Global RNA Analysis Market By Product Type (Kits & Reagents, Instruments, and Services), By Technology (Real Time-PCR (qPCR) Technology, Sequencing Technology, and Other Technologies), By Application, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 100852

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

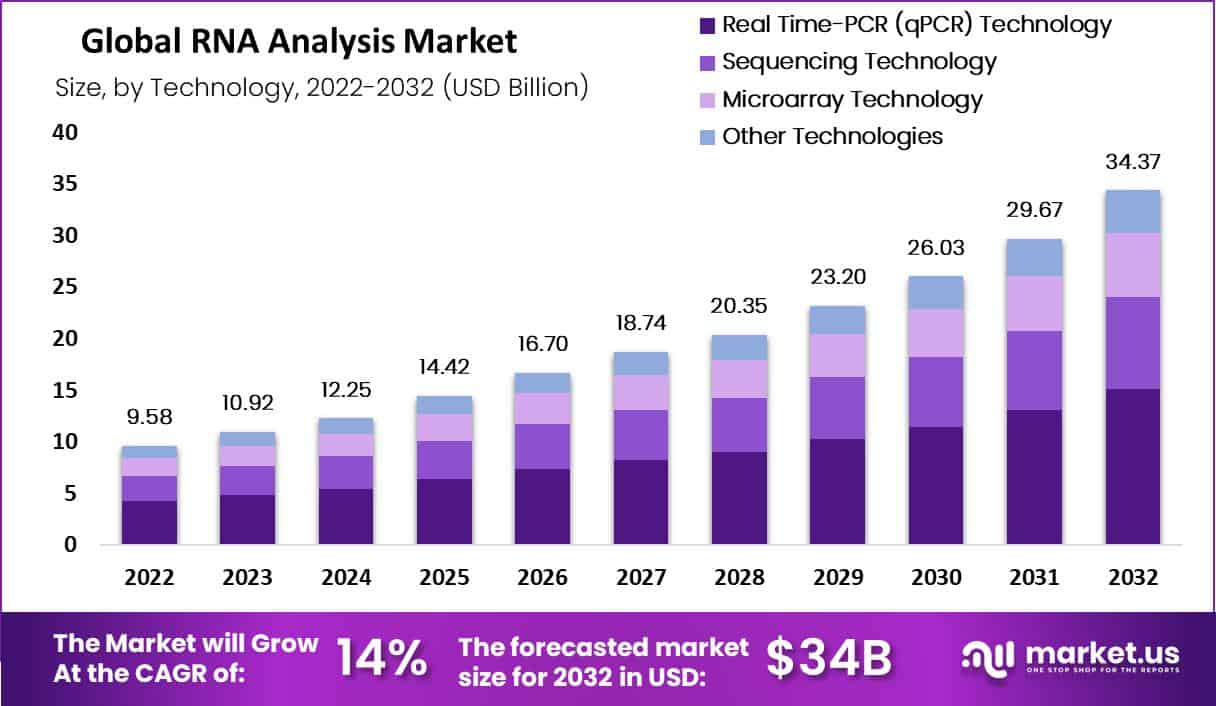

In 2022, the global RNA analysis market size was valued at USD 9.58 billion and is expected to reach USD 34.37 billion in 2032. This market is estimated to register a CAGR of 14% between 2023 and 2032.

Transcriptomics is one of the most advanced fields in post-genomic science. This field’s rapid progress can be attributed to its increasing applications in life science for capturing polyadenylated RNA. With the advancement of next-generation high-throughput sequencing technology, transcriptome analysis is progressing towards providing a better insight into the regulatory network for RNA-based genes.

In July 2021, a Lithuanian team is developing a droplet-based technique for simultaneous mRNA and microRNA capture and sequencing within one cell. The growing need to analyze a large number of genes to better comprehend gene-drug interactions is anticipated to further accelerate the use of transcriptomics technologies in discovery applications and drug development. For instance, transcriptome profiles of COVID-19 patients have been analyzed to better understand their disease prognosis and management.

Furthermore, rising demand for personalized medicines is expected to propel industry growth over the forecast period. In April 2020, Caris Life Sciences announced the submission of Pre-Market Approval applications for MI Transcriptome CDx to the USFDA. This precision medicine assay contains significant companion diagnostic biomarkers; however, data management in transcriptomic research and the absence of effective bioinformatics tools remain major obstacles in this industry.

Key Takeaways

- Market Size: In 2022, the market stood at USD 9.58 billion, forecasted to hit USD 34.37 billion by 2032, indicating a robust 14% CAGR.

- Product Types: Kits and reagents capture 57% of the market, boosted by RNA sequencing demand, while instruments reign for advanced technologies.

- Technology Analysis: Real Time-PCR (qPCR) technology leads with a 44% market share, particularly vital for COVID-19 diagnostics.

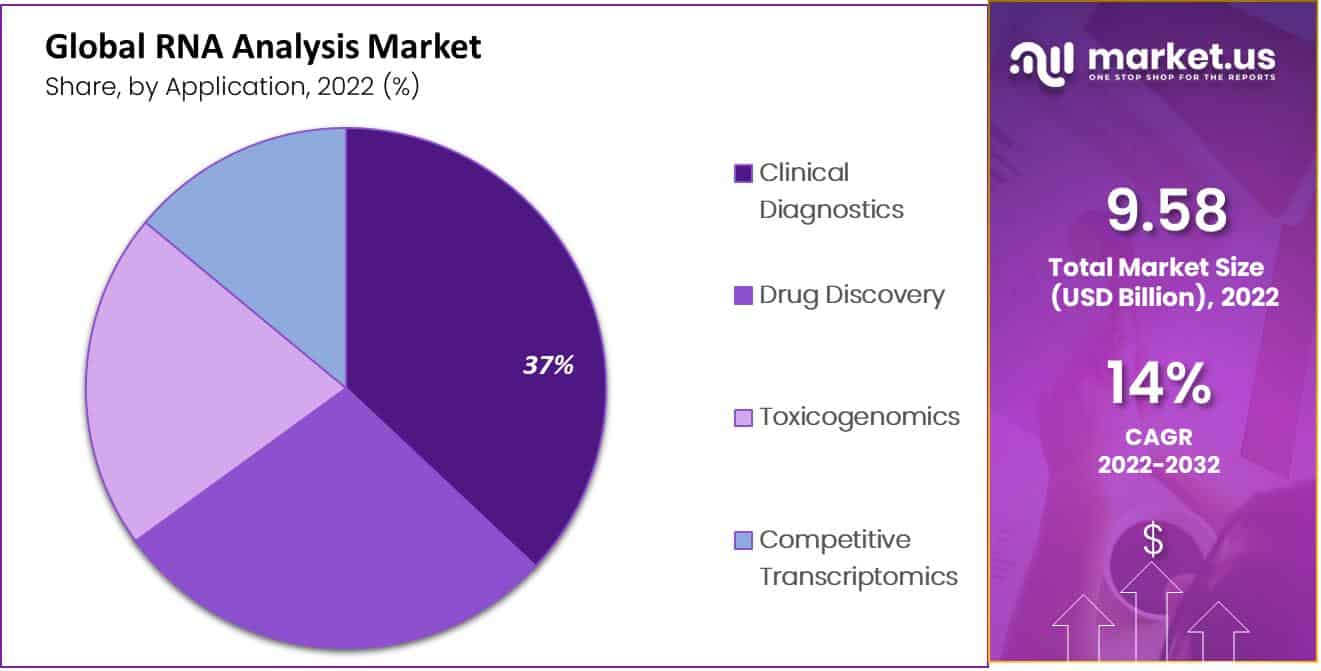

- Application Analysis: Clinical diagnostics segment commands a 37% market share, fueled by the surge in demand for personalized medicine.

- End-User Analysis: Government institutes and academic centers claim a 35% market share, propelled by high throughput technologies and research.

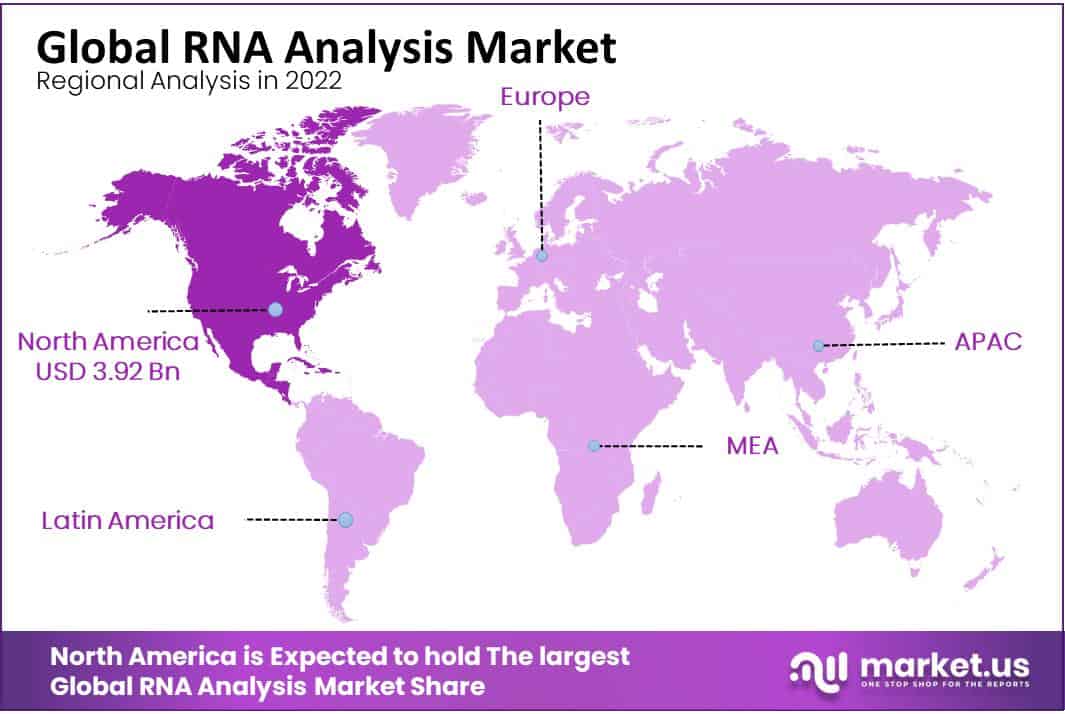

- Regional Analysis: North America emerges as the dominant region, securing 41% of the market share.

Driving Factors

These medicines are increasingly being used to treat illnesses such as cancer, infectious diseases, and genetic disorders. This growth is fueled by the development of new RNA-based drugs. Advances in RNA Sequencing Technologies As RNA Sequencing Technologies advance rapidly, they produce vast amounts of RNA Data. The resulting demand has led to growth in the RNA industry.

Government Funding for RNA Research Many governments around the world invest in RNA Research, leading to new technologies and products in this market. The RNA market is growing as more and more players from academia and industry join forces to create novel RNA products and technologies. The use of RNA-based technologies and products is increasing in personalized medicine. This involves tailoring treatments to each patient based on genetic makeup. The RNA market has grown as a result of this, which stimulates demand for RNA diagnostics and therapeutics.

Restraining Factors

Researching RNA-based technologies and therapeutics can be costly, and clinical trials are often fraught with failure. This could limit the development and introduction of new technologies and products in the RNA industry. The approval of RNA-based technologies and therapeutics can be a long and complex process. The regulatory hurdles and compliance requirements may impede the commercialization and development of RNA-based products. Limited Understanding of RNA Biology Despite the great progress made in RNA research over the past few years, much remains to be learned about its structure and functions.

This could impede the creation of new RNA-based technologies and products. RNA-based therapeutics and technology face competition from other technologies, such as gene therapies, small molecules, or antibodies. It may also limit the growth in the RNA market, by decreasing the demand for RNA products and services. The rapid development of RNA research poses intellectual property challenges. It could hinder the development of RNA-based technologies and products by reducing incentives for researchers and companies to invest.

Product Type Analysis

By the product type’s analysis, the kits and reagent segment with 57% market share.

This segment covers various reagents and kits used for RNA analysis, such as RNA isolation kits, RNA amplification kits, and RNA sequencing kits. The reagents and kits segment is expected to experience rapid growth due to rising demand for RNA sequencing and transcriptome analysis. Companies like Qiagen N.V., Bio-Rad Laboratories Inc., and New England Biolabs Inc. are some of the key players in this space.

This segment covers various instruments used for RNA analysis, such as PCR instruments, microarrays, sequencers, and more. The instruments segment dominates the market due to rising demand for advanced technologies in RNA analysis and an increasing adoption of next-generation sequencing (NGS) technologies. Companies such as Illumina Inc., Thermo Fisher Scientific Inc., and Pacific Biosciences of California Inc. are key players in the instruments sector.

This segment includes various reagents and kits used for RNA analysis, such as RNA isolation kits, RNA amplification kits, and RNA sequencing kits. The reagents and kits segment is expected to experience significant growth due to rising demand for RNA sequencing and transcriptome analysis. Companies like Qiagen N.V., Bio-Rad Laboratories Inc., and New England Biolabs Inc. are some of the key players in this space.

This segment includes various RNA analysis services such as sequencing, gene expression analysis, and transcriptome analysis. The services segment is projected to grow rapidly due to the increasing outsourcing of RNA analysis services by biotech and pharmaceutical companies. Companies such as Eurofins Scientific SE, GenScript Biotech Corporation, and BGI Group are some of the key players in this space.

Technology Analysis

By Technology Analysis, Real Time-PCR (qPCR) Technology Segment Dominates The Market With 44% Market Share.

The high share was due to the widespread adoption of PCR for COVID-19 diagnostic purposes around the world. This sensitive and quantitative method makes qPCR ideal for interrogating a small number of transcripts across a broad range of samples, offering relatively high sensitivity detection of SARS-CoV-2, evaluation of viral RNA in various clinical samples, detection of mutations associated with SARS-CoV-2, as well as evaluation of anti-SARS drugs.

Thus, the COVID-19 pandemic served as a driving factor for industry growth. Furthermore, quantitative Real-Time PCR is employed to conduct a comparative analysis between transcriptomes from the host and viral samples. Sequencing is expected to experience substantial expansion over the coming years due to advances in next-generation and SMRT sequencing technology, along with several companies offering single-cell RNA sequencing services and the advent of bioinformatics algorithms.

Application Analysis

By Application Analysis, The Clinical Diagnostics Segment Dominates The Market With A 37% Market Share.

RNA analysis is increasingly being employed in clinical diagnostics to aid diagnosis and prognosis for various diseases. The clinical diagnostics market is expected to expand rapidly due to the rising demand for personalized medicine and the rising adoption of RNA-based diagnostic tools. Companies such as Roche Diagnostics, Thermo Fisher Scientific Inc., and Qiagen N.V. are some of the key players in clinical diagnostics. RNA analysis plays a pivotal role in drug discovery, from target identification and validation to lead optimization and pharmacodynamics and pharmacokinetic studies.

The drug discovery segment is projected to grow at an impressive rate due to the increasing demand for novel and effective therapeutics. Companies such as Gilead Sciences Inc., Novartis International AG, and Pfizer Inc. are some of the key players within this space. RNA analysis is widely employed in toxic genomics for the identification of genes related to toxicology and the construction of predictive toxicity models. The toxic genomics segment is expected to experience rapid growth due to rising demand for toxicity testing and the development of safer drugs and chemicals.

Companies like Merck KGaA, BASF SE, and Dow Chemical Company are some of the key players in this space. Competitive transcriptomics is an increasingly popular application of RNA analysis that involves the comparison of gene expression profiles across various organisms or conditions. The competitive transcriptomics segment is expected to experience rapid growth due to rising demand for comparative genomics and the identification of evolutionary and ecological factors. Companies such as Illumina Inc., Pacific Biosciences of California Inc., and Oxford Nanopore Technologies Ltd. are some of the key players in this space.

End-User Analysis

By End-User analysis, Government Institutes & Academic Centers segment dominates the market 35% market share.

The adoption rate of high throughput technologies for RNA analysis by government institutes and academic centers is driving segment growth. Transcriptomics applications in drug discovery are fueling demand across pharmaceutical, biotechnological, pharmaceutical, and clinical diagnostic industries alike. Furthermore, research in drug discovery contributes to market size just like clinical diagnostics research does; for instance, TORNADO-seq was developed in April 2021 – an RNA sequencing-based platform to monitor gene expression for studying cell phenotypes in organoids.

Key Market Segments

Based on Product Type

- Kits & Reagents

- Instruments

- Services

Based on Technology

- Real Time-PCR (qPCR) Technology

- Sequencing Technology

- Microarray Technology

- Other Technologies

Based on Application

- Clinical Diagnostics

- Drug Discovery

- Toxic genomics

- Competitive Transcriptomics

Based on End-User

- Government Institutes & Academic Centers

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Hospitals & Clinics

- Other End-Users

Growth Opportunity

Development of New RNA-Based Therapeutics The advances in RNA Delivery Technology, such as nanoparticle-based systems, present an exciting market prospect. Researchers hope to treat many diseases using RNA by improving the efficiency and specificity of these therapies. Expansion in RNA Sequencing Services This represents a significant opportunity for the RNA industry. As the availability of sequencing data increases, so does the demand for services to handle and analyze this data effectively. This creates opportunities for companies that offer these services along with related bioinformatics software.

Personalized medical treatment, which is based on the genetic makeup of each patient, offers a great opportunity for the RNA industry. RNA-based therapeutics and diagnostics can play a major role in personalized medicine, enabling treatment tailored to the genetic profile of each patient. Investing in RNA Research Investing in RNA Research is an exciting prospect for the market. Governments, universities, and private firms are all investing in the RNA research field, which creates many opportunities for collaborations and new RNA products and technologies.

AI and Machine Learning Integration: AI and Machine Learning integration present a significant opportunity for the RNA Market. These technologies, when combined, can analyze huge amounts of RNA sequence data. This will lead to more precise treatments and less resource-intensive therapies.

Latest Trends

RNA-Based Therapeutics RNA-based therapies are a growing trend in the RNA industry. Recent advances in delivery systems, like nanoparticles, have spurred research on new RNA drugs that target specific tissues and cells. RNA sequences are a growing trend in the RNA sector. As the amount of data generated by this process grows, companies that offer RNA sequencing services and bioinformatics will find more opportunities.

Personalized medicine, which is based on the genetic makeup and characteristics of each patient is a trend that is emerging in the RNA sector. RNA-based diagnostics and therapeutics can play a crucial role in personalized medicine by allowing treatment to be tailored to a specific patient’s genetic profile. RNA molecules are increasingly being edited using gene-editing technologies such as CRISPR or Cas9. This creates new opportunities for developing novel RNA-based therapeutics and diagnostics.

Increasing investments in RNA Research across all sectors: Government, academia, and private companies are increasing their investment in RNA Research. RNA research has created new opportunities for collaborations, and the development of new RNA-based products and technologies.

Regional Analysis

By Regional Analysis, North America dominates the market with 41% market share.

This growth can be attributed to the rapid advancement of structure-based drug designs, increased focus on transcriptomics research, and high investments in biopharmaceutical R&D. Additionally, increasing investment in pharmaceutical research and drug development is the driving factor behind the revenue growth of companies in this region. Asia Pacific, however, is projected to experience the fastest compound annual growth rate during the forecast period. Governments and enterprises are investing more heavily in biotechnology research across Asia Pacific countries, spurring research growth.

The Japanese government and non-profit organizations have shown great encouragement for biotechnology research in Japan, providing funding for projects related to medicine and life sciences. This has spurred researchers to actively explore transcriptomics as a potential avenue for growth. Furthermore, the increasing focus on APAC countries due to their low-cost manufacturing service is expected to provide growth opportunities for manufacturers. Furthermore, strategic activities like partnerships will further foster this region’s development. In January 2020, Genetron Holdings Ltd. entered into a partnership agreement with Thermo Fisher Scientific to expand precision cancer monitoring and diagnosis in China’s public hospitals.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The industry is highly fragmented, featuring numerous small, mid, and large players that compete by adopting organic growth strategies such as product development and regional expansion to expand their market presence. For instance, in May 2021 Bio-Rad Laboratories Inc. released the SEQuoia RiboDepletion Kit for next-generation (NGS) sequencing which can improve assessment efficiency by eliminating irrelevant rRNA fragments from RNA sequencing libraries. Some key players in the global RNA analysis market include

Market Key Players

- Agilent Technologies, Inc.

- Hoffmann-La Roche AG

- Illumina, Inc.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Eurofins Scientific

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Pacific Bioscience of California, Inc.

- Affymetrix, Inc.

- Danaher Corp.

- Promega

- Other Key players

Recent Developments:

- In June 2022: Bio-Rad Laboratories recently introduced their SEQuoia Express Stranded RNA Library Prep Kit, providing biopharmaceuticals and analysis scientists with an easy-to-use solution for creating robust libraries to support efficient RNA-Seq workflows for complete transcriptome profiling. Furthermore, this kit offers cost efficiency and automation compatibility – two essential qualities in today’s library era.

- Mar-2022: Illumina unveiled TruSight Oncology Comprehensive, a single test that assesses multiple tumor genes. This kit covers mutations as well as current and emerging biomarkers linked to European Society for Medical Oncology guidelines, clinical trials, and drug labels to increase the chances of discovering actionable data from each patient’s biopsy.

- Dec-2021: Eurofins Technologies released the GSD Nova Type Detect + Select K417N SARS-CoV-2 test kit as a fast and cost-effective way of verifying Omicron variants before specimens undergo whole genome sequencing. This new kit is claimed to provide an accurate solution for this task.

Report Scope

Report Features Description Market Value (2022) USD 9.58 Bn Forecast Revenue (2032) USD 34.37 Bn CAGR (2023-2032) 14% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type, By Technology, By Application, By End-User Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Agilent Technologies; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Illumina, Inc.; QIAGEN; Thermo Fisher Scientific, Inc.; Eurofins Scientific; Merck KGaA; Pacific Bioscience of California, Inc.; Affymetrix, Inc.; Danaher Corp.; Promega Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for RNA Analysis Market in 2032?In 2032, the RNA Analysis Market will reach USD 34.37 billion.

What CAGR is projected for the RNA Analysis Market?The RNA Analysis Market is expected to grow at 14% CAGR (2023-2032).

Name the major industry players in the RNA Analysis Market.Agilent Technologies, Inc., Hoffmann-La Roche AG, Illumina, Inc., QIAGEN, Thermo Fisher Scientific, Inc., Eurofins Scientific, Merck KGaA, Bio-Rad Laboratories, Inc., Pacific Bioscience of California, I and Other Key Players are the main vendors in this market.

List the segments encompassed in this report on the RNA Analysis Market?Market.US has segmented the RNA Analysis Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Product Type, market has been segmented into Kits & Reagents, Instruments and Services. By Technology, the market has been further divided into, Real Time-PCR (qPCR), Technology, Sequencing Technology, Microarray Technology and Other Technologies.

-

-

- Agilent Technologies, Inc.

- Hoffmann-La Roche AG

- Illumina, Inc.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Eurofins Scientific

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Pacific Bioscience of California, Inc.

- Affymetrix, Inc.

- Danaher Corp.

- Promega

- Other Key players