Global Self-Service Kiosk Market By Component (Hardware, Software, Services), By Location (Indoor Kiosks and Outdoor Kiosks), End-User Industry (Retail, BFSI, Hospitality, Transportation, Healthcare, Other End-User Industries), and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec. 2023

- Report ID: 19271

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

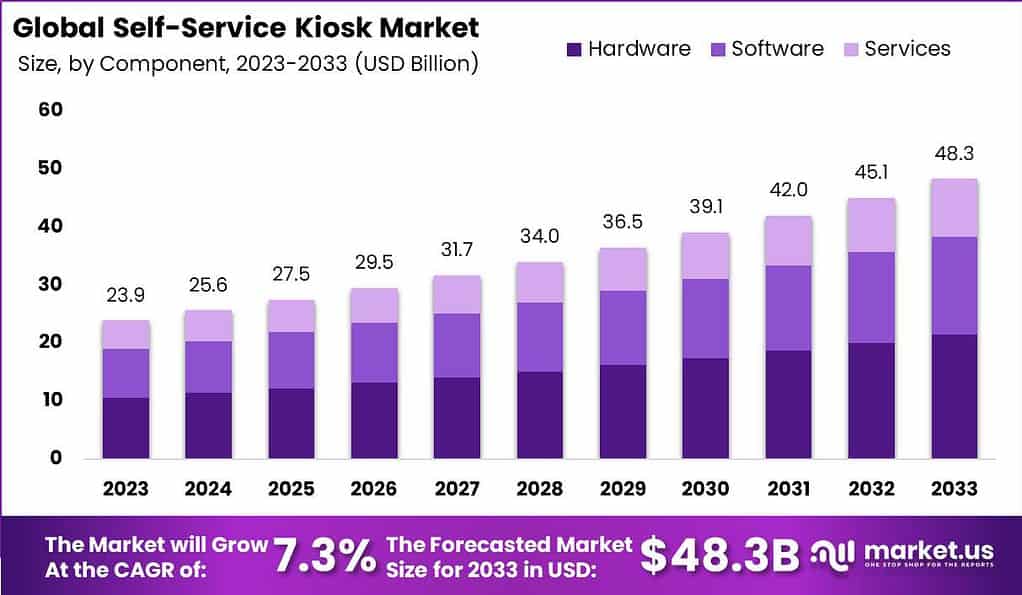

The global Self-service Kiosk Market is anticipated to be USD 48.3 billion by 2033. It is estimated to record a steady CAGR of 7.3% in the Forecast period 2023 to 2033. It is likely to total USD 23.9 billion in 2023.

A self-service kiosk is essentially a standalone terminal that allows customers to access information and perform transactions by themselves. Kiosks have a user interface screen, computer inside, and card readers or printers. They are deployed at public locations instead of going to a service counter.

Some common examples are automated teller machines (ATMs), airport check-in terminals, movie/event ticket dispensers, food ordering stations, and devices to recharge metro cards. Kiosks enable users to independently complete tasks digitally via touchscreens and keypads.

Note: Actual Numbers Might Vary In Final Report

The market for self-service kiosks refers to the business that develops, manufacturers, designs, and supplies self-service kiosks. It includes companies that are that design and manufacture the software, hardware, and other services used in self-service kiosks.

This market also includes businesses which operate and maintain self-service kiosks in various industries. Self-service kiosks are convenient and efficiency to both business and consumers. Customers can access services on their own or work at their own pace without the need for staff.

Key Takeaways

- Market Size and Growth: The global self-service kiosk market is estimated to reach USD 48.3 billion by 2033 with an anticipated compound annual growth rate (CAGR) of 7.3%.

- What are Self-Service Kiosks?: Self-service kiosks are standalone terminals designed to enable customers to independently access information and conduct transactions. Widely deployed in various public locations, they alleviate the necessity for traditional service counters. Examples include ATMs, airport check-in terminals, and food ordering stations.

- Market Participants: The market encompasses companies involved in the development, manufacturing, design, and supply of self-service kiosk solutions. This includes those creating software, hardware, and offering other related services. Some businesses also operate and maintain self-service kiosks across different industries.

- Components Matter: In 2023, the hardware segment dominated the market, accounting for over 44.5% of the market share. Hardware components like touchscreens, payment terminals, and printers play a vital role in self-service kiosk systems. Software, although holding a substantial share, focuses on user-friendly applications.

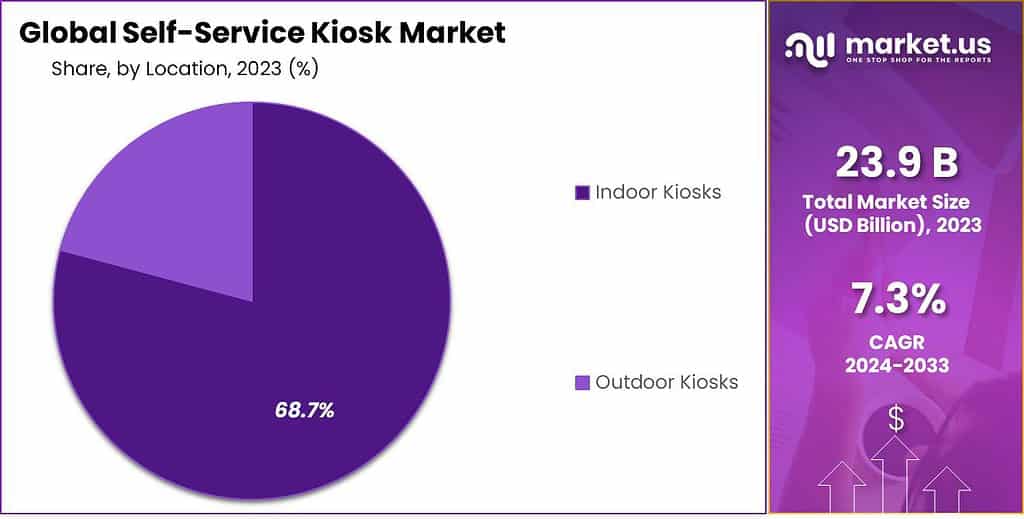

- Location Matters Too: Indoor kiosks held a dominant market share of over 68.7% in 2023. They are widely deployed in retail stores, airports, healthcare facilities, and other indoor environments, offering convenient self-service options. Outdoor kiosks, while significant, serve specialized purposes like outdoor ticketing and drive-thru ordering.

- End-User Industries: In 2023, the Banking, Financial Services, and Insurance (BFSI) sector captured the largest market share, accounting for over 23.9%. Self-service kiosks are increasingly adopted in banking for transactions like cash deposits and withdrawals. Other sectors, including Retail, Hospitality, Transportation, and Healthcare, also represent substantial portions of the market.

- Driving Factors: Self-service kiosks improve customer experience by providing convenience, streamline operations, and offer cost savings through automation. They also provide valuable data for businesses to tailor their offerings.

- Challenges: Initial investment costs can be a barrier for small businesses. Maintenance, security, and ensuring user acceptance are ongoing challenges.

- Growth Opportunities: Customization and personalization, expansion into emerging markets, integration with mobile apps, and support for contactless payments are identified as growth opportunities in the self-service kiosk industry.

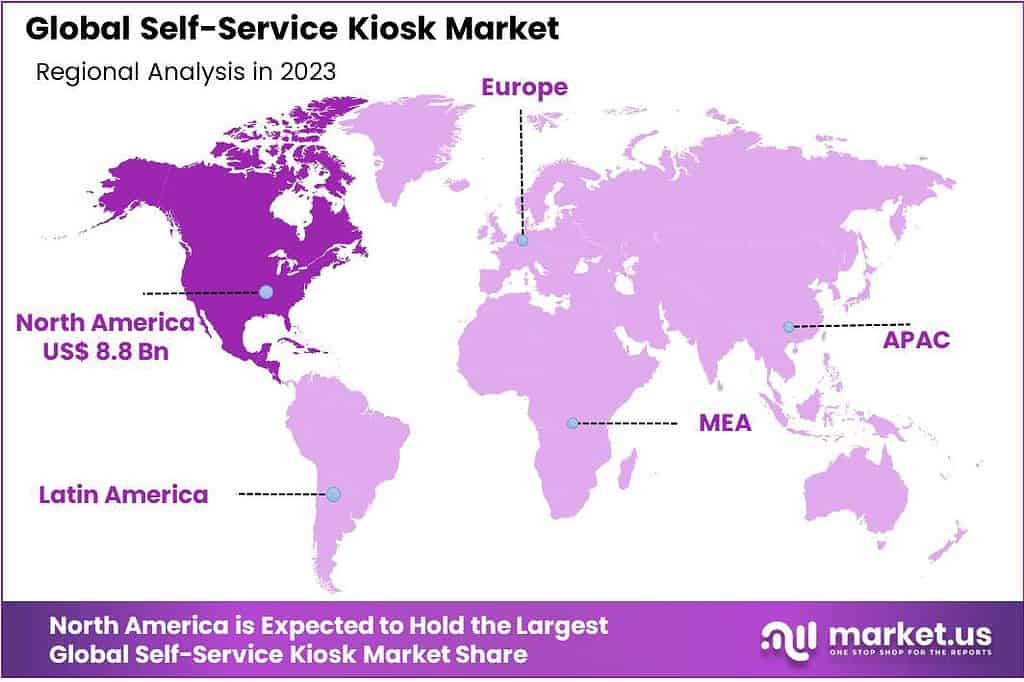

- Key Regions: In 2023, North America held a dominant market share, followed by Europe and the Asia-Pacific region. Emerging markets, particularly in Asia, are witnessing significant growth in self-service kiosk adoption.

- Key Players: Key players in the self-service kiosk industry include NCR Voyix Corporation, Diebold Nixdorf, KIOSK Information Systems, VeriFone Systems, Inc., Zebra Technologies Corporation, Olea Kiosks, Inc., Meridian Kiosks, and others.

Component Insights

In 2023, the Self-Service Kiosk market saw the Hardware segment secure a dominant market position, capturing an impressive share of over 44.5%. This significant advantage can be attributed to various factors, primarily the tangible and essential role of hardware components in self-service kiosk systems. Elements like touchscreens, payment terminals, and printers constitute the physical interface facilitating user interaction with kiosks, making them a vital component for delivering a seamless and efficient self-service experience.

Moreover, with the continued expansion of self-service kiosks across diverse sectors such as retail, hospitality, and healthcare, the demand for robust and dependable hardware solutions consistently remains high. In contrast, the Software segment, though holding a substantial market share, concentrates on developing user-friendly and feature-rich software applications that empower self-service kiosks.

Location Insights

In 2023, the Self-Service Kiosk market witnessed the Indoor Kiosks segment firmly establish its dominant market position, capturing an impressive share of over 68.7%. This substantial lead can be attributed to several key factors, including the widespread deployment of indoor kiosks across a broad spectrum of industries and settings. Indoor kiosks are prominently featured in retail stores, airports, healthcare facilities, and various other indoor environments, offering users convenient and efficient self-service options. Their applications range from automated check-in and payment processing to information retrieval and product selection, making indoor kiosks an integral part of enhancing customer experiences and operational efficiencies.

In contrast, the Outdoor Kiosks segment, while representing a significant portion of the market, addresses specific use cases such as outdoor ticketing, drive-thru ordering, and outdoor information kiosks. These kiosks are designed to withstand diverse weather conditions and are commonly found in settings like parking lots, drive-thru lanes, and outdoor event venues. Although their applications are specialized, outdoor kiosks play a crucial role in enhancing accessibility and service availability in outdoor environments.

Note: Actual Numbers Might Vary In Final Report

End-User Industry

In 2023, the Self-Service Kiosk market witnessed the BFSI (Banking, Financial Services, and Insurance) segment firmly establish its dominant market position, capturing an impressive share of over 23.9%. This significant lead can be attributed to several key factors, including the increasing adoption of self-service kiosks in banking and financial institutions to enhance customer service and streamline routine transactions. Self-service kiosks in the BFSI sector provide services like cash deposits, withdrawals, account inquiries, and even document printing, offering customers convenient access to their financial needs while reducing wait times in branches.

Meanwhile, other segments such as Retail, Hospitality, Transportation, and Healthcare represent significant portions of the market, each catering to specific industry requirements. Retailers leverage self-service kiosks for efficient checkout processes and product information dissemination, while the Hospitality sector employs them for self-check-in and ordering services.

In the Transportation industry, self-service kiosks facilitate ticketing and check-in procedures, improving passenger experiences. In Healthcare, patient check-in and appointment scheduling are made more accessible through self-service kiosks. The market’s diversity reflects the adaptability of self-service kiosks across various industries, with the BFSI segment leading the way in 2023, showcasing the pivotal role of kiosks in modernizing financial services and improving customer interactions.

Driving Factors

- Improved Customer Experience: Self-service kiosks provide users with convenience and speed, elevating the overall customer experience by decreasing wait times and offering straightforward access to information and services.

- Operational Streamlining: Businesses experience enhanced operational efficiency through the implementation of self-service kiosks, as these systems streamline processes, cut labor costs, and mitigate errors linked to manual transactions.

- Financial Savings: Organizations achieve cost savings with the use of self-service kiosks by automating various tasks and transactions, including order processing, ticketing, and check-in services.

- Data Analytics: Kiosks provide valuable data on user behavior and preferences, enabling businesses to gather insights and tailor their offerings, ultimately driving sales and customer satisfaction.

Restraining Factors

- Initial Investment: The upfront cost of deploying self-service kiosks, including hardware, software, and installation, can be a barrier for small businesses and startups.

- Maintenance and Support: Regular maintenance and technical support are necessary to ensure kiosk reliability and performance, adding ongoing operational costs.

- Security Concerns: Ensuring the security of customer data and transactions is paramount, and any breaches can erode trust and lead to legal and financial repercussions.

- User Acceptance: Some users may be hesitant to embrace self-service technology, requiring businesses to invest in user-friendly interfaces and adequate training.

Growth Opportunities

- Customization and Personalization: Tailoring self-service kiosk experiences to individual users through personalization options and targeted promotions can boost customer engagement and loyalty.

- Expansion into Emerging Markets: The untapped potential in emerging markets, where self-service kiosk adoption is on the rise, offers significant growth opportunities for businesses and kiosk providers.

- Integration with Mobile Apps: Integrating self-service kiosks with mobile applications allows for seamless interaction and offers users a consistent experience across channels.

- Contactless Payments: With the growing demand for contactless transactions, self-service kiosks can tap into this trend by supporting various payment methods, including mobile wallets and NFC technology.

Challenges

- Technical Issues: Technical glitches and system downtime can disrupt kiosk operations, leading to customer frustration and business losses.

- Regulatory Compliance: Ensuring compliance with industry regulations and data protection laws can be complex, especially when dealing with sensitive customer information.

- Vandalism and Security Threats: Protecting kiosks from vandalism, theft, and cybersecurity threats is an ongoing challenge, particularly for outdoor and unattended kiosks.

- Maintenance Logistics: Maintaining a network of geographically dispersed kiosks can be logistically challenging and costly, requiring efficient maintenance and repair processes.

Key Market Trends

- Touchless and Gesture-Based Interfaces: Kiosks are increasingly adopting touchless and gesture-based interfaces to minimize physical contact and improve hygiene, especially in public settings.

- Interactive Digital Signage: Kiosks are evolving into interactive digital signage solutions, providing not only self-service capabilities but also dynamic content delivery and advertising opportunities.

- AI and Chatbots: Integration of artificial intelligence (AI) and chatbots allows kiosks to offer advanced user interactions, including natural language processing and personalized recommendations.

- Modular Kiosk Design: Modular kiosk designs enable businesses to adapt kiosks for various applications and easily upgrade components, enhancing flexibility and longevity.

Key Market Segments

Component

- Hardware

- Software

- Services

Location

- Indoor Kiosks

- Outdoor Kiosks

End-User Industry

- Retail

- BFSI

- Hospitality

- Transportation

- Healthcare

- Other End-User Industries

Regional Analysis

By 2023, North America held a dominating market share on the Self-Service Kiosk market, capturing more than 37.2% share. The dominance of the region is due to the early adoption of cutting-edge technology and a robust economic environment. The well-established industries of hospitality and retail are in the forefront of using self-service kiosks to improve customer experiences and simplify operations. The demand for Self-Service Kiosk in North America was valued at US$ 8.8 billion in 2023 and is anticipated to grow significantly in the forecast period.

Europe has also played an important part within the Self-Service Kiosk market in 2023 which accounted for a significant part. European countries, including Europe, including the United Kingdom, Germany, and France are witnessing an increase in self-service kiosks, particularly in banking, retail and food service. The focus of the region on enhancing customer interaction and reducing operational expenses has prompted the introduction of self-service services, adding to the market share.

The Asia-Pacific (APAC) region witnessed an extraordinary growth rate within the Self-Service Kiosk market, with countries such as China, Japan, and India being the leaders. The rapid growth of urbanization, the expanding retail market, and the growing demands for convenience from consumers has led to the rise of self-service kiosks in a variety applications such as ordering food at restaurants to self-checkouts in supermarkets. The dynamic of the APAC consumer market as well as the increasing popularity of payment options that are digital are further fueling the development of self-service kiosks across the region.

Latin America showcased a growing demand for kiosks with self-service in 2023. While the market share of Latin America was comparatively lower than other regions, its potential for growth was clear. Self-service kiosks’ adoption in areas such as telecoms, banking and government services proved the readiness of the region to adopt self-service technology.

In the Middle East and Africa (MEA) region saw a rapid growth in the Self-Service Kiosk market. With the goal of the improvement of customer experience and increasing effectiveness, MEA countries, particularly in the Gulf Cooperation Council (GCC) region, have embraced self-service kiosks in areas such as hospitality, healthcare and transportation. MEA’s market share is small, but its dedication to self-service options suggests that it will grow significantly in the near future.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players refer to the leading and influential companies that are driving growth and innovation in the self-service kiosk industry. Analyzing key players involves assessing their market position, solutions, capabilities, and strategic moves.

Top Player’s Company Profiles

- NCR Voyix Corporation

- Diebold Nixdorf

- KIOSK Information Systems

- VeriFone Systems, Inc.

- Zebra Technologies Corporation

- Olea Kiosks, Inc.

- Meridian Kiosks

- Advantech Co., Ltd.

- Thales Group

- DynaTouch Corporation

- GRGBanking

- RedyRef Interactive Kiosks

- Other Key Players

Recent Developments

- In 2023, Amazon Go inaugurated its first cash-less convenience store within New York City. With a variety of technology such as self-service kiosks, the store allows customers to shop and make transactions without having to contact with a cashier.

- In 2023, McDonald’s announced plans to install self-service kiosks in every one of its 14,000 U.S. restaurants by the closing date in 2023. The kiosks allow customers to make orders, pay payments, and monitor the progress of their orders in a seamless manner.

- Also in 2023, Walmart initiated a pilot program featuring a new self-service kiosk for hassle-free item returns. This kiosk scans items and generates a receipt, allowing customers to proceed directly to the customer service counter for refunds without waiting in line.

- In 2022, NCR Corporation introduced its latest generation self-service kiosks, namely the NCR SelfServ 80R and 90R. Boasting a modern design, these kiosks incorporate new features such as an enlarged touchscreen display, enhanced audio and video capabilities, and support for multiple payment options.

- In 2022,, Diebold Nixdorf revealed the ProXchange X1, its innovative self-service kiosk. Versatile in application, it serves purposes like retail checkout, restaurant ordering, and hotel check-in. With a modular design, businesses can tailor the kiosk to meet their specific requirements.

Report Scope

Report Features Description Market Value (2023) US$ 23.9 Bn Forecast Revenue (2033) US$ 48.3 Bn CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Location (Indoor Kiosks and Outdoor Kiosks), End-User Industry (Retail, BFSI, Hospitality, Transportation, Healthcare, Other End-User Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape NCR Voyix Corporation, Diebold Nixdorf, KIOSK Information Systems, VeriFone Systems, Inc., Zebra Technologies Corporation, Olea Kiosks, Inc., Meridian Kiosks, Advantech Co., Ltd., Thales Group, DynaTouch Corporation, GRGBanking, RedyRef Interactive Kiosks, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Self-service Kiosk Market?The Self-service Kiosk Market refers to the industry involved in the development, manufacturing, and deployment of self-service kiosk solutions. This market includes hardware, software, and services associated with self-service kiosks.

How do self-service kiosks enhance customer experience?Self-service kiosks improve customer experience by providing convenience and speed. Users can independently access services, reducing wait times and offering easy access to information and transactions.

How big is Self-service Kiosk Market?The global Self-service Kiosk Market is anticipated to be USD 48.3 billion by 2033. It is estimated to record a steady CAGR of 7.3% in the Forecast period 2023 to 2033. It is likely to total USD 25.6 billion in 2024.

Who are the top 12 kiosk manufacturers?However, some prominent kiosk manufacturers include: NCR Voyix Corporation, Diebold Nixdorf, KIOSK Information Systems, VeriFone Systems, Inc., Zebra Technologies Corporation, Olea Kiosks, Inc., Meridian Kiosks, Advantech Co., Ltd., Thales Group, DynaTouch Corporation, GRGBanking, RedyRef Interactive Kiosks, Other Key Players

What are some common applications of self-service kiosks?Common applications of self-service kiosks include ordering and payment in restaurants, ticketing at transportation hubs, check-in services in hotels, and various transactions in retail environments.

What are the future trends in the Self-service Kiosk industry?Future trends in the Self-service Kiosk industry include the integration of artificial intelligence, enhanced user interfaces, increased personalization, and the adoption of contactless solutions.

-

-

- NCR Voyix Corporation

- Diebold Nixdorf

- KIOSK Information Systems

- VeriFone Systems, Inc.

- Zebra Technologies Corporation

- Olea Kiosks, Inc.

- Meridian Kiosks

- Advantech Co., Ltd.

- Thales Group

- DynaTouch Corporation

- GRGBanking

- RedyRef Interactive Kiosks

- Other Key Players