Global Robotics Over 5G Platforms Market By Component (Software, Services (Professional Services, Managed Services)), By Deployment (On-Premises, Cloud-based), By Robot Type (Industrial Robots, Service Robots, Collaborative Robots, Autonomous Mobile Robots), By End-User Industry (Manufacturing, Logistics & Warehousing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170730

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Demand Analysis

- Component Analysis

- Deployment Analysis

- Robot Type Analysis

- End-User Industry Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Key Benefits

- Key Usage Areas

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Emerging Trends

- Growth Factors

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

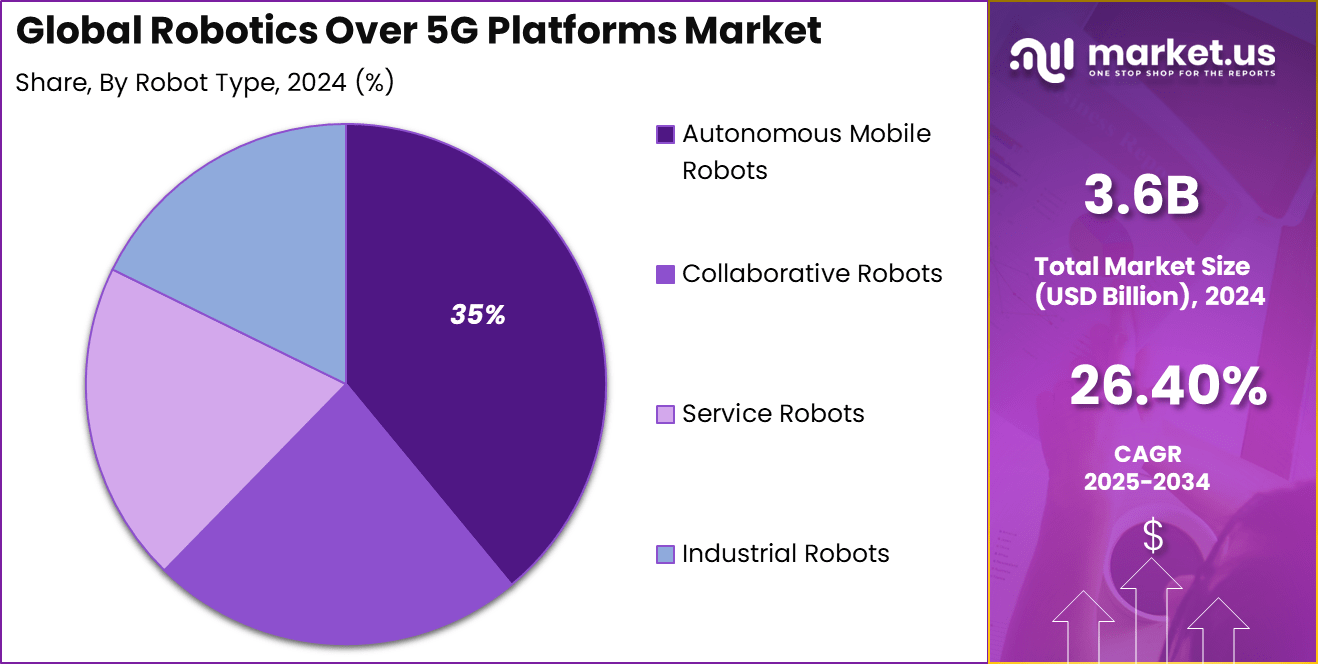

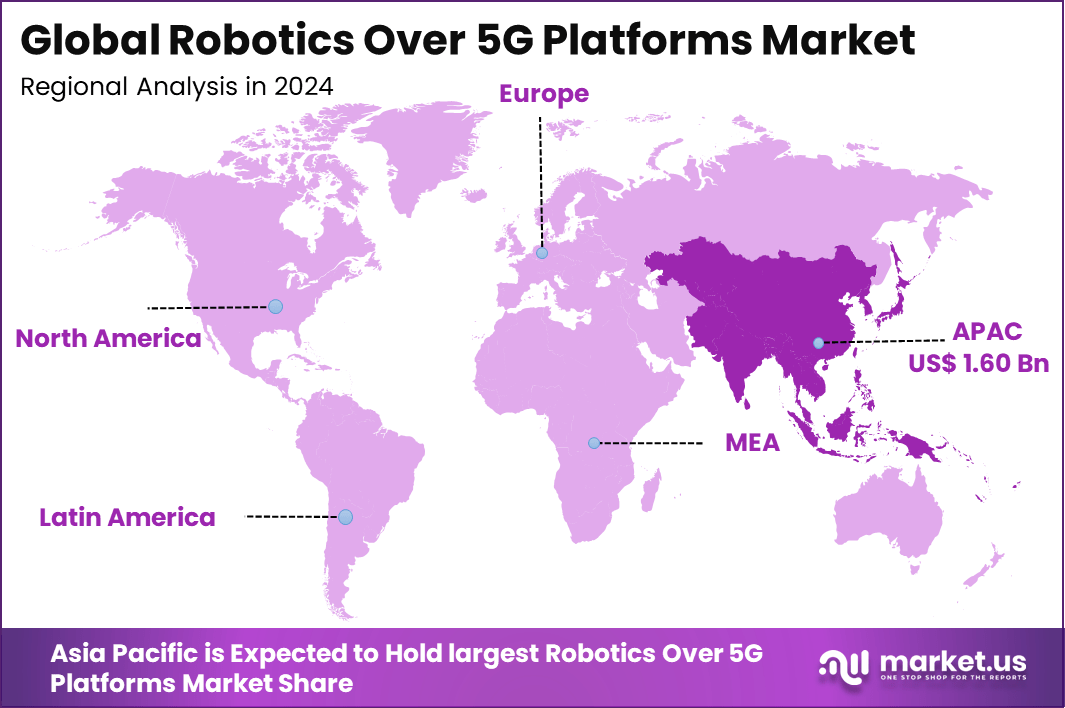

The Global Robotics Over 5G Platforms Market generated USD 3.6 billion in 2024 and is predicted to register growth from USD 4.5 billion in 2025 to about USD 37.3 billion by 2034, recording a CAGR of 26.40% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 44.8% share, holding USD 1.60 Billion revenue.

The robotics over 5G platforms market refers to systems where robotic devices are connected, managed, and enhanced through fifth generation (5G) wireless networks. These platforms leverage high bandwidth, low latency, and reliable connectivity to enable real-time control, remote operation, coordination of multiple robots, and off-board computing for artificial intelligence and sensing tasks.

5G integration allows robots to perform advanced functions that would be limited by traditional wireless or wired connections, supporting use cases in manufacturing, healthcare, logistics, and autonomous operations. High speed and responsive communication are key enablers of these capabilities, improving how robots interact with environments and centralized platforms for mission critical tasks.

This market plays a crucial role in advancing robotics capabilities by removing traditional communication constraints and enabling distributed computing architectures. With 5G, robots can stream sensor data to cloud or edge platforms for analysis and receive control inputs with minimal delay, supporting coordinated fleets and intelligent automation. This capability enhances mission reliability and predictive maintenance, and enables remote supervision of robots working in hazardous, remote, or large-scale environments.

Growth is driven by the rapid rollout of 5G infrastructure, increased adoption of robotics in enterprise and industrial settings, and demand for real-time data processing. Industry infrastructure improvements make high-capacity wireless connectivity more accessible to robotics platforms. Robotics use cases such as autonomous mobile robots, remote inspection systems, and telepresence machines require responsive and robust communication, which 5G can uniquely provide due to low latency and high bandwidth.

Top Market Takeaways

- By component, software accounted for 57.6% of the robotics over 5G platforms market, as it handles real-time control and data processing for robots.

- By deployment, on-premises solutions held 73.5% share, chosen for better security and low delay in factory settings.

- By robot type, autonomous mobile robots like AMRs and AGVs captured 35.2%, using 5G for navigation and fleet coordination.

- By end-user industry, manufacturing represented 32.3%, driven by needs for connected robots in production lines.

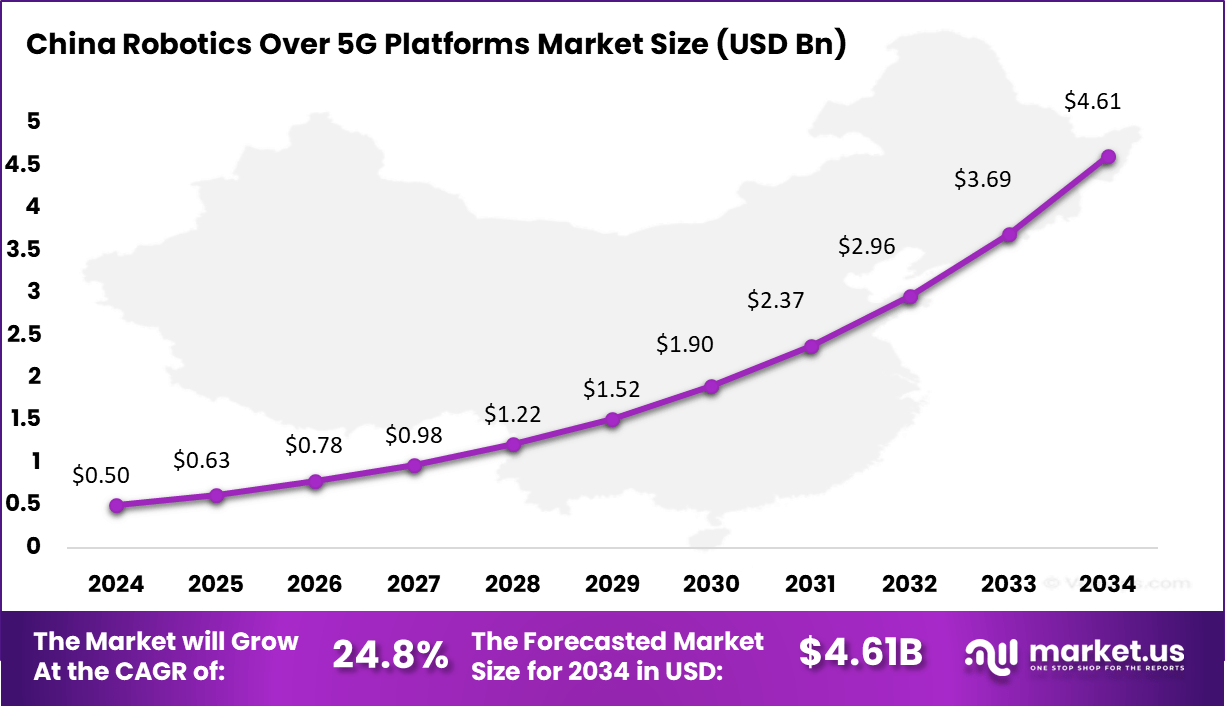

- Asia Pacific dominated with 44.8% of the global market, where China reached USD 0.503 billion in 2025 and projects a CAGR of 24.8% due to fast 5G rollout and robot growth.

Demand Analysis

Demand for robotics over 5G platforms is increasing steadily across sectors where real-time coordination, remote supervision, and cloud-based intelligence are priorities. Manufacturing and logistics environments benefit from fleet coordination and responsive control, while healthcare robotics use 5G to support teleoperation and remote diagnostics.

Autonomous and service robotics use high-capacity networks to stream sensor and AI processing data, enabling adaptive behaviour in dynamic environments. As enterprises seek to improve productivity and respond to labour shortages, 5G enabled robotic platforms are becoming part of broader digital transformation strategies.

Component Analysis

The software segment holds 57.6% of the Robotics Over 5G Platforms market, underlining its critical role in enabling real-time robot communication and control. Software platforms manage data transmission, device orchestration, network slicing, and latency optimization over 5G networks.

These platforms act as the central layer that connects robots with cloud systems, edge servers, and control dashboards. Their importance increases as robots are required to perform tasks that demand instant response and high data accuracy.

From an operational perspective, software solutions support mission planning, monitoring, and analytics across connected robotic fleets. They allow manufacturers and operators to update robot behavior, manage workloads, and monitor performance remotely. The strong share of software reflects the shift toward intelligence-driven robotics, where value is created through connectivity, data processing, and centralized control rather than hardware alone.

Deployment Analysis

On-premises deployment dominates the market with a share of 73.5%, driven by strict requirements for data security, reliability, and low latency. Many organizations prefer to keep 5G robotics platforms within their own facilities to maintain full control over network performance and sensitive operational data. This approach is especially common in environments where uninterrupted connectivity is critical to safety and productivity.

On-premises systems also allow tighter integration with existing IT and operational technology infrastructure. They reduce dependency on external networks and support predictable performance even in high-load conditions. The strong adoption of this deployment model shows that users prioritize control and stability when running robotics applications over advanced communication networks.

Robot Type Analysis

Autonomous Mobile Robots, including AGVs, account for 35.2% of the robot type segment, making them the most prominent users of 5G-enabled platforms. These robots rely heavily on continuous communication for navigation, obstacle detection, and task coordination. The use of 5G enhances their ability to operate safely and efficiently in dynamic environments where real-time data exchange is essential.

AMRs and AGVs are widely used in factories, warehouses, and distribution centers, where they move materials and goods across large areas. Robotics over 5G platforms support fleet coordination and reduce delays caused by network congestion. The growing adoption of mobile robots explains the strong presence of this segment, as connectivity directly impacts their performance and scalability.

End-User Industry Analysis

Manufacturing represents 32.3% of the end-user industry segment, reflecting early adoption of robotics over 5G platforms in production environments. Manufacturers use these platforms to connect robots performing assembly, inspection, and material handling tasks. High-speed and low-latency communication supports precise coordination between machines and reduces downtime on the factory floor.

The use of 5G-enabled robotics also helps manufacturers adapt to flexible production models. Robots can be reconfigured quickly, monitored remotely, and integrated with digital production systems. The strong share of manufacturing highlights the sector’s focus on automation, efficiency, and real-time operational control, which aligns closely with the capabilities offered by robotics over 5G platforms.

Increasing Adoption Technologies

Key technologies supporting adoption include edge computing, artificial intelligence, synchronized multi-robot coordination, and advanced sensing. Edge computing paired with 5G allows processing of complex perception and planning tasks near the point of operation, reducing dependence on onboard compute hardware.

AI models can run centrally and send decisions to robots over 5G links. These technologies help robots achieve higher levels of autonomy and responsiveness, particularly in dynamic industrial environments and autonomous mobility scenarios. Organizations adopt robotics over 5G platforms to improve responsiveness, reduce latency in control loops, and support remote operation at scale.

Low latency and high reliability allow operators to supervise robots from distant locations with the confidence that commands and feedback occur in near real-time. The ability to centralize AI computation and update models quickly benefits fleets of robots with consistent performance. These platforms also reduce costs related to onboard computing hardware and simplify maintenance workflows by centralizing software updates.

Investment and Business Benefits

Investment opportunities exist in 5G connected robotic hardware, cloud and edge platform services, secure connectivity solutions, and integrated software stacks that support fleet management and analytics. Industry stakeholders are exploring tools that combine 5G networking with AI-driven orchestration for coordinated robotic systems.

Expansion of private 5G networks in enterprise environments presents opportunities for service providers to offer managed connectivity solutions tailored for robotic use cases. Future opportunities also include tools that monitor and optimize network performance specifically for robotic operations. Robotics over 5G platforms deliver measurable business benefits including improved operational efficiency, lower downtime, and faster decision cycles.

Real-time connectivity supports rapid response to changing conditions, enhances safety in remote or hazardous environments, and enables automated coordination of robotic fleets. Organizations using these platforms can shift processing from individual robots to central platforms, reducing hardware redundancy and simplifying maintenance. Enhanced visibility into robotic operations across sites also supports better planning and optimization of resources.

Key Benefits

- Faster response time improves accuracy and task execution

- Reduced downtime is achieved through continuous connectivity

- Centralized monitoring improves operational visibility

- Lower infrastructure complexity compared to wired systems

- Supports advanced automation and smart factory goals

Key Usage Areas

- Manufacturing plants for real time robotic assembly and inspection

- Warehousing and logistics for autonomous material handling

- Healthcare for remote robotic assistance and monitoring

- Construction sites for connected robotic equipment

- Smart cities for service robots in public infrastructure

Emerging Trends

Key Trend Description Low Delay Control 5G reduces communication delay, allowing robots to move smoothly and respond quickly from remote locations. Cloud Smart Brains Robots rely on cloud based AI processing instead of heavy onboard computing hardware. Edge Fast Process Edge computing enables faster data handling for real time robot operations. Team Robot Work Multiple robots communicate rapidly over 5G networks to operate together as a coordinated unit. Safe Link Guard Advanced cybersecurity tools protect 5G robot networks from hacking attempts. Growth Factors

Key Factors Description 5G Towers Spread Wider 5G coverage allows robots to operate reliably across more locations. Factory Robots Grow Manufacturing plants deploy more robots that require stable and fast 5G connectivity. Remote Jobs Boom Remote robot operation reduces site visits and improves operational safety. AI Needs Speed AI driven robots depend on rapid data transfer for accurate and timely decision making. Rent Robot Plans 5G supports affordable robot rental models with cloud updates and remote management. Key Market Segments

By Component

- Software

- Services

- Professional Services

- Managed Services

By Deployment

- On-Premises

- Cloud-based

By Robot Type

- Industrial Robots

- Service Robots

- Collaborative Robots

- Autonomous Mobile Robots

By End-User Industry

- Manufacturing

- Logistics & Warehousing

- Healthcare

- Energy & Utilities

- Agriculture

- Mining & Construction

- Others

Regional Analysis

Asia Pacific accounted for 44.8% share, supported by rapid expansion of smart manufacturing, large scale automation projects, and early deployment of private and industrial 5G networks. Countries across the region have focused on integrating robotics with high speed wireless communication to support real time control, remote monitoring, and flexible factory layouts.

Demand has been strengthened by high production volumes in electronics, automotive, and logistics, where reliable connectivity is critical for coordinating multiple robots at the same time. The region’s strong focus on digital transformation and industrial modernization has positioned robotics over 5G platforms as a core technology for next generation factories.

China reached a market value of USD 0.5 Bn and is projected to grow at a 24.8% CAGR, reflecting aggressive investment in industrial automation and 5G infrastructure. Large manufacturing clusters have adopted robotics over 5G platforms to support high density robot deployment, flexible production lines, and centralized control systems.

The ability to manage robots wirelessly across large facilities has improved productivity and reduced downtime, making these platforms highly attractive for export oriented manufacturing sectors. Growth in China has also been driven by strong collaboration between telecom providers, robotics manufacturers, and industrial users.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Shift Toward Cloud-Connected and Edge-Assisted Robots

A major trend in this market is the movement toward cloud-connected robots. Instead of relying on local processors, many robots now use 5G networks to access remote computing resources. This reduces hardware requirements inside the robot while allowing more complex analysis through cloud platforms. Real-time communication makes it possible for robots to receive updates and process instructions more efficiently.

Another trend is the rise of edge-assisted robotics. Edge computing stations placed near industrial sites help process data from robots with minimal delay. With 5G linking robots to nearby edge devices, industries can use advanced monitoring tools, computer vision models, and safety systems without slowing down operations. This trend strengthens the connection between robotics, sensors, and distributed computing environments.

Growth Factors

Increase in Automation and Connected Industrial Systems

A major growth factor is the adoption of automation across manufacturing, logistics, and service industries. Companies seek robots that can work continuously, handle complex tasks, and respond instantly to operational changes. 5G networks support faster data flow between robots and control centers, making automated processes more dependable. This drives investment in robotic systems linked to 5G connectivity.

Another growth factor is rising demand for remote operations. Industries use robots to inspect hazardous locations, manage remote sites, and support healthcare procedures. Stable 5G communication allows operators to control robots from a distance with minimal delay. This capability improves safety and enables organizations to manage operations across wider geographic areas.

Competitive Analysis

ABB, Qualcomm, Huawei, Nokia, Samsung, and Ericsson lead the robotics over 5G platforms market by enabling ultra reliable, low latency connectivity between robots, controllers, and cloud systems. Their platforms support real time control, remote operation, and edge computing across factories and logistics sites. These companies focus on network stability, security, and seamless integration with private 5G infrastructure. Rising demand for flexible and connected automation continues to strengthen their leadership.

Siemens, KUKA, FANUC, Yaskawa, Rockwell Automation, Universal Robots, and Mitsubishi Electric strengthen the market by combining industrial robots with 5G enabled control and monitoring systems. Their solutions improve coordination, mobility, and safety in dynamic production environments. These providers emphasize deterministic communication, predictive maintenance, and scalable deployment. Growing adoption of smart factories and collaborative robots supports wider use of 5G based robotics platforms.

Intel, Cisco, SK Telecom, SoftBank Robotics, Boston Dynamics, Omron, LG Electronics, and other players expand the ecosystem with edge processors, networking hardware, and autonomous mobile robots optimized for 5G. Their offerings support AI driven perception, fleet management, and remote updates. These companies focus on performance optimization and global scalability. Increasing investment in private 5G and autonomous systems continues to drive steady growth in the robotics over 5G platforms market.

Top Key Players in the Market

- ABB Ltd.

- Qualcomm Technologies, Inc.

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Ericsson AB

- Siemens AG

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Rockwell Automation, Inc.

- Universal Robots A/S

- Mitsubishi Electric Corporation

- Intel Corporation

- Cisco Systems, Inc.

- SK Telecom Co., Ltd.

- SoftBank Robotics Group Corp.

- Boston Dynamics, Inc.

- Omron Corporation

- LG Electronics Inc.

- Others

Future Outlook

The future outlook for the Robotics Over 5G Platforms market is expected to strengthen as industries demand faster, more reliable, and flexible robot operations. Use of private 5G networks in factories, ports, and warehouses is supporting real time control, remote monitoring, and coordinated robot fleets. These platforms are helping reduce wiring complexity and allow robots to be reconfigured quickly when production needs change.

In the coming years, closer integration with edge computing, cloud control systems, and AI based analytics is likely to improve decision making, safety, and system uptime, making 5G enabled robotics a core part of smart industrial environments.

Opportunities lie in

- Private industrial network deployment: Dedicated 5G networks can support stable and secure robot communication in controlled environments.

- Remote operation and maintenance services: High quality connectivity enables off site supervision, diagnostics, and software updates.

- Multi robot coordination use cases: 5G platforms can support synchronized movement and task sharing across large robot fleets.

Recent Developments

- September, 2025 – ABB Robotics turned heads at the China International Industry Fair by unveiling OmniCore EyeMotion and Automatic Path Planning tech, pushing their vision for robots that handle tasks on their own with AI vision and real-time navigation. These tools cut cycle times by up to 50% in pick-and-place jobs, all tied to smarter connectivity that fits right into 5G setups for factories.

- March, 2025 – Huawei teamed up with China Mobile and Leju Robotics to debut the world’s first 5G-A powered humanoid robot at MWC 2025, using ultra-low latency networks for precise control in industrial spots without extra gear. This move opens doors for multi-robot teams handling complex tasks faster and cheaper.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 37.3 Bn CAGR(2025-2034) 26.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services (Professional Services, Managed Services)), By Deployment (On-Premises, Cloud-based), By Robot Type (Industrial Robots, Service Robots, Collaborative Robots, Autonomous Mobile Robots), By End-User Industry (Manufacturing, Logistics & Warehousing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., Qualcomm Technologies, Inc., Huawei Technologies Co., Ltd., Nokia Corporation, Samsung Electronics Co., Ltd., Ericsson AB, Siemens AG, KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Rockwell Automation, Inc., Universal Robots A/S, Mitsubishi Electric Corporation, Intel Corporation, Cisco Systems, Inc., SK Telecom Co., Ltd., SoftBank Robotics Group Corp., Boston Dynamics, Inc., Omron Corporation, LG Electronics Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotics Over 5G Platforms MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Robotics Over 5G Platforms MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Qualcomm Technologies, Inc.

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Ericsson AB

- Siemens AG

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Rockwell Automation, Inc.

- Universal Robots A/S

- Mitsubishi Electric Corporation

- Intel Corporation

- Cisco Systems, Inc.

- SK Telecom Co., Ltd.

- SoftBank Robotics Group Corp.

- Boston Dynamics, Inc.

- Omron Corporation

- LG Electronics Inc.

- Others