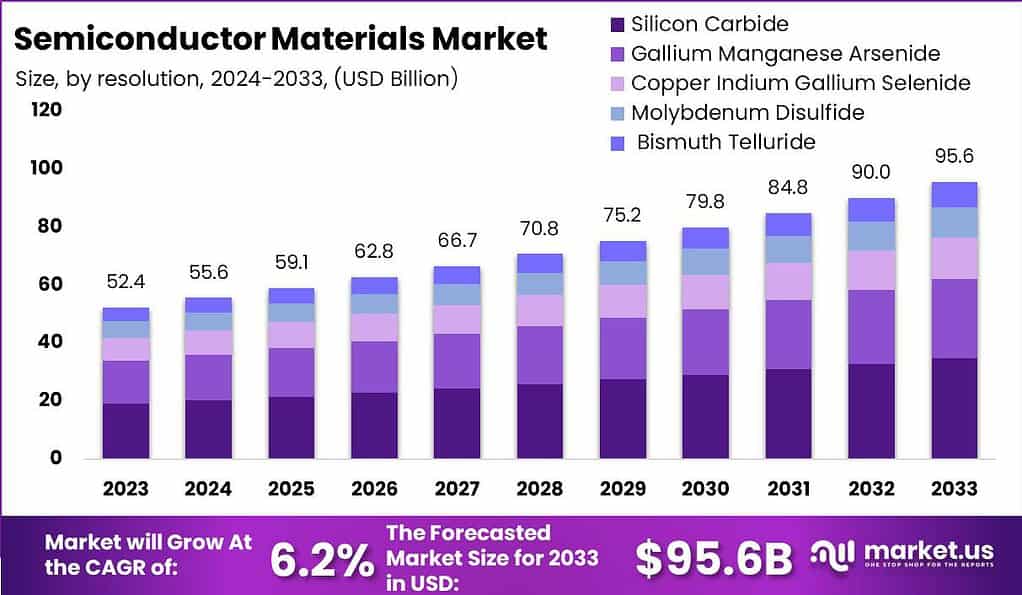

The Global Semiconductor Materials Market size is expected to be worth around USD 95.6 Billion By 2033, from USD 52.4 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Semiconductor materials are essential components used in the manufacturing of electronic devices. These materials, such as silicon, gallium arsenide, and indium phosphide, are known for their ability to control electrical current. This unique property makes them crucial for producing a wide range of products, including smartphones, computers, and solar cells.

The semiconductor materials market is experiencing significant growth. This expansion can be attributed to the increasing demand for electronic devices and advancements in technology. Key drivers include the rising popularity of smart devices, the growth of renewable energy solutions, and the expanding use of semiconductors in automotive electronics. Additionally, ongoing research and development are leading to the creation of new and improved materials, further propelling market growth.

However, the market also faces challenges. High production costs and complex manufacturing processes can hinder growth. Moreover, the semiconductor industry is highly competitive, with companies constantly striving to innovate and reduce costs. Despite these challenges, the semiconductor materials market is expected to continue its upward trajectory, driven by the ongoing digital transformation and the increasing need for advanced electronic devices.

Investments in material innovations within the semiconductor sector have yielded significant advancements, leading to a 30% increase in performance efficiency over the past decade. This progress underscores the critical role that ongoing research and development play in enhancing the capabilities of semiconductor devices.

China holds the position as the world’s largest consumer of semiconductor materials, indicating its pivotal role in the global electronics supply chain. Meanwhile, Taiwan and South Korea stand out as leading producers of semiconductor wafers, highlighting their technological prowess and significant contributions to the industry’s global output.

The employment landscape within the semiconductor materials industry is poised for substantial growth, with an expected creation of over 60,000 new jobs by 2025. This expansion reflects the industry’s robust development trajectory and its increasing importance to technological advancements.

In terms of materials innovation, Gallium Nitride (GaN) and Silicon Carbide (SiC) are identified as the fastest-growing semiconductor materials. Their superior properties are increasingly leveraged in various applications, driving demand and fostering sector growth.

Europe’s share in the global semiconductor materials market stands at approximately 10%, demonstrating its steady but more modest role in the global market context compared to Asia’s leading markets. Overall, the semiconductor materials industry provides direct employment to over 300,000 people worldwide, illustrating its scale and the critical role it plays in the global economic fabric, driving innovations and supporting myriad technologies.

Key Takeaways

- The global semiconductor materials market size is estimated to reach USD 95.6 billion in the year 2033 with a CAGR of 6.2% during the forecast period. The market was valued at USD 52.4 billion in the year 2023.

- Based on the material type, the silicon carbide segment has dominated the market with a share of 36.5% in the year 2023.

- Based on the application, the fabrication segment has dominated the market with a share of 61.5% in the year 2023.

- In 2023, the Asia-Pacific (APAC) region held a dominant position in the semiconductor materials market, capturing more than a 42.3% share.

Material Type Analysis

Based on the material type, the market is segmented into Silicon Carbide, Gallium Manganese Arsenide, Copper Indium Gallium Selenide, Molybdenum Disulphides, and Bismuth Telluride segments. Among these, the silicon carbide segment has dominated the market with a share of 36.5% in the year 2023. This prominence is primarily attributed to Silicon Carbide’s exceptional properties such as high thermal conductivity, significant electron mobility, and the ability to withstand high voltages and temperatures.

These characteristics make SiC an ideal choice for power electronics applications found in electric vehicles, industrial motors, and power supplies where efficiency and durability are crucial. The increasing demand for energy-efficient electronics and electric vehicles has significantly driven the growth of the SiC market. SiC components are preferred for their ability to enhance the range and efficiency of electric vehicles by managing power more effectively than traditional silicon-based components.

Additionally, the need for advanced infrastructure in renewable energy sectors that require robust materials capable of handling fluctuating high power loads further bolsters the demand for Silicon Carbide. This has led to substantial investments in R&D by major market players aiming to optimize the performance and cost-effectiveness of SiC-based components.

Overall, the Silicon Carbide segment’s leadership in the semiconductor materials market can be seen as a response to the broader trends towards energy efficiency, enhanced performance requirements in high-power applications, and the global shift towards electric vehicles and renewable energy solutions. Its superior properties not only meet the demands of these applications but also promise significant advancements in semiconductor technology, ensuring its continued market dominance.

Application Analysis

Based on the application, the market is segmented into Fabrication and Packaging segments, where the fabrication segment has dominated the market with a share of 61.5% in the year 2023. This segment encompasses the processes involved in the creation of semiconductor devices, including the intricate design and manufacturing of semiconductor wafers.

Fabrication requires precise and high-quality materials, as these components form the core of all semiconductor devices. The significant market share of this segment reflects the essential nature of these processes in the production of electronic devices. The dominance of the Fabrication segment can be attributed to the ongoing expansion of the consumer electronics industry, where there is a continuous demand for more sophisticated and compact devices.

As consumer preferences evolve towards faster, smaller, and more energy-efficient devices, the need for advanced semiconductor fabrication technologies grows. This has spurred innovations in materials science, particularly in developing materials that can withstand the demanding conditions of modern fabrication processes, such as high temperatures and the need for ultra-pure materials.

Moreover, the growth in other sectors such as automotive and energy, which increasingly rely on electronic components for functionality and efficiency, further supports the strong position of the Fabrication segment. Innovations such as electric vehicles and smart grids require high-performance semiconductor devices that can only be produced through advanced fabrication techniques. Thus, the ongoing technological advancements and the broad application across various industries ensure the continued dominance and growth of the Fabrication segment in the semiconductor materials market.

End User Analysis

Based on the end user, the market is segmented into consumer electronics, manufacturing, automotive, energy and utility, and other segments. Among these, the consumer electronics segment has dominated the market with a share of 26.4%. This leading role is primarily due to the surge in demand for consumer electronics such as smartphones, tablets, laptops, and other personal devices, which heavily depend on semiconductors.

The consumer electronics market’s rapid growth is driven by continual technological advancements and the increasing penetration of internet connectivity globally, which fuels the need for advanced semiconductor materials to improve device performance and energy efficiency. The Consumer Electronics segment’s dominance is also reinforced by the trend towards smart home devices and wearables, which require a wide range of semiconductor components.

Innovations in these products demand semiconductors that are not only smaller and more powerful but also capable of handling more complex tasks while consuming less power. As manufacturers push the boundaries of what these devices can do, the reliance on cutting-edge semiconductor materials increases significantly. Furthermore, the launch of new technologies such as 5G and the expansion of the Internet of Things (IoT) are crucial growth drivers for this segment.

These technologies require the integration of advanced semiconductors to manage increased data speeds and connectivity features, making semiconductor materials even more critical to the development and enhancement of consumer electronics. Therefore, the continuous innovation and growing consumer demand in the electronics sector are likely to keep the Consumer Electronics segment at the forefront of the semiconductor materials market.

Key Market Segments

By Material Type

- Silicon Carbide

- Gallium Manganese Arsenide

- Copper Indium Gallium Selenide

- Molybdenum disulfide

- Bismuth Telluride

By Application

- Fabrication

- Packaging

By End-User

- Consumer Electronics

- Manufacturing

- Automotive

- Energy and Utility

- Others

Driver

Increased Demand for Advanced Technology

The semiconductor materials market is driven by the surge in demand for technologies such as artificial intelligence (AI), Internet of Things (IoT), and 5G networks. These technologies require sophisticated semiconductor chips, which in turn boost the demand for high-quality semiconductor materials. Companies are continuously advancing their chip solutions to be more energy-efficient and performance-optimized, meeting global energy concerns and contributing to sustainability goals. This trend is expected to persist and intensify, further propelling the market forward.

Restraint

Geopolitical Tensions and Economic Uncertainty

One of the main restraints facing the semiconductor materials market is the ongoing geopolitical tensions and economic uncertainties, which can disrupt supply chains and create volatile market conditions. These challenges were particularly pronounced in 2023, impacting the stability and predictability of the market. Concerns about international trade relations and tariffs can lead to hesitation in investment and development within the sector, potentially delaying advancements and the deployment of new technologies.

Opportunity

Expansion in Automotive and Consumer Electronics Sectors

There is a significant opportunity for growth in the semiconductor materials market through the expansion of applications in the automotive and consumer electronics sectors. As vehicles become more technologically equipped and consumer electronics continue to advance, the demand for semiconductors that offer new functionalities and enhanced performance increases. Additionally, the integration of semiconductors into a wider range of products, such as smart home devices and wearables, opens up new avenues for market expansion.

Challenge

Rapid Technological Changes and Innovation Pressures

The semiconductor materials market faces the challenge of keeping pace with rapid technological changes and the constant pressure to innovate. Companies must continually invest in research and development to stay competitive, which can be resource-intensive. Moreover, the fast-evolving nature of technology means that products can quickly become obsolete, posing a risk to firms that fail to adapt swiftly enough. This environment demands a high level of agility and foresight from companies within the industry to navigate these challenges effectively.

Growth Factors

- Increasing Automotive Electronics: The demand for automotive electronics significantly boosts the semiconductor materials market. Advanced automotive technologies such as electric vehicles, advanced battery management systems, and self-driving components rely heavily on semiconductor materials for enhanced safety, connectivity, and efficiency.

- Technological Advancements: Innovations in semiconductor manufacturing technology, including developments in sensors and high-performance computing, drive the demand for advanced semiconductor materials. These advancements are crucial for supporting emerging technologies like AI and edge computing.

- Expansion of Data Centers and Cloud Computing: The growth of data centers and the increasing reliance on cloud computing require high-performance computing capabilities and specialized semiconductor materials to handle large volumes of data and complex computations.

- Government Initiatives: Several governments are investing heavily in the development of their domestic semiconductor industries. For instance, the South Korean and Indian governments are offering significant financial support to bolster local production capabilities, which in turn drives the demand for semiconductor materials.

- Supply Chain Optimization: Effective supply chain management is critical, especially in regions like North America where the efficient management of supply chains supports robust market growth despite increasing material demands.

Latest Trends

- Miniaturization and Efficiency: There is a continuous push towards producing smaller and more efficient semiconductor materials, which is essential for modern electronic devices and applications ranging from consumer electronics to medical and aerospace industries.

- Environmental and Regulatory Compliance: Increasing awareness of environmental impacts and stricter regulatory standards are influencing the production and use of semiconductor materials. Companies are now more inclined to develop environmentally friendly and sustainable materials.

- Rise in Portable and Wearable Technology: The growing adaptation of portable and wearable devices drives the need for specialized semiconductor materials that can support the functionality and connectivity requirements of these devices.

- Advancements in Medical Technology: The medical sector’s expansion into more advanced electronic devices for diagnostics and patient care is creating new opportunities for the semiconductor materials market. This trend is supported by the need for high precision and reliability in medical devices.

- Increasing Demand from Renewable Energy Sector: The renewable energy sector, including solar energy applications, is becoming a significant consumer of semiconductor materials, driven by the global shift towards sustainable energy sources.

Regional Analysis

In 2023, the Asia-Pacific (APAC) region held a dominant position in the semiconductor materials market, capturing more than a 42.3% share. This substantial market share can be attributed to several key factors that have fostered a conducive environment for growth in this sector. Primarily, the concentration of semiconductor manufacturing capabilities in countries like Taiwan, South Korea, and China has been a pivotal element.

These nations have invested heavily in scaling up their semiconductor production facilities, which is supported by robust government policies and subsidies aimed at bolstering the technological infrastructure. Furthermore, the demand within the APAC region for consumer electronics, driven by a large and increasingly affluent population, continues to surge. This has directly influenced the semiconductor materials market, as semiconductors are integral components of consumer electronics such as smartphones, tablets, and computers.

Additionally, the shift towards digitalization and the adoption of advanced technologies like 5G, artificial intelligence, and the Internet of Things (IoT) across the region have necessitated the development of sophisticated semiconductor devices, further fueling the demand for high-quality semiconductor materials. As for North America, Europe, Latin America, the Middle East, and Africa, each region exhibits unique characteristics and growth dynamics in the semiconductor materials market.

North America, particularly the United, States continues to excel in the R&D of advanced semiconductor technologies, supported by its strong technological ecosystem and leading semiconductor companies. Europe’s market is driven by the increasing automation in automotive and industrial applications, necessitating advanced semiconductor solutions.

In Latin America and the Middle East and Africa, the growth is more gradual, influenced by the expanding telecommunications networks and the gradual adoption of consumer electronics. Each region’s contribution to the global semiconductor materials market underscores the diverse and dynamic nature of this industry, highlighting varying regional strengths and opportunities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The semiconductor materials market is characterized by the presence of several key players that significantly influence the industry landscape. Among these, BASF SE and Cabot Microelectronics are notable for their contributions to material innovation and processing technologies, which are critical for advancing semiconductor manufacturing. DowDuPont brings a robust portfolio of electronic materials that cater to the evolving needs of the semiconductor industry, emphasizing durability and efficiency.

Hemlock Semiconductor is renowned for its high-purity polysilicon products, essential for manufacturing photovoltaic cells and electronic devices. Henkel AG and Air Liquide SA play pivotal roles in providing specialized chemical materials and gases that are fundamental to the semiconductor fabrication process. Avantor Performance Materials and Hitachi High-Technologies offer tailored solutions that enhance the precision and performance of semiconductors.

Top Key Players in the Market

- BASF SE

- Cabot Microelectronics

- DowDuPont

- Hemlock Semiconductor

- Henkel AG

- Air Liquide SA

- Avantor Performance Materials

- Hitachi High-Technologies

- Honeywell Electronic Materials

- JSR Corporation

- Tokyo Ohka Kogyo America

- Mitsui High-Tec

- Other Key Players

Recent Developments

- BASF SE: Acquisition (March 2023), BASF acquired Precision Microchemicals from Entegris for $90 million, including intellectual property and trademarks, enhancing its portfolio in high-purity chemicals for semiconductor manufacturing.

- DowDuPont: Investment (November 2023): DowDuPont invested in digital twin technology for semiconductor material production, improving process optimization and efficiency through advanced predictive analytics

- Hitachi High-Technologies: Innovation (October 2023): Launched a novel 3D printing technology for semiconductor materials, enabling rapid prototyping and customization of chip designs, significantly reducing development time.

Report Scope

Report Features Description Market Value (2023) USD 52.4 Bn Forecast Revenue (2033) USD 95.6 Bn CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type (Silicon Carbide, Gallium Manganese Arsenide, Copper Indium Gallium Selenide, Molybdenum Disulfide, Bismuth Telluride), By Application (Fabrication, Packaging), By End-User (Consumer Electronics, Manufacturing, Automotive, Energy and Utility, Others), By End-User (Consumer Electronics, Manufacturing, Automotive, Energy and Utility, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF SE, Cabot Microelectronics, DowDuPont, Hemlock Semiconductor, Henkel AG, Air Liquide SA, Avantor Performance Materials, Hitachi High-Technologies, Honeywell Electronic Materials, JSR Corporation, Tokyo Ohka Kogyo America, Mitsui High-Tec, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is Semiconductor Materials Market?The Global Semiconductor Materials Market size is expected to be worth around USD 95.6 Billion By 2033, from USD 52.4 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

What factors are driving the growth of the semiconductor materials market?Growth drivers include the increasing use of semiconductor materials in consumer electronics, automotive, and communication technologies. Expansions in semiconductor manufacturing capacity and advancements in new device technologies are also significant contributors.

Which regions dominate the semiconductor materials market?Asia-Pacific leads the market due to strong manufacturing bases in countries like China, Taiwan, Japan, and South Korea. North America and Europe also hold significant shares.

What challenges does the semiconductor materials market face?Major challenges include supply chain constraints, geopolitical issues, high manufacturing costs, and the need for skilled labor. Regulatory hurdles and environmental concerns also pose significant challenges.

Who are the key players in the semiconductor materials market?Key companies include BASF SE, Cabot Microelectronics, DowDuPont, Hemlock Semiconductor, Henkel AG, Air Liquide SA, Avantor Performance Materials, Hitachi High-Technologies, Honeywell Electronic Materials, JSR Corporation, Tokyo Ohka Kogyo America, Mitsui High-Tec, Other Key Players

What are the latest trends in the semiconductor materials market?Trends include increased investments in R&D, expansions in manufacturing capacities, and strategic mergers and acquisitions to enhance global market presence. There's also a growing focus on sustainable materials.

Semiconductor Materials MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Materials MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Cabot Microelectronics

- DowDuPont

- Hemlock Semiconductor

- Henkel AG

- Air Liquide SA

- Avantor Performance Materials

- Hitachi High-Technologies

- Honeywell Electronic Materials

- JSR Corporation

- Tokyo Ohka Kogyo America

- Mitsui High-Tec

- Other Key Players