Global Semiconductor Foundry Market By Technology (10/7/5 nm, 16/14 nm, 20 nm, 28 nm, 45/40 nm, 65 nm, Other Technology Nodes), By Industry (Telecommunication, Defense and Military, Industrial, Consumer Electronics, Automotive, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124975

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

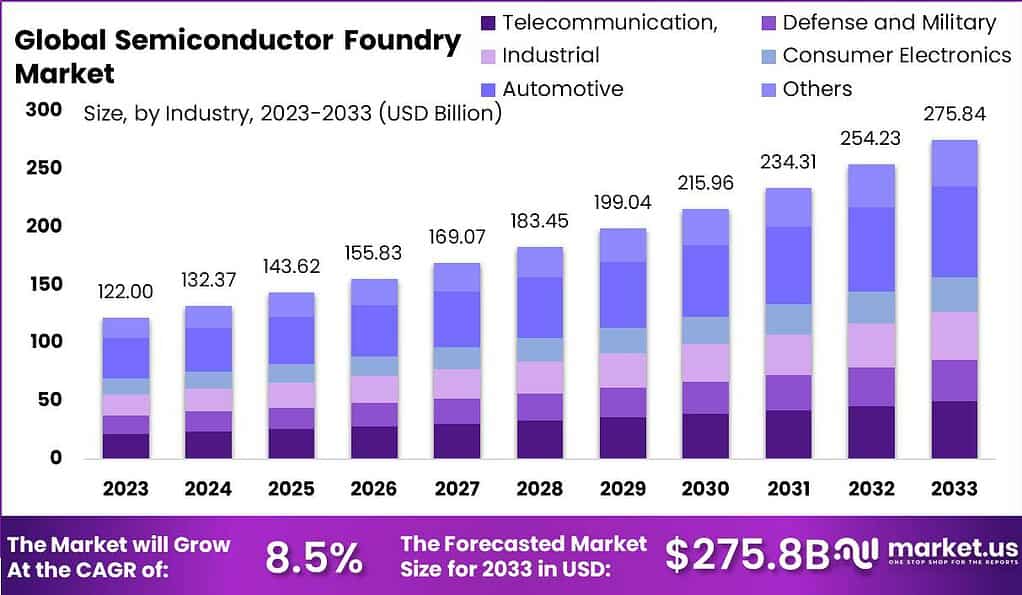

The Global Semiconductor Foundry Market size is expected to be worth around USD 275.84 Billion By 2033, from USD 122 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

A semiconductor foundry, also known as a fab or fabrication plant, specializes in the manufacturing of silicon wafers from which microchips are made. These facilities are highly sophisticated, requiring enormous investment in clean room environments and cutting-edge technology to handle the complex processes of photolithography, etching, doping, and packaging.

Semiconductor foundries operate on a contract basis, producing chips for companies that design but do not have the facilities to manufacture semiconductors. This model allows for a division of labor between design and manufacturing, enabling companies to focus on either side without the massive capital expenditure involved in building and maintaining a fab.

The global semiconductor foundry market is experiencing significant growth, driven by increasing demand for sophisticated electronics across multiple sectors including automotive, consumer electronics, and telecommunications. This growth is further fueled by the advancement in technologies such as 5G, Internet of Things (IoT), and artificial intelligence (AI), which require advanced semiconductor chips.

Despite the growth opportunities, the semiconductor foundry market faces challenges such as technological advancements and increasing competition. Foundries must continuously invest in cutting-edge technologies to meet the demands for smaller, more efficient semiconductors while maintaining cost-effectiveness. Moreover, the global semiconductor industry is highly competitive, with foundries vying for market share and striving to differentiate themselves through technological innovation and quality of service.

Despite these challenges, the semiconductor foundry market presents substantial opportunities. There is a growing need for semiconductors in emerging technologies, which encourages continuous innovation and investment in research and development. Additionally, initiatives by governments worldwide to support local semiconductor production are opening new avenues for market expansion.

According to Market.us, The Global Semiconductor Market is projected to expand significantly, with its valuation anticipated to grow from USD 530 Billion in 2023 to approximately USD 996 Billion by 2033. This growth represents a compound annual growth rate (CAGR) of 6.5% over the forecast period from 2024 to 2033.

Taiwan Semiconductor Manufacturing Company (TSMC) continues to dominate the global semiconductor foundry market, holding a substantial market share of 61.7% in the first quarter of 2024. Samsung Electronics, the largest company in South Korea in terms of semiconductor revenue, follows distantly with a market share of 11%. Collectively, the top ten semiconductor foundries generated impressive revenues totaling $29.2 billion in the first quarter of 2024 alone.

According to Z2Data’s recent analysis, there are 73 new semiconductor fabrication facilities (fabs) currently under development globally. Of these, 23 (31%) involve expansions at existing sites, primarily enhancing production capabilities for 28nm technology nodes. Notably, 40% of these new fabs are strategically located in the United States, emphasizing the region’s growing prominence in semiconductor manufacturing. In particular, Texas is set to host 10 new fabs, all slated for completion between 2023 and 2042, with a focus on advanced 10nm and smaller process technologies.

On a broader scale, South Korean and Taiwanese companies collectively command about 80% of all semiconductor foundry revenue, with U.S. based GlobalFoundries maintaining between 6% and 8% over the past three years. Meanwhile, China has emerged as a formidable player in the semiconductor industry, holding a 29% market share of global semiconductor sales in 2023 and accounting for 53% of sales in the Asia-Pacific region.

Key Takeaways

- The Semiconductor Foundry Market size is expected to be worth around USD 275.8 Billion by 2033, from USD 122 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

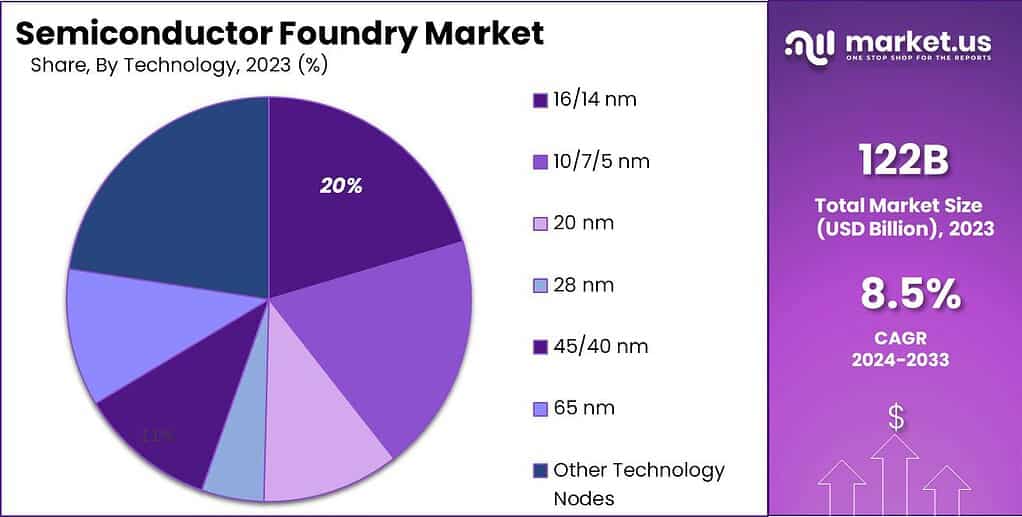

- In 2023, the 16/14 nm technology segment emerged as a frontrunner in the Semiconductor Foundry market, commanding a substantial market share exceeding 20.4%.

- In 2023, the Automotive segment emerged as a pivotal driver within the Semiconductor Foundry market, securing a commanding market share exceeding 28.4%.

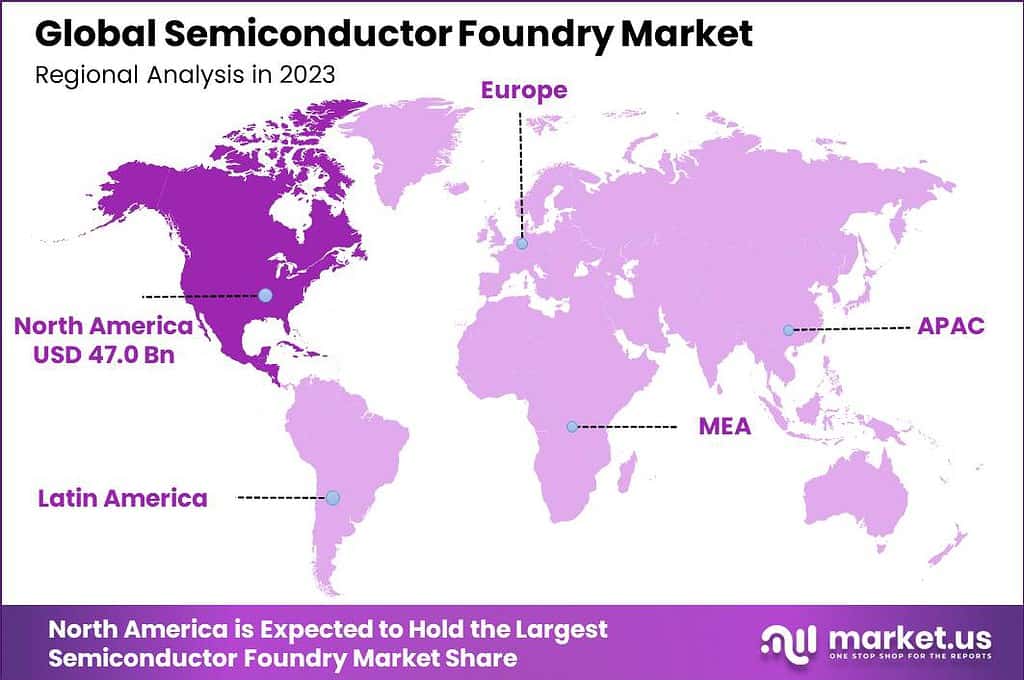

- In 2023, North America asserted its dominance in the Semiconductor Foundry Market, commanding a significant market share exceeding 38.6%.

Technology Segment Analysis

In 2023, the 16/14 nm technology segment held a dominant position in the semiconductor foundry market, capturing more than a 20.4% share. This segment leads primarily due to its optimal balance between performance, cost, and power efficiency, making it highly attractive for high-volume and performance-critical applications.

As semiconductor technology advances, the 16/14 nm nodes offer a significant improvement over larger nodes by providing greater density and thus more functionality per chip. This is crucial in sectors such as consumer electronics and automotive, where manufacturers demand high performance and energy efficiency.

The predominance of the 16/14 nm segment also stems from its widespread adoption by major industry players who continue to leverage these nodes for their mainstream and high-performance products. For instance, several leading smartphone and consumer electronics manufacturers rely on this technology for their processors and memory chips, driving up demand.

Additionally, the 16/14 nm nodes are at a mature stage of development, which brings production stability and lower defect rates compared to newer, smaller nodes that are still scaling up and facing technical challenges.

Furthermore, this technology strikes a beneficial compromise for many semiconductor companies, providing substantial performance improvements without the prohibitive costs associated with moving to smaller, more advanced nodes like 10/7/5 nm. As such, the 16/14 nm nodes remain a critical part of the semiconductor manufacturing landscape, serving a wide array of industries and applications that require reliable and efficient chip performance.

Industry Segment Analysis

In 2023, the Automotive segment held a dominant market position in the semiconductor foundry sector, capturing more than a 28.4% share. This leadership can be attributed to the rapid integration of advanced electronics in vehicles, driven by trends such as electric vehicles (EVs), autonomous driving, and enhanced safety features. Semiconductors are crucial for these applications, as they enable better performance, connectivity, and energy efficiency in automotive systems.

The surge in demand within the Automotive segment is further fueled by the global push towards EVs and hybrid vehicles, which require a significant number of semiconductor components compared to traditional combustion engines. Components such as power management devices, sensors, and microcontrollers are increasingly used to enhance the efficiency and functionality of these modern vehicles.

Additionally, the rise of connected cars and the Internet of Things (IoT) applications in the automotive industry has led to an increased demand for semiconductors that facilitate wireless communication and data processing. Moreover, regulatory requirements for safety and emissions are driving car manufacturers to adopt more semiconductor-based technologies to meet these standards.

Technologies such as Advanced Driver Assistance Systems (ADAS) and the push towards fully autonomous vehicles are expected to further boost the semiconductor content per vehicle, reinforcing the Automotive segment’s leading position in the market. This ongoing evolution in automotive technology ensures a steady demand for semiconductors, underpinning the segment’s dominance in the semiconductor foundry market.

Key Market Segments

By Technology

- 10/7/5 nm

- 16/14 nm

- 20 nm

- 28 nm

- 45/40 nm

- 65 nm

- Other Technology Nodes

By Industry

- Telecommunication

- Defense and Military

- Industrial

- Consumer Electronics

- Automotive

- Others

Driver

Increased Demand for Custom-Designed Integrated Circuits

The semiconductor foundry market is experiencing robust growth driven by the increased demand for custom-designed integrated circuits across various industries, including automotive, consumer electronics, and industrial sectors.

This surge is attributed to the ongoing advancements in technology, which necessitate specialized semiconductor components that can meet specific operational requirements. As industries continue to innovate and integrate more digital technologies, the need for tailored semiconductor solutions is expected to keep rising, ensuring sustained growth for foundries that provide these custom solutions

Restraint

Technological Obsolescence

A significant challenge faced by the semiconductor foundry market is technological obsolescence. The rapid pace of innovation in semiconductor technology means that processes and products can quickly become outdated, posing a challenge for foundries to stay current with the latest technological standards.

This necessitates continuous investment in research and development to upgrade and maintain relevance in a highly competitive market. The high costs associated with frequent technology upgrades can strain resources and impact the profitability of foundries, making it a critical restraint for the industry.

Opportunity

Advancements in Automotive and IoT Applications

The semiconductor foundry market is poised for growth through the increasing integration of semiconductors in automotive applications and the expansion of the Internet of Things (IoT). As vehicles become more electronic with advancements in EVs and autonomous driving technologies, the demand for sophisticated semiconductor components is set to rise.

Similarly, the proliferation of IoT devices across residential, industrial, and public domains demands robust semiconductor support, presenting substantial opportunities for foundries to expand their market presence and technological offerings

Challenge

Supply Chain and Production Complexities

One of the persistent challenges in the semiconductor foundry market is managing the complexities associated with the supply chain and production processes. The requirement for precise manufacturing conditions and the need to manage a global supply chain add layers of complexity to operations.

These factors often lead to increased costs and can affect the ability to meet client demands efficiently. Additionally, geopolitical tensions and trade disputes can further complicate the supply chain, impacting the availability of raw materials and the distribution of final products, thus posing a significant challenge to maintaining steady market growth

Growth Factors

- Increasing Demand for Advanced Semiconductor Technologies: Driven by sectors such as consumer electronics, automotive, and telecommunications.

- Technological Advancements in Manufacturing Processes: Including smaller process nodes (e.g., 7nm and below) enhancing performance and efficiency.

- Proliferation of AI, IoT, and 5G Technologies: Creating demand for specialized semiconductor solutions.

- Global Expansion of Digitalization and Connectivity: Fueling the need for high-performance semiconductor components.

- Rising Investment in Research and Development: To innovate and meet evolving market demands.

- Shift towards Outsourced Semiconductor Manufacturing: Favoring fabless semiconductor companies and increasing foundry utilization.

Latest Trends

- Transition to Advanced Process Nodes: Continued adoption of smaller nodes like 7nm and below to enhance performance and energy efficiency.

- Rise of AI-specific Chips: Increasing demand for AI accelerators and processors tailored for machine learning tasks.

- Expansion in 5G Infrastructure: Growing need for RF and millimeter-wave ICs to support 5G networks and devices.

- Automotive Semiconductor Solutions: Development of chips for electric vehicles (EVs), autonomous driving, and in-vehicle connectivity.

- Internet of Things (IoT) Growth: Demand for low-power, high-performance ICs to support IoT devices and applications.

- Focus on Cybersecurity: Integration of security features into semiconductor designs to address growing cybersecurity concerns.

Regional Analysis

In 2023, North America held a dominant market position in the semiconductor foundry market, capturing more than a 38% share and generating USD 47 billion in revenue. This leadership is largely attributed to the region’s robust technological infrastructure and the presence of major industry players who drive innovation and development in semiconductor technologies.

North America’s commitment to research and development, supported by substantial investments from both public and private sectors, plays a critical role in advancing semiconductor manufacturing capabilities. The region benefits significantly from advanced manufacturing techniques and a highly skilled workforce, which are pivotal in maintaining high standards of production quality and efficiency.

Moreover, North America’s strategic focus on securing supply chains for critical semiconductor components has intensified, especially given global disruptions. This focus is part of a broader initiative to bolster national security and technological sovereignty, particularly in key areas like telecommunications, defense, and consumer electronics.

Furthermore, the push towards digital transformation across various sectors, including automotive and healthcare, which are increasingly reliant on high-performance computing capabilities, continues to spur demand for semiconductor foundries in the region. The integration of artificial intelligence and the Internet of Things in these industries necessitates advanced and specialized semiconductor chips, ensuring sustained growth within the North American market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Semiconductor Foundry Market represent a diverse landscape of companies driving innovation and competitiveness in semiconductor manufacturing. These key players drive innovation through investments in research and development, strategic partnerships, and expanding manufacturing capabilities to meet the evolving demands of global semiconductor markets.

Their competitive strategies include focusing on advanced process nodes, customization capabilities, and addressing emerging applications such as AI, 5G, and automotive electronics. Understanding their market strategies and technological advancements is crucial for stakeholders navigating the dynamic Semiconductor Foundry Market landscape.

Top Key Players in the Market

- Micron Technology Inc.

- Hua Hong Semiconductor Limited

- GLOBALFOUNDRIES Inc.

- Texas Instruments Incorporated

- TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED,

- Samsung Electronics Co. Ltd

- X-FAB Silicon Foundries SE

- United Microelectronics Corporation

- Intel Corporation

- Semiconductor Manufacturing International Corporation (SMIC)

- Other Key Players

Recent Developments

- In March 2024, India launched the semiconductor fab project in Dholera, Gujarat, and the semiconductor assembly and test center in Assam.

- In February 2024, Intel launched the world’s first systems foundry that is being designed for the AI Era which would excel in technology, sustainability, and resiliency.

- In January 2024, Valens Semiconductor and Intel Foundry Services announced a strategic relationship for next-generation A-PHY chipsets using its advanced process nodes.

Report Scope

Report Features Description Market Value (2023) USD 122.0 Bn Forecast Revenue (2033) USD 275.84 Bn CAGR (2024-2033) 8.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (10/7/5 nm, 16/14 nm, 20 nm, 28 nm, 45/40 nm, 65 nm, Other Technology Nodes), By Industry (Telecommunication, Defense and Military, Industrial, Consumer Electronics, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Micron Technology, Inc., Hua Hong Semiconductor Limited, GLOBALFOUNDRIES Inc., Texas Instruments Incorporated, TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED, Samsung Electronics Co. Ltd, X-FAB Silicon Foundries SE, United Microelectronics Corporation, Intel Corporation, Semiconductor Manufacturing International Corporation (SMIC), Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a semiconductor foundry?A semiconductor foundry, also known as a fab or fabrication plant, is a facility that manufactures semiconductor devices or integrated circuits (ICs) for other companies. These foundries do not design their own chips but produce chips based on designs provided by clients.

How big is Semiconductor Foundry Market?The Global Semiconductor Foundry Market size is expected to be worth around USD 275.84 Billion By 2033, from USD 122 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

What is the role of foundries in the semiconductor industry ecosystem?Foundries are critical in the semiconductor supply chain, providing manufacturing services to fabless design companies. They enable the production of a wide range of semiconductor products, from consumer electronics to industrial and automotive applications.

What are the key factors driving the growth of the Semiconductor Foundry Market?Key factors include the increasing demand for semiconductors in consumer electronics, automotive, and industrial applications; advancements in semiconductor technology, such as the transition to smaller node sizes; the rise of 5G and AI technologies; and the trend of outsourcing manufacturing to foundries by fabless companies.

What are the current trends and advancements in the Semiconductor Foundry Market?Current trends include the development of advanced process nodes (e.g., 5nm, 3nm), the growth of heterogeneous integration and chiplets, the adoption of extreme ultraviolet (EUV) lithography, increased focus on power efficiency and performance, and expansion into new markets like IoT and automotive.

What are the major challenges and opportunities in the Semiconductor Foundry Market?Major challenges include high capital expenditures for new fabs and equipment, supply chain disruptions, intense competition among foundries, and the complexity of advanced manufacturing processes. Opportunities lie in the growing demand for advanced chips, emerging markets such as automotive and AI, and the push for semiconductor self-sufficiency in various regions.

Who are the leading players in the Semiconductor Foundry Market?Leading players include Micron Technology, Inc., Hua Hong Semiconductor Limited, GLOBALFOUNDRIES Inc., Texas Instruments Incorporated, TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED, Samsung Electronics Co. Ltd, X-FAB Silicon Foundries SE, United Microelectronics Corporation, Intel Corporation, Semiconductor Manufacturing International Corporation (SMIC), Other Key Players.

Semiconductor Foundry MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Foundry MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Micron Technology Inc.

- Hua Hong Semiconductor Limited

- GLOBALFOUNDRIES Inc.

- Texas Instruments Incorporated

- TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED,

- Samsung Electronics Co. Ltd

- X-FAB Silicon Foundries SE

- United Microelectronics Corporation

- Intel Corporation

- Semiconductor Manufacturing International Corporation (SMIC)

- Other Key Players