Global Robotic Parcel Inductor Market Size, Share Report Analysis By Component (Hardware, Software, Services), By Application (E-commerce Fulfillment Centers, Courier, Express & Parcel (CEP) Hubs, Postal & Logistics Sorting Centers, Retail & Third-Party Logistics (3PL) Warehouses, Others), By End-User Industry (Logistics & Transportation, Retail & E-commerce, Manufacturing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170714

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Performance and Efficiency

- Quick Market Facts

- By Component

- By Application

- By End User Industry

- US Market Size

- Increasing Adoption Technologies

- Investment and Business Benefits

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Future Outlook and Opportunities

- Report Scope

Report Overview

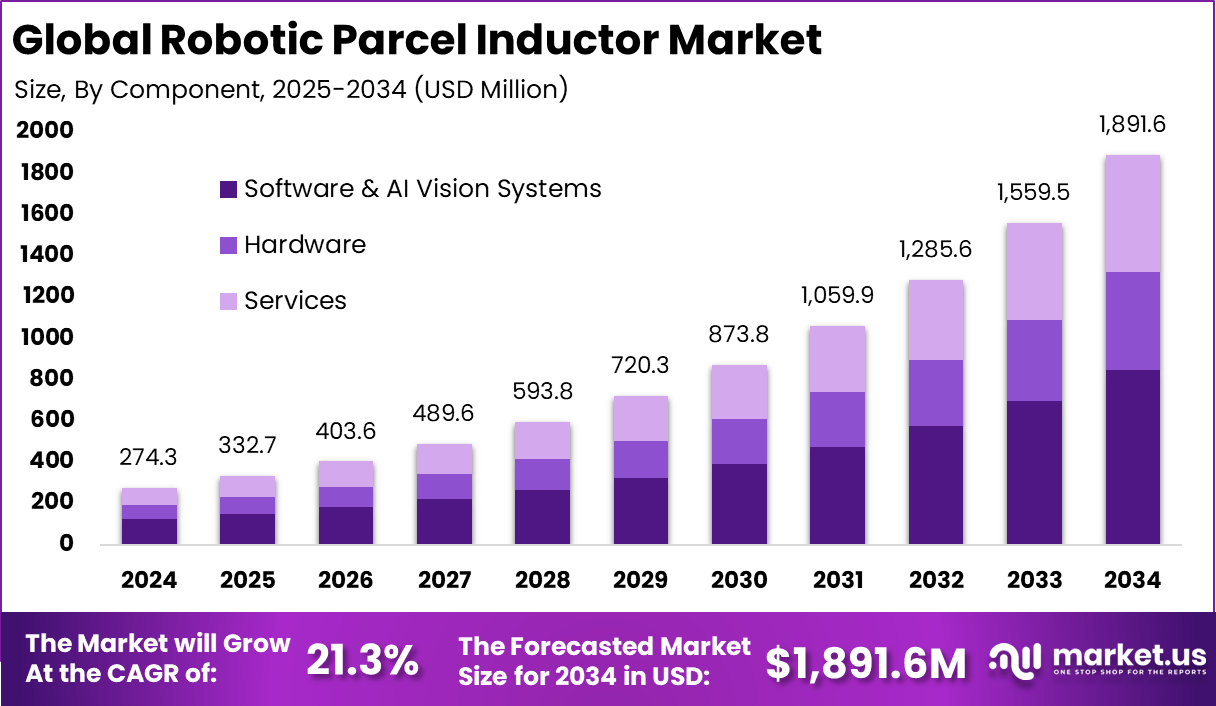

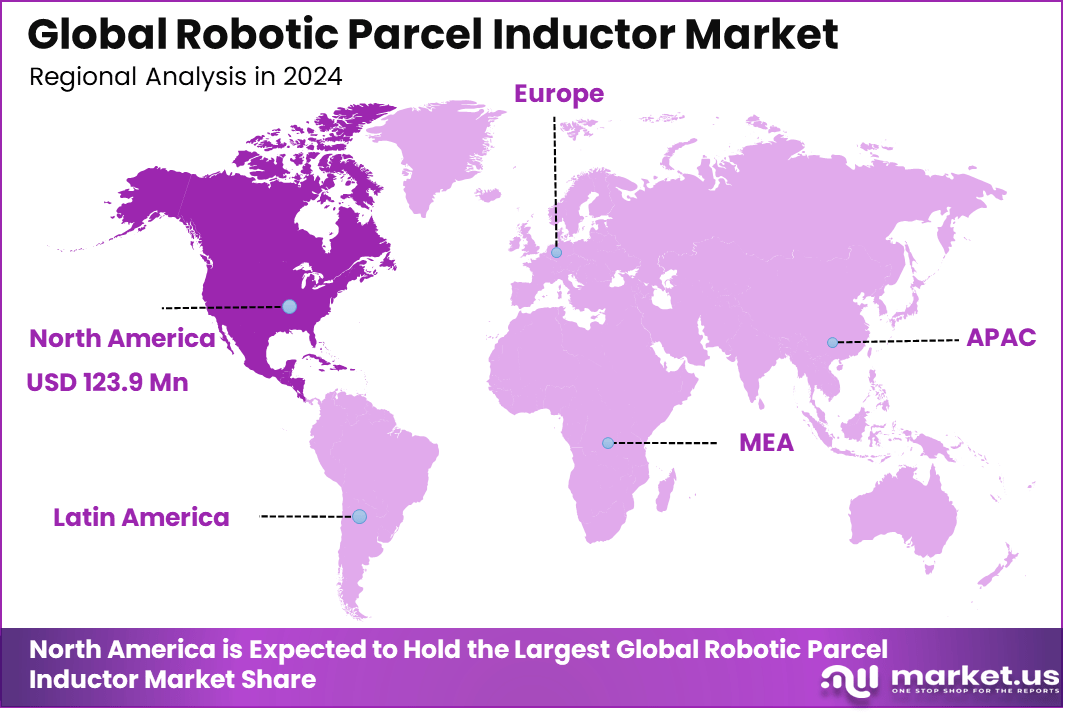

The Global Robotic Parcel Inductor Market generated USD 274.3 Million in 2024 and is predicted to register growth from USD 332.7 Million in 2025 to about USD 1,891.6 Million by 2034, recording a CAGR of 21.3% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 45.2% share, holding USD 123.9 Million revenue.

The robotic parcel inductor market includes automated systems that pick, orient, and feed parcels into conveyor, scanning, and sorting lines within logistics and distribution centers. These systems replace manual lifting and placement tasks by using robotic arms, vision systems, and advanced grippers to handle parcels of different sizes and shapes. Adoption is rising as e-commerce volumes grow and operators focus on higher throughput, accuracy, and worker safety.

Robotic parcel inductors play a critical role in reducing bottlenecks at parcel intake points and ensuring smooth flow into sortation systems. Accurate and consistent induction minimizes jams and manual intervention, which is especially important in high volume facilities. Studies on automated logistics show that effective induction automation can cut downstream sorting errors by over 30%, improving overall efficiency and reducing labor related delays.

Top Market Takeaways

- Software and AI vision systems lead with 44.8%, showing strong reliance on intelligent vision, automation software, and machine learning for accurate parcel handling.

- Courier, Express, and Parcel hubs account for 39.6%, driven by high parcel volumes, fast sorting requirements, and growing e-commerce deliveries.

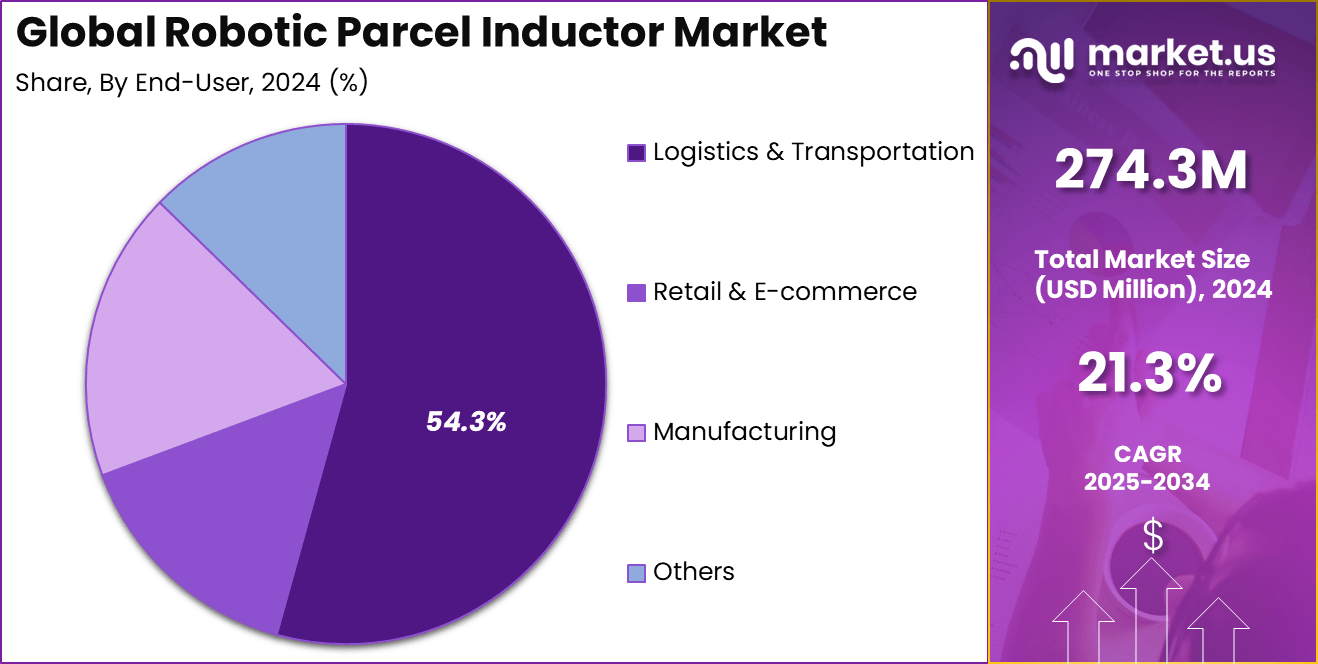

- Logistics and transportation dominate end use with 54.3%, as operators invest in automation to improve speed, accuracy, and labor efficiency.

- North America holds a 45.2% share, supported by advanced logistics infrastructure and early adoption of robotic automation.

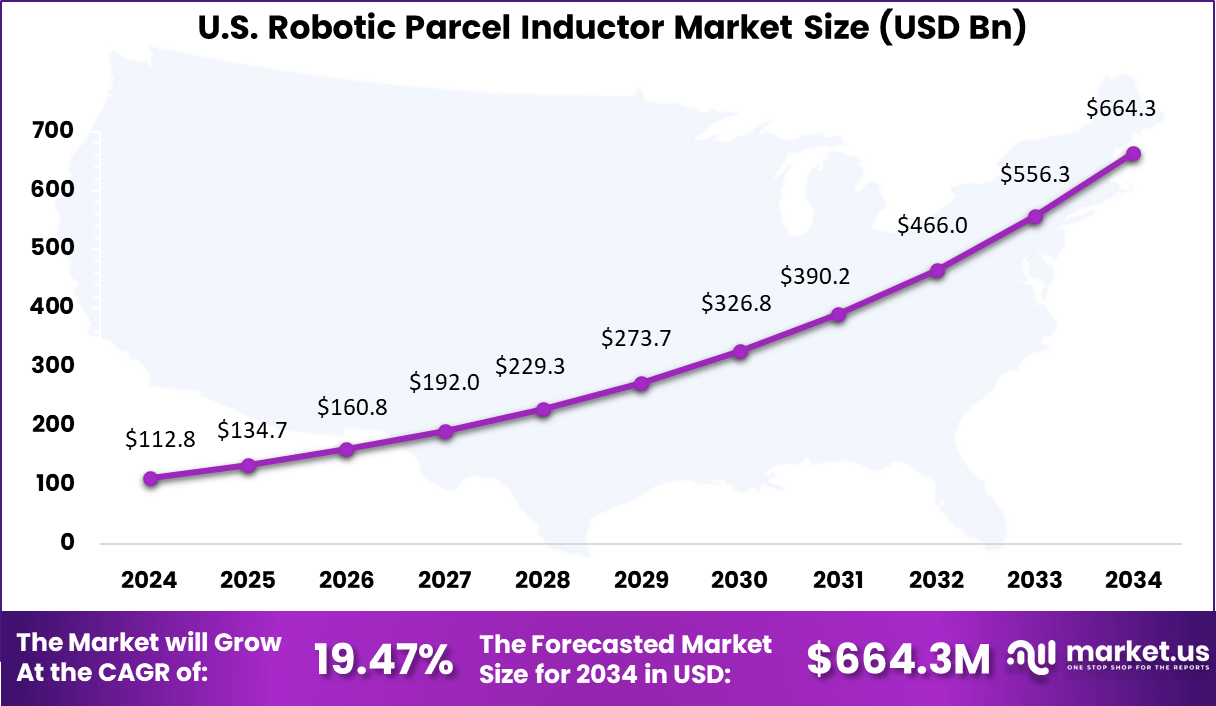

- The U.S. market reached USD 112.8 million, reflecting strong deployment across major distribution and fulfillment hubs.

- A CAGR of 19.47% highlights rapid growth, fueled by rising parcel volumes, labor shortages, and demand for high-throughput automated induction systems.

Performance and Efficiency

- Robotic parcel induction systems can handle 2,500+ picks per hour, far exceeding manual throughput.

- Automation reduces dependency on repetitive manual labor and helps lower employee turnover.

- AI-based vision enables over 99% picking accuracy, even with randomly placed or unknown parcels.

- Systems can identify and reject non-inducible items, ensuring smooth and reliable operations.

- Operational picking costs can drop by 40% to 70% after robotic induction deployment.

- Rapid growth in e-commerce volumes, projected to reach 256 billion parcels per year by 2027, is a major demand driver.

- Mid-size warehouses processing around 2 million parcels annually can save nearly USD 400,000 in labor and error costs.

- Many operators achieve ROI within one year, supported by labor savings and improved accuracy.

Quick Market Facts

Growth is driven by rapid expansion of e commerce and rising customer expectations for fast delivery. Parcel volumes have increased sharply, placing pressure on distribution networks to process packages quickly and accurately. Labor challenges, including high turnover and rising costs, have prompted logistics operators to automate physically demanding induction tasks.

Advances in robotic vision, machine learning, and adaptive gripping technologies have improved the ability of robots to handle diverse package types. Industry logistics reports show that automated induction can increase processing rates by over 25% compared to manual methods. Demand for robotic parcel inductors is increasing among third party logistics providers, courier companies, and large retailers with in house distribution centers.

Facilities with high throughput requirements particularly benefit from automation to maintain consistent performance during peak periods. Demand is also driven by safety concerns, as manual induction tasks are associated with repetitive strain injuries and workplace incidents. Surveys of logistics operations indicate that over 60% of facilities view induction automation as a priority when planning upgrades to material handling systems.

By Component

Software and AI vision systems lead with 44.8%, highlighting their critical role in automated parcel identification and sorting. These systems use computer vision, barcode recognition, and real-time analytics to detect parcel orientation, size, and labels before induction into conveyor systems.

Adoption is driven by the need for higher accuracy and speed in parcel handling. AI-powered software reduces manual intervention, lowers error rates, and improves throughput, which is essential for high-volume logistics environments.

By Application

Courier, express, and parcel hubs account for 39.6%, making them the primary application area for robotic parcel inductors. These hubs process large volumes of parcels daily and require fast, reliable automation to meet delivery timelines.

Growth in this segment is supported by rising e-commerce shipments and same-day delivery expectations. Robotic inductors help hubs manage peak loads, reduce labor dependency, and maintain consistent sorting performance.

By End User Industry

The logistics and transportation sector holds 54.3%, reflecting strong adoption of robotic automation across warehousing and distribution networks. Companies in this sector prioritize efficiency, accuracy, and scalability in parcel handling operations.

Robotic parcel inductors support these goals by improving operational flow and reducing handling bottlenecks. Their use helps logistics providers control costs while meeting growing shipment volumes and service-level commitments.

US Market Size

The United States reached USD 112.8 Million with a CAGR of 19.47%, reflecting rapid growth driven by e-commerce expansion and labor optimization efforts. Continuous upgrades in fulfillment and sorting centers continue to support market growth.

North America leads with 45.2%, supported by advanced logistics infrastructure and high automation adoption. The region shows strong investment in robotic systems to modernize parcel handling facilities.

Increasing Adoption Technologies

Key technologies supporting adoption include high resolution vision systems, force controlled grippers, real time motion planning, and integrated conveyor controls. Artificial intelligence is used to identify package orientation and select optimal grasp points. Cloud connected monitoring tools allow remote performance analysis and predictive maintenance.

Industry research suggests that more than 70% of new induction automation projects incorporate vision guided robotics to handle package variability. Organizations adopt robotic parcel inductors to improve throughput, reduce labor dependency, and enhance workplace safety.

Robots can operate continuously without fatigue and handle repetitive movements that are physically demanding for human workers. Automated induction also supports consistent data capture at the start of the processing chain, improving sortation accuracy. Logistics managers report that automated induction systems contribute to smoother operations and lower overall processing costs.

Investment and Business Benefits

Investment opportunities exist in robotic hardware optimized for logistics environments, advanced perception software, and integration services for complex sortation systems. There is also growing demand for turnkey solutions that combine robots, conveyors, and control platforms. Service based models, including leasing and managed automation, offer alternative investment pathways for smaller operators.

Logistics technology spending trends indicate that material handling automation continues to attract significant investment, particularly in high growth e commerce regions. Robotic parcel inductors deliver tangible business benefits including higher throughput, reduced error rates, and lower injury related costs.

Automation of induction tasks frees human workers to focus on value added activities such as quality checks and exception handling. Consistent induction quality leads to fewer downstream stoppages and less rework. Case studies from automated facilities show measurable gains in processing rate and overall system reliability.

Emerging Trends

Integration with Vision-Guided Robotics and AI Models

One emerging trend in this market is the use of advanced vision systems and basic artificial intelligence models to improve parcel detection and handling accuracy. Traditional sensors can detect parcel presence, but combining vision systems with machine learning models helps identify parcel orientation, label position, and surface characteristics. This allows robotic inductors to adjust grasping strategies in real time and reduce handling errors.

Another trend involves modular robotic inductor designs that can be configured to work with different conveyor types or sorting machines. Rather than installing a full custom solution each time, operators can choose pre-engineered modules that fit their layout and parcel flow. This trend helps facilities upgrade existing lines with minimal disruption and supports faster deployment of automated induction systems.

Growth Factors

Increase in Online Shopping and Delivery Expectations

A key growth factor for the robotic parcel inductor market is the continued growth of online shopping. More e-commerce purchases lead to higher daily parcel volumes at distribution hubs and last-mile facilities. Consumers increasingly expect faster delivery times, including next-day and same-day services. To meet these expectations without excessive labor costs, logistics operators are turning to automation for front-end tasks such as parcel induction.

Another growth factor arises from persistent labor challenges in logistics operations. Many parcel handling facilities have difficulty hiring and retaining workers for repetitive tasks such as manual induction. Labor shortages and rising wages motivate companies to invest in robotics that can operate consistently and reduce dependence on seasonal or temporary labor. Automated induction systems help sustain high parcel throughput while managing staffing constraints.

Key Market Segments

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Parcel Volumes and Labor Challenges

A major driver of this market is the steady increase in parcel volumes handled by logistics and distribution networks. Growth in online shopping and direct-to-consumer deliveries has pushed parcel counts higher year after year. Traditional manual induction of parcels into sorting lines becomes slower and more error-prone as volumes increase.

Robotic parcel inductors help maintain consistent processing rates even during peaks, which supports smoother operations in busy logistics centers. Another driver is the ongoing challenge of labor availability and cost in parcel handling operations. Many logistics operators report difficulty in hiring and retaining workers for repetitive tasks such as parcel induction.

These tasks involve lifting, positioning, and feeding items into sorting machines, which can be physically demanding. Automated inductor systems reduce dependence on manual labor for these repetitive steps, making operations more resilient and less vulnerable to shifts in workforce availability.

Restraint Analysis

High Initial Investment and System Integration

One restraint on the market is the cost associated with robotic parcel inductor systems. These systems combine robotics, sensors, and control software, which raises upfront expenditure compared to manual handling or simple conveyor setups. Smaller logistics facilities or operators with limited capital may delay or avoid investment until they can justify the cost with clear productivity gains.

Another restraint is the complexity of integrating robotic inductors with existing sorting and conveyor systems. Many logistics hubs operate on legacy infrastructure that was not designed for automation. Installing a robotic inductor often requires layout changes, software integration, and coordination with control systems.

Opportunity Analysis

Expansion in E-Commerce and Same-Day Delivery Services

A strong opportunity exists as e-commerce continues to expand globally. More online purchases translate into higher parcel throughput at logistics hubs and last-mile facilities. Facilities that handle same-day and next-day delivery face especially high throughput requirements, which creates demand for automated induction systems that keep pace with parcel arrival patterns.

Another opportunity lies in combining robot inductors with advanced data and control systems. When these systems connect with warehouse management and execution software, operators gain better visibility into parcel flows and can plan work more efficiently. Parcel inductors that offer seamless data integration support real-time tracking and performance monitoring, which can help logistics providers enhance operational planning and reduce bottlenecks.

Challenge Analysis

Variation in Parcel Size, Shape, and Packaging

A key challenge is the wide variability among parcels. Packages differ in size, weight, shape, cushioning, labels, and material. Some parcels may be bulky, others thin or irregularly shaped. Designing robotic systems that can reliably grasp and orient all types of parcels without causing damage requires advanced sensing and flexible handling mechanisms. This complexity increases engineering requirements and may limit throughput if not addressed effectively.

Another challenge is maintaining consistent system performance over time. Robotics and sensor systems must be calibrated and maintained regularly to ensure reliability. Dust, wear, hardware faults, or misalignment can reduce accuracy and slow induction rates. Ensuring ongoing performance requires technical support and preventive maintenance, which adds to operational responsibility for logistics operators.

Competitive Analysis

ABB, KUKA, FANUC, and Yaskawa lead the robotic parcel inductor market with high speed robotic arms and vision guided systems used in logistics hubs and distribution centers. Their solutions automate parcel singulation, orientation, and induction onto conveyors and sorters. These companies focus on throughput accuracy, payload flexibility, and reliable operation in high volume environments. Rapid growth in e commerce and parcel volumes continues to reinforce their leadership.

Dematic, Honeywell Intelligrated, Vanderlande, Beumer Group, Siemens, and Toshiba strengthen the market by integrating robotic inductors into large scale material handling and sorting systems. Their platforms support seamless flow between receiving, sorting, and dispatch operations. These providers emphasize system integration, uptime, and scalable deployment. Increasing investment in automated warehouses and smart logistics infrastructure supports wider adoption.

Okura Yusoki, Plus One Robotics, RightPick, Berlinger, ULMA Handling Systems, and other players expand the landscape with AI powered picking, vision based induction, and flexible robotic cells. Their offerings help operators handle mixed parcel sizes and reduce manual labor dependency. These companies focus on adaptability, fast deployment, and cost efficiency. Growing demand for labor optimization and faster order fulfillment continues to drive growth in the robotic parcel inductor market.

Top Key Players in the Market

- ABB, Ltd.

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation (Motoman)

- Dematic GmbH

- Honeywell Intelligrated

- Vanderlande

- Beumer Group

- Siemens AG

- Toshiba Infrastructure Systems & Solutions Corporation

- Okura Yusoki Co., Ltd.

- Plus One Robotics, Inc.

- RightPick

- Berlinger & Co. AG

- ULMA Handling Systems

- Others

Recent Developments

- January 2025, ABB expanded its Item Picking family with the AI‑powered Robotic Parcel Inductor module, targeting small‑parcel singulation and sorter induction at up to 1,500 picks per hour and more than 99.5 percent picking accuracy in post and parcel centers.

- March 2025, Siemens Digital Logistics announced new software for digital planning and control of logistics chains, using optimization and real‑time data capabilities that can be combined with robotic sorting and induction systems in parcel hubs to orchestrate end‑to‑end flows

Future Outlook and Opportunities

The future outlook for the robotic parcel inductor market remains positive as logistics operations continue to scale and consumer demand for rapid delivery persists. Opportunities are expected in flexible induction solutions that can adapt to seasonal peaks and diverse package profiles.

Integration with autonomous mobile robots for intra facility transport and advanced analytics for performance optimization will further expand use cases. Industry insights suggest that robotic induction will become a standard element of modern distribution centers seeking high efficiency and resilience.

Report Scope

Report Features Description Market Value (2024) USD 274.3 Mn Forecast Revenue (2034) USD 1,891.6 Mn CAGR(2025-2034) 21.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Application (E-commerce Fulfillment Centers, Courier, Express & Parcel (CEP) Hubs, Postal & Logistics Sorting Centers, Retail & Third-Party Logistics (3PL) Warehouses, Others), By End-User Industry (Logistics & Transportation, Retail & E-commerce, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation (Motoman), Dematic GmbH, Honeywell Intelligrated, Vanderlande, Beumer Group, Siemens AG, Toshiba Infrastructure Systems & Solutions Corporation, Okura Yusoki Co., Ltd., Plus One Robotics, Inc., RightPick, Berlinger & Co. AG, ULMA Handling Systems, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotic Parcel Inductor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Robotic Parcel Inductor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB, Ltd.

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation (Motoman)

- Dematic GmbH

- Honeywell Intelligrated

- Vanderlande

- Beumer Group

- Siemens AG

- Toshiba Infrastructure Systems & Solutions Corporation

- Okura Yusoki Co., Ltd.

- Plus One Robotics, Inc.

- RightPick

- Berlinger & Co. AG

- ULMA Handling Systems

- Others