Global Robotics in Semiconductor Market Size, Share Report By Robot Type (Articulated Robots, SCARA Robots, Collaborative Robots), By Application (Wafer Handling, Assembly & Packaging, Inspection & Testing, Transfer and Material Handling, Others), By End-User (Semiconductor Manufacturers, Consumer Electronics, Automotive, Telecommunications, Research & Development, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169308

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

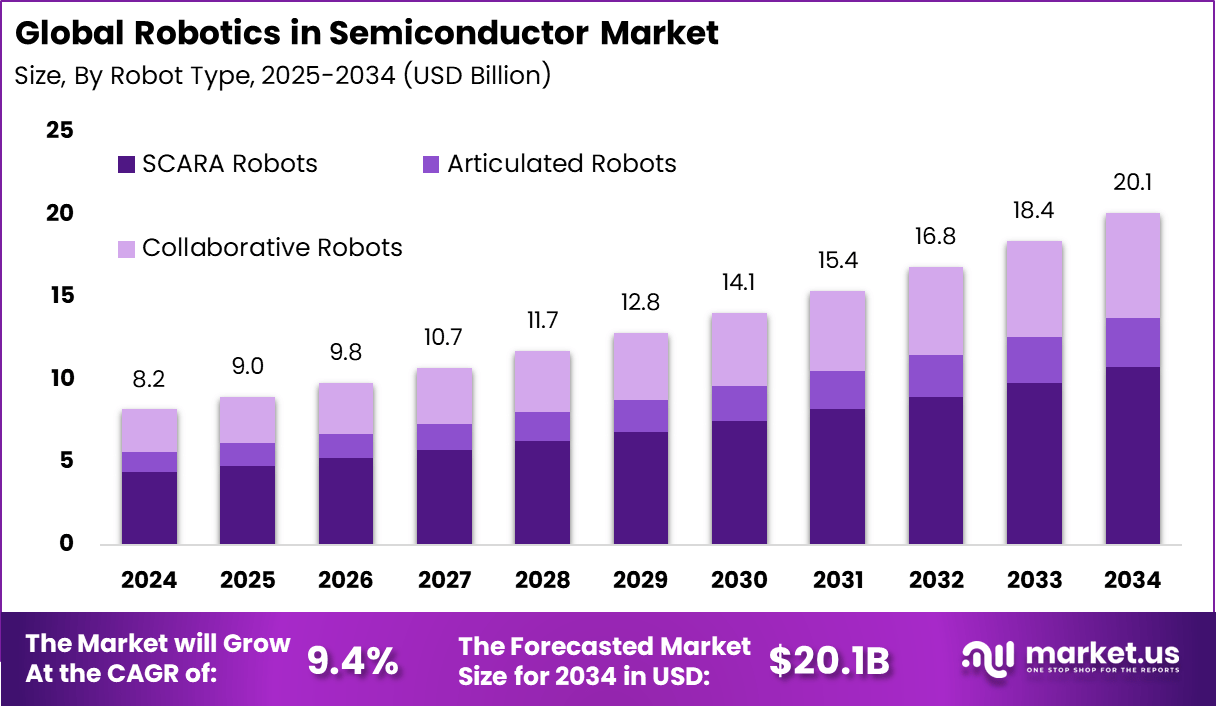

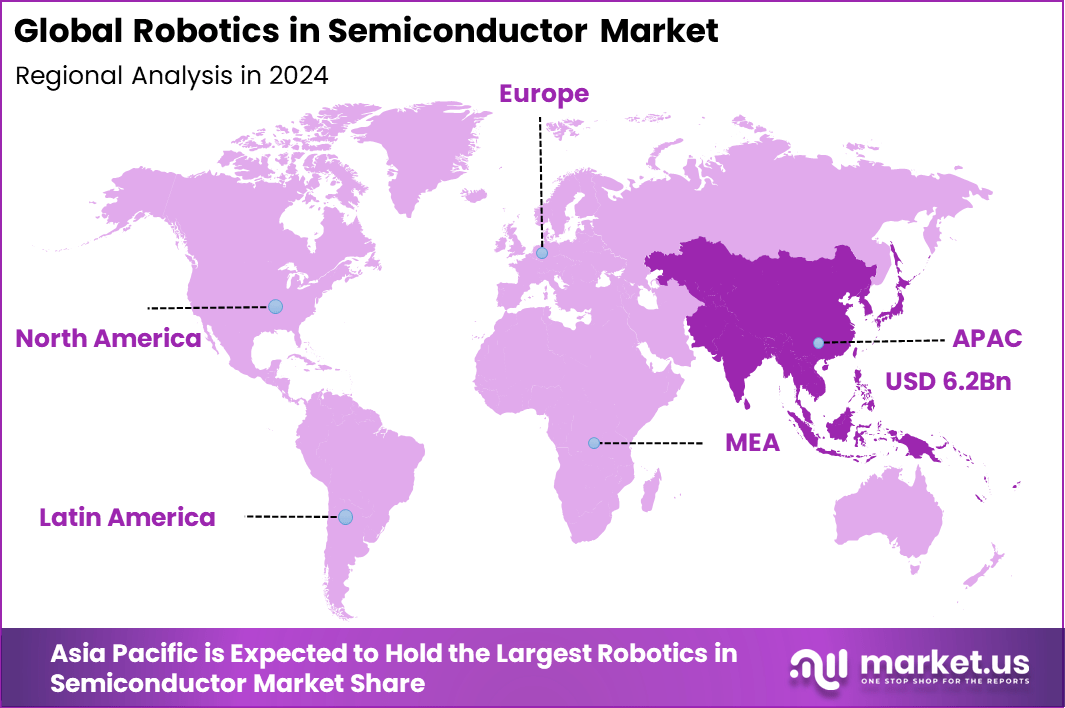

The Global Robotics in Semiconductor Market generated USD 8.2 billion in 2024 and is predicted to register growth from USD 9.0 billion in 2025 to about USD 20.1 billion by 2034, recording a CAGR of 5.94% throughout the forecast span. In 2024, APAC held a dominan market position, capturing more than a 75.8% share, holding USD 6.2 Billion revenue.

The robotics in semiconductor market has expanded as chip manufacturers automate complex, high precision tasks across fabrication, inspection and packaging lines. Growth reflects rising process complexity, shrinking device geometries and the need for consistent output in highly controlled environments. Robotics now play a central role in handling wafers, managing contamination risk and improving production efficiency across modern fabs.

The growth of the market can be attributed to increasing demand for advanced chips, rising capital investment in fabrication facilities and strict requirements for cleanroom operations. Robotic systems reduce human interference, which lowers contamination risk and improves process stability. The push toward smaller nodes and tighter tolerances further accelerates demand for automation that can operate with high repeatability.

Top Market Takeaways

- SCARA robots accounted for 53.4%, showing their strong suitability for high-precision, high-speed tasks across semiconductor production lines.

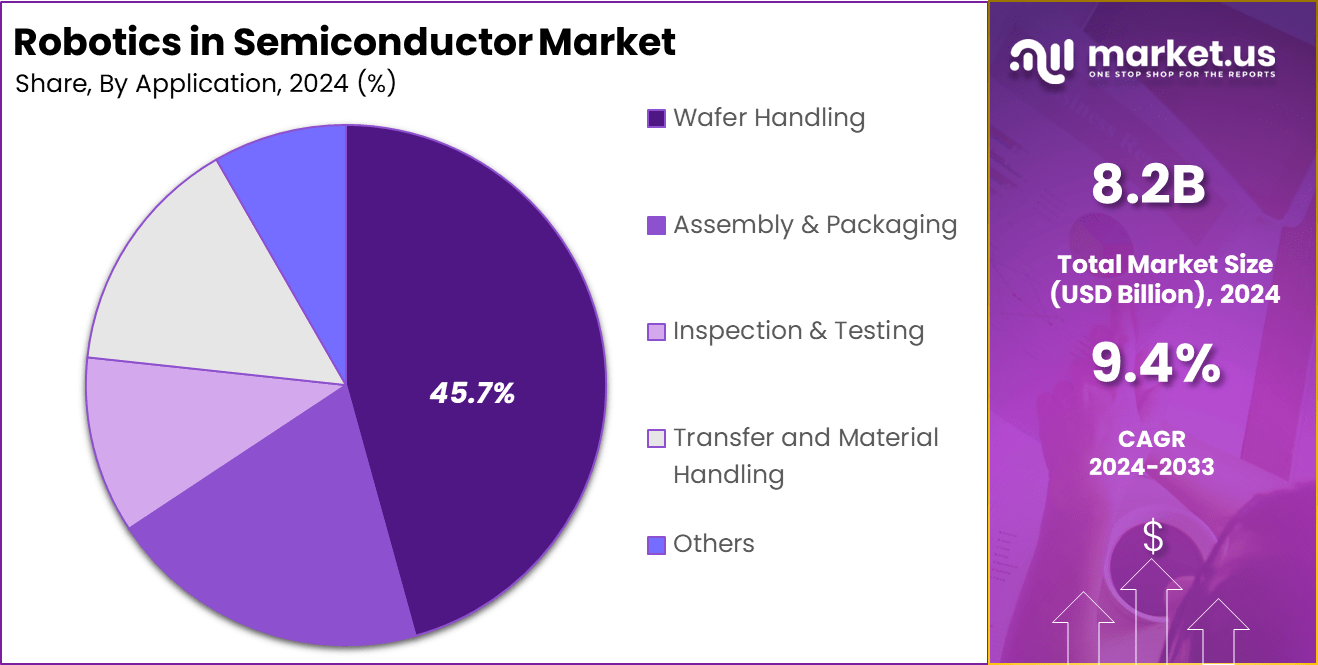

- Wafer handling captured 45.7%, reflecting its critical role in maintaining accuracy, contamination control, and throughput in chip manufacturing.

- Semiconductor manufacturers represented 70.2%, indicating that core fabrication plants remain the primary adopters of robotics for automation and yield improvement.

- Asia Pacific held 75.8%, supported by large-scale fabrication capacity and aggressive automation investments across leading chip-producing nations.

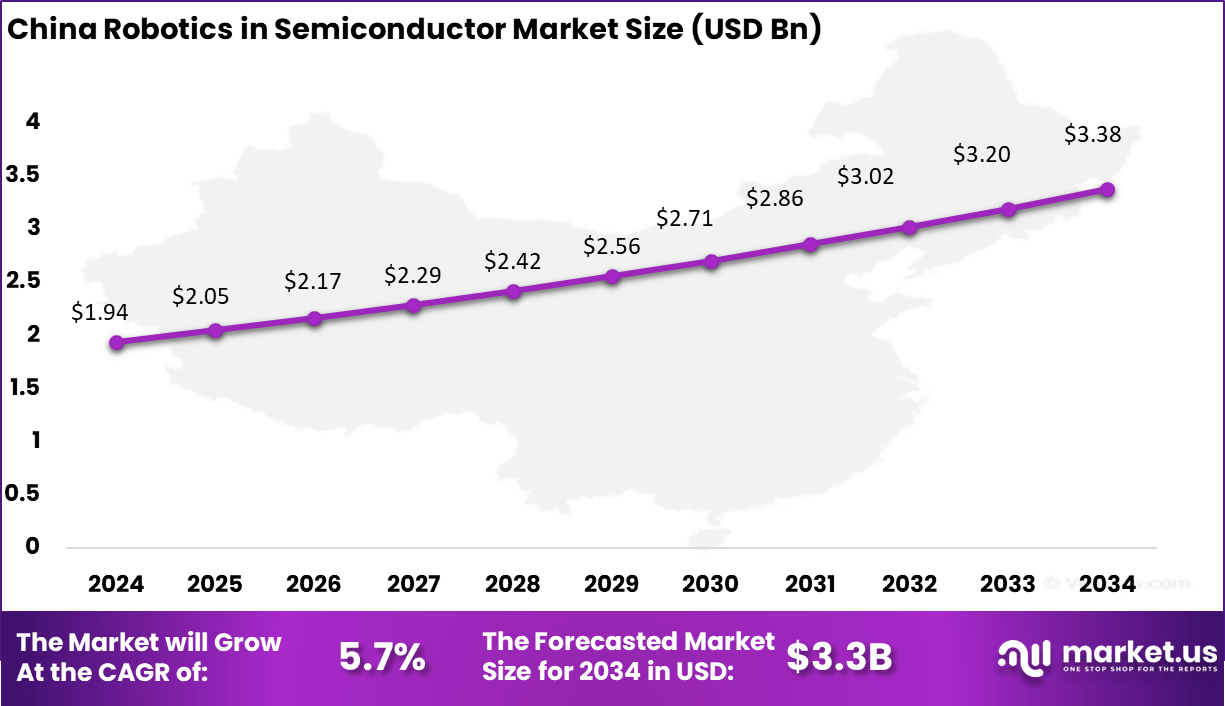

- China reached USD 1.94 billion, highlighting significant spending on robotics to enhance production efficiency and strengthen domestic semiconductor output.

- A CAGR of 5.7% suggests steady adoption as fabs continue modernizing their workflows to meet rising global chip demand.

Quick Market Facts

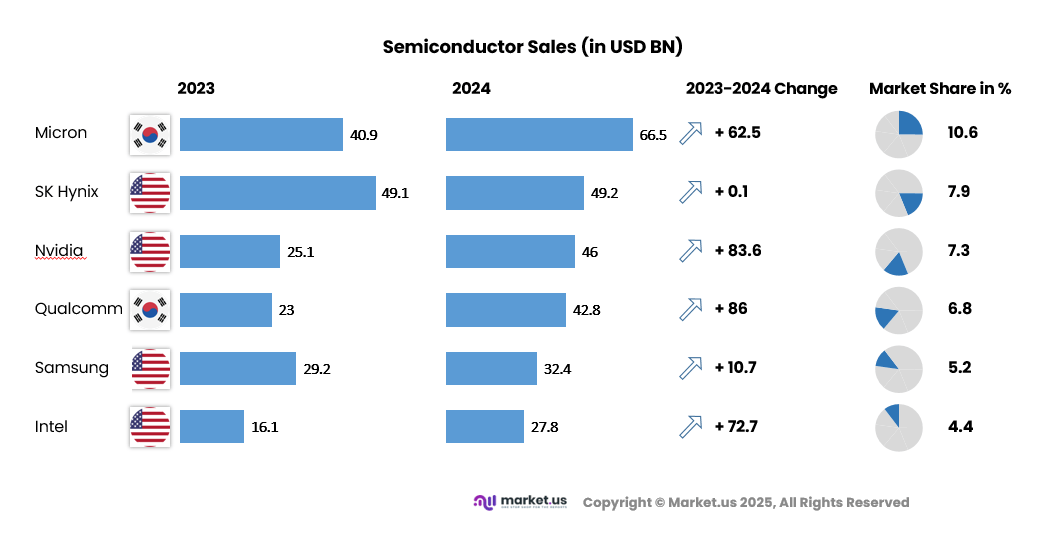

According to the Semiconductor Industry Association, global semiconductor sales reached USD 208.4 billion in the third quarter of 2025, reflecting a 15.8% increase over Q2. Monthly sales for September 2025 were USD 69.5 billion, which is 25.1% higher than the USD 55.5 billion recorded in September 2024 and 7.0% above August 2025. These figures are reported by the World Semiconductor Trade Statistics and represent a three month moving average.

By Robot Type

SCARA robots hold 53.4% of the market, showing that this configuration remains the most preferred choice for semiconductor production lines. Their speed and precision make them suitable for repetitive, high-accuracy tasks that are common in wafer transfer systems and assembly stages. SCARA robots are valued because they can reduce contamination risk in controlled cleanroom environments, where consistent handling is crucial for maintaining wafer quality.

Their high adoption also reflects the strong push toward automation in semiconductor plants as manufacturers attempt to improve throughput and maintain stable production cycles. SCARA systems are often selected because they offer faster deployment and easier maintenance than more complex robotic architectures. As chip designs become more advanced and production volumes continue to rise, demand for SCARA robots is expected to remain steady across most fabs.

By Application

Wafer handling accounts for 45.7% of the robotics application share, which highlights how sensitive and labor-intensive this process can be. Wafers must be moved between tools, inspection stations, deposition chambers, and lithography units with extremely high precision. Manual handling increases the risk of contamination, scratches, and particle transfer, so fabs depend heavily on robotic systems to maintain quality and yield.

The dominance of wafer handling also reflects increasing fab investments in cleanroom automation. As wafer sizes grow and process nodes shrink, the margin of error becomes smaller. Robots provide stable and repeatable motion that supports higher production consistency. This makes wafer handling one of the first operations where manufacturers adopt robotic solutions, reinforcing its strong share in the overall market.

By End-User

Semiconductor manufacturers represent 70.2% of the end-user demand for robotics, indicating that fabs themselves are the largest buyers of these automated systems. Their production lines operate continuously and require high-precision equipment to meet output targets. Robots help stabilize cycle times, reduce human error, and maintain the cleanliness standards needed for advanced semiconductor nodes.

The strong share also shows that manufacturers are investing directly in automation to respond to rising chip consumption across electronics, automotive, and industrial sectors. As fabs expand or shift to new technology nodes, they upgrade robotic systems to increase accuracy and reliability. This trend is expected to intensify as global semiconductor competition accelerates and manufacturers focus on improving efficiency in their high-cost environments.

China Market Size

China’s market value of USD 1.94 billion and a growth rate of 5.7% indicate strong national investments in building a self-reliant semiconductor ecosystem. Robotics adoption in China is being supported by expansion in domestic fabs, government-backed modernization programs, and rising demand for advanced chips across consumer electronics and electric vehicles.

Asia Pacific leads the market with 75.8% share, which reflects the region’s position as the global hub for semiconductor fabrication. Countries such as China, Taiwan, South Korea, and Japan continue to expand manufacturing capacity, driving significant adoption of robotics across wafer processing, packaging, and assembly lines. The availability of large-scale fabs has created steady demand for both new robotic systems and upgrades to existing automation infrastructure.

Emerging Trends

A key emerging trend in the robotics in semiconductor market is the movement toward complete cleanroom automation. Semiconductor facilities are moving from isolated robotic units toward connected robotic ecosystems that handle wafers smoothly across different production stages. This shift is encouraged by growing pressure to reduce particle contamination and achieve consistent results in environments where even minor variation can affect chip quality.

Another visible trend is the rising interest in collaborative robots within supporting areas of semiconductor operations. These systems assist in inspection, sorting, packaging, and other surrounding tasks that require precision but do not involve direct wafer transfer. This helps manufacturers balance their workforce and optimize how high-value robots are used in critical locations.

Growth Factors

A major growth factor for robotics in the semiconductor industry is the rising global consumption of chips for smartphones, computing devices, automobiles, and industrial machinery. As demand increases, manufacturers face pressure to expand output while maintaining strict quality requirements. Robots help achieve these targets by reducing human contact, improving production accuracy, and supporting continuous operation.

Another important factor is the growing complexity of semiconductor manufacturing itself. As wafer sizes increase and technology nodes shrink, every step of wafer handling requires high precision and cleanliness. Robots offer reliable and repeatable motion that helps reduce defects and maintain yield levels needed for advanced chip architectures. This makes automation essential for manufacturers who plan to stay competitive while meeting the technical requirements of modern fabrication processes.

Key Market Segments

By Robot Type

- SCARA Robots

- Articulated Robots

- Collaborative Robots

By Application

- Wafer Handling

- Assembly & Packaging

- Inspection & Testing

- Transfer and Material Handling

- Others

By End-User

- Semiconductor Manufacturers

- Consumer Electronics

- Automotive

- Telecommunications

- Research & Development

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growth in the robotics in semiconductor market is supported by the rising need for very precise handling of wafers. Semiconductor wafers are thin and sensitive to dust, scratches, or pressure, and even small mistakes can reduce yield. Robots provide controlled and steady movement of wafers inside cleanrooms, lowering the risk of damage and keeping production output stable.

Another factor supporting this demand is the pressure on manufacturers to increase production volume. More chips are required for products such as smartphones, electric vehicles, servers, and AI hardware. Robots allow continuous operation by handling tasks such as tool loading, wafer transfer, and inspection without interruption. This improves consistency and helps plants keep up with rising output requirements.

Restraint Analysis

A major restraint lies in the high investment needed for cleanroom-grade robotic systems. These systems must be built with materials and design features that meet cleanroom standards, and the cost of installation, calibration, and integration can be substantial. Smaller manufacturers may find these costs difficult to justify, slowing adoption in certain segments.

Another restraint is the complexity of customizing robots for different semiconductor processes. Many fabrication plants use unique flows and tools, and robots must be adapted to these variations. This reduces standardization and increases the time needed to integrate robotics into existing production lines, which may discourage rapid deployment.

Opportunity Analysis

There is a strong opportunity as chip designs move toward smaller structures and more advanced packaging. These processes require extremely careful handling and inspection, which becomes difficult with manual labor. Robots equipped for delicate movement and fine adjustments offer clear benefits as manufacturers shift to advanced nodes. This creates demand for new robotic systems that support the next stage of semiconductor innovation.

The growth of automated inspection using sensors and vision tools also presents opportunity. Robots that assist with surface checks, pattern review, and alignment tasks help reduce inspection time and improve quality tracking. As fabrication plants expand their production of high-performance chips, demand for automated inspection support is expected to rise.

Challenge Analysis

A significant challenge is the need to integrate robotics with existing legacy tools in older fabrication plants. Many facilities operate on equipment that has been in place for decades, and combining new robotic systems with older hardware can cause delays and technical issues. This increases the risk of disruption during the transition period.

Another challenge comes from limited availability of trained staff who can manage both robotics and semiconductor process requirements. Operating and maintaining cleanroom robots requires knowledge of mechanics, electronics, and process control. Lack of skilled workers can slow down adoption and may force manufacturers to depend on external support.

Competitive Analysis

KUKA, FANUC, ABB, Universal Robots, and Yaskawa lead the robotics in semiconductor market with high-precision robotic systems designed for wafer handling, cleanroom transport, and automated fabrication processes. Their solutions focus on accuracy, contamination control, and continuous uptime, which are essential in advanced semiconductor manufacturing. These companies support high-volume fabs with reliable, repeatable motion systems.

Omron, Kawasaki Robotics, Stäubli, Acieta, Bastian Solutions, Comau, and Balyo strengthen the competitive landscape with flexible robotic platforms suited for cleanroom logistics, tool loading, packaging, and end-of-line handling. Their systems help fabs increase throughput and reduce human error while maintaining strict environmental standards. These providers emphasize integration readiness, compact footprints, and advanced safety features.

DF Automation, Omron Adept, READY Robotics, and other participants broaden the market by offering AMRs, modular robotic cells, and easy-to-program systems tailored for semiconductor equipment transport and secondary automation tasks. Their solutions target fabs seeking scalable automation without major infrastructure changes. These companies focus on adaptability, software-driven orchestration, and interoperability with existing fab equipment.

Top Key Players in the Market

- KUKA Robotics

- FANUC Corporation

- ABB Ltd.

- Universal Robots

- Yaskawa Electric Corporation

- Omron Corporation

- Kawasaki Robotics

- Stubli

- Acieta

- Bastian Solutions

- Comau (FCA)

- Balyo

- BA Systems

- DF Automation

- Omron Adept Technologies

- READY Robotics

- Others

Recent Developments

- KUKA Robotics unveiled a mobile robotic solution for chip production at SEMICON West in July 2024. The KMR iisy AMR with LBR iisy cobot manages 200mm and 300mm wafer boxes, FOUPs, and reticles in cleanrooms, boosting efficiency amid labor shortages.

- FANUC Corporation announced a partnership with Nvidia in December 2025 to integrate AI into robots for virtual testing and voice commands. This aims to cut deployment risks in semiconductor lines, with shares jumping 9.4% post-news.

- ABB Ltd. saw its robotics division acquired by SoftBank for $5.4 billion in October 2025, targeting physical AI fusion; closure expected mid-2026. Earlier in September 2025, ABB launched OmniCore and IRB models at CIIF for electronics handling.

- Yaskawa Electric Corporation completed Robot Plant No.5 in 2025, enabling integrated servo-robot production and expanding orders for AI chip middle-end processes. The facility boosts monthly output by 1.5 times to 8,100 units amid semiconductor demand.

Report Scope

Report Features Description Market Value (2024) USD 8.2 Bn Forecast Revenue (2034) USD 20.1 Bn CAGR(2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Robot Type (Articulated Robots, SCARA Robots, Collaborative Robots), By Application (Wafer Handling, Assembly & Packaging, Inspection & Testing, Transfer and Material Handling, Others), By End-User (Semiconductor Manufacturers, Consumer Electronics, Automotive, Telecommunications, Research & Development, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034 Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape KUKA Robotics, FANUC Corporation, ABB Ltd., Universal Robots, Yaskawa Electric Corporation, Omron Corporation, Kawasaki Robotics, Stäubli, Acieta, Bastian Solutions, Comau (FCA), Balyo, BA Systems, DF Automation, Omron Adept Technologies, READY Robotics, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotics in Semiconductor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Robotics in Semiconductor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- KUKA Robotics

- FANUC Corporation

- ABB Ltd.

- Universal Robots

- Yaskawa Electric Corporation

- Omron Corporation

- Kawasaki Robotics

- Stubli

- Acieta

- Bastian Solutions

- Comau (FCA)

- Balyo

- BA Systems

- DF Automation

- Omron Adept Technologies

- READY Robotics

- Others