Global Redispersible Polymer Powder Market By Type(Acrylics, Vinyl Acetate Ethylene (VAE), Vinyl Ester of Versatic Acid (VeoVa), Styrene Butadiene, Others), By Application(Tiling & Flooring, Mortars, Plastering, Insulation Systems, Self-leveling Underlayment, Others), By End-use( Residential Construction, Commercial Construction, Industrial Construction), By Sales Channel(Direct Sales, Distributor Sales) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 129787

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

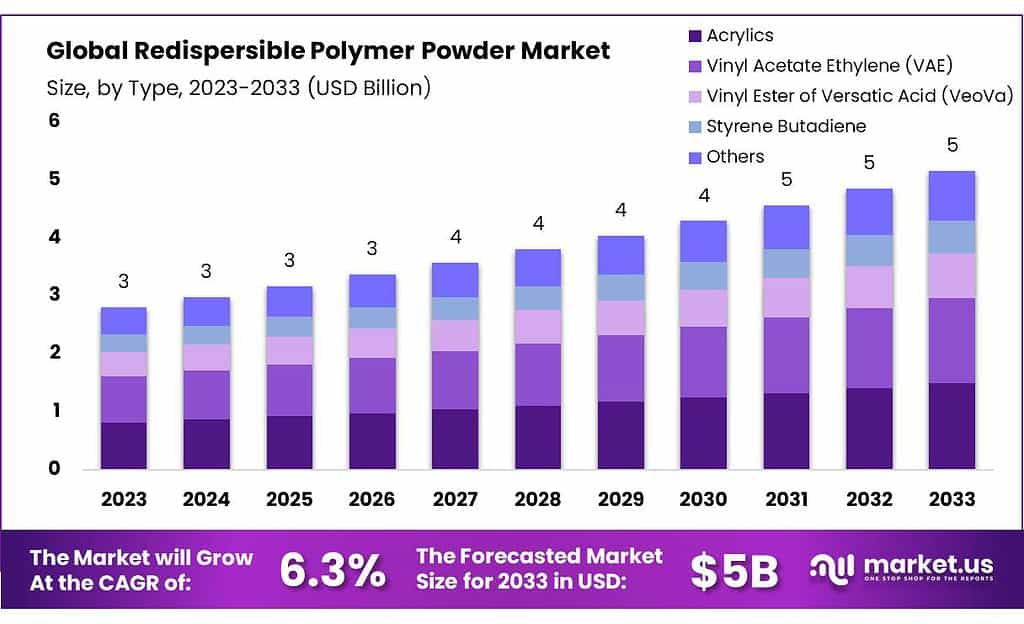

The global Redispersible Polymer Powder Market size is expected to be worth around USD 5 billion by 2033, from USD 3 billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2023 to 2033.

The Redispersible Polymer Powder (RDP) market is a critical segment within the global construction industry, recognized for its specialized chemical products that enhance the performance of building materials such as mortars, plasters, and adhesives. These powders improve the durability, flexibility, and environmental resistance of construction materials, catering to the needs of modern infrastructure demands.

The production, distribution, and sale of RDP encompass a complex market ecosystem that includes trend analysis, demand forecasting, and strategic planning across various geographical regions. Manufacturers in this market are continually innovating and expanding their product offerings to align with the global construction sector’s requirements.

These companies also actively participate in mergers, acquisitions, and partnerships to strengthen their market positions and capitalize on emerging opportunities, with industry leaders like BASF SE, Wacker Chemie AG, and Dow Chemical Company at the forefront of strategic growth initiatives.

Government regulations play a pivotal role in shaping the RDP market by enforcing standards that ensure the safety, sustainability, and efficiency of building materials. These regulations are designed to promote the use of environmentally friendly products and are directly influencing the demand for RDPs, which are seen as a beneficial solution in achieving these regulatory goals.

Investment dynamics within the RDP market are influenced by both public and private sector initiatives. These investments are often directed towards new construction projects as well as the renovation of existing structures, where the advanced properties of RDPs can significantly enhance material performance and durability. The economic impact of these investments is substantial, as they contribute to the development of more sustainable and resilient infrastructure.

The international trade of RDPs is also a critical aspect of the market. It is heavily influenced by global economic conditions and trade policies, with export activities primarily driven by production surpluses in key manufacturing regions.

Import needs, on the other hand, align closely with regional demands and the local availability of products. These dynamics ensure that the RDP market remains responsive to the global construction industry’s evolving needs, emphasizing its crucial role in building safer and more durable structures.

Key Takeaways

- Redispersible Polymer Powder Market size is expected to be worth around USD 5 billion by 2033, from USD 3 billion in 2023, growing at a CAGR of 6.3%.

- Acrylics held a dominant market position, capturing more than a 29.7% share.

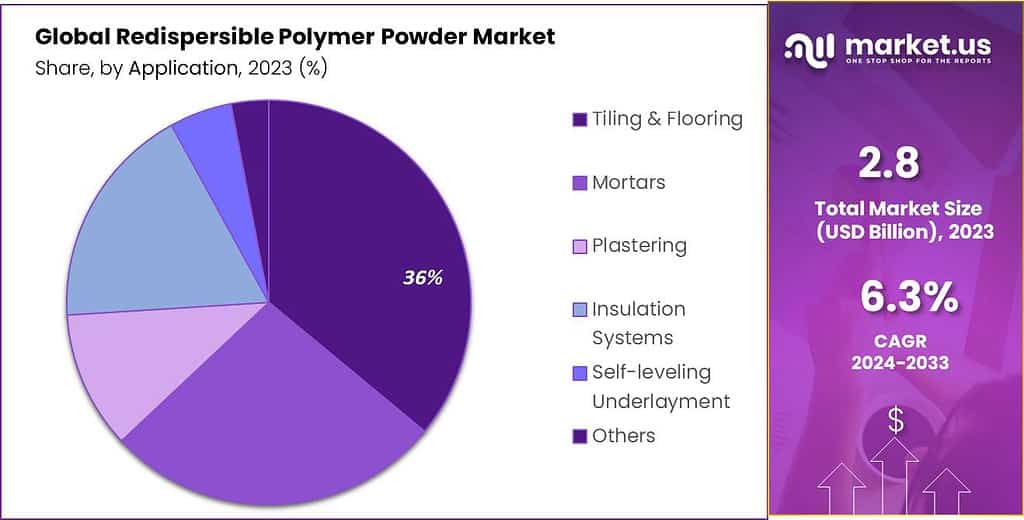

- Tiling & Flooring held a dominant market position, capturing more than a 36.7% share.

- Residential Construction held a dominant market position, capturing more than a 44.5% share.

- Direct Sales held a dominant market position, capturing more than a 57.7% share.

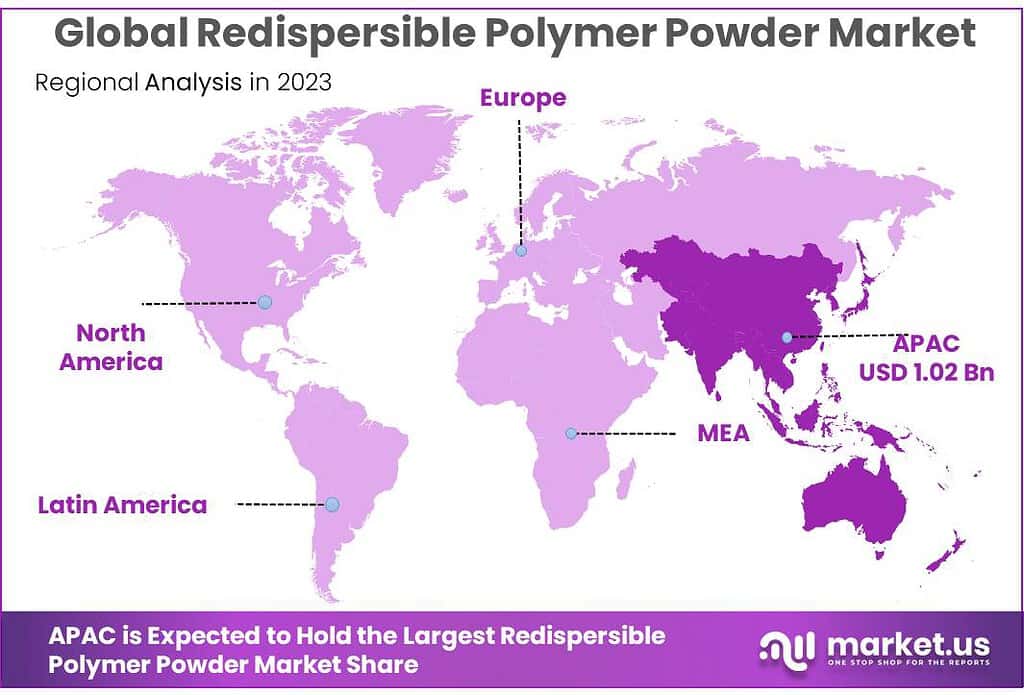

- Asia Pacific (APAC) dominated the redispersible polymer powder market, accounting for approximately 35%.

By Type

In 2023, Acrylics held a dominant market position, capturing more than a 29.7% share. This segment benefits significantly from the superior adhesive properties and durability that acrylic-based redispersible polymer powders offer, making them ideal for high-performance end uses such as exterior insulation and finish systems and decorative plasters. The versatility and excellent weather resistance of acrylics drive their preference in both residential and commercial constructions.

Following closely, Vinyl Acetate Ethylene (VAE) powders are also a significant segment, known for their flexibility and cost-effectiveness. VAE powders are extensively used in tile adhesives, grouts, and sealants due to their excellent bonding strength and ease of use. Their market appeal is enhanced by the balance they offer between performance and affordability, which makes them suitable for widespread application in developing regions where cost concerns are paramount.

The Vinyl Ester of Versatic Acid (VeoVa) segment is noted for its exceptional water resistance and durability. These characteristics make VeoVa powders a preferred choice in environments that demand high moisture resistance, such as bathrooms and kitchens. Although smaller in market share compared to Acrylics and VAE, the demand for VeoVa continues to grow with increasing awareness of its benefits in moisture-prone applications.

Styrene Butadiene powders cater to niches that require robust resistance against abrasion and wear. Often used in commercial and industrial flooring, their market position is bolstered by their performance in heavy-duty applications where durability is critical. Despite facing stiff competition from other polymers, Styrene Butadiene maintains a stable market presence due to its specialized applications.

By Application

In 2023, Tiling & Flooring held a dominant market position, capturing more than a 36.7% share of the redispersible polymer powder market. This segment’s strong performance is attributed to the critical role of these powders in enhancing the adhesion and flexibility of tile adhesives and grouts. The demand is driven by global urbanization and the consequent rise in residential and commercial construction projects.

Mortars, another key application segment, utilize redispersible polymer powders to improve workability and mechanical strength. The addition of these powders allows mortars to withstand thermal and mechanical stresses better, catering to the rigorous demands of modern construction standards.

The Plastering segment benefits from the incorporation of redispersible polymer powders to achieve smoother finishes and improved durability of plaster applications. This segment thrives on the need for aesthetic and long-lasting wall coatings in both interior and exterior applications.

Insulation Systems utilize these powders to enhance the bonding strength and flexibility of insulation materials, ensuring they remain effective under various environmental conditions. The growth in this segment is propelled by increasing energy efficiency standards and green building regulations globally.

Self-leveling Underlayment relies heavily on redispersible polymer powders for achieving level surfaces with high mechanical resistance and excellent adhesion properties. The demand in this segment is supported by the growth in industrial and commercial flooring requirements.

By End-use

In 2023, Residential Construction held a dominant market position, capturing more than a 44.5% share of the redispersible polymer powder market. This segment’s leadership is largely due to the continuous global expansion of housing developments and the renovation of existing residential structures.

The powders are integral in improving the durability and performance of construction materials used in homes, responding to the high demand for quality living spaces.

Commercial Construction also makes significant use of redispersible polymer powders, particularly in projects that require robust and durable building materials. This segment benefits from the ongoing growth in office spaces, retail complexes, and hospitality facilities worldwide.

The enhanced properties that these powders provide to mortars and plasters are crucial for meeting the stringent standards of commercial construction.

Industrial Construction, while a smaller segment, relies heavily on redispersible polymer powders for specialized applications such as heavy-duty flooring and protective coatings.

The demands of industrial environments, which include resistance to chemicals and mechanical stress, drive the need for advanced construction solutions offered by these versatile powders. This segment is expected to see growth aligned with industrial expansion and the need for more sophisticated construction techniques.

By Sales Channel

In 2023, Direct Sales held a dominant market position, capturing more than a 57.7% share of the redispersible polymer powder market. This sales channel is particularly favored by manufacturers for its ability to establish strong relationships with major construction firms and industrial clients.

Direct sales offer precise control over the supply chain, enabling tailored customer solutions and rapid response to specialized requirements, which is crucial in high-stakes construction projects.

On the other hand, Distributor Sales play an essential role in the market by enhancing the accessibility of redispersible polymer powders to a wider range of customers, including smaller contractors and businesses in geographically dispersed areas.

This channel helps manufacturers reach markets that are otherwise challenging to penetrate due to logistical constraints or limited direct presence. Distributors add value by managing local customer relationships and streamlining the supply process, making them an indispensable part of the distribution strategy.

Key Market Segments

By Type

- Acrylics

- Vinyl Acetate Ethylene (VAE)

- Vinyl Ester of Versatic Acid (VeoVa)

- Styrene Butadiene

- Others

By Application

- Tiling & Flooring

- Mortars

- Plastering

- Insulation Systems

- Self-leveling Underlayment

- Others

By End-use

- Residential Construction

- Commercial Construction

- Industrial Construction

By Sales Channel

- Direct Sales

- Distributor Sales

Drivers

Increasing Demand for Green Building Practices

One of the primary driving factors for the redispersible polymer powder market is the escalating demand for green building practices globally. This demand is particularly fueled by the increasing emphasis on sustainable and energy-efficient construction to reduce the environmental impact of buildings.

According to the United Nations Environment Programme (UNEP), the buildings and construction sector accounts for approximately 37% of energy and process-related CO2 emissions globally. This significant environmental footprint has spurred a movement towards more sustainable construction practices, which extensively utilize redispersible polymer powders to enhance the durability, energy efficiency, and overall performance of building materials.

Governments and international bodies are actively promoting green construction to meet ambitious climate goals, such as those set by the Paris Agreement. For instance, the IEA’s Breakthrough Agenda Report 2023 highlights the importance of transitioning to net-zero buildings, stressing that operational emissions in buildings need to fall by about 50% from their 2022 levels by 2030 to align with the Net Zero Emissions Scenario.

This transition necessitates the incorporation of advanced materials, including redispersible polymer powders, which contribute to the energy efficiency and resilience of construction materials.

Furthermore, as global urbanization continues, with significant growth expected in the floor area of buildings, particularly in emerging economies, the demand for sustainable building materials is projected to rise sharply.

The IEA outlines that around 80% of the growth in buildings’ floor area through 2030 will occur in these regions, pushing for advancements in construction practices that incorporate sustainability from the ground up.

Restraints

High Production Costs and Availability of Alternatives

One of the primary restraining factors for the redispersible polymer powder market is the high production costs associated with these materials. The complex production process, which involves spray drying of polymer emulsions, can be both energy-intensive and costly.

This factor significantly impacts the price sensitivity in various markets, particularly in developing regions where cost considerations are paramount. As a result, the higher costs can deter some buyers, limiting the adoption of redispersible polymer powders in cost-sensitive applications and regions.

Furthermore, the availability of alternative construction chemicals poses a significant challenge. Alternatives such as liquid polymers, pre-mixed solutions, and other additives are often more established in the market and may offer competitive advantages in terms of cost or performance for specific applications.

These alternatives are well-adopted in the industry, making it challenging for redispersible polymer powders to gain widespread acceptance, especially in markets that are not highly regulated in terms of environmental compliance.

These challenges are compounded by the economic barriers in emerging markets, where the additional cost of advanced materials like redispersible polymer powders may not be justifiable against cheaper, traditional materials that are already well-integrated into local construction practices

Opportunities

Rising Demand for Sustainable Construction Materials

One significant growth opportunity for the redispersible polymer powder market is the increasing demand for sustainable and eco-friendly construction materials. As the global emphasis on environmental sustainability intensifies, the construction industry is seeking innovative solutions that enhance building performance while minimizing environmental impact.

Redispersible polymer powders play a crucial role in this transformation by improving the durability, energy efficiency, and overall sustainability of construction materials.

These powders are extensively used in applications such as tiling and flooring, insulation systems, and plastering, where they contribute significantly to enhancing the properties like adhesion, flexibility, and water resistance of building materials. Their ability to improve the performance of mortars and cements, for instance, makes them invaluable in projects aiming for enhanced longevity and reduced maintenance needs.

The market is poised for expansion, particularly in regions undergoing rapid infrastructure development. Asia-Pacific, for example, has emerged as a dominant player due to the extensive construction activities in countries like China and India. This regional market boom is fueled by urbanization and the continuous growth of the residential and commercial construction sectors.

Furthermore, the industry is driven by innovations and the development of new products that align with global sustainability goals, such as the creation of bio-based redispersible polymer powders. These developments not only cater to the green building trend but also open new avenues for market expansion across various regions.

Trends

Sustainability and Bio-Based Innovations in Redispersible Polymer Powders

A significant trend in the redispersible polymer powder (RDP) market is the growing emphasis on sustainability and the development of bio-based RDPs. As the construction industry increasingly focuses on reducing its environmental impact, the demand for eco-friendly materials has surged.

This trend is driving innovations in RDP technology to produce materials that not only meet the performance standards required in construction but also align with global sustainability goals.

The transition towards green construction materials is supported by advancements in RDP formulations that incorporate bio-based ingredients. These new formulations are designed to maintain or enhance the functional benefits of traditional RDPs—such as improved adhesion, flexibility, and water resistance—while significantly reducing the carbon footprint associated with their production and use.

This shift is not only a response to regulatory pressures and building codes that prioritize energy efficiency and low environmental impact but also reflects a broader industry move towards materials that can contribute to more sustainable building practices.

The development of bio-based RDPs is likely to continue as manufacturers seek to capitalize on the growing market demand for sustainable construction solutions and to differentiate their products in a competitive market.

Regional Analysis

In 2023, Asia Pacific (APAC) dominated the redispersible polymer powder market, accounting for approximately 35% of the global share and valued at around USD 1.02 billion.

The region’s dominance is driven by rapid urbanization, infrastructure development, and growing construction activities, particularly in countries like China and India. China alone consumed over 2.37 billion metric tons of cement in recent years, reflecting the high demand for construction materials in the region.

North America is another key market, particularly the United States, where residential and commercial construction activities are growing. With over 1.41 million housing units completed in 2024, the demand for RDP is steadily increasing to support high-quality building materials. The region is also driven by sustainability initiatives and energy-efficient building regulations, which boost the use of RDP in insulation and other applications.

Europe plays a significant role, with a focus on sustainable construction practices. Countries like Germany, France, and the UK are at the forefront, with strict regulations encouraging the use of eco-friendly materials. The region also has a strong demand for RDP in renovation projects.

The Middle East & Africa region shows potential due to increasing construction investments in commercial projects, particularly in Gulf Cooperation Council (GCC) countries like Saudi Arabia and the UAE. Latin America, led by Brazil and Mexico, is witnessing a rise in infrastructure development, further expanding the RDP market in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The redispersible polymer powder market is characterized by a competitive landscape featuring several key players, each contributing significantly to the industry’s growth and innovation. Wacker Chemie AG, a leading global supplier, is known for its high-quality RDP products utilized in various applications, particularly in construction and coatings.

BASF SE and Dow Inc. also stand out, leveraging their extensive research and development capabilities to enhance product performance and meet the evolving needs of the market. Celanese Corporation and Synthomer plc are recognized for their innovative solutions that focus on sustainability and functionality, catering to a growing demand for eco-friendly materials.

Dairen Chemical Corporation and Organik Kimya, which provide specialized polymer solutions for diverse applications. Companies like Ashland Global Holdings Inc. and Japan Coating Resin Corporation are expanding their portfolios to include bio-based and sustainable options, responding to increasing regulatory pressures and consumer preferences for greener products. Emerging players such as Anhui Wanwei Group Co., Ltd. and Quanzhou Sailun Building Materials Technology Co., Ltd. are also gaining traction by innovating within niche markets.

Market Key Players

- Wacker Chemie AG

- Dow Inc.

- BASF SE

- Celanese Corporation

- Acquos Pty Ltd

- Synthomer plc

- Ashland Global Holdings Inc.

- Japan Coating Resin Corporation

- Bosson

- Chemical Co., Ltd.

- Dairen Chemical Corporation

- Organik Kimya

- Puyang Yintai New Building Materials Company Ltd.

- Divnova Specialties Pvt. Ltd.

- Sidley Chemical Co., Ltd.

- Vinavil S.p.A.

- Shanxi Sanwei Group Co., Ltd.

- Archroma

- Guangzhou Yuanye Industrial Co., Ltd.

- Anhui Wanwei Group Co., Ltd.

- Quanzhou Sailun Building Materials Technology Co., Ltd.

Recent Development

In 2023, Wacker expanded its production capabilities with a substantial investment of approximately USD 100 million at its Nanjing facility in China, which included a new reactor and spray dryer specifically for vinyl-acetate-ethylene (VAE) dispersible polymer powders.

In 2023, Dow focused on expanding its portfolio with advanced redispersible latex powders, such as DLP 212 and DLP 2300. These products are designed to improve the adhesion, flexibility, and overall performance of construction applications like tile adhesives and self-leveling compounds.

Report Scope

Report Features Description Market Value (2023) USD 3 Billion Forecast Revenue (2033) USD 5 Billion CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Acrylics, Vinyl Acetate Ethylene (VAE), Vinyl Ester of Versatic Acid (VeoVa), Styrene Butadiene, Others), By Application(Tiling & Flooring, Mortars, Plastering, Insulation Systems, Self-leveling Underlayment, Others), By End-use( Residential Construction, Commercial Construction, Industrial Construction), By Sales Channel(Direct Sales, Distributor Sales) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Wacker Chemie AG, Dow Inc., BASF SE, Celanese Corporation, Acquos Pty Ltd, Synthomer plc, Ashland Global Holdings Inc., Japan Coating Resin Corporation, Bosson, Chemical Co., Ltd., Dairen Chemical Corporation, Organik Kimya, Puyang Yintai New Building Materials Company Ltd., Divnova Specialties Pvt. Ltd., Sidley Chemical Co., Ltd., Vinavil S.p.A., Shanxi Sanwei Group Co., Ltd., Archroma, Guangzhou Yuanye Industrial Co., Ltd., Anhui Wanwei Group Co., Ltd., Quanzhou Sailun Building Materials Technology Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Redispersible Polymer Powder MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample

Redispersible Polymer Powder MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Wacker Chemie AG

- Dow Inc.

- BASF SE

- Celanese Corporation

- Acquos Pty Ltd

- Synthomer plc

- Ashland Global Holdings Inc.

- Japan Coating Resin Corporation

- Bosson

- Chemical Co., Ltd.

- Dairen Chemical Corporation

- Organik Kimya

- Puyang Yintai New Building Materials Company Ltd.

- Divnova Specialties Pvt. Ltd.

- Sidley Chemical Co., Ltd.

- Vinavil S.p.A.

- Shanxi Sanwei Group Co., Ltd.

- Archroma

- Guangzhou Yuanye Industrial Co., Ltd.

- Anhui Wanwei Group Co., Ltd.

- Quanzhou Sailun Building Materials Technology Co., Ltd.