Global RTA Furniture Market By Material (Wood, Glass, Steel, Others), By Product Type (Table, Chair, Beds, Sofa, Storage, Others), By Distribution Channel (Specialty Stores, Home Centers, Flagship Stores, Online, Others), By End-User (Residential, Commercial), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 73506

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

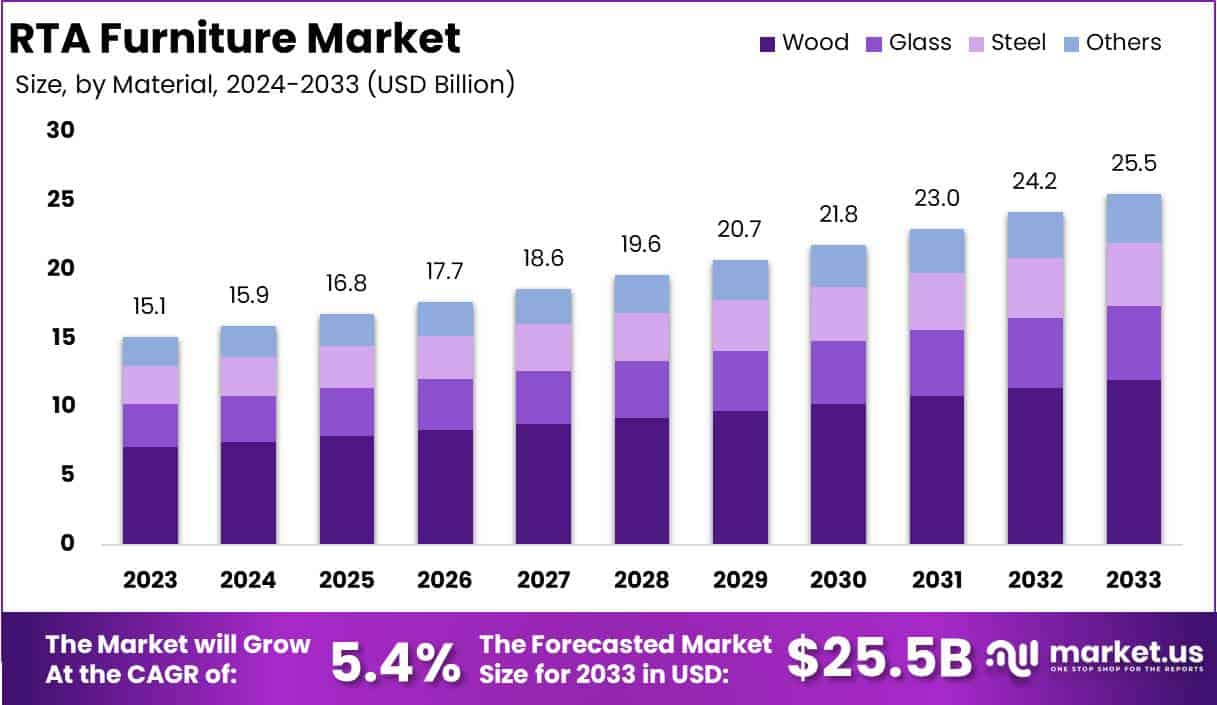

The Global RTA Furniture Market size is expected to be worth around USD 25.5 Billion by 2033, from USD 15.1 Billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

Ready-to-Assemble (RTA) furniture, often referred to as flat-pack furniture, consists of pieces that are designed for easy assembly by the end-user. This type of furniture is packaged in a compact format, reducing shipping costs and enabling convenient transportation.

Typically, RTA furniture includes items such as shelves, desks, tables, cabinets, and beds, making it popular for home, office, and commercial settings. The appeal of RTA furniture lies in its affordability, versatility, and ease of customization, allowing consumers to tailor the assembly process to their own preferences.

The RTA Furniture Market encompasses the manufacturing, distribution, and sales of flat-pack furniture across residential and commercial sectors. This market is characterized by a broad range of products offered through online and offline channels, catering to diverse consumer needs.

It is driven by innovation in design, material usage, and assembly mechanisms. Manufacturers and retailers in this market aim to provide a balance of cost-efficiency, style, and functionality, making RTA furniture an attractive option in various regions worldwide.

The growth of the RTA Furniture Market is propelled by several factors. One of the primary drivers is the rising demand for affordable, space-saving furniture solutions, particularly among urban dwellers and the millennial demographic, who often face space and budget constraints.

The increasing penetration of e-commerce platforms has also significantly contributed to the market’s expansion by simplifying product discovery and providing competitive pricing.

Demand for RTA furniture has been robust, fueled by shifts in lifestyle and living arrangements. The trend of remote work, combined with the rise of smaller living spaces, has intensified the need for functional, compact, and flexible furniture solutions. Consumers prioritize furniture that is quick to assemble, easy to disassemble, and adaptable to different room layouts.

Furthermore, the market benefits from demand in the hospitality and commercial sectors, where cost-effective furnishings are essential for setting up offices, co-working spaces, and rental accommodations.

Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing significant demand growth, driven by urbanization, rising disposable incomes, and the adoption of Western furniture trends.

The RTA Furniture Market presents a wide range of opportunities. Advancements in smart home solutions and Internet of Things (IoT)-enabled furniture can be integrated with RTA offerings to attract tech-savvy consumers seeking smart and multifunctional furniture. Expanding sales through omnichannel retail strategies, combining traditional retail with online offerings, could further boost market penetration.

Additionally, catering to consumer demand for sustainable products by developing furniture from recycled materials or offering eco-friendly certifications can create a competitive advantage. Companies that invest in enhanced logistics, rapid delivery models, and virtual reality-based assembly guides will be better positioned to capture market share and satisfy the evolving preferences of consumers.

According to Shopify, 89% of consumers have shifted toward buying sustainable products, with nearly 30% reporting a significant change. In the RTA Furniture Market, this trend is evident as Gen Z, a key demographic, prioritizes sustainability in purchasing decisions, aligning with the sector’s increased focus on eco-friendly designs.

According to PwC, inflation remains a significant concern, with 31% of consumers identifying it as the top risk in their region. This impacts the RTA (Ready-to-Assemble) furniture market as 62% of consumers expect groceries to see the highest cost increases, tightening budgets for non-essential spending, including furniture.

However, the demand for sustainability remains strong. Nearly 85% of consumers report experiencing the impacts of climate change and are willing to pay 9.7% more for sustainably sourced products, including RTA furniture. Meanwhile, 46% of consumers are purchasing directly via social media, underscoring the importance of digital channels in driving growth.

Key Takeaways

- The Global RTA Furniture Market is projected to grow from USD 15.1 billion in 2023 to USD 25.5 billion by 2033, achieving a CAGR of 5.4% over the forecast period (2024-2033).

- The Wood material sub-segment leads the market, capturing over 47% of the material segment share, due to its durability and aesthetic appeal.

- The Table product type dominates with a 21% market share, fueled by demand for multi-functional, space-saving tables in residential and commercial settings.

- Specialty Stores hold the largest distribution channel share at 25%, attributed to their wide selection and hands-on shopping experience.

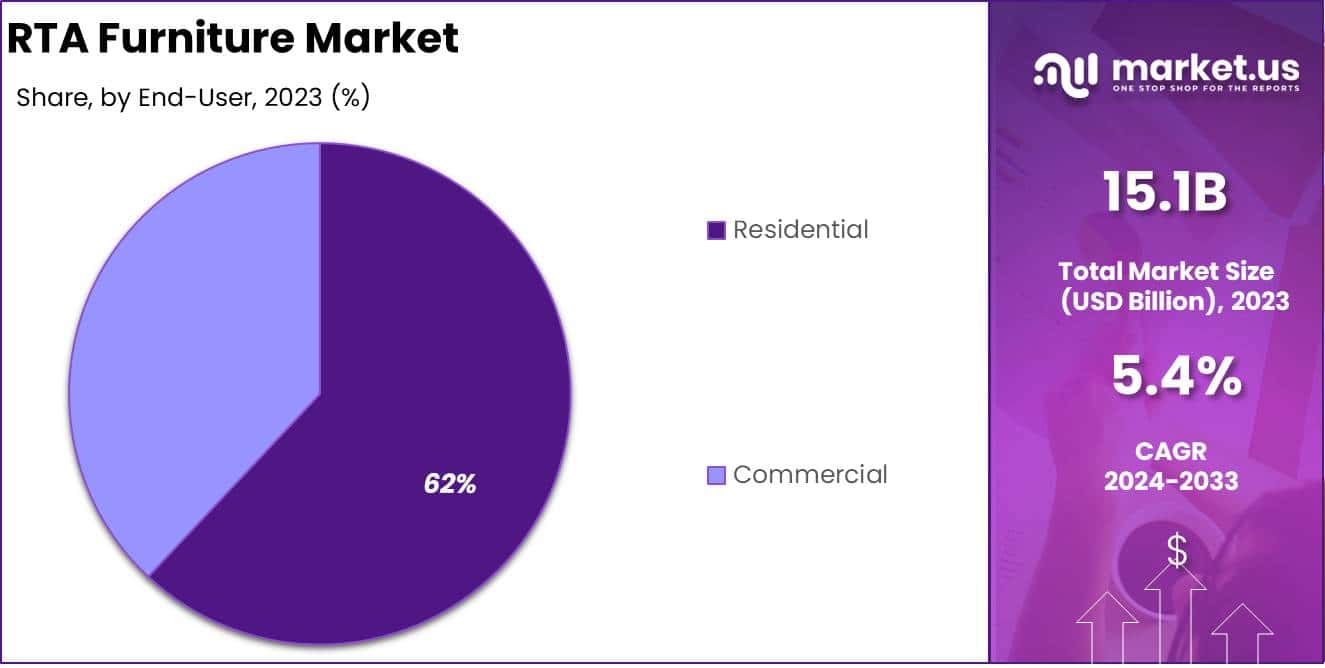

- The Residential end-user segment dominates with 62% of the market share, driven by the growing demand for cost-effective, easy-to-assemble home furnishings.

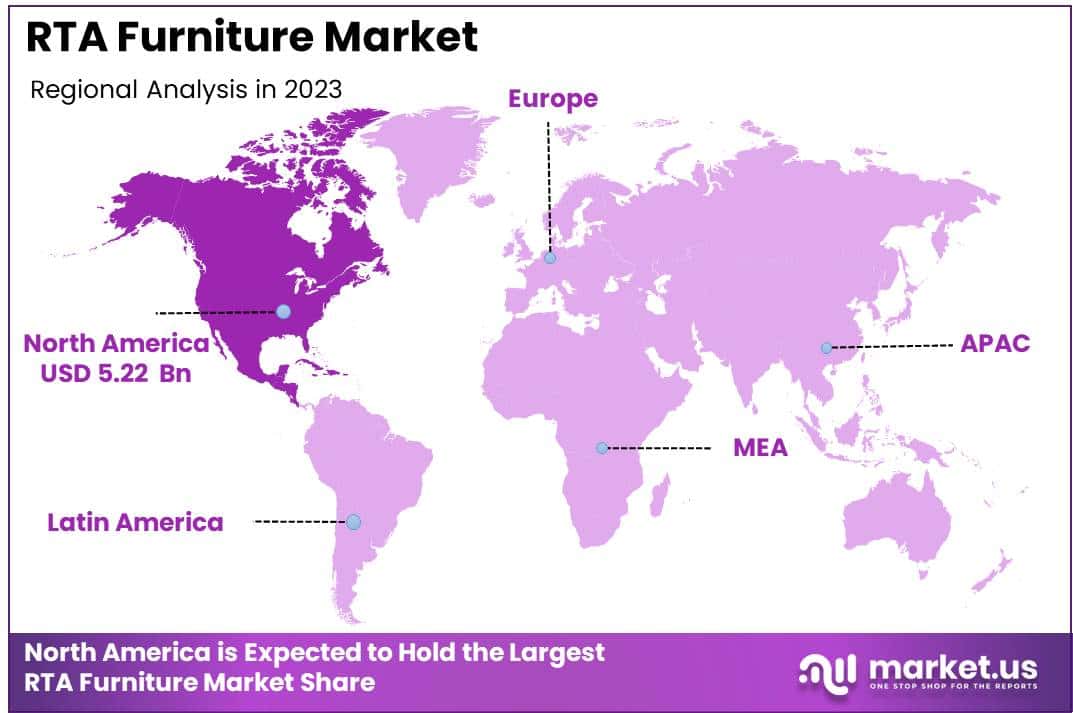

- North America leads with a 34.6% market share, supported by a strong e-commerce infrastructure and preference for DIY home improvement solutions.

By Material Analysis

Wood Dominated the Material Segment in RTA Furniture Market, Capturing Over 47% Share

In 2023, Wood held a dominant market position in the RTA (Ready-to-Assemble) Furniture Market, capturing more than 47% of the material segment’s market share. The widespread adoption of wood can be attributed to its durability, aesthetic appeal, and cost-effectiveness, making it a preferred choice among consumers.

The growing demand for wooden RTA furniture, particularly in the residential sector, has reinforced its leadership in the segment. Glass accounted for approximately 21% of the RTA Furniture Market by material segment in 2023.

The demand for glass-based RTA furniture, including dining tables, desks, and shelves, is primarily driven by its modern and sleek look, aligning well with contemporary interior designs. The segment has benefited from increasing consumer preference for minimalist aesthetics, which has led to steady growth.

In 2023, Steel represented around 18% of the market share within the material segment of the RTA Furniture Market. Steel’s popularity stems from its robustness, resistance to wear and tear, and suitability for a variety of furniture designs, such as frames for beds, tables, and storage units. The material’s role in industrial-style interiors and commercial settings has contributed to its sustained demand.

The Others category, encompassing materials such as plastic, aluminum, and engineered wood, collectively held 14% of the market share in 2023. These materials cater to specific consumer needs, such as lightweight, affordable, and eco-friendly furniture options. Despite their niche appeal, ongoing innovation in material processing and design is expected to drive moderate growth in this segment.

By Product Type Analysis

Table Segment Dominates RTA Furniture Market with 21% Share

In 2023, the Table segment held a dominant market position within the product type category of the RTA (Ready-to-Assemble) Furniture Market, capturing over 21% of the total market share.

Tables remain a crucial component in both residential and commercial settings, driven by increased consumer preference for easy-to-assemble, space-saving furniture solutions. The growing adoption of multi-functional tables—such as dining, study, and work desks—has significantly contributed to this segment’s leadership position.

The Chair segment accounted for approximately 18% of the RTA Furniture Market in 2023. This segment benefits from the rising demand for ergonomic and aesthetically pleasing seating solutions in home and office environments. The affordability and variety of RTA chairs make them an attractive option for consumers, fueling steady growth.

In 2023, the Beds segment captured around 16% of the RTA Furniture Market. This segment has experienced steady demand, particularly due to the rising trend of compact living spaces and consumer interest in modular bedroom furniture. The increasing availability of easy-to-assemble bed frames and foldable beds has contributed to this segment’s expansion.

The Sofa segment secured a 14% share of the RTA Furniture Market in 2023. This growth is driven by the need for affordable and customizable living room furniture. Consumers are increasingly opting for RTA sofas due to their versatility and suitability for small urban apartments, supporting the segment’s positive market performance.

The Storage segment accounted for a 12% share of the RTA Furniture Market in 2023. Demand for space-efficient storage solutions, such as cabinets, shelves, and wardrobes, has boosted this segment’s performance. The increasing focus on organizing residential and commercial spaces has further supported growth in this category.

The Others segment, comprising various RTA furniture products like entertainment centers, benches, and bookcases, maintained a 9% market share in 2023. The segment reflects diverse consumer needs for specialized and supplementary furniture items, contributing to the broader RTA market dynamics.

By Distribution Channel Analysis

Specialty Stores Lead RTA Furniture Market with 25% Share

In 2023, Specialty Stores held a dominant market position within the distribution channel segment of the RTA (Ready-to-Assemble) Furniture Market, capturing over 25% of the total market share.

These stores are popular among consumers due to their wide selection, expert guidance, and focused product offerings. The segment’s success is also driven by consumer trust and the hands-on shopping experience provided by these stores.

The Home Centers segment accounted for approximately 22% of the RTA Furniture Market in 2023. This segment benefits from its ability to offer a wide range of home improvement and furnishing products under one roof, making it a convenient choice for consumers seeking RTA furniture.

Increased spending on home renovations has contributed to the steady performance of home centers. In 2023, the Flagship Stores segment captured a 20% share of the RTA Furniture Market.

These stores play a significant role in brand building and customer loyalty by offering immersive brand experiences and showcasing the latest product lines. Their strategic locations in key urban areas have supported consistent sales growth.

The Online segment achieved an 18% share of the RTA Furniture Market in 2023. This segment has experienced rapid growth, driven by the increasing adoption of e-commerce and consumer preference for convenient, at-home shopping experiences. The availability of diverse RTA furniture options, competitive pricing, and easy delivery options have fueled the rise of this channel.

The Others segment, which includes distribution channels like warehouse clubs, independent furniture stores, and discount stores, maintained a 15% share in the RTA Furniture Market in 2023. These channels cater to varied consumer preferences and often focus on competitive pricing, contributing to their steady market presence.

By End-User Analysis

Residential Segment Dominates RTA Furniture Market with 62% Share

In 2023, the Residential segment held a dominant position within the end-user category of the RTA (Ready-to-Assemble) Furniture Market, capturing over 62% of the total market share.

This segment’s leadership is fueled by growing consumer demand for affordable, easy-to-assemble furniture for homes, especially in urban areas where space-saving and modular designs are increasingly favored. The rise in apartment living and home renovations has further supported the growth of this segment.

The Commercial segment accounted for approximately 38% of the RTA Furniture Market in 2023. This segment benefits from the increasing adoption of cost-effective furniture solutions in offices, hotels, and other commercial establishments.

The demand for flexible and ergonomic furniture in workspaces, combined with the convenience of quick assembly, has driven the segment’s growth.

Key Market Segments

By Material

- Wood

- Glass

- Steel

- Others

By Product Type

- Table

- Chair

- Beds

- Sofa

- Storage

- Others

By Distribution Channel

- Specialty Stores

- Home Centers

- Flagship Stores

- Online

- Others

By End-User

- Residential

- Commercial

Driver

Rising Demand for Affordable and Customizable Home Solutions

The increasing demand for affordable and customizable home solutions is a major driver for the global RTA (Ready-to-Assemble) furniture market in 2024. With urbanization on the rise and a growing number of young homeowners seeking budget-friendly furnishing options, RTA furniture has emerged as a popular choice.

This furniture style offers significant cost advantages over traditional pre-assembled furniture, allowing consumers to furnish their homes at lower prices while retaining the flexibility to customize designs.

Additionally, the appeal of modern and modular designs that cater to various aesthetic preferences adds to its growing popularity. The DIY (Do-It-Yourself) nature of RTA furniture also appeals to consumers who are increasingly inclined toward personalizing their living spaces.

Moreover, the market benefits from increased e-commerce penetration, making RTA furniture more accessible to a wider audience. With online platforms providing a range of choices, competitive pricing, and convenient delivery options, consumers find RTA furniture more attractive than ever.

Furthermore, shifting lifestyles, including the rise in remote work and the need for adaptable home environments, are reinforcing the demand. The trend is especially strong in emerging economies where cost-conscious consumers are rapidly adopting RTA furniture due to its affordability and ease of assembly. This focus on economical solutions that do not compromise style or quality is expected to sustain the growth trajectory of the RTA furniture market.

Restraint

Product Quality Concerns and Limited Durability

Despite the advantages, the RTA furniture market faces significant restraints, primarily due to concerns over product quality and limited durability. Many RTA products are made from less expensive materials such as particleboard and MDF (Medium-Density Fiberboard), which are more prone to damage compared to solid wood.

This raises issues of wear and tear, especially in high-use areas like living rooms and kitchens, limiting consumer confidence in long-term use. Such concerns are critical in markets where consumers prioritize durability and value-for-money over initial cost savings.

The perception that RTA furniture is less robust than fully assembled alternatives can deter potential buyers, thus restricting market growth.

Additionally, the assembly process, though part of the product’s appeal, can be a source of frustration for some consumers. Complicated instructions, missing parts, or the need for specific tools can lead to negative customer experiences, thereby impacting brand loyalty and customer retention.

In developed markets, where consumers have higher expectations for quality and longevity, these challenges are more pronounced.

As a result, manufacturers must focus on enhancing the material quality and simplifying assembly processes to overcome these limitations. Improved customer support and clearer instructions could mitigate some of these barriers, but overcoming the fundamental issues of quality perception remains crucial for broader market acceptance.

Opportunity

Sustainability Initiatives Creating New Opportunities for Market Expansion

Growing consumer awareness about sustainability is creating substantial opportunities for the RTA furniture market in 2024. As more consumers prioritize eco-friendly options, there is a clear demand for furniture that utilizes sustainable materials, energy-efficient production processes, and recyclability.

RTA furniture manufacturers are increasingly adopting eco-conscious practices, including the use of certified sustainable wood, recycled materials, and non-toxic finishes, which not only appeal to environmentally conscious buyers but also align with global regulations promoting sustainability.

The adoption of circular economy principles, where products are designed for longevity and easy recycling, also presents opportunities for innovation in the RTA sector.

Furthermore, the shift towards green building practices and eco-friendly home interiors has led to an increased demand for sustainable RTA products. Governments in various countries are promoting sustainable consumer goods, providing incentives for manufacturers to use recycled materials and reduce carbon footprints.

This not only broadens the consumer base but also helps manufacturers meet regulatory requirements, thereby reducing potential compliance costs. As sustainability becomes a central theme in consumer purchasing behavior, RTA furniture brands that align their strategies with these preferences are likely to capture greater market share.

By emphasizing eco-friendliness alongside cost-effectiveness and design flexibility, RTA furniture can appeal to a broader and more conscientious audience, driving overall market growth.

Trends

Emergence of Smart Furniture and Multifunctionality

The emergence of smart furniture and multifunctionality is a defining trend in the RTA furniture market in 2024. Consumers are increasingly seeking furniture that offers multiple uses, integrates technology, and adapts to smaller living spaces.

Smart RTA furniture, such as beds with built-in storage, desks with integrated charging ports, and expandable tables, caters to the evolving needs of urban dwellers and tech-savvy consumers.

The adoption of IoT (Internet of Things) in furniture design, like app-controlled lighting or automated height adjustments, aligns well with modern lifestyle demands, particularly in densely populated urban centers where efficient space utilization is crucial.

Multifunctional RTA furniture not only maximizes space but also aligns with the preferences of younger consumers who value innovation, convenience, and affordability.

The trend is further supported by the growing popularity of compact living arrangements, such as studio apartments and co-living spaces, where versatile furniture becomes essential. As a result, RTA furniture that offers functionality beyond basic needs is becoming a preferred choice, driving the market forward.

The integration of these features not only increases the perceived value of RTA products but also supports premium pricing, which can enhance profitability for manufacturers. This trend underscores the need for ongoing innovation, as it reflects the consumer desire for products that blend practicality, technology, and modern aesthetics.

Regional Analysis

North America Leads RTA Furniture Market with Largest Share of 34.6%

In 2023, North America emerged as the largest regional market for RTA furniture, capturing 34.6% of the global market share. Valued at USD 5.22 billion, this dominance is driven by strong consumer preference for DIY home improvement, higher disposable income, and a well-established e-commerce infrastructure that supports wider distribution.

Urbanization trends, coupled with a growing inclination toward cost-effective yet stylish furniture solutions, have fueled demand across the region. The U.S., as the key contributor, exhibits robust growth, supported by increasing residential constructions and a strong focus on sustainability, which aligns well with eco-friendly RTA offerings.

The Canadian market also shows notable growth due to the adoption of multifunctional furniture catering to smaller living spaces in urban areas.

Europe holds the second largest share in the global RTA furniture market, driven by a strong focus on sustainability and design aesthetics. Countries like Germany, the U.K., and France are at the forefront, with consumers in these markets emphasizing eco-friendly materials, recyclability, and energy-efficient production.

The rising trend of smaller living spaces, particularly in cities like London and Paris, has increased the demand for multifunctional RTA furniture.

The region’s well-developed retail sector, coupled with an active online shopping culture, further facilitates RTA sales. Additionally, government initiatives promoting sustainable products and green building practices have positively impacted the market, supporting a steady growth trajectory.

The Asia Pacific region is experiencing the fastest growth in the RTA furniture market, spurred by rapid urbanization, increasing disposable income, and a growing middle class. Key markets like China, India, and Japan are leading the charge, with a burgeoning demand for affordable, space-saving furniture solutions that cater to smaller apartments common in densely populated urban centers.

The rise of e-commerce, coupled with manufacturers’ efforts to offer customizable and trendy designs, has boosted RTA furniture adoption in the region. In particular, China’s significant manufacturing capacity and cost advantages enable the production of competitively priced RTA products, making it a crucial market for global players aiming to expand their presence.

Middle East & Africa: Emerging Demand Driven by Real Estate Growth and Urbanization

In the Middle East & Africa, the RTA furniture market is gradually expanding, primarily fueled by growth in the residential and commercial real estate sectors.Key countries like the UAE and Saudi Arabia are experiencing increased urban development projects, creating opportunities for RTA furniture adoption. With a younger population seeking affordable furnishing options and growing e-commerce platforms making products more accessible, the region shows potential for steady growth.

However, challenges such as economic instability in some countries and limited infrastructure for e-commerce in rural areas could affect the pace of market expansion.

Latin America exhibits steady growth in the RTA furniture market, driven by increasing e-commerce penetration and a growing preference for cost-effective home solutions.

Brazil and Mexico lead the market, supported by a rising middle class and expanding urbanization. Consumers in these countries are showing an increasing interest in modern, space-efficient designs, which align with RTA furniture offerings.

E-commerce growth, driven by improved logistics and a shift toward online retail, has made RTA furniture more accessible across the region. Despite economic challenges, the long-term outlook remains positive due to ongoing real estate development and a young population’s desire for affordable and stylish home furnishings.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global Ready-to-Assemble (RTA) Furniture Market in 2024 is characterized by a diverse set of key players, each leveraging unique strategies to drive growth and maintain market relevance. Inter IKEA Holding SA remains a dominant force, benefiting from a global distribution network, strong brand recognition, and consistent investment in sustainable and modular designs.

Its focus on affordable and stylish products tailored to varying consumer preferences continues to enhance its competitive edge. Similarly, Sauder Woodworking Company and Bush Industries Inc. have capitalized on the rising demand for home office solutions, positioning themselves as leaders in cost-effective and easy-to-assemble furniture that addresses changing work-from-home trends.

Whalen Furniture Manufacturing and Steinhoff Holding are also well-established in this market, with a broad product range and efficient supply chain management. Their competitive pricing and extensive distribution channels, particularly in North America and Europe, contribute significantly to their market positions.

Leicht Kuchen AG, although primarily focused on kitchen furnishings, is driving growth through its emphasis on high-quality RTA kitchen cabinetry, meeting the demand for custom home renovations.

South Shore Furniture and Dorel Industries Inc. continue to expand in North America, targeting both residential and institutional markets. Their agility in launching new designs quickly aligns with evolving consumer tastes.

Companies like Flexsteel (Home Styles) and Simplicity Sofas focus on niche, high-quality segments, offering tailored and premium RTA furniture, while balancing functionality and aesthetic appeal.

The market is further enhanced by several other key players that emphasize innovation, sustainable materials, and omnichannel sales strategies. Collectively, these companies shape a dynamic and competitive landscape, driven by innovation, product customization, and a focus on consumer-centric solutions.

Top Key Players in the Market

- Inter IKEA Holding SA

- Sauder Woodworking Company

- Bush Industries Inc.

- Whalen Furniture Manufacturing

- Steinhoff Holding

- Leicht Kuchen AG

- South Shore Furniture

- Dorel Industries Inc.

- Flexsteel (Home Styles)

- Simplicity Sofas

- Other Key Players

Recent Developments

- In April 20, 2023, IKEA announced a $2.2 billion investment to fuel its omnichannel growth strategy across the United States over the next three years. This strategic move represents IKEA’s largest U.S. investment in nearly 40 years, aiming to enhance customer experiences and expand accessibility. The investment will focus on opening new retail locations, strengthening the company’s fulfillment network to offer faster and more efficient deliveries, and tailoring product offerings to fit regional lifestyle needs.

- On February 5, 2024, Flexsteel Industries, Inc. (NASDAQ: FLXS), a major player in the U.S. residential furniture market, reported its second quarter fiscal 2024 results. The company also announced plans to optimize its North American manufacturing operations. This initiative aims to enhance production efficiency and further align resources with evolving market demands.

- In 2024, Flexsteel Industries (NASDAQ: FLXS) reported a strong performance during its first-quarter fiscal year 2025 earnings call on October 21, 2023. Despite facing macroeconomic pressures, the company experienced a 9.9% increase in net sales, reaching $104 million. Operating margins rose to 5.8%, a marked improvement from the previous year’s 2%. CEO Derek Schmidt and CFO Mike Ressler expressed optimism for sustained growth, driven by strategic investments and new product introductions.

- In 2024, Relso, India’s innovative cloud-based furniture manufacturer, raised $840,000 in funding to support its expansion plans. The funding round was co-led by Venture Catalysts and Inflection Point Ventures, with participation from notable investors like Ramakant Sharma (Livspace Founder and Global COO), Shantanu Deshpande (Founder of Bombay Shaving Co.), and Saurabh Jain (CEO of Livspace India). The capital will be directed toward scaling production capabilities and meeting growing demand.

Report Scope

Report Features Description Market Value (2023) USD 15.1 Billion Forecast Revenue (2033) USD 25.5 Billion CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Wood, Glass, Steel, Others), By Product Type (Table, Chair, Beds, Sofa, Storage, Others), By Distribution Channel (Specialty Stores, Home Centers, Flagship Stores, Online, Others), By End-User (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Inter IKEA Holding SA, Sauder Woodworking Company, Bush Industries Inc., Whalen Furniture Manufacturing, Steinhoff Holding, Leicht Kuchen AG, South Shore Furniture, Dorel Industries Inc., Flexsteel (Home Styles), Simplicity Sofas, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Inter IKEA Holding SA

- Sauder Woodworking Company

- Bush Industries Inc.

- Whalen Furniture Manufacturing

- Steinhoff Holding

- Leicht Kuchen AG

- South Shore Furniture

- Dorel Industries Inc.

- Flexsteel (Home Styles)

- Simplicity Sofas

- Other Key Players