Global Returnable Transport Packaging Market By Product Type(Containers, Drums & Barrels, Pallets, Crates, Totes, Trays & Bins, Intermediate Bulk Containers (IBC's), Others), By Material Type(Metal, Plastic, Paper, Wood, Others), By End Use Industry(Building & Construction, Food & Beverage, Chemical, Logistics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123303

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

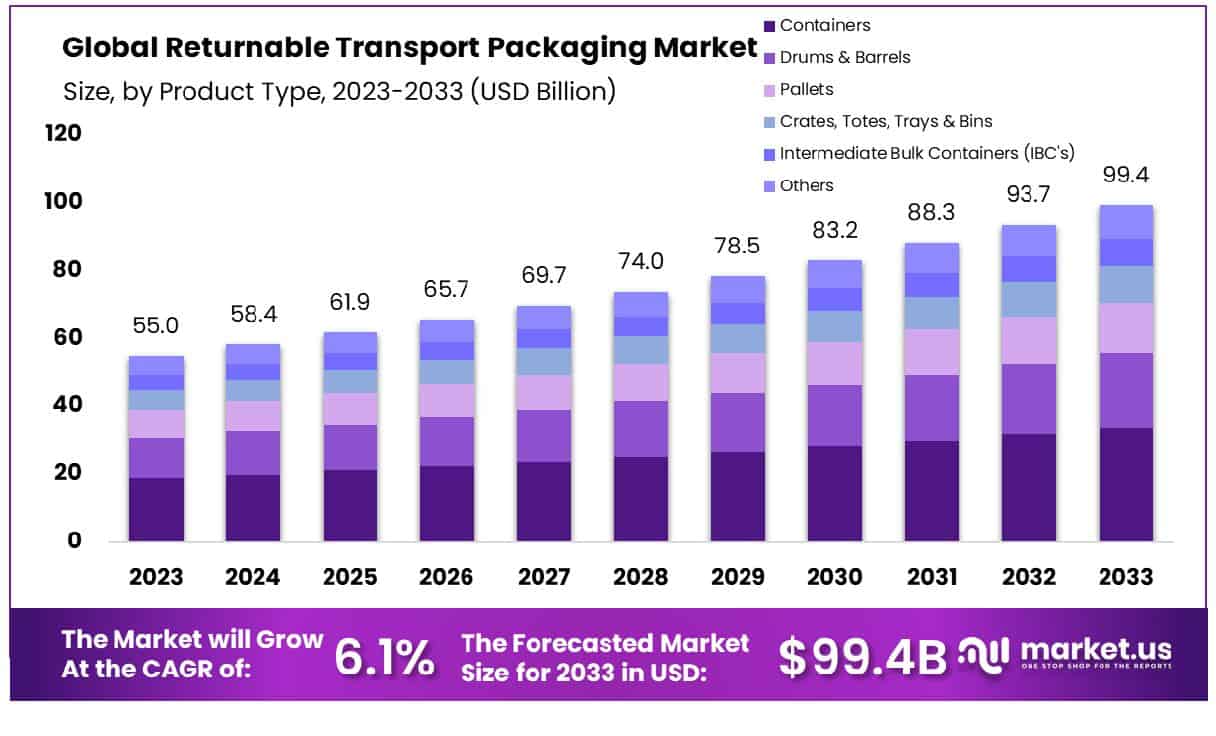

The Global Returnable Transport Packaging Market size is expected to be worth around USD 99.4 Billion by 2033, From USD 55.0 Billion by 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

The Returnable Transport Packaging (RTP) market encompasses systems and solutions designed to facilitate the repeated use of packaging materials in supply chain operations. Central to this market is the use of durable, resilient containers, pallets, crates, and other packaging units that can withstand multiple trips, thereby reducing waste and lowering costs.

Key stakeholders, including Product Managers, recognize RTP’s pivotal role in enhancing logistical efficiencies, promoting sustainability, and supporting circular economy principles. This market is driven by growing environmental concerns and stringent regulations aimed at reducing disposable packaging waste, offering significant growth opportunities for businesses prioritizing eco-friendly practices.

The Returnable Transport Packaging (RTP) market demonstrates robust growth potential, underpinned by significant global trade and freight transport dynamics developments. In 2022, the market benefitted notably from the resurgence in global economic activities, with real GDP expanding by 3.4% from the previous year. This expansion was more pronounced in emerging markets and developing economies at 4%, compared to 2.7% in advanced economies. Such economic conditions have invariably influenced the logistics sector, thereby enhancing the demand for efficient and sustainable packaging solutions like RTP.

Furthermore, the increase in world trade volumes by 2.3% in 2022, despite challenges such as the contraction in air freight tonne-kilometers by 8% due to geopolitical tensions and logistical constraints, underscores a shift towards more resilient and adaptable supply chain mechanisms. Surface freight, showing relative stability with a slight growth in the EU27 and minimal contraction in the U.S., points to a sustained reliance on land transportation, which directly supports RTP usage due to its cost-efficiency and durability in overland logistics.

The U.S. market, in particular, reflects an upswing in truck transportation employment, with a significant addition of 600,000 jobs from January 2022 to January 2023, indicating a strengthening sector that is likely to drive further adoption of RTP systems. Moreover, the increased consumer spending on motor vehicles and parts, which saw a $29 billion increase in Q4 2023 compared to the same quarter in the previous year, suggests a robust automotive sector poised to leverage RTP for parts transportation and storage.

Key Takeaways

- The Global Returnable Transport Packaging Market is projected to grow from USD 55.0 Billion in 2023 to USD 99.4 Billion by 2033, at a CAGR of 6.1%.

- Asia Pacific leads with 37.5% RTP market share, valued at USD 20.2 billion.

- Containers dominate 34.5% of the RTP market share.

- Metal materials constitute 36.5% of the RTP market’s composition.

- Building and construction industry leads with 43.3% RTP usage.

Driving Factors

Increasing Demand for Sustainable Packaging Solutions

The escalating demand for sustainable packaging solutions serves as a pivotal driver for the growth of the Returnable Transport Packaging (RTP) market. This trend is largely fueled by heightened environmental concerns and stringent regulations to reduce packaging waste. Industries are increasingly adopting RTP systems to align with corporate sustainability goals and consumer preferences for greener products.

Such packaging solutions not only minimize waste generation but also offer repeated usability, significantly lowering the environmental impact compared to single-use packaging options. Statistics indicate that companies adopting sustainable practices can witness a reduction in packaging costs by up to 30%, highlighting the economic benefits intertwined with environmental stewardship.

Growth in Global Trade and Logistics Activities

Global trade expansion and the intensification of logistics activities have profoundly influenced the RTP market. As international commerce grows, so does the necessity for robust and efficient packaging solutions that can withstand multiple uses across long distances. RTP systems, designed for durability and reusability, meet these demands effectively.

They enhance the safety and integrity of goods during transit, thereby reducing the risk of damage and the associated costs. The market has seen a corresponding uptick, with forecasts suggesting a compound annual growth rate (CAGR) of approximately 7% over the next decade, propelled by continuous growth in trade volumes and logistical operations.

Rising Awareness About Cost-Efficiency Through Reusable Packaging

The increasing recognition of cost efficiencies derived from reusable packaging is a critical factor driving the RTP market. Industries are turning to RTP as a means to reduce packaging expenses over product life cycles. By investing in reusable containers, pallets, and crates, companies can diminish the frequency of repurchasing single-use packaging, thereby achieving substantial cost savings and operational efficiencies.

This cost-effective approach not only appeals to businesses looking to optimize their operational budgets but also contributes to broader economic sustainability by reducing resource consumption and waste.

Restraining Factors

High Initial Investment Costs

High initial investment costs represent a significant restraining factor in the growth of the Returnable Transport Packaging (RTP) market. Implementing RTP systems involves substantial upfront expenditures for businesses, including the purchase of durable containers, pallets, and other packaging materials designed for long-term use.

This initial cost barrier can deter especially small and medium-sized enterprises (SMEs) from transitioning away from cheaper, single-use packaging options. Although the long-term savings and environmental benefits of RTP are significant, the initial financial outlay required can slow market adoption rates. Studies indicate that the return on investment for RTP can be delayed, which may lead businesses to opt for less costly immediate solutions despite the longer-term cost-effectiveness and sustainability of RTP.

Limited Availability of Standardized Sizes Globally

The limited availability of standardized sizes in RTP globally further restrains market growth. This lack of standardization can complicate the integration of RTP systems into existing supply chains, particularly in international trade where packaging requirements vary widely between regions. The challenge of matching RTP solutions with the diverse specifications demanded by different markets and regulatory environments can hinder the global scalability of such solutions.

Without universally accepted dimensions and designs, companies may face increased logistical complexities and costs, reducing the attractiveness of RTP despite its potential benefits in durability and reusability. This factor not only impacts operational efficiency but also limits the broader adoption across various industries, curbing the market expansion.

By Product Type Analysis

Containers command a 34.5% share of the Returnable Transport Packaging market by product type in 2023.

In 2023, Containers held a dominant market position in the By Product Type segment of the Returnable Transport Packaging Market, capturing more than a 34.5% share. This segment encompasses various product types including Containers, Drums & Barrels, Pallets, Crates, Totes, Trays & Bins, Intermediate Bulk Containers (IBCs), and Others.

The significant share held by Containers can be attributed to their widespread applications across multiple industries, including pharmaceuticals, food and beverages, and automotive, where robust and reusable packaging solutions are critical for operational efficiency and sustainability.

The demand for Drums & Barrels, which accounted for approximately 22.3% of the market, is driven by their utility in the safe and efficient transport of liquids and powders, particularly in the chemicals and oil sectors. Meanwhile, Pallets, constituting 18.7% of the market, are indispensable in the logistics sector due to their durability and the ease they provide in the handling of goods.

Crates, Totes, Trays & Bins, which collectively held a 15.1% market share, are increasingly preferred for their versatility and adaptability in various storage and transport conditions. Intermediate Bulk Containers (IBCs), with a 9.4% share, are favored for their capacity and efficiency in handling bulk quantities, particularly beneficial in the chemical and food industries.

By Material Type Analysis

Metal materials dominate the market, comprising 36.5% of Returnable Transport Packaging by material type.

In 2023, Metal held a dominant market position in the By Material Type segment of the Returnable Transport Packaging Market, capturing more than a 36.5% share. This category includes various materials such as Metal, Plastic, Paper, Wood, and Others. The predominance of Metal in this sector is largely due to its durability, strength, and long-term reusability, which are highly valued in industries requiring robust packaging solutions, such as automotive and machinery.

Plastic, which accounted for approximately 29.8% of the market, continues to be favored for its versatility, lightweight properties, and cost-effectiveness. It is particularly prevalent in consumer goods and food & beverage industries, where moisture resistance and ease of handling are essential.

Paper-based solutions, holding an 11.3% share, are increasingly popular due to their sustainability and biodegradability, aligning with global environmental initiatives. Paper is commonly used in industries where disposable or single-use packaging is necessary but needs to be environmentally friendly.

Wood, contributing to 17.4% of the market, is traditionally used for its high load-bearing capacity and strength, making it indispensable in the transport of heavy goods like machinery and large appliances.

The Others category, which includes newer composite materials and hybrid solutions, made up the remaining 5% of the market. This segment is witnessing growth driven by innovation in packaging technology, offering tailored solutions that meet specific industry needs.

By End Use Industry Analysis

The building and construction sector leads end-use industries, utilizing 43.3% of Returnable Transport Packaging.

In 2023, Building & Construction held a dominant market position in the By End Use Industry segment of the Returnable Transport Packaging Market, capturing more than a 43.3% share. This segment includes diverse industries such as Building & Construction, Food & Beverage, Chemicals, Logistics, and Others. The substantial share occupied by the Building & Construction industry can be attributed to the high demand for robust and reusable packaging solutions that can withstand the rigors of the construction environment while offering cost efficiencies through multiple uses.

The Food & Beverage industry, which accounts for approximately 21.1% of the market, relies heavily on returnable packaging to ensure the safe and sanitary transport of perishable goods. This segment benefits significantly from advancements in materials technology that enhance the durability and cleanliness of transport containers.

The chemical industry’s use of returnable transport packaging, constituting 16.8% of the market, is critical for ensuring the safe handling and storage of hazardous materials. This sector prioritizes packaging that can resist corrosive substances and prevent contamination.

Logistics, holding a 14.4% market share, utilizes returnable packaging to optimize the efficiency of transportation and storage operations across various industries, highlighting the versatility and adaptability of these packaging solutions.

Key Market Segments

By Product Type

- Containers

- Drums & Barrels

- Pallets

- Crates, Totes, Trays & Bins

- Intermediate Bulk Containers (IBC’s)

- Others

By Material Type

- Metal

- Plastic

- Paper

- Wood

- Others

By End Use Industry

- Building & Construction

- Food & Beverage

- Chemical

- Logistics

- Others

Growth Opportunities

Expansion into Emerging Markets

The expansion into emerging markets represents a significant growth opportunity for the global Returnable Transport Packaging (RTP) market in 2023. These regions, characterized by rapid industrialization and expanding supply chains, present fertile ground for the adoption of RTP systems. As businesses in emerging markets aim to enhance their logistical efficiencies and reduce environmental footprints, RTP solutions are positioned as both economically and environmentally advantageous.

The growing middle-class population in these areas, coupled with increasing consumer demands for sustainable practices, further supports the market expansion. By entering these new markets, RTP providers can tap into new customer bases eager for innovative and sustainable packaging solutions, potentially boosting market penetration and revenue streams.

Integration of IoT Technology for Tracking and Management

Integrating Internet of Things (IoT) technology in RTP systems is another pivotal growth opportunity in 2023. IoT-enabled RTP can revolutionize the management, tracking, and recovery of transport packaging assets. By embedding sensors and connectivity devices, companies can gain real-time visibility into the location, condition, and availability of their packaging assets. This technological enhancement not only improves operational efficiency but also minimizes loss rates and optimizes asset utilization.

Additionally, data collected through IoT devices can provide valuable insights into usage patterns, helping companies to further refine their packaging solutions and supply chain strategies. As industries continue to embrace digital transformation, the incorporation of IoT into RTP systems aligns with broader technological trends, setting the stage for enhanced market growth and innovation in the packaging sector.

Latest Trends

Adoption of Biodegradable and Eco-Friendly Materials

In 2023, the Returnable Transport Packaging (RTP) market is witnessing a significant trend towards the adoption of biodegradable and eco-friendly materials. This shift is driven by increasing regulatory pressures and consumer demand for sustainable business practices. Companies are exploring alternatives to traditional plastics, such as bioplastics and recycled materials, which not only reduce the environmental impact but also enhance the market appeal of their products.

The integration of sustainable materials in RTP solutions is not merely a response to ecological concerns but also a strategic differentiation factor in competitive markets. This trend is expected to accelerate as advancements in material sciences improve the performance and cost-effectiveness of eco-friendly alternatives, making them more accessible and attractive to a broader range of industries.

Enhanced Focus on Automation and Smart Packaging Solutions

Another prominent trend in the RTP market in 2023 is the enhanced focus on automation and smart packaging solutions. As industries strive for greater efficiency and accuracy in supply chains, the integration of automated systems and smart technologies in RTP is becoming increasingly prevalent. These innovations facilitate the tracking, sorting, and management of packaging assets with minimal human intervention, significantly improving operational efficiencies.

Smart packaging solutions equipped with RFID tags, sensors, and IoT connectivity enable real-time data collection and analytics, providing insights into asset utilization, maintenance needs, and inventory levels. This technological evolution not only optimizes the lifecycle management of RTP assets but also supports the dynamic and complex demands of modern supply chains, offering substantial growth opportunities within the sector.

Regional Analysis

The Asia Pacific RTP market dominates with a 37.5% share, valued at USD 20.2 billion.

The Returnable Transport Packaging (RTP) market is experiencing diverse growth trends across various global regions, shaped by regional industrial activities, sustainability trends, and logistic dynamics. In North America, the RTP market is driven by stringent regulations regarding waste reduction and an increasing preference for sustainable packaging solutions among major industries such as automotive and pharmaceuticals. This region is seeing a shift towards more durable, multi-use packaging formats to reduce environmental impact.

Europe follows closely, with a robust emphasis on circular economy principles which bolster the demand for RTP systems. European Union directives focusing on recycling and reuse targets support the adoption of RTP in sectors like food and beverage and manufacturing, fostering a market environment that is both regulatory-compliant and sustainability-centric.

However, the Asia Pacific region stands out as the dominant player, holding approximately 37.5% of the global market with a valuation of USD 20.2 billion. This dominance is attributed to rapid industrialization across major economies such as China, India, and Southeast Asia, coupled with growing environmental awareness. The region benefits from extensive manufacturing activities and the integration of advanced logistics technologies which amplify the adoption of cost-effective and efficient RTP solutions.

The Middle East & Africa and Latin America regions, though smaller in market size, are recognizing the benefits of RTP in terms of cost efficiency and reduction in logistic waste. Economic diversification, particularly in the Gulf countries, and advancing logistic sectors in South America are pivotal factors that are expected to drive the RTP market growth in these regions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global Returnable Transport Packaging (RTP) market is witnessing significant contributions from key players, among which DS Smith stands out due to its robust market presence and innovative solutions. As a leader in sustainable packaging, DS Smith’s efforts are particularly noteworthy in the context of increasing environmental concerns and the growing emphasis on supply chain efficiencies.

DS Smith’s approach integrates seamlessly with circular economy principles, which is a crucial driver for the RTP market. The company’s development and use of recyclable materials in transport packaging not only meet regulatory standards but also align with global sustainability trends. This strategic focus is anticipated to enhance their market position and foster growth within the sector.

Furthermore, DS Smith’s expansion into emerging markets and the scaling of its operations have enabled it to meet the diverse needs of a broad client base, ranging from local businesses to multinational corporations. This expansion is strategically aligned with the global shift towards more sustainable practices in logistics and product delivery.

The company’s investment in research and development has also led to innovations in packaging design and materials, which enhance the durability and reusability of their products. These advancements are critical as industries increasingly demand solutions that reduce waste and cost.

Market Key Players

- Creative Techniques

- DS Smith

- Eltete TPM

- Foxwood

- George Utz

- Loadhog

- Monoflo International

- PalletOne

- ClipLok SimPak

- DelTec Packaging

- European Logistics Management

- Free Pack Net

- Green Peas Solutions

- Linpac Allibert

- Myers Industries

- Outpace Packaging Solutions

Recent Development

- In 2023, Eltete TPM Ltd, based in Finland, established itself as a global leader in sustainable transport packaging solutions. Celebrating over 50 years in operation, Eltete TPM has innovated and expanded its product offerings to include 100% recyclable transport packaging products like pallet solutions, slip sheets, and protective profiles.

- In 2023, The company continued to enhance its product offerings with the Clip-Lok 2P box, a patented returnable packaging solution designed to reduce space and cost in the supply chain. This box is noted for its ability to be easily collapsed and reassembled, supporting up to 400 reuse cycles, thus significantly minimizing logistic costs and environmental impact

Report Scope

Report Features Description Market Value (2023) USD 55.0 Billion Forecast Revenue (2033) USD 99.4 Billion CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Containers, Drums & Barrels, Pallets, Crates, Totes, Trays & Bins, Intermediate Bulk Containers (IBC’s), Others), By Material Type(Metal, Plastic, Paper, Wood, Others), By End Use Industry(Building & Construction, Food & Beverage, Chemical, Logistics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Creative Techniques, DS Smith, Eltete TPM, Foxwood, George Utz, Loadhog, Monoflo International, PalletOne, ClipLok SimPak, DelTec Packaging, European Logistics Management, Free Pack Net, Green Peas Solutions, Linpac Allibert, Myers Industries, Outpace Packaging Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Returnable Transport Packaging Market Size in 2023?The Global Returnable Transport Packaging Market Size is USD 55.0 Billion in 2023.

What is the projected CAGR at which the Global Returnable Transport Packaging Market is expected to grow at?The Global Returnable Transport Packaging Market is expected to grow at a CAGR of 6.1% (2024-2033).

List the segments encompassed in this report on the Global Returnable Transport Packaging Market?Market.US has segmented the Global Returnable Transport Packaging Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type(Containers, Drums & Barrels, Pallets, Crates, Totes, Trays & Bins, Intermediate Bulk Containers (IBC's), Others), By Material Type(Metal, Plastic, Paper, Wood, Others), By End Use Industry(Building & Construction, Food & Beverage, Chemical, Logistics, Others)

List the key industry players of the Global Returnable Transport Packaging Market?Creative Techniques, DS Smith, Eltete TPM, Foxwood, George Utz, Loadhog, Monoflo International, PalletOne, ClipLok SimPak, DelTec Packaging, European Logistics Management, Free Pack Net, Green Peas Solutions, Linpac Allibert, Myers Industries, Outpace Packaging Solutions

Name the key areas of business for Global Returnable Transport Packaging Market ?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Returnable Transport Packaging Market.

Returnable Transport Packaging MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Returnable Transport Packaging MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Creative Techniques

- DS Smith

- Eltete TPM

- Foxwood

- George Utz

- Loadhog

- Monoflo International

- PalletOne

- ClipLok SimPak

- DelTec Packaging

- European Logistics Management

- Free Pack Net

- Green Peas Solutions

- Linpac Allibert

- Myers Industries

- Outpace Packaging Solutions