Global RPA in Insurance Market Size, Share, Industry Analysis Report By Component (Software, Services), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Application (Claims Processing, Policy Administration, Underwriting & Risk Assessment, Insurance Underwriting, Customer Onboarding, Regulatory Compliance Reporting, Finance and Accounting, Others), By Insurance Type (Life & Health Insurance, Property & Casualty (P&C) Insurance, Reinsurance, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163109

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Quick Market Facts

- Key Performance Improvements

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Organization Size Analysis

- Application Analysis

- Insurance Type Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

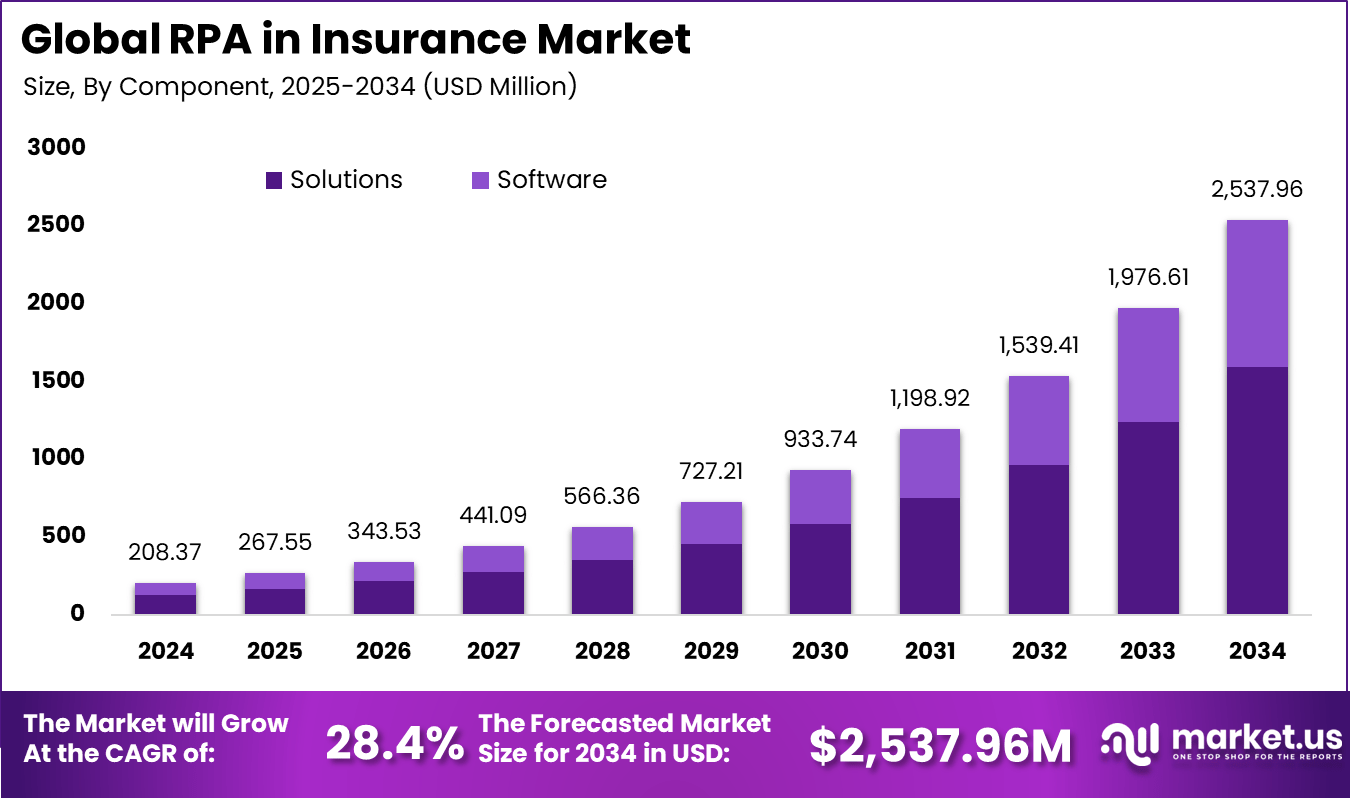

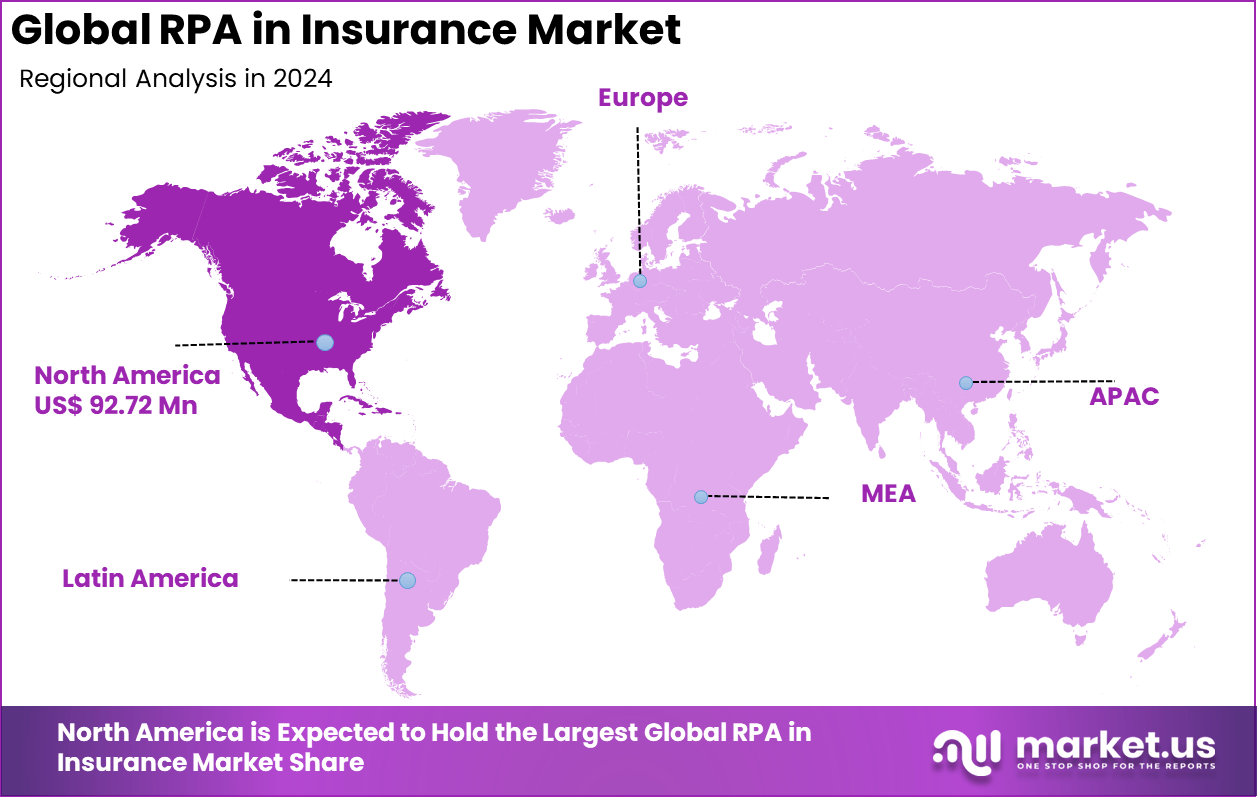

The Global RPA in Insurance Market size is expected to be worth around USD 2,537.96 million by 2034, from USD 208.37 million in 2024, growing at a CAGR of 28.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 44.5% share, holding USD 92.72 million in revenue.

Robotic Process Automation (RPA) in the insurance market is transforming how insurers operate by automating repetitive, rule-based tasks. This technology allows insurance companies to streamline operations such as claims processing, policy administration, underwriting, and customer service. By replacing manual data entry and routine workflows with software bots, RPA accelerates processes, reduces errors, and improves overall efficiency.

One major driver is the intense pressure to increase operational efficiency and reduce costs. Insurance providers face growing customer expectations for quick results, which pushes them to automate lengthy claims validation and policy issuance. In 2025, over 60% of global insurance companies invested in automation for this reason. Automation of decision-making processes using data-driven models also ensures improved accuracy and minimizes manual errors.

The market for RPA in insurance is driven by the need to enhance operational efficiency and accuracy. By automating repetitive tasks such as claims processing and data entry, RPA reduces manual errors and accelerates workflows. This improves customer service speed and helps insurers comply with complex regulations more effectively.

The growing demand for scalable, cost-effective solutions in a competitive insurance landscape is pushing companies to adopt RPA, making it a key factor in modernizing operations and boosting business performance. Demand analysis shows RPA adoption rising sharply due to operational benefits and competitive pressure. Claims processing is a dominant use case where RPA can hasten workflow by up to 75%, using natural language processing and optical character recognition to extract and validate data with minimal human intervention.

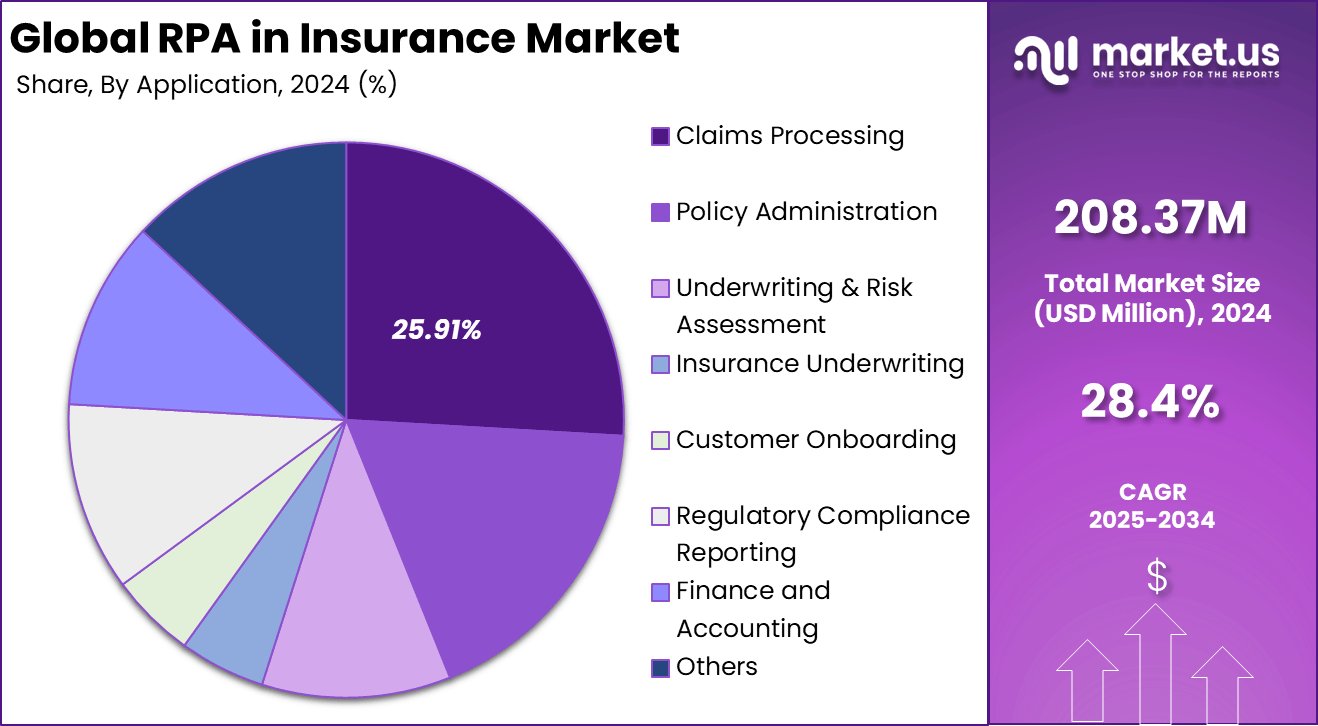

Quick Market Facts

Segmentations Leading Segment Share Value By Component Solutions 62.8% By Organization Size Large Enterprises 72.65% By Application Claims Processing 25.91% By Insurance Type Property & Casualty (P&C) Insurance 45.2% Region North America 44.5% Country U.S. USD 84.57 Mn (CAGR: 26.6%) According to data from Flobotics and Deloitte’s Global Robotic Process Automation (RPA) Survey, approximately 53% of businesses have already implemented RPA solutions, and widespread adoption is projected within the next two years. Around 78% of surveyed companies have either implemented or plan to implement RPA initiatives, reflecting growing confidence in automation as a driver of operational efficiency.

The survey also found that 98% of IT leaders consider automation essential for achieving financial gains, underscoring its strategic value in enterprise transformation. Moreover, about 72% of organizations express strong support for intelligent automation strategies, though support levels are slightly lower within IT departments compared to other business functions.

For instance, in March 2025, UiPath acquired UK-based AI firm Peak to expand its AI-powered vertical automation solutions, enhancing pricing and inventory management capabilities for insurance and other sectors. This strengthens UiPath’s vertical AI automation platform, enabling industry-specific decisioning applications at scale.

Key Performance Improvements

- Claims processing: Robotic Process Automation (RPA) has had a transformative effect on insurance claims management. Processing time has been reduced by 90%, from 72 hours to under 5 minutes, with accuracy rates reaching 99% for standard forms. This level of automation has enabled insurers to cut operational costs for claims by 40-70%.

- Cost and efficiency: Broader operational efficiencies are also evident. Research shows RPA can reduce costs by up to 30% in functions such as claims management and policy administration. On the workforce side, automation can save 34% of an employee’s time typically spent on data processing, freeing resources for higher-value activities.

- Customer experience: RPA also delivers measurable improvements in service delivery. Insurance carriers using automated solutions have reported a 65% decrease in customer service costs. Routine customer interactions are highly automatable, with RPA managing 92% of these tasks, resulting in faster response times and improved satisfaction.

- Fraud detection: The integration of AI with RPA is strengthening fraud detection capabilities. AI-augmented systems have identified 53% more potential fraud indicators, contributing to average annual savings of about $4.2 million for mid-sized insurers.

Role of Generative AI

Generative AI is playing an important role in automating many insurance operations. It helps analyze big data sets to identify risk factors more accurately, leading to better underwriting and pricing of policies. Using generative AI, insurers can speed up the creation and adjustment of complex models, saving time and reducing errors that often come with manual work.

About 37% of tasks in insurance can be automated with these technologies, showing how widely firms are applying generative AI alongside RPA to improve claim handling and policy management. Generative AI also improves customer service by enabling faster and more precise responses during the claims process. It helps detect fraud by analyzing data patterns and flags suspicious claims efficiently.

Research shows RPA can reduce claim processing time by up to 75%, meaning customers get quicker service while companies save costs. This technology combination is becoming essential for insurers looking to remain competitive and responsive to client needs.

Investment and Business Benefits

Investment opportunities abound as the insurance industry embraces cloud-hosted RPA platforms and AI-infused automation tools. The market sees growing interest from both large insurers and mid-sized companies scaling pilot projects. Vendors are expanding capabilities to include end-to-end automation for claims processing, underwriting, and customer servicing.

This diversity creates openings for technology providers, system integrators, and investors focused on insurance-specific automation innovations. The shift towards digital ecosystems and data-driven decision-making also highlights automation as a strategic investment area. Business benefits of RPA in insurance are significant, including up to 30% cost reductions in processing claims and policies.

Automated workflows accelerate turnarounds from days to hours and improve claims accuracy, which reduces exposure to fraud and regulatory penalties. Enhanced customer experiences come from quicker, error-free servicing and personalized communications. These advantages translate into better operational agility, stronger competitive positioning, and increased customer loyalty, critical for insurers navigating a fast-evolving market landscape.

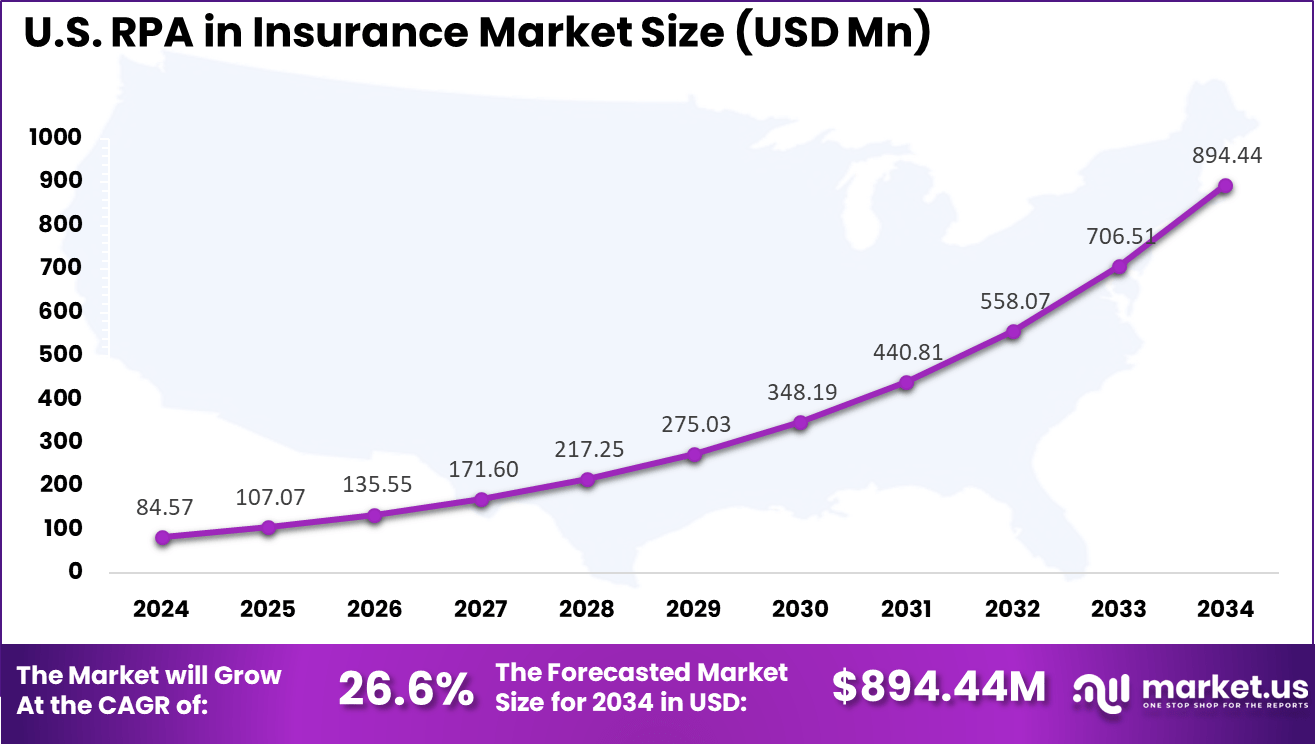

U.S. Market Size

The market for RPA in Insurance within the U.S. is growing tremendously and is currently valued at USD 84.57 million, the market has a projected CAGR of 26.6%. The market is growing rapidly, driven by insurers’ increasing need to improve operational efficiency and reduce costs. Automation addresses the high volume of repetitive tasks in claims processing, underwriting, and policy administration, freeing staff to focus on higher-value work.

RPA also helps insurers navigate complex regulatory requirements by automating compliance processes, reducing manual errors, and enhancing data accuracy. This leads to faster processing times, improved customer experiences, and significant cost savings. Additionally, advancements in AI integration with RPA enable more intelligent automation, improving decision-making in claims and risk assessments.

For instance, in March 2025, UiPath acquired Peak, an AI-native company, to launch vertically specialized agents within its agentic automation platform. This acquisition boosts UiPath’s AI capabilities in optimizing pricing and inventory management for industries, including insurance, allowing for more intelligent and autonomous decision-making processes.

In 2024, North America held a dominant market position in the Global RPA in Insurance Market, capturing more than a 44.5% share, holding USD 92.72 million in revenue. This dominance is due to the region’s advanced digital infrastructure and early technology adoption among insurers.

Companies leverage RPA to streamline claims processing, enhance regulatory compliance, and improve data accuracy, which reduces risks and operational costs effectively. The U.S. government’s supportive programs and investments further accelerate RPA adoption, enabling insurers to manage workflows more efficiently and deliver better customer service.

For instance, in June 2025, Microsoft expanded Power Automate’s AI and low-code robotic process automation features to support insurance workflows such as claims processing and policy management. This enhances automation capabilities on both desktop and cloud environments to improve operational speed and reduce manual work.

Component Analysis

In 2024, The Solutions segment held a dominant market position, capturing a 62.8% share of the Global RPA in Insurance Market. This emphasizes that insurers mainly invest in ready solutions that automate routine and repetitive tasks such as processing documents and managing workflows. These solutions enable faster and more accurate handling of claims and policy management while reducing dependency on manual labor.

Insurance providers benefit from these tools as they optimize internal operations and lower operational costs. Beyond efficiency, solution adoption helps firms stay competitive by allowing rapid integration with existing systems. The increasing shift towards digital workflows makes these solutions essential for modern insurers aiming to improve customer service and compliance.

For Instance, in September 2025, UiPath announced new integrated solutions at UiPath FUSION 2025. These solutions are built to handle complex, repetitive insurance processes like claims management and quality assurance using agentic automation. This approach uses AI-driven robots and agents to optimize workflows, reduce errors, and improve processing speed.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 72.65% share of the Global RPA in Insurance Market. These companies have substantial operational complexity and high transaction volumes, creating strong demand for automating manual processes to improve efficiency. Their extensive resources facilitate investment in RPA technologies to reduce errors and speed up workflows across underwriting, claims, and customer service functions.

Smaller firms often lack the scale or budget for comprehensive automation, so large insurers lead with broader RPA integration. The impact is cost reductions, improved accuracy, and enhanced compliance, which are critical for maintaining profitability in this competitive industry. Large enterprises gain a marked advantage in productivity and service quality by prioritizing RPA.

For instance, in June 2025, SS&C Blue Prism was recognized as a leader in the Gartner Magic Quadrant for RPA for the seventh consecutive year. SS&C Blue Prism supports large insurers by combining RPA with AI and orchestration technologies to manage complex, scalable automation tasks. Their platform is deployed across thousands of digital workers and AI agents globally, helping large enterprises reduce costs and operational friction while enhancing compliance and risk management.

Application Analysis

In 2024, The Claims Processing segment held a dominant market position, capturing a 25.91% share of the Global RPA in Insurance Market. This area involves high-volume, rule-based tasks such as data collection, validation, and decision-making that are ideal for automation. RPA accelerates claims workflows by reducing manual input and routing claims faster through adjudication processes.

Automating claims improves accuracy by eliminating processing errors and helps insurers resolve claims efficiently, benefiting both the company and the policyholders. Enhanced speed and consistency in claims handling lead to better customer satisfaction and lower operational costs. This application remains a primary driver of RPA value in insurance.

For Instance, In May 2025, Microsoft implemented an RPA solution for a major healthcare insurer using Power Automate and AI Builder. The system automated document processing, reduced manual effort, and improved claims validation. It integrated with legacy systems, applied business rules, and delivered real-time analytics, enabling faster and more accurate claims management.

Insurance Type Analysis

In 2024, The Property & Casualty (P&C) Insurance segment held a dominant market position, capturing a 45.2% share of the Global RPA in Insurance Market. The segment involves complex claims related to property damage, liability, and catastrophe events that demand detailed processing and risk evaluation. RPA supports faster claim settlements by automating repetitive tasks in this segment while ensuring compliance with regulatory standards.

The P&C space benefits from automation through improved risk assessment and customer responsiveness. With rising claims complexity, RPA tools are crucial for handling surges efficiently without compromising accuracy or service quality. This segment’s growing reliance on RPA reflects its operational intensity and evolving customer expectations.

For Instance, in May 2025, Automation Anywhere highlighted the role of AI agents in transforming P&C insurance operations. Their platform enables insurers to automate underwriting, claims, and fraud detection processes with AI-powered RPA, improving speed and accuracy. One client example reported improvements in core workflows by deploying intelligent bots that reduced delays and enhanced customer service quality at scale.

Emerging Trends

One rising trend in insurance is hyperautomation, where RPA is combined with AI and machine learning to automate entire workflows rather than just individual tasks. This integration helps insurers share and use data across departments such as claims processing, underwriting, and customer service, breaking down traditional silos. Studies find nearly 43% of insurance tasks are suited for such automation, highlighting its expanding role.

Cloud-based RPA solutions are growing quickly as insurers adopt cloud platforms for scalability and flexibility. Over 20% of automation projects have moved to the cloud, allowing faster deployment and better support for remote teams. Additionally, low-code and no-code RPA tools are empowering non-technical staff to create and manage automation, making processes faster and more adaptable to changing business environments.

Growth Factors

Efficiency gains are a key driver for RPA adoption in insurance. Automating repetitive tasks like data entry and compliance checks frees employees for more complex work. Some insurers report saving tens of thousands of labor hours annually and improving productivity by up to 30%. This shift greatly reduces manual errors and operational costs.

Regulatory demands also encourage the use of RPA. Automated systems help ensure adherence to evolving rules with timely, error-free compliance reporting. Customer expectations for quick service boost RPA use as well, with insurers automating claims and policy updates to provide faster responses. These factors together create strong motivation to expand automation efforts across the industry.

Key Market Segments

By Component

- Software

- Services

- Consulting

- Implementation & Integration

- Managed Services

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Claims Processing

- Policy Administration

- Underwriting & Risk Assessment

- Insurance Underwriting

- Customer Onboarding

- Regulatory Compliance Reporting

- Finance and Accounting

- Others

By Insurance Type

- Life & Health Insurance

- Property & Casualty (P&C) Insurance

- Reinsurance

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Efficiency and Cost Reduction

Robotic Process Automation drives efficiency in insurance by automating repetitive tasks like claims processing and data entry, significantly cutting down manual work. This automation not only speeds up workflows but also reduces errors, leading to lower operational costs and freeing employees to focus on strategic tasks. The ability to handle high-volume, rule-based processes quickly is a strong motivator for insurers to adopt RPA.

By improving process speed and accuracy, RPA helps insurance firms reduce turnaround times, enhance customer satisfaction, and achieve substantial cost savings. This combination makes RPA a key growth driver as insurers seek to improve efficiency while managing rising operational pressures

For instance, in September 2025, UiPath announced enhanced automation capabilities tailored for insurance claims processing. This update focused on improving operational efficiency and compliance by integrating AI insights directly into RPA workflows, helping insurers speed up claims handling and reduce errors. This development reflects the broader trend of RPA boosting efficiency and compliance in the insurance sector.

Restraint

High Implementation Costs

Despite its benefits, implementing RPA in insurance requires significant investment in technology, integration, and ongoing maintenance. This initial high cost can be a barrier, especially for smaller insurers or those with limited budgets. Integrating RPA with existing legacy systems often demands major IT upgrades and customization, further driving up expenses.

Moreover, the total cost of ownership extends beyond deployment, as insurers must allocate resources for continuous updates and system scaling. These financial constraints can slow down RPA adoption, as decision-makers weigh upfront costs against long-term benefits.

Opportunities

Enhanced Regulatory Compliance

RPA unlocks new opportunities by automating compliance-related tasks such as data validation, audit trails, and reporting. Insurance companies face complex and frequently changing regulations, which require meticulous adherence to avoid penalties. RPA bots can quickly adapt to regulatory updates across all affected processes, ensuring consistent compliance without manual intervention.

This ability to streamline compliance enhances governance and reduces the risk of costly regulatory breaches. It also enables insurers to focus more on innovation and customer service, knowing that compliance tasks are systematically managed by automation.

For instance, in July 2025, IBM Corporation launched new customer-centric automation solutions combining RPA with AI to improve personalized insurance services. The company emphasized how rising customer expectations for fast and personalized interactions are driving insurers to adopt innovative automation solutions, expanding opportunities in the market.

Challenges

Regulatory and Security Requirements Add Complexity

Regulations around data privacy, security, and compliance create ongoing challenges for RPA implementation in insurance. Automation tools must securely manage sensitive customer and policy information while meeting strict legal standards like GDPR and HIPAA. Failure to do so risks heavy penalties and reputational damage.

Cybersecurity risks also increase as RPA connects many systems and data sources, demanding continuous monitoring and protective measures. Insurers need strong governance frameworks and skilled staff to oversee automated processes safely. These regulatory and security demands complicate RPA projects, sometimes slowing adoption and increasing costs in the short term.

For instance, in June 2025, Microsoft Power Automate published guidance addressing data privacy and security concerns in RPA deployments within insurance firms. This release acknowledged that regulatory compliance and safeguarding sensitive customer data remain critical challenges slowing down automation projects.

Key Players Analysis

The RPA in Insurance Market is dominated by leading automation and technology providers such as UiPath, SS&C Blue Prism, Automation Anywhere, Inc., and IBM Corporation. These companies deliver enterprise-grade robotic process automation platforms that enable insurers to streamline repetitive tasks such as claims processing, underwriting, and policy management. Their AI-driven bots improve accuracy, compliance, and operational speed, significantly reducing administrative costs while enhancing customer satisfaction.

Key enterprise technology enablers including Microsoft Power Automate, Pegasystems, Inc., NICE, and Infosys Limited are driving large-scale digital transformation within insurance operations. Their solutions integrate RPA with cognitive intelligence, process mining, and analytics, allowing insurers to automate workflows, detect fraud, and optimize decision-making. These platforms also support hybrid human-robot collaboration for improved efficiency across policy servicing and customer interaction.

Emerging participants such as Vuram, Opteamix, Fidel Technologies, Aspire Systems, Dynpro, Royal Cyber Inc., and other market contributors focus on providing customized automation frameworks and implementation services. Their expertise in legacy system integration and cloud-based deployment is accelerating RPA adoption among mid-tier and regional insurers, enabling greater agility and faster time-to-value in a highly regulated insurance landscape.

Top Key Players in the Market

- UiPath

- SS&C Blue Prism

- IBM Corporation

- Microsoft Power Automate

- NICE

- Microsoft

- Vuram

- Infosys Limited

- Opteamix

- Pegasystems, Inc.

- Fidel Technologies

- Aspire Systems

- Royal Cyber Inc.

- Dynpro

- Automation Anywhere, Inc.

- Others

Recent Developments

- In June 2025, Microsoft launched new capabilities in Power Automate to boost low-code, AI-enhanced RPA solutions for desktop and cloud workflows, relevant for insurance processes, including claims and policy handling. The release wave 1 plan through September 2025 focuses on deeper automation and AI integration.

- In June 2025, SS&C Blue Prism was recognized as a Leader in the 2025 Gartner Magic Quadrant for Robotic Process Automation for the seventh consecutive year. The company has scaled more than 2,700 digital workers and AI agents, delivering over $200 million in annual savings. The integration of Blue Prism’s RPA with SS&C’s business process management and AI capabilities continues to advance automation in insurance operations.

Report Scope

Report Features Description Market Value (2024) USD 208.3 Million Forecast Revenue (2034) USD 2,537.9 Million CAGR(2025-2034) 28.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Component (Software, Services), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Application (Claims Processing, Policy Administration, Underwriting & Risk Assessment, Insurance Underwriting, Customer Onboarding, Regulatory Compliance Reporting, Finance and Accounting, Others), By Insurance Type (Life & Health Insurance, Property & Casualty (P&C) Insurance, Reinsurance, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape UiPath, SS&C Blue Prism, IBM Corporation, Microsoft Power Automate, NICE, Microsoft, Vuram, Infosys Limited, Opteamix, Pegasystems, Inc., Fidel Technologies, Aspire Systems, Royal Cyber Inc., Dynpro, Automation Anywhere, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)

-

-

- UiPath

- SS&C Blue Prism

- IBM Corporation

- Microsoft Power Automate

- NICE

- Microsoft

- Vuram

- Infosys Limited

- Opteamix

- Pegasystems, Inc.

- Fidel Technologies

- Aspire Systems

- Royal Cyber Inc.

- Dynpro

- Automation Anywhere, Inc.

- Others