Global Recycled Copper Market By Grade (Bare Bright Copper, Grade 1 Copper, Grade 2 Copper, and Light Copper) By Source (New Scrap and Old Scrap), By End-Use (Energy & Power, Electrical & Electronics, Transportation, Building & Construction, Machinery & Equipment and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 105511

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

In 2022, the Global Recycled Copper Market was valued at USD 76.9 Billion and is expected to reach USD 126.4 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 5.1%.

Copper stands as a unique material, capable of undergoing repeated recycling cycles without any degradation in performance. The quality of recycled copper, obtained through secondary production, equals that of mined copper from primary sources, rendering them interchangeable. This recycling process exhibits exceptional eco-efficiency, demanding 80-90% less energy than primary production.

This global practice annually prevents the emission of 40 million tons of CO2, equivalent to the environmental impact of removing 16 million passenger cars from the roads. In the past decade, expanding economies, alongside increased utilization of copper in innovative and sustainable energy technologies, have driven up demand for recycled copper. The recovery and recycling of copper play a pivotal role in meeting this demand and fostering a sustainable future for both humanity and the planet.

Over the past decade, there has been growing interest in using recycled copper and respective alloys to address the global supply-demand imbalance for copper. Thus, various Asian countries such as China and India had increased their import of copper and brass from the US, a significant copper and brass exporter.

For instance, as per recent data published by the U.S. Census Bureau, from January to November 2022, China imported around 270,430 metric tons of copper and brass scrap, which rose 26 percent compared to 2021 statistics of 80,229 metric tons.

Furthermore, India had also increased the import of red metal scrap from the US, accounting for 80,229 metric tons, a rise of 66 percent compared to 2021 statistics of 48,346 metric tons. Thus, the US copper scrap export rose by 2.5 percent from 843,282 metric tons in 2021 to 864,237 metric tons in 2022.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth and Value: The Recycled Copper Market was valued at USD 76.9 billion in 2022 and is projected to reach USD 126.4 billion by 2032, with a compound annual growth rate (CAGR) of 5.1%.

- Eco-Efficiency of Recycled Copper: Recycled copper is a sustainable material that can be recycled repeatedly without a loss in performance. It requires 80-90% less energy for production compared to primary copper, leading to an annual reduction of 40 million tons of CO2 emissions.

- Global Demand for Recycled Copper: Increasing demand for copper in innovative and sustainable technologies, such as renewable energy systems, has driven the demand for recycled copper.

- Circular Economy and Sustainability: The focus on a circular economy, which promotes the efficient use and recycling of materials, is positively impacting the recycled copper market. Copper’s 100% recyclability and perpetual life cycle make it an ideal candidate for this approach.

- Price Volatility: The market for recycled copper is influenced by price fluctuations in primary (virgin) copper. Low primary copper prices can reduce the economic viability of recycling, while high prices can incentivize recycling.

- Grade Analysis: Bare Bright Copper This grade is preferred in various applications due to its high purity, with a copper content of 99.9%. It is characterized by its pristine condition, unadulterated composition, and absence of coatings. In 2022, it held the largest market share in the global recycled copper market, accounting for 43.9%.

- By Source Analysis: New Scrap The “New Scrap” segment is the dominant source of recycled copper in the market. This category includes copper materials that are derived from manufacturing or industrial processes. New scrap is highly desirable for recycling because it tends to be relatively clean and pure, with minimal impurities.

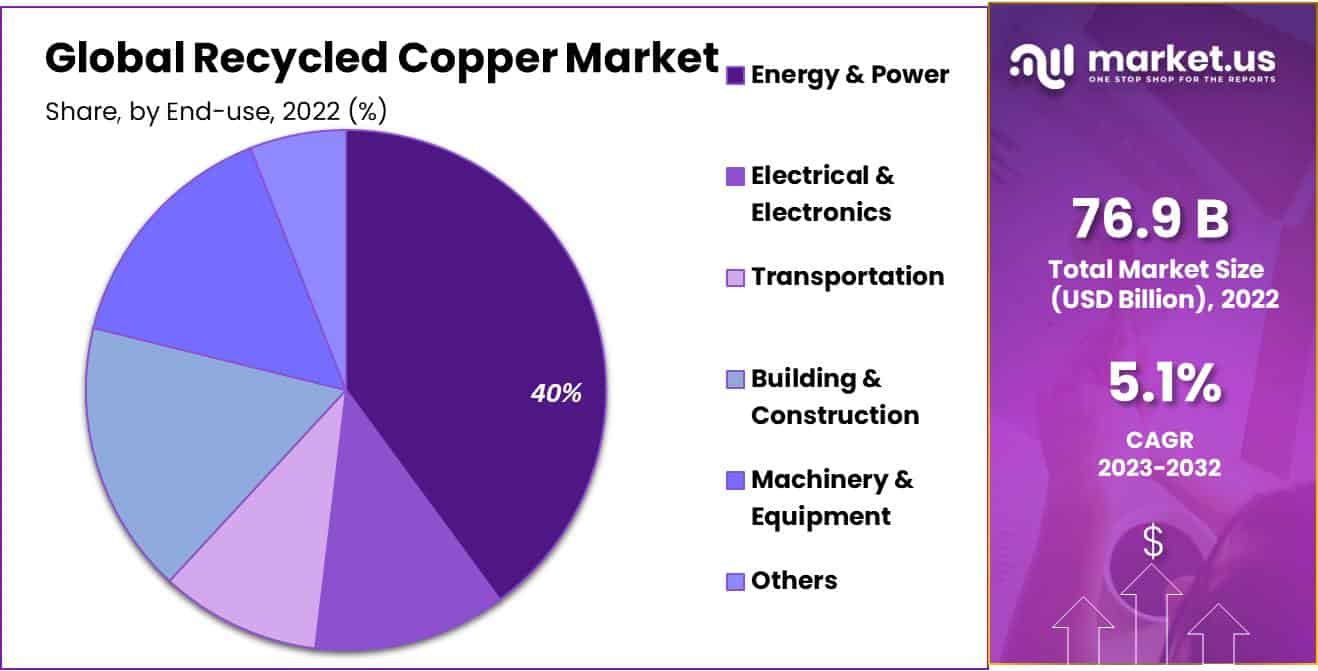

- End-Use Analysis: The “Energy & Power” segment dominated the global recycled copper market in 2022, accounting for 40% of the market share. Copper plays a crucial role in electrical power generation, transmission, and distribution systems.

- Growth Opportunities: The rising adoption of electric vehicles is increasing the demand for copper, as it plays a crucial role in vehicle electrical systems.

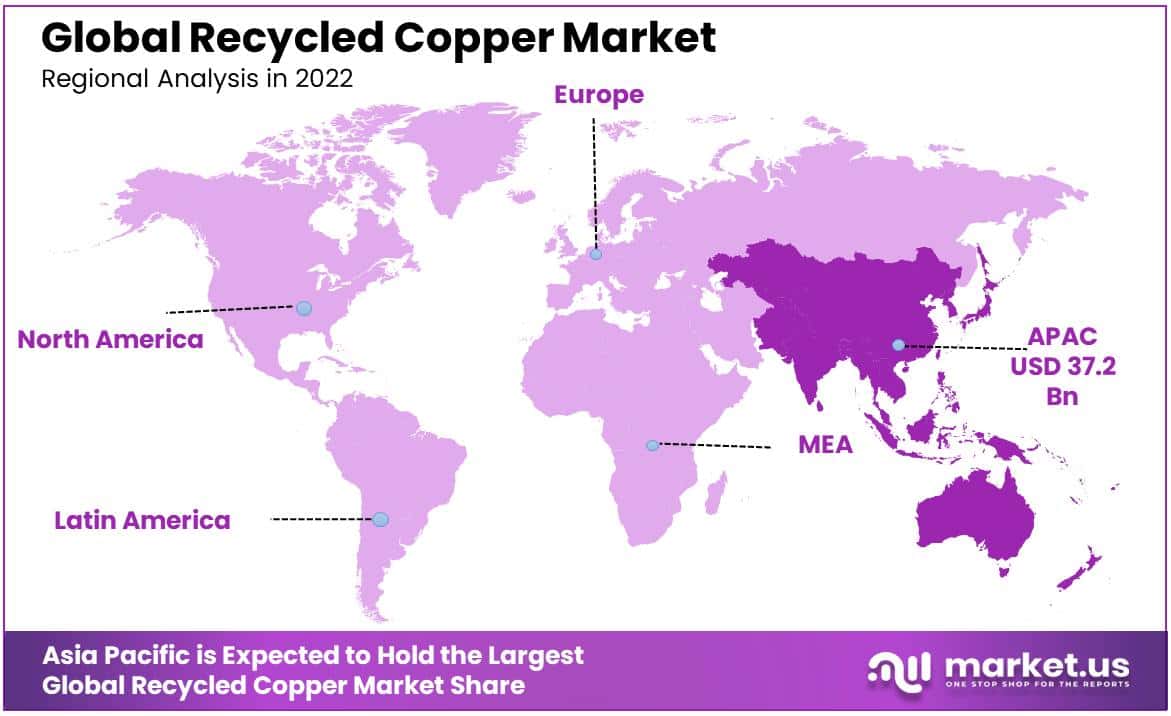

- Regional Analysis: Asia Pacific will lead the global recycled copper market in 2022, driven by rapid industrialization, urbanization, and infrastructure development. Other regions, including North America, Europe, Latin America, and the Middle East & Africa, are also significant.

- Key Players: Major players in the industry include Glencore, Aurubis Olen nv, Umicore N.V., Kuusakoski Oy, and Commercial Metals Company, among others.

Driving Factors

A rising focus on the circular economy would have a positive influence on the global recycled copper market

To achieve global sustainability objectives, recycling, and primary production will be required to meet demand, which is estimated to expand by 2050. Copper is an ideal candidate due to its 100 percent recyclability and perpetual life cycle, preserving its chemical and physical properties through successive uses. Embracing an actual circular economy means leveraging materials like copper that enhance circular systems and value chains, thereby reducing resource consumption, energy usage, waste generation, and greenhouse gas emissions.

Copper plays a pivotal role in this circular approach, offering durability, versatility, and limitless recyclability. It extends the lifespan of various applications, ensuring they can be efficiently reintegrated when they reach the end of their usability.

Beyond sustainability, copper’s applications drive the transition to green technologies, including renewable energy systems, energy-efficient solutions, and sustainable construction, all of which reduce energy consumption and carbon footprints. Circular value chains further curtail pollution and waste, amplifying the environmental benefits of copper applications.

Restraining Factors

Uncertainty And Volatility In Copper Prices Would Hamper The Market Growth For Recycled Copper.

The recycled copper market is closely tied to the fluctuations in primary (virgin) copper prices. When primary copper prices are low, recyclers may find it less economically viable to process and sell recycled copper, potentially reducing recycling activities. Conversely, high primary copper prices can incentivize recycling but also impact the market dynamics.

This price volatility can make it challenging for recyclers to predict their revenue and plan for long-term investments in recycling infrastructure and technology. Additionally, it can affect the competitiveness of recycled copper compared to newly mined copper, impacting the market’s growth and stability.

Market Scope

By Grade Analysis

Due To Its High Purity, Bare Bright Copper is Preferred in Various Applications. Hence, It Held the Largest Market Share in 2022.

Based on grade, the market for recycled copper is segmented into bare bright copper, grade 1 copper, grade 2 copper, and light copper. Among these, the bare bright copper segment was the most lucrative in the global recycled copper market, with a market share of 43.9% in 2022, and it is estimated to project a CAGR of 5.9%. It is the most valuable category within copper scrap and is characterized by its pristine condition, unadulterated composition, and absence of coatings.

This particular form of copper, often referred to as “bright and shiny copper,” boasts an exceptionally high copper content of 99.9%, rendering it the purest iteration of this metal. Its distinctive bright and unalloyed appearance makes it a preferred choice, particularly for electrical applications. Furthermore, this grade of copper is synonymous with superior profitability in the scrap industry.

By Source Analysis

The New Scrap Segment is Dominant in the global recycled copper market due to its relatively higher purity and ease of collection from manufacturing processes.

By type, the market is further divided into new scrap and old scrap. Among these, new scrap held the largest market share. New scrap refers to copper materials that are derived from manufacturing or industrial processes. This category includes copper scraps generated during the production of copper-based products or from fabrication processes such as wire, pipe, bus bars, contacts, and other copper products.

New scrap is highly desirable in recycling because it tends to be relatively clean and pure, with minimal impurities, making it easier to recycle and reuse. The new scrap segment is crucial for industries that rely on high-purity copper, such as electronics, telecommunications, and electrical equipment manufacturing. Its availability supports the consistent production of quality copper products.

By End-use

The Energy and Power Segment Dominated The Global Market In 2022 Owing To The Extensive Use Of Copper In Electrical Infrastructure, Where The Demand For High-Quality, Conductive Recycled Copper Is Vital For Efficient Energy Transmission And Distribution

Based on end-use, the market for recycled copper is segmented into energy and power, electrical and electronics, transportation, building construction, machinery equipment, and others. Among these, the energy power segment was the most lucrative in the global recycled copper market, with a market share of 40% in 2022. The energy and power sector constitutes a substantial consumer base for recycled copper, where copper assumes a vital role in electrical power generation, transmission, and distribution systems.

Recycled copper is prominently employed in the fabrication of essential components, including transformers, motors, generators, and other mission-critical elements, significantly enhancing the operational efficiency of the electrical grid. Copper’s exceptional electrical conductivity, second in rank only to silver, firmly establishes it as the preferred material for effective power generation and transmission, thereby ensuring the secure and efficient conveyance of electricity to residential and commercial establishments.

Key Market Segments

Based on Grade

- Bare Bright Copper

- Grade 1 Copper

- Grade 2 Copper

- Light Copper

Based on Source

- New Scrap

- Old Scrap

Based on End-Use

- Energy & Power

- Electrical & Electronics

- Transportation

- Building & Construction

- Machinery & Equipment

- Others

Growth Opportunities

The Rising Adoption Of Electric Vehicles Would Have Influence On The Copper Demand.

Copper has traditionally played a crucial role in vehicle electrical systems, and its significance is set to grow with the automotive industry’s transition toward fully electric vehicles, driven by a commitment to environmental sustainability. To align with these sustainability goals, automakers are exploring more eco-friendly options, and adopting recycled copper emerges as a promising solution.

Copper possesses exceptional electrical conductivity, remarkable flexibility, and robust resistance to heat and corrosion, making it an ideal choice for transmitting power and signals within vehicles. The Copper Development Association highlights that conventional automobiles contain between 8 kg and 22 kg of copper. However, in the case of battery electric vehicles, the copper requirement can soar to as much as 83 kg. This escalation primarily results from the increased demand for high-voltage cables and busbars, which often necessitate thicker configurations than low-voltage wiring.

Latest Trends

Rising Demand For Electrical Components

In the broader landscape of technology, a trajectory reminiscent of Moore’s Law characterizes progress. Each year, swifter and superior smartphones, larger televisions boasting higher resolutions, and electric vehicles that continually enhance efficiency appear. However, this exponential surge in technological advancement places substantial demands on copper reserves.

Concurrently, in various developing nations, infrastructural improvements are underway, accompanied by the adoption of cutting-edge technologies and the integration of renewable energy sources. While wind turbines and solar panels stand as commendable sustainable solutions, their operational effectiveness relies significantly on copper-based wiring and various associated components essential for efficiently conveying electricity from generators to the power grid.

Regional Analysis

Asia Pacific is a Dominant Region in the Global Recycled Copper Market Due To Rapid Industrialization, Urbanization, And Infrastructure Development.

In 2022, Asia Pacific held the leading position in the global market, with a market share of 48.4%. Foremost, the region is marked by swift industrialization and urban expansion, leading to a significant upswing in construction, manufacturing, and infrastructure advancement. These sectors display a substantial demand for copper, particularly in applications such as electrical wiring and plumbing, thus propelling the need for recycled copper.

Moreover, nations in the Asia Pacific region are making substantial investments in diverse infrastructure projects encompassing energy distribution, transportation, and telecommunications networks, all of which necessitate substantial copper utilization. Additionally, the region demonstrates an increasing commitment to renewable energy endeavors, emphasizing wind and solar power. Recycled copper plays a pivotal role in producing components for these environmentally sustainable systems, further amplifying its relevance and demand in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players who significantly influence the industry drive the global Recycled Copper market. Glencore, Aurubis Olen nv, Umicore N.V. Kuusakoski Oy, and Commercial Metals Company are the major players known for their diversified recycled copper production and supply chain network. These key players and other industry participants collectively influence the Recycled Copper market’s growth, supply, and demand dynamics. Their continuous innovation, expansion, and market strategies contribute significantly to the industry’s development.

Market Key Players

- Glencore

- Aurubis Olen nv

- Umicore N.V.

- Kuusakoski Oy

- Commercial Metals Company

- Schnitzer Steel Industries, Inc.

- Sims Limited

- Pacific Metal Group

- OmniSource, LLC

- Elgin Recycling

- Aaron Metals

- Wilton Waste Recycling

- SA Recycling LLC

- LKM Recycling

- Reukema

- Jain Metal Group

- Copper Recycling Company

- SGNCO Green Resources Limited

- Nirvana Recycling Pvt. Ltd.

- Cohen Recycling

- Wieland Group

- Other Key Players

Recent Developments

- In April 2023, AMTE Power, a prominent UK firm specializing in developing and producing lithium-ion and sodium-ion battery cells for specialized applications in expanding markets, revealed the signing of a memorandum of understanding with CalPac Resources Limited. CalPac Resources is engaged in pioneering technology stemming from green hydrogen manufacturing, specifically designed for refining copper sourced from industrial scrap materials.

- In October 2022, Wieland unveiled plans for a substantial €80 million investment in a new copper recycling facility to be situated at its primary production site in Vöhringen, Germany. This investment marks a significant milestone in the company’s global strategy to enhance its recycling capabilities. It is set to bring an additional annual recycling capacity of around 80,000 metric tons, underlining Wieland’s commitment to expanding its recycling endeavors on a global scale.

Report Scope

Report Features Description Market Value (2022) USD 76.9 Bn Forecast Revenue (2032) USD 126.4 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2020-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade (Bare Bright Copper, Grade 1 Copper, Grade 2 Copper, and Light Copper), By Source (New Scrap and Old Scrap), By End-use (Energy & Power, Electrical & Electronics, Transportation, Building & Construction, Machinery & Equipment and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America – Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Glencore, Aurubis Olen nv, Umicore N.V., Kuusakoski Oy, Commercial Metals Company, Schnitzer Steel Industries, Inc., Sims Limited, Pacific Metal Group, OmniSource, LLC, Elgin Recycling, Aaron Metals, Wilton Waste Recycling, SA Recycling LLC, LKM Recycling, Reukema, Jain Metal Group, Copper Recycling Company, SGNCO Green Resources Limited, Nirvana Recycling Pvt. Ltd., Cohen Recycling, Wieland Group and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the recycled copper market?The recycled copper market refers to the industry that deals with the collection, processing, and reuse of copper materials that have been previously used in various products and applications. This includes copper from discarded electronics, wiring, plumbing, and other sources.

-

-

- Glencore

- Aurubis Olen nv

- Umicore N.V.

- Kuusakoski Oy

- Commercial Metals Company

- Schnitzer Steel Industries, Inc.

- Sims Limited

- Pacific Metal Group

- OmniSource, LLC

- Elgin Recycling

- Aaron Metals

- Wilton Waste Recycling

- SA Recycling LLC

- LKM Recycling

- Reukema

- Jain Metal Group

- Copper Recycling Company

- SGNCO Green Resources Limited

- Nirvana Recycling Pvt. Ltd.

- Cohen Recycling

- Wieland Group

- Other Key Players