Global Semiconductor Logistics Market Size, Share, Growth Analysis By Product Type (Raw Materials and Chemicals, Wafers, Packaging Materials, Finished Semiconductor Products, Others), By Function (Transportation, Warehousing and Distribution, Value-Added Services), By Mode of Operation (Cold-Chain Logistics, Non-Cold-Chain Logistics), By Destination (Domestic, International), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170600

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

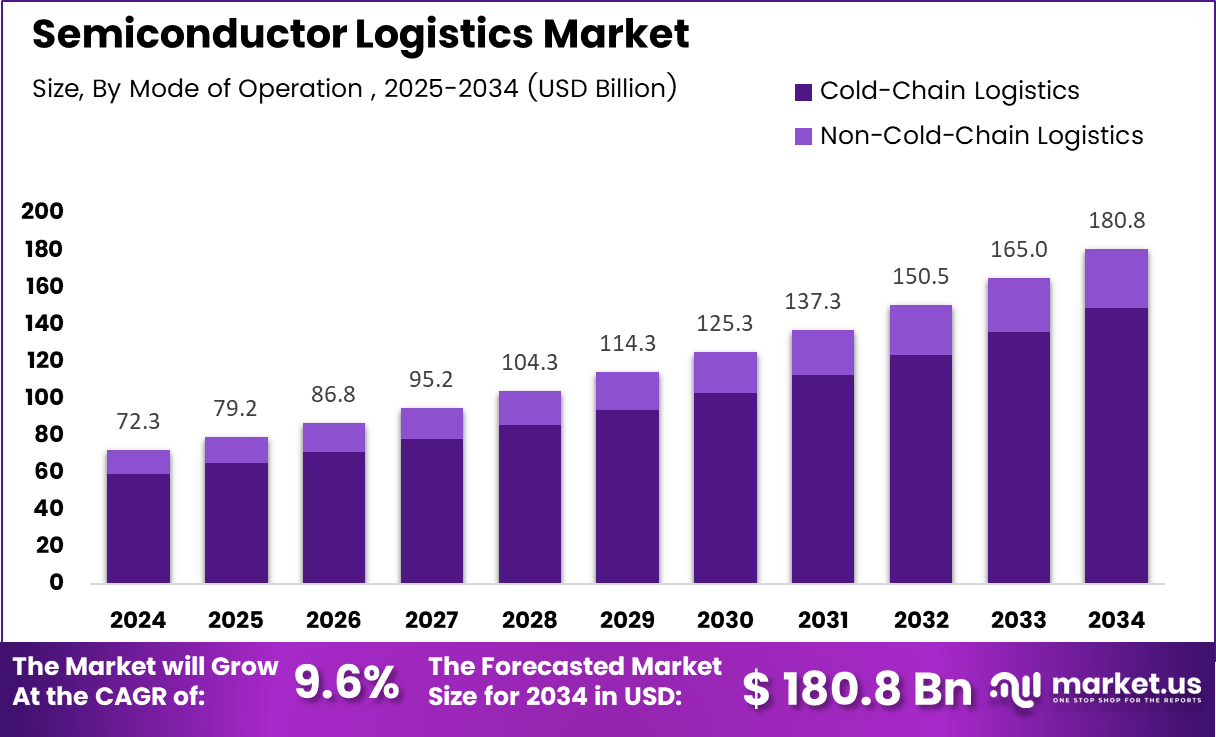

The Global Semiconductor Logistics Market size is expected to be worth around USD 180.8 billion by 2034, from USD 72.3 billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034.

The Semiconductor Logistics Market refers to specialized logistics services supporting the movement, storage, and handling of semiconductor materials, equipment, and finished chips. This market operates at the intersection of precision logistics, cleanroom compliance, and time critical supply chains, supporting fabrication, assembly, testing, and distribution workflows globally.

From a growth perspective, semiconductor logistics is expanding steadily due to rising chip consumption across electronics, automotive, and industrial applications. Consequently, demand for secure, temperature controlled, and vibration sensitive transportation is increasing. Moreover, higher capital intensity in semiconductor manufacturing elevates the importance of logistics reliability, traceability, and risk mitigation across global supply networks.

In terms of opportunity, governments and industry stakeholders are emphasizing supply chain resilience and localization. As a reFinsult, logistics providers aligned with semiconductor ecosystems are expected to benefit from long term capacity planning. Additionally, integration of digital freight management, real time visibility tools, and compliance driven documentation is improving operational efficiency and customer confidence across semiconductor logistics workflows.

From a regulatory and policy standpoint, semiconductor logistics is increasingly influenced by export controls, customs regulations, and national industrial strategies. Therefore, logistics frameworks are being designed to meet stringent documentation, security screening, and cross border compliance requirements. These regulations are shaping investment decisions and encouraging standardized logistics protocols across semiconductor corridors.

From an investment lens, incentives and infrastructure programs are strengthening downstream logistics demand. According to the Government of India, fiscal support of up to 50% of project cost is offered on a pari passu basis for large scale TFT LCD and AMOLED fabrication facilities. This policy is anticipated to stimulate inbound equipment logistics and outbound component distribution.

In parallel, India’s semiconductor roadmap prioritizes capacity building in mature process nodes. According to official policy statements, 28nm and above technologies currently constitute nearly 70% of volume demand. Consequently, logistics demand is expected to rise for equipment, wafers, chemicals, and finished chips associated with high volume, cost sensitive manufacturing nodes.

From a commercial shipping perspective, cost optimization is becoming critical for semiconductor exporters. According to DHL, registered business customers can access international shipping discounts of up to 70%, improving cross border logistics affordability. Such pricing structures support faster market access, especially for fabless firms and component exporters operating on tight margins.

Key Takeaways

- The global Semiconductor Logistics Market is projected to grow from USD 72.3 billion in 2024 to USD 180.8 billion by 2034, registering a CAGR of 9.6% during 2025 to 2034.

- Raw Materials and Chemicals emerged as the leading product type segment in 2024, accounting for a dominant market share of 31.8%.

- Transportation represented the largest functional segment in 2024, holding a significant share of 56.9% due to high frequency semiconductor movement.

- Non Cold Chain Logistics dominated the mode of operation segment in 2024 with a substantial share of 82.3%.

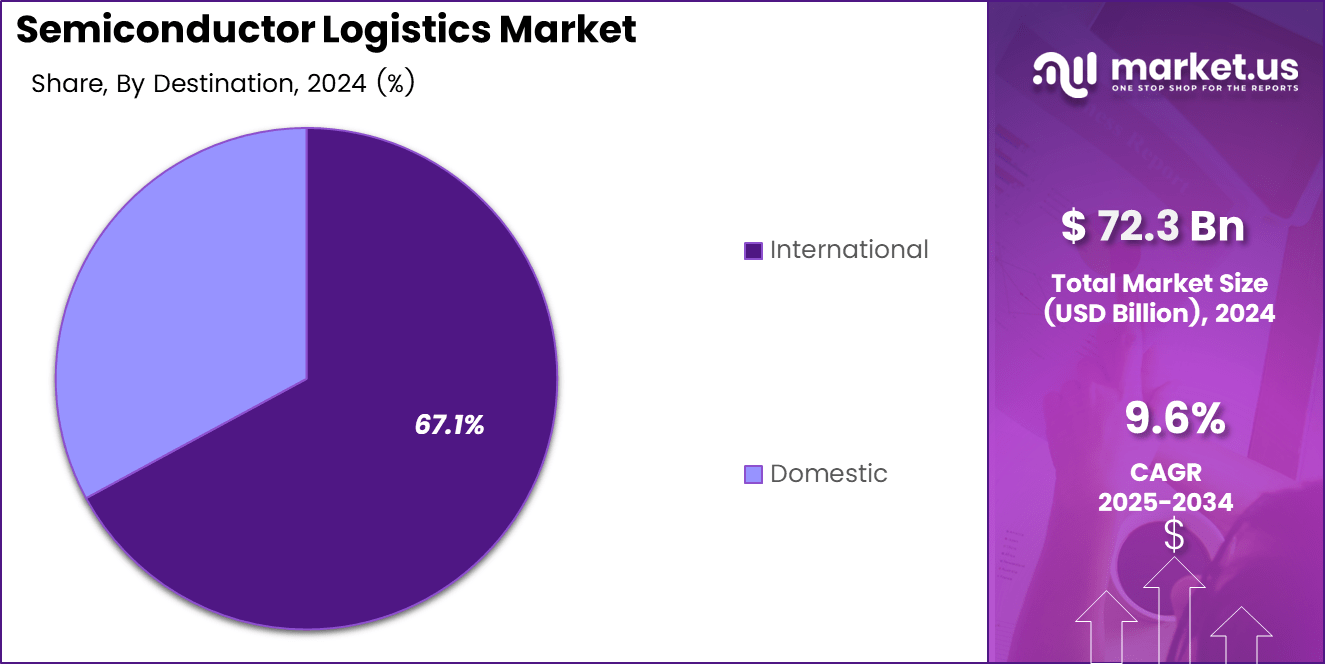

- International logistics accounted for the largest destination segment in 2024, capturing a market share of 67.1%.

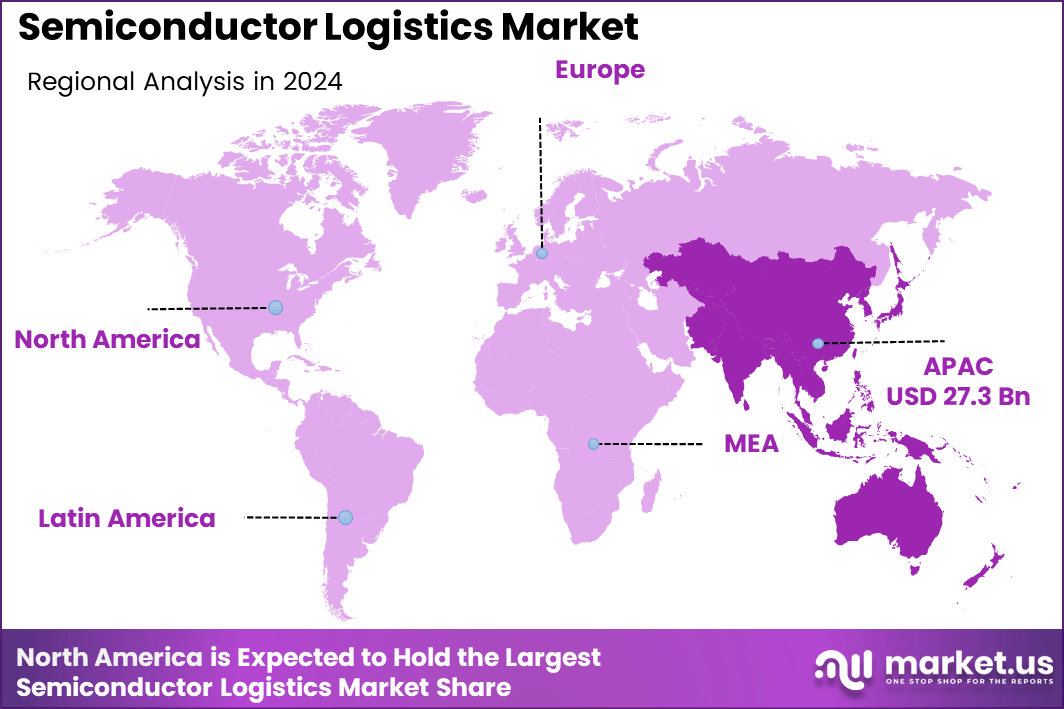

- Asia Pacific led the global Semiconductor Logistics Market in 2024 with a market share of 37.8%, valued at USD 27.3 billion.

By Product Type Analysis

In 2024, Raw Materials and Chemicals held a dominant market position in the By Product Type Analysis segment of Semiconductor Logistics Market, with a 31.8% share, reflecting its critical role in upstream semiconductor manufacturing workflows.

In 2024, Raw Materials and Chemicals held a dominant market position in the By Product Type Analysis segment of Semiconductor Logistics Market, with a 31.8% share. This dominance is supported by consistent movement of specialty gases, photoresists, and process chemicals requiring regulated handling. As semiconductor fabrication expands, logistics providers increasingly prioritize reliability, safety compliance, and contamination control across chemical supply chains.

Wafers represent a highly sensitive logistics category, driven by rising wafer fabrication capacity and advanced node investments. Moreover, wafer transportation demands vibration control, cleanroom compatible packaging, and time critical delivery. Consequently, logistics solutions for wafers emphasize precision handling and real time tracking to reduce yield loss and maintain production continuity.

Packaging Materials logistics continues to gain importance as backend semiconductor operations scale globally. Furthermore, the movement of substrates, lead frames, and protective materials supports assembly and testing activities. As a result, logistics providers align inventory availability with just in time manufacturing models to minimize storage costs and improve operational efficiency.

Finished Semiconductor Products and Others collectively support downstream electronics manufacturing and aftermarket demand. Additionally, these shipments prioritize speed, security, and customs efficiency. Therefore, logistics strategies increasingly integrate multimodal transport and digital documentation to ensure timely delivery across consumer electronics, automotive, and industrial end markets.

By Function Analysis

In 2024, Transportation held a dominant market position in the By Function Analysis segment of Semiconductor Logistics Market, with a 56.9% share, supported by high frequency cross border and domestic chip movements.

In 2024, Transportation held a dominant market position in the By Function Analysis segment of Semiconductor Logistics Market, with a 56.9% share. This leadership reflects rising demand for rapid movement of semiconductor inputs and outputs across fabs, assembly units, and OEMs. Consequently, air freight and expedited road transport remain essential for supply chain continuity.

Warehousing and Distribution services play a stabilizing role by supporting buffer inventory and regional fulfillment. Moreover, semiconductor specific warehouses emphasize clean environments, temperature control, and secure access. As supply chains regionalize, distribution hubs increasingly align with major semiconductor manufacturing clusters.

Value Added Services enhance logistics differentiation through activities such as kitting, labeling, customs brokerage, and inventory optimization. Additionally, these services reduce operational burden for semiconductor firms. Therefore, logistics providers integrate digital platforms and process automation to deliver higher service efficiency and transparency.

By Mode of Operation Analysis

In 2024, Non-Cold-Chain Logistics held a dominant market position in the By Mode of Operation Analysis segment of Semiconductor Logistics Market, with a 82.3% share, reflecting broader applicability across semiconductor shipments.

In 2024, Non-Cold-Chain Logistics held a dominant market position in the By Mode of Operation Analysis segment of Semiconductor Logistics Market, with a 82.3% share. Most semiconductor products tolerate controlled ambient conditions, supporting cost effective transport. As a result, standard logistics networks remain widely adopted across high volume semiconductor flows.

Cold Chain Logistics serves niche but critical applications involving temperature sensitive materials and chemicals. Moreover, precise thermal control reduces degradation risk and ensures regulatory compliance. Consequently, cold chain solutions are selectively deployed where product integrity directly impacts manufacturing yields.

By Destination Analysis

In 2024, International shipments held a dominant market position in the By Destination Analysis segment of Semiconductor Logistics Market, with a 67.1% share, driven by globalized semiconductor supply chains.

In 2024, International shipments held a dominant market position in the By Destination Analysis segment of Semiconductor Logistics Market, with a 67.1% share. Semiconductor manufacturing spans multiple countries, requiring frequent cross border movement. Therefore, customs efficiency, trade compliance, and global network reach remain essential logistics priorities.

Domestic logistics supports intra country movement between fabs, assembly plants, and local OEMs. Additionally, domestic routes benefit from faster transit times and lower regulatory complexity. As governments encourage local semiconductor ecosystems, domestic logistics demand is expected to remain strategically important.

Key Market Segments

By Product Type

- Raw Materials and Chemicals

- Wafers

- Packaging Materials

- Finished Semiconductor Products

- Others

By Function

- Transportation

- Warehousing and Distribution

- Value-Added Services

By Mode of Operation

- Cold-Chain Logistics

- Non-Cold-Chain Logistics

By Destination

- Domestic

- International

Drivers

Expansion of Advanced Semiconductor Fabrication and Packaging Capacity Drives Market Growth

The expansion of advanced semiconductor fabrication and packaging facilities across regions such as Asia Pacific, North America, and Europe is a key driver for the semiconductor logistics market. As new fabs and OSAT units come online, the need for reliable inbound and outbound logistics rises steadily. These facilities require highly coordinated material movement to avoid production delays.

Rising demand for time critical and contamination controlled transport is further strengthening logistics requirements. Semiconductor chips are high value and highly sensitive to temperature, moisture, and vibration. As a result, manufacturers increasingly rely on specialized logistics providers that can ensure clean handling and fast delivery across long distances.

The growing complexity of global semiconductor supply chains also supports market growth. Chip production now spans multiple locations, from design centers to wafer fabs and final assembly plants. This fragmented structure increases dependency on efficient logistics networks to maintain smooth production flows.

Additionally, growth in end use industries such as automotive electronics, data centers, and AI hardware is boosting chip volumes. As semiconductor demand expands across these sectors, logistics services are becoming an essential enabler of timely and secure chip availability.

Restraints

High Logistics Costs Associated with Secure Handling Restrain Market Expansion

High logistics costs remain a major restraint for the semiconductor logistics market. Transporting sensitive chips requires secure packaging, climate control, and specialized equipment, which significantly raises operating expenses. These costs can be challenging for smaller manufacturers and emerging chip startups.

Geopolitical tensions and trade restrictions also disrupt semiconductor supply chains. Export controls, tariffs, and regulatory checks increase transit time and uncertainty. Such disruptions make logistics planning more complex and reduce overall supply chain efficiency.

Limited availability of specialized infrastructure further restricts market growth. Not all regions have access to cleanroom compatible warehouses or temperature controlled transport fleets designed for semiconductor products. This creates bottlenecks, especially in emerging manufacturing locations.

Moreover, coordination challenges across multiple global partners add to operational risk. Delays at any single stage can impact production timelines. Together, these factors limit the scalability and flexibility of semiconductor logistics services despite rising demand.

Growth Factors

Development of Dedicated Semiconductor Logistics Hubs Creates New Growth Opportunities

The development of dedicated semiconductor logistics hubs near fabs and OSAT facilities presents strong growth opportunities. These hubs reduce transit time, improve inventory management, and support just in time manufacturing models. Proximity also lowers risk related to handling and environmental exposure.

Adoption of digital supply chain visibility platforms is another major opportunity. Real time tracking and monitoring improve shipment transparency and help manufacturers respond quickly to delays or disruptions. Digital tools also support better planning and cost control.

Outsourcing logistics operations by fabless companies is increasing. Many fabless players prefer specialized logistics partners instead of building in house capabilities. This trend is opening new revenue streams for third party logistics providers with semiconductor expertise.

Expansion of cold chain and cleanroom compatible logistics services is also gaining traction. As chip complexity rises, demand for advanced handling solutions is expected to grow, supporting long term market expansion.

Emerging Trends

Increasing Use of AI in Supply Chain Planning Shapes Market Trends

The increasing use of AI and predictive analytics is a key trend in semiconductor logistics. These tools help forecast demand, optimize routes, and reduce delays. As supply chains become more complex, data driven decision making is gaining importance.

There is also a clear shift toward regionalized and nearshore logistics networks. Companies are reducing dependence on long global routes to shorten lead times and improve resilience. This trend is reshaping logistics strategies across the semiconductor industry.

Integration of blockchain for traceability and anti counterfeit measures is emerging. Blockchain improves transparency and helps verify product authenticity, which is critical for high value chips used in sensitive applications.

Sustainability is another growing focus. Logistics providers are adopting low emission transport options and reusable packaging solutions. These practices align semiconductor logistics with broader environmental goals and regulatory expectations.

Regional Analysis

Asia Pacific Dominates the Semiconductor Logistics Market with a Market Share of 37.8%, Valued at USD 27.3 Billion

Asia Pacific leads the semiconductor logistics market due to its strong concentration of semiconductor fabrication, assembly, and testing facilities across China, Taiwan, South Korea, and Southeast Asia. In 2024, the region accounted for a dominant share of 37.8%, with market value reaching USD 27.3 Billion, supported by high intra regional movement of wafers, chips, and packaging materials. Growing investments in advanced fabs, government backed semiconductor policies, and rising exports of electronics continue to strengthen logistics demand. Additionally, the need for time sensitive and contamination controlled transport is accelerating adoption of specialized semiconductor logistics services across the region.

North America Semiconductor Logistics Market Trends

North America represents a mature and strategically important semiconductor logistics market, supported by strong domestic chip design capabilities and expanding fabrication investments. The region benefits from reshoring initiatives, advanced supply chain infrastructure, and high demand from data centers, defense electronics, and AI hardware manufacturing. Increased focus on secure, compliant, and temperature controlled logistics solutions is shaping service innovation. Cross border semiconductor movement between the US and neighboring regions further sustains logistics activity.

Europe Semiconductor Logistics Market Trends

Europe’s semiconductor logistics market is driven by rising investments in automotive electronics, industrial automation, and power semiconductor manufacturing. Regional demand is supported by growing emphasis on supply chain resilience, local sourcing, and sustainability aligned logistics operations. Logistics providers are increasingly adapting to stringent regulatory standards and quality requirements for semiconductor transport. Expanding fab and packaging projects across Western and Central Europe continue to generate steady logistics demand.

Middle East and Africa Semiconductor Logistics Market Trends

The Middle East and Africa region is witnessing gradual growth in semiconductor logistics, supported by increasing electronics imports, data center expansion, and smart infrastructure projects. While local semiconductor manufacturing remains limited, the region plays an important role as a logistics transit hub linking Asia, Europe, and Africa. Investments in ports, free trade zones, and air cargo infrastructure are improving handling capabilities. Demand is primarily centered on secure international transportation and warehousing services.

Latin America Semiconductor Logistics Market Trends

Latin America’s semiconductor logistics market is developing steadily, driven by rising electronics assembly activities and growing consumer electronics demand. The region relies heavily on imports of semiconductors and related materials, creating consistent demand for cross border logistics services. Improvements in trade agreements, customs processes, and logistics infrastructure are supporting market expansion. Automotive electronics and industrial equipment manufacturing are emerging as key demand contributors.

US Semiconductor Logistics Market Trends

The US semiconductor logistics market is expanding as domestic fabrication, packaging, and R&D activities accelerate. Increased government support for local semiconductor manufacturing is driving demand for secure, high reliability logistics solutions. The market is characterized by strong requirements for traceability, compliance, and rapid delivery across design, fab, and assembly locations. Growing AI, defense, and advanced computing applications continue to reinforce logistics demand across the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Semiconductor Logistics Company Insights

the global Semiconductor Logistics Market in 2024 is characterized by rising complexity, tighter delivery timelines, and growing demand for contamination controlled, secure, and time critical transportation. Leading logistics providers are strengthening semiconductor specific capabilities to support fabs, OSAT facilities, and global electronics supply chains amid increasing chip value and sensitivity.

Kuehne + Nagel continues to play a significant role in semiconductor logistics by leveraging its strong air freight, sea freight, and advanced supply chain visibility tools. The company’s focus on time-critical handling, secure transport, and cleanroom-compatible processes aligns well with the needs of high-value wafers and finished semiconductor products.

Nippon Express maintains a strong presence due to its deep experience in precision logistics and close proximity to major semiconductor manufacturing hubs in Asia. Its expertise in temperature-controlled transport, vibration-sensitive handling, and integrated domestic and international networks supports efficient movement across fabs, assembly, and testing locations.

DSV is recognized for its scalable global logistics platform and ability to manage complex, multi region semiconductor supply chains. The company emphasizes end-to-end coordination, flexible routing, and risk mitigation strategies, which are increasingly important as semiconductor production footprints expand across multiple geographies.

Yusen Logistics strengthens its position through customized logistics solutions designed for high tech and semiconductor customers. Its focus on value added services, including secure warehousing, real time tracking, and just in time delivery, supports manufacturers seeking reliability and supply chain resilience in a volatile global environment.

Top Key Players in the Market

- Kuehne + Nagel

- Nippon Express

- DSV

- Yusen Logistics

- UPS Supply Chain Solutions

- FedEx Logistics

- CEVA Logistics

- Omni Logistics

- Dimerco

- NNR Global Logistics

Recent Developments

- In Aug 14, 2025, Infineon Technologies AG completed the acquisition of Marvell Technology, Inc.’s Automotive Ethernet business following regulatory approvals, with the transaction originally announced in Apr 2025. The acquisition strengthens Infineon’s capabilities in software defined vehicles and expands its leadership in automotive microcontrollers.

- In Jun 20, 2024, Renesas Electronics Corporation successfully completed the acquisition of Transphorm, Inc., a global leader in gallium nitride (GaN) technology. The deal enables Renesas to deliver GaN based power products and reference designs, addressing rising demand for wide bandgap semiconductor solutions.

- In May 21, 2024, Amphenol Corporation completed its acquisition of Carlisle Interconnect Technologies (CIT) from Carlisle Companies Incorporated. This acquisition broadens Amphenol’s portfolio of harsh environment connectivity solutions, strengthening offerings for commercial aviation, defense, and industrial markets.

Report Scope

Report Features Description Market Value (2024) USD 72.3 billion Forecast Revenue (2034) USD 180.8 billion CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Raw Materials and Chemicals, Wafers, Packaging Materials, Finished Semiconductor Products, Others), By Function (Transportation, Warehousing and Distribution, Value-Added Services), By Mode of Operation (Cold-Chain Logistics, Non-Cold-Chain Logistics), By Destination (Domestic, International) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Kuehne + Nagel, Nippon Express, DSV, Yusen Logistics, UPS Supply Chain Solutions, FedEx Logistics, CEVA Logistics, Omni Logistics, Dimerco, NNR Global Logistics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Semiconductor Logistics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Logistics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kuehne + Nagel

- Nippon Express

- DSV

- Yusen Logistics

- UPS Supply Chain Solutions

- FedEx Logistics

- CEVA Logistics

- Omni Logistics

- Dimerco

- NNR Global Logistics