Global Selective Catalytic Reduction SCR Market Size, Share, Growth Analysis By Type (High Dust SCR, Low Dust SCR, Tail-End SCR), By Application (Power Generation, Industrial Boilers and Furnaces, Cement and Lime Kilns, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163110

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

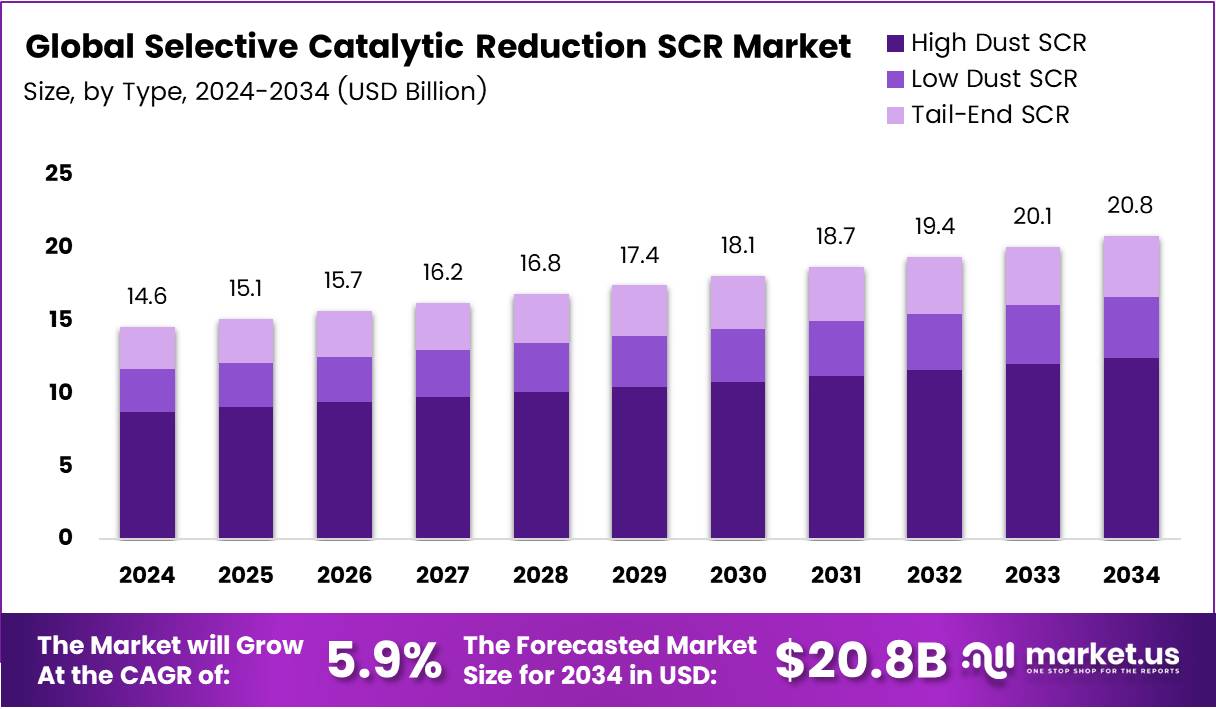

The Global Selective Catalytic Reduction SCR Market size is expected to be worth around USD 20.8 Billion by 2034, from USD 14.6 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

The Selective Catalytic Reduction (SCR) system is an advanced emissions-control technology used to minimize nitrogen oxide (NOx) emissions from diesel and heavy-duty engines. It works by injecting a urea-based solution into exhaust gases, converting harmful NOx into nitrogen and water vapor. This technology plays a vital role in achieving stringent emission standards worldwide.

The Selective Catalytic Reduction SCR Market is witnessing consistent growth, driven by environmental mandates and clean mobility initiatives. Governments and regulators are enforcing stricter emission laws for on-road and off-road vehicles. As a result, automakers and engine manufacturers are adopting SCR systems to ensure compliance while maintaining fuel efficiency and performance reliability across fleets.

Furthermore, industrial applications—such as power plants and marine engines—are increasingly utilizing SCR systems to meet regional emission control area (ECA) standards. These sectors are witnessing a steady shift toward retrofitting existing systems with high-efficiency SCR units, reinforcing market demand and boosting the adoption rate of advanced catalytic formulations and urea dosing technologies.

The rising penetration of diesel vehicles in logistics and heavy industries continues to strengthen market fundamentals. Simultaneously, infrastructure investments in the transport and energy sectors are increasing the installation of SCR units in stationary engines and construction equipment. This trend is expected to sustain the demand trajectory through the next decade.

Moreover, supportive government policies promoting low-emission mobility and cleaner transportation networks are reshaping market dynamics. The shift toward Euro VI and EPA 2027 standards globally underlines the technological transition toward efficient aftertreatment solutions. These regulations stimulate R&D spending in materials, sensors, and real-time monitoring systems integrated within SCR frameworks.

According to Industry Report, the EPA Heavy-Duty Engine Rule targets up to 80% lower NOx emissions compared to current limits starting in model year 2027. This regulation mandates the integration of advanced aftertreatment systems like SCR across U.S. fleets, driving significant compliance investments and accelerating large-scale retrofit programs across the commercial vehicle sector.

Key Takeaways

- The global Selective Catalytic Reduction (SCR) Market was valued at USD 14.6 Billion in 2024 and is projected to reach USD 20.8 Billion by 2034, growing at a CAGR of 5.9%.

- High Dust SCR led the market with a 43.9% share in 2024 due to its effectiveness in handling high-particulate exhaust in power and industrial sectors.

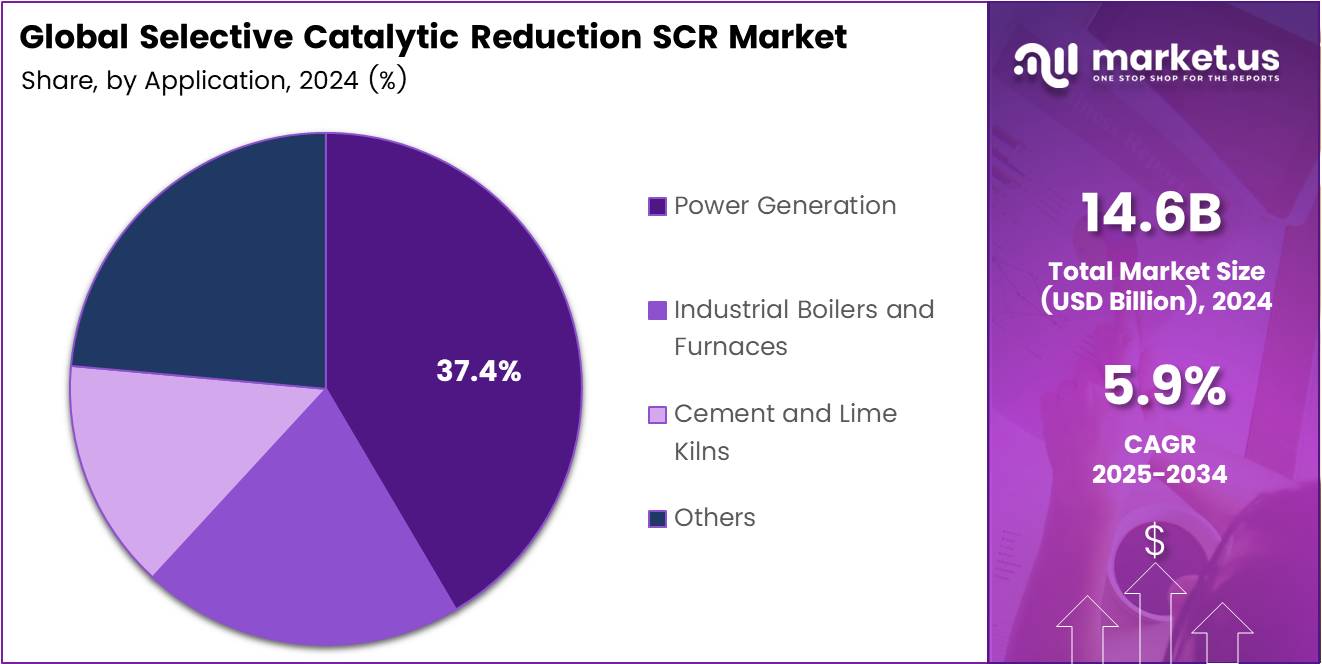

- Power Generation dominated the application segment with a 37.4% share, driven by large-scale adoption in thermal and gas-fired power plants.

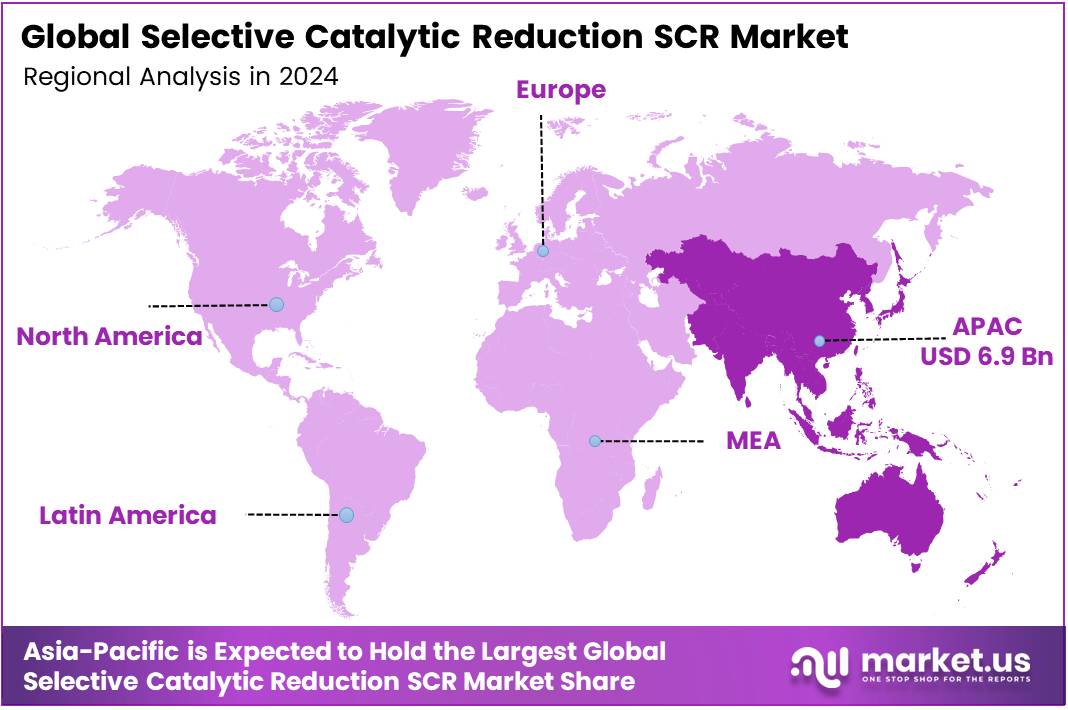

- Asia Pacific emerged as the leading region, accounting for a 47.3% share valued at USD 6.9 Billion, supported by stringent emission norms and industrial growth.

By Type Analysis

High Dust SCR dominates with 43.9% due to its robustness and suitability for heavy-duty industrial applications.

In 2024, High Dust SCR held a dominant market position in the By Type Analysis segment of the Selective Catalytic Reduction (SCR) Market, with a 43.9% share. This dominance is attributed to its exceptional capability to handle flue gases containing high particulate matter, making it ideal for coal-based and biomass power plants. The technology’s efficiency in removing nitrogen oxides (NOx) from heavily contaminated exhaust streams enhances its preference in energy-intensive sectors. Additionally, its proven operational reliability and longer catalyst life further strengthen its market presence.

Low Dust SCR systems are witnessing steady adoption, particularly in industries aiming to achieve higher emission control with cleaner flue gas inputs. These systems are generally positioned downstream of dust collection units, allowing for lower catalyst fouling and maintenance requirements. Their use in combined-cycle gas turbine plants and cleaner fuel operations is expected to rise as emission norms tighten globally. The balance between operational cost and efficiency continues to attract moderate investment in this category.

Tail-End SCR solutions are gaining traction due to their flexibility in retrofitting existing plants. Positioned at the end of the process line, they offer effective NOx reduction with minimal interference in core operations. Although initial costs are higher, their adaptability and low impact on process design make them suitable for diverse industries pursuing sustainability goals.

By Application Analysis

Power Generation dominates with 37.4% due to the extensive integration of SCR systems in thermal and gas-fired plants.

In 2024, Power Generation held a dominant market position in the By Application Analysis segment of the Selective Catalytic Reduction (SCR) Market, with a 37.4% share. The segment’s leadership stems from the rising installation of SCR systems in coal, gas, and biomass power plants to comply with stringent emission regulations. As governments push for cleaner energy, utilities increasingly deploy SCR to minimize NOx emissions, improving air quality. The continued modernization of thermal plants ensures sustained growth in this segment.

Industrial Boilers and Furnaces represent a vital application area for SCR technologies. These units are prevalent across manufacturing, food processing, and chemical sectors. The push to enhance fuel efficiency and reduce industrial emissions has accelerated the adoption of SCR in this category. Industries are focusing on retrofitting existing systems with advanced catalysts to meet evolving environmental standards.

Cement and Lime Kilns are progressively integrating SCR systems to control emissions from combustion processes. These kilns generate substantial NOx levels due to high-temperature operations. The integration of SCR units ensures compliance with local emission caps while improving operational sustainability. Investments in green construction further support SCR adoption within cement production facilities.

Others include diverse sectors such as waste incineration, glass manufacturing, and pulp & paper. These industries are recognizing the benefits of SCR in reducing industrial emissions while ensuring operational efficiency. The increasing emphasis on clean air and sustainability across industrial domains supports the gradual expansion of SCR implementation within these varied applications.

Key Market Segments

By Type

- High Dust SCR

- Low Dust SCR

- Tail-End SCR

By Application

- Power Generation

- Industrial Boilers and Furnaces

- Cement and Lime Kilns

- Others

Drivers

Rising Adoption of Emission Control Technologies in Heavy-Duty Diesel Engines Drives Market Growth

The Selective Catalytic Reduction (SCR) market is growing as heavy-duty diesel engine manufacturers increasingly adopt advanced emission control technologies. These systems help meet strict emission norms by converting nitrogen oxides (NOx) into harmless nitrogen and water, improving air quality and engine performance.

Government regulations worldwide are becoming more stringent on NOx emissions, pushing industries such as automotive, marine, and power generation to integrate SCR systems. This regulatory pressure encourages large-scale deployment of SCR units in both on-road and off-road applications.

Emerging economies are also witnessing rapid growth in automotive manufacturing, creating new opportunities for SCR system adoption. The expansion of commercial and passenger vehicle production in countries like India and China is contributing significantly to market expansion.

Additionally, the use of urea-based catalysts, such as AdBlue or DEF, is increasing to improve system efficiency and reduce operational costs. These catalysts enhance the performance and longevity of SCR units, supporting wider acceptance across industrial and transportation sectors.

Restraints

High Installation and Maintenance Costs of SCR Systems Restrains Market Growth

The SCR market faces challenges due to the high installation and maintenance costs associated with these systems. Setting up SCR units requires specialized equipment and skilled labor, making it a costly investment, especially for small and medium-sized enterprises.

In remote or underdeveloped areas, the availability of high-quality urea (AdBlue/DEF) is limited. This shortage disrupts system operation and increases the risk of equipment inefficiency or downtime, restraining market penetration in rural and industrial regions.

Moreover, fluctuations in raw material prices used for catalyst production—such as vanadium, titanium, and other metals—add further pressure on manufacturers. Price volatility affects overall production costs, which can discourage adoption among cost-sensitive industries.

These factors collectively slow down the widespread implementation of SCR systems, particularly in regions with limited infrastructure or financial resources. As a result, despite strong regulatory support, market expansion remains moderate in several developing countries.

Growth Factors

Integration of SCR Systems with Hybrid and Electric Vehicle Platforms Creates Growth Opportunities

The integration of SCR technology with hybrid and electric vehicle platforms presents a major growth opportunity for the market. Automakers are exploring ways to combine SCR with alternative powertrains to reduce emissions during hybrid mode operations, enhancing overall efficiency.

Rising demand for emission control solutions in the marine and shipping sectors is also fueling market opportunities. With global efforts to reduce maritime pollution, SCR systems are becoming essential for complying with International Maritime Organization (IMO) emission standards.

Developing compact and lightweight SCR systems tailored for passenger cars is another key opportunity. These innovations make it easier for automakers to install SCR units without compromising vehicle design or fuel efficiency.

Furthermore, the expansion of SCR applications in power generation and industrial boilers is expected to boost market growth. Industries are adopting these systems to meet environmental compliance standards and minimize air pollution from large-scale combustion processes.

Emerging Trends

Emergence of Advanced Catalyst Materials with Extended Life Cycles Shapes Market Trends

The SCR market is witnessing strong trends driven by advancements in catalyst materials that offer longer lifespans and better performance. These next-generation catalysts reduce maintenance frequency and improve the overall efficiency of emission control systems.

Digital monitoring and IoT-based technologies are becoming increasingly popular for real-time emission tracking. Integration of smart sensors allows industries to monitor NOx levels continuously, optimize urea dosing, and enhance system reliability.

Investments in green hydrogen and ammonia-based SCR systems are also gaining attention. These sustainable alternatives are being developed to minimize carbon footprints and align with global clean energy goals.

Collaboration between original equipment manufacturers (OEMs) and technology providers is another emerging trend. Joint efforts are focused on developing next-generation emission solutions that combine compact design, cost efficiency, and advanced control features to meet future regulatory demands.

Regional Analysis

Asia Pacific Dominates the Selective Catalytic Reduction (SCR) Market with a Market Share of 47.3%, Valued at USD 6.9 Billion

Asia Pacific holds the dominant position in the Selective Catalytic Reduction (SCR) market, capturing a 47.3% share valued at USD 6.9 Billion. The region’s growth is driven by stringent emission norms across China, Japan, and South Korea, alongside rising heavy-duty vehicle production. Expanding industrial activities and strong government initiatives for clean transportation continue to fuel SCR system adoption.

North America SCR Market Trends

North America shows strong growth due to the U.S. Environmental Protection Agency’s (EPA) heavy-duty engine emission rules mandating advanced aftertreatment technologies. High diesel vehicle adoption, infrastructure expansion, and fleet upgrades to meet NOx standards are enhancing market penetration. Additionally, investments in clean diesel and low-emission fleets support long-term regional demand.

Europe SCR Market Trends

Europe remains a mature market for SCR systems, supported by Euro VI regulations and strict NOx reduction requirements. Countries like Germany, the U.K., and France continue investing in sustainable transport infrastructure. The region’s focus on decarbonization, combined with OEM initiatives for greener mobility, ensures consistent market stability and adoption.

Middle East & Africa SCR Market Trends

The Middle East & Africa market is steadily growing, driven by the modernization of industrial facilities and transportation fleets. Rising awareness of emission control technologies and adoption in power generation sectors are shaping future demand. Government efforts toward cleaner energy and improved air quality are encouraging SCR system implementation.

Latin America SCR Market Trends

Latin America witnesses gradual expansion, primarily supported by policy shifts in Brazil and Mexico toward Euro VI-equivalent emission standards. Growing mining, logistics, and construction sectors are pushing the use of diesel vehicles equipped with SCR systems. Economic recovery and regional industrialization further enhance market opportunities across the continent.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Selective Catalytic Reduction SCR Company Insights

ANDRITZ Clean Air Technologies continues to strengthen its position in the SCR market in 2024 by leveraging turnkey pollution control systems aimed at large-scale industrial emitters such as power generation, waste incineration, and heavy manufacturing. The company’s strategy focuses on high-dust and tail-end SCR configurations that help customers meet tightening NOx limits without major process redesign, which is attractive in regions with mature installed assets.

BASF remains a critical SCR catalyst supplier in 2024 with deep intellectual property around advanced catalyst formulations aimed at durability, sulfur resistance, and high conversion efficiency even at lower temperatures. BASF’s presence across both on-road and stationary applications allows it to benefit from increasingly strict vehicle emissions standards as well as regulatory pushes in industrial combustion.

Bosal focuses on exhaust aftertreatment modules, including SCR systems, primarily for light-duty and commercial vehicles. In 2024, Bosal’s positioning is shaped by OEM partnerships and its ability to deliver compact, integrated SCR-on-filter and urea dosing architectures optimized for packaging constraints in modern powertrains.

BOSCH is pushing SCR as part of a broader clean diesel and commercial powertrain efficiency narrative in 2024. Its strengths include dosing control, sensors, and system-level optimization that improve urea consumption, reduce ammonia slip, and ensure compliance over real-driving emissions cycles. BOSCH’s scale, embedded supplier relationships, and software-driven control strategies keep it deeply relevant in the SCR value chain despite rising hybridization and zero-emission policies.

Top Key Players in the Market

- ANDRITZ Clean Air Technologies

- BASF

- BOSAL

- BOSCH

- Ceram-Ibiden

- CONCORD Thermal Efficiency

- Cummins Inc.

- Dürr Systems, Inc.

- Faurecia

- Haldor Topsoe

Recent Developments

- In March 2025, ANDRITZ completed the acquisition of LDX Solutions, expanding its Clean Air Technologies portfolio with advanced air pollution control systems and strengthening its global footprint in the industrial emissions sector.

- In July 2024, Volvo Trucks North America introduced a CARB 2024-Omnibus compliant heavy-duty engine equipped with an advanced after-treatment system featuring SCR, emphasizing the company’s commitment to stricter emission standards and cleaner transportation technologies.

- In March 2024, the U.S. Department of Energy’s Vehicle Technologies Office awarded USD 10.5 million to Cummins, Paccar, and Mahle to develop hydrogen internal combustion engines with integrated aftertreatment systems, promoting ultra-low NOx solutions and supporting SCR-based emission control innovations.

Report Scope

Report Features Description Market Value (2024) USD 14.6 Billion Forecast Revenue (2034) USD 20.8 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (High Dust SCR, Low Dust SCR, Tail-End SCR), By Application (Power Generation, Industrial Boilers and Furnaces, Cement and Lime Kilns, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ANDRITZ Clean Air Technologies, BASF, BOSAL, BOSCH, Ceram-Ibiden, CONCORD Thermal Efficiency, Cummins Inc., Dürr Systems, Inc., Faurecia, Haldor Topsoe Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Selective Catalytic Reduction SCR MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Selective Catalytic Reduction SCR MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ANDRITZ Clean Air Technologies

- BASF

- BOSAL

- BOSCH

- Ceram-Ibiden

- CONCORD Thermal Efficiency

- Cummins Inc.

- Dürr Systems, Inc.

- Faurecia

- Haldor Topsoe