Global Real Time Location System Market Size, Share Report Analysis By Component (Hardware, Software, Services), By Technology (RFID, Wi-Fi, UWB, BLE, Infrared (IR), Ultrasound, GPS, Others), By Application (Inventory/Asset-Tracking and Management, Personnel/Staff-Locating and Monitoring, Access Control/Security, Environmental Monitoring, Yard, Dock, Fleet Warehouse-Management and Monitoring, Supply Chain Management and Operational Automation/Visibility, Others), By Vertical (Healthcare, Manufacturing and Automotive, Retail, Transportation and Logistics, Government and Defense, Education, Oil and Gas, Mining, Sports and Entertainment, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171180

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Adoption Rates by Industry

- Usage and Implementation Insights

- U.S. Market Size

- Component Analysis

- Technology Analysis

- Application Analysis

- Vertical Analysis

- Increasing Adoption Technologies

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

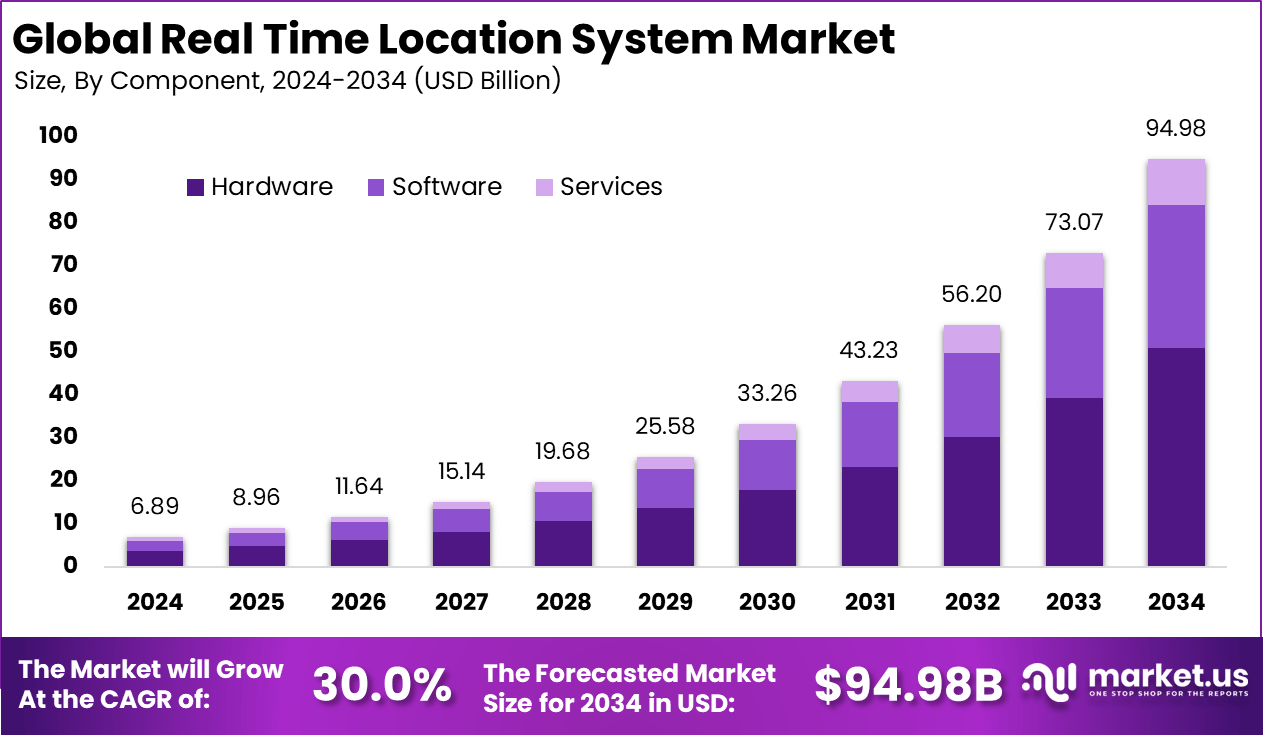

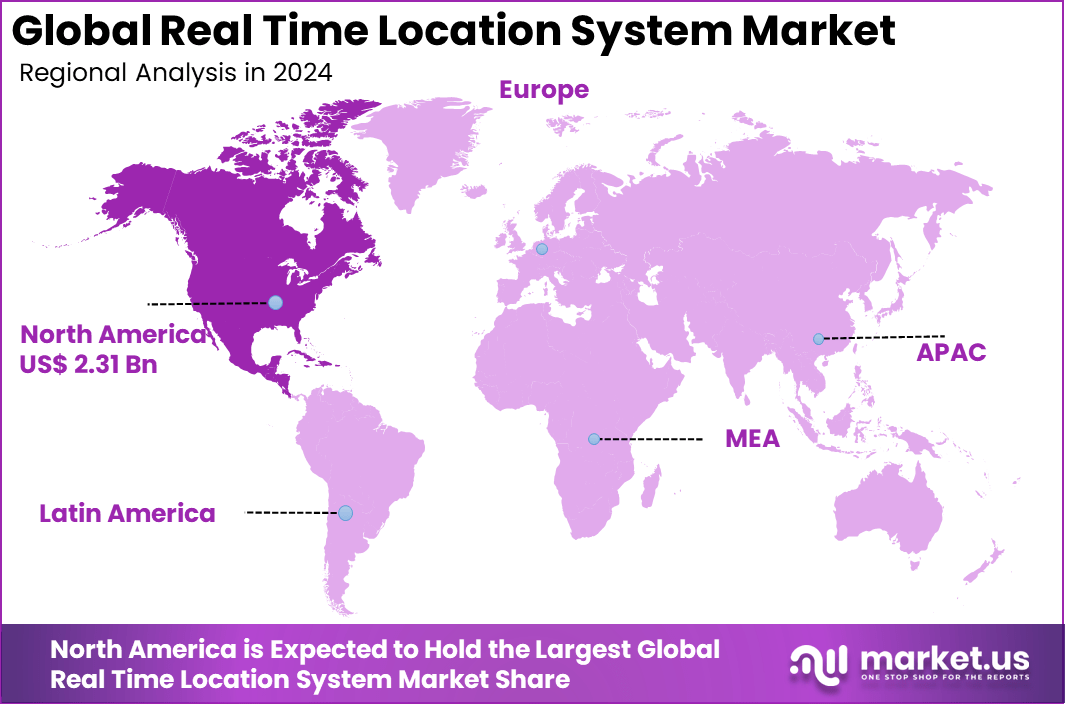

The Global Real Time Location System Market size is expected to be worth around USD 94.98 billion by 2034, from USD 6.89 billion in 2024, growing at a CAGR of 30.0% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 33.6% share, holding USD 2.31 billion in revenue.

The real time location system market covers technologies that enable continuous tracking of assets, people, or equipment within a defined area. These systems work by capturing live location signals and converting them into usable data that supports monitoring and control across indoor and outdoor environments. Real time tracking is widely applied in healthcare facilities, factories, warehouses, and large campuses where visibility of movement is critical.

Real time location systems are built on technologies such as RFID, Wi-Fi, Bluetooth, and Ultra-Wideband, each offering different accuracy levels and deployment flexibility. The market has expanded as organizations prioritize operational visibility, safety monitoring, and efficient use of physical resources. Growing reliance on digital infrastructure has further strengthened the role of location intelligence in daily operations.

One of the key driving factors is the increasing need for accurate asset tracking to reduce losses and improve utilization. Industries handling high-value equipment or time-sensitive operations require continuous visibility to maintain productivity and service quality. Real time location data supports faster decision-making and reduces operational delays.

Demand for real time location systems has grown strongly in environments where asset availability directly affects outcomes. Hospitals use location tracking to find critical equipment quickly and manage patient movement more effectively. This demand reflects the need to reduce idle time and improve service delivery.

For instance, in August 2025, Siemens AG patched its SIMATIC RTLS Locating Manager to version 3.3, fixing key vulnerabilities like CVE-2025-30034 while boosting security for industrial tracking. Even in Europe-based firms with strong U.S. operations, North America’s focus on reliable, hardened RTLS keeps factories running smoothly.

The adoption of IoT-enabled tracking devices has accelerated the use of real time location systems. Connected sensors and tags continuously transmit location data, allowing centralized platforms to process and visualize movements in real time. This has improved scalability and reliability of tracking solutions.

Key Takeaway

- In 2024, the hardware segment led the market with a 53.7% share, as physical tags, sensors, and readers remained essential for accurate real-time tracking.

- RFID technology accounted for 32.6%, supported by its cost efficiency, wide availability, and proven performance across multiple industries.

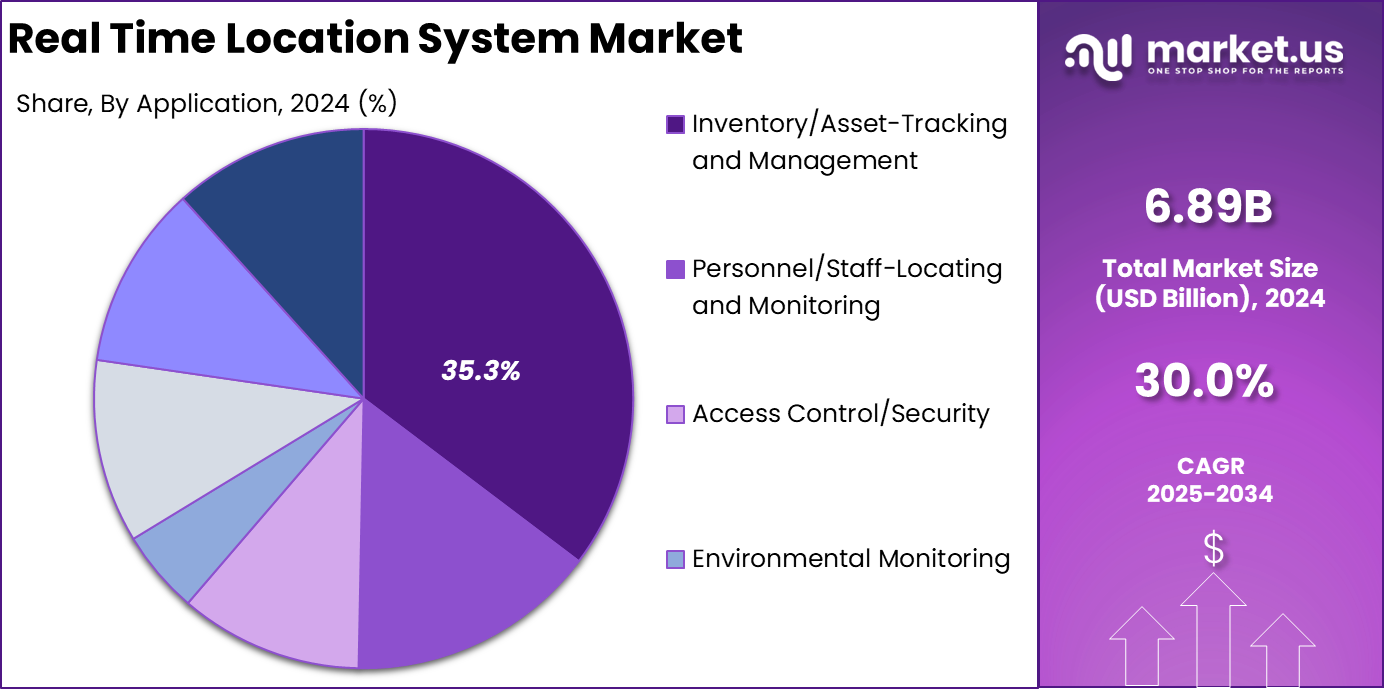

- Inventory and asset tracking and management captured 35.3%, reflecting strong demand for real-time visibility, loss prevention, and operational control.

- The healthcare sector held a 39.2% share, driven by the need for patient tracking, medical asset monitoring, and workflow optimization.

- The U.S. market showed strong growth momentum, supported by rapid adoption across healthcare, logistics, and industrial environments.

- North America led globally with over 33.6% share, backed by advanced infrastructure, early technology adoption, and strong enterprise demand.

Adoption Rates by Industry

- Around 30% of hospitals worldwide had adopted RTLS by 2024 to 2025, showing steady penetration in clinical environments.

- RTLS adoption in North American hospitals is expected to reach 50% of facilities by 2028, supported by patient safety and workflow needs.

- About 75% of manufacturers expect RTLS to become standard in complex production plants by 2028.

- More than 50% of North American enterprises across logistics, retail, and manufacturing have already implemented RTLS solutions.

Usage and Implementation Insights

- Asset tracking is the largest use case, accounting for nearly 38% of total RTLS deployments.

- Staff and personnel monitoring is the fastest-growing application, with a projected 27.4% growth rate as worker safety becomes a priority.

- In healthcare, 96% of providers plan to expand RTLS usage to track patients across the full care journey.

- Around 95% of healthcare facilities aim to use RTLS for managing medical equipment and specimens.

- RTLS adoption in healthcare has resulted in a 25% reduction in operational costs and a 30% improvement in patient safety indicators.

- Manufacturing facilities using RTLS have reduced equipment and tool search times by up to 90%, improving productivity and uptime.

U.S. Market Size

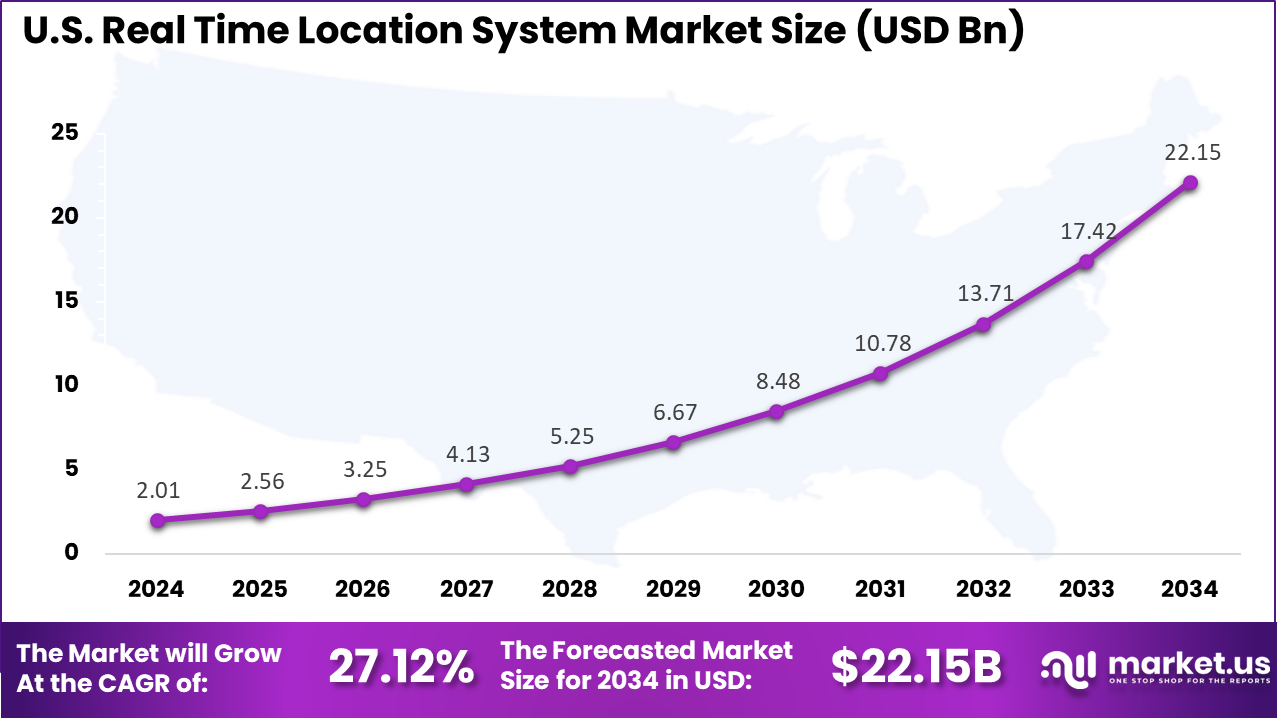

The United States reached USD 2.01 Billion with a CAGR of 27.12%, reflecting rapid market expansion. Growth is driven by increased adoption across healthcare, logistics, and industrial sectors. Demand for real time visibility continues to rise.

For instance, in November 2025, AiRISTA was recognized by The Silicon Review as a Top RTLS Software Platform to Watch in 2025 and secured an Asset Tracking & Management Solutions agreement with Premier, Inc., enabling special pricing for healthcare members. These developments underscore U.S. leadership in scalable RTLS platforms for asset management and workflow optimization.

In 2024, North America held a dominant market position in the Global Real Time Location System Market, capturing more than a 33.6% share, holding USD 2.31 billion in revenue. This dominance is due to the advanced infrastructure in the US and Canada that supports quick RTLS rollouts in hospitals and warehouses.

Healthcare facilities track beds and staff live to handle peak loads smoothly. Logistics hubs cut delays with precise asset views amid rising e-commerce. Strict safety rules and tech investments keep operations tight, drawing steady adoption across key sites.

For instance, in March 2025, CenTrak launched a plug-and-play Bluetooth Low Energy (BLE) platform, expanding its RTLS portfolio for healthcare with unprecedented flexibility and scalability. Demonstrated at HIMSS25, this innovation reinforces North American dominance in interoperable RTLS solutions for patient safety and operational efficiency.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 53.7% share of the Global Real Time Location System Market. These components include tags, sensors, and anchors that capture precise location data in real time. Factories and hospitals depend on them for steady performance in harsh conditions.

Teams value the rugged build that withstands daily wear without frequent fixes. Advances in battery life and compact sizes make hardware a natural fit for expanding setups. This reliability drives its top position across industries. Demand for hardware grows as sites seek seamless integration into workflows. Sensors provide instant updates on asset positions, cutting delays in operations. Warehouses cut losses from misplaced items thanks to these durable tools.

Maintenance stays low, letting staff focus on core tasks. Hardware edges out software in share because it handles the heavy lifting of data collection. Real-world needs for tough, always-on tracking keep this segment ahead.

For Instance, in March 2024, CenTrak, Inc. launched a BLE multi-mode RTLS platform with new hardware badges. These IP67-rated tags offer long battery life and duress buttons for healthcare use. The design fits hardware needs by enabling quick installs and reliable data collection in busy wards. Facilities gain from durable components that cut maintenance time.

Technology Analysis

In 2024, the RFID segment held a dominant market position, capturing a 32.6% share of the Global Real Time Location System Market. It tracks pallets and tools in bulk without line-of-sight needs. Readers pick up signals quickly, suiting high-volume environments like logistics hubs. Sites choose RFID for easy setup with current systems. It delivers consistent results day in and day out. This balance of cost and scale explains its strong hold.

RFID thrives where speed trumps ultra-precision, like inventory checks. It scales well for large areas without breaking budgets. Updates flow fast to central systems, aiding quick decisions. Many operations pair it with other tech for hybrid gains. Low power use extends tag life in busy spots. Practical appeal keeps RFID as a key player in tracking solutions.

For instance, in February 2025, IDENTEC SOLUTIONS AG discussed Chirp technology for RFID-based RTLS in factories. This approach tracks assets zone-by-zone without constant scanning hassles. It suits high-volume sites where RFID signals cover wide areas at low cost. Operations speed up as tags update positions seamlessly through readers.

Application Analysis

In 2024, The Inventory/Asset-Tracking and Management segment held a dominant market position, capturing a 35.3% share of the Global Real Time Location System Market. Facilities monitor equipment and stock to slash search times and errors. Clinics and depots gain from knowing exact locations at a glance. Staff grab needed items fast, boosting daily flow. This cuts excess purchases and idle time. Operational efficiency fuels its dominance.

Real-time visibility transforms how teams manage resources. Busy sites avoid disruptions from lost gear. Data logs help spot patterns in usage for better planning. Integration with software amps up accuracy across shifts. Demand rises as controls tighten on high-value assets. Tracking stays central to smooth runs in dynamic settings.

For Instance, in January 2025, Zebra advanced warehouse visibility with RTLS using RFID and Wi-Fi for asset flows. The tech pinpoints goods and tools, cutting manual checks. Managers spot trends to plan stock better without excess buys.

Vertical Analysis

In 2024, The Healthcare segment held a dominant market position, capturing a 39.2% share of the Global Real Time Location System Market. Hospitals track wheelchairs, carts, and meds for instant access during rushes. Staff stress drops with live location views. Care flows better as critical tools stay ready. Networks expand safely with this oversight. Patient outcomes link directly to such quick responses.

In healthcare, systems cut waste and sharpen coordination. Beds and staff positions update live for peak-hour handling. Safety rises as responses speed up to meet needs. Growing facilities lean on it for scale. Regulations push for precise tracking of valuables. This sector’s unique pressures cement its lead.

For Instance, in July 2024, RF Technologies Inc. enhanced its RTLS safety solutions for hospitals and clinics. The system combines RFID with software for staff and patient protection. It alerts on wander risks and equipment needs in real time. Healthcare sites use it to streamline workflows during high-demand shifts.

Increasing Adoption Technologies

Key technologies supporting market adoption include BLE beacons, ultra wideband for high precision indoor positioning, RFID tags for asset identification, and Wi-Fi based localization for environments with existing network infrastructure. Integration with cloud platforms and edge computing enables scalable data processing and analytics.

Artificial intelligence and machine learning are increasingly used to refine location accuracy, reduce noise, and predict movement patterns. APIs and standards-based integration support interoperability with enterprise systems such as ERP, CMMS (computerised maintenance management systems), and safety platforms. Organisations adopt RTLS to improve asset utilisation, reduce time lost to manual searches, and enhance safety and compliance.

By knowing where assets and personnel are at any moment, companies can streamline workflows, improve scheduling, and reduce downtime. In high value environments such as hospitals or high throughput warehouses, locating critical equipment quickly can translate to measurable gains in productivity and service quality. Real time alerts and automated location logs also reduce manual data entry and errors.

Emerging trends

A significant trend in the real time location system market is the growing integration of advanced wireless technologies such as ultra wideband, Bluetooth low energy, and Wi-Fi into tracking solutions to deliver higher precision and reliability for indoor applications. These technologies help businesses monitor the exact location of assets, personnel, and equipment within facilities where traditional global positioning systems fall short.

This trend reflects the increasing demand for real time spatial data to support operational visibility and workflow optimisation across complex environments such as warehouses, hospitals, and manufacturing floors. Another clear trend is the convergence of RTLS with cloud platforms, Internet of Things frameworks, and data analytics tools to enable scalable, connected tracking ecosystems.

Cloud enabled solutions provide remote access to location insights, support integration with business intelligence applications, and reduce infrastructure burden for organisations adopting these systems. This movement toward hybrid architectures supports seamless data sharing and automation, amplifying the value of real time location intelligence across enterprise functions.

Growth Factors

A core growth factor in this market is the increasing emphasis on operational efficiency and asset visibility across industries managing large, distributed inventories or critical equipment. Real time location systems give organisations continuous awareness of where assets are located and how they are being used, which helps streamline procedures, minimise asset loss, and improve throughput in logistics, healthcare, and industrial environments.

Another important factor supporting market expansion is the heightened focus on safety and personnel monitoring in high-risk work environments. RTLS solutions provide real time location data that helps organisations enforce safety protocols, respond rapidly to emergencies, and ensure compliance with workplace regulations. The ability to protect staff and safeguard operations contributes to wider adoption of these systems.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- RFID

- Wi-Fi

- UWB

- BLE

- Infrared (IR)

- Ultrasound

- GPS

- Others

By Application

- Inventory/Asset-Tracking and Management

- Personnel/Staff-Locating and Monitoring

- Access Control/Security

- Environmental Monitoring

- Yard, Dock, Fleet Warehouse-Management and Monitoring

- Supply Chain Management and Operational Automation/Visibility

- Others

By Vertical

- Healthcare

- Manufacturing and Automotive

- Retail

- Transportation and Logistics

- Government and Defense

- Education

- Oil and Gas, Mining

- Sports and Entertainment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Drivers

Need for Efficiency Gains

Businesses across industries are increasingly adopting RTLS to enhance operational efficiency and reduce waste. In sectors like healthcare and manufacturing, real-time tracking helps organizations locate assets faster, reduce search times, and improve workflow coordination. By linking RTLS data with digital twins or AI-driven systems, companies can identify process bottlenecks early and prevent costly disruptions, keeping operations smooth even under pressure.

Rising labor expenses and supply chain disruptions have reinforced the appeal of RTLS as a cost-effective automation tool. Instead of expanding headcounts, businesses use location intelligence to optimize asset use, improve maintenance schedules, and boost productivity. The technology provides measurable performance gains and quick paybacks, supporting smarter resource management in demanding environments.

Restraint

High Setup Costs

One of the main hurdles for RTLS adoption is the substantial upfront investment required for hardware, software, and infrastructure integration. Deploying sensors, anchors, and tracking systems often means redesigning existing networks, which can be challenging for older facilities. For small and midsized companies, even low-cost or partial installations can stretch budgets, especially when factoring in periodic maintenance and calibration.

Customization needs further increase deployment complexity and cost, particularly when linking RTLS with existing IT systems or enterprise tools. Implementation delays are common as technical and operational teams align specifications or adjust workflows. This financial and structural burden forces many organizations to postpone or scale down projects despite the potential efficiency benefits.

For instance, in March 2025, CenTrak rolled out a scalable BLE RTLS platform at HIMSS25, stressing easy shifts from basic to advanced setups. Hospitals face big initial spends on tags and networks, but this design cuts long-term costs. It uses plug-and-play devices to avoid full rewires. Still, smaller sites hesitate over upfront hardware bills. The focus stays on flexible growth to ease budget strains.

Opportunities

Hybrid Tech Demand

Hybrid RTLS systems are gaining traction as they combine different connectivity options such as Wi-Fi, UWB, and BLE to deliver accuracy, flexibility, and cost control. These multi-technology solutions are well-suited for large or complex spaces, offering reliable coverage where standalone systems fall short. They provide a strong alternative for companies seeking precision without needing to replace older infrastructure completely.

The appeal of hybrid setups lies in their ease of deployment and adaptability across varied environments. They allow seamless operation in mixed indoor layouts like warehouses, hospitals, and factories, improving visibility and continuity. As interoperability and scalability improve, hybrid RTLS is becoming the preferred model for organizations looking for balanced performance and future-proof integration.

For instance, in November 2025, Zebra partnered with Penguin for hybrid BLE RTLS and passive RFID in healthcare asset tracking. The ecosystem delivers room-level precision for high-value items alongside high-volume inventory coverage. The unified platform provides complete visibility from equipment location to audits. It reduces reliance on single-tech limits in large facilities. This combo enhances accuracy and lowers deployment barriers.

Challenges

Design Trade-offs

Developing RTLS solutions requires balancing factors such as tracking range, energy consumption, and location precision. Longer range often comes at the cost of battery life, while high accuracy demands more power-hungry sensors. Finding the right equilibrium for each use case, whether monitoring mobile equipment or tracking staff movement, remains a persistent engineering challenge.

Environmental factors such as signal interference, multipath reflections, or heavy machinery also complicate deployment in real-world conditions. Vendors continue experimenting with optimized chipsets and adaptive algorithms, but users still experience limitations depending on layout and density. Until a universal standard or balance emerges, design trade-offs will shape how RTLS systems are implemented in different industries.

For instance, in January 2025, Siemens pushed SIMATIC RTLS with UWB for factories, tackling battery and range issues in harsh spots. Tags balance accuracy and power for material flow, but crowded areas test limits. Software adds digital twins to manage trade-offs better. No perfect fix yet for all scales. Providers tweak for logistics needs.

Key Players Analysis

Airista Flow, CenTrak, General Electric, IBM, Siemens, and Zebra Technologies lead the real time location system market with platforms that track assets, equipment, and people across healthcare, manufacturing, and logistics environments. Their solutions use RFID, BLE, Wi-Fi, and ultrasound technologies to deliver real time visibility and workflow optimization. These companies focus on accuracy, scalability, and integration with enterprise systems.

IDENTEC Solutions, PINC Solutions, PLUS Location Systems, RF Technologies, Sonitor Technologies, STANLEY, and TeleTracking strengthen the market with RTLS solutions tailored for hospitals, warehouses, and industrial sites. Their systems support asset utilization, staff coordination, and loss prevention. These providers emphasize reliable location accuracy, ease of deployment, and compliance with industry standards.

Radiance and other players expand the market with niche and region focused RTLS offerings. Their solutions address specific use cases such as patient flow, fleet tracking, and high value asset monitoring. These companies focus on customization, cost efficiency, and rapid implementation. Increasing digitalization of physical operations continues to drive steady growth in the real time location system market.

Top Key Players in the Market

- Airista Flow Inc.

- CenTrak, Inc.

- General Electric Company

- IBM corporation

- IDENTEC SOLUTIONS AG

- PINC Solutions

- PLUS Location Systems USA

- Radiance

- RF Technologies Inc

- Siemens AG

- Sonitor Technologies Inc.

- STANLEY corporation

- TeleTracking Technologies Inc

- Zebra Technologies Corporation

- Others

Recent Developments

- In September 2025, RF Technologies rolled out the CareConnect Mobile Web App for its Nurse Call Enterprise Systems, enhancing RTLS functionality so caregivers can track assets and respond faster from any device. It’s a practical upgrade that’s already gaining traction in busy U.S. facilities focused on patient safety.

- In July 2024, Airista Flow acquired Ekahau’s RTLS division, keeping Wi-Fi-based tags and software alive while blending them with its own tech for healthcare and manufacturing. This keeps North American innovation strong by expanding hybrid location solutions without disrupting customers.

Report Scope

Report Features Description Market Value (2024) USD 6.8 Bn Forecast Revenue (2034) USD 94.9 Bn CAGR(2025-2034) 30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Technology (RFID, Wi-Fi, UWB, BLE, Infrared (IR), Ultrasound, GPS, Others), By Application (Inventory/Asset-Tracking and Management, Personnel/Staff-Locating and Monitoring, Access Control/Security, Environmental Monitoring, Yard, Dock, Fleet Warehouse-Management and Monitoring, Supply Chain Management and Operational Automation/Visibility, Others), By Vertical (Healthcare, Manufacturing and Automotive, Retail, Transportation and Logistics, Government and Defense, Education, Oil and Gas, Mining, Sports and Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airista Flow Inc., CenTrak, Inc., General Electric Company, IBM corporation, IDENTEC SOLUTIONS AG, PINC Solutions, PLUS Location Systems USA, Radiance, RF Technologies Inc., Siemens AG, Sonitor Technologies Inc., STANLEY corporation, TeleTracking Technologies Inc., Zebra Technologies Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Real Time Location System MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Real Time Location System MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Airista Flow Inc.

- CenTrak, Inc.

- General Electric Company

- IBM corporation

- IDENTEC SOLUTIONS AG

- PINC Solutions

- PLUS Location Systems USA

- Radiance

- RF Technologies Inc

- Siemens AG

- Sonitor Technologies Inc.

- STANLEY corporation

- TeleTracking Technologies Inc

- Zebra Technologies Corporation

- Others