Global Real Estate Market Size, Share and Industry Analysis Report Based on Property(Residential, Commercial, Industrial, Land, Other Properties), By Property Type(Fully Furnished, Semi Furnished, Unfurnished), Based on Business(Sales, Rental, Lease), Based on Mode(Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 103740

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

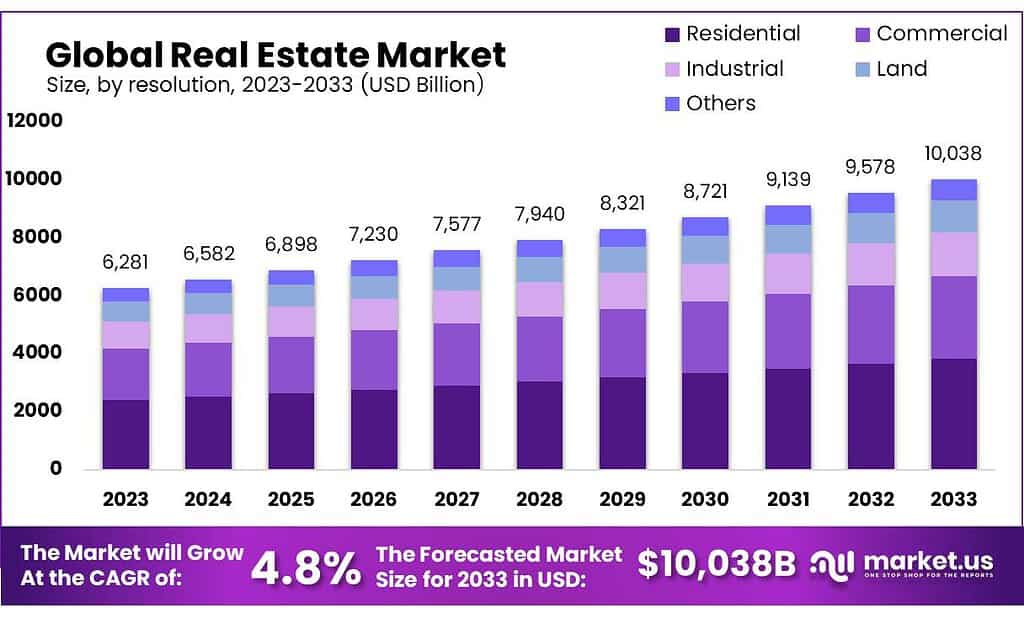

Real Estate Market size is expected to be worth around USD 10038 Billion by 2033, from USD 6281 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

The global real estate industry encompasses a wide range of property types and locations and it is affected by many factors including demographic trends, geopolitical events, technological advancements, and economic conditions.

The global real estate market is divided by various variations in different countries, for example, in some countries like the U.S. dominated by the residential segment while in other countries like China, the commercial segment is more dominant.

Additionally, local market conditions like interest rates, government policies, and supply & demand have a major impact on the performance of the real estate market in a particular region.

Besides the variations in different countries, the real estate market is generally considered a stable and reliable investment option. Investment in real estate is often considered a reliable investment option.

Key Takeaways

- Market Size: Real Estate Market projected to reach USD 10038 billion by 2033, growing at 4.8% CAGR from USD 6281 billion in 2023.

- Segment Dominance: Residential segment captured over 38.3% market share in 2024, indicating strong demand for housing properties.

- Property Preferences: Fully furnished properties held 41.6% market share in 2024, followed by semi-furnished and unfurnished options.

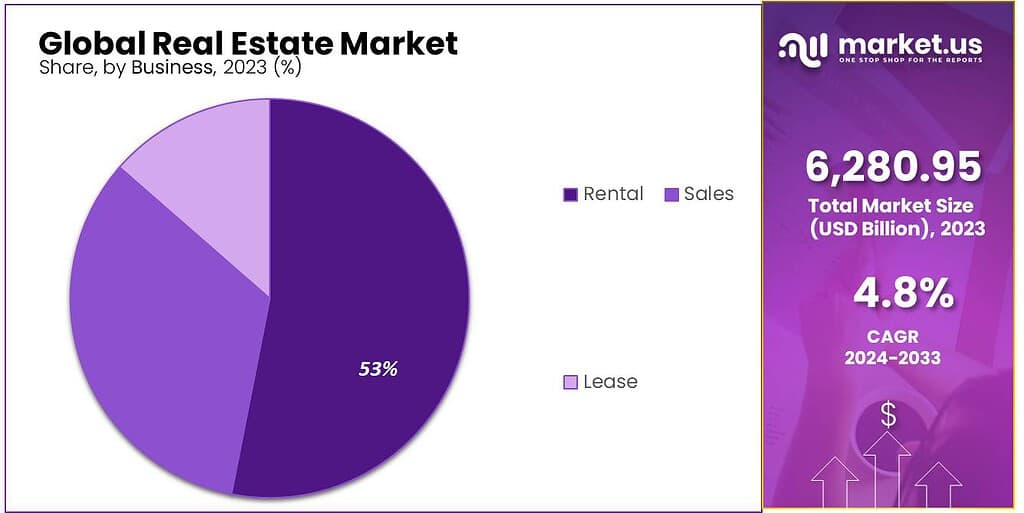

- Business Segment Significance: Rental properties accounted for over 54.5% market share in 2024, reflecting demand for flexible accommodation.

- Mode Analysis: Offline transactions dominated with 76.3% market share in 2024, although online transactions are expected to grow rapidly.

- Latest Trends: Global urbanization and technological integration drive market growth, particularly in the Asia Pacific region, which captured 53% market share in 2024.

- Home prices are expected to rise by around 5.4% in 2023, according to Fannie Mae’s housing forecast.

- The median rent in the United States was $1,717 in February 2023, an increase of 6.7%.

By Property Analysis

The Residential Segment Accounted for the Largest Revenue Share in Real Estate Market in 2024.

In 2024, Residential held a dominant market position, capturing more than a 38.3% share. This segment includes properties such as single-family homes, apartments, and condominiums, catering to individuals and families looking for places to live.

Commercial real estate accounted for a significant share, with its diverse range of properties including office buildings, retail spaces, and hotels. This segment attracts businesses and investors seeking opportunities in commercial activities and rental income.

Industrial properties emerged as a vital segment, comprising warehouses, manufacturing facilities, and distribution centers. The growing demand for logistics and e-commerce drove the demand for industrial real estate, especially in key logistics hubs.

Land properties, including undeveloped land and agricultural land, also held a notable market share. Investors and developers often seek land for development projects, agriculture, or investment purposes, contributing to the market’s diversity.

Other types of real estate encompass a variety of niche properties such as healthcare facilities, educational institutions, and recreational properties. While representing a smaller portion of the market, these properties serve specialized needs and offer unique investment opportunities.

By Property Type

In 2024, Fully Furnished held a dominant market position, capturing more than a 41.6% share. This segment caters to tenants or buyers seeking properties equipped with furniture, appliances, and amenities, offering convenience and immediate occupancy.

Semi-Furnished properties accounted for a significant share, providing a middle ground between fully furnished and unfurnished options. These properties typically include essential fixtures and appliances, allowing tenants to customize their living space to some extent.

Unfurnished properties, although representing a smaller portion of the market, still hold importance. They provide a blank canvas for tenants or buyers to furnish and decorate according to their preferences, offering flexibility and potential cost savings in the long run.

By Business Analysis

The Rental Segment Holds the Significant Share of the Type Segment in the Real Estate Market.

In 2024, Rental held a dominant market position, capturing more than a 54.5% share. This segment involves the temporary use of properties in exchange for periodic payments, catering to individuals and businesses looking for flexibility and short-term accommodation.

Sales of real estate properties accounted for a significant share, representing transactions where ownership of properties is transferred from sellers to buyers. This segment includes residential homes, commercial buildings, and land, among others, and involves one-time transactions with long-term implications.

Lease, or long-term rental, also held importance in the market, offering tenants the opportunity to occupy properties for extended periods under a contractual agreement. This segment is popular among businesses and individuals seeking stability and predictability in their occupancy arrangements.

By Mode Analysis

Offline Holds the Significant Share in Mode Segment of Real Estate Market.

In 2024, Offline held a dominant market position, capturing more than a 76.3% share. This segment includes traditional methods of real estate transactions conducted through physical offices, agents, and property viewings, appealing to individuals preferring face-to-face interactions and personalized assistance.

Online real estate transactions, although representing a smaller portion of the market, are gaining traction. This segment involves the use of digital platforms, websites, and apps to search for properties, communicate with agents, and complete transactions, offering convenience and accessibility to tech-savvy individuals and investors.

The Online is Expected as Fastest Growing Mode Segment in Forecasted Period.

Transportation is projected as the fastest-growing end-user segment with a CAGR of 6.7% in the forecasted period. Owing increased availability & use of technology which made it easy & more convenient for buyers & sellers to connect & transact online.

The COVID-19 pandemic has accelerated the adoption of online real estate tools as people have become more comfortable with conducting business online & trying to avoid in-person interactions.

The online segment offers buyers & sellers more transparency & access to information which allows them to make more informed decisions. Additionally, the online segment of the real estate market is more cost-effective than the traditional offline segment with low fees & commissions charged by brokers & agents.

Key Market Segments

Based on Property

- Residential

- Commercial

- Industrial

- Land

- Other Properties

By Property Type

- Fully Furnished

- Semi Furnished

- Unfurnished

Based on Business

- Sales

- Rental

- Lease

Based on Mode

- Online

- Offline

Driving Factors

Interest Rates, Government Policies, and Technological Advancements Drive the Market Growth

One of the key drivers of the real estate market is interest rates, Interest rates have a significant impact on the cost of borrowing money which can impact the requirements for property purchases & the ability of developers to finance new construction.

Low-interest rates can make it easier for homebuyers for safe financing, which also can drive demand for properties and lead to increasing prices.

Conversely, high-interest rates can minimize the requirement for properties & limit the ability of developers to finance new construction projects. Another major driver of the real estate market is demographic trends.

Changes in household sizes, population growth, and shifts in age demographics can affect the demand for housing. Government policies also play a key role in shaping the real estate market.

Tax incentives for the buyers or investors, and regulations on property management practices can all impact the industry.

Technological advancements are also a driver in the real estate market. The rise in online real virtual property tours & estate platforms has made it easier for buyers & sellers to connect, which increased the effectiveness & transparency of the industry.

Additionally, the use of smart home technology & energy-efficient building practices is shaping the design & construction of new properties, as developers seek to meet the increasing needs of buyers & tenants.

Restraining Factors

Economic Uncertainty and Recession Can Restrain the Real Estate Market Growth

Economic conditions are one of the most significant restraints for the real estate market. Due to uncertainty or recession, people may be less likely to invest in property purchases or development projects, which can lead to a decrease in demand for properties & a slowdown in the industry’s growth.

Government policies can also act as a restraint on the real estate market. Building codes, environmental regulations, and zoning laws can restrict the availability of land & restrict the types of properties that can be developed.

Additionally, tax policies like property taxes or capital gains taxes also can impact the profitability of real estate investments & disclosure investors from entering the market. Regulatory constraints are another restraint on the real estate market.

Social factors can also impact the real estate market. Cultural shifts, social attitudes, and changing demographics can influence the types of properties that are in demand & the design & location of new developments.

Growth Opportunity

Property Investment is One of the Common Opportunities in the Real Estate Market

Real estate presents various opportunities for developers, investors, and other industry participants. Property investment is one of the most common opportunities, where investors purchase properties to generate income through rent or capital appreciation.

Real estate development is another opportunity, where developers create value by constructing new properties or renovating existing ones. Property management is also a key opportunity as maintaining and managing properties is essential for their long-term success.

Real estate financing & lending are other areas where investors can provide capital to real estate projects in exchange for a return on their investment.

Additionally, real estate technology is a growing sector that provides innovative solutions for the industry’s challenges, offering new opportunities for investors & developers alike.

The real estate market’s diverse range of opportunities makes it a compelling industry for anyone looking to invest or build a career in the field.

Latest Trends

Global Urbanization in Real Estate Trending in the Market

Global urbanization is one of the factors which are driving the growth of this market. Real estate is growing because of the increasing population, the need for infrastructure & quality housing, as well as the trend toward nuclear families.

The market is also boosted by the changing consumer preferences towards a safe, secure, and clean environment. Rapid infrastructural developments, which include enhanced connectivity via air, railways, and roads are all contributing to this.

The market is also boosted by technological advances which include the integration of artificial intelligence (AI), the Internet of Things, and other innovations. These technologies provide a central platform for the storage of documents, messages, and emails related to online rent payments.

The market is also positively impacted by the rapid growth of the IT industry. The market is expected to grow because of other factors like government initiatives and consumer spending power which are aimed at developing infrastructure projects.

Regional Analysis

In 2024, the Asia Pacific region emerged as a significant player in the global real estate market, capturing a substantial share of 53%. This growth is primarily driven by the rapid expansion of the real estate sector in the region, fueled by increasing urbanization, population growth, and infrastructure development projects.

Countries like China and India have notably influenced the Asia Pacific market’s dominance in the real estate industry. Their booming economies and large-scale urbanization initiatives have spurred demand for residential, commercial, and industrial properties, driving investment and development activities across the region.

Moreover, the region’s substantial demand for real estate is further amplified by its diverse applications in various sectors, including retail, hospitality, healthcare, and education. With China and India leading the way, the Asia Pacific benefits from robust construction and development capabilities, facilitating the construction of new properties and infrastructure projects to meet growing demand.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The market is characterized by a small number of established players also new entrants. The real estate market is a growing trend that many big players are focusing on and for maintaining their share of the market, players in the market diversify the services they offer.

Market Key Players

- Brookfield Asset Management Inc.

- CBRE Global Investors

- CBRE Group, Inc.

- Colliers International Group Inc.

- Cushman & Wakefield

- Digital Realty Trust, Inc.

- Equity Residential

- Hines

- Host Hotels & Resorts, Inc.

- Jones Lang LaSalle (JLL)

- Knight Frank LLP

- Lendlease Corporation Limited

- Mitsui Fudosan Co., Ltd.

- Newmark Group, Inc.

- Prologis, Inc.

- Savills plc

- Simon Property Group, Inc.

- The Blackstone Group Inc.

- Unibail-Rodamco-Westfield SE

- Vornado Realty Trust

Recent Developments

- 2023 Brookfield Asset Management Inc.: As a major institutional investor, they likely focused on acquiring high-quality assets in sectors poised for growth, such as industrial and logistics.

- 2023 ATC IP LLC (American Tower Corporation): The cell tower business is somewhat insulated from general market fluctuations. They likely continued steady growth driven by increasing demand for mobile data.

- 2023 Prologis Inc.: This industrial real estate giant likely benefitted from the continued strong demand for warehouse space due to e-commerce growth.

Report Scope

Report Features Description Market Value (2023) USD 10038 Bn Forecast Revenue (2033) USD 6281 Bn CAGR (2023-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Property(Residential, Commercial, Industrial, Land, Other Properties), By Property Type(Fully Furnished, Semi Furnished, Unfurnished), Based on Business(Sales, Rental, Lease), Based on Mode(Online, Offline) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Brookfield Asset Management Inc., CBRE Global Investors, CBRE Group, Inc., Colliers International Group Inc., Cushman & Wakefield, Digital Realty Trust, Inc., Equity Residential, Hines, Host Hotels & Resorts, Inc., Jones Lang LaSalle (JLL), Knight Frank LLP, Lendlease Corporation Limited, Mitsui Fudosan Co., Ltd., Newmark Group, Inc., Prologis, Inc., Savills plc, Simon Property Group, Inc., The Blackstone Group Inc., Unibail-Rodamco-Westfield SE, Vornado Realty Trust Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Brookfield Asset Management Inc.

- CBRE Global Investors

- CBRE Group, Inc.

- Colliers International Group Inc.

- Cushman & Wakefield

- Digital Realty Trust, Inc.

- Equity Residential

- Hines

- Host Hotels & Resorts, Inc.

- Jones Lang LaSalle (JLL)

- Knight Frank LLP

- Lendlease Corporation Limited

- Mitsui Fudosan Co., Ltd.

- Newmark Group, Inc.

- Prologis, Inc.

- Savills plc

- Simon Property Group, Inc.

- The Blackstone Group Inc.

- Unibail-Rodamco-Westfield SE

- Vornado Realty Trust