Global Raw, Fresh, and Frozen Dog Food Market By Food Type (Raw Food, Fresh Food, Frozen Food), By Breed Size (Small Breeds, Medium Breeds, Large Breeds), By Application (Dental Care, Digestive Care, Bone and Joint Health, Weight Management, Immune Support, Energy and Muscle Support, Other Applications), By Flavor Type, By Sales Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132448

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

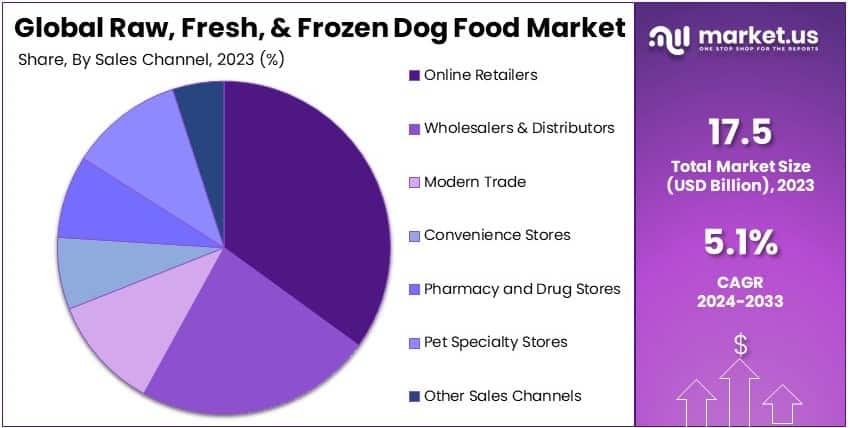

The Global Raw, Fresh, & Frozen Dog Food Market size is expected to be worth around USD 28.8 Billion by 2033, from USD 17.5 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Raw, fresh, and frozen dog food refers to minimally processed meals designed to preserve natural nutrients. These products include raw meats, vegetables, and grains, often stored in refrigerated or frozen conditions. They aim to provide a balanced diet, improving digestion and overall health for dogs.

The raw, fresh, and frozen dog food market covers the production and distribution of premium pet food. It targets health-conscious pet owners seeking high-quality, natural meals. The market includes specialized brands offering tailored nutrition for dogs. Demand is driven by the growing trend of pet humanization.

Raw and fresh dog food is seen as a premium option in pet nutrition. Its popularity stems from perceived health benefits, such as better digestion and shinier coats. According to Report, 71% of pet owners treat their pets as family, boosting demand for higher-quality, human-grade products.

The market is expanding as pet owners prioritize health and wellness. The U.S. pet industry alone spent US$ 64.4 billion on pet food and treats, as per APPA. With an estimated 900 million dogs worldwide, the market offers significant growth opportunities, especially in emerging economies.

Growing awareness about pet health drives demand for premium dog food. Pet humanization trends are fueling this growth. Consumers prefer natural and minimally processed options. Additionally, the rising dog population contributes to the increasing demand for raw, fresh, and frozen products.

Opportunities exist in emerging markets where premium pet food is gaining traction. However, in developed regions, market saturation is a challenge. Competition is fierce, with brands introducing innovative products to capture market share. Price sensitivity also plays a critical role.

Globally, the trend toward healthier pet diets is shaping the market. Locally, urban areas see higher adoption rates due to greater access and awareness. The shift towards premium products is more pronounced in developed regions, reflecting broader economic and lifestyle changes.

Governments are increasingly regulating pet food quality to ensure safety. These regulations support market growth by fostering consumer trust. In developed countries, subsidies and incentives for premium pet food manufacturers encourage innovation. Such policies align with the broader trend of enhancing pet care standards.

Key Takeaways

- The Raw, Fresh, & Frozen Dog Food Market was valued at USD 17.5 billion in 2023 and is expected to reach USD 28.8 billion by 2033, with a CAGR of 5.1%.

- In 2023, Fresh Food dominates the food type segment, driven by consumer preference for quality ingredients.

- In 2023, Medium Breeds are the leading breed size, reflecting demand across a wide range of dog owners.

- In 2023, Digestive Care is the primary application, highlighting the focus on pet health.

- In 2023, Chicken is the top flavor type, preferred for its palatability.

- In 2023, Online Retailers lead the sales channel, benefiting from convenience and variety.

Food Type Analysis

Fresh Food Dominates Due to Health Benefits and Consumer Demand for Quality

In the Raw, Fresh, & Frozen Dog Food Market, Fresh Food leads the “Food Type” segment. This dominance is driven by the rising awareness of the health benefits associated with fresh food diets for dogs. Pet owners are increasingly choosing fresh dog food because it is minimally processed, retaining more nutrients than traditional kibble or canned options.

Fresh dog food is also seen as closer to a natural diet, which many pet owners believe improves coat quality, digestion, and overall health. Consequently, this growing demand for nutrient-rich, preservative-free food has made fresh dog food the top choice in this segment.

Raw food, while popular among certain groups, occupies a smaller market share due to concerns over safety and storage. Raw diets are often favored by pet owners seeking to mimic ancestral diets, and they are especially popular for dogs with specific dietary needs.

Frozen food, on the other hand, offers a longer shelf life than fresh food and is convenient for owners who want to provide high-quality meals but need flexibility in storage. These three types together highlight the diversity in pet food preferences, addressing various dietary goals and practical needs in the market.

Breed Size Analysis

Medium Breeds Lead Due to High Population and Balanced Dietary Needs

In the “Breed Size” segment, Medium Breeds dominate the market due to their large population and balanced nutritional requirements. Medium breeds, which include popular family pets, have dietary needs that are easier to meet with standard portions of fresh and raw food options.

Additionally, owners of medium-sized dogs are often more willing to invest in high-quality food that supports their pet’s health without the substantial expense seen with large breeds. Consequently, this segment has emerged as a key driver in the market, as medium breeds make up a substantial portion of the pet population globally.

Small Breeds, while smaller in market share, have unique nutritional needs that require concentrated nutrients in smaller servings, often making premium food options appealing to their owners.

Large Breeds consume higher volumes of food, which drives demand for affordable and bulk-buy options. Thus, each breed size impacts the market differently, contributing to a variety of product offerings to suit size-specific dietary requirements.

Application Analysis

Digestive Care Dominates Due to Increased Awareness of Gut Health

The “Application” segment is led by Digestive Care, reflecting a rising focus on gut health as a foundation for overall well-being in dogs. Many fresh and raw dog food brands now prioritize digestive health by including pet food ingredients that support gut function, such as probiotics, fiber, and natural enzymes.

This focus on digestion aligns with growing awareness among pet owners that a healthy digestive system can prevent common issues like bloating, constipation, and diarrhea, which are prevalent in many dog breeds.

Other key applications include Bone and Joint Health, which is particularly popular among owners of large and aging breeds that are prone to joint issues. Weight Management has also seen growth as pet obesity rates rise, with many owners seeking food options that are high in protein and low in fillers. Immune

Support and Energy & Muscle Support contribute to market growth by addressing specific health needs, providing tailored solutions that are appealing to pet owners who want the best for their pets’ overall health.

Flavor Type Analysis

Chicken Dominates Due to Its Availability and High Acceptance by Dogs

In the “Flavor Type” segment, Chicken leads the market due to its widespread availability, affordability, and high palatability among dogs. Chicken-based dog food is typically well-received by most dogs, making it a go-to option for both manufacturers and pet owners.

Additionally, chicken offers a high-protein, low-fat profile that aligns well with the nutritional goals of fresh and raw dog food diets, meeting the dietary needs of dogs without causing digestive issues.

Beef, another popular flavor, is valued for its rich protein content and robust taste, though it can be more expensive and less digestible for some dogs.

Lamb, Turkey, and Fish flavors provide alternative protein sources for dogs with allergies or sensitivities to common proteins, thus supporting market growth by catering to a wide range of dietary needs. Other flavors include unique or exotic options, adding diversity to the market and appealing to pet owners who want to offer variety in their dog’s diet.

Sales Channel Analysis

Online Retailers Lead Due to Convenience and Variety of Choices

In the “Sales Channel” segment, Online Retailers dominate due to the convenience they offer and the wide variety of products available. Online platforms provide pet owners with access to a broader range of brands and specialized food options, allowing them to compare and select products that meet their dog’s specific dietary needs.

Additionally, online retailers offer home delivery, making it easier for pet owners to maintain a regular supply of fresh or frozen dog food, which is especially beneficial for time-sensitive products.

Wholesalers and Distributors are crucial in ensuring a steady supply of dog food to pet specialty stores and larger retail channels, supporting widespread access. Pet Specialty Stores remain important, offering curated selections and professional advice that can guide pet owners in choosing the right diet for their dog.

Modern Trade and Convenience Stores also contribute by offering accessible options for fresh and frozen dog food, catering to customers who prefer in-store shopping. Each channel plays a role in market distribution, meeting the varied shopping preferences of dog owners and enhancing the reach of fresh, raw, and frozen dog food products.

Key Market Segments

By Food Type

- Raw Food

- Fresh Food

- Frozen Food

By Breed Size

- Small Breeds

- Medium Breeds

- Large Breeds

By Application

- Dental Care

- Digestive Care

- Bone and Joint Health

- Weight Management

- Immune Support

- Energy and Muscle Support

- Other Applications

By Flavor Type

- Chicken

- Beef

- Lamb

- Turkey

- Fish

- Other Flavors

By Sales Channel

- Wholesalers and Distributors

- Modern Trade

- Convenience Stores

- Pharmacy and Drug Stores

- Online Retailers

- Pet Specialty Stores

- Other Sales Channels

Drivers

Increasing Pet Ownership Drives Market Growth

The growth in pet ownership drives significant demand in the raw, fresh, and frozen dog food market. As more households adopt pets, there is a corresponding increase in the need for diverse and high-quality pet food products. This trend is especially prominent in urban areas, where pets are often viewed as family members.

Rising awareness of animal health is another critical driver. Pet owners today are more conscious of the importance of nutrition in maintaining their pets’ overall well-being. This awareness leads them to seek out food that is high in natural ingredients and devoid of fillers and preservatives. Raw, fresh, and frozen dog food products, often marketed as healthier alternatives to traditional dry kibble, cater to this demand.

The demand for premium pet food also supports market growth. Owners, particularly in affluent markets, view their pets’ nutrition as an investment in health. Premium brands, which emphasize fresh, high-quality ingredients, attract these consumers.

Additionally, a preference for natural and organic ingredients further fuels growth. Modern consumers, including pet owners, are shifting towards organic and minimally processed food, reflecting health and sustainability concerns. This trend extends to pet care, where there is growing preference for foods that mirror human-grade standards.

Restraints

High Product Costs Restraint Market Growth

The high cost of raw, fresh, and frozen dog food products acts as a significant restraint in the market. Premium ingredients, specialized storage requirements, and strict production standards contribute to higher prices. These costs make raw and fresh dog food less accessible to budget-conscious pet owners, reducing the potential customer base.

Short shelf life and storage challenges further restrict market expansion. Raw and fresh dog food requires refrigeration or freezing to maintain its quality. This need for temperature control throughout the supply chain increases logistics costs and limits product availability.

Limited availability in emerging markets presents another restraint. While raw, fresh, and frozen dog food options are popular in developed economies, they are less accessible in regions with limited infrastructure for cold chain logistics.

Lack of awareness and education among pet owners also hinders market growth. Many consumers are unfamiliar with the benefits of raw and fresh diets for dogs, making them hesitant to switch from traditional pet food. Without sufficient information, pet owners may view raw and fresh options as unnecessary or complicated, impacting the market’s ability to attract a wider audience.

Opportunity

Expansion in Online Sales Channels Provides Opportunities

The rise of online sales channels offers substantial growth opportunities for the raw, fresh, and frozen dog food market. E-commerce platforms allow brands to reach a wider audience, transcending geographical limitations. Online channels also offer subscription models, which are increasingly popular among pet owners for the convenience of regular delivery.

Innovation in preservation techniques presents another opportunity. Companies are exploring advanced methods to extend the shelf life of raw and fresh dog food without compromising quality. Technologies like freeze-drying and vacuum sealing enable manufacturers to create products that require less stringent storage conditions.

Increased partnerships with veterinary clinics also contribute to market opportunities. Veterinarians play a crucial role in educating pet owners about nutrition, and endorsements from professionals can boost consumer trust. Collaborating with veterinary practices allows brands to reach pet owners through trusted channels, encouraging them to consider premium raw and fresh options.

The trend of pet humanization supports growth opportunities as well. Pet owners increasingly treat pets as family members, making food quality a priority. This mindset drives interest in health-focused pet foods, including raw, fresh, and frozen options.

Challenges

Competition from Conventional Pet Food Brands Challenges Market Growth

Competition from conventional pet food brands poses a significant challenge to the raw, fresh, and frozen dog food market. Established brands with broad distribution networks and brand loyalty dominate the pet food industry, making it difficult for raw and fresh food brands to gain market share.

Regulatory and safety compliance issues further challenge the market. Raw and fresh dog food requires strict handling and processing to ensure safety, given its perishable nature. Compliance with these regulations can be costly and time-consuming, adding to production costs.

Dependence on cold chain logistics also presents a challenge. The need for refrigerated transport and storage facilities increases logistical complexity and cost. Any disruptions in the cold chain can lead to spoilage, impacting product availability and brand reputation.

High production costs further complicate growth. The use of premium, organic ingredients and specialized processing methods raises production expenses, which are often passed on to consumers. As a result, raw, fresh, and frozen dog food products are priced higher than conventional options, limiting their appeal to a niche audience.

Growth Factors

Increase in Single-Pet Households Is a Growth Factor

The rise in single-pet households positively impacts the raw, fresh, and frozen dog food market. Single-pet owners often focus more on the quality of care, including food, for their pets. This focus supports demand for premium, health-focused pet food options.

The increase in pet healthcare spending is another growth factor. Pet owners are willing to invest more in preventive care, including high-quality food that supports overall health. With rising awareness of diet’s impact on pet health, consumers allocate larger portions of their budgets to nutrition, driving demand for premium food products.

Urbanization and higher disposable incomes further drive this market. Urban residents with higher incomes are more likely to spend on premium pet products. As more people move to urban centers, they are adopting pets and investing in their wellbeing.

Government initiatives promoting pet health awareness add to market growth. Some regions are implementing programs to educate pet owners about nutrition. These initiatives raise awareness of premium pet food benefits, encouraging consumers to consider raw, fresh, and frozen diets.

Emerging Trends

Demand for Customized Nutrition Is Latest Trending Factor

The demand for customized nutrition represents a key trend in the raw, fresh, and frozen dog food market. Pet owners increasingly seek diets tailored to their dogs’ unique health needs, from weight management to allergy-friendly options.

Subscription-based services are also trending in this market. These services offer pet owners convenience through regular deliveries and personalized meal plans. Subscription models encourage customer loyalty and provide a steady revenue stream for companies.

The growth in freeze-dried options is another prominent trend. Freeze-drying preserves the nutritional value of raw ingredients while offering a longer shelf life. This process makes raw diets more accessible to consumers who may lack the resources for refrigerated storage.

Finally, sustainable packaging solutions are increasingly valued in the pet food market. Eco-conscious consumers prefer brands that use recyclable or biodegradable materials. Companies that adopt sustainable packaging appeal to these environmentally aware pet owners.

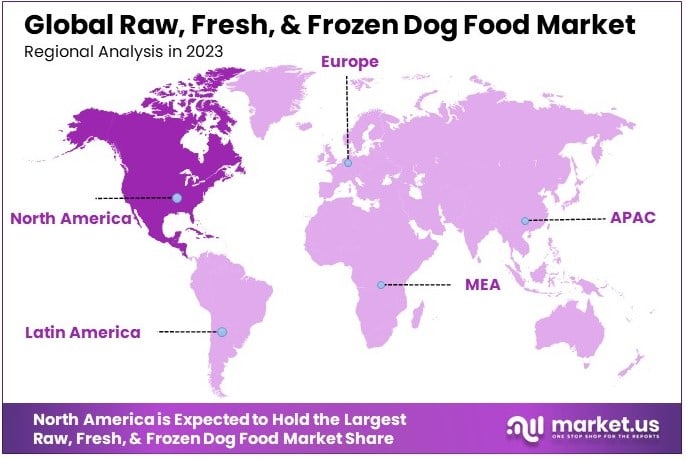

Regional Analysis

North America Dominates with a Significant Market Share

North America currently dominates in the Raw, Fresh, & Frozen Dog Food Market. The region is a significant player due to high pet ownership rates and a strong demand for premium, health-focused pet food options. Consumers increasingly seek nutritious, minimally processed food for their pets.

Key factors contributing to North America’s market potential include a growing trend toward pet humanization and a high willingness to spend on premium pet food. Pet owners prioritize quality and health benefits, favoring raw, fresh, and frozen options that promote wellness and align with holistic pet care practices.

Regional market dynamics are shaped by the availability of a wide variety of premium pet foods and a strong network of pet specialty stores. Additionally, the popularity of raw and fresh food diets for pets is supported by veterinarians and pet wellness influencers, further driving consumer interest in these products across the region.

Regional Mentions:

- Europe: Europe shows strong growth in the raw, fresh, and frozen dog food market, driven by high pet health awareness. The demand for natural and minimally processed pet food is particularly high in countries like Germany and the UK, supporting market expansion.

- Asia-Pacific: Asia-Pacific is an emerging market, with rising pet ownership and disposable incomes fueling demand for premium pet foods. Countries like Japan and Australia lead in adopting raw and fresh pet diets as pet care trends grow.

- Middle East & Africa: The Middle East and Africa show gradual adoption, with urban areas driving demand for premium pet products. Although niche, the interest in raw and fresh dog food is rising among affluent pet owners.

- Latin America: Latin America sees increasing interest in raw and fresh pet food, especially in Brazil and Argentina. Growing awareness of pet health and a rising middle class support demand for high-quality pet nutrition solutions in the region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Raw, Fresh, & Frozen Dog Food Market is shaped by companies committed to natural, high-quality ingredients and health-focused pet diets. Key players—The Farmers Dog, Primal Pet Foods, Nature’s Variety Instinct, and Steve’s Real Food—stand out by offering premium, minimally processed pet food designed to support canine wellness.

The Farmers Dog leads the market with a direct-to-consumer model, delivering fresh, customized dog food tailored to individual pets’ needs. Known for its use of human-grade ingredients and nutritional balance, The Farmers Dog appeals to pet owners looking for quality and convenience. Its focus on transparency and customization has earned it a loyal consumer base.

Primal Pet Foods emphasizes raw, organic ingredients in its dog food, catering to health-conscious pet owners. With a commitment to holistic pet nutrition, Primal offers raw and freeze-dried options that maintain the nutritional value of the ingredients. The company’s reputation for quality and sustainable sourcing positions it as a trusted name among pet wellness advocates.

Nature’s Variety Instinct is renowned for its diverse product line, offering both raw and frozen options to meet various dietary needs. Instinct’s focus on innovation and nutritional science ensures its products provide balanced meals that promote pet health. Its dedication to using natural ingredients appeals to pet owners seeking premium, raw food options.

These leading companies drive the Raw, Fresh, & Frozen Dog Food Market by focusing on quality, nutrition, and pet health. Their commitment to natural ingredients and transparency resonates with consumers, setting high standards in this fast-growing segment focused on premium pet nutrition.

Top Key Players in the Market

- The Farmers Dog

- Primal Pet Foods

- Nature’s Variety Instinct

- Steve’s Real Food

- Open Farm

- Stella & Chewy’s

- Darwin’s Natural Pet Products

- Vital Essentials

- Ollie Pets

- Raw Paws Pet Food

- Northwest Naturals

- BARF World

- Smallbatch Pets

- Answers Pet Food

- K9 Natural

Recent Developments

- Pet Valu: In May 2024, Pet Valu introduced Performatrin Culinary, a line of minimally processed and frozen dog foods and snacks. This line includes eight raw and seven gently cooked meals, featuring flavors such as Beef Risotto and Pork Feast, aiming to provide high-quality, convenient nutrition for dogs. The products are free from gluten, wheat, corn, soy, and artificial additives, aligning with the growing consumer demand for less processed pet foods.

- Dog Standards: In October 2024, Dog Standards launched a Topper program to address the rising issue of pet obesity, with 59% of dogs classified as overweight or obese. The program allows pet owners to add human-grade, gently cooked nutrition to their dogs’ existing diets, aiming to improve health outcomes.

- Stella & Chewy’s: In October 2024, Stella & Chewy’s launched a direct-to-consumer e-commerce platform, offering nearly 100 cat and dog freeze-dried raw products, treats, and kibble. This initiative responds to the increasing trend of online pet food purchases, with 80% of pet parents buying pet food online in 2022.

- Ted’s Bowl: In April 2024, Ted’s Bowl introduced the UK’s first microwaveable meals for dogs and cats, offering a new option beyond traditional wet, dry, cooked, and raw pet foods. These meals consist of high-quality British meats, seasonal vegetables, and essential vitamins and minerals, with a minimum meat content of 70% for dogs and 98% for cats.

Report Scope

Report Features Description Market Value (2023) USD 17.5 Billion Forecast Revenue (2033) USD 28.8 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Food Type (Raw Food, Fresh Food, Frozen Food), By Breed Size (Small Breeds, Medium Breeds, Large Breeds), By Application (Dental Care, Digestive Care, Bone and Joint Health, Weight Management, Immune Support, Energy and Muscle Support, Other Applications), By Flavor Type (Chicken, Beef, Lamb, Turkey, Fish, Other Flavors), By Sales Channel (Wholesalers and Distributors, Modern Trade, Convenience Stores, Pharmacy and Drug Stores, Online Retailers, Pet Specialty Stores, Other Sales Channels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Farmers Dog, Primal Pet Foods, Nature’s Variety Instinct, Steve’s Real Food, Open Farm, Stella & Chewy’s, Darwin’s Natural Pet Products, Vital Essentials, Ollie Pets, Raw Paws Pet Food, Northwest Naturals, BARF World, Smallbatch Pets, Answers Pet Food, K9 Natural Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Raw, Fresh, and Frozen Dog Food MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Raw, Fresh, and Frozen Dog Food MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- The Farmers Dog

- Primal Pet Foods

- Nature’s Variety Instinct

- Steve's Real Food

- Open Farm

- Stella & Chewy’s

- Darwin’s Natural Pet Products

- Vital Essentials

- Ollie Pets

- Raw Paws Pet Food

- Northwest Naturals

- BARF World

- Smallbatch Pets

- Answers Pet Food

- K9 Natural