Global Robotics Training Services Market Size, Share Report Analysis By Service Type (Online Training, Classroom Training, On-site Training, Customized Training, Others), By Robot Type (Industrial Robotic Arms, Collaborative Robots, Mobile Robots, Specialized Robots), By End-User (Educational Institutions, Industrial, Commercial, Government, Others), By Industry Vertical (Automotive & Aerospace, Electrical & Electronics, Manufacturing, Logistics & Warehousing, Healthcare & Life Sciences, Food & Beverage, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169936

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

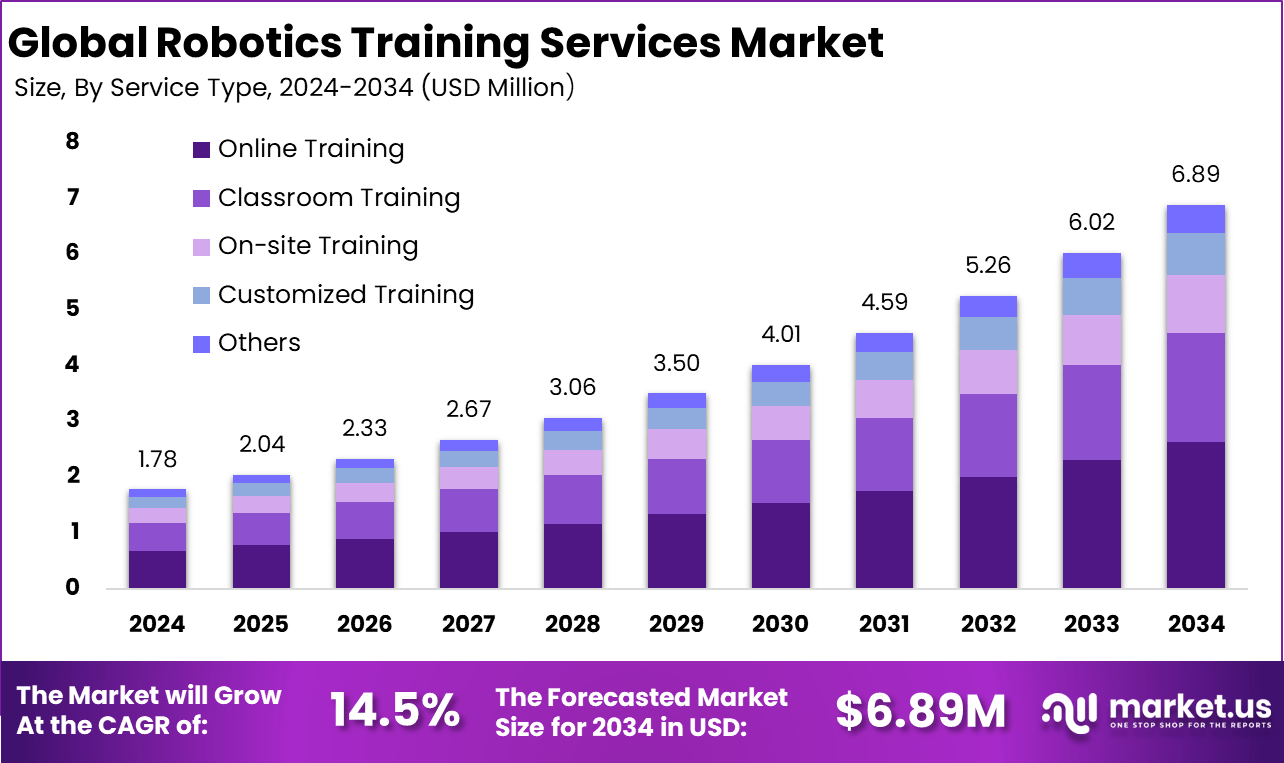

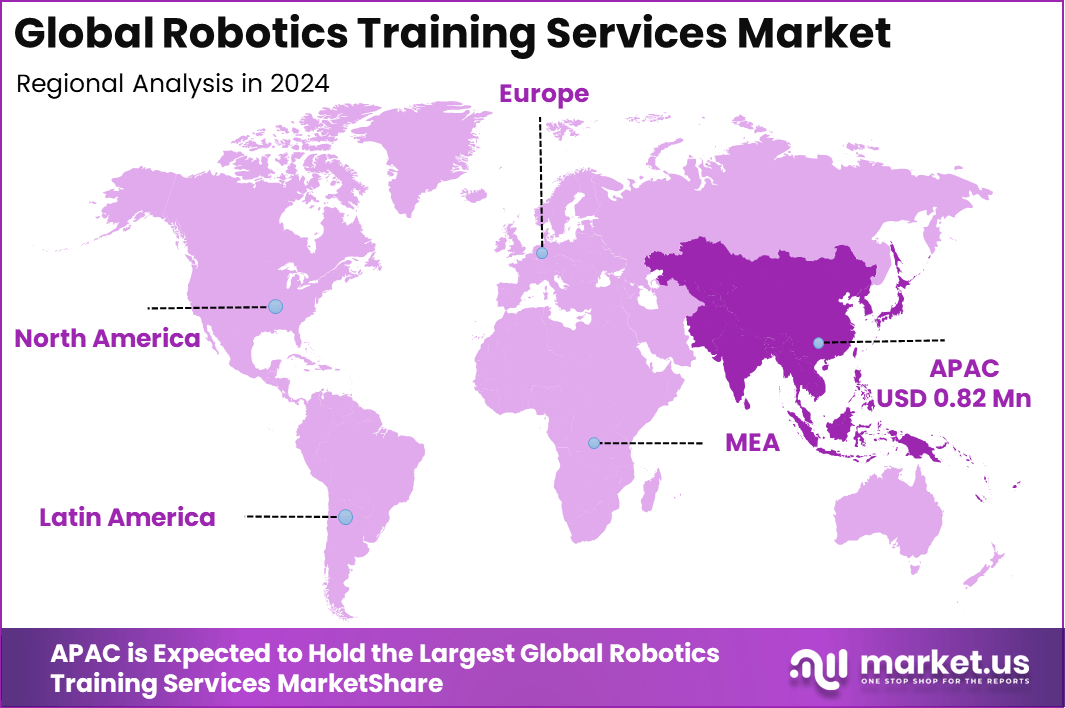

The Global Robotics Training Services Market size is expected to be worth around USD 6.89 million by 2034, from USD 1.78 million in 2024, growing at a CAGR of 14.5% during the forecast period from 2025 to 2034. Asia Pacific held a dominant market position, capturing more than a 46.4% share, holding USD 0.82 million in revenue.

The robotics training services market has grown as industries increase the use of automated systems across manufacturing, logistics, healthcare and education. Growth is linked to the rising need for skilled workers who can operate, program and maintain robotic systems. Training services support engineers, technicians and operators in using both industrial and service robots safely and correctly.

The growth of the market can be attributed to rising automation across factories, warehouses and production units. Many organisations face a lack of trained personnel who understand robotic systems. Training services help close this skill gap and ensure that robots are used efficiently. Safety requirements and complex system operations also increase the need for proper training.

Companies seek robotics training due to rising automation in manufacturing and logistics. Skills gaps push this need, with 70% of workers showing better output on robot tasks after training. Safety concerns grow as robots work close to humans, needing practice to spot dangers. Labor shortages also play a role, since trained teams handle more complex setups. Overall, these factors make training a must for staying competitive in modern plants.

The market for robotics training services is driven by the rapid adoption of industrial and service robots across manufacturing, logistics, healthcare, and warehousing, which creates an urgent need for skilled operators, programmers, and maintenance staff. Companies investing in automation want to minimize downtime, improve safety, and get full value from expensive robotic systems, so they increasingly mandate formal training and certification for their workforce.

Demand for robotics training climbs as factories adopt collaborative robots and mobile units alongside humans. Roughly 95% of robot mishaps occur in manufacturing from operators missing personal risks like fatigue. Businesses turn to training to lower these risks and maintain steady operations. The shift to smarter robots increases the call for skilled hands to manage daily tweaks. This steady pull comes from real workplace changes, not just trends.

For instance, in November 2025, Omron also broadened its industrial automation training services in Europe, adding customized collaborative robot courses and modular training packs that mix classroom, on-site, and remote formats for manufacturers at different maturity levels. This flexible model allows companies to upskill teams around real production use cases and shortens deployment time for Omron robots on the factory floor.

Key Takeaway

- Online training led with a 38.2% share in 2024, showing strong preference for flexible and remote robotics skill development programs.

- Industrial robotic arms captured 43.6%, reflecting high demand for hands-on training focused on production-line automation.

- The industrial segment dominated with 74.5%, confirming that factory automation remains the primary driver of robotics training demand.

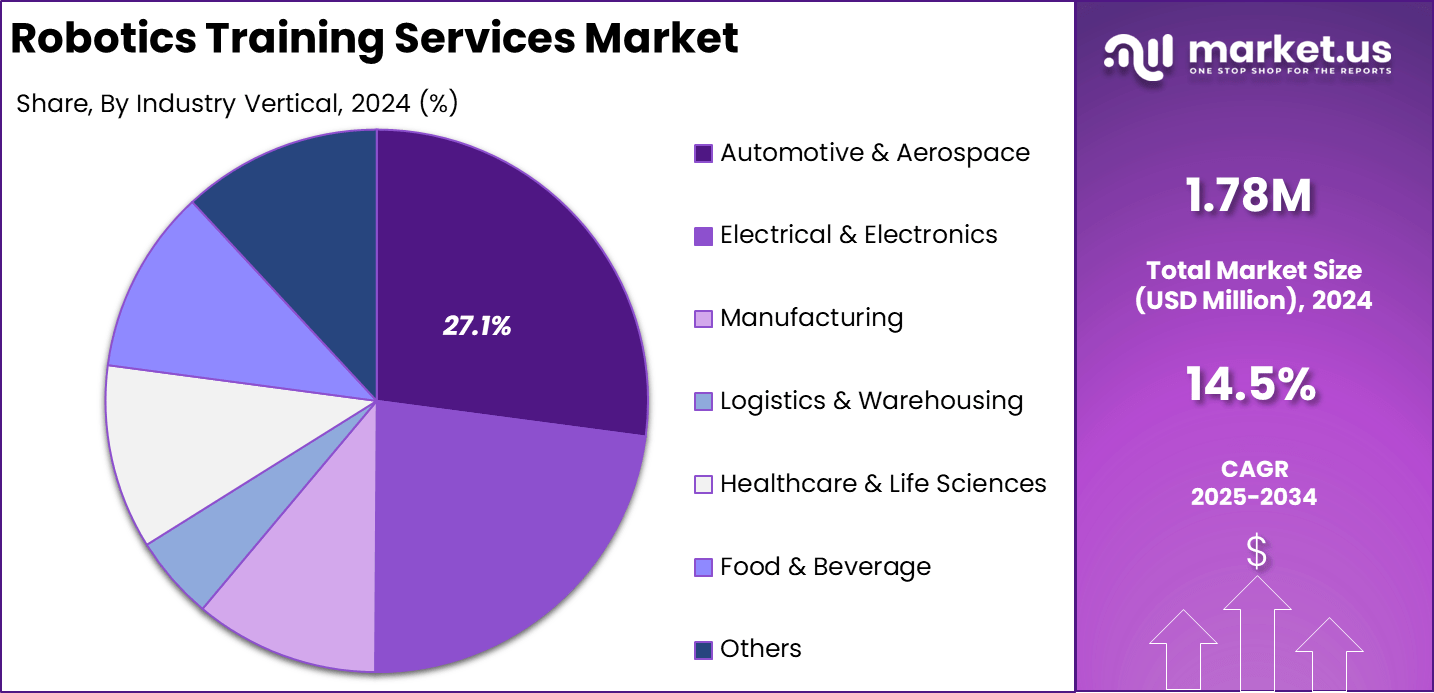

- Automotive and aerospace accounted for 27.1%, supported by continuous investments in precision manufacturing and advanced assembly robotics.

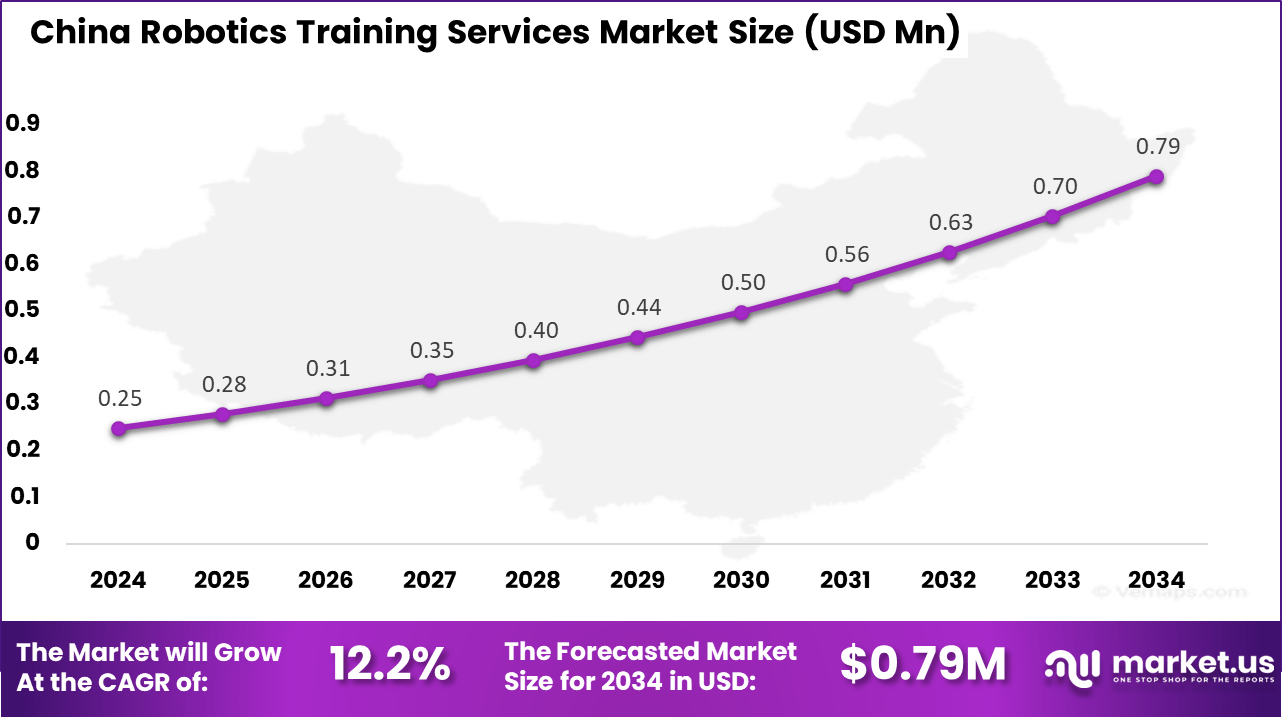

- China’s market reached USD 0.25 million in 2024 with a steady 12.2% CAGR, indicating rising adoption of structured robotics skill programs.

- Asia Pacific held more than 46.4% share, driven by rapid industrial automation, electronics manufacturing, and workforce upskilling initiatives across the region.

Role of Generative AI

Generative AI is being used to create synthetic images, sensor data, and task scenarios so that robots can be trained without relying only on real-world data. Recent studies show that using generative models for action planning can increase decision accuracy for robots by close to 30% in complex environments, which directly improves the quality of training programs built on these models.

Training providers are also using large language models to explain code, generate practice tasks, and provide instant feedback to learners. Industry surveys indicate that more than 70% of organisations experimenting with advanced AI now explore at least one generative AI use case, and robotics is becoming a visible beneficiary in areas such as simulation, lesson generation, and assessment.

China Market Size

The market for Robotics Training Services within China is growing tremendously and is currently valued at USD 0.25 million, the market has a projected CAGR of 12.2%. The market is growing due to rapid factory automation across electronics and auto sectors, where firms need skilled operators to handle dense robot fleets without downtime.

The government pushes for smart manufacturing, funds vocational programs and local academies, blending online modules with hands-on practice. Rising adoption of collaborative arms in SMEs also drives demand for accessible training in native languages, helping technicians master programming and safety quickly.

In 2024, Asia Pacific held a dominant market position in the Global Robotics Training Services Market, capturing more than a 46.4% share, holding USD 0.82 million in revenue. This dominance is due to massive manufacturing hubs in China, Japan, and South Korea driving robot installs in electronics and autos.

Factories train thousands on programming and upkeep to hit production targets fast. Governments back skills programs with funds for local academies and online tools, helping SMEs adopt cobots too. Dense industry clusters create a constant need for certified operators across logistics and assembly lines.

For instance, in August 2025, Mitsubishi Electric India strengthened Asia Pacific leadership in robotics training by supplying factory automation equipment and structured hands-on training programs to technical institutes, helping create a pipeline of skilled robot operators and maintenance engineers for regional manufacturing hubs.

Service Type Analysis

In 2024, The Online Training segment held a dominant market position, capturing a 38.2% share of the Global Robotics Training Services Market. This dominance is due to its flexibility for busy professionals who need to learn robot programming and safety without leaving their workplaces.

Workers access videos, simulations, and quizzes anytime, which helps them master skills like controller setup and error handling at their own pace. Providers build platforms with interactive modules that mimic real robot operations, making remote learning effective for global teams. The rise of online formats also cuts travel costs for companies rolling out new robot systems.

Teams complete certifications quickly, staying current with software updates and new features. This approach suits small firms and large plants alike, as it scales easily to train hundreds without dedicated classrooms. Demand grows as more vendors offer blended programs mixing self-paced content with live expert sessions for complex troubleshooting.

For Instance, in August 2025, Siemens released Basics of Robotics on Coursera, an introductory online course. It covers programming, safety, and automation basics with hands-on overviews. Professionals complete it at their own pace to build industrial robot skills. The program targets quick upskilling for factory teams.

Robot Type Analysis

In 2024, the Industrial Robotic Arms segment held a dominant market position, capturing a 43.6% share of the Global Robotics Training Services Market. Operators learn precise movements, tool changes, and collision avoidance through hands-on sessions tailored to these machines. Training focuses on daily setup and maintenance to keep production lines running smoothly without interruptions from unskilled handling.

As arms integrate with sensors and AI, training covers advanced topics like path optimization and adaptive gripping. This prepares technicians for modern cells where robots handle varied parts. Factories invest here because skilled staff directly boosts output and reduces scrap, making this segment a core part of robotics education efforts worldwide.

For instance, in June 2025, ABB showcased autonomous robotics at Automatica 2025, highlighting OmniCore for industrial arms. Training demos focused on precise path planning and tool integration. Operators learned multi-axis control for welding tasks. This advances skills for heavy factory arms.

End-User Analysis

In 2024, The Industrial segment held a dominant market position, capturing a 74.5% share of the Global Robotics Training Services Market. Training ensures operators handle loading, monitoring, and basic repairs to avoid costly stops. Programs teach integration with conveyor systems and quality checks, helping plants achieve full robot potential from day one.

Large-scale industrial adoption means ongoing refresher courses for safety and efficiency. With robots linking to factory networks, staff learn data logging and predictive maintenance. This focus keeps industrial users ahead, turning automation investments into reliable gains amid rising labor and speed demands.

For Instance, in November 2023, Rockwell integrated robotics into its industrial training ecosystem. Courses link arms to PLCs for seamless factory cells. Operators learn data integration and uptime strategies. This prepares industrial teams for connected production.

Industry Vertical Analysis

In 2024, The Automotive & Aerospace segment held a dominant market position, capturing a 27.1% share of the Global Robotics Training Services Market. Teams train on cycle programming and tolerance settings to meet strict quality rules. These industries refresh skills often as lines shift for new vehicle designs or aircraft components.

High-stakes applications demand deep knowledge of robot calibration and failure modes. Training builds confidence in handling heavy payloads under tight deadlines. This segment thrives on customized modules that align with sector standards, ensuring safe and efficient operations in demanding environments.

For Instance, in April 2025, Siemens launched an MSc in Robotics and Automation with an automotive focus. Hands-on modules cover AI and digital twins for line reconfiguration. Graduates lead upgrades in body work and machining. It targets aerospace precision needs, too.

Emerging Trends

One notable trend in the robotics training services market is the steady rise of training programs focused on collaborative robots and mobile robots. Many industries now deploy robots that work close to human operators, so training is expanding beyond basic programming to include safe operation, task planning and human interaction skills.

Training providers are developing structured modules that help workers adapt to mixed human and robot environments, which is becoming common in manufacturing, logistics and warehousing. Another emerging trend is the move toward simulation based training.

Many institutions now use virtual environments to teach robot programming, motion planning and troubleshooting without needing physical robots. This reduces training cost and allows learners to practise complex tasks safely. Simulation tools are also used by companies to train staff before new robots arrive on site, helping reduce downtime and speeding up adoption.

Growth Factors

A major growth factor for the market is the rapid expansion of robotics across industries such as manufacturing, automotive, logistics, healthcare and agriculture. As more robots are introduced into daily operations, employers need structured training to ensure workers can operate, maintain and integrate these systems correctly.

This creates sustained demand for training programs that improve workforce readiness and reduce operational errors. Another growth factor is the widening skills gap in automation and robotics. Many companies struggle to find workers who understand robot operation, safety and basic troubleshooting.

Training services help bridge this gap by offering industry-focused modules, certification programs and practical workshops. As organizations continue to invest in automation to improve productivity and address labour shortages, the need for trained workers increases and drives market growth.

Key Market Segments

By Service Type

- Online Training

- Classroom Training

- On-site Training

- Customized Training

- Others

By Robot Type

- Industrial Robotic Arms

- Collaborative Robots

- Mobile Robots

- Specialized Robots

By End-User

- Educational Institutions

- Industrial

- Commercial

- Government

- Others

By Industry Vertical

- Automotive & Aerospace

- Electrical & Electronics

- Manufacturing

- Logistics & Warehousing

- Healthcare & Life Sciences

- Food & Beverage

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

A primary driver is the push for higher productivity and consistent quality in industrial settings. Robots offer stable performance, but outcomes depend heavily on how well workers understand programming, maintenance and safety routines. Companies invest in training to reduce downtime, lower error rates and keep robots running at optimal capacity. This operational need strongly supports market demand.

Another driver is the rising safety requirement in workplaces where humans and robots interact. Training helps employees recognise risks, follow safety procedures and manage emergency responses. As safety standards tighten across industries, structured training becomes an essential component of robot deployment, encouraging steady adoption of training services.

For instance, In December 2024, ABB Ltd. expanded its Autonomous Mobile Robotics training and showroom facility in Madrid to support workforce upskilling for AI enabled mobile robots in logistics and manufacturing. The center focuses on commissioning, maintenance, and software training, reflecting how increased factory automation is driving demand for structured robotics training services.

Restraint

A major restraint is the cost of training programs. High quality training often requires access to physical robots, advanced software, skilled instructors and dedicated training spaces. Smaller firms may struggle to fund these programs or release workers from daily tasks, which slows adoption.

Another restraint is the rapid pace of technological change. Robotics hardware and software evolve frequently, and training programs must be updated to stay relevant. Providers face challenges in redesigning material, maintaining updated robots and securing new tools. Organizations that cannot keep pace may postpone training investments until systems stabilise.

For instance, In May 2025, FANUC Corporation partnered with the Digital Foundry to deliver certified robotics operation and programming courses using advanced robots and simulation tools. The initiative also highlighted challenges related to high infrastructure costs and the need for specialized instructors, which can limit the wider availability of robotics training, especially for smaller institutions.

Opportunities

Cloud and AI based training platforms are creating strong growth opportunities for robotics training services by enabling virtual labs, digital twins, and on demand simulations without constant reliance on physical robots. This approach reduces training costs per learner, supports remote and multi site workforces, and allows enterprises to deploy standardized training programs consistently across regions.

AI driven tools further enhance effectiveness by personalizing learning paths, analyzing performance data, and recommending targeted practice scenarios that reflect real world robot behavior. When combined with hardware neutral cloud environments, analytics, certifications, and integration with enterprise learning systems, robotics training can be delivered as a recurring service rather than a one time classroom activity.

In December 2024, Universal Robots expanded its global Academy platform by offering free e learning, virtual classes, and in person training through certified partners worldwide. This model demonstrates how cloud based delivery lowers access barriers, standardizes training outcomes, and supports recurring revenue generation in robotics training services.

Challenges

Rapid innovation in robotics technology creates continuous pressure on training providers, as each new generation of collaborative robots, vision systems, and AI controllers demands updated course content and retrained instructors. When training materials fall behind real world deployments, learners often experience a skills gap between classroom instruction and operational systems on factory floors.

Content development is further complicated by fragmentation across robot brands, proprietary programming languages, and differing safety standards. Training providers must balance platform specific depth with broader conceptual skills while keeping programs affordable and widely accessible, which increases the complexity and cost of delivery.

In March 2025, ABB Robotics introduced the RoboMasters app based training tool and its AI Startup Challenge to address fast changing requirements in AI enabled robotics. These initiatives highlight how quickly skill demands evolve and reinforce the need for continuous updates in robotics training content and methods.

Key Players Analysis

One of the leading players in October 2025, ABB Ltd. partnered with a leading Indian technical university to co-develop specialized robotics training programs focused on industrial automation and robot programming, intending to build a future-ready workforce for advanced manufacturing. The collaboration combines ABB robots and software with curriculum design, giving students hands-on access to real industrial cells and digital twins while helping ABB deepen its training footprint in emerging markets.

Top Key Players in the Market

- ARM Holdings

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Siemens AG

- Universal Robots

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation

- Staubli International AG

- DENSO Robotics

- Kawasaki Robotics

- Honeywell International Inc.

- Epson Robots

- Comau S.p.A.

- Others

Recent Developments

- In November 2025, Omron Corporation expanded its robotics training portfolio by rolling out a new live, instructor-led course on autonomous mobile robot (AMR) programming and fleet management, delivered via remote and on-site formats. The course is designed to help plant engineers and technicians build practical skills in configuring AMR routes, traffic control, and multi-robot coordination, strengthening Omron’s role as a full-lifecycle training provider in mobile robotics.

- In July 2025, Phoenix Robotics in the UK launched expanded multi-brand training offerings for KUKA, FANUC, and ABB robots, including new advanced programming and electrical maintenance courses that take robots apart at the training facility. By offering brand-agnostic, application-driven training, Phoenix supports OEM ecosystems like KUKA and FANUC and helps integrators and end users get more productivity from their installed robot bases.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 6.8 Bn CAGR(2025-2034) 14.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Online Training, Classroom Training, On-site Training, Customized Training, Others), By Robot Type (Industrial Robotic Arms, Collaborative Robots, Mobile Robots, Specialized Robots), By End-User (Educational Institutions, Industrial, Commercial, Government, Others), By Industry Vertical (Automotive & Aerospace, Electrical & Electronics, Manufacturing, Logistics & Warehousing, Healthcare & Life Sciences, Food & Beverage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ARM Holdings, ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Siemens AG, Universal Robots, Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation, Staubli International AG, DENSO Robotics, Kawasaki Robotics, Honeywell International Inc., Epson Robots, Comau S.p.A., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotics Training Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Robotics Training Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ARM Holdings

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Siemens AG

- Universal Robots

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation

- Staubli International AG

- DENSO Robotics

- Kawasaki Robotics

- Honeywell International Inc.

- Epson Robots

- Comau S.p.A.

- Others