Global Satellite Communication (SATCOM) Equipment Market Size, Share, Industry Analysis Report By Component (Transponders, Transceivers, Converters, Amplifiers, Antennas, Others), By Satellite Type (Low Earth Orbit (LEO) Satellites, Medium Earth Orbit (MEO) Satellites, Geostationary Equatorial Orbit (GEO) Satellites), By Application (Earth Observation & Remote Sensing, Communication, Scientific Research & Exploration, Navigation, Others), By End-User (Commercial, Government & Military), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 160024

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- Investment and Business benefits

- Government-led Investments

- U.S. Market Size

- Component Analysis

- Satellite Type Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Latest Trends

- Growth factors

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

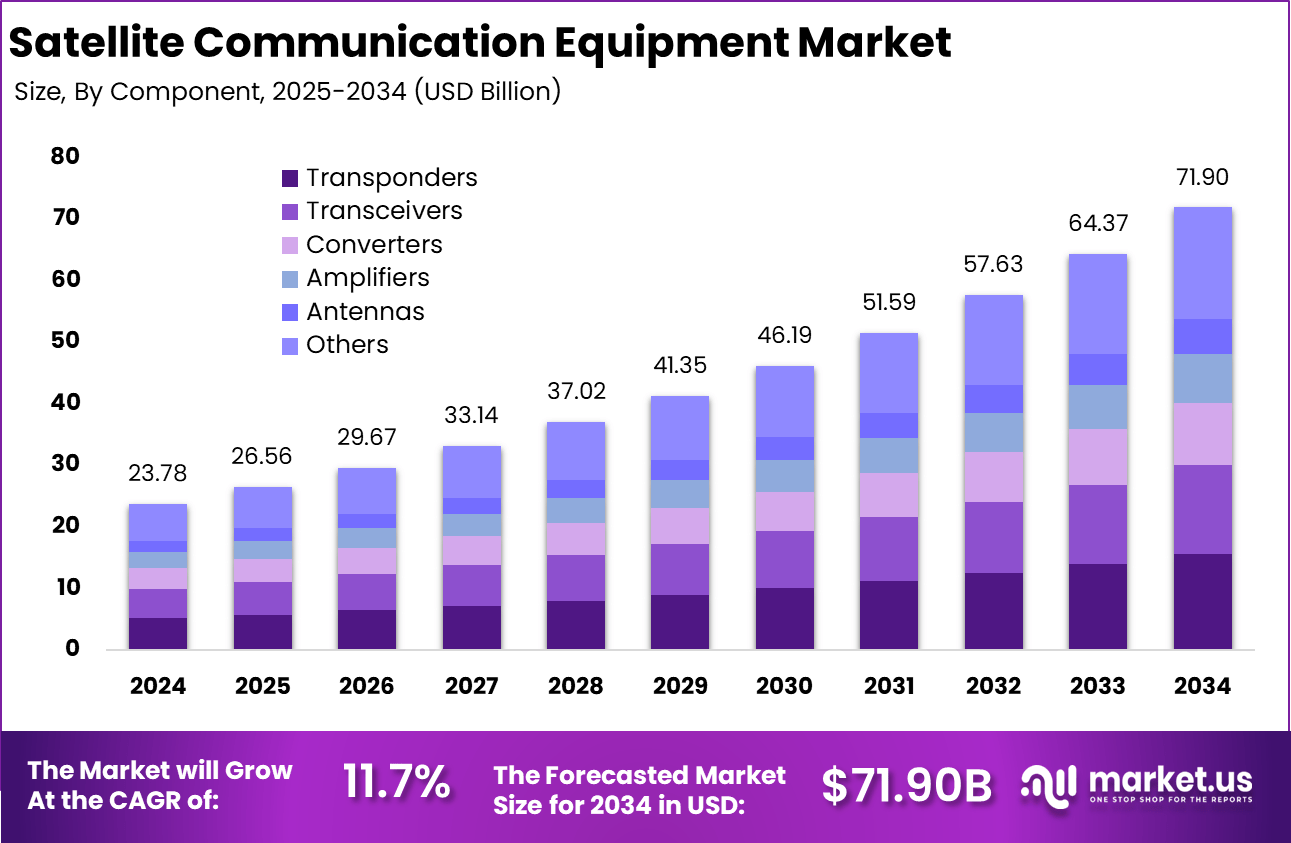

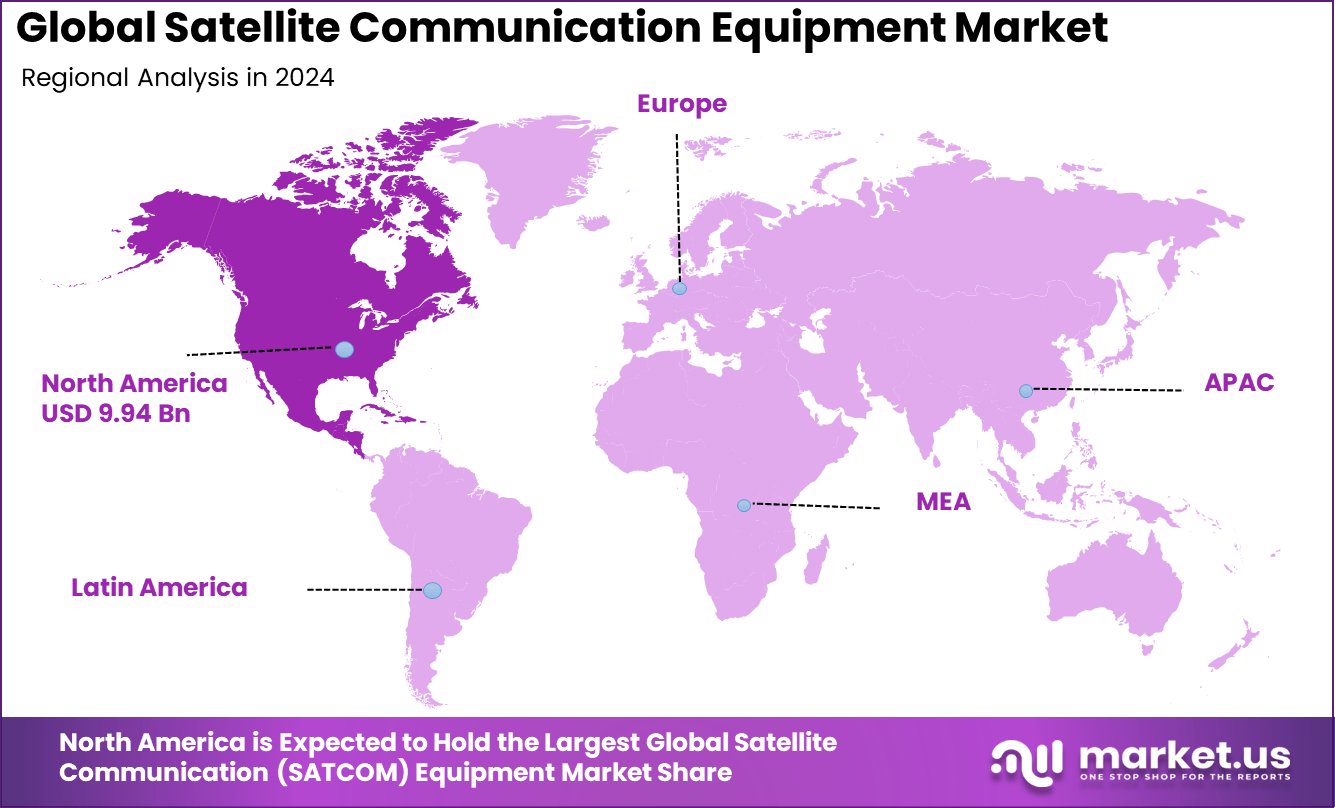

The Global Satellite Communication Equipment Market size is expected to be worth around USD 71.90 billion by 2034, from USD 23.78 billion in 2024, growing at a CAGR of 11.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.8% share, holding USD 9.94 billion in revenue.

The satellite communication equipment market covers hardware and devices used to send, receive, and relay signals via satellites. Equipment includes antennas, transmitters, receivers, transceivers, amplifiers, modulators/demodulators, frequency converters, and ground station gear. It also comprises mobile terminals (satcom-on-the-move), fixed earth stations, satellite payload interface components, and integration or installation hardware

Top driving factors for the SATCOM equipment market include the rapid advancement and deployment of Low Earth Orbit (LEO) satellite constellations, high-throughput satellite (HTS) technology, and increasing integration with 5G networks. The expansion of autonomous and connected vehicles in defense and commercial use also propels demand.

Technological improvements such as phased array antennas, software-defined radios, and AI-driven network management further enhance performance and efficiency. For example, North America leads in market share due to significant investments in secure and high-performance defense communications and broadband satellite networks, with over 60% of global SATCOM equipment demand originating here.

For instance, in September 2025, EchoStar Corporation announced that it would sell its spectrum licenses to SpaceX for approximately $17 billion. This deal, which involves both cash and stock payments, aims to support SpaceX’s Starlink satellite network expansion. The transaction is part of a broader strategy to enhance global satellite broadband services, addressing increasing demand for high-speed internet in remote and underserved areas.

Key Takeaway

- Transponders hold 21.8%, highlighting their critical role in enabling secure and reliable satellite links.

- Low Earth Orbit (LEO) satellites dominate with 72.15%, reflecting the rapid expansion of constellations for broadband and global coverage.

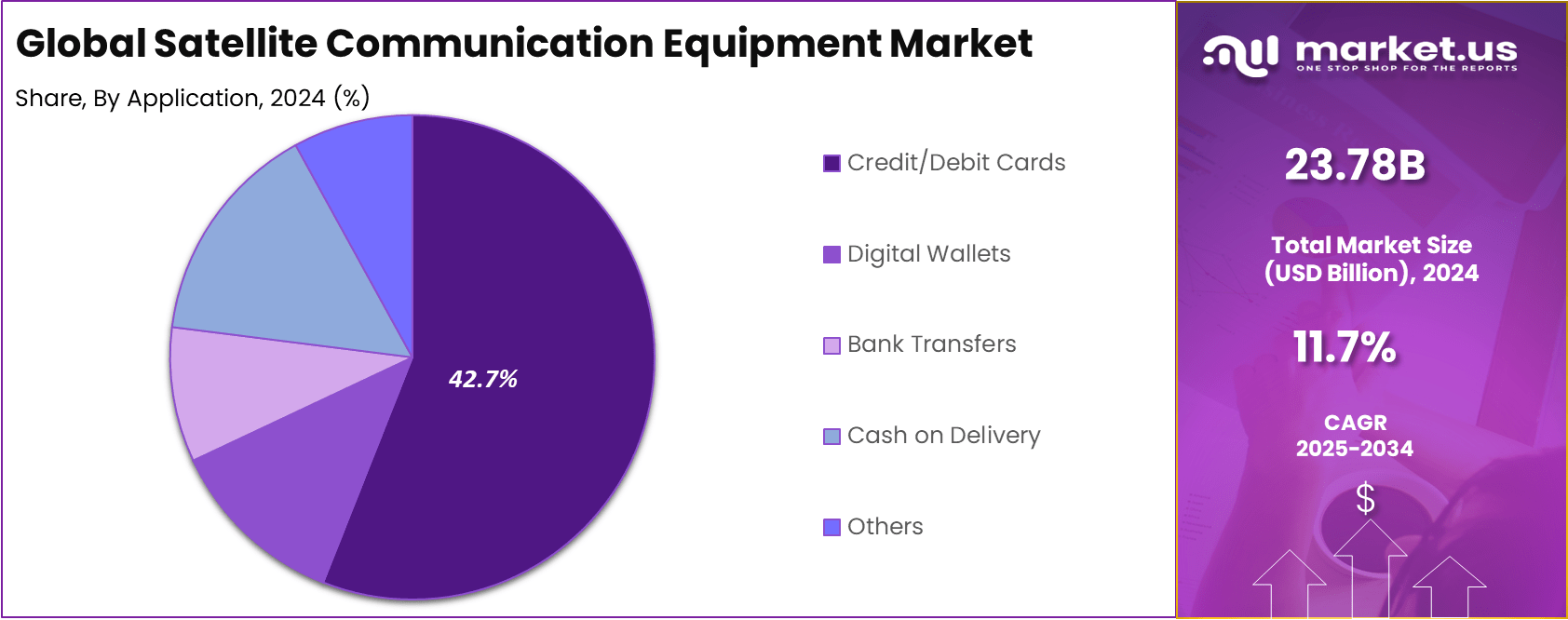

- Communication applications account for 42.7%, supported by rising demand for high-speed connectivity in remote areas.

- Government and military users lead with 68.3%, as defense agencies prioritize secure and resilient satellite systems.

- North America captures 41.8%, driven by large-scale defense contracts and commercial satellite deployments.

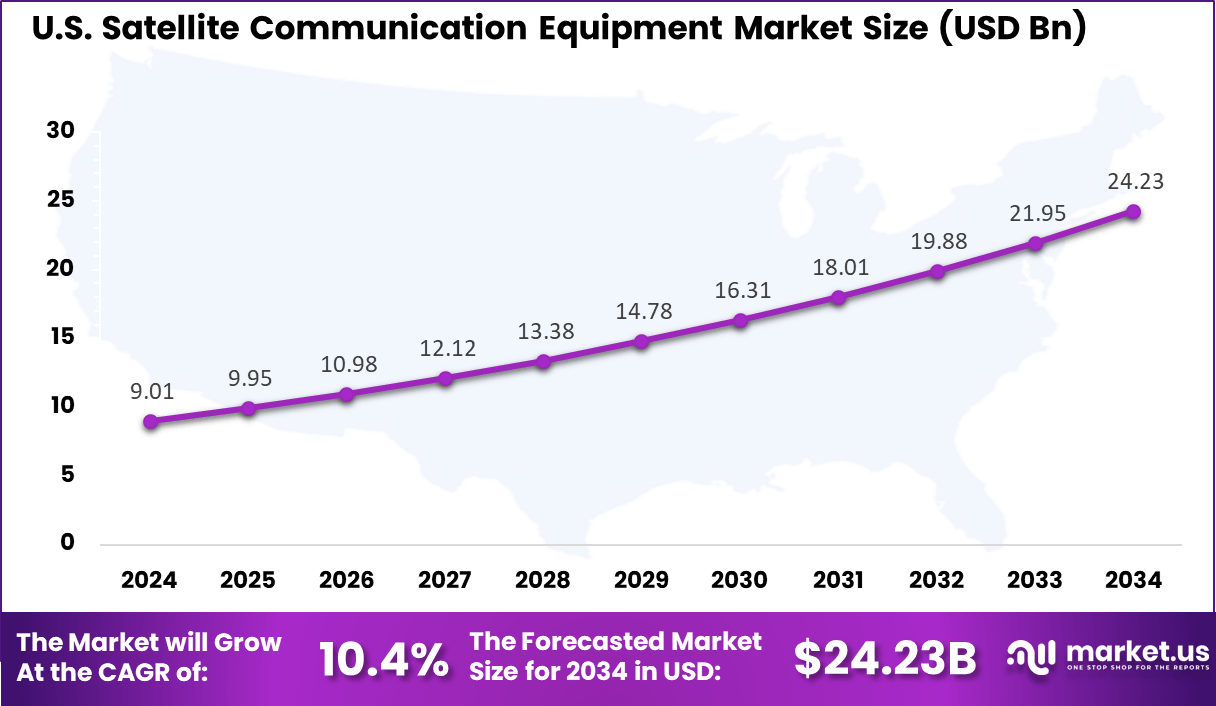

- The US market reached USD 9.01 billion and is advancing at a CAGR of 10.4%, underscoring strong investment in national security and next-generation satellite networks.

Analysts’ Viewpoint

Demand analysis reveals an ever-increasing need for high-speed data transmission and low-latency communication across multiple sectors including telecommunications, government, aviation, and maritime. The rise of broadband internet demand in remote locations, alongside the growing use of IoT devices across industries like agriculture, transportation, and healthcare, drives this appetite.

SATCOM technology enables seamless data flow for these applications, accounting for a growth rate exceeding 12% annually in recent years. Increasing adoption technologies prominently include LEO satellites, HTS, software-defined satellite technology, electronically steered antennas, and hybrid satellite-terrestrial networks.

These advances address challenges like latency, coverage, and bandwidth, enabling more efficient, smaller, and cost-effective equipment. The adoption of AI for network optimization and satellite management is also growing, enabling real-time adjustments for improved communication quality. This technology adoption is motivated by the need for secure, scalable, and flexible communication networks that can operate in hostile or hard-to-access environments.

Key reasons for adopting SATCOM equipment revolve around the need for reliable connectivity where ground networks fall short. Defense sectors require secure, real-time communications for mission-critical operations, while commercial sectors seek to enhance connectivity in aviation, maritime, and remote industrial operations. SATCOM enables rapid communication recovery during disasters and handles over 70% of emergency response communications in remote areas when terrestrial networks fail.

Investment and Business benefits

Investment opportunities in the SATCOM market are growing as satellite deployment accelerates and technology costs decrease. The expansion of LEO mega-constellations requires extensive ground infrastructure and user terminals, generating robust capital inflows into manufacturing and service sectors.

Emerging markets with vast rural and underserved areas present attractive opportunities due to increasing digital inclusion efforts. Investors also find promising prospects in developing advanced antenna and amplifier technologies, such as flat-panel electronically steered antennas, which enhance terminal performance and reduce costs.

SATCOM equipment offers broader coverage, secure links, and high-capacity broadband in regions without terrestrial networks. Industries such as energy, transportation, and media benefit from real-time data transfer, remote monitoring, and uninterrupted connectivity. It also strengthens continuity plans in disaster-prone or remote areas, with over 65% of companies in these zones considering it crucial for risk management.

Government-led Investments

Government-led investments play a pivotal role in the development and growth of the SATCOM equipment market. The US Department of Defense, for instance, is investing heavily with contracts worth over $1.7 billion forecasted in 2024 to support next-generation military space and SATCOM infrastructure.

Governments worldwide are fostering research and development efforts to enhance SATCOM capabilities, focusing on secure and flexible communication solutions. Policy developments related to satellite spectrum allocation also support the expansion of commercial SATCOM services.

In India, for example, the regulatory framework for satellite spectrum allocation is advancing, facilitating market entry for private satellite service providers and stimulating further investments. These government initiatives are critical in shaping the future landscape of satellite communications, supporting both national security and commercial growth.

U.S. Market Size

Within North America, the United States plays a central role, advancing the market with innovative satellite communication programs and a strong defense-driven demand. The market is also projected to expand steadily at a 10.4% CAGR, reflecting consistent growth in both government and commercial usage.

Government initiatives like the Rural Digital Opportunity Fund (RDOF) are driving broadband expansion, while the rise of LEO satellite constellations (e.g., Starlink) is enhancing connectivity nationwide. Additionally, the need for secure communication in defense, aviation, and emergency services, coupled with advancements in 5G integration and IoT applications, is further fueling market growth.

For instance, in March 2025, L3Harris Technologies unveiled its upgraded multiband antenna designed for satellite communication (SATCOM) and electronic warfare jamming applications. This advancement highlights U.S. dominance in the global SATCOM equipment market, as the country continues to lead in defense and security innovations.

In 2024, North America held a dominant market position in the Global Satellite Communication (SATCOM) Equipment Market, capturing more than a 41.8% share, holding USD 9.94 billion in revenue. This dominance is due to the strong demand for high-speed internet, particularly in rural and underserved regions.

The rapid deployment of LEO satellite constellations, such as Intelsat and L3Harris Technologies, is boosting connectivity. Additionally, the region’s robust defense and aerospace sectors drive SATCOM adoption for secure communication. Government initiatives, including the Rural Digital Opportunity Fund (RDOF), further promote infrastructure expansion, ensuring widespread connectivity and market growth.

For instance, in April 2024, CNH Industrial expanded its network connectivity by collaborating with Intelsat, a leading provider of satellite communication (SATCOM) solutions. This partnership aims to enhance the company’s agricultural and industrial operations across North America by leveraging Intelsat’s satellite infrastructure for reliable, high-speed communication in remote and rural areas.

Component Analysis

In 2024, The Transponders segment held a dominant market position, capturing a 21.8% share of the Global Satellite Communication (SATCOM) Equipment Market. This dominance is due to the essential role transponders play in enabling communication between satellite and ground stations.

As the demand for high-speed data transfer, broadcasting services, and secure government communications continues to grow, transponders are critical in ensuring reliable, high-capacity satellite services. The increasing adoption of LEO satellite constellations and expanding broadband networks further fuel this segment’s growth.

For instance, in September 2022, Airbus agreed to supply advanced satellite communications to the UK armed forces. The deal includes transponders and related technologies for next-generation secure satellite systems. These components are vital for delivering reliable, high-capacity, and secure communication services, supporting military operations in both domestic and international settings.

Satellite Type Analysis

In 2024, Low Earth Orbit (LEO) satellites dominated the market with 72.15% share, as they have become the most widely deployed type of satellite. Positioned at lower altitudes compared to traditional satellites, LEO satellites provide reduced latency and stronger communication capabilities, driving their adoption for modern applications such as broadband internet and secure tactical communications.

Their cost-effectiveness and ability to work in large constellations make LEO satellites ideal for addressing growing connectivity demands. These deployments are particularly attractive for global broadband projects and government-driven communication missions, where quick data transfer and real-time feedback are essential.

Application Analysis

In 2024, The Communication segment held a dominant market position, capturing a 42.7% share of the Global Satellite Communication (SATCOM) Equipment Market. This dominance is due to the widespread demand for reliable, high-speed communication across various sectors, including broadcasting, telecommunications, and military applications.

The need for seamless connectivity in remote areas, coupled with the growth of 5G networks, satellite internet services, and secure communication for defense and emergency services, has driven strong market growth in this application segment.

For Instance, in September 2025, Honeywell partnered with Redwire to develop next-generation quantum-secured satellite communication systems. This collaboration focuses on enhancing the security of satellite communication (SATCOM) equipment by leveraging quantum encryption technologies, ensuring that sensitive data transmitted via satellite networks remains protected from cyber threats.

End-User Analysis

In 2024, The Government & Military segment held a dominant market position, capturing a 68.3% share of the Global Satellite Communication (SATCOM) Equipment Market. This dominance is due to the critical need for secure, reliable, and real-time communication in defense and national security operations.

SATCOM enables mission-critical connectivity for military communications, intelligence gathering, and tactical operations. Furthermore, governments are increasingly relying on satellite systems for emergency response, disaster management, and border security, fueling consistent demand in this segment.

For Instance, in June 2025, the U.S. Army launched a major initiative aimed at modernizing its satellite communication (SATCOM) capabilities in the Pacific region. The project focuses on upgrading existing military communication infrastructure with advanced satellite technologies, enhancing the Army’s ability to provide secure, high-speed connectivity for operations in remote and contested environments.

Key Market Segments

By Component

- Transponders

- Transceivers

- Converters

- Amplifiers

- Antennas

- Others

By Satellite Type

- Low Earth Orbit (LEO) Satellites

- Medium Earth Orbit (MEO) Satellites

- Geostationary Equatorial Orbit (GEO) Satellites

By Application

- Earth Observation & Remote Sensing

- Communication

- Scientific Research & Exploration

- Navigation

- Others

By End-User

- Commercial

- Government & Military

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Drivers

Increasing Demand for High-Speed Broadband Connectivity

The push for global digital inclusion is driving strong demand for high-speed broadband, especially in remote and underserved regions. Satellite communication is playing a pivotal role, with LEO constellations like Starlink and OneWeb enabling low-latency, high-throughput internet access.

As traditional connectivity solutions struggle with terrain and cost limitations, SATCOM offers a viable, scalable alternative for governments and enterprises aiming to bridge the digital divide and support data-intensive applications across geographies.

For instance, in March 2025, Jio signed a strategic agreement with SpaceX to bring high-speed Starlink satellite internet to India. This collaboration aims to provide satellite-based broadband connectivity across remote and underserved regions of the country, leveraging Starlink’s low Earth orbit (LEO) satellites.

Restraint

High Development and Maintenance Costs

A major restraint in the SATCOM equipment market is the high cost associated with developing, deploying, and maintaining satellite communication infrastructure. Establishing earth stations and launching satellites require substantial upfront capital investment, making entry costly for new companies.

For example, building advanced ground stations equipped with sophisticated antennas and supporting technology involves prolonged lead times and complex procurement processes, placing a financial burden on industry players.

Furthermore, maintenance expenses and technological upgrades add ongoing costs, which can hamper market expansion, particularly in price-sensitive regions. These financial challenges slow adoption rates and limit the deployment of satellite communication solutions in emerging markets despite increasing demand.

Opportunities

Integration with 5G and Hybrid Network Architectures

As 5G networks scale globally, SATCOM is emerging as a powerful complement, especially in rural and hard-to-reach regions. The convergence of satellite and terrestrial networks opens up new use cases, from backhaul support to ultra-low latency edge computing.

This hybrid approach enables seamless connectivity across diverse environments such as urban, remote, and mobile. For SATCOM vendors, aligning with telcos and tech providers presents a significant growth opportunity to embed satellite capabilities within next-generation communication ecosystems.

For instance, in April 2025, L3Harris partnered with Amazon’s Kuiper Government Solutions to deliver hybrid satellite communications solutions. This collaboration aims to provide high-speed and low-latency global connectivity by integrating L3Harris’s communication systems with Kuiper’s satellite network.

Challenges

Market Saturation in Developed Regions

In developed regions like North America and Western Europe, the SATCOM equipment market is approaching saturation. Most infrastructure is already in place, and customer acquisition costs are rising due to intense competition and limited incremental demand.

Vendors face pressure to differentiate through price or innovation, often leading to shrinking margins. This saturation challenges growth prospects and shifts the competitive focus toward emerging markets, new technologies, and niche applications to sustain long-term relevance and profitability.

For instance, in January 2024, EchoStar Corporation completed its merger with DISH Network Corporation, creating a combined entity that positions itself as a major player in the satellite communication (SATCOM) and broadband sectors. This merger aims to address market saturation in developed regions by leveraging both companies’ satellite and terrestrial capabilities to offer more competitive services.

Latest Trends

Emerging trends in SATCOM equipment include the rapid deployment of low Earth orbit (LEO) satellite constellations, which have gained traction for providing global broadband coverage with low latency. Small satellites or “smallsats” are becoming crucial components due to their cost-effectiveness, modular hardware, and ability to provide high-speed 5G network coverage globally.

Startups and operators are mass producing these smallsats, contributing to the proliferation of satellite-based connectivity for various industries such as aviation, maritime, and emergency response. Additionally, satellite systems are increasingly integrating with 5G terrestrial networks to provide seamless hybrid connectivity.

The trend toward more advanced electronically steered antennas (ESA) and materials like gallium nitride (GaN) is also notable, improving equipment efficiency and performance. The Asia-Pacific region is emerging as the fastest-growing market in this sector, driven by government initiatives to bridge the digital divide through satellite communications.

For instance, in March 2025, the UK government made significant strides in advancing its military satellite capabilities with the successful completion of the initial testing phase for the Skynet 6A satellite. As part of the UK Ministry of Defence’s ongoing investment in secure communications, the Skynet 6A satellite is designed to provide critical, high-speed, and resilient satellite communication services to the British Armed Forces.

Growth factors

Growth factors for the SATCOM equipment market include rising demand for reliable, high-speed communication services across sectors like telecommunications, defense, maritime, and oil & gas. The increasing need for uninterrupted data connectivity for IoT, autonomous systems, and smart networks fuels investments in modern SATCOM hardware.

The expansion of satellite networks globally to enhance coverage and capacity necessitates sophisticated and efficient SATCOM equipment. Government and defense spending plays a crucial role in supporting robust and secure satellite communication systems, emphasizing national security needs.

The market is also driven by technological advancements, such as high-throughput satellites and software-defined networking, which enhance satellite system capabilities. Industry reports highlight that North America currently leads the market, with Asia-Pacific showing the fastest growth due to active government programs supporting digital infrastructure modernization.

Key Players Analysis

The Satellite Communication Equipment Market is anchored by global defense and aerospace leaders such as Echostar Corporation, L3Harris Technologies Inc., Thales, RTX, and General Dynamics Corporation. These firms provide advanced satellite terminals, modems, and ground systems to support military, government, and commercial applications.

Commercial and specialized players such as Cobham Satcom, Honeywell International Inc., Viasat, Inc., and Gilat Satellite Networks contribute significantly through broadband solutions, airborne satcom terminals, and VSAT equipment. Aselsan A.Ş, Elbit Systems Ltd., and ST Engineering play important roles in defense-grade communication systems, focusing on tactical connectivity and electronic warfare resilience.

Emerging and innovative providers like Iridium Communication Inc., Intellian Technologies Inc., SpaceX, Campbell Scientific, Inc., and ND SatCom GmbH enhance the market by deploying satellite terminals, ground stations, and antenna systems for both mobility and fixed applications. Other key players continue to expand technological capabilities in satellite broadband, IoT integration, and LEO/MEO-based communication, ensuring wider adoption across aviation, maritime, and remote terrestrial sectors.

Major tech companies

- Echostar Corporation

- L3Harris Technologies Inc.

- Thales

- RTX

- General Dynamics Corporation

- Cobham Satcom

- Honeywell International Inc.

- Viasat, Inc.

- Gilat Satellite Networks

- Aselsan A.Ş

- Iridium Communication Inc.

- Intellian Technologies Inc.

- ST Engineering

- SpaceX

- Elbit Systems Ltd.

- Campbell Scientific, Inc.

- ND SatCom GmbH

- Others

Recent Developments

- In September 2025, EchoStar agreed to sell wireless spectrum licenses to SpaceX for approximately $17 billion. This transaction aims to support Starlink’s satellite network and resolve regulatory concerns raised by the Federal Communications Commission (FCC). The deal includes both cash and stock payments, along with covering EchoStar’s debt interest through 2027.

- In May 2024, Thales acquired Israeli company Get SAT, known for its electronically steered phased array antenna technology. This acquisition strengthens Thales’s capabilities in providing advanced satellite communication solutions for the defense and civil aviation sectors.

Report Scope

Report Features Description Market Value (2024) USD 23.7 Bn Forecast Revenue (2034) USD 71.9 Bn CAGR(2025-2034) 11.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Transponders, Transceivers, Converters, Amplifiers, Antennas, Others), By Satellite Type (Low Earth Orbit (LEO) Satellites, Medium Earth Orbit (MEO) Satellites, Geostationary Equatorial Orbit (GEO) Satellites), By Application (Earth Observation & Remote Sensing, Communication, Scientific Research & Exploration, Navigation, Others), By End-User (Commercial, Government & Military) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Echostar Corporation, L3Harris Technologies Inc., Thales, RTX, General Dynamics Corporation, Cobham Satcom, Honeywell International Inc., Viasat, Inc., Gilat Satellite Networks, Aselsan A.Ş., Iridium Communication Inc., Intellian Technologies Inc., ST Engineering, SpaceX, Elbit Systems Ltd., Campbell Scientific, Inc., ND SatCom GmbH, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Satellite Communication Equipment MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Satellite Communication Equipment MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Echostar Corporation

- L3Harris Technologies Inc.

- Thales

- RTX

- General Dynamics Corporation

- Cobham Satcom

- Honeywell International Inc.

- Viasat, Inc.

- Gilat Satellite Networks

- Aselsan A.Ş

- Iridium Communication Inc.

- Intellian Technologies Inc.

- ST Engineering

- SpaceX

- Elbit Systems Ltd.

- Campbell Scientific, Inc.

- ND SatCom GmbH

- Others