Robotic Prosthetics Market By Extremity (Lower Limb Prosthetics and Upper Limb Prosthetics), By Technology (Microprocessor-Controlled (MPC) Prosthetics, Myoelectric Prosthetics, and Body Powered Prosthetics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 28004

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

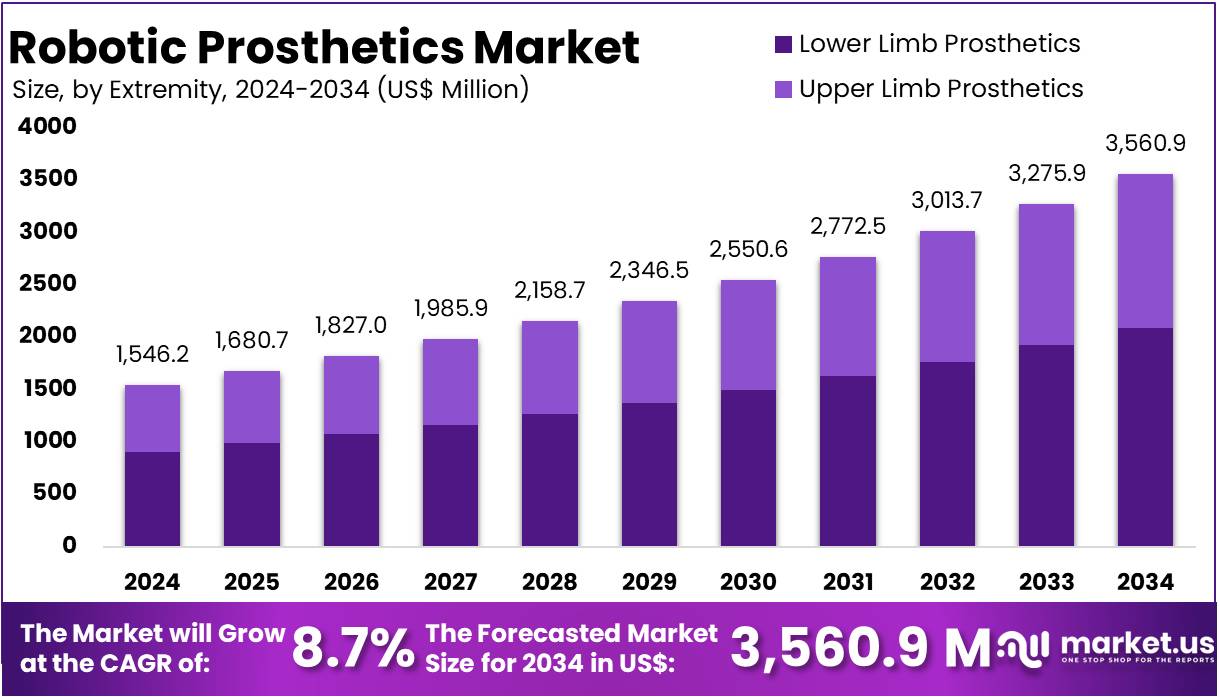

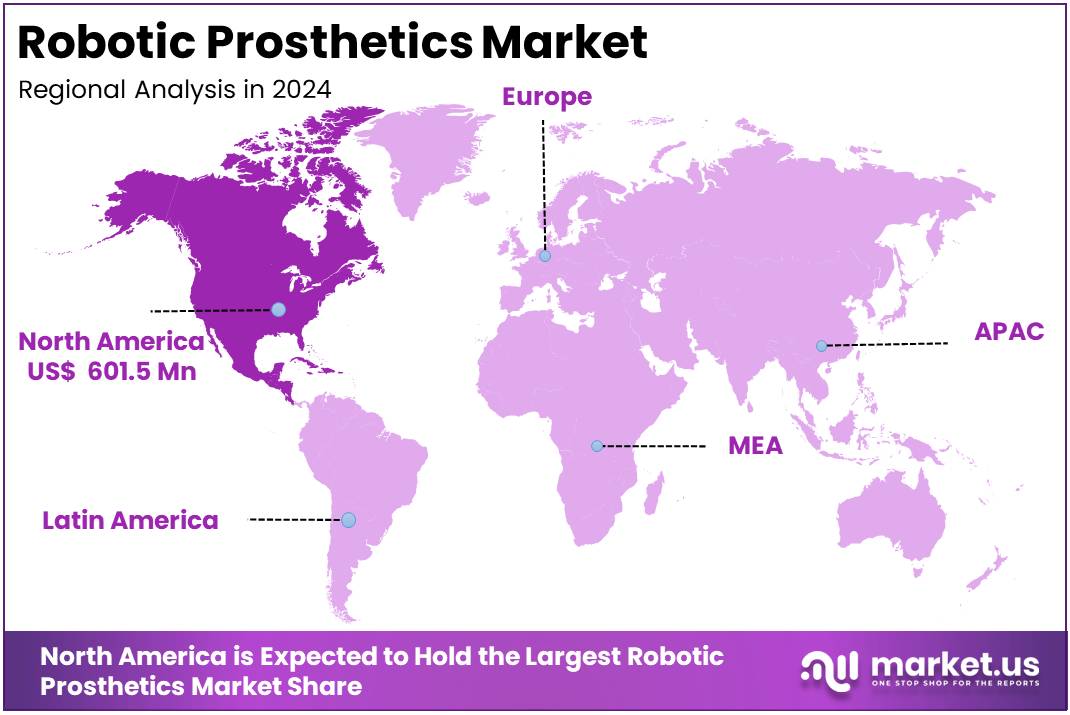

The Robotic Prosthetics Market Size is expected to be worth around US$ 3,560.9 million by 2034 from US$ 1,546.2 million in 2024, growing at a CAGR of 8.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.9% share and holds US$ 601.5 Million market value for the year.

The global robotic prosthetics market is experiencing significant growth, driven by technological advancements and increasing demand for enhanced mobility solutions. Innovations in microprocessor-controlled (MPC) systems, myoelectric prosthetics, and bionic limbs have greatly improved the functionality and performance of prosthetic devices. These developments enable prosthetics to mimic natural limb movement more effectively, providing enhanced comfort and mobility to users.

The growing demand for personalized and customizable prosthetic solutions presents an opportunity for companies to develop tailored devices that meet the unique needs of individual users. Advances in 3D printing technologies enable the creation of custom prosthetics at a lower cost and with faster turnaround times, making them more accessible to a broader audience.

In June 2025, Axiles Bionics, a deeptech and medtech spin-off from Brubotics at Vrije Universiteit Brussel (VUB), is excited to announce the successful completion of the first €6 million tranche in its €8 million Series A funding round. This round was led and organized by PE Group, which served as the cornerstone investor, and supported by the EIC Fund, Finance & Invest brussels, experienced entrepreneurs, private investors, and the company’s management team. The funding will drive the global commercialization of Lunaris, the most advanced biomimetic prosthetic foot, which combines adaptive mechanics with embedded intelligence to provide intuitive and natural movement.

Moreover, AI is being integrated into prosthetic devices to enhance their functionality. AI-equipped prosthetics offer improved adaptability and control by learning and forecasting user behavior through real-time movement data. This capability is especially advantageous in microprocessor-controlled (MPC) prosthetics that require automatic adjustment with regard to the user’s terrain, gait, and load; these enhancements greatly improve the user experience.

However, advanced robotic prosthetics come with significant costs, making them less accessible to a large segment of the population, especially in developing regions. The high price points are attributed to the cost of materials, advanced technology integration, and the complexity of manufacturing.

Key Takeaways

- In 2024, the market for Robotic Prosthetics generated a revenue of US$ 1,546.2 million, with a CAGR of 8.7%, and is expected to reach US$ 3,560.9 million by the year 2034.

- The product type segment is divided into Lower Limb Prosthetics and Upper Limb Prosthetics with Lower Limb Prosthetics taking the lead in 2023 with a market share of 58.7%.

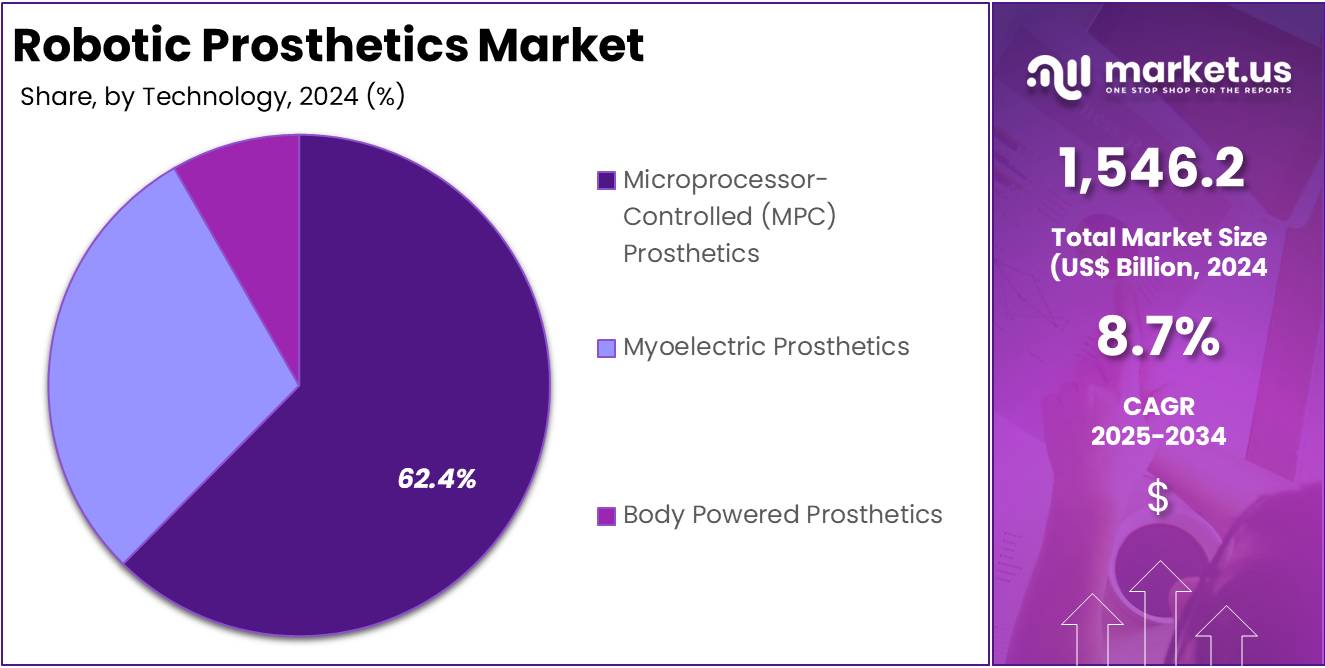

- By Technology, the market is bifurcated into Microprocessor-Controlled (MPC) Prosthetics, Myoelectric Prosthetics, and Body Powered Prosthetics, with Microprocessor-Controlled (MPC) Prosthetics leading the market with 62.4% of market share.

- North America led the market by securing a market share of 38.9% in 2023.

Extremity Analysis

The dominating segment in the robotic prosthetics market for extremities is Lower Limb Prosthetics accounting for over 58.7% market share. This dominance is driven by the higher incidence of lower limb amputations, often resulting from diabetes, vascular diseases, and trauma. Lower limb amputations are more common than upper limb amputations due to the increased prevalence of conditions such as peripheral vascular disease and diabetes, which often lead to foot or leg amputations.

As these patients require prosthetic solutions for mobility, the demand for advanced lower limb prosthetics has significantly increased. Furthermore, advancements in robotic prosthetics, such as microprocessor-controlled knee and ankle systems, allow users to achieve a more natural gait and improved stability, driving market growth. Lower limb prosthetics are also used extensively in rehabilitation centers and hospitals, contributing to their dominance in the segment. The demand for personalized and customized solutions for amputees further supports the growth of this segment, as users seek prosthetic solutions tailored to their specific needs.

Technology Analysis

Microprocessor-Controlled (MPC) Prosthetics is the leading technology in the robotic prosthetics market which accounted for 62.4% market share. MPC systems are designed to offer enhanced stability, comfort, and functionality by integrating microprocessors that automatically adjust the prosthetic to real-time changes in terrain and walking patterns. This technology allows for more fluid, natural movement compared to traditional prosthetics.

MPC systems enable adjustments for walking speed, incline, and other environmental factors, providing users with greater freedom of movement. The rise in adoption of MPC prosthetics is also attributed to the growing demand for high-performance solutions that improve user quality of life. As these prosthetics continue to evolve with advanced sensors and algorithms, the market for MPC prosthetics is anticipated to grow significantly. Additionally, the increasing awareness of the benefits of these systems among healthcare professionals and patients is further boosting their adoption.

Key Market Segments

By Extremity

- Lower Limb Prosthetics

- Upper Limb Prosthetics

By Technology

- Microprocessor-Controlled (MPC) Prosthetics

- Myoelectric Prosthetics

- Body Powered Prosthetics

Drivers

Technological Advancements in Prosthetic Devices

Technological advancements are a significant driver in the growth of the robotic prosthetics market. Innovations in microprocessor-controlled (MPC) systems, myoelectric prosthetics, and bionic limbs have greatly improved the functionality and performance of prosthetic devices. These developments enable prosthetics to mimic natural limb movement more effectively, providing enhanced comfort and mobility to users.

The integration of artificial intelligence (AI) and machine learning algorithms in prosthetics further contributes to adaptive behavior, allowing devices to adjust to the user’s unique movement patterns. Additionally, advancements in materials, such as carbon fiber and lightweight alloys, have reduced the weight of prosthetic limbs, increasing wearability.

In March 2025, engineers at Johns Hopkins University unveiled a groundbreaking prosthetic hand capable of gripping everyday objects such as plush toys and water bottles with human-like precision. The hand adjusts its grasp to carefully conform to the object, preventing damage or mishandling. This hybrid design marks a first in robotic hand technology, overcoming the limitations of previous designs that were either too rigid or too soft to mimic the human touch when interacting with objects of varying textures and materials.

As these technologies improve, the demand for advanced prosthetic solutions grows, driving market expansion. Furthermore, the increasing accessibility of robotic prosthetics, especially in developed regions, and the continuous research and development efforts by major players fuel this technological growth, making advanced prosthetics more reliable and practical for a larger group of amputees.

Restraints

High Costs of Robotic Prosthetics

The high cost of robotic prosthetics remains a major restraint for the market. Advanced prosthetic devices, particularly robotic and bionic solutions, are often prohibitively expensive for a large segment of the population, especially in developing regions. The cost of materials, advanced technology integration, and the complexity of manufacturing contribute significantly to the high price points.

Moreover, the insurance coverage for these devices is limited in several regions, adding to the financial burden on users. Although prosthetics offer improved functionality, their price may limit their adoption among individuals who need them the most. This is particularly evident in countries where healthcare systems do not provide full reimbursement for these high-tech devices. Consequently, the market’s growth is stifled by the financial accessibility issues faced by potential users.

For example, LUKE Arm, a highly advanced bionic arm known for its powered shoulder and multi-degree-of-freedom motion; such myoelectric and neuroprosthetic devices can cost from $20,000 to over $100,000 depending on complexity and features. These bionic and myoelectric prosthetics utilize sensors to detect muscle signals and employ sophisticated robotics, artificial intelligence, and sometimes sensory feedback to mimic natural limb movement much more closely than simple cosmetic or body-powered devices. The high price is due to embedded technology, advanced materials (such as carbon fiber or titanium), and the customization required to fit each user.

Opportunities

Growing Demand for Personalized Prosthetics

An emerging opportunity in the robotic prosthetics market lies in the growing demand for personalized and customizable prosthetic solutions. Each individual’s needs are unique, and personalized prosthetics offer a tailored fit and functionality that standard models may not provide. Advances in 3D printing technologies enable the creation of custom prosthetics at a lower cost and with faster turnaround times, making them more accessible to a broader audience. Additionally, personalized prosthetics improve user comfort, mobility, and psychological well-being by ensuring that the devices closely match the user’s natural anatomy and preferences.

The growing trend of patient-centered care in healthcare emphasizes the need for individualized solutions, which presents significant market potential for companies focused on personalized robotic prosthetics. The war in Ukraine has resulted in over 10,000 amputation victims, creating a significant need for prostheses. To assist, in September 2022, Unlimited Tomorrow Global Initiative (UTGI) has partnered with Singularity Group to deliver 100 personalized TrueLimb prostheses to Ukraine. Siemens Caring Hands has contributed an initial $250,000 donation, covering the costs for 25 victims.

Impact of Macroeconomic / Geopolitical Factors

The overall economic health of a region directly affects the adoption of advanced prosthetics. In developed economies, where disposable incomes are higher, the demand for high-end prosthetic devices, including robotic limbs, tends to increase. However, in emerging markets or during economic downturns, the affordability of such high-cost technologies may hinder growth.

Economic instability, like recessions, can lead to reduced healthcare spending, making it difficult for individuals to access these advanced prosthetic solutions. The allocation of government spending on healthcare influences the availability of robotic prosthetics. In countries with well-funded healthcare systems, robotic prosthetics are more likely to be covered by insurance, leading to increased adoption. Conversely, in nations with constrained healthcare budgets, the cost of robotic prosthetics may limit their accessibility, thus affecting market expansion.

Geopolitical tensions and tariffs can affect the supply chain of materials used in prosthetic manufacturing, including advanced sensors and robotics components. Increased tariffs or trade restrictions can drive up the cost of production, which, in turn, increases the price of prosthetic devices. Different countries have varying regulatory standards for medical devices, including prosthetics.

Geopolitical factors that impact regulatory alignment between countries can either expedite or slow the approval and adoption process of new robotic prosthetic technologies. For instance, regulatory hurdles in some regions may prevent rapid market penetration of advanced prosthetics, limiting their accessibility and slowing market growth.

Latest Trends

Integration of Artificial Intelligence

A prominent trend in the robotic prosthetics market is the integration of artificial intelligence (AI) and robotics. AI allows prosthetic devices to “learn” from user behavior, adapting to different tasks and environments in real-time. Robotic prosthetics powered by AI can recognize patterns in movement, adjust to changes in terrain, and provide a more natural user experience. These advancements significantly improve the performance of prosthetics, offering users better functionality and flexibility.

In December 2024, researchers at the University of Alberta’s Bionic Limbs for Improved Natural Control (BLINC) Lab, under the leadership of Adam Parker, initiated groundbreaking work in the development of AI-enabled prosthetics. This research marks a significant shift from conventional prosthetic technologies, which have long functioned as passive tools. The AI-based systems being developed are designed to learn from and adapt to each user’s movements and behaviors, offering a more personalized and responsive experience. By creating a dynamic interaction between the user and the device, these next-generation prosthetics aim to enhance both functionality and user comfort.

Additionally, the integration of robotics enables users to control their prosthetics with greater precision and less effort, enhancing ease of use. The trend of incorporating AI into prosthetics is gaining momentum, with companies exploring machine learning algorithms to provide better feedback, predictive control, and even sensory feedback. As AI technology continues to evolve, prosthetics are expected to become more intuitive and responsive, further improving the quality of life for users. This trend not only benefits individuals but also creates new growth avenues for companies in the sector.

Regional Analysis

North America is leading the Robotic Prosthetics Market

The growth of this region is largely supported by its well-developed infrastructure and strong access to advanced technology. The presence of established players in the robotics and prosthetics sectors further strengthens regional performance. A steady rise in research and development activities has created a favorable environment for innovation. In addition, supportive healthcare systems and skilled workforce availability contribute to a thriving market. These factors together position the region as a hub for medical robotic advancements and next-generation prosthetic technologies.

Government initiatives have played a crucial role in driving market expansion. Programs aimed at providing advanced prosthetics to veterans have helped increase adoption rates. Such public efforts are creating a steady demand for high-performance devices. These initiatives also encourage collaborations between public health agencies and technology developers. By offering funding, policy support, and infrastructure, governments are accelerating both research and accessibility. This progress reflects a broader trend toward human-centered robotics in healthcare and rehabilitation.

The presence of leading robotics companies has also been pivotal to regional growth. For instance, Sarcos Robotics, a U.S.-based firm, is advancing AI-powered robotic systems. The company recently secured over USD 95.0 million in funding to expand its R&D efforts. In April 2025, LEM Surgical received FDA 510(k) clearance for its Dynamis Robotic Surgical System. This clearance marks a major achievement in robotic-assisted hard tissue surgery. It underscores the region’s leadership in developing precision surgical technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Robotic Prosthetics market includes Össur hf., Ottobock SE & Co. KGaA, Touch Bionics (Now part of Össur), HDT Global Inc., SynTouch, Inc., Shadow Robot Company, Open Bionics Ltd., Fillauer LLC, Stryker Corporation, Blatchford Limited, ReWalk Robotics Ltd., Medrobotics Corporation, Zimmer Biomet, and Other key players.

Össur is a global leader in non-invasive orthopedics, specializing in prosthetics, bracing, and support solutions. Their bionic technology platform includes products like the Rheo Knee and Power Knee, which utilize artificial intelligence to restore natural limb function. Össur’s commitment to innovation and patient care has positioned them as a key player in the prosthetics industry.

Ottobock is a pioneer in orthopedic technology, offering a comprehensive range of prosthetic and orthotic solutions. Their product lineup includes the Genium X3 microprocessor-controlled knee and the Michelangelo Hand, both designed to provide users with enhanced mobility and dexterity. Shadow Robot Company specializes in developing advanced robotic hands and teleoperation systems. Their flagship product, the Shadow Dexterous Hand, is a highly articulated robotic hand designed for research and industrial applications.

Top Key Players in the Robotic Prosthetics Market

- Össur hf.

- Ottobock SE & Co. KGaA

- Touch Bionics (Now part of Össur)

- HDT Global Inc.

- SynTouch, Inc.

- Shadow Robot Company

- Open Bionics Ltd.

- Fillauer LLC

- Stryker Corporation

- Blatchford Limited

- ReWalk Robotics Ltd.

- Medrobotics Corporation

- Zimmer Biomet

- Other key players

Recent Developments

- In July 2025: Point Designs, a Boulder-based startup, announced an impending acquisition agreement with Hanger, Inc., a leading provider of orthotic and prosthetic (O&P) patient care services and solutions. Point Designs specializes in creating high-strength, 3D-printed titanium prosthetic fingers for individuals with partial hand amputations.

- In April 2025: Myomo, Inc., a wearable medical robotics company focused on enhancing arm and hand function for individuals with upper-limb paralysis and neuromuscular conditions, has announced the launch of the MyoPro 2x. This new product is the latest advancement in its flagship MyoPro product line.

- In October 2023: Blatchford, a world-renowned prosthetics manufacturer, has announced the launch of Tectus, an innovative intelligent orthotic device designed to help individuals with partial lower limb paralysis walk more easily, naturally, and comfortably. The device enhances confidence and safety, offering life-changing benefits to its users.

- In August 2023: Minister of Health and Wellness, Dr. the Hon Christopher Tufton, signed a Memorandum of Understanding (MOU) with Hon. Pearnel Charles Jr., Minister of Labour and Social Security, committing JMD $50 million to implement their partnership. The joint venture was initially announced during the Minister’s Sectoral Presentation in Parliament in May.

Report Scope

Report Features Description Market Value (2024) US$ 1,546.2 million Forecast Revenue (2034) US$ 3,560.9 million CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Extremity (Lower Limb Prosthetics and Upper Limb Prosthetics), By Technology (Microprocessor-Controlled (MPC) Prosthetics, Myoelectric Prosthetics, and Body Powered Prosthetics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Össur hf., Ottobock SE & Co. KGaA, Touch Bionics (Now part of Össur), HDT Global Inc., SynTouch, Inc., Shadow Robot Company, Open Bionics Ltd., Fillauer LLC, Stryker Corporation, Blatchford Limited, ReWalk Robotics Ltd., Medrobotics Corporation, Zimmer Biomet, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotic Prosthetics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Robotic Prosthetics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Össur hf.

- HDT Global

- SynTouch Inc.

- Shadow Robot Company

- Human Technology, Inc

- Ottobock

- Open Bionics

- Fillauer

- Hanger Inc

- Other Key Players