Global Seaweed Fertilizers Market Size, Share, And Business Benefits By Form (Dry, Liquid), By Active Ingredient (Alginate, Fucoidan, Laminarin), By Crop Type (Fruits and Vegetables, Oilseeds and Pulses, Cereals and Grains, Turf and Ornamental, Others), By Application (Soil Application, Foliar Application, Seed Treatment), By End Use (Agriculture, Household Garden, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156083

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

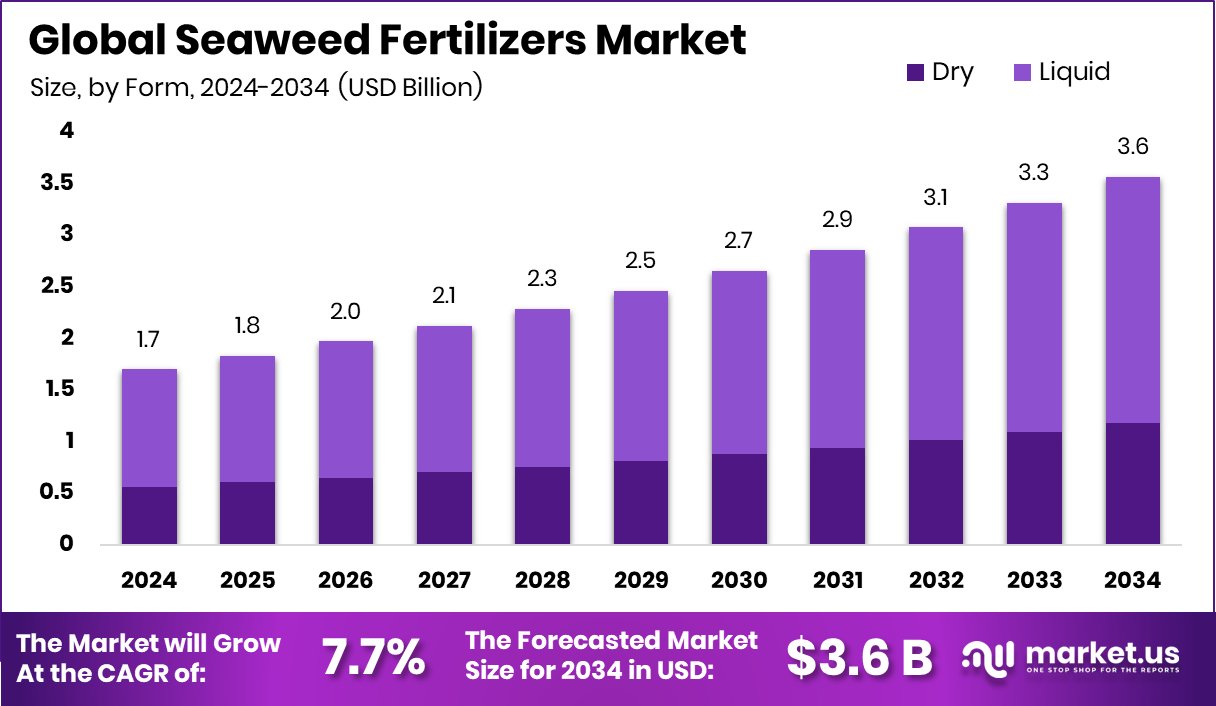

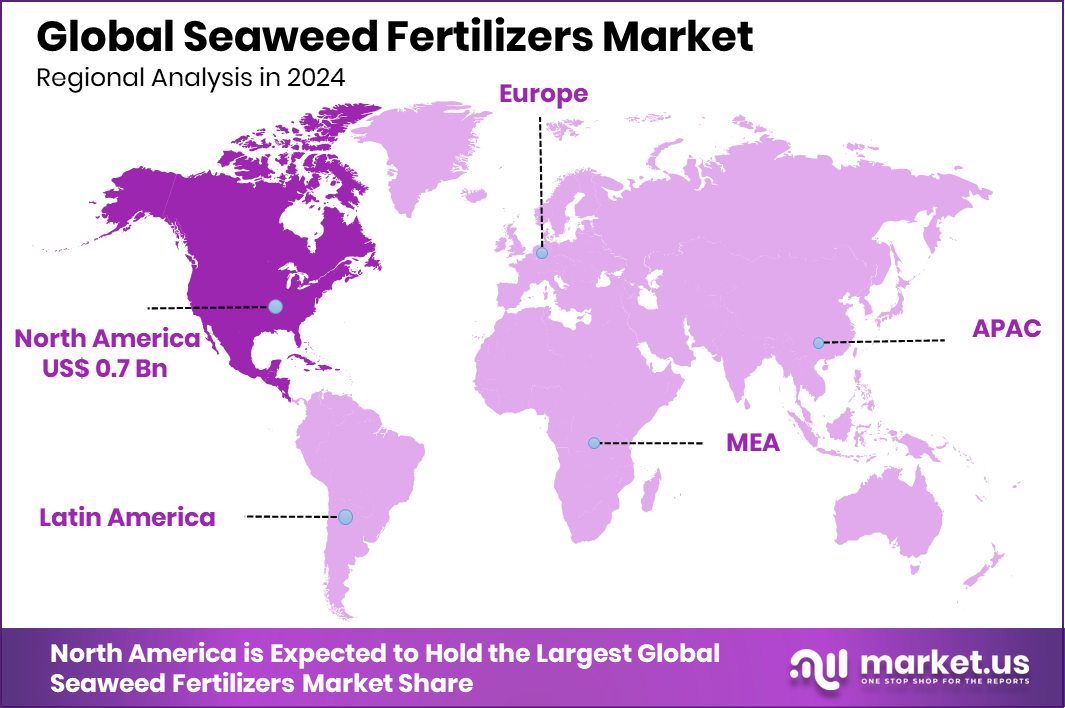

The Global Seaweed Fertilizers Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.7 billion in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034. With a USD 0.7 Bn value, North America drives sustainable fertilizer adoption.

Seaweed fertilizers are natural plant growth enhancers made from different species of marine algae. They are rich in essential nutrients such as potassium, magnesium, nitrogen, and trace minerals, along with bioactive compounds like amino acids and plant growth hormones.

Unlike synthetic fertilizers, seaweed-based formulations improve soil health, boost microbial activity, and enhance plants’ ability to absorb nutrients, making them an eco-friendly option for sustainable farming. Cascadia Seaweed raises CAD 4 million in new funding, strengthening innovation and scaling of seaweed-based solutions.

The seaweed fertilizers market refers to the global trade and application of fertilizers derived from marine algae in farming and gardening. This market is gaining traction due to the rising demand for organic and sustainable agricultural inputs. Governments across many regions are promoting natural fertilizers to reduce chemical usage, improve soil fertility, and cut carbon emissions.

The market is also supported by increasing awareness among farmers and consumers regarding the long-term benefits of seaweed-based products for food quality and environmental sustainability. Carbonwave completes initial close of $5 million Series A round, signaling growing investor confidence in seaweed applications.

One of the major growth factors is the global shift toward organic farming and eco-friendly crop solutions. Farmers are looking for alternatives that can maintain soil fertility while reducing chemical dependence, and seaweed fertilizers fulfill this need effectively. Cascadia Seaweed receives $1.5 million investment from CICE, further encouraging the development of sustainable agricultural inputs.

The demand is further fueled by population growth and the rising need for high-yield farming practices. With limited arable land, seaweed fertilizers help farmers improve crop productivity while maintaining soil health, creating strong adoption in both developed and emerging economies. Seaweed-based bacon company secures $3 million in funding, highlighting the broader opportunities in seaweed-derived products beyond farming.

Key Takeaways

- The Global Seaweed Fertilizers Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.7 billion in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034.

- In 2024, liquid form dominated the Seaweed Fertilizers Market, holding 67.4% due to ease of application.

- Alginate emerged as the leading active ingredient, capturing 39.1% share in Seaweed Fertilizers Market formulations globally.

- Fruits and vegetables accounted for 37.9% of the Seaweed Fertilizers Market, driven by higher crop yield benefits.

- Foliar application led the Seaweed Fertilizers Market with 49.7%, offering faster nutrient absorption and plant growth.

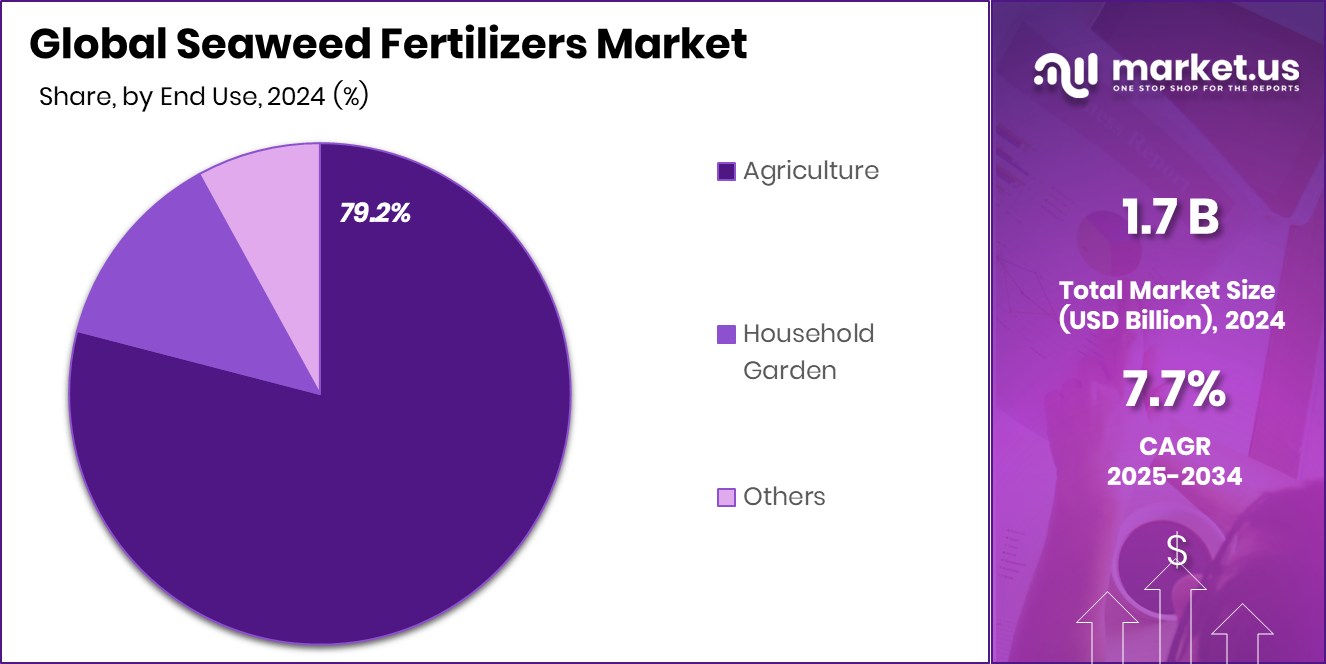

- The agriculture sector dominated the Seaweed Fertilizers Market at 79.2%, reflecting rising demand for sustainable farming practices.

- North America’s 43.8% market dominance reflects rising demand for organic farming.

By Form Analysis

In 2024, liquid form dominated the seaweed fertilizers market with 67.4%.

In 2024, Liquid held a dominant market position in the By Form segment of the Seaweed Fertilizers Market, with a 67.4% share. The preference for liquid formulations is largely due to their ease of application, fast absorption, and compatibility with modern farming practices such as foliar sprays and drip irrigation systems. Farmers increasingly favor liquid seaweed fertilizers because they deliver nutrients directly to the plants in an immediately usable form, leading to faster growth, improved root development, and higher crop resilience against stress conditions like drought or pest attacks.

Another factor supporting this dominance is the suitability of liquid seaweed fertilizers across a wide variety of crops, including cereals, fruits, vegetables, and horticultural produce. Their ability to mix easily with other organic or mineral-based inputs makes them a practical solution for large-scale farming operations, ensuring uniform coverage and efficient use of resources.

The strong share of liquid formulations also reflects the broader trend toward sustainable and precision agriculture. As farmers seek products that save time and enhance efficiency, liquid fertilizers offer a reliable option that supports higher yields while maintaining soil health. This strong adoption rate positions liquid formulations as the most preferred choice in the seaweed fertilizers market, reinforcing their leadership in 2024.

By Active Ingredient Analysis

Alginate emerged as the leading active ingredient, capturing 39.1% market share.

In 2024, Alginate held a dominant market position in the By Active Ingredient segment of the Seaweed Fertilizers Market, with a 39.1% share. Alginate, a natural polysaccharide extracted from brown seaweeds, is widely recognized for its water-retention capacity, soil-conditioning properties, and ability to stimulate plant growth. Farmers and growers increasingly prefer alginate-based fertilizers because they improve soil structure, enhance nutrient absorption, and promote root development, which directly contributes to healthier and more resilient crops.

The dominance of alginate in this segment is also linked to its role in improving soil aeration and microbial activity. By forming a gel-like structure when applied to soil, alginate helps retain moisture, making it highly valuable in regions facing water scarcity or irregular rainfall. This characteristic is particularly important for high-value crops such as fruits, vegetables, and ornamentals that require consistent soil moisture and nutrient availability.

The rising emphasis on sustainable and organic farming practices further strengthens the demand for alginate-based seaweed fertilizers. With its natural origin and proven benefits for soil and crop productivity, alginate continues to be the most trusted active ingredient among farmers. This strong market position underscores its importance in shaping the seaweed fertilizers industry in 2024.

By Crop Type Analysis

Fruits and vegetables accounted for a 37.9% share in crop type usage.

In 2024, Fruits and Vegetables held a dominant market position in the By Crop Type segment of the Seaweed Fertilizers Market, with a 37.9% share. This leadership reflects the growing reliance of horticultural farming on natural and organic inputs to enhance both yield and quality. Fruits and vegetables are highly sensitive crops that require balanced nutrition, improved soil health, and protection against environmental stress. Seaweed fertilizers, rich in bioactive compounds, plant growth hormones, and trace minerals, provide these benefits effectively, making them a preferred choice for growers in this segment.

The adoption of seaweed fertilizers in fruit and vegetable cultivation is also driven by their proven ability to improve crop size, color, taste, and shelf life, which are critical factors in meeting consumer preferences and export standards. Farmers value these fertilizers for boosting root growth and enhancing nutrient uptake, leading to healthier plants and higher productivity.

The strong share of fruits and vegetables in this segment also highlights the rising demand for chemical-free, sustainably produced produce. With consumer awareness about food safety and organic farming on the rise, seaweed fertilizers are becoming integral to horticulture. This positions the fruits and vegetables segment as a key driver of growth in 2024.

By Application Analysis

Foliar application led the market in 2024, holding 49.7% adoption.

In 2024, Foliar Application held a dominant market position in the By Application segment of the Seaweed Fertilizers Market, with a 49.7% share. This dominance is mainly due to the effectiveness of foliar sprays in delivering nutrients directly to plant leaves, allowing for rapid absorption and immediate impact on growth and yield. Farmers prefer foliar application because it bypasses soil limitations, ensuring crops receive essential nutrients even in poor soil conditions or during critical growth stages.

Another factor supporting the popularity of foliar application is its ability to strengthen plant tolerance against stress caused by drought, salinity, or pest pressure. The bioactive compounds and natural growth hormones present in seaweed fertilizers enhance photosynthesis, improve leaf development, and boost overall plant vigor when applied as a spray.

The 49.7% share also reflects the convenience and cost-effectiveness of foliar spraying, which integrates easily with existing farming practices and equipment. By providing quicker results and higher efficiency, foliar application has become the most trusted and widely adopted method, reinforcing its leadership in the seaweed fertilizers market throughout 2024.

By End Use Analysis

Agriculture remained the largest end-use sector, representing 79.2% of overall demand.

In 2024, Agriculture held a dominant market position in the By End Use segment of the Seaweed Fertilizers Market, with a 79.2% share. The widespread adoption of seaweed fertilizers in agriculture is driven by the need for sustainable, high-yield farming practices that can balance productivity with soil health. Farmers are increasingly turning to seaweed-based inputs because they supply essential nutrients, natural growth hormones, and trace minerals that enhance crop growth while reducing dependence on synthetic fertilizers.

The dominance of agriculture also reflects the rising global demand for food, fueled by population growth and shrinking arable land. Seaweed fertilizers are particularly effective in improving soil fertility, increasing nutrient uptake, and boosting crop resilience against environmental stress such as drought and salinity. These qualities make them highly valuable for staple crops as well as cash crops, ensuring consistent yield and quality.

The 79.2% share in 2024 also underscores the alignment of agriculture with global sustainability goals. With growing government support for eco-friendly farming inputs, seaweed fertilizers have become a vital component of agricultural practices, reinforcing the segment’s leadership in shaping the market.

Key Market Segments

By Form

- Dry

- Liquid

By Active Ingredient

- Alginate

- Fucoidan

- Laminarin

By Crop Type

- Fruits and Vegetables

- Oilseeds and Pulses

- Cereals and Grains

- Turf and Ornamental

- Others

By Application

- Soil Application

- Foliar Application

- Seed Treatment

By End Use

- Agriculture

- Household Garden

- Others

Driving Factors

Rising Shift Toward Organic and Sustainable Farming

One of the strongest driving factors for the seaweed fertilizers market is the global shift toward organic and sustainable farming practices. Farmers and governments are actively reducing the use of chemical-based fertilizers because of their harmful effects on soil health, water quality, and the environment.

Seaweed fertilizers provide a natural alternative, as they are rich in nutrients, growth hormones, and bioactive compounds that improve soil fertility and plant growth without causing long-term damage.

Consumers are also becoming more aware of food safety and prefer crops grown with natural inputs, which further pushes farmers to adopt eco-friendly solutions. This trend has positioned seaweed fertilizers as a trusted choice for building a healthier, more sustainable agricultural system worldwide.

Restraining Factors

Higher Production Costs Compared To Chemical Fertilizers

A major restraining factor for the seaweed fertilizers market is the higher cost of production compared to conventional chemical fertilizers. Collecting, processing, and extracting nutrients from seaweed requires advanced techniques and careful handling, which increases the overall price of the final product.

For many farmers, especially in developing regions, affordability is a key concern, and chemical fertilizers remain a cheaper option for boosting yields in the short term. This price gap often discourages large-scale adoption of seaweed fertilizers despite their long-term benefits for soil and crop health.

Unless production technologies become more cost-efficient and government subsidies expand, the higher cost barrier will continue to limit the growth and accessibility of seaweed fertilizers in many regions.

Growth Opportunity

Expanding Government Support For Eco-Friendly Farming Inputs

A key growth opportunity for the seaweed fertilizers market lies in the expanding government support for eco-friendly and sustainable farming practices. Many countries are promoting organic agriculture through subsidies, tax benefits, and awareness programs that encourage farmers to reduce chemical fertilizer use.

Seaweed fertilizers, being natural and environmentally safe, perfectly align with these initiatives. Governments are also funding research to develop advanced formulations that are more efficient and cost-effective, which can help farmers adopt them on a larger scale.

Additionally, international trade regulations are increasingly favoring organic and chemical-free produce, creating strong export opportunities for crops grown with seaweed fertilizers. This rising policy backing opens the door for rapid adoption, positioning seaweed fertilizers as a vital input for future farming.

Latest Trends

Increasing Use Of Liquid Seaweed Fertilizer Sprays

One of the latest trends in the seaweed fertilizers market is the increasing use of liquid seaweed fertilizer sprays. Farmers prefer liquid formulations because they are easy to apply, can be directly absorbed by plant leaves, and provide quicker results compared to traditional methods.

These sprays are highly effective in improving plant growth, boosting resistance to stress, and enhancing the quality of crops such as fruits, vegetables, and cereals. With the rise of modern farming practices like drip irrigation and foliar spraying, liquid seaweed fertilizers fit seamlessly into existing systems.

Their convenience, fast action, and compatibility with other inputs have made them the preferred choice for many growers, reflecting a clear trend toward liquid solutions in 2024.

Regional Analysis

In 2024, North America held a 43.8% share, worth USD 0.7 Bn.

The Seaweed Fertilizers Market shows varied growth patterns across regions, shaped by agricultural practices, government policies, and demand for sustainable inputs. North America emerged as the dominating region in 2024, capturing a 43.8% share valued at USD 0.7 billion.

The region’s leadership is strongly supported by the rising adoption of organic farming, especially in the United States and Canada, where government incentives and consumer demand for chemical-free produce are high. Farmers are increasingly investing in seaweed-based inputs to improve soil health and crop resilience, aligning with sustainability goals.

Europe follows with strong demand, driven by stringent regulations on chemical fertilizers and increasing emphasis on eco-friendly agricultural practices. Asia Pacific is witnessing rapid adoption as countries like India and China focus on improving crop yields to feed their large populations, supported by expanding organic farming initiatives.

In the Middle East & Africa, limited arable land and water scarcity are pushing farmers toward bio-based fertilizers such as seaweed to improve soil quality and moisture retention. Latin America, with its vast agricultural base, is gradually embracing seaweed fertilizers for fruits and vegetables to meet export standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ICL Specialty Fertilizers continues to strengthen its position by offering seaweed-based products designed to improve crop productivity and soil health. The company leverages its global distribution network and expertise in specialty plant nutrition to integrate seaweed formulations into mainstream agriculture. By aligning with farmers’ growing demand for organic and sustainable inputs, ICL is expanding its role in high-value crop markets, especially fruits and vegetables.

Koppert Biological Systems, known for its biological solutions in agriculture, is actively advancing the use of natural inputs such as seaweed fertilizers. The company focuses on crop protection and plant resilience, positioning seaweed as part of a broader sustainable farming toolkit. Its strong emphasis on research and close collaboration with growers allows it to tailor seaweed-based solutions that enhance plant growth and reduce dependency on synthetic inputs.

FMC Corporation also plays a vital role, bringing technological innovation and scalability to seaweed fertilizer production. With its background in crop protection and plant health, FMC integrates seaweed-based biostimulants into its product line, offering farmers solutions that improve nutrient efficiency and stress tolerance. The company’s ability to combine research, advanced formulations, and market reach ensures seaweed fertilizers gain wider adoption.

Top Key Players in the Market

- ICL Specialty Fertilizers

- Koppert Biological Systems

- FMC Corporation

- Qingdao Bright Moon Seaweed Group

- Acadian Seaplants

- BASF SE

- Biolchim

- Yantai Fucoidan Tech Group

Recent Developments

- In March 2025, Koppert introduced Stingray 25 in France, a seaweed-derived product made from Ascophyllum nodosum. It boosts soil microbiological activity, root health, nutrient uptake, stress resistance, and overall crop yield. This launch marks a notable move in Koppert’s offerings.

- In July 2024, ICL acquired U.S.-based Custom Ag Formulators for around USD 60 million. This move boosted ICL’s liquid and dry formulation capabilities, strengthening their offerings (including seaweed-enriched solutions) in key growing regions across North America.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Dry, Liquid), By Active Ingredient (Alginate, Fucoidan, Laminarin), By Crop Type (Fruits and Vegetables, Oilseeds and Pulses, Cereals and Grains, Turf and Ornamental, Others), By Application (Soil Application, Foliar Application, Seed Treatment), By End Use (Agriculture, Household Garden, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ICL Specialty Fertilizers, Koppert Biological Systems, FMC Corporation, Qingdao Bright Moon Seaweed Group, Acadian Seaplants, BASF SE, Biolchim, Yantai Fucoidan Tech Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Seaweed Fertilizers MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Seaweed Fertilizers MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ICL Specialty Fertilizers

- Koppert Biological Systems

- FMC Corporation

- Qingdao Bright Moon Seaweed Group

- Acadian Seaplants

- BASF SE

- Biolchim

- Yantai Fucoidan Tech Group