Global Recruitment Process Outsourcing (RPO) Market Size, Share Analysis Report By Type (On-demand, Function-based, Enterprise-based), By Service (On-site, Off-site / Virtual), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Industry Vertical (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Education, Government, Others (Energy, Hospitality, etc.)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147689

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Role of Generative AI

- U.S. Market Acceleration

- North America Market Value

- By Type Analysis

- By Service Analysis

- By Enterprise Size Analysis

- By Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

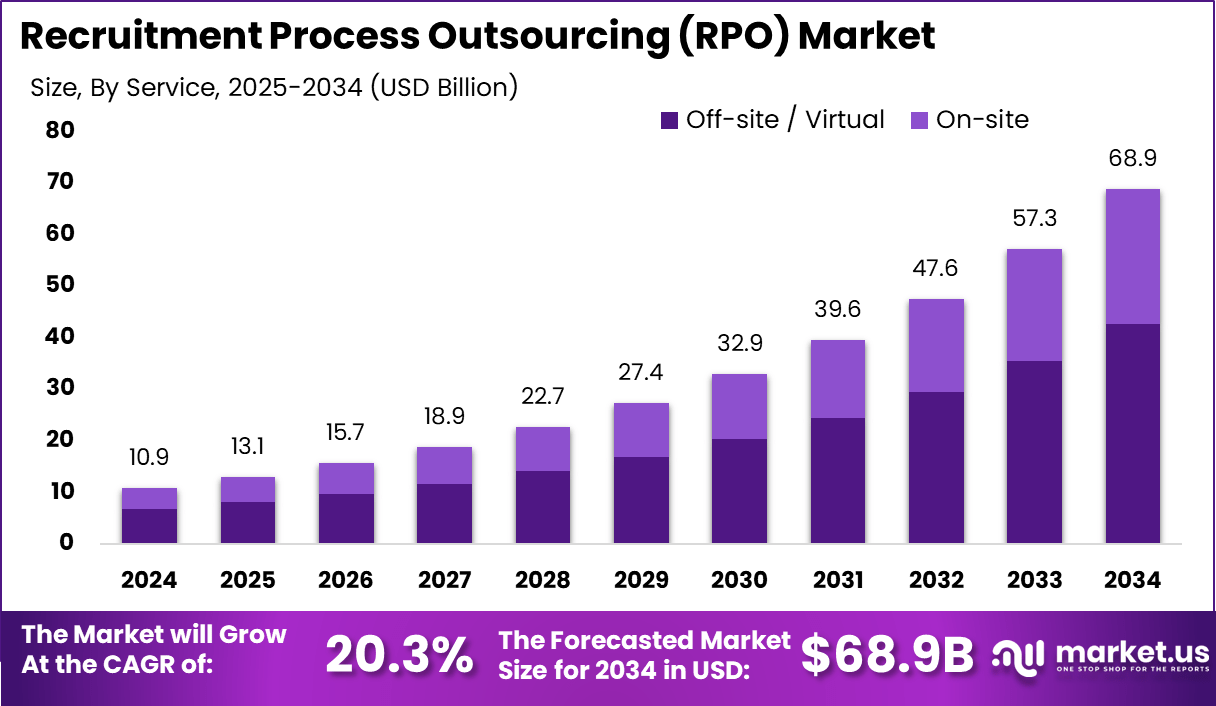

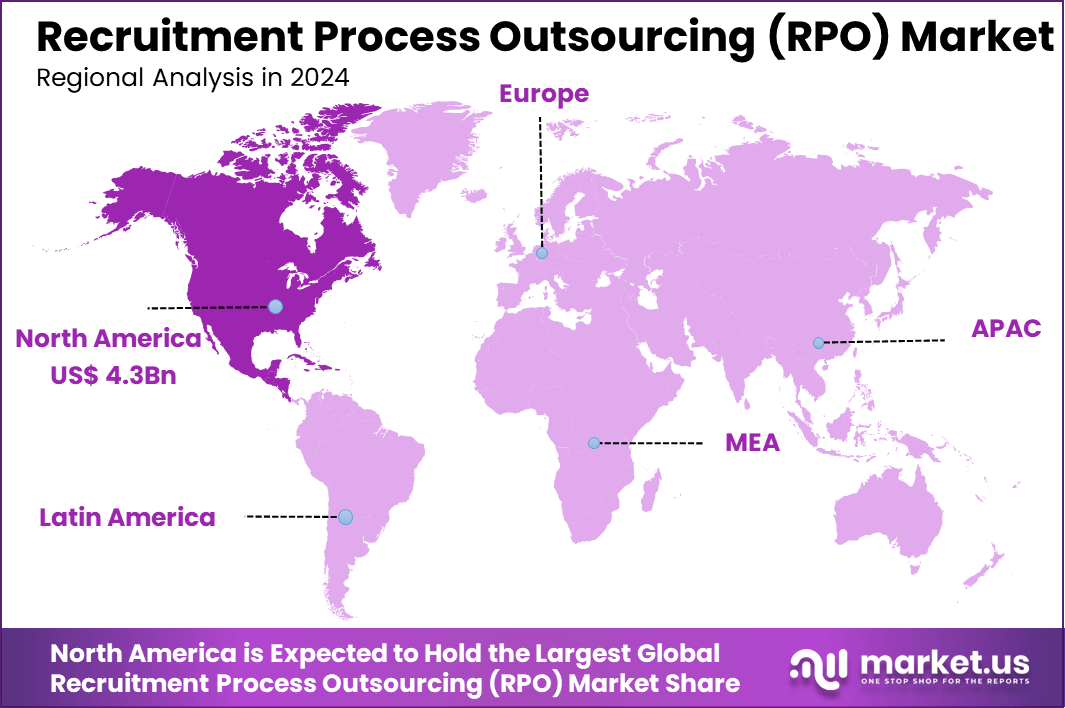

The Global Recruitment Process Outsourcing Market size is expected to be worth around USD 68.9 Billion By 2034, from USD 10.9 billion in 2024, growing at a CAGR of 20.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 10% share, holding USD 4.3 Billion revenue.

Recruitment Process Outsourcing (RPO) refers to the practice where an organization delegates all or part of its recruitment activities to an external service provider. This provider acts as an extension of the company’s human resources department, managing tasks such as candidate sourcing, screening, interviewing, and onboarding.

The primary objective is to enhance the efficiency and effectiveness of the hiring process, allowing companies to focus on their core business functions while benefiting from the expertise and scalability offered by specialized recruitment firms. Several key factors are propelling the growth of the RPO market. Organizations are seeking to streamline their hiring processes to reduce time-to-fill and cost-per-hire metrics.

The complexity of talent acquisition, especially for specialized roles, necessitates the expertise of RPO providers. Additionally, the globalization of the workforce and the rise of remote work have expanded the talent pool, requiring more sophisticated recruitment strategies that RPO firms are well-equipped to provide.

The demand for RPO services is notably high in sectors such as information technology, healthcare, and manufacturing, where there is a continuous need for skilled professionals. Small and medium-sized enterprises (SMEs) are increasingly adopting RPO solutions to compete with larger organizations in attracting top talent.

According to the findings from Outsource Accelerator, 70% of firms now conduct their recruitment and onboarding processes in a hybrid (half-virtual) format, reflecting a major shift in how companies engage talent post-pandemic. While only 1 in 10 have adopted a fully virtual hiring model, this indicates a growing comfort with remote workflows. At the same time, employee expectations are evolving – 79% of US workers are now looking for more than just salary, demanding culture, flexibility, and purpose in their jobs.

The flexibility and scalability offered by RPO providers enable these businesses to adjust their recruitment efforts in response to market fluctuations and project-based needs. One of the primary reasons for the surge in RPO adoption is the significant cost savings it offers. By outsourcing recruitment functions, companies can reduce overhead expenses associated with maintaining an in-house hiring team.

According to insights from Genius, organizations that adopt Recruitment Process Outsourcing (RPO) see their time-to-hire reduced by 40%, while 60% report better hire quality. Offshore recruitment further improves cost efficiency, with companies saving up to 70% on labor costs. Today, 75% of US businesses already use some form of offshore talent, marking a clear trend toward globalized workforce strategies that prioritize both efficiency and reach.

Key Takeaways

- The global RPO market is projected to surge from USD 10.9 billion in 2024 to nearly USD 68.9 billion by 2034, driven by widespread digital adoption and a growing need for agile hiring, reflecting a robust CAGR of 20.3%.

- North America led the global RPO market in 2024 with over 10% share, generating USD 4.3 billion in revenue, supported by strong demand for specialized talent and increasing outsourcing among U.S. based enterprises.

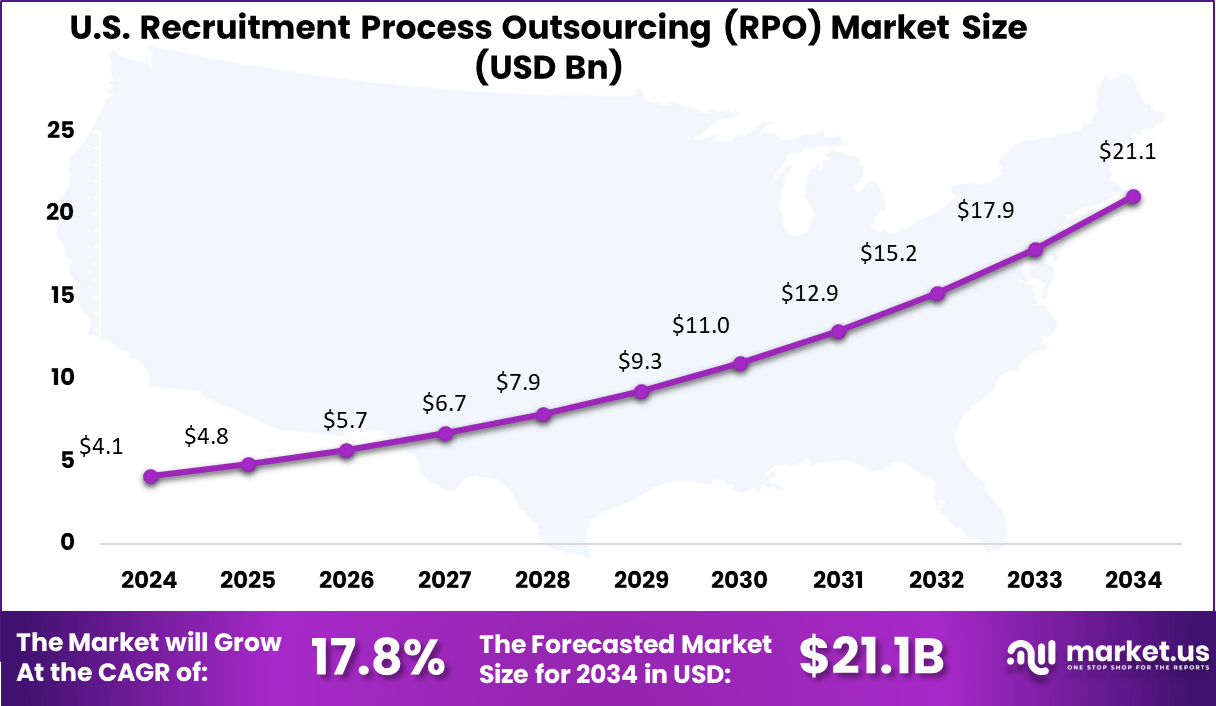

- The U.S. RPO market is set to grow from USD 4.8 billion in 2025 to USD 21.1 billion by 2034, advancing at a CAGR of 17.8%, as firms prioritize scalability and cost-effective recruitment solutions amid evolving workforce dynamics.

- In 2024, Enterprise-based RPO solutions commanded more than 56% of the global market, as large companies continued to favor end-to-end hiring support for handling complex and high-volume recruitment needs.

- Off-site / Virtual RPO models dominated with over 62% share in 2024, reflecting a major shift toward remote hiring practices and cloud-based talent acquisition platforms post-pandemic.

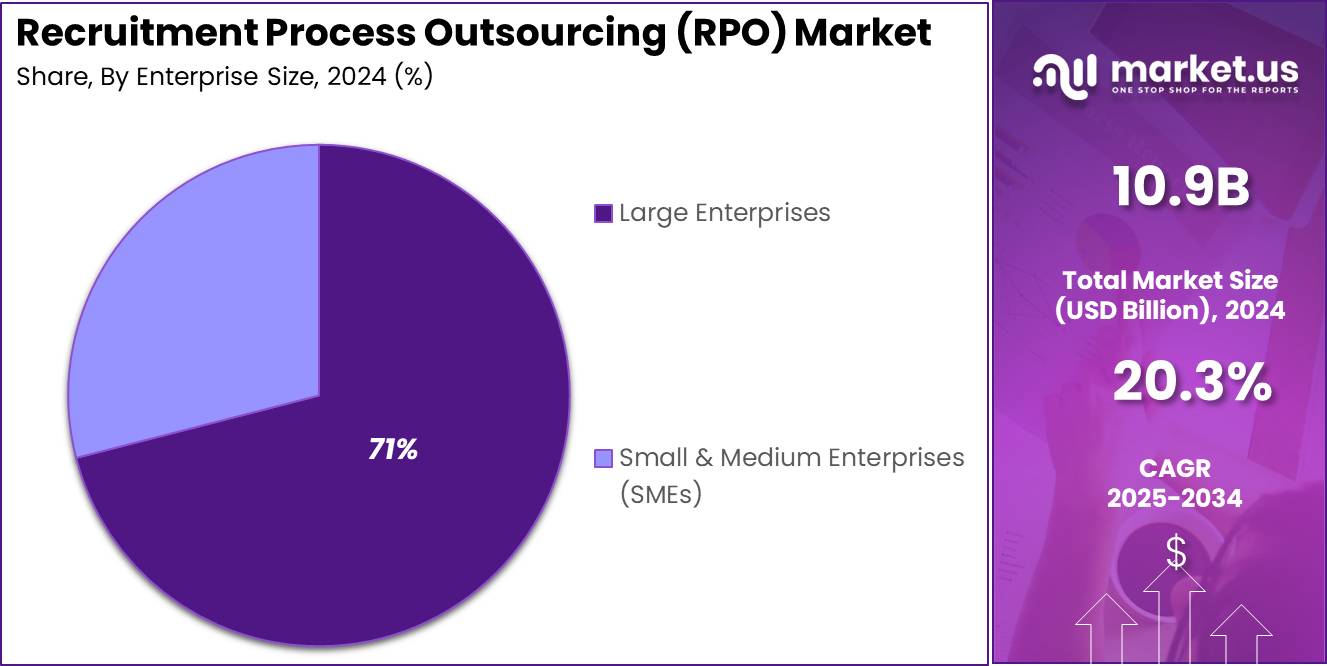

- Large Enterprises held over 71% of the market share in 2024, showcasing their strong reliance on outsourced recruitment to enhance efficiency, reduce overheads, and meet global workforce targets.

- The IT and Telecommunications sector accounted for more than 22% share in 2024, making it the leading industry vertical, fueled by persistent talent shortages and the high demand for skilled digital professionals.

Analysts’ Viewpoint

The RPO market presents numerous investment opportunities, particularly in emerging economies where businesses are increasingly seeking efficient recruitment solutions. Investors can explore partnerships with RPO providers that specialize in niche industries or offer innovative technological solutions.

Businesses that engage RPO services benefit from improved recruitment outcomes, including reduced time-to-hire, enhanced candidate quality, and increased retention rates. RPO providers bring specialized expertise and access to extensive talent networks, enabling organizations to fill positions more effectively.

The regulatory environment plays a significant role in shaping the RPO market. Compliance with labor laws, data protection regulations, and industry-specific standards is critical for RPO providers. Organizations must ensure that their RPO partners adhere to relevant legal requirements to mitigate risks associated with non-compliance.

Role of Generative AI

Generative AI is playing an increasingly pivotal role in Recruitment Process Outsourcing (RPO), fundamentally transforming how organizations attract, assess, and hire talent. By automating labor-intensive tasks, such as resume screening and candidate engagement, Generative AI enables RPO providers to enhance efficiency and reduce time-to-hire.

This technological advancement allows for more accurate matching of candidates to job requirements, improving the quality of hires and reducing turnover rates. Moreover, Generative AI supports diversity and inclusion initiatives by minimizing unconscious biases in the recruitment process, ensuring a more equitable evaluation of candidates.

The Latest study revealed that, The adoption of Generative AI in RPO is accelerating rapidly. A 2023 Study revealed that 81% of HR leaders have either implemented or are exploring Generative AI solutions in their recruitment processes. This surge is driven by the need for scalable and flexible recruitment solutions that can adapt to fluctuating market conditions and talent demands.

Companies investing in Generative AI are witnessing significant returns, with each dollar invested yielding an average return of ~$3.69. These figures underscore the tangible benefits of integrating Generative AI into RPO strategies. In addition to operational efficiencies, Generative AI enhances the candidate experience by providing timely and personalized communication throughout the recruitment journey.

U.S. Market Acceleration

The US Recruitment Process Outsourcing (RPO) Market is valued at approximately USD 4.1 Billion in 2024 and is predicted to increase from USD 4.8 Billion in 2025 to approximately USD 21.1 Billion by 2034, projected at a CAGR of 17.8% from 2025 to 2034.

North America Market Value

In 2024, North America held a dominant market position, capturing more than 40% share, with total revenue estimated at USD 4.3 billion in the RPO market. This leadership is primarily driven by the early and extensive adoption of advanced HR technologies, strong digital infrastructure, and the presence of numerous multinational corporations across industries such as IT, healthcare, BFSI, and manufacturing.

These enterprises are increasingly outsourcing recruitment tasks to RPO firms to enhance workforce agility, reduce hiring timelines, and ensure compliance with labor regulations. The demand is further supported by growing complexities in talent acquisition, skill shortages in niche roles, and an intense focus on diversity, equity, and inclusion (DEI) hiring initiatives.

North America’s dominance is also rooted in its mature employment ecosystem, where strategic outsourcing has become a long-term operational model rather than a reactive cost-saving measure. The U.S., in particular, shows aggressive adoption of AI and analytics in recruitment workflows, empowering RPO providers to offer high-precision hiring solutions.

By Type Analysis

In 2024, the Enterprise-based Recruitment Process Outsourcing (RPO) segment held a dominant market position, capturing more than 56% of the global market share. This leadership is attributed to the increasing preference of large organizations for comprehensive, end-to-end recruitment solutions that align with their strategic objectives.

Enterprise-based RPO offers a holistic approach, encompassing the entire recruitment lifecycle – from talent sourcing and screening to onboarding and retention strategies. Such integrated solutions enable organizations to streamline their hiring processes, reduce time-to-fill metrics, and enhance the quality of hires, thereby providing a competitive advantage in talent acquisition.

The prominence of the Enterprise-based RPO segment is further reinforced by the growing complexity of hiring needs in large enterprises, especially those operating across multiple geographies and industries. These organizations face challenges such as compliance with diverse regulatory environments, the need for specialized skill sets, and the imperative to maintain a consistent employer brand.

Enterprise-based RPO providers address these challenges by offering scalable and customizable solutions, leveraging advanced technologies like artificial intelligence and data analytics to optimize recruitment outcomes. This strategic partnership allows organizations to focus on their core business functions while ensuring that their talent acquisition processes are efficient, compliant, and aligned with their long-term goals.

By Service Analysis

In 2024, the Off-site / Virtual Recruitment Process Outsourcing (RPO) segment held a dominant market position, capturing more than 62% of the global market share. This significant lead is attributed to the increasing demand for flexible, scalable, and cost-effective recruitment solutions that transcend geographical boundaries.

The shift towards remote work and digital transformation has accelerated the adoption of virtual RPO services, enabling organizations to tap into a broader talent pool without the constraints of physical location. By leveraging advanced technologies such as artificial intelligence and cloud-based platforms, off-site RPO providers offer streamlined and efficient recruitment processes that align with the evolving needs of modern businesses.

The prominence of the Off-site / Virtual RPO segment is further reinforced by the benefits it offers in terms of operational efficiency and cost savings. Organizations are increasingly recognizing the value of outsourcing recruitment functions to virtual RPO providers, who can deliver consistent and high-quality hiring outcomes while reducing overhead expenses associated with maintaining in-house recruitment teams.

Moreover, the ability to quickly scale recruitment efforts up or down in response to changing business demands makes off-site RPO an attractive option for companies seeking agility in their talent acquisition strategies. As the global workforce continues to embrace remote work and digital collaboration, the Off-site / Virtual RPO segment is poised to maintain its leading position in the market.

By Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant position in the Recruitment Process Outsourcing (RPO) market, capturing more than 71% of the global share. This substantial lead is primarily due to the extensive and complex hiring needs of large organizations, which often span multiple regions and require a diverse range of skill sets.

By partnering with RPO providers, these enterprises can streamline their recruitment processes, ensuring consistency and compliance across various jurisdictions. The scalability offered by RPO solutions allows large companies to efficiently manage fluctuating hiring demands without overextending internal resources.

Furthermore, large enterprises are increasingly leveraging advanced technologies integrated into RPO services, such as artificial intelligence and data analytics, to enhance candidate sourcing and selection. These tools provide valuable insights into talent markets, enabling organizations to make informed decisions and improve the quality of hires.

By Industry Vertical Analysis

In 2024, the Information Technology (IT) and Telecommunications sector held a dominant position in the Recruitment Process Outsourcing (RPO) market, capturing more than 22% of the global share. This leadership is primarily driven by the sector’s rapid technological advancements and the continuous demand for skilled professionals in areas such as software development, cybersecurity, and network infrastructure.

The dynamic nature of the IT and Telecom industry necessitates agile and efficient recruitment processes, making RPO solutions particularly valuable for these organizations. The prominence of the IT and Telecom segment in the RPO market is further reinforced by the sector’s global expansion and the increasing complexity of talent acquisition.

Organizations within this industry often operate across multiple regions, requiring recruitment strategies that can navigate diverse regulatory environments and cultural nuances. RPO providers offer scalable and customizable solutions that address these challenges, enabling IT and Telecom companies to maintain a competitive edge in attracting top talent.

Key Market Segments

By Type

- On-demand

- Function-based

- Enterprise-based

By Service

- On-site

- Off-site / Virtual

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry Vertical

- IT & Telecom

- BFSI

- Healthcare

- Retail & E-commerce

- Manufacturing

- Education

- Government

- Others (Energy, Hospitality, etc.)

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Cost Efficiency and Operational Scalability

The adoption of Recruitment Process Outsourcing (RPO) is primarily driven by the imperative for cost efficiency and operational scalability. Organizations, especially those experiencing rapid growth or operating in competitive markets, are increasingly outsourcing recruitment functions to achieve significant cost savings.

By leveraging the expertise and infrastructure of RPO providers, companies can reduce expenses associated with in-house recruitment teams, advertising, and technology investments. This strategic move allows for a more predictable and often lower cost per hire, enabling businesses to allocate resources more effectively across other critical areas.

Moreover, RPO offers the flexibility to scale recruitment efforts up or down in response to fluctuating hiring needs without the burden of maintaining a large permanent recruitment staff. This scalability is particularly beneficial for organizations facing seasonal hiring spikes or project-based staffing requirements.

Restraint

Loss of Control Over Recruitment Processes

A significant restraint in the adoption of RPO is the perceived loss of control over recruitment processes. When outsourcing recruitment functions, organizations may feel disconnected from the hiring process, leading to concerns about the alignment of recruitment strategies with company culture and values.

This detachment can result in hires that, while technically qualified, may not fit well within the organizational environment, potentially affecting team dynamics and overall performance. Additionally, reliance on external providers can lead to challenges in maintaining consistent communication and feedback loops, which are essential for refining recruitment strategies and ensuring quality hires.

The lack of direct oversight may also hinder the organization’s ability to respond swiftly to recruitment issues or changes in hiring requirements. These factors contribute to hesitancy among some organizations to fully embrace RPO solutions, as they weigh the benefits of outsourcing against the potential risks of diminished control.

Opportunity

Expansion into Emerging Markets

Emerging markets present a significant opportunity for the growth of RPO services. As businesses expand globally, the need for efficient and effective recruitment strategies in new regions becomes paramount. RPO providers can offer valuable insights and localized expertise, assisting organizations in navigating diverse labor markets, regulatory environments, and cultural nuances.

This support is crucial for companies aiming to establish a strong presence in emerging economies where talent acquisition processes may differ substantially from their home countries. Furthermore, RPO services can help organizations tap into vast pools of untapped talent in these markets, providing access to skilled professionals who can drive innovation and growth.

By leveraging RPO providers’ networks and knowledge, companies can accelerate their entry into new markets, reduce time-to-hire, and ensure compliance with local employment laws. This strategic partnership enables businesses to build robust, diverse teams that are essential for competing in the global marketplace.

Challenge

Integration with Existing HR Systems

Integrating RPO solutions with existing Human Resources (HR) systems poses a considerable challenge for organizations. Disparities between the technologies used by RPO providers and the client’s internal systems can lead to data inconsistencies, process inefficiencies, and communication breakdowns.

Such integration issues may result in delays in the recruitment process, errors in candidate information, and difficulties in tracking recruitment metrics, ultimately affecting the quality of hires and overall recruitment effectiveness.

To mitigate these challenges, organizations must invest time and resources in ensuring compatibility between systems, which may involve customizing interfaces, training staff, and establishing clear protocols for data management. This integration process can be complex and resource-intensive, potentially offsetting some of the cost and efficiency benefits that RPO aims to provide.

Growth Factors

Technological Integration and Strategic Flexibility

The expansion of Recruitment Process Outsourcing (RPO) services is significantly influenced by the integration of advanced technologies and the demand for adaptable recruitment strategies. Organizations are increasingly adopting RPO to leverage technologies such as artificial intelligence (AI), machine learning (ML), and data analytics, which enhance the efficiency and effectiveness of talent acquisition processes.

These technologies enable RPO providers to automate routine tasks, improve candidate sourcing, and provide data-driven insights, thereby streamlining recruitment operations and reducing time-to-hire. Furthermore, the need for strategic flexibility in recruitment is propelling the growth of RPO.

Companies are seeking scalable solutions that can adapt to fluctuating hiring demands, whether due to seasonal variations, market expansions, or project-based needs. RPO offers the ability to scale recruitment efforts up or down efficiently, providing organizations with the agility to respond to changing business environments without the burden of maintaining large, permanent recruitment teams.

Emerging Trends

AI-Driven Recruitment and Diversity Focus

Emerging trends in RPO are characterized by the adoption of AI-driven recruitment processes and an increased emphasis on diversity and inclusion. AI technologies are being utilized to enhance various aspects of recruitment, including resume screening, candidate matching, and interview scheduling.

These advancements allow for more precise and efficient identification of suitable candidates, improving the overall quality of hires and reducing recruitment timelines. Simultaneously, there is a growing focus on promoting diversity and inclusion within recruitment practices.

RPO providers are implementing strategies to attract a diverse talent pool, such as utilizing inclusive job descriptions and leveraging platforms that reach underrepresented groups. This trend reflects a broader organizational commitment to building inclusive workplaces and recognizing the value of diverse perspectives in driving innovation and business success.

Business Benefits

Enhanced Efficiency and Quality of Hires

RPO offers significant business benefits, notably in enhancing recruitment efficiency and improving the quality of hires. By outsourcing recruitment processes, organizations can access specialized expertise and advanced technologies, leading to more streamlined and effective hiring practices.

This approach reduces the time and resources required for recruitment, allowing internal teams to focus on core business activities. Additionally, RPO providers bring a wealth of experience and industry knowledge, contributing to higher-quality hiring outcomes.

Their ability to identify and attract top talent ensures that organizations are staffed with individuals who not only possess the necessary skills but also align with the company’s culture and values. This alignment is crucial for employee retention and overall organizational performance.

Key Player Analysis

Key players in the Recruitment Process Outsourcing (RPO) market are actively pursuing strategic initiatives such as product launches, acquisitions, and collaborations to expand their global presence and improve service offerings.

A notable example occurred in April 2023, when Recruiter.com launched the Recruiter Marketplace, a digital platform aimed at transforming talent acquisition. This solution leverages automation to seamlessly connect employers with a global network of verified freelance recruitment professionals. The platform meets modern workforce needs by providing greater flexibility, cost savings, and wider access to skilled talent.

Randstad Sourceright has made significant strides by launching a new app in September 2024, designed to enhance the connection between job seekers and employers. This platform offers real-time job matching and provides employers with immediate access to a vast pool of vetted candidates, streamlining the hiring process.

ManpowerGroup Talent Solutions has focused on innovation through its 2025 VivaTech Startup Challenge, aiming to revolutionize the talent experience with AI. This initiative seeks innovative ideas at the intersection of technology and human potential, emphasizing AI-powered marketing to create emotional connections and match individuals with suitable job opportunities.

Top Key Players in the Market

- Randstad Sourceright

- ManpowerGroup Solutions

- Allegis Global Solutions

- Korn Ferry

- Hudson Global, Inc.

- Cielo, Inc.

- Alexander Mann Solutions

- IBM Talent Acquisition Optimization

- ADP RPO

- PeopleScout (TrueBlue Inc.)

- Pontoon Solutions

- AMS (formerly Alexander Mann Solutions)

- KellyOCG

- Sevenstep RPO

- Hays Talent Solutions

- Others

Recent Developments

- In February 2025, Kelly Services integrated KellyOCG’s RPO operations with Sevenstep, forming a unified permanent hiring solutions business line.

- In August 2024, ManpowerGroup’s Talent Solutions was acknowledged as a Leader in Recruitment Process Outsourcing across North America, EMEA, and Asia Pacific by Everest Group.

- In 2024, Hudson RPO acquired Dubai-based Executive Solutions and entered into agreements with Striver to expand its presence in the Middle East.

Report Scope

Report Features Description Market Value (2024) USD 10.9 Bn Forecast Revenue (2034) USD 68.9 Bn CAGR (2025-2034) 20.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (On-demand, Function-based, Enterprise-based), By Service (On-site, Off-site / Virtual), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Industry Vertical (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Education, Government, Others (Energy, Hospitality, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Randstad Sourceright, ManpowerGroup Solutions, Allegis Global Solutions, Korn Ferry, Hudson Global, Inc., Cielo, Inc., Alexander Mann Solutions, IBM Talent Acquisition Optimization, ADP RPO, PeopleScout (TrueBlue Inc.), Pontoon Solutions, AMS (formerly Alexander Mann Solutions), KellyOCG, Sevenstep RPO, Hays Talent Solutions, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Recruitment Process Outsourcing MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Recruitment Process Outsourcing MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Randstad Sourceright

- ManpowerGroup Solutions

- Allegis Global Solutions

- Korn Ferry

- Hudson Global, Inc.

- Cielo, Inc.

- Alexander Mann Solutions

- IBM Talent Acquisition Optimization

- ADP RPO

- PeopleScout (TrueBlue Inc.)

- Pontoon Solutions

- AMS (formerly Alexander Mann Solutions)

- KellyOCG

- Sevenstep RPO

- Hays Talent Solutions

- Others