Global Robot Market Size, Share Analysis By Type (Industrial Robots , Service Robots), By Component (Hardware (Controllers, Sensors (e.g., LiDAR, Cameras), Actuators, End Effectors), Software, Services (Integration Services, Maintenance and Support), By Deployment (Cloud-based Robotics, On-premises Robotics), By Mobility (Fixed Robots, Mobile Robots, Humanoid Robots), By Application (Assembly & Production, Inspection & Quality Control, Material Handling, Welding & Soldering, Packaging & Palletizing, Others), By End Use Industry (Manufacturing & Industrial (Automotive, Electronics & Semiconductor, Food & Beverage, Pharmaceuticals, Metal & Machinery), Healthcare, Defense, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154829

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of AI in Robot Market

- Top 5 Growth Factors

- APAC Market Size

- By Type

- By Component

- By Deployment

- By Mobility

- By Application

- By End Use Industry

- Top 5 Latest Trends

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

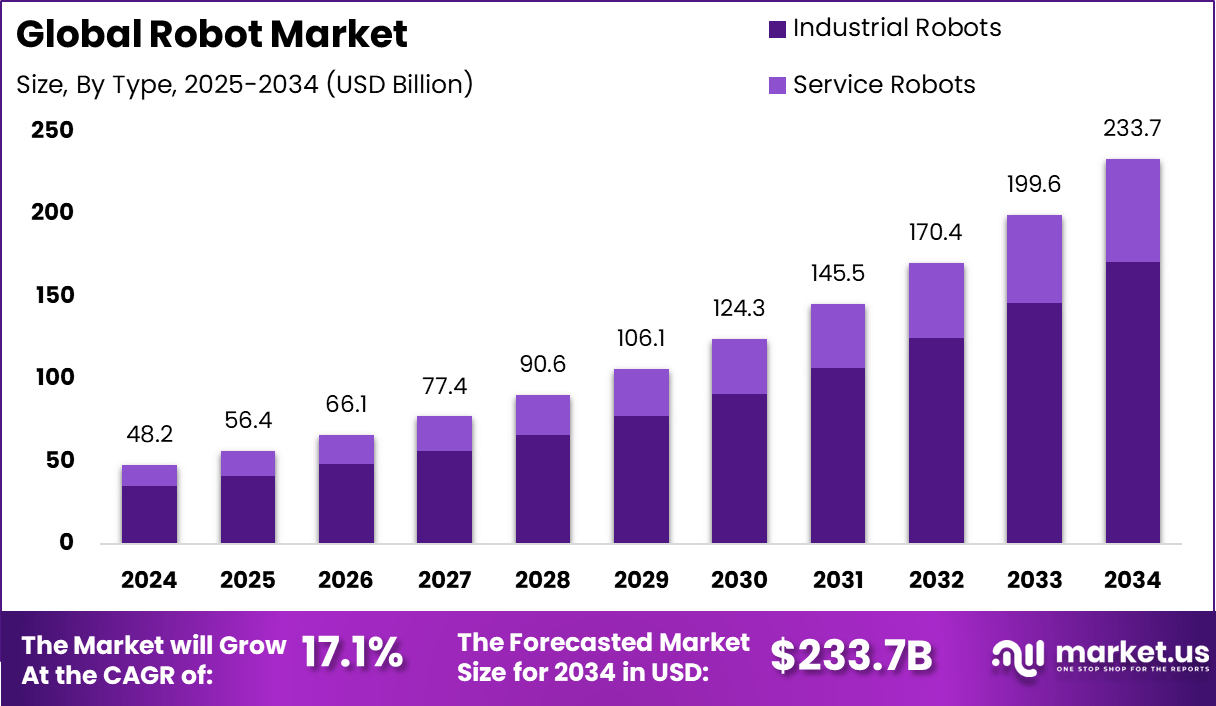

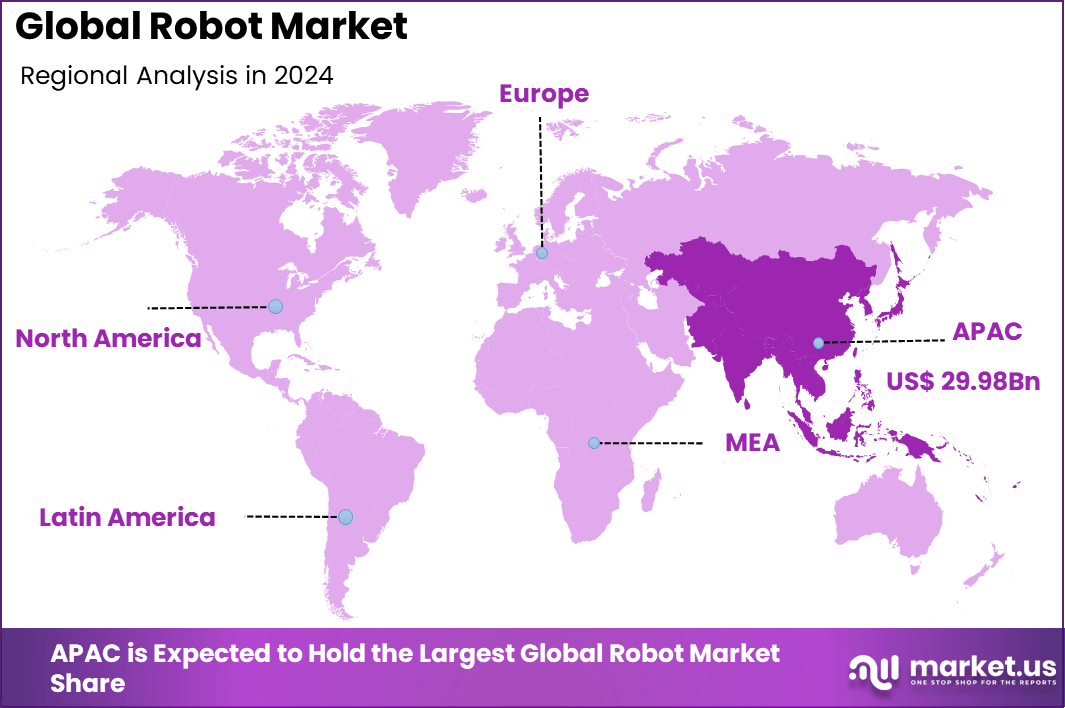

The Global Robot Market size is expected to be worth around USD 233.7 Billion By 2034, from USD 48.2 billion in 2024, growing at a CAGR of 17.1% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 62.2% share, holding USD 29.98 Billion revenue.

The robot market encompasses a broad range of mechanical and intelligent machines designed to perform tasks autonomously or semi‑autonomously. It spans industrial robots, service robots (including humanoids, quadrupeds, rescue units), and robotic process automation systems. The market is characterised by rapid innovation, integration with artificial intelligence, and deployment across diverse sectors.

According to Exploding Topics, Asia contributes over one-third of the global robotics industry’s revenue, highlighting its dominant role in the sector. Currently, there are over 3.4 million industrial robots operating worldwide, and the robot-to-human ratio in manufacturing stands at 1:71. Industrial companies are expected to allocate 25% of their capital to automation within the next five years, while 14% of workers have already lost jobs due to robotic integration.

Data from Zippia reinforces this trend, reporting that 88% of companies plan to adopt robotics in their operations. An estimated 3 million robots are in use globally, with approximately 400,000 new units entering the market each year. The global industrial robotics industry holds a market value of $43.8 billion by revenue, with the North American robotics sector growing at a CAGR of 11.70% through 2026

The top driving factors can be attributed to a growing need for automation and operational efficiency in industries such as manufacturing, logistics, healthcare, and emergency response. Rapid improvements in sensor technologies, artificial intelligence, machine learning, and cloud‑based infrastructure have accelerated robotic capabilities. Governments and large economies are funding R&D and deploying incentive programs to support robotics adoption.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 48.2 Bn Forecast Revenue (2034) USD 233.7 Bn CAGR(2025-2034) 17.1% Leading Segment Industrial Segment: 73.2% Market Share Region with Largest Share APAC [62.2% Market Share] According to the International Federation of Robotics (IFR), industrial robot installations in U.S. manufacturing rose by 12% in 2023, totaling 44,303 units. The automotive industry led adoption, contributing around 40% of new installations, followed by the electronics and electrical sectors.

Increasing adoption technologies include embodied AI systems that couple perception, planning and actuation, digital twins, advanced sensor arrays, and edge computing. These enable real‑time processing, coordination among robot swarms, and safer interaction with human environments.

Key reasons for adopting these technologies are enhanced precision, scalability, adaptability to various environments (e.g. rough, hazardous), and ability to perform repetitive or physically demanding tasks without fatigue. Businesses benefit from reduced human risk, higher throughput, and improved quality control.

For instance, In November 2024, Hellmann Worldwide Logistics successfully implemented Geekplus robotic automated storage solutions at its e-commerce hub in Dubai CommerCity. The deployment has enhanced storage capacity, improved operational efficiency, and reduced delivery times for local businesses.

The U.S. holds the fifth position globally in robot density within automotive manufacturing, matching levels seen in Germany and Japan, and surpassing China. However, in overall manufacturing automation, the U.S. ranks tenth worldwide, with a robot density of 295 units per 10,000 employees. This indicates considerable growth potential, especially when compared to China, which leads with 470 robots per 10,000 employees.

Key Insight Summary

- The market is projected to grow from USD 48.2 billion in 2024 to USD 233.7 billion by 2034, registering a strong CAGR of 17.1%, driven by automation across manufacturing, logistics, and service industries.

- Asia-Pacific (APAC) led the global market with a dominant 62.2% share, generating USD 29.98 billion in revenue, supported by large-scale industrialization, robotics investments, and strong export-oriented economies.

- The Industrial segment is expected to hold the largest share at 73.2%, reflecting high deployment of robots in heavy-duty tasks such as welding, assembly, and material handling.

- The Hardware segment accounted for USD 12.9 billion in 2024, driven by the rising demand for actuators, sensors, and controllers in robotics systems.

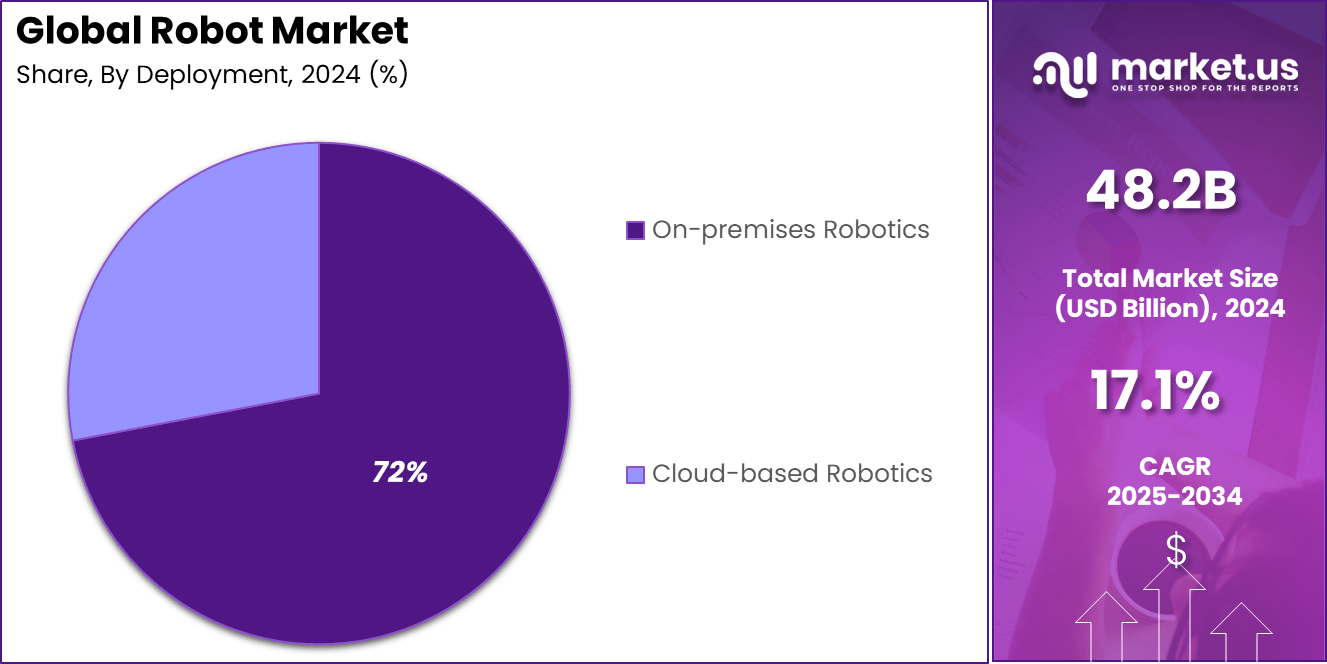

- On-premises robotics solutions are expected to account for 72% of the market, as industries continue to prioritize full control over robotic infrastructure and data security.

- Fixed robots dominated the market, contributing USD 21.2 billion in 2024, particularly in repetitive, high-speed operations across automotive and electronics sectors.

- The Manufacturing & Industrial vertical is set to lead with a 49.9% share, underscoring the sector’s dependency on robotic systems for operational efficiency, precision, and throughput.

- Assembly & Production emerged as the top application area, reflecting the widespread use of robotics in streamlining labor-intensive and error-prone manufacturing processes.

Role of AI in Robot Market

Role/Function Description Autonomy & Decision-Making AI enables robots to perform complex tasks in dynamic environments with minimal human input Intelligent Perception Advanced vision, speech, and sensor processing for navigation, recognition, and safety Human-Robot Collaboration AI powers safe and efficient interaction between robots and humans (cobots, assistive robots) Adaptive Learning & Training Robots use reinforcement and transfer learning to adapt, optimize, and self-correct Predictive Maintenance AI-driven diagnostics to reduce downtime and improve lifecycle management Natural Interfaces NLP and emotion AI enable intuitive control via voice, gestures, and even emotional cues Top 5 Growth Factors

Growth Factor Description Global Labor Shortages Declining working-age populations (esp. in Japan, Europe, N. America) drive demand for automation Smart Manufacturing/Industry 4.0 Factories deploy robots for assembly, logistics, and quality, integrating IoT and AI Rising Service & Personal Robot Use Aging societies, healthcare, cleaning, logistics, and convenience boost home/service robot demand Technological Breakthroughs Advances in AI, batteries, sensors, and connectivity improve robot autonomy, safety, cost E-commerce & Warehousing Expansion Surge in online retail increases automation for picking, packing, delivery, and inventory APAC Market Size

In 2024, APAC held a dominant market position, capturing more than 62.2% share and generating approximately USD 29.98 billion in revenue in the global robot market. The region’s leadership has been primarily driven by strong industrial automation adoption across major economies such as China, Japan, and South Korea.

These nations have significantly invested in robotics to enhance manufacturing productivity and compensate for labor shortages. Furthermore, the integration of robots in electronics, automotive, and logistics sectors has been rapidly expanding, supported by favorable government incentives and long-term digital transformation policies.

The increasing demand for high-precision manufacturing and the steady growth of e-commerce logistics have further fueled robotic deployments in Asia-Pacific. Countries like China have set national goals to become global robotics innovation hubs, with dedicated zones for industrial robot development. In addition, APAC benefits from a robust supply chain for hardware manufacturing and a rapidly evolving AI ecosystem.

By Type

In 2024, the industrial segment accounts for approximately 73.2% of the robot market, demonstrating its dominant role in automating large-scale manufacturing and production processes. Industrial robots are widely adopted for their ability to perform repetitive, precise, and high-speed operations such as assembly, welding, and material handling. Their widespread deployment reflects the manufacturing sector’s drive towards increased productivity and quality control.

As industries continue to face competitive pressures and demand for customization, these robots provide scalable automation solutions. They help reduce human error, improve safety, and optimize operational efficiency across various manufacturing verticals including automotive, electronics, and heavy equipment.

By Component

In 2024, Hardware forms the backbone of robotics, incorporating essential elements like sensors, actuators, controllers, and structural components. In 2024, the hardware segment remains critical for supporting advancements in robot functionality, durability, and precision. Continuous innovation in hardware design enables robots to operate reliably in complex environments, contributing to the widespread adoption of robotic systems.

Investment in hardware development ensures that robots can meet industry-specific requirements such as speed, load capacity, and environmental resistance. The strength of the hardware segment underpins nearly all applications of robotics, driving improvements in performance and operational longevity.

By Deployment

In 2024, On-premises deployment dominates with about 72% of robotic installations. This preference stems from organizations’ need for direct control, data security, and seamless integration with existing manufacturing systems. On-premises robotic solutions allow businesses to maintain tight oversight on production workflows and ensure continuous uptime critical for industrial operations.

These systems are especially favored in sectors with stringent data governance and compliance requirements. On-premises deployment supports real-time decision-making and system customization, enabling manufacturers to optimize productivity and respond quickly to operational demands.

By Mobility

In 2024, Fixed robots, which accounted for a large portion of the market in 2024, are integral to stationary and highly precise manufacturing tasks. This category includes articulated arms, SCARA, and gantry robots predominantly used for tasks such as assembly, painting, and welding. Their fixed positions allow for high repeatability and accuracy, essential to quality-focused industrial production.

Their dominance is largely due to the need for stable and reliable performance in controlled work cells. Fixed robots streamline repetitive tasks while enabling human operators to focus on higher-value activities, thereby boosting overall plant efficiency.

By Application

In 2024, Manufacturing and industrial applications represent nearly half of the robotic market share at 49.9 percent. Robots in this segment improve efficiency by automating labor-intensive, hazardous, or precision-dependent tasks. They enable faster production cycles and higher throughput without compromising on product quality.

The rise of advanced manufacturing technologies has further integrated robots into core industrial processes. Robotics foster flexibility and scalability crucial for adapting to changing product lines and volumes, making them indispensable in modern manufacturing ecosystems.

By End Use Industry

In 2024, Assembly and production dominate the end-use industry segment, reflecting the primary operational areas where robots add significant value. These processes benefit from automation through enhanced speed, accuracy, and consistency, which ultimately reduce costs and improve product standards.

Robotics in assembly and production not only streamline workflows but also contribute to safer work environments by minimizing human exposure to repetitive and hazardous tasks. This strong focus supports the continuous growth and technological advancement of the robot market.

Top 5 Latest Trends

Trend/Innovation Description Collaborative & Mobile Robots Cobots and AMRs for flexible, safe use alongside people in dynamic, non-traditional settings AI-Driven Adaptive Robotics Use of generative AI, reinforcement learning, and multi-agent systems for more flexible, capable robots Modular & Customizable Platforms Robots with swappable hardware/software for multiple tasks, industries, and payloads Human-Like Interaction Advances in NLP, facial expression, gesture, and emotional intelligence for more natural engagement Green & Energy-Efficient Robots Low-power motors, sustainable materials, and circular life cycles to reduce operational costs/emissions Key Market Segments

By Type

- Industrial Robots

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Delta Robots

- Collaborative Robots (Cobots)

- Parallel Robots

- Service Robots

- Personal Service Robots

- Professional Service Robots

By Component

- Hardware

- Controllers

- Sensors (e.g., LiDAR, Cameras)

- Actuators

- End Effectors

- Software

- Services

- Integration Services

- Maintenance and Support

By Deployment

- Cloud-based Robotics

- On-premises Robotics

By Mobility

- Fixed Robots

- Mobile Robots

- Humanoid Robots

By Application

- Assembly & Production

- Inspection & Quality Control

- Material Handling

- Welding & Soldering

- Packaging & Palletizing

- Others

By End Use Industry

- Manufacturing & Industrial

- Automotive

- Electronics & Semiconductor

- Food & Beverage

- Pharmaceuticals

- Metal & Machinery

- Healthcare

- Defense

- Agriculture

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Demand for Automation in Industries

One significant driver propelling the robot market is the growing demand for automation across various industries. Many sectors such as manufacturing, logistics, and healthcare are increasingly adopting robotic systems to enhance operational efficiency and productivity. Robots can perform repetitive and precise tasks faster and more accurately than human labor, which helps companies reduce production time and lower costs.

Additionally, the integration of smart technologies like artificial intelligence and machine learning in robots enables more adaptive and intelligent systems, further increasing their appeal. This trend is reinforced by labor shortages and the need to reduce workplace accidents, making robots a crucial solution for modern industrial challenges. The adoption of robotics not only streamlines processes but also improves product quality and consistency, which is vital in competitive markets.

Moreover, technological advancements continuously expand the capabilities of robots, opening new application areas and driving broader market acceptance. Innovations such as low-code programming platforms simplify robot deployments, making automation accessible to small and medium enterprises who previously lacked the resources or skills.

Restraint Analysis

Skill Gap and Integration Challenges in SMEs

Despite the robust growth prospects, the robot market faces a major restraint in the form of a persistent skill gap, especially among small and medium-sized enterprises (SMEs). Many SMEs struggle to find or train engineers and technicians skilled enough to deploy, operate, and maintain robotic systems effectively. This shortage extends payback periods on investments and leads to under-utilization of robotic assets, limiting the market’s full potential.

The concentration of expert integrators in urban hubs leaves many regional and smaller firms underserved. Without accelerated skill development programs or more turnkey robotics solutions, a considerable portion of the potential demand remains untapped, slowing market growth. Additionally, the integration of robots into existing operations is complicated by technical and organizational challenges.

Companies must align robotics with their workflows, supply chains, and IT infrastructure, which can be costly and time-consuming. For many businesses, especially in developing markets, this integration complexity acts as a barrier to robotics adoption. Until solutions that simplify deployment and provide comprehensive support become widely available, these restraints will continue to dampen enthusiasm among smaller players in the market.

Opportunity Analysis

Expansion of Robotics in Emerging Markets

The expanding adoption of robotics in emerging economies presents a key opportunity for market growth. Countries in Asia-Pacific, Latin America, and parts of the Middle East are witnessing rising demand as they accelerate industrialization and modernization. In these regions, robotics can address labor shortages and improve manufacturing quality and throughput in sectors such as automotive, electronics, and logistics.

Governments in many emerging markets are actively promoting automation and smart manufacturing through policies, incentives, and investment in skill development. This supportive environment creates fertile ground for robotics companies to expand their footprint.

Furthermore, the increasing affordability of robots due to declining prices and innovations such as RaaS business models makes robotics accessible to smaller enterprises and startups that previously could not afford automation. This democratization of robotics technology enables new users across diverse sectors to benefit from automation, unlocking vast unrealized demand.

Challenge Analysis

High Costs and Complexity of Robot Deployment

A major challenge facing the robot market is the high cost and complexity associated with purchasing, integrating, and programming advanced robotic systems. The upfront procurement expenses, combined with the need for specialized accessories and software, can be prohibitive for many potential buyers.

Additionally, implementing robots often requires significant changes to existing workflows, staff training, and infrastructure upgrades, which complicates deployment and prolongs return on investment timelines. For industries with fluctuating demand or limited capital, these factors create hesitation to adopt robotics broadly.

Moreover, the technological sophistication of modern robots, including AI and sensor integration, demands skilled personnel and robust cybersecurity measures, adding layers of complexity and cost. Supply chain disruptions and component price volatility, such as for rare-earth magnets used in robot motors, also affect market stability and increase project risks.

Competitive Landscape

In the global robot market, ABB Ltd. has maintained a strong foothold due to its versatile portfolio in industrial automation. The company is known for its advanced robotic arms used across automotive, electronics, and logistics industries. ABB has been investing in collaborative robots to strengthen its presence in human-machine interaction spaces.

Fanuc Corporation is widely recognized for its high-performance automation systems and robust industrial robots. The company’s strength lies in its precision control, reliability, and energy-efficient models, which are widely used in manufacturing and assembly lines. Fanuc has emphasized artificial intelligence integration in recent years, enhancing productivity through smart diagnostics and predictive maintenance.

KUKA AG, Universal Robots, and Boston Dynamics are reshaping the competitive dynamics of the robot industry. KUKA focuses on intelligent automation for smart factories, while Universal Robots dominates the collaborative robot segment due to its compact and flexible designs. These robots are widely adopted by small and medium enterprises. Boston Dynamics has disrupted the market with its agile, mobile robots tailored for logistics, defense, and construction sectors.

Top Key Players in the Market

- ABB Ltd.

- Fanuc Corporation

- KUKA AG

- Universal Robots

- Boston Dynamics

Recent Developments

- In July 2025, ABB expanded its robot portfolio further by introducing three new families tailored for the Chinese mid-market, aiming to address growing automation demand among mid-sized businesses. These new robots offer flexible payload handling and high-speed operations, supporting sectors from electronics to food and beverage with an expected 8% annual growth in the Chinese market over the next few years.

- Fanuc Corporation, despite a challenging global economic landscape, has maintained resilience. Their industrial robot sales saw a slight dip of around 16% for the fiscal period ending March 2025, impacted mostly by weaker demand in China, Europe, and the Americas automotive sectors.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Sensors and Detectors, Command and Control (C2) Systems, Communication Infrastructure, Trigger Mechanisms, Weapon Platforms, Others), By Platform (Land-Based, Naval-Based, Air-Based), By End-User (National Strategic Forces, Defense Ministries & Intelligence Agencies, Defense Contractors & System Integrators) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services, Intel Corporation, Nvidia Corporation, AT&T, China Mobile, Deutsche Telekom, Telefónica, SK Telecom, Verizon, Vodafone, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Fanuc Corporation

- KUKA AG

- Universal Robots

- Boston Dynamics