Global Robot OTA Update Platforms Market By Component (Software Platform (Update Management & Orchestration Engine, Rollback & Version Control Systems,Others), Services (Professional Services, Managed Services)), By Update Type (Firmware Updates, Software Updates, Security Updates, Others), By Robot Type (Industrial Robots, Service Robots, Collaborative Robots, Others), By Deployment Mode (Cloud-Based, On-Premises), By End-User (Manufacturing, Healthcare, Others) By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170423

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Component Analysis

- Update Type Analysis

- Robot Type Analysis

- Deployment Mode Analysis

- End User Analysis

- Key reasons for adoption

- Benefits of Users

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- By Deployment Mode

- Regional Analysis

- Opportunities & Threats

- Key Challenges

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

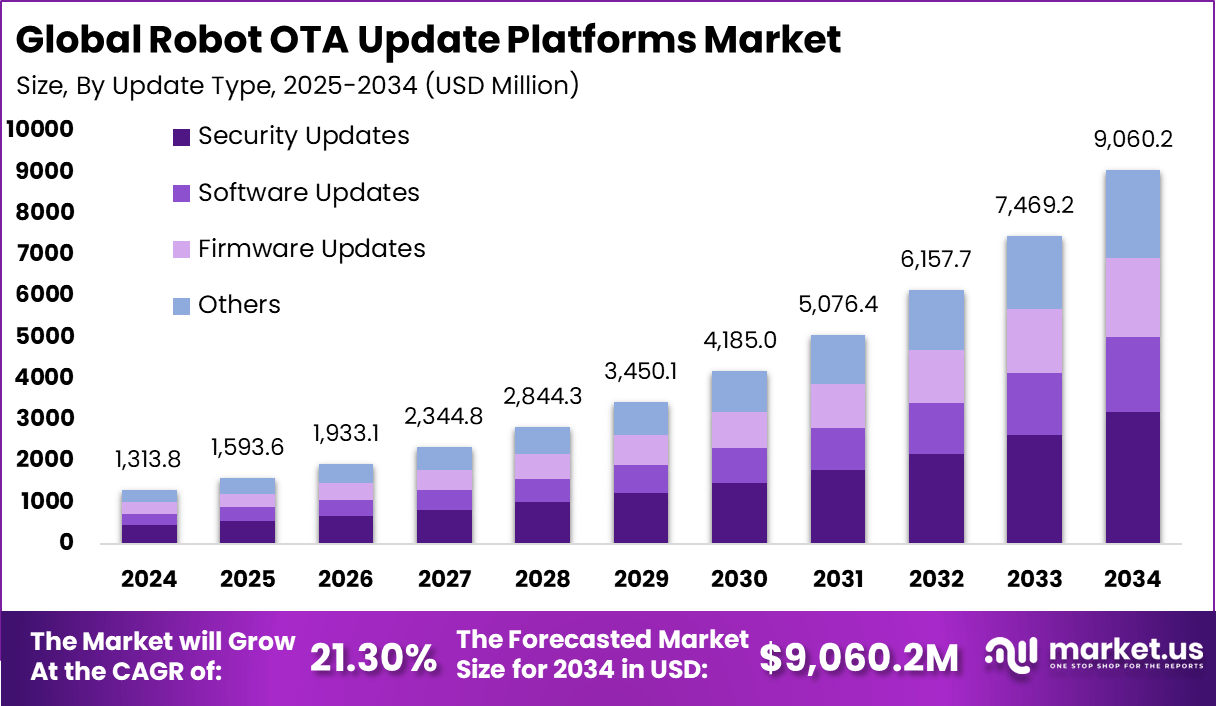

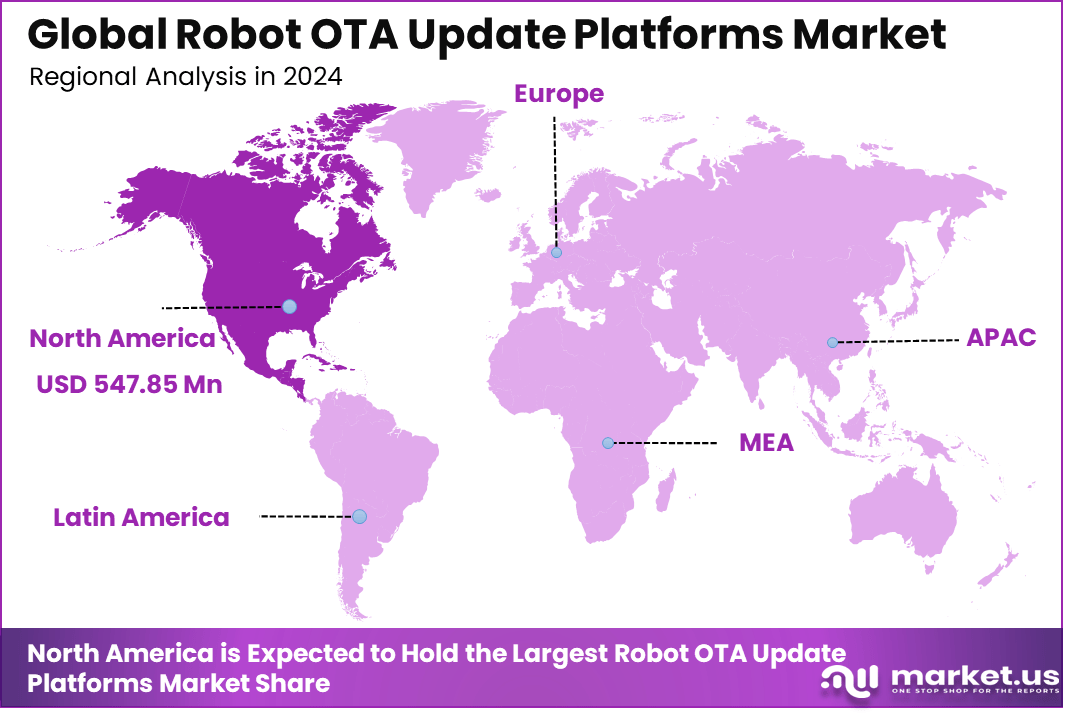

The Global Robot OTA Update Platforms Market generated USD 1,313.8 million in 2024 and is predicted to register growth from USD 1,593.6 million in 2025 to about USD 9,060.2 million by 2034, recording a CAGR of 21.30% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 41.7% share, holding USD 547.85 Million revenue.

The robot OTA update platforms market focuses on software systems that enable secure, remote, and centralized updates of robot firmware, operating systems, and applications. These platforms allow robot manufacturers and operators to deploy updates without physical access to devices. OTA platforms are increasingly used across industrial robots, service robots, autonomous mobile robots, and collaborative robots.

This market plays a crucial role in ensuring operational continuity and system reliability for deployed robots. OTA platforms help organizations fix software bugs, deploy new features, and address security vulnerabilities in real time. They reduce downtime by eliminating the need for manual updates and on site maintenance. In large robot fleets, OTA updates support consistent configuration and version control.

Growth is driven by the rapid increase in connected and autonomous robots across industries. As robots rely more on cloud connectivity, AI models, and sensors, frequent software updates are required. Cybersecurity concerns are also a major driver, as unpatched robots pose safety and data risks. Expansion of robot fleets in logistics, manufacturing, and healthcare has increased demand for scalable update solutions.

Industrial automation reports show that cyber incidents targeting operational technology systems have risen by more than 30%, accelerating adoption of secure OTA platforms. Demand for robot OTA update platforms is growing steadily among manufacturers, system integrators, and end users managing large robot fleets. Logistics warehouses, factories, and public service environments require continuous updates to adapt to changing workflows.

Top Market Takeaways

- By component, software platforms dominated the robot OTA update platforms market with a 72.8% share, enabling centralized management, secure delivery, and scalable firmware deployment across robot fleets.

- By update type, security updates led at 35.4%, critical for patching vulnerabilities in robotic systems and ensuring compliance with evolving cyber security standards in connected environments.

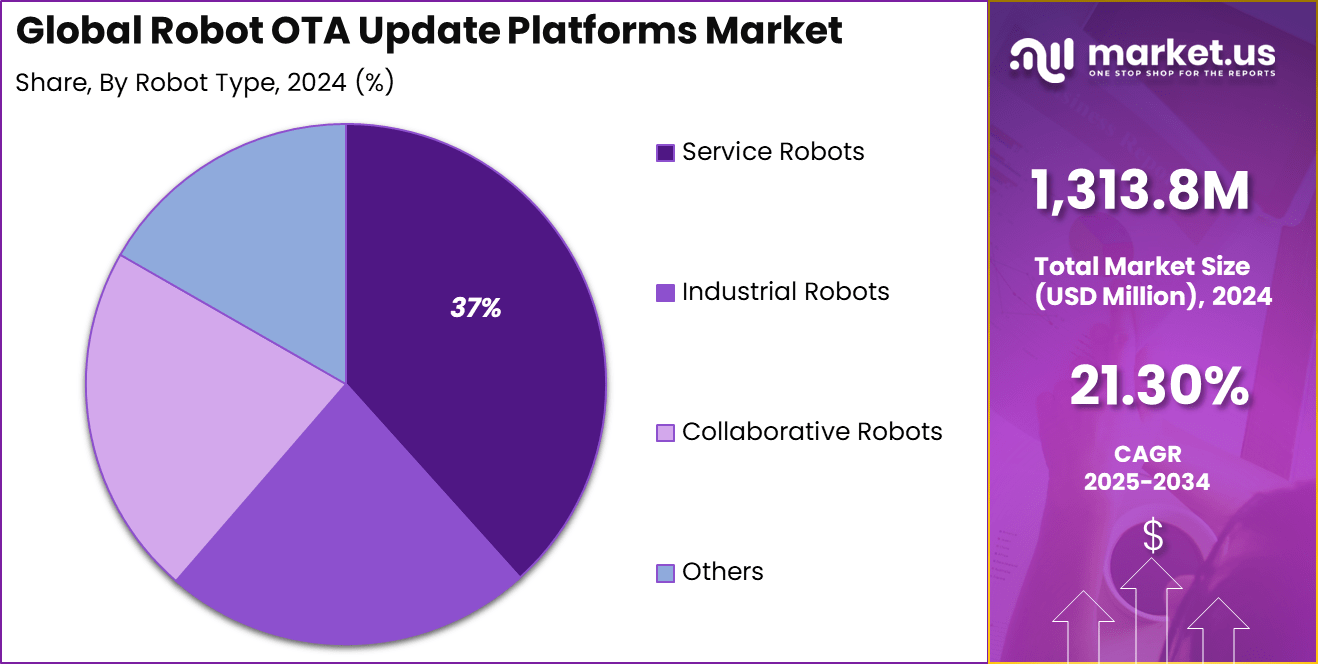

- By robot type, service robots accounted for 36.7%, driven by needs for frequent enhancements in navigation, AI capabilities, and task adaptability in dynamic settings like healthcare and hospitality.

- By deployment mode, cloud-based solutions captured 77.8%, offering real-time monitoring, seamless scalability, and remote fleet management without on-site interventions.

- By end-user, logistics and warehousing represented 28.3%, supported by demand for optimized pathing, predictive maintenance, and rapid feature roll outs to handle e-commerce volume surges.

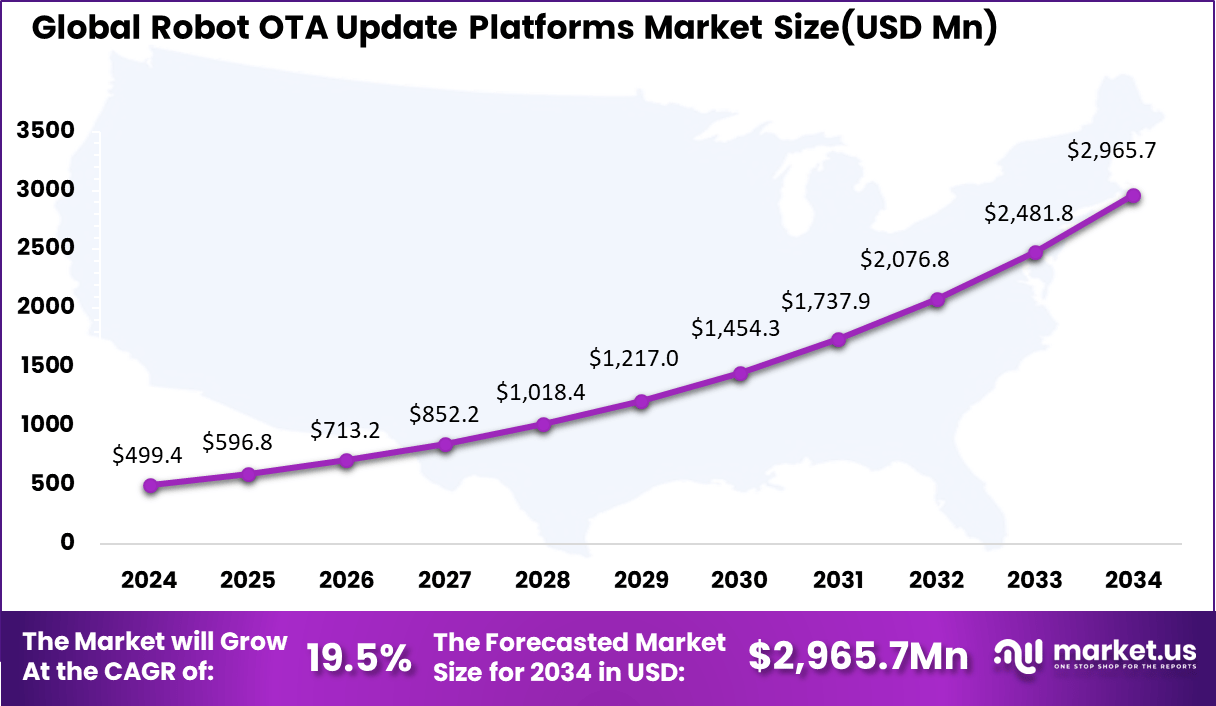

- North America held 41.7% of the global market, with the U.S. valued at USD 499.4 million in 2025 and projected to grow at a CAGR of 19.5% fueled by advanced warehouse automation and IoT integration.

Component Analysis

The software platform segment held a 72.8% share in the Robot OTA Update Platforms Market, showing its central role in managing over the air updates for robotic systems. Software platforms act as the core layer that controls update scheduling, version management, device monitoring, and rollback functions. As robots become more software driven, companies are relying on unified platforms to manage fleets efficiently and reduce manual intervention during updates.

Growth in this segment is supported by the need for scalable and centralized control. Software platforms allow operators to deploy updates across thousands of robots from a single dashboard. This improves operational reliability and reduces downtime. Vendors are also adding analytics and automation features, which further strengthens the value of software platforms in large scale robotic deployments.

Update Type Analysis

Security updates accounted for 35.4% of the Robot OTA Update Platforms Market, reflecting strong focus on protecting robots from cyber threats. Robots connected to networks are exposed to vulnerabilities that can affect safety, data integrity, and system availability. Security updates help patch software flaws, fix access control issues, and protect communication channels used by robots.

The demand for security updates is rising as enterprises recognize the risks of delayed patching. Regular security updates help maintain compliance and reduce the chances of system compromise. OTA platforms make this process faster and more reliable by enabling remote deployment, which is especially important for robots operating in distributed or hard to reach locations.

Robot Type Analysis

Service robots held a 37% share in the Robot OTA Update Platforms Market, driven by their widespread use in public and commercial environments. These robots are used in areas such as delivery, cleaning, healthcare support, and customer assistance. Because service robots operate in dynamic settings, frequent software updates are required to improve performance, navigation, and safety features.

OTA update platforms are widely adopted for service robots to ensure continuous improvement without physical access. This approach reduces maintenance costs and supports faster feature rollout. As service robots become more intelligent and user facing, reliable update mechanisms are becoming a critical requirement for operators and manufacturers.

Deployment Mode Analysis

Cloud based deployment dominated the market with a 77.8% share, highlighting the preference for remote and scalable update management. Cloud platforms allow real time monitoring and centralized update control across geographically dispersed robot fleets. This is especially useful for companies managing robots across multiple sites or regions.

The popularity of cloud based solutions is supported by lower infrastructure costs and faster deployment. Cloud platforms also support automated updates, data logging, and security management. These benefits make cloud based OTA platforms the preferred choice for organizations aiming to scale robotic operations efficiently.

End User Analysis

The logistics and warehousing sector captured a 28.3% share of the Robot OTA Update Platforms Market, reflecting high adoption of mobile and autonomous robots in this industry. Warehouses use robots for picking, sorting, and transportation tasks, which depend on stable and updated software to maintain accuracy and efficiency.

OTA update platforms help logistics operators deploy updates without disrupting operations. Updates can be rolled out during low activity periods, reducing downtime. As warehouses expand automation and operate around the clock, reliable OTA update systems are becoming essential to maintain performance and security across robotic fleets.

Key reasons for adoption

- Large robot fleets are being deployed across multiple sites, which is increasing the need for centralized and remote software management.

- Frequent software improvements in autonomy, vision, and safety functions are making manual updates slow and risky for operations teams.

- Growing use of connected robots is raising cybersecurity concerns, so timely patching is required to reduce exposure to known threats.

- Operational uptime is becoming critical, pushing companies to adopt controlled update processes that limit disruption to live systems.

- Compliance and quality standards are encouraging traceable and auditable update mechanisms across the robot lifecycle.

Benefits of Users

- Software updates can be delivered faster without physically accessing each robot, reducing maintenance effort and travel costs.

- Fleet reliability improves as bugs and performance issues are resolved consistently across all deployed units.

- Security posture is strengthened because vulnerabilities can be patched quickly after detection.

- Update rollback and validation features help prevent system failures during deployment.

- Engineering teams gain better visibility into software versions and deployment status across the fleet.

Usage

- Firmware and application updates are pushed remotely to robots operating in factories, warehouses, and outdoor environments.

- Staged deployment is used to test updates on a limited group of robots before full rollout.

- Continuous monitoring tracks update success, failures, and system health after deployment.

- Secure authentication and encryption are applied to ensure only trusted updates are installed.

- Life cycle management supports long term maintenance, version control, and end of support planning for deployed robots.

Emerging Trends

Key Trend Description Cloud OTA Updates Software fixes are delivered over the internet without physically accessing the robot. AI Safe Updates AI systems verify updates in advance to prevent robot errors or sudden shutdowns. Fleet Wide Changes Multiple robots are updated simultaneously through a single control platform. 5G Fast Downloads High speed connectivity enables faster software updates for mobile robots. Auto Rollback Robots automatically return to a stable version if an update does not work. Growth Factors

Key Factors Description More Robots in Use Growing robot adoption increases the need for frequent and reliable software updates. Cut Down Time Off Faster updates help robots stay operational with minimal interruptions. Save Fix Costs Remote updates reduce site visits and lower maintenance expenses. New Smart Rules Regulations encourage secure and validated software updates for robots. Robot Rent Plans Robotics as a service models include built in update and maintenance support. Key Market Segments

By Component

- Software Platform

- Update Management & Orchestration Engine

- Rollback & Version Control Systems

- Compliance & Reporting Dashboard

- Security & Cryptography Module

- Services

- Professional Services

- Managed Services

By Update Type

- Firmware Updates

- Software Updates

- Security Updates

- Others

By Robot Type

- Industrial Robots

- Service Robots

- Collaborative Robots

- Others

By Deployment Mode

- Cloud-Based

- On-Premises

By End-User

- Manufacturing

- Healthcare

- Automotive

- Logistics

- Consumer Electronics

- Others

Regional Analysis

North America held 41.7% share of the Robot OTA Update Platforms Market, supported by early adoption of connected robots and strong digital infrastructure. Industries such as manufacturing, logistics, healthcare, and defense increasingly rely on robots that require regular software and firmware updates. Over-the-air update platforms are used to manage these updates remotely, reduce downtime, and ensure consistent performance across large robot fleets.

The U.S. market reached USD 499.4 Mn and is growing at a 19.5% CAGR, driven by large-scale deployment of industrial and service robots. U.S. enterprises operate complex robot fleets across factories, warehouses, and public spaces, creating strong demand for centralized update management. OTA platforms help organizations roll out software patches quickly, fix bugs, and add new features without interrupting operations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Opportunities & Threats

The growing use of connected and autonomous robots is creating strong opportunities for robot OTA update platforms. As robots are deployed across factories, warehouses, healthcare facilities, and public spaces, the need to update software remotely is becoming essential. OTA platforms help operators fix bugs, improve performance, and add new features without stopping operations.

This is supporting wider adoption, especially among companies managing large robot fleets. The shift toward cloud based robot management is also increasing demand, as OTA updates fit naturally into centralized monitoring and control systems.

One of the main threats to robot OTA update platforms is concern about security and reliability. Remote updates can become a target for cyber attacks if not properly protected. Any failure during an update process can disrupt robot operations or create safety risks, which makes some users cautious about adoption. Resistance is stronger in environments where robots perform critical or hazardous tasks.

Another challenge comes from system complexity and compatibility issues. Robots often use different hardware, operating systems, and communication protocols, which makes standard OTA solutions harder to implement.

Integration costs and technical barriers can limit adoption, especially for older robot models. Data privacy concerns and limited network connectivity in certain locations can also restrict the effectiveness of OTA update platforms.

Key Challenges

- Ensuring update security across distributed robot fleets. Unauthorized access or tampered updates can create serious operational and safety risks.

- Managing network reliability in remote or industrial locations. Poor connectivity can delay updates or cause incomplete installations.

- Handling device and software fragmentation. Robots often run on different hardware versions and operating systems, which complicates update compatibility.

- Minimizing downtime during update cycles. Many operators require robots to stay active, making scheduled updates difficult.

- Maintaining rollback and recovery capabilities. Failed updates must be reversed quickly to avoid service disruption.

- Meeting safety and regulatory requirements. Updates must be validated to ensure they do not affect certified robot behavior.

- Scaling update management as fleets grow. Larger deployments increase monitoring, testing, and coordination challenges.

- Integrating OTA platforms with existing robotics management systems. Lack of interoperability slows adoption and increases deployment effort.

Competitive Analysis

Microsoft, Siemens, ABB, Bosch Rexroth, and PTC lead the robot OTA update platforms market with secure cloud based systems that enable remote software updates, firmware management, and lifecycle control for industrial robots. Their platforms support large scale robot fleets and ensure consistent performance across sites. These companies focus on cybersecurity, version control, and minimal downtime.

Honeywell, Rockwell Automation, KUKA, FANUC, Yaskawa, Universal Robots, Omron, and Mitsubishi Electric strengthen the market by embedding OTA capabilities into robot controllers and automation ecosystems. Their solutions help manufacturers deploy updates faster, fix vulnerabilities, and add new functions remotely. These providers emphasize reliability, safety compliance, and seamless integration with factory systems.

NVIDIA, Amazon Web Services, IBM, and other players expand the market with AI driven update management, edge computing support, and scalable cloud infrastructure. Their offerings enable analytics based update planning and secure device connectivity. These companies focus on flexibility, global scalability, and data driven optimization. Increasing demand for remote robot management and continuous improvement continues to drive growth in robot OTA update platforms.

Top Key Players in the Market

- Microsoft Corporation

- Siemens AG

- ABB Ltd.

- Bosch Rexroth AG

- PTC Inc.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Universal Robots A/S

Omron Corporation - Mitsubishi Electric Corporation

- NVIDIA Corporation

- Amazon Web Services, Inc.

- IBM Corporation

- Others

Recent Developments

- June, 2025 – ABB used the Automatica 2025 stage to position its OmniCore controller and AMR Studio software as the backbone for remotely managed, software‑defined robots, with a roadmap for deploying new safety, motion and AI features across fleets via secure over‑the‑air controller updates instead of on‑site reconfiguration.

- September, 2025 – At CIIF 2025 in Shanghai, ABB highlighted its “Autonomous Versatile Robotics” vision, where OmniCore‑based arms and Flexley AMRs are configured, tuned and patched through a common software stack, enabling lifecycle updates to navigation, path planning and safety logic to be rolled out remotely across installed robots.

Report Scope

Report Features Description Market Value (2024) USD 1,313 Mn Forecast Revenue (2034) USD 9.060.2 Mn CAGR(2025-2034)21 21.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered Global Robot OTA Update Platforms Market By Component (Software Platform (Update Management & Orchestration Engine, Rollback & Version Control Systems,Others), Services (Professional Services, Managed Services)), By Update Type (Firmware Updates, Software Updates, Security Updates, Others), By Robot Type (Industrial Robots, Service Robots, Collaborative Robots, Others), By Deployment Mode (Cloud-Based, On-Premises), By End-User (Manufacturing, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Siemens AG, ABB Ltd., Bosch Rexroth AG, PTC Inc., Honeywell International Inc., Rockwell Automation, Inc., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots A/S, Omron Corporation, Mitsubishi Electric Corporation, NVIDIA Corporation, Amazon Web Services, Inc., IBM Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robot OTA Update Platforms MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Robot OTA Update Platforms MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Siemens AG

- ABB Ltd.

- Bosch Rexroth AG

- PTC Inc.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Universal Robots A/S

- Omron Corporation

- Mitsubishi Electric Corporation

- NVIDIA Corporation

- Amazon Web Services, Inc.

- IBM Corporation

- Others