Global Commercial Seed Market By Type(Conventional seeds, Genetically Modified (GM) seeds), By Crop Type(Cereals, Corn, Wheat, Rice, Barley, Others, Oilseeds, Soybean, Canola, Cotton, Sunflower, Others, Fruits & Vegetables, Tomato, Pepper, Brassica, Melons, Others, Other Crops), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 23825

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

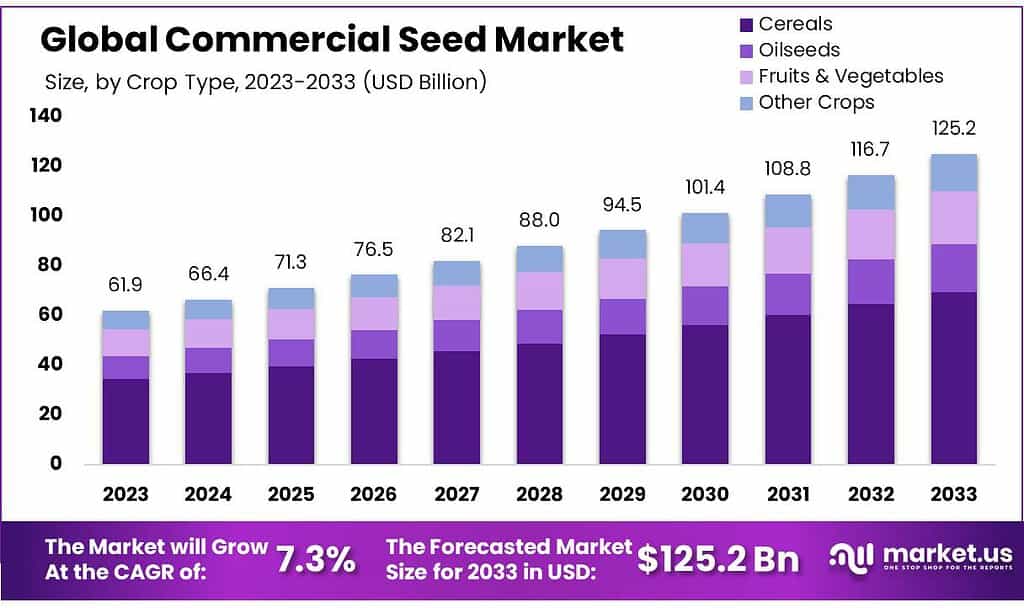

The Commercial Seed Market size is expected to be worth around USD 125.2 billion by 2033, from USD 61.9 Bn in 2023, growing at a CAGR of 7.3% during the forecast period from 2023 to 2033.The market’s growth is largely driven by commercial seed manufacturers’ ability to increase the production of crops and decrease arable land.

By 2050, the world population is expected to exceed 10 billion. This is expected to fuel the demand for food, which will, in turn, drive the market. The rising disposable income per person is predicted to cause an inefficient and excessive consumption of resources.

Due to commercial demand for seeds’ ability to improve crop yield, this is expected to be a lucrative opportunity. This Commercial Seeds market report gives an overview of the market size, value, growth, and other key factors & industry trends.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Commercial Seed Market is anticipated to expand to approximately USD 125.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.3% from 2023 to 2033.

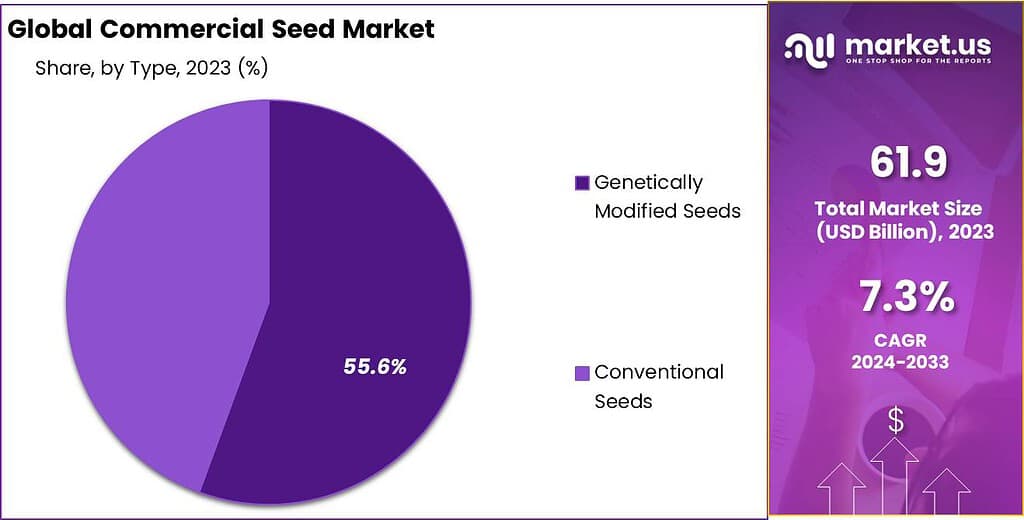

- Type Preference: In 2023, Genetically Modified (GM) Seeds were favored by a majority, capturing 55.6% of the market share. Despite this, Conventional Seeds remain significant due to concerns about environmental impact and farming traditions.

- Crop Preference: Corn seeds were dominant in 2023 across various crop types, particularly in the cereals category, claiming a 42% market share. The diversity of seed types for oilseeds, fruits, and vegetables highlights their importance in meeting various agricultural needs.

- Market Drivers: The increasing world population, expected to surpass 10 billion by 2050, drives the demand for food. Commercial seeds play a pivotal role in improving crop yield to meet this rising demand. Moreover, advancements in technology enhance seed quality and productivity, contributing to market growth.

- Challenges: Rising research and development costs, along with safety and regulatory concerns, pose challenges to the market’s anticipated growth trajectory. Addressing these concerns requires attention to maintain market progression.

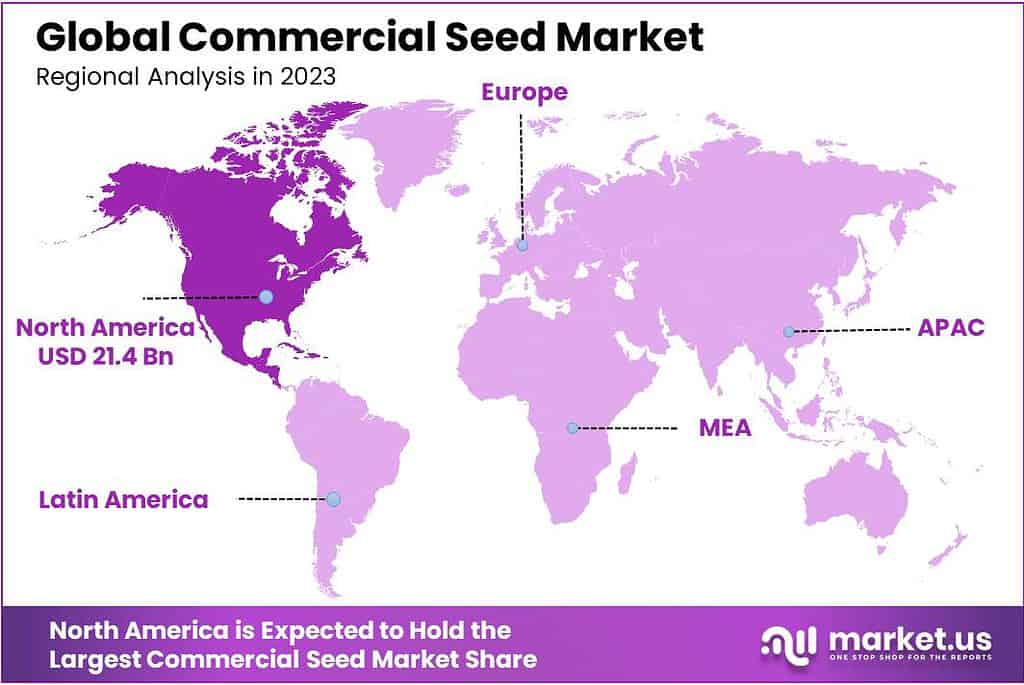

- Regional Insights: North America held the highest revenue share in 2023, with extensive research and supportive regulations driving market growth. Central and South America are expected to witness the fastest growth due to diverse farming practices.

- Key Players and Strategies: The market is highly consolidated, with the top four companies holding over half of the global market share. Strategies employed by industry leaders include collaborations and deals to enhance business performance.

- Opportunities and Investments: Increasing investments in advanced seed development aim to create innovative varieties with improved resilience against diseases and enhanced productivity. This underscores the industry’s commitment to research and development to meet evolving agricultural demands.

By Type

In the Commercial Seed Market of 2023, the majority of users favored Genetically Modified (GM) Seeds. They held a significant portion, capturing around 55.6% of the market share. In the market for seeds used in farming, the favorite in 2023 was Genetically Modified (GM) Seeds. These seeds are changed in a lab to have special qualities, like being able to fight off pests or diseases. They’re made this way to help crops grow better and be stronger, which is useful for modern farming.

Conventional Seeds are natural seeds that haven’t been genetically altered. They are traditional seeds used for planting without any laboratory modifications. Genetically Modified (GM) Seeds became more popular because they have the potential to make crops grow better and resist problems like pests or bad weather. But not all farmers choose them.

Some still go for Conventional Seeds because they worry about how GM Seeds might affect the environment or because they prefer farming the traditional way. What farmers pick depends on lots of things – what they grow, how they farm, what people want to buy, and what the rules say. Both kinds of seeds are important in farming. They each have their place and help different types of farmers with different needs and ways of doing things.

For many of the world’s population, rice is their staple food. Rice demand is expected to increase by around 1.0% annually. This is also correlated with population growth. Because of its large food consumption, Asia has a significant market for the rice segment. However, the main obstacles to growth include high dependence on labor and low yield productivity.

Note: Actual Numbers Might Vary In The Final Report

By Crop Type

Corn seeds were overwhelmingly popular across different types of crops in 2023’s Commercial Seed Market; cereals specifically boasting a 42% market share for Corn. Cereals Group Plant Seeds for Corn (or maize), Wheat, Rice and Barley crops, and more.

Then, in the Oilseeds group, there are seeds for plants like Soybean, Canola, Cotton, Sunflower, and others that make oil. Among these, Soybean seeds were really popular because they’re used in lots of different ways.

And lastly, in the Fruits and vegetables part, you’ll find seeds for crops like Tomato, Pepper, Brassica (which is stuff like broccoli or cabbage), Melons, and tons of other fruits and veggies. Each seed helps grow different kinds of yummy foods we enjoy eating.

In 2023, lots of people wanted Corn seeds for their farms. But apart from the big groups like cereals, oilseeds, and fruits/veggies, there’s this different category called Other Crops. It’s for seeds of some unusual plants that don’t quite belong in those big groups.

Even though Corn was the big winner, all these different seed types are important. They each have their role in farming because they’re needed for different plants people grow and like to eat. People pick seeds based on what they want to grow and what people want to buy.

Key Market Segments

By Type

- Conventional seeds

- Genetically Modified (GM) seeds

By Crop Type

- Cereals

- Corn

- Wheat

- Rice

- Barley

- Others

- Oilseeds

- Soybean

- Canola

- Cotton

- Sunflower

- Others

- Fruits & Vegetables

- Tomato

- Pepper

- Brassica

- Melons

- Others

- Other Crops

Drivers

The commercial seeds market is poised for substantial growth, spurred by several influential factors. The evolution of the commercial seed landscape contributes to this expansion. Before, commercial seeds were mainly for important crops like corn, soybeans, cotton, and canola. But now, they cover a wider range, including plants like alfalfa, sugar beets, papaya, squash, eggplant, potatoes, and apples.

Also, groups like public organizations are working on making commercial seeds for crops such as rice, banana, potatoes, wheat, chickpeas, pigeon peas, and mustard. These new seeds give different economic benefits and have good stuff in them that helps both farmers and people who eat the food.

More people mean more need for food. That’s why as the world’s population gets bigger, we need more food. To meet this growing demand, farmers use commercial seeds. These special seeds help them grow more food and meet their bigger needs. Also, new and better technologies help make these seeds even better. They improve the quality of the seeds, how well they work, and how much they produce. These advancements make people like these seeds more and use them more, making the market for these seeds grow.

Restraints

There are some challenges facing the global commercial seeds market that might slow down its growth. One of these challenges is the increasing cost related to research and development. This rise in expenses could make it tougher for the market to grow as expected. Safety and regulatory concerns might also hold back the growth of the commercial seeds market in the future. These concerns need attention and might affect how things move forward in this market.

This report about the commercial seeds market gives a lot of information, including recent developments, trade rules, how much is imported and exported, production details, ways to improve the value chain, market share, the impact of local and international players, opportunities for new income sources, changes in market rules, strategies for market growth, market size, different areas where the market is growing, new products being approved and launched, expansions to new places, and new technologies in the market.

Opportunities

As investment for advanced and technical product development in commercial seeds increases, more resources and funding will be directed toward creating innovative and high-tech seed varieties with improved traits such as enhanced resilience against diseases, more favorable climate adaptation, and higher productivity.

This investment seeks to stimulate innovation within this industry and will ultimately benefit customers by producing seeds with greater resilience against diseases, better climate adaptation, and enhanced productivity.

Advances in seed technology could present new opportunities to the commercial seeds market. They could result in seeds with higher yields, better nutritional profiles, and greater resistance to environmental stresses; such developments could benefit both farmers and consumers by providing more efficient agricultural practices that ensure greater food security across different regions.

This surge in investment highlights the industry’s commitment to research and development, signaling its proactive response to meeting agriculture’s evolving demands. This increases investment into more sophisticated seed solutions to help meet modern agriculture challenges; creating the opportunity for an ever more robust commercial seeds market in the future.

Challenges

In the dynamic landscape of the commercial seed market, several challenges persist, influencing its trajectory and growth potential. Regulatory complexities present a significant hurdle, with varying standards across regions impacting market access and the introduction of innovative seed technologies. Navigating these diverse regulatory landscapes demands substantial resources and compliance efforts, affecting the speed and efficiency of seed development and commercialization.

Research and development expenses pose another formidable hurdle, necessitating substantial investments into producing genetically enhanced seed varieties with improved traits and traits that require considerable investments for production. This financial strain can hinder seed producers in introducing innovative new varieties onto the market. Market fragmentation adds complexity, compounded by intense competitive pressures. Rivalries among numerous players jostling for market share increase pricing pressures and profit margin reduction, further complicating competition for market leadership and slowing innovation within sectors.

Management of intellectual property rights related to seed technologies, patents and licensing agreements adds another level of complexity. Negotiating these rights and navigating legal frameworks may cause hurdles and disputes that significantly change market dynamics. Addressing these complex challenges requires concerted efforts from industry players, policymakers, and regulatory bodies. Collaborative research, regulatory harmonization, sustainable agricultural practices, and consumer education are key strategies for meeting these obstacles to creating a vibrant seed market.

Regional Analysis

North America held the highest revenue share at over 34.6% in 2023. The region’s market will grow due to extensive R&D and supportive government regulations. Precision farming is a new method of gathering more precise data from farmers. This should increase farmers’ awareness about these seeds.

Central and South America are expected to grow at the fastest CAGR rate of 10.9% during the forecast period. A wide range of farming practices and structures make the agriculture sector an integral part of the region’s economic structure. This includes smallholders in Central America, farmers in Brazil, and Argentine farmers. Latin America plays a significant role in global agricultural trade. Brazil, Argentina, and Chile are the largest exporters of soybeans and corn.

Asia Pacific’s agriculture industry includes both basic agricultural systems in India and Japan. It also has the highest technical standards in Japan. Common features are the dominance of smallholders in the region and the importance of rice. Australasia is an exception.

Note: Actual Numbers Might Vary In The Final Report

Кеу Regions and Countries

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Global market share is high-consolidated, with the top four companies holding over half of it. Syngenta International AG is the dominant player. DuPont Pioneer, Vilmorin & Cie SA are the other major players. The most prominent strategies of industry experts are collaborations and deals to maintain and improve their business performance.

Key companies in this Commercial Seed Industry include DuPont Pioneer, Syngenta International, Sakata Seed Corporation, Pfister Seeds, Vilmorin & Cie, Monsanto Company, Rijk Zwaan Zaadteelt, and other key countries.

Маrkеt Кеу Рlауеrѕ

- American Takii Inc.

- BASF SE

- Bayer AG

- Bejo Zaden B.V.

- East-West Seed Group

- Enza Zaden Beheer B.V.

- Groupe Limagrain Holding

- Namdhari Seeds Pvt Ltd.

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Sakata Seed Corporation

- Syngenta Crop Protection AG

- UPL Limited

Recent Development

- Bayer: Bayer is a German multinational pharmaceutical and life sciences company that is one of the world’s leading producers of commercial seeds. In 2018, Bayer acquired Monsanto, another major seed company. The acquisition made Bayer the world’s largest seed company.

- BASF: BASF is a German multinational chemical company that is one of the world’s leading producers of pesticides and herbicides. BASF is also a major player in the commercial seed market, particularly in Europe and Asia.

Report Scope

Report Features Description Market Value (2023) US$ 61.9 Bn Forecast Revenue (2033) US$ 125.2 Bn CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Conventional seeds, Genetically Modified (GM) seeds), By Crop Type(Cereals, Corn, Wheat, Rice, Barley, Others, Oilseeds, Soybean, Canola, Cotton, Sunflower, Others, Fruits & Vegetables, Tomato, Pepper, Brassica, Melons, Others, Other Crops) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape American Takii Inc., BASF SE, Bayer AG, Bejo Zaden B.V., East-West Seed Group, Enza Zaden Beheer B.V., Groupe Limagrain Holding, Namdhari Seeds Pvt Ltd., Rijk Zwaan Zaadteelt en Zaadhandel B.V., Sakata Seed Corporation, Syngenta Crop Protection AG, UPL Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are commercial seeds, and what distinguishes them from regular seeds?Commercial seeds are specially bred and processed for specific qualities like disease resistance, higher yield, better taste, or suitability for particular growing conditions. They are optimized for commercial farming and often come with specific traits desired by farmers.

What are the different types of commercial seeds available in the market?Commercial seeds include genetically modified (GM) seeds, hybrid seeds, conventional seeds, and organic seeds. Each type offers unique traits and benefits depending on the farming needs and practices.

What are the challenges faced by the commercial seed market?Challenges include stringent regulations on genetically modified organisms (GMOs), concerns regarding biodiversity loss, patent issues related to seed ownership, and resistance among some farmers to adopt new technologies.

-

-

- American Takii Inc.

- BASF SE

- Bayer AG

- Bejo Zaden B.V.

- East-West Seed Group

- Enza Zaden Beheer B.V.

- Groupe Limagrain Holding

- Namdhari Seeds Pvt Ltd.

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Sakata Seed Corporation

- Syngenta Crop Protection AG

- UPL Limited