Global Reconnaissance Drone Market Size, Share, Industry Analysis Report By Platform Type (High-Altitude Long-Endurance (HALE), Medium-Altitude Long-Endurance (MALE), Tactical Unmanned Aerial Vehicles, Small Unmanned Aerial Systems (SUAS)), By System (Airframe, Payload, Spectral/Geo-Spatial Sensors, Ground Control Station (GCS), Data Links, Launch and Recovery Systems), By Application (Military & Defense, Homeland Security & Law Enforcement, Environment & Agricultural Monitoring, Infrastructure Inspection), By Range (Visual Line of Sight, Beyond Visual Line of Sight), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165786

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Revenue and Usage Statistics

- Adoption Rate and Usage Statistics

- Global Fleet Statistics

- By Platform Type

- By System

- By Application

- By Range

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

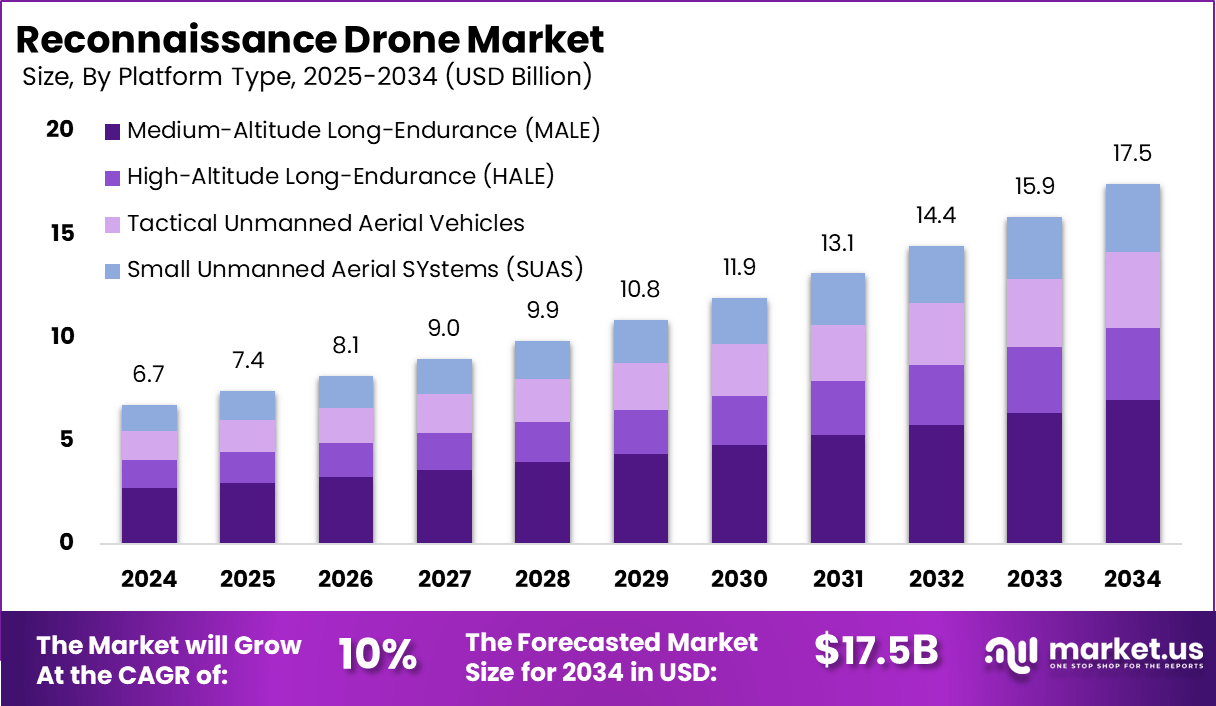

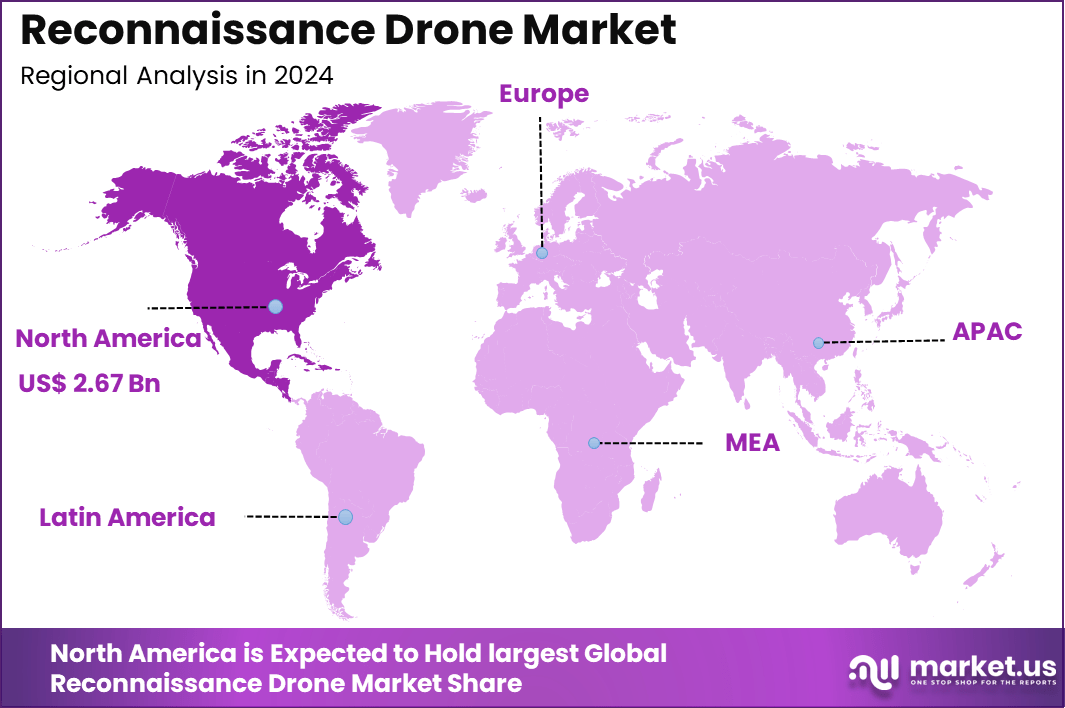

The Global Reconnaissance Drone Market generated USD 6.7 billion in 2024 and is predicted to register growth from USD 7.4 billion in 2025 to about USD 17.5 billion by 2034, recording a CAGR of 10% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.8% share, holding USD 2.67 Billion revenue.

The reconnaissance drone market is growing strongly across both military and civil sectors. Driven by evolving defense needs and wider adoption in public safety, border security, and disaster response, these drones offer new aerial intelligence capabilities. The technology’s ability to provide real-time, precise information enhances both operational effectiveness and security measures.

Top driving factors include rising defense budgets, technological progress in AI and autonomy, and the demand for persistent, precise surveillance. Advances in navigation algorithms and sensor technology allow drones to operate autonomously with minimal human input, improving mission success and reducing risk to personnel. Increasing urbanization and geopolitical tensions further boost demand for drone-based intelligence, surveillance, and reconnaissance (ISR) solutions across various continents.

Demand is rising among defence forces, homeland security agencies, emergency response units and private sector operators responsible for infrastructure surveillance. Military users require drones for reconnaissance missions, terrain mapping and target observation. Civil agencies adopt them for border patrol, wildlife tracking and disaster assessment. Industrial sectors rely on reconnaissance drones to inspect remote pipelines, transmission lines and large facility perimeters.

Top Market Takeaways

- By platform type, Medium-Altitude Long-Endurance (MALE) drones dominate with a 40.1% share. These drones are favored for their ability to remain airborne for extended periods, providing persistent surveillance essential for reconnaissance missions.

- By system type, payload systems hold a 45.8% market share. Payloads typically include advanced EO/IR cameras, radar, and signal intelligence equipment critical for intelligence gathering.

- By application, military and defense lead overwhelmingly with 80.5% share, reflecting the primary use of reconnaissance drones in ISR (Intelligence, Surveillance, and Reconnaissance) for national security and defense operations.

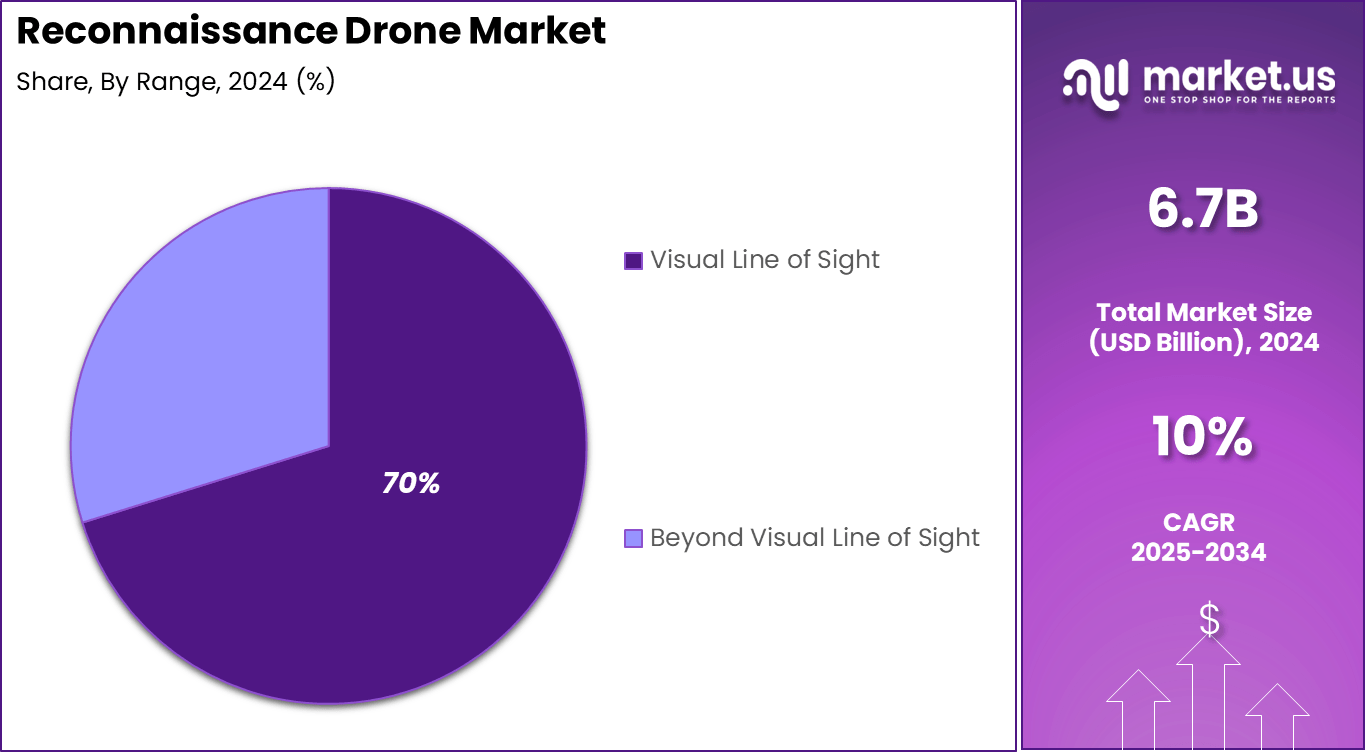

- By range, Beyond Visual Line of Sight (BVLOS) operations account for 70.2% of the market, enabling drones to cover larger geographic areas critical for extended reconnaissance missions.

- Regionally, North America holds approximately 39.8% of the market.

- The U.S. market size is estimated at USD 2.41 billion in 2025.

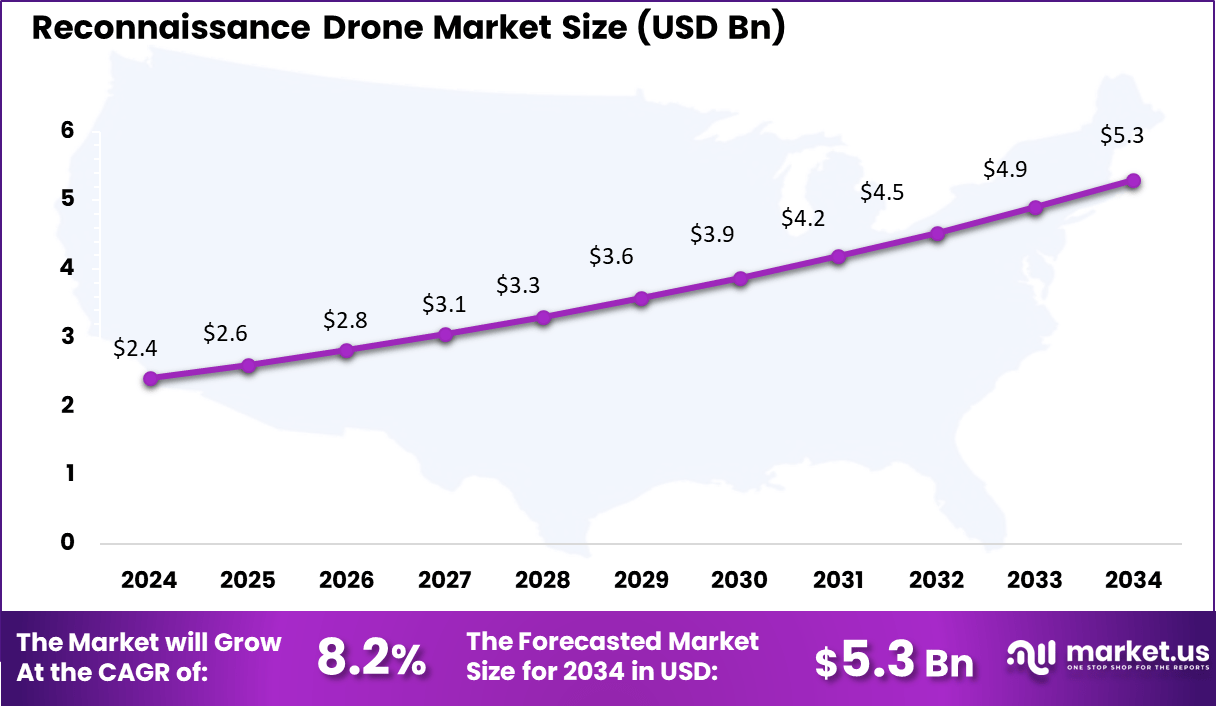

- The market is growing at a CAGR of 8.2%, driven by increasing defense spending, technological advancements in drone autonomy and sensor integration, and the rising need for persistent, long-range surveillance capabilities.

- Key drivers include growing demand for real-time intelligence, enhanced battlefield awareness, and improved situational awareness facilitated by advanced sensor payloads and extended drone endurance.

Revenue and Usage Statistics

- The reconnaissance and surveillance segment held a 25% share of the military drone market in 2024, making it one of the primary applications for defense drone operations.

- The Drone Market size is expected to be worth around USD 95.4 Billion by 2034, from USD 36.4 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 40.2% share, holding USD 14.63 Billion revenue.

- The global commercial drone market is anticipated to surge to USD 125.9 billion by 2033. It is estimated to record a steady CAGR of 29.9% in the review period 2024 to 2033. It is likely to total USD 9.2 billion in 2023.

- Remotely controlled drones dominate operational preferences, with remote operation accounting for 40.8% of the laser drone market in 2025.

Adoption Rate and Usage Statistics

- Civilian drone adoption has reached mainstream levels, with 8% of Americans owning a drone, equal to about 26.8 million people.

- Recreational drones represent 63% of FAA registrations in 2025, compared with 37% for commercial drone operations.

- Commercial usage is expanding rapidly, particularly in inspection and maintenance (30.3%) and industrial or manufacturing applications (32%) where advanced sensors and precise targeting are required.

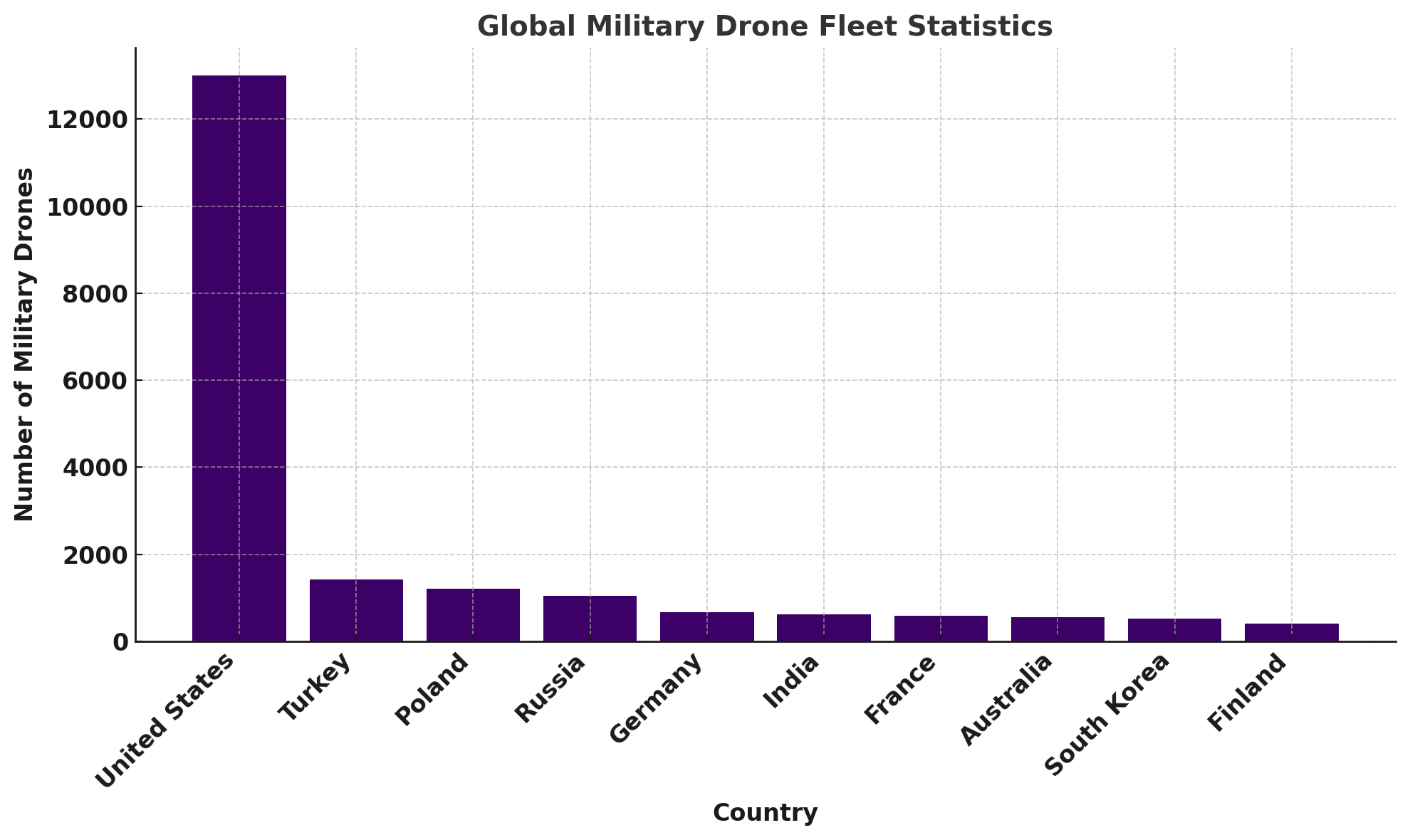

Global Fleet Statistics

By Platform Type

In 2024, Medium-Altitude Long-Endurance (MALE) drones hold a significant 40.1% share in the reconnaissance drone market. Renowned for their ability to provide persistent surveillance and intelligence at medium altitudes for extended periods, these drones are vital for military and strategic operations.

Their long endurance and medium altitude range allow them to cover vast areas, making them indispensable for border security and critical infrastructure monitoring. Developments such as AI-driven navigation and modular payloads enhance MALE drones versatility, allowing quick adaptation to reconnaissance, electronic warfare, and environmental monitoring missions. This flexibility cements their leadership in reconnaissance platforms.

By System

In 2024, Payload systems dominate with 45.8% market share, reflecting the emphasis on the variety and sophistication of sensors carried by drones. These payloads often include cameras, infrared sensors, synthetic aperture radar, and signal intelligence equipment, enabling drones to gather comprehensive real-time data.

The modular design of payloads allows operators to tailor drone capabilities for specific missions such as surveillance, target acquisition, or disaster management. Improved payload technology enhances drones’ effectiveness, supporting mission-critical operations with precise intelligence and situational awareness.

By Application

In 2024, Military and defense applications overwhelmingly lead with an 80.5% market share in the reconnaissance drone market. Drones serve as force multipliers by providing intelligence, surveillance, and reconnaissance (ISR) capabilities while reducing human risk.

Their strategic value lies in persistent observation, border control, electronic warfare, and tactical support in hostile environments. Continual investment in drone technology by defense agencies worldwide is driven by the demand for high reliability, operational versatility, and integration with existing military frameworks.

By Range

In 2024, Beyond Visual Line of Sight (BVLOS) operations dominate with 70% share. BVLOS allows drones to fly extended distances beyond the operator’s line of sight, critical for large-area surveillance and reconnaissance missions.

Regulatory progress and technological advancements in command and control systems have made BVLOS a practical reality for military and commercial users. This capability maximizes the operational reach of drones, enabling efficient monitoring of remote, hostile, or inaccessible regions without direct human supervision.

Emerging Trends

Key Trends Description AI-Guided Reconnaissance Reconnaissance drones increasingly use AI for autonomous navigation and real-time data analysis, helping improve mission accuracy and reduce operator workload. Disposable Recon Drones Lightweight, single-use drones are gaining acceptance for quick and low-risk surveillance in high-threat environments, enabling safer and more efficient data collection. Hybrid UAVs for Extended Flight Hybrid drones that combine battery and fuel propulsion are supporting long-duration missions, with flight endurance extending beyond 10 hours for enhanced reconnaissance capability. Swarm Drone Technology Coordinated drone swarms are emerging to provide wide-area surveillance and advanced reconnaissance tactics, enabling synchronized operations across multiple units. Advanced Sensor Integration Recon drones are now equipped with high-resolution cameras, thermal sensors, radar systems, and real-time data links, significantly strengthening situational awareness during surveillance operations. Growth Factors

Key Factors Description Rising Defense Budgets Increased government spending on defense and surveillance technologies is boosting demand for advanced reconnaissance drones. Escalating Security Threats Geopolitical tensions, cross-border conflicts, and rising terrorism are driving the need for real-time drone-based surveillance. Demand for Autonomous Operations Military forces are increasingly adopting drones capable of operating autonomously, improving mission efficiency and reducing human risk. Regional Military Modernization Defense modernization programs across Asia-Pacific and North America are accelerating drone adoption, supported by strong R&D investment. Technological Advances in UAVs Advances in battery technology, AI integration, sensor systems, and communications are enabling more capable and versatile reconnaissance UAV platforms. Key Market Segments

By Platform Type

- High-Altitude Long-Endurance (HALE)

- Medium-Altitude Long-Endurance (MALE)

- Tactical Unmanned Aerial Vehicles

- Small Unmanned Aerial SYstems (SUAS)

By System

- Airframe

- Payload

- tral/Geo-Spatial Sensors

- Ground Control Station (GCS)

- Data Links

- Launch and Recovery Systems

By Application

- Military & Defense

- Homeland Security & Law Enforcement

- Environment & Agricultural Monitoring

- Infrastructure Inspection

By Range

- Visual Line of Sight

- Beyond Visual Line of Sight

Regional Analysis

In 2024, North America holds a commanding 39.8% share in the global reconnaissance drone market, reflecting its widespread adoption across defense, security, agriculture, and infrastructure sectors. The market in this region thrives on technological innovation, with key players focusing on enhancing drone capabilities such as extended flight time, improved image resolution, and advanced sensor integration.

Increasing investment in border security, disaster management, and precision agriculture fuels demand, supported by progressive regulatory developments that facilitate commercial and military drone use. The presence of an extensive ecosystem of drone manufacturers, software developers, and service providers further consolidates North America’s leadership in reconnaissance drone technologies.

In the U.S., the reconnaissance drone market is valued at approximately USD 2.41 billion in 2024, with a steady CAGR of 8.2%. The U.S. government’s significant defense budget allocation and advanced R&D infrastructure drive innovation in this space, making it a key market globally.

Military and homeland security sectors are the major adopters, utilizing drones for surveillance, intelligence, and tactical operations. Meanwhile, commercial applications such as agricultural monitoring, infrastructure inspection, and environmental surveillance also contribute to market growth.

The increasing integration of AI and machine learning for autonomous operation, along with supportive FAA regulations, propels the U.S. reconnaissance drone market, ensuring it remains at the forefront of global advancements. This dynamic environment fosters continuous innovation and robust demand across diverse sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand for Real-Time Intelligence and Surveillance

A key driver in the reconnaissance drone market is the increasing demand for real-time intelligence, surveillance, and reconnaissance (ISR) across both military and civilian sectors. Drones offer rapid deployment and extensive coverage, enabling authorities to monitor vast areas efficiently and safely. This ability proves crucial for border security, disaster management, and critical infrastructure protection.

The integration of advanced sensors, high-resolution cameras, and real-time data transmission enhances situational awareness, helping decision-makers respond swiftly and accurately. Rising geopolitical tensions and security concerns globally further boost investments, making reconnaissance drones indispensable tools in modern surveillance operations.

Restraint

Regulatory Complexities and Airspace Restrictions

Despite rapid market growth, regulatory barriers and complex airspace management pose significant restraints. Governments impose strict regulations to ensure safety, privacy, and prevent unauthorized drone use, limiting operational flexibility for commercial and defense operators.

Acquiring permits, especially for beyond-visual-line-of-sight (BVLOS) flights, can be time-consuming and costly. Privacy concerns from the public and lawmakers lead to tighter rules on data collection and drone usage, creating uncertainties for manufacturers and service providers. These complexities delay deployment and raise compliance costs affecting market scalability, particularly in densely populated and urban areas.

Opportunity

AI Integration and Autonomous Mission Capabilities

The integration of artificial intelligence and machine learning technologies presents a major opportunity for enhancing reconnaissance drone capabilities. AI supports autonomous navigation, target recognition, and data analytics, reducing human intervention and improving mission efficiency. These technologies enable drones to operate in complex environments with minimal supervision.

Expanding use cases in civilian applications such as environmental monitoring, agriculture, and infrastructure inspection further widen market potential. As AI-driven drones become more cost-effective and reliable, adoption rates are expected to surge, opening new commercial and government revenue streams.

Challenge

Cybersecurity Risks and Data Management

A critical challenge faced by the reconnaissance drone market is ensuring robust cybersecurity and efficient data management. Drones collect massive amounts of sensitive and mission-critical data, making them targets for hacking, data breaches, and signal interference. Protecting communication links and stored information from cyber threats is imperative to maintain operational integrity.

Additionally, processing, storing, and analyzing large volumes of complex sensor data require high-performance computing infrastructure and advanced analytics tools. Managing data privacy concerns and regulatory compliance adds to the complexity, demanding continuous innovation and collaboration between drone manufacturers and cybersecurity experts.

Competitive Analysis

Northrop Grumman, Lockheed Martin, AeroVironment, and General Atomics hold a leading position in the reconnaissance drone market. Their platforms focus on long-endurance surveillance, real-time intelligence gathering, and secure mission operations. These companies provide advanced sensor suites, high-altitude capabilities, and reliable communication links. Strong demand from defense forces for persistent aerial monitoring continues to reinforce their dominance.

DroneShield, Swift Engineering, Israel Aerospace Industries, Elbit Systems, BAE Systems, and Textron expand the competitive landscape with versatile reconnaissance drones suited for tactical missions. Their systems support rapid deployment, multi-sensor integration, and enhanced situational awareness for border security, battlefield intelligence, and special operations. These providers invest in lightweight airframes, electronic warfare resistance, and improved data handling.

Kratos Defense, Thales Group, Hewlett Packard Enterprise, Raytheon Technologies, Insitu, Leonardo, and other participants contribute to market depth with specialized reconnaissance platforms and advanced data-processing capabilities. Their solutions incorporate AI-assisted analytics, autonomous navigation, and secure cloud-based intelligence platforms. These companies help defense agencies accelerate decision-making through high-quality aerial insights.

Top Key Players in the Market

- Northrop Grumman

- Lockheed Martin

- AeroVironment

- DroneShield

- Swift Engineering

- Israel Aerospace Industries

- Elbit Systems

- General Atomics

- BAE Systems

- Textron

- Kratos Defense & Security Solutions

- Thales Group

- Hewlett Packard Enterprise

- Raytheon Technologies

- Insitu

- Leonardo

- Others

Recent Developments

- November 2025, Northrop Grumman is conducting flight trials for its Beacon drone testbed, the first to link AI with real aircraft to support future military jets and pilot missions. The program is designed to accelerate autonomous capabilities, reduce risks, and shorten software deployment timelines in reconnaissance and related missions. Partner firms are integrating specialized autonomy applications on this platform, with trials expanding through 2025.

- November 2025, Israel Aerospace Industries’ subsidiary BlueBird Aero Systems launched a drone production facility in Morocco to build SpyX loitering munitions. This marks the first production of such advanced kamikaze drones outside Israel in North Africa and the Middle East. The facility also focuses on training local engineers. SpyX drones offer precise targeting capabilities and autonomous mission endurance, supporting regional military modernization.

Report Scope

Report Features Description Market Value (2024) USD 6.7 Bn Forecast Revenue (2034) USD 17.5 Bn CAGR(2025-2034) 10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform Type (High-Altitude Long-Endurance (HALE), Medium-Altitude Long-Endurance (MALE), Tactical Unmanned Aerial Vehicles, Small Unmanned Aerial Systems (SUAS)), By System (Airframe, Payload, Spectral/Geo-Spatial Sensors, Ground Control Station (GCS), Data Links, Launch and Recovery Systems), By Application (Military & Defense, Homeland Security & Law Enforcement, Environment & Agricultural Monitoring, Infrastructure Inspection), By Range (Visual Line of Sight, Beyond Visual Line of Sight) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Northrop Grumman, Lockheed Martin, AeroVironment, DroneShield, Swift Engineering, Israel Aerospace Industries, Elbit Systems, General Atomics, BAE Systems, Textron, Kratos Defense & Security Solutions, Thales Group, Hewlett Packard Enterprise, Raytheon Technologies, Insitu, Leonardo, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Reconnaissance Drone MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Reconnaissance Drone MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Northrop Grumman

- Lockheed Martin

- AeroVironment

- DroneShield

- Swift Engineering

- Israel Aerospace Industries

- Elbit Systems

- General Atomics

- BAE Systems

- Textron

- Kratos Defense & Security Solutions

- Thales Group

- Hewlett Packard Enterprise

- Raytheon Technologies

- Insitu

- Leonardo

- Others