Global Ready Meals Market By Product(Chilled, Frozen, Shelf-stable, Canned), By Meal Type(Vegan, Vegetarian, Non-vegetarian), By Age Group(18-24 Years, 25-34 Years, 35-44 Years, 45-54 Years, Above 55 Years), By End-use(Residential, Food Services), By Distribution Channel(Convenience Stores, Supermarkets & Hypermarkets, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 22864

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

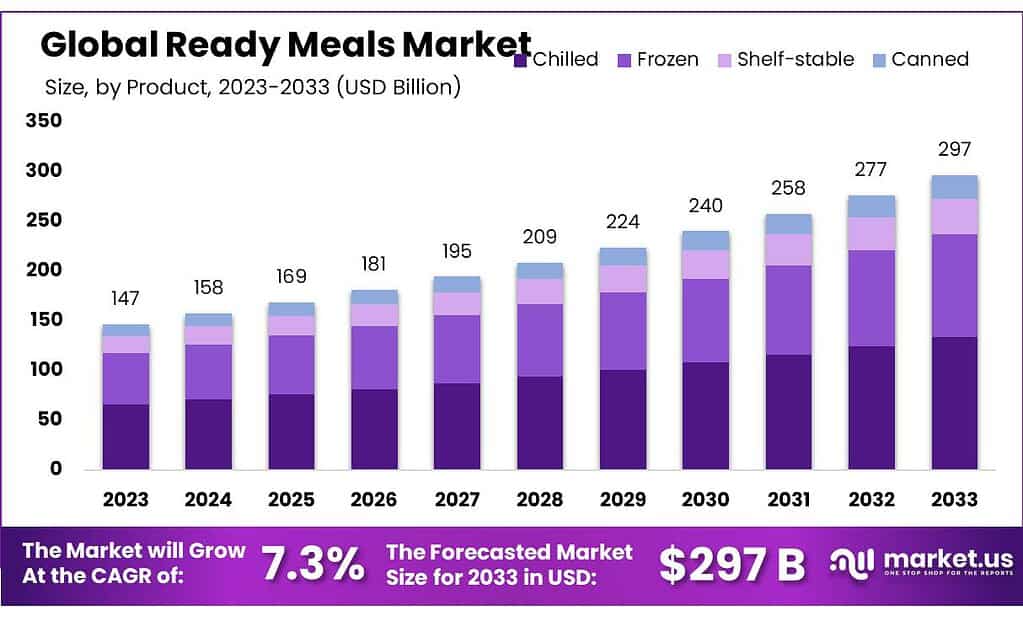

The Global Ready Meals Market size is expected to be worth around USD 297 Billion by 2033 from USD 147 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2023 to 2032.

Instant foods are becoming more popular in advanced countries where ready meals consumption is higher than in developing countries. Increasing numbers of workers in emerging markets such as China and India and the trend towards more extended and different working hours are gradually shifting away from the traditional methods of everyday cooking.

A ready meal is prepackaged and cooked and requires less cooking time at home. Ready meals are economical alternatives that take less time to prepare because they are pre-cooked and available year-round.

The change in consumers’ food preferences for ready-to-eat food products due to the busy lifestyles of workers as well as the busy work schedules of students is likely to spur the growth of the ready meals Market.

Key Takeaways

- Market Growth Projection: The ready meals market is set to reach USD 297 billion by 2033, growing at 7.3% CAGR from 2023.

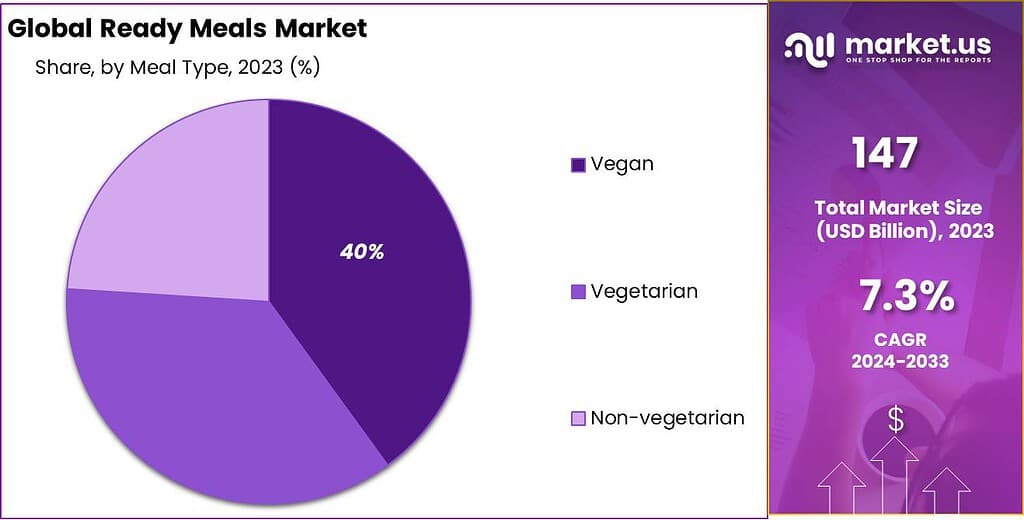

- Consumer Preferences: Increasing interest in plant-based diets drives demand for vegan-ready meals, capturing a 40.3% market share.

- Product Dominance: Chilled ready meals hold over 45.6% market share, favored for freshness and minimal processing.

- Demographic Trends: The 18-24 years age group leads in consumption, accounting for a 45.3% share, driven by convenience.

- Distribution Channels: Supermarkets & Hypermarkets dominate with 46.7% share, followed by Convenience Stores and Online platforms.

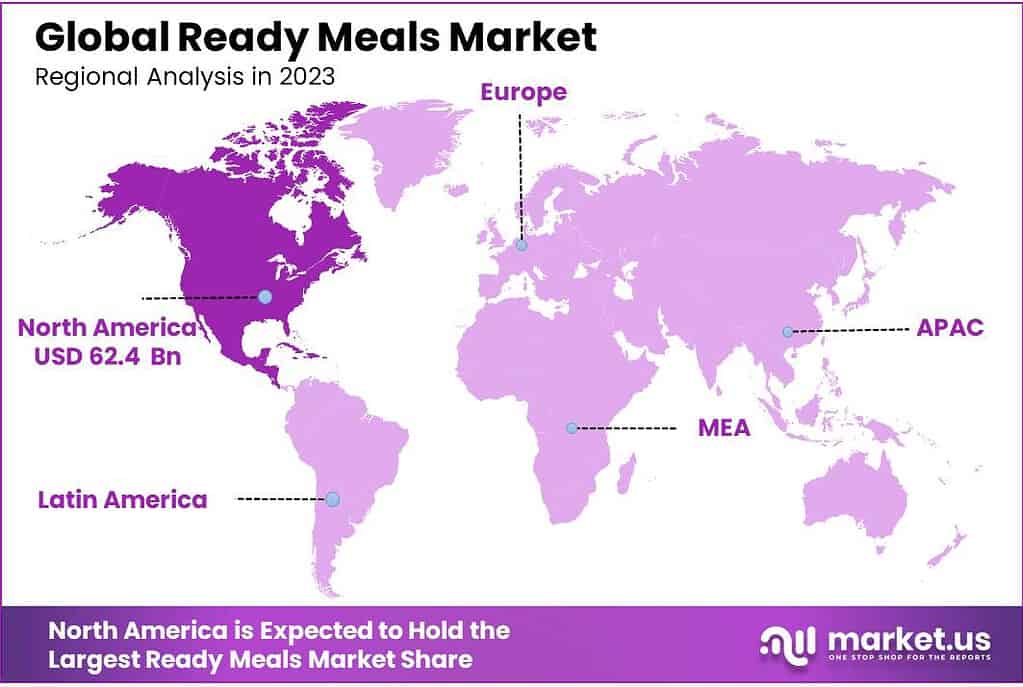

- Regional Market Analysis: North America leads with 42.4% market share; Asia Pacific shows significant growth potential.

- American Frozen Food Institute found that 62% of Americans considered the taste of ready meals to be their primary concern in 2022.

- International Food Information Council found that 28% of Americans felt guilty about consuming ready meals in 2022.

By Product

Chilled Segment Holds Largest Share

In 2023, Chilled ready meals dominated the market, capturing over 45.6% share, driven by their freshness and minimal processing, appealing to consumers seeking convenient yet nutritious options with a shorter shelf life.

Frozen ready meals also held a significant market share, offering longer shelf life and convenient storage, making them popular among consumers looking for extended meal preservation and easy preparation.

Shelf-stable ready meals secured their position in the market, with their extended shelf life and minimal refrigeration requirements, catering to consumers prioritizing convenience and long-term storage capabilities.

Canned ready meals maintained a notable presence, favored for their durability and portability, appealing to consumers seeking non-perishable meal options for on-the-go consumption or emergency preparedness.

Overall, the diverse range of ready-meal products provides consumers with options tailored to their preferences for freshness, convenience, and storage needs, driving the continued growth and evolution of the ready-meals market.

By Meal Type

In 2023, Vegan ready meals dominated the market, holding over 40.3% share. This surge is attributed to increasing consumer interest in plant-based diets for health and environmental reasons. Vegan meals exclude animal products, appealing to individuals seeking cruelty-free and sustainable food options. They offer a variety of plant-based ingredients rich in nutrients, catering to health-conscious consumers.

Following Vegan meals, Vegetarian ready meals also maintained a significant presence in the market. These meals omit meat but may contain dairy and eggs, offering a flexible approach to reducing meat consumption. Vegetarian options appeal to individuals looking to embrace a more plant-focused diet without eliminating animal-derived products.

In contrast, Non-vegetarian ready meals retained their market share, appealing to consumers who prefer meat-based options. These meals include various meat, poultry, and seafood dishes, providing convenience and flavor variety. Non-vegetarian options cater to individuals with diverse dietary preferences and cultural backgrounds, offering quick and satisfying meal solutions.

Each type of ready meal addresses distinct consumer needs and preferences. Vegan and Vegetarian options appeal to those prioritizing plant-based diets for health, environmental, or ethical reasons, while Non-vegetarian meals cater to consumers who enjoy meat-based dishes and seek convenience without compromising on taste.

As consumer awareness of health and sustainability grows, the market for Vegan and Vegetarian ready meals is expected to continue expanding, driven by innovation and increased availability in retail and food service channels.

By Age Group

In 2023, the 18-24 Years age group dominated the ready meals market, securing over 45.3% share. This demographic segment typically comprises young adults and college students who prioritize convenience and quick meal solutions due to busy lifestyles and limited cooking skills. They seek ready meals that are easy to prepare and offer a variety of flavors to suit their taste preferences.

Following closely, the 25-34 Years age group also held a significant market share. These individuals, often young professionals and new parents, value convenience and time-saving options amid hectic schedules. Ready meals cater to their need for quick and hassle-free meal solutions, allowing them to balance work, family, and other commitments without compromising on nutrition or taste.

Additionally, the 35-44 Years age group maintained a notable presence in the market. As busy working professionals and parents, they rely on ready meals to streamline meal preparation and save time in their daily routines. These consumers prioritize nutritious and wholesome options that offer convenience without sacrificing quality, making ready meals a convenient choice for their busy lifestyles.

Similarly, the 45-54 Years age group continued to contribute to the ready meals market. This demographic, consisting of established professionals and empty nesters, appreciates the convenience and versatility of ready meals. They seek options that are flavorful, nutritious, and tailored to their dietary preferences, providing them with convenient meal solutions without the need for extensive cooking or meal planning.

Lastly, the Above 55 Years age group also played a significant role in the market. These consumers, often retirees or seniors, value convenience and ease of preparation when it comes to meal options. Ready meals offer them flexibility and convenience, allowing them to enjoy nutritious and flavorful meals without the hassle of cooking from scratch, making them an attractive choice for this demographic segment.

By End-use

In 2023, Food Services emerged as the dominant segment in the ready meals market, capturing over 65.4% share. This segment includes various establishments such as restaurants, cafeterias, catering services, and other food service providers. Food services cater to a wide range of consumers, including individuals dining out, corporate clients, and event organizers.

The popularity of food services in the ready meals market is driven by factors such as busy lifestyles, increased dining-out culture, and the growing demand for convenient meal options. Consumers opt for food services for their convenience, variety of menu offerings, and the ability to enjoy freshly prepared meals without the need for cooking or meal preparation at home.

On the other hand, Residential accounts for the remaining market share in the ready meals segment. This segment encompasses households and individuals who purchase ready meals for consumption at home. Residential consumers seek ready meals for various reasons, including convenience, time-saving benefits, and the desire for quick and easy meal solutions.

Ready meals offer residential consumers the flexibility to enjoy restaurant-quality meals in the comfort of their own homes, without the need for extensive cooking or meal planning. The residential segment caters to individuals and families with diverse dietary preferences and taste preferences, providing a range of options from traditional comfort foods to gourmet cuisine. Despite the dominance of food services, the residential segment continues to hold significance in the ready meals market, serving as a convenient and accessible option for consumers seeking quick and hassle-free meal solutions at home.

By Distribution Channel

In 2023, Supermarkets & Hypermarkets dominated the ready meals market, capturing over 46.7% share. These retail outlets offer a wide variety of ready meals, catering to the diverse preferences of consumers. Supermarkets & Hypermarkets are preferred by shoppers due to their convenient locations, extensive product range, and one-stop shopping experience.

Customers appreciate the ability to browse through aisles and select from a plethora of ready meal options, ranging from frozen dinners to freshly prepared deli items. The expansive shelf space and promotional activities within Supermarkets & Hypermarkets further contribute to their dominance in the market.

Convenience Stores held a significant share in the ready meals market, providing consumers with quick and convenient meal options. These stores are favored for their accessibility and extended operating hours, allowing customers to purchase ready meals on the go.

Convenience Stores typically stock a selection of grab-and-go meals, including sandwiches, salads, microwavable entrees, and snacks. The strategic placement of convenience stores in high-traffic areas such as gas stations, transit hubs, and urban centers makes them an attractive option for consumers seeking fast and easy meal solutions.

Online platforms emerged as a growing distribution channel for ready meals, leveraging the convenience of e-commerce to reach a broader customer base. Online retailers offer a wide assortment of ready meals, ranging from freshly prepared gourmet dishes to pantry-stable options.

The convenience of online ordering, doorstep delivery, and subscription services appeal to busy consumers seeking hassle-free meal solutions. Online platforms also provide a platform for specialty and niche ready-meal brands to reach customers directly, catering to specific dietary preferences and taste profiles.

Other distribution channels, such as specialty stores, vending machines, and meal kit services, contribute to the ready meals market by offering unique and targeted meal solutions. Specialty stores focus on niche markets and artisanal products, appealing to discerning consumers seeking premium ready-meal options.

Vending machines provide convenient access to ready meals in high-traffic locations such as airports, office buildings, and schools. Meal kit services offer subscription-based meal solutions, providing customers with pre-portioned ingredients and recipes to prepare meals at home. These diverse distribution channels cater to the evolving needs and preferences of consumers, driving innovation and competition in the ready meals market.

Key Market Segments

By Product

- Chilled

- Frozen

- Shelf-stable

- Canned

By Meal Type

- Vegan

- Vegetarian

- Non-vegetarian

By Age Group

- 18-24 Years

- 25-34 Years

- 35-44 Years

- 45-54 Years

- Above 55 Years

By End-use

- Residential

- Food Services

By Distribution Channel

- Convenience Stores

- Supermarkets & Hypermarkets

- Online

- Others

Driving Factors

Increased Demand for Convenience Food and Penetration of Several Food Manufacturers Driving the Market Growth

Ready meals have proven a good alternative for foods that require more time to cook and have small durability. Changes in people’s hectic lifestyles have increased the need for packaged, ready meals products.

Population growth and the cost-effectiveness of these meals are other factors driving the market’s growth. According to the National Institutes of Health (NIH), more than 90% of the US population consumes convenience foods daily, further fueling the market growth.

Manufacturers now place more emphasis on packaging, which plays a vital role in preserving product texture, quality, food color, shelf life, and flavors. Manufacturers work with packaging companies to manufacture innovative and advanced packaging, such as biodegradable barrier trays, which are expected to drive demand in the ready-to-eat food market shortly.

Restraining Factors

Increasing Popularity Among Fresh Food

Fresh foods are the most superior alternatives for ready meals. Recent developments in fresh foods due to COVID-19 indicate rising popularity for fresh foods other than ready meals. Growing consciousness regarding health and lifestyle disorders is the primary factor behind the increasing popularity of fresh food.

The nutritional value of ready meals is comparatively less than fresh foods; this negatively impacts prepared meals. However, health concerns and negative customer perceptions about the health effects of prepared foods hinder the ready meals market growth.

Growth Opportunities

Growing Population and Increasing Eating Habits

Globally, the demand for ready-to-eat foods, especially instant noodles, rice, snack foods, and meat products, is growing due to changing social and economic patterns, increased spending on food & beverages, and health awareness of healthy foods.

The ready meals market is growing due to changing existing food habits, the growing population of foreign settlements around the world, alternatives to junk food, and the desire to try new products. Easy-to-prepare snacks and convenience foods are trendy, especially among working-class people, teens, dorm residents, and singles.

Furthermore, the important concept is closely related to the ease of consumption and handling of products that ready meals can provide. The demand for ready food is increasing due to the associated consumption convenience and, at the same time, being supported by single-use packaging.

Trending Factors

Increase in the Popularity of Prepared Food due to its Nutritional Values

Rising disposable incomes of many consumers across the globe, coupled with an increase in the popularity of ready meals, are expected to offer lucrative growth opportunities over the forecast period.

Additionally, the growing popularity of prepared foods with nutritional benefits will increase growth opportunities. All these aspects will bring significant growth to the ready meals market.

Millennials and younger generations are the easiest targets for convenience food, as they spend most of their income on such foods. Therefore, the convenience level of such products increases the overall demand in the global ready meals market.

Regional Analysis

North America Holds Largest Market Share

North America is estimated to be the most lucrative market in the global ready meals market, with the largest market share of 42.4%, during the forecast period. In North America, the advancements in lifestyle As such, the need for ready meals is anticipated to grow.

Furthermore, introducing more exotic products and pushing towards an easy lifestyle is estimated to increase in Europe.

Asia Pacific region is likely to witness significant growth in the forecast period. Developing countries like India, Singapore, the Philippines, and Australia exhibit strong growth and less saturation. Increasing awareness regarding ready meals and increasing research and development facilities ready meals market is expected to grow in the Middle East and Africa region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on various strategic policies to develop their respective businesses in foreign markets. Key market players are undergoing product innovation, new product launches, mergers and acquisitions, geographic expansions, etc., as part of critical strategies to remain competitive in the market.

Several ready meals market companies are concentrating on improving their product quality and nutritional values. Furthermore, the prepared meals market firms are developing new products and portfolio expansion strategies through investments, mergers, and acquisitions.

In addition, several key players are now focusing on different marketing strategies, such as spreading awareness about their products’ nutritional values and boosting the target products’ growth.

Due to the high profitability of the industry, manufacturers are formulating robust competitive strategies and intensifying competition among existing market players. Companies also position their products based on various marketing efforts to gain a competitive advantage in the market.

Market Key Players

- Nestlé

- General Mills, Inc.

- Kellogg Company

- 2 Sisters Food Group

- Conagra Brands Inc.

- Dr. Oetker

- Green Mill Foods

- Hormel Foods Corporation

- Iceland Foods Ltd

- McCain Foods Limited

- Nomad Foods

- The Campbell Soup

- The JM Smucker Co.

- The Kraft Heinz

- Tyson Foods Inc

- Tyson Foods, Inc.

- Unilever

Recent Developments

- 2024 General Mills, Inc.: Acquired a leading ready meals company to diversify its product portfolio and strengthen its presence in the market.

- 2024 Kellogg Company: Introduced a range of breakfast-ready meals targeting busy consumers, offering convenient and nutritious options.

- 2023 Nestlé SA: Launched a new line of plant-based ready meals to cater to the growing demand for vegan options.

- 2023 Conagra Brands, Inc.: Introduced innovative packaging solutions for ready meals, enhancing convenience and freshness.

Report Scope

Report Features Description Market Value (2023) USD 147 Bn Forecast Revenue (2033) USD 297 Bn CAGR (2023-2033) 7.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Chilled, Frozen, Shelf-stable, Canned), By Meal Type(Vegan, Vegetarian, Non-vegetarian), By Age Group(18-24 Years, 25-34 Years, 35-44 Years, 45-54 Years, Above 55 Years), By End-use(Residential, Food Services), By Distribution Channel(Convenience Stores, Supermarkets & Hypermarkets, Online, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nestlé, General Mills, Inc., Kellogg Company, 2 Sisters Food Group, Conagra Brands Inc., Dr. Oetker, Green Mill Foods, Hormel Foods Corporation, Iceland Foods Ltd, McCain Foods Limited, Nomad Foods, The Campbell Soup, The JM Smucker Co., The Kraft Heinz, Tyson Foods Inc, Tyson Foods, Inc., Unilever Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Frequently Asked Questions (FAQ)

Which region will lead the Global Ready Meals Market?North America generated the most revenue in the Ready Meals Market in 2022. It covers over 41.0% of the total market share.

Who are the prominent key players in the Ready Meals Market?The major players in the Ready Meals Market are Nestlé SA, General Mills, Inc., Kellogg Company, Conagra Brands, Inc., Tyson Foods, Inc., Dr. Oetker, Nomad Foods, Green Mill Foods, and several others.

Which segment was the most prominent in the Ready Meals Market?By Type Analysis, The non-vegetarian segment will hold a dominant share of the prepared food market in 2022. On basis Product Analysis, the canned ready meals was the most purchased among consumers, thanks to their long-lasting nature.

List the segments encompassed in this report on the Ready Meals Market.The Global Ready Meals Market is segmented By Type (Vegetarian, Non-Vegetarian, and Vegan), By Product (Canned, Chilled, Frozen, and Dried), By Distribution Channels (Supermarkets, Hypermarkets, Online Retailers, and Others), By Region (North America, Latin America, Europe, Asia-Pacific, the Middle East & Africa)

-

-

- Nestlé

- General Mills, Inc.

- Kellogg Company

- 2 Sisters Food Group

- Conagra Brands Inc.

- Dr. Oetker

- Green Mill Foods

- Hormel Foods Corporation

- Iceland Foods Ltd

- McCain Foods Limited

- Nomad Foods

- The Campbell Soup

- The JM Smucker Co.

- The Kraft Heinz

- Tyson Foods Inc

- Tyson Foods, Inc.

- Unilever