Sample Preparation Market By Product (Instruments, Consumables and Accessories) By Application (Clinical Research Applications, Diagnostic Applications, Genomics Studies, Proteomics Studies, Analytical Testing, Epigenomics & Epigenetics and Other Applications) By Technique (Protein Preparation, Solid-phase Extraction, Liquid-liquid Extraction, Filtration, Purification and Other Techniques) By End-Users (Hospitals, Diagnostic Centres, Pharmaceutical & Biotechnology Industry, Research & Academic Institutes, Food & Beverage Industry and Other End Users), By Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 83176

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

The Global Sample Preparation Market size is expected to be worth around USD 11,774.1 Million by 2033 from USD 6,155.8 Million in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

Sample preparation is a technique used to convert chemical and biological products into a form that can be placed directly in an analytical instrument for further examination. The sample preparation process varies based on the chemical or biological product used for analysis.

The various steps include extraction, isolation, and purification. The quality of the sample used for analysis can significantly impact the accuracy of the research. The process is used in pharmaceutical and biotechnological companies, the food & beverage industry, research & academic institutes, and forensic laboratories to monitor environmental substances.

Current sample preparation trends include miniaturization, automation, high-throughput performance, the ability of new sample preparation instruments to be combined with existing analytical instruments, as well as a reduction in solvent volume and time.

Moreover, continuous innovations in sample preparation and the integration of new technology are expected to boost further the overall expansion of the global sample preparation market.

Key Takeaways

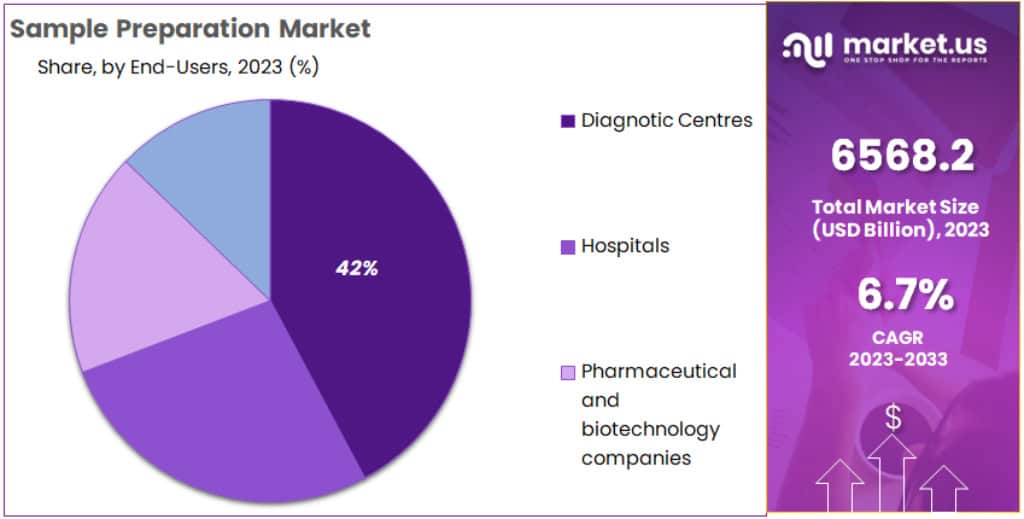

- The Sample Preparation Market was valued at USD 6,155.8 million in 2023.

- It is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% during the forecast period.

- The market is expected to reach USD 11,774.1 million by 2033.

- Consumables dominate the market, accounting for over 63% of the share in 2023.

- Genomics Studies is the leading application segment, with more than a 30% market share in 2023.

- Protein Preparation is the dominant technique, capturing over 37% of the market share in 2023.

- Diagnostic Centres are the major end-users, holding a 42.2% market share in 2023.

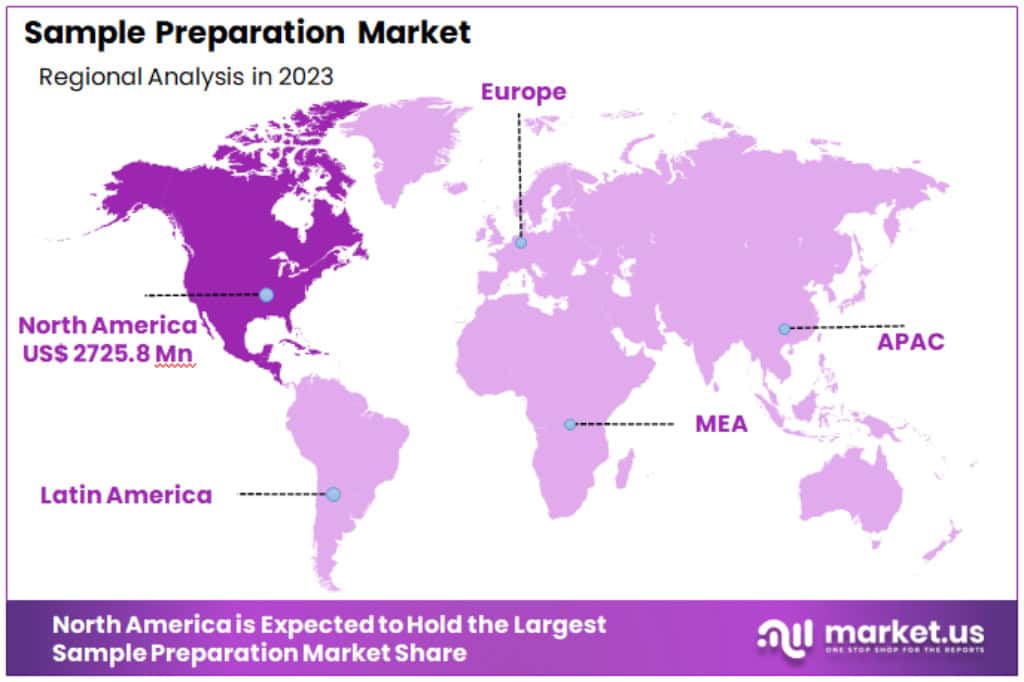

- North America leads the market with a 41.5% share, while Asia Pacific is emerging as a key player.

Product Analysis

In 2023, Consumables held a dominant market position in the Sample Preparation Market, capturing more than a 63% share. This segment includes essential items like Kits, Filters, Columns, Tubes, Plates, and Other Consumables vital for various laboratory processes. The high demand for these products is driven by their recurring usage in numerous experiments and procedures, emphasizing their critical role in research and diagnostics.

The Instruments segment, featuring Sample Preparation Workstations/Systems, Liquid Handling Systems, and other related devices, also plays a significant role. These instruments, including Pipetting Systems and Microplate Washers, streamline laboratory workflows, enhancing precision and efficiency. Although they have a smaller market share compared to Consumables, their impact is significant due to their high value and essential function in sample preparation.

Accessories, though a smaller category, support the primary functions of Instruments and Consumables. This segment’s growth is linked to the rising complexity of research and the need for specialized tools in sample preparation processes.

Application Analysis

In 2023, Genomics Studies held a dominant market position in the Sample Preparation Market, capturing more than a 30% share. This sector’s growth is fueled by advancements in genetic research and the increasing demand for personalized medicine. Genomic studies require precise sample preparation to ensure accurate DNA sequencing and analysis, highlighting the importance of this market segment.

Diagnostic Applications also play a vital role in the market. As the need for rapid and accurate diagnostics grows, especially in healthcare settings, the demand for efficient sample preparation in this area continues to rise. This segment includes applications in disease detection and monitoring, contributing significantly to public health.

Clinical Research Applications, focusing on drug discovery and development, form another key segment. The precision and efficiency in sample preparation are crucial for the success of clinical trials, making this segment essential for the pharmaceutical and biotech industries.

Proteomics Studies and Analytical Testing are also noteworthy segments. Proteomics involves the large-scale study of proteins, essential for understanding cellular processes, while analytical testing spans across various industries, including environmental and chemical.

Epigenomics and Epigenetics, though smaller segments, are gaining traction due to their role in understanding gene expression and regulation without altering the DNA sequence. Other Applications, including agriculture and forensic science, further diversify the market, catering to specialized needs in sample preparation.

Technique Analysis

In 2023, Protein Preparation held a dominant market position in the Sample Preparation Market, capturing more than a 37% share. This technique is crucial in various fields like biotechnology and pharmaceuticals, where protein analysis is essential for drug development and diagnostic tests. The high demand for protein preparation is driven by its critical role in understanding biological processes and disease mechanisms.

Solid-phase Extraction (SPE) is another key segment. SPE is widely used for purifying and concentrating samples, particularly in environmental and clinical applications. Its efficiency in removing impurities and concentrating analytes makes it a preferred choice in many laboratories.

Liquid-liquid Extraction, a traditional technique used in sample preparation, remains significant. This method is essential for separating compounds based on their solubility in different liquids and is commonly used in chemical analysis.

Filtration plays an important role in both research and industrial settings. This technique is indispensable for separating solids from liquids and is widely used in water testing, environmental monitoring, and quality control in various industries.

Purification, a broad segment, encompasses several techniques aimed at isolating specific components from a mixture. It is vital in pharmaceutical manufacturing, biotechnology, and academic research.

Other Techniques, which include newer and more specialized methods, cater to niche applications. They are increasingly important in addressing complex and specific analytical challenges in sample preparation.

End-Users Analysis

In 2023, Diagnostic Centres held a dominant market position in the Sample Preparation Market, capturing more than a 42.2% share. Their leading status is driven by the growing demand for accurate and timely diagnostics, which rely heavily on efficient sample preparation. Diagnostic centers are pivotal in healthcare for disease detection, monitoring, and management.

Hospitals, as another major end-user, significantly contribute to the market. The need for reliable sample preparation in hospitals is critical for patient diagnosis and treatment, making this segment a key player in the overall market.

The Pharmaceutical and biotechnology Industry is also a substantial end-user. This sector relies on sample preparation for drug development and research, playing a crucial role in advancing medical science and producing new therapies.

Research and academic Institutes form an essential part of the market. These institutions often lead in scientific discoveries and innovations, requiring high-quality sample preparation for accurate research outcomes.

The Food and beverage Industry is another significant end-user. In this sector, sample preparation is vital for quality control, safety testing, and compliance with regulatory standards.

Other End Users, including environmental agencies, forensic laboratories, and agricultural sectors, diversify the market. Their varied needs for sample preparation underline the versatility and widespread application of these techniques.

Key Market Segments

Based on Product

- Instruments

- Sample Preparation Workstations/Systems

- Liquid Handling Systems

- Liquid Handling Workstations

- Pipetting Systems

- Reagent Dispensers

- Microplate Washer

- Other Liquid Handling Systems

- Extraction Systems

- Other Instruments

- Consumables

- Kits

- Filters

- Columns

- Tubes

- Plates

- Other Consumables

- Accessories

- Other Sample Preparation Products

Based on Application

- Clinical Research Applications

- Diagnostic Applications

- Genomics Studies

- Proteomics Studies

- Analytical Testing

- Epigenomics & Epigenetics

- Other Applications

Based on Technique

- Protein Preparation

- Solid-phase extraction

- Liquid-liquid extraction

- Filtration

- Purification

- Other Techniques

Based on End-Users

- Hospitals

- Diagnostic Centres

- Pharmaceutical & Biotechnology Industry

- Research & Academic Institutes

- Food & Beverage Industry

- Other End Users

Drivers

- Technological Advances in Sample Preparation: The sample preparation market is growing due to advancements in technology. More efficient and accurate methods are being developed, such as automation and miniaturization. These improvements help in better sample analysis, making laboratories more effective.

- Increased Life Sciences Research: There’s more research in life sciences like genomics and proteomics. This requires precise sample preparation, pushing the market forward. Researchers need methods for various samples, from tissues to fluids, boosting the development of new sample preparation techniques.

Restraints

- Sample Complexity and Variability: Different types of samples can be challenging to prepare consistently. This variability is a hurdle, as it requires tailored approaches for each sample type.

- High Initial Costs: Advanced sample preparation systems are expensive. This high cost can deter smaller labs from using these technologies, slowing down their widespread adoption.

Opportunities

- New Product Development: In October 2022, Thorne HealthTech and GenTegra collaborated to create a new blood DNA collection and extraction kit. This partnership aims to produce a product that’s cost-effective in research and development.

- Market Growth from COVID-19: The pandemic increased the market’s revenue. For instance, in September 2022, startups like Inso Biosciences received grants for COVID-19 research, with a total funding of USD 15.3 million.

- Sample Integrity in Clinical Trials: Agilex Biolabs, an Australian lab, set up a satellite lab for clinical trials in September 2022. This lab helps maintain sample integrity, which is important for accurate results.

- Advancements in Sequencing: The market is growing due to the varying needs in sequencing. Different sequencing types require different sample preparation methods.

Trends

- Pharmaceuticals Leading the Market: The pharmaceutical sector extensively uses sample preparation in product development. It’s crucial for isolating analytes from complex mixtures. Increased pharmaceutical spending, like in South Korea and Italy, is driving this trend.

- R&D Investment Boost: Government and private investments in R&D are rising. This increase supports the adoption of advanced sample preparation instruments. For example, in March 2018, German Research Foundation funded US$ 17.3 million for sequencing research.

- Growing Adoption of Advanced Techniques: Industries are increasingly using advanced techniques like mass spectrometry. This demands high-quality sample preparation, promoting the use of automated systems and driving market growth.

- Expansion in Environmental and Food Safety Research: There’s more research in environmental testing and food safety. This requires accurate sample preparation for detecting contaminants, driving the need for more innovative approaches in this area.

Regional Analysis

In 2023, North America leads the Sample Preparation Market, holding a significant 41.5% share, with a market value of USD 2725.8 Million. This region’s dominance is largely due to its advanced laboratories, innovative approach, and strong pharmaceutical and biotechnology sectors. These factors drive the demand for sophisticated sample preparation techniques in North America.

Meanwhile, Asia Pacific is rapidly emerging as a key player in this market. This region’s growth is driven by its expanding life sciences sector and industrial development. Countries like China and India are increasingly adopting sequencing technologies for various applications, including personalized medicine. The focus on genomics and proteomics research in Asia Pacific offers significant growth opportunities for the sample preparation market.

Key Regions

- North America

-

- The US

- Canada

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Mexico

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Sample Preparation Market is growing because more people need fast, automated ways to prepare samples, and they’re using advanced sequencing technologies more often.

The top companies in this market are QIAGEN N.V., Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent Technologies Inc., and Danaher Corporation. They’re leading because they have a lot of different products, are well-known brands, and sell their products worldwide.

Other important companies in this market include Hamilton Company, Sigma-Aldrich Corporation, Norgen Biotek Corporation, Millipore Corporation, Promega Corporation, Bio-Rad Laboratories Inc., Roche Applied Science, Illumina Inc., and Tecan Group Ltd.

These companies are constantly coming up with new products and spreading their sales networks to get a bigger share of the market. For instance, in 2021, QIAGEN introduced the QIAcube Connect, which is an automated workstation for preparing samples for next-generation sequencing. Thermo Fisher Scientific also released new products in 2021, like the Ion Torrent Ion AmpliSeq Library Prep Kit and the MagMAX DNA Isolation Kit.

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Agilent Technologies Inc.

- Danaher Corporation

- Hamilton Company

- Sigma-Aldrich Corporation

- Norgen Biotek Corporation

- Millipore Corporation

- Promega Corporation

- Bio-Rad Laboratories Inc.

- Roche Applied Science

- Illumina Inc.

- Tecan Group Ltd.

- Other Key Players

Recent Developments

- October 2023: QIAGEN launches the QIAcube Connect, an automated sample preparation workstation for NGS applications.

- September 2023: Thermo Fisher Scientific launches the Ion Torrent Ion AmpliSeq Library Prep Kit and the MagMAX DNA Isolation Kit.

- August 2023: Agilent Technologies announces the launch of the SureSelect XT Target Enrichment Kit, a new NGS target enrichment kit that offers higher sensitivity and specificity.

- July 2023: PerkinElmer launches the JANUS Automated Workstation, a new automated liquid handling platform for sample preparation applications.

- June 2023: Bio-Rad Laboratories launches the Magnesil-PRISCILLA Kit, a new kit for the purification of RNA from formalin-fixed, paraffin-embedded (FFPE) tissues.

Report Scope

Report Features Description Market Value (2023) USD 6,155.8 Million Forecast Revenue (2033) USD 11,774.1 Million CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2017-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Instruments, Consumables and Accessories) By Application (Clinical Research Applications, Diagnostic Applications, Genomics Studies, Proteomics Studies, Analytical Testing, Epigenomics & Epigenetics and Other Applications) By Technique (Protein Preparation, Solid-phase Extraction, Liquid-liquid Extraction, Filtration, Purification and Other Techniques) By End-Users (Hospitals, Diagnostic Centres, Pharmaceutical & Biotechnology Industry, Research & Academic Institutes, Food & Beverage Industry and Other End Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape QIAGEN N.V., Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent Technologies Inc., Danaher Corporation, Hamilton Company, Sigma-Aldrich Corporation, Norgen Biotek Corporation, Millipore Corporation, Promega Corporation, Bio-Rad Laboratories Inc., Roche Applied Science, Illumina Inc., Tecan Group Ltd., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Agilent Technologies Inc.

- Danaher Corporation

- Hamilton Company

- Sigma-Aldrich Corporation

- Norgen Biotek Corporation

- Millipore Corporation

- Promega Corporation

- Bio-Rad Laboratories Inc.

- Roche Applied Science

- Illumina Inc.

- Tecan Group Ltd.

- Other Key Players