Global Security System Integrators Market Size, Share, Industry Analysis Report By Service Type (Consulting & Advisory, Implementation & Integration, Risk & Compliance Management, Support & Maintenance), By Security Type (Cybersecurity (Network Security, Endpoint Security, Cloud Security, Identity & Access Management (IAM), Security Operations Center (SOC) Services), Physical Security (Video Surveillance & Analytics, Access Control Systems, Intrusion Detection & Prevention, Converged Security)), By Organization Size (Large Enterprises, Small & Mediumsized Enterprises (SMEs)), By Industry Vertical (Government & Defense, BFSI (Banking, Financial Services & Insurance), Healthcare & Life Sciences, IT & Telecommunications, Energy & Utilities, Retail & Ecommerce, Manufacturing & Critical Infrastructure, Others (Education, Transportation, etc.)), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162265

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Generative AI

- Investment and Business Benefit

- US Market Size

- Top 5 Use Cases

- Emerging Trends

- Growth Factors

- By Service Type

- By Security Type

- By Organization Size

- By Industry Vertical

- Key Market Segment

- Key Regions and Countries

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

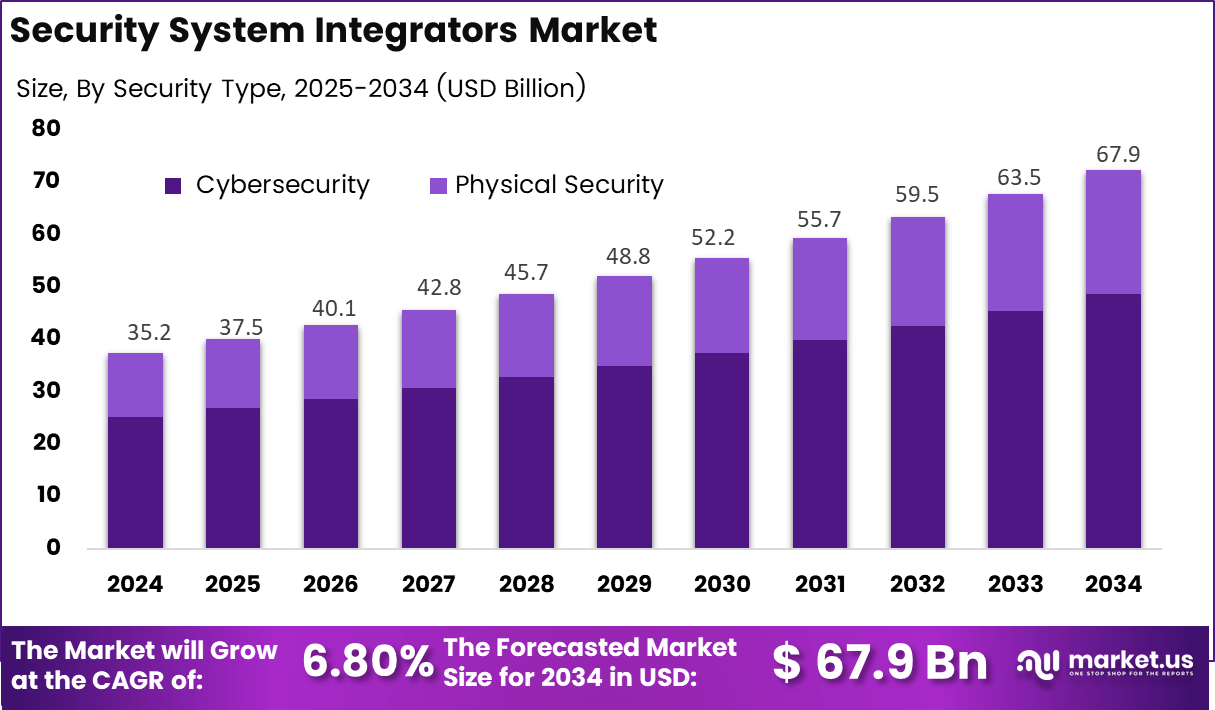

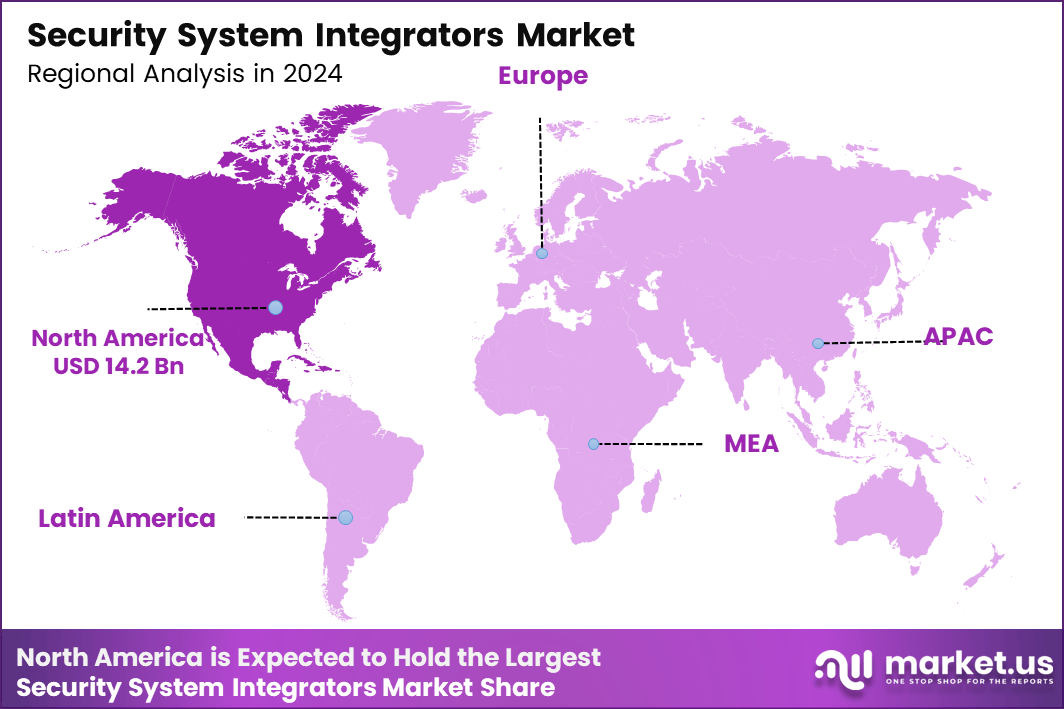

The Global Security System Integrators Market generated USD 35.2 billion in 2024 and is predicted to register growth from USD 37.5 billion in 2025 to about USD 67.9 billion by 2034, recording a CAGR of 6.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 40.4% share, holding USD 14.2 Billion revenue.

The security system integrators market refers to firms that design, implement and manage integrated security solutions for organisations. These firms combine hardware and software such as surveillance cameras, access control systems, alarms, intrusion detection, identity management and cybersecurity modules into unified architectures. They serve sectors such as commercial real-estate, critical infrastructure, transportation, healthcare, retail and government.

Top driving factors for the Security System Integrators Market include the rising frequency and sophistication of cyberattacks and physical breaches. Data from 2024 reports show 68% of organizations encountered hybrid security threats, pushing demand for integrated systems capable of coordinating cybersecurity with physical safety controls. Another major factor is the shift toward cloud-based security solutions, which offers scalability and centralized management to support distributed workforces.

Key Takeaways

- Implementation and Integration services led with 40.3%, reflecting strong demand for end-to-end deployment of security infrastructure.

- Cybersecurity dominated with 71.6%, driven by the increasing need for advanced digital protection and network defense systems.

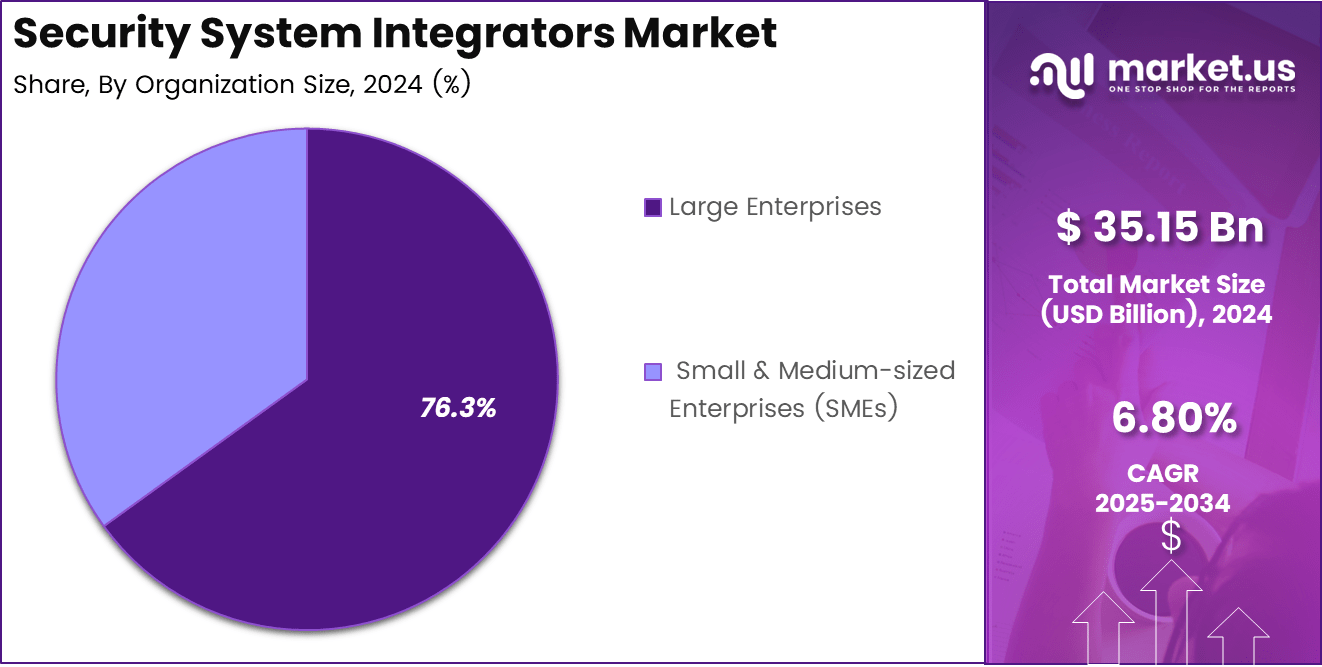

- Large enterprises accounted for 76.3%, highlighting their focus on unified security management across complex IT environments.

- The Government and Defense sector contributed 22.6%, underscoring the importance of national security modernization and cyber resilience programs.

- North America captured 40.4% of the global market, supported by rapid adoption of advanced security frameworks and regulatory compliance.

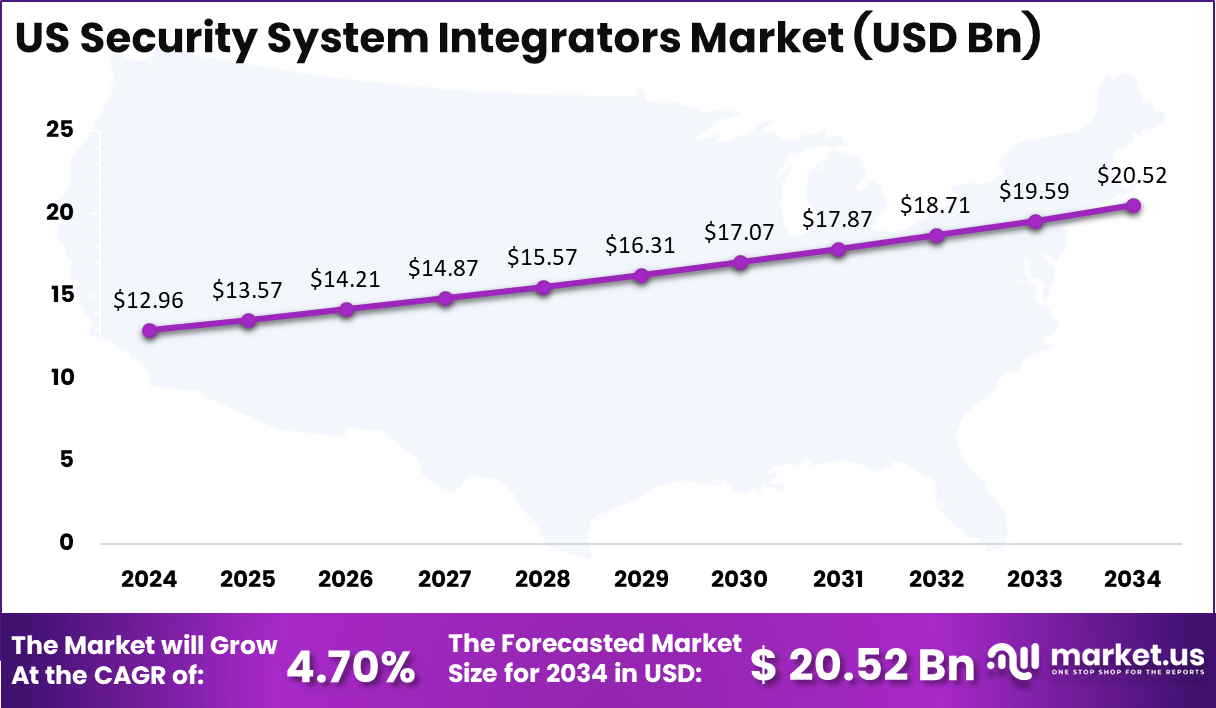

- The US market reached USD 12.96 Billion in 2024 with a steady 4.7% CAGR, driven by continuous investment in defense-grade and enterprise-level cybersecurity integration.

Role of Generative AI

Generative AI is transforming how security system integrators approach threat detection and response. By creating sophisticated models that simulate cyberattacks and unusual behavior patterns, generative AI enhances the ability to identify threats faster and with greater accuracy. This technology automates routine tasks such as incident triage and script generation for containment actions, allowing security teams to focus on complex problems.

Studies show that real-time AI analysis reduces threat dwell time significantly, helping organizations respond more effectively to attacks and adapt proactively to emerging risks. By continuously learning from new data, these AI models maintain defenses that evolve ahead of attacker tactics, making security systems more resilient and dynamic.

Generative AI’s contribution extends beyond cybersecurity to integrating physical and digital security measures in unified systems. For integrators, this means designing more intelligent, seamless solutions that optimize both protection and operational insights for clients. Security environments become smarter and more adaptable, with AI-powered analytics supporting comprehensive threat intelligence and automated responses.

Investment and Business Benefit

Investment opportunities arise from expanding needs for smart city projects, enterprise digital transformation, and digital infrastructure security. Governments and corporations are investing in cybersecurity and physical security convergence, creating openings for integrators who offer multi-disciplinary expertise and scalable solutions.

Moreover, the trend toward remote monitoring and managed security services allows investors to tap into recurring revenue models that support ongoing system maintenance and upgrades. The growing shortage of skilled security professionals further highlights the business potential for integrators offering end-to-end services, including training and support.

Business benefits from using security system integrators include streamlined management through single dashboards, enhanced operational efficiency, energy savings (up to 40% reduction through smart system automation), and improved security effectiveness owing to cross-system data correlation. Additionally, integrators help reduce administrative overhead, prevent costly false alarms, and ensure regulatory compliance with automated logging and reporting features.

US Market Size

The US Security System Integrators Market was valued at USD 12.96 billion in 2024 and is projected to reach approximately USD 20.52 billion by 2034, growing at a steady CAGR of 4.7%. The growth is driven by increasing adoption of AI-based security solutions, digital surveillance, and integrated cybersecurity frameworks across government, defense, and corporate sectors.

Rising incidents of cyberattacks, growing smart city investments, and the modernization of industrial security systems are strengthening demand. Enterprises are prioritizing comprehensive, end-to-end integration services to secure assets, automate monitoring, and enhance real-time threat management capabilities nationwide.

In 2024, North America dominated the security system integrators market with a valuation of USD 14.2 billion, driven by extensive infrastructure protection programs and strict compliance standards. The US leads regional growth, supported by the rapid adoption of IoT-based surveillance and AI-integrated access control systems.

Europe follows, propelled by GDPR-driven cybersecurity initiatives, while the Asia-Pacific (APAC) region is emerging as the fastest-growing hub due to industrial automation and smart governance initiatives. Meanwhile, Latin America and the Middle East & Africa (MEA) are witnessing a gradual uptake, particularly in defense and critical infrastructure sectors.

Top 5 Use Cases

- Critical Infrastructure Protection: Integration of advanced AI-powered systems for safeguarding energy grids, water utilities, and transportation networks against both cyber and physical threats.

- Smart City Surveillance: Deployment of IoT-enabled security networks and facial recognition analytics for urban monitoring, traffic control, and emergency response coordination.

- Enterprise Cybersecurity Management: Unified platforms combining endpoint security, identity management, and intrusion detection, projected to reduce breach incidents by nearly 35–40% by 2030.

- Defense and Border Security: Adoption of multi-layered integration solutions for threat intelligence, perimeter monitoring, and real-time situational awareness in military operations.

- Data Center and Cloud Security: Implementation of GenAI-driven threat prediction and compliance automation to protect high-value data assets across hybrid cloud environments.

Emerging Trends

The security system integrator landscape in 2025 is marked by rapid adoption of AI and Internet of Things (IoT) technologies, which are redefining how security platforms operate. Integrators are moving towards open architecture systems that support seamless interoperability across multiple devices and software brands.

This shift enables the creation of interconnected smart environments that deliver both security and business intelligence insights. Data-driven decision-making powered by integrated video surveillance and AI analytics is becoming a standard expectation, with reported increases of up to 30% in demand for systems that provide operational as well as protective functions.

Another major trend is the growing preference for cloud-based security deployments. Cloud solutions offer scalability, flexibility, and simplified management for enterprise security environments. In 2025, cloud-based security management is expected to account for nearly 59% share of deployments, driven by the needs of organizations for remote and distributed system control.

Growth Factors

Several key growth factors are fueling the expansion of security system integrators. Heightened awareness of cybersecurity threats and stricter regulatory requirements compel organizations to invest in more sophisticated, integrated security solutions. Approximately 26% of the market share in 2025 is attributed to government and critical infrastructure sectors, highlighting the demand for compliance-driven security investments.

Additionally, the growth of IoT devices and smart city initiatives significantly amplifies the need for integrators who can manage complex, multi-layered security architectures across physical and digital domains. Technological advancements also boost growth by enabling more comprehensive and automated security systems. AI-powered threat detection, cloud infrastructure adoption, and interoperability standards reduce complexity and improve system effectiveness.

The shift towards managed security services creates opportunities for integrators to provide ongoing expertise and support. In regions like Asia-Pacific, rapid urbanization and increased security spending translate into the highest growth rates for integrators, illustrating how regional factors combine with global technological trends to drive market expansion.

By Service Type

Implementation and integration services take a prominent role in the security system integrators market with a 40.3% share. These services are critical as organizations look to seamlessly combine multiple security solutions – such as cybersecurity, surveillance, and access control – into a unified system. Integrators help navigate complex technology landscapes and tailor solutions to the specific security needs of each client, ensuring cohesive operation and optimized protection.

As cyber and physical threats evolve rapidly, demand for expert integration grows. Organizations seek vendors who can not only supply hardware and software but also provide seamless implementation with minimal disruption. This focus on integration services reflects the need for holistic security ecosystems that address both legacy systems and new tech.

By Security Type

Cybersecurity dominates the market with a commanding 71.6% share, driven by escalating digital threats and regulatory demands. Organizations prioritize protecting data, networks, and critical infrastructure from sophisticated cyberattacks. Integrators design and deploy advanced security frameworks that include threat detection, prevention, response, and compliance management, aimed at mitigating evolving cyber risks.

The rising prevalence of hybrid work models and cloud adoption fuels cybersecurity’s critical role. Enterprises require comprehensive solutions that integrate cybersecurity into overall security systems, reducing vulnerabilities across physical and digital domains, which substantially lifts demand in this segment.

By Organization Size

Large enterprises dominate demand with a 76.3% market share due to their complex security requirements spanning multiple sites and technologies. The size and scale of these organizations necessitate integrated, robust security systems to protect assets, intellectual property, and personnel across extensive operations. They often have dedicated budgets to invest in comprehensive security integration services.

These enterprises face increased regulatory scrutiny, the need for risk mitigation, and heightened awareness of cyber and physical threats, all driving investment in advanced security solutions. They value vendors with the expertise to deliver end-to-end integration across multi-layered security architectures.

By Industry Vertical

The government and defense vertical commands a 22.6% share of the market, driven by the need to secure critical infrastructure, sensitive information, and national security interests. This sector demands highly specialized integration solutions that comply with strict regulatory frameworks and withstand sophisticated threat scenarios.

Government initiatives toward digital transformation, infrastructure protection, and modernization of defense systems further support robust market demand. Security integrators serve as strategic partners to governments to create tailored, scalable, and resilient security frameworks that address both cyber and physical risks.

Key Market Segment

By Service Type

- Consulting & Advisory

- Implementation & Integration

- Risk & Compliance Management

- Support & Maintenance

By Security Type

- Cybersecurity

- Network Security

- Endpoint Security

- Cloud Security

- Identity & Access Management (IAM)

- Security Operations Center (SOC) Services

- Physical Security

- Video Surveillance & Analytics

- Access Control Systems

- Intrusion Detection & Prevention

- Converged Security

By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

By Industry Vertical

- Government & Defense

- BFSI (Banking, Financial Services & Insurance)

- Healthcare & Life Sciences

- IT & Telecommunications

- Energy & Utilities

- Retail & E-commerce

- Manufacturing & Critical Infrastructure

- Others (Education, Transportation, etc.)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Cyber and Physical Security Threats

The increasing frequency of cyberattacks and physical security breaches has emerged as a primary driver for the security system integrators market. Organizations face escalating risks to their critical infrastructure and sensitive data, creating a strong demand for integrated and unified security solutions that combine cybersecurity, surveillance, and access control.

This integrated approach minimizes vulnerabilities by providing a comprehensive platform that addresses multiple threat vectors simultaneously. The need to comply with growing regulatory requirements related to data and infrastructure protection further accelerates adoption of these systems by enterprises and government bodies.

Due to this rise in hybrid security threats, organizations are compelled to adopt advanced integration services tailored to evolving risks, positioning security system integrators as essential partners for secure operational environments. This trend is expected to sustain market growth, particularly among critical infrastructure clients and regulated industries where security is paramount.

Restraint Analysis

High Initial Costs and Complex Integration

A significant restraint limiting the security system integrators market is the high upfront cost and complexity involved in integrating diverse security components. Deploying integrated solutions requires considerable capital investment encompassing hardware, software, and professional services, making it less accessible, especially for small and medium-sized enterprises.

The integration process often involves technical challenges like interoperability issues, legacy system compatibility, and adherence to stringent compliance standards such as GDPR or NIST, which can delay projects and increase total expenditure.

These complexities raise barriers to adoption, where organizations may hesitate due to uncertainty over return on investment and operational disruptions. Additionally, the shortage of skilled professionals capable of managing these sophisticated integrations compounds the problem, slowing implementation and limiting market expansion in some segments.

Opportunity Analysis

Growth of Cloud-Based Security Integration Solutions

The rise of cloud-based security integration presents a significant opportunity for market growth. Cloud platforms offer scalability, flexibility, and centralized management of security systems, which is crucial for supporting distributed workforces and hybrid digital environments.

Organizations increasingly seek cloud solutions to reduce operational costs, simplify updates, and enable integration of cybersecurity with physical security systems in a seamless manner. These cloud offerings also accelerate digital transformation efforts by providing real-time threat detection and simplified administration through remote access.

The penetration of cloud-based security solutions is especially promising among small and medium businesses, which find cloud deployments more cost-effective and easier to scale compared to traditional on-premises systems. This shift opens new market segments and drives innovation in integrated security technologies, with several key players launching cloud-centric platforms tailored to different industries’ needs.

Challenge Analysis

Shortage of Skilled Security Integration Professionals

One of the market’s main challenges is the persistent shortage of skilled cybersecurity and integration professionals. The complexity of modern security ecosystems – with a need to combine IoT, AI-driven surveillance, real-time analytics, and cybersecurity – demands highly knowledgeable experts to deploy and maintain integrated solutions effectively.

However, the supply of trained personnel has not kept pace with demand, leading to shortages that slow down project delivery and increase costs for organizations looking to adopt comprehensive security systems.

This skill gap presents a significant bottleneck, especially for projects requiring customization and continuous monitoring. For integrators, balancing workforce training, recruitment, and retention becomes critical to maintain service quality and client trust. Until this shortage is addressed, the market growth potential may be constrained by limited execution capacity and delayed implementations.

SWOT Analysis

Strengths

- Strong demand driven by rising cybersecurity threats and government-led infrastructure protection programs.

- Expanding adoption of AI, IoT, and cloud-based integration enhances scalability and real-time monitoring capabilities.

- Established players such as Honeywell, Bosch, and Siemens possess diversified portfolios and strong global networks.

- The ability to offer end-to-end solutions combining physical and digital security systems increases customer retention.

Weaknesses

- High implementation costs and complex integration processes limit adoption among SMEs.

- Dependence on skilled professionals and system-specific certifications slows project execution.

- Compatibility challenges between legacy systems and modern technologies cause operational inefficiencies.

- Limited awareness of integrated security benefits in developing economies hampers penetration.

Opportunities

- Rapid growth of smart cities and connected infrastructure projects across emerging markets.

- Rising adoption of Generative AI and predictive analytics is expected to improve threat prevention by nearly 45–50% by 2030.

- Increasing shift toward cloud-native and managed security services offering cost-effective scalability.

- Expansion through strategic partnerships and acquisitions enhances market presence and solution diversity.

Threats

- Escalating cyberattack sophistication increases risk exposure even for advanced systems.

- Regulatory complexities and varying data protection laws across regions pose compliance challenges.

- Growing competition from new AI-based startups offering low-cost, modular integration services.

- Economic slowdowns or reduced government budgets can delay large-scale security modernization projects.

Key Player Analysis

The Security System Integrators Market is led by global technology and defense organizations such as IBM Corporation, Cisco Systems, Inc., Honeywell International Inc., Siemens AG, and Johnson Controls International plc. These companies provide integrated security solutions that combine physical and cyber defense systems, access control, and surveillance networks.

Prominent defense and intelligence solution providers including BAE Systems plc, Thales Group, Raytheon Technologies Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, and General Dynamics Corporation play a crucial role in delivering mission-critical security integrations. Their offerings cover advanced threat detection, encrypted communication systems, and secure network command architectures for defense and homeland security applications.

Global consulting and IT service firms such as Accenture plc, Hewlett Packard Enterprise (HPE), Deloitte Touche Tohmatsu Limited, Leidos Holdings, Inc., Atos SE, Booz Allen Hamilton Inc., Unisys Corporation, and SAIC (Science Applications International Corporation), along with other market participants, focus on digital transformation, risk assessment, and cybersecurity integration.

Top Key Players

- IBM Corporation

- Cisco Systems, Inc.

- Honeywell International Inc.

- Siemens AG

- Johnson Controls International plc

- BAE Systems plc

- Thales Group

- Accenture plc

- Hewlett Packard Enterprise (HPE)

- Deloitte Touche Tohmatsu Limited

- Raytheon Technologies Corporation

- Booz Allen Hamilton Inc.

- Leidos Holdings, Inc.

- Atos SE

- Unisys Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- General Dynamics Corporation

- SAIC (Science Applications International Corporation)

- Others

Recent Developments

- June 2025, IBM introduced the industry’s first unified software to combine AI security and governance for enterprise AI risk management. The new integration of IBM Guardium AI Security with watsonx.governance offers automated risk detection and compliance policy enforcement across AI use cases, enhancing enterprise trust and governance at scale.

- June 2025, Accenture expanded its collaboration with Microsoft on generative AI-powered cybersecurity solutions, addressing the gap where 90% of organizations remain unprepared against AI-augmented cyber threats. The partnership focuses on SOC modernization, AI security, identity management, and migration services.

Report Scope

Report Features Description Market Value (2024) USD 35.15 Bn Forecast Revenue (2034) USD 67.9 Bn CAGR(2025-2034) 6.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Service Type (Consulting & Advisory, Implementation & Integration, Risk & Compliance Management, Support & Maintenance), By Security Type (Cybersecurity, [Network Security, Endpoint Security, Cloud Security, Identity & Access Management (IAM), Security Operations Center (SOC) Services], Physical Security, [Video Surveillance & Analytics, Access Control Systems, Intrusion Detection & Prevention, Converged Security]), By Organization Size (Large Enterprises, Small & Mediumsized Enterprises (SMEs)), By Industry Vertical (Government & Defense, BFSI (Banking, Financial Services & Insurance), Healthcare & Life Sciences, IT & Telecommunications, Energy & Utilities, Retail & Ecommerce, Manufacturing & Critical Infrastructure, Others (Education, Transportation, etc.)), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Cisco Systems, Inc., Honeywell International Inc., Siemens AG, Johnson Controls International plc, BAE Systems plc, Thales Group, Accenture plc, Hewlett Packard Enterprise (HPE), Deloitte Touche Tohmatsu Limited, Raytheon Technologies Corporation, Booz Allen Hamilton Inc., Leidos Holdings, Inc., Atos SE, Unisys Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, General Dynamics Corporation, SAIC (Science Applications International Corporation), Others, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Security System Integrators MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Security System Integrators MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Cisco Systems, Inc.

- Honeywell International Inc.

- Siemens AG

- Johnson Controls International plc

- BAE Systems plc

- Thales Group

- Accenture plc

- Hewlett Packard Enterprise (HPE)

- Deloitte Touche Tohmatsu Limited

- Raytheon Technologies Corporation

- Booz Allen Hamilton Inc.

- Leidos Holdings, Inc.

- Atos SE

- Unisys Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- General Dynamics Corporation

- SAIC (Science Applications International Corporation)

- Others