Global Rapid Liquid Printing Market By Material Type(Photopolymers, Thermoplastics, Epoxy Resins, Others), By Technology(Stereo-lithography (SLA), Digital Light Processing (DLP), Continuous Liquid Interface Production (CLIP)), By Application(Prototyping, Tooling, Functional Parts, others), By End-User Industry(Automotive, Aerospace & Defense, Healthcare, Consumer Goods, Construction and Architecture, Education and Research, Electronics, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 73374

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

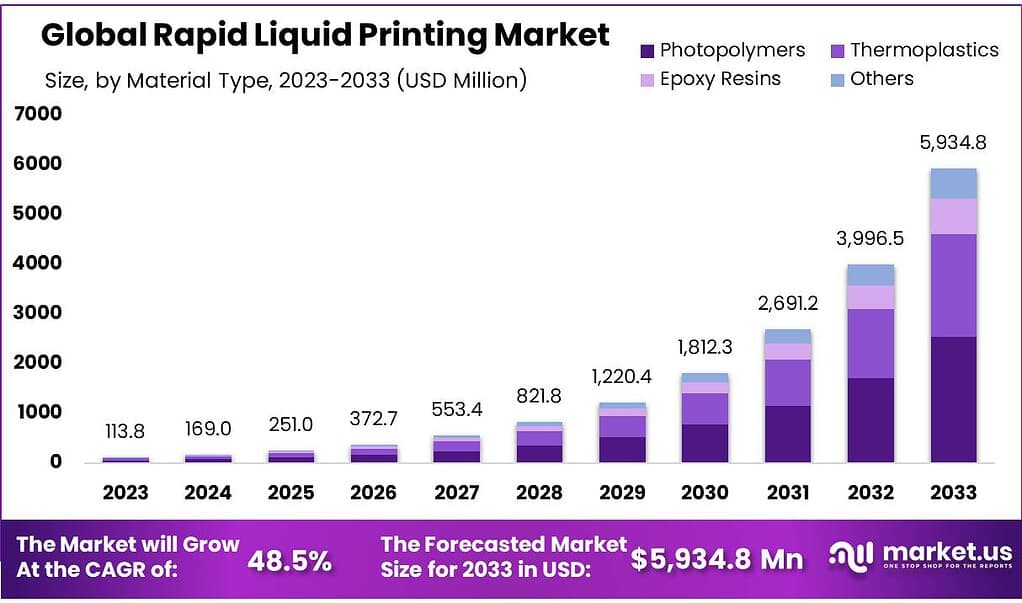

The global Rapid Liquid Printing Market size is expected to be worth around USD 5934.8 Million by 2033, from USD 1013.8 Million in 2023, growing at a CAGR of 48.5% during the forecast period from 2023 to 2033.

Rapid Liquid Printing (RLP) is an innovative 3D printing technology that significantly differs from traditional layer-by-layer additive manufacturing methods. This process involves the extrusion of a printing material into a gel-like support bath, where the material solidifies upon contact, allowing for the creation of complex structures with considerable speed and flexibility. Unlike conventional 3D printing techniques, RLP can produce objects in a matter of minutes, depending on the complexity and size of the design.

The technology’s distinct advantage lies in its ability to print freely in three dimensions without the need for support structures, which are often required in other forms of 3D printing to prevent the design from collapsing during production. This capability not only speeds up the manufacturing process but also enables the creation of designs that were previously considered too intricate or too time-consuming to produce using traditional methods.

Key Takeaways

- Market Growth: Rapid Liquid Printing Market is projected to reach USD 5934.8 Million by 2033, with a robust CAGR of 48.5% from 2023 to 2033.

- Photopolymers Dominance: In 2023, Photopolymers claimed a significant market share of over 42.7%, known for versatility and quick curing under light for detailed structures.

- SLA Precision: Stereo-lithography (SLA) led in 2023 with a market share exceeding 37.4%, chosen for its precision and smooth finishes in dental, jewelry, and automotive sectors.

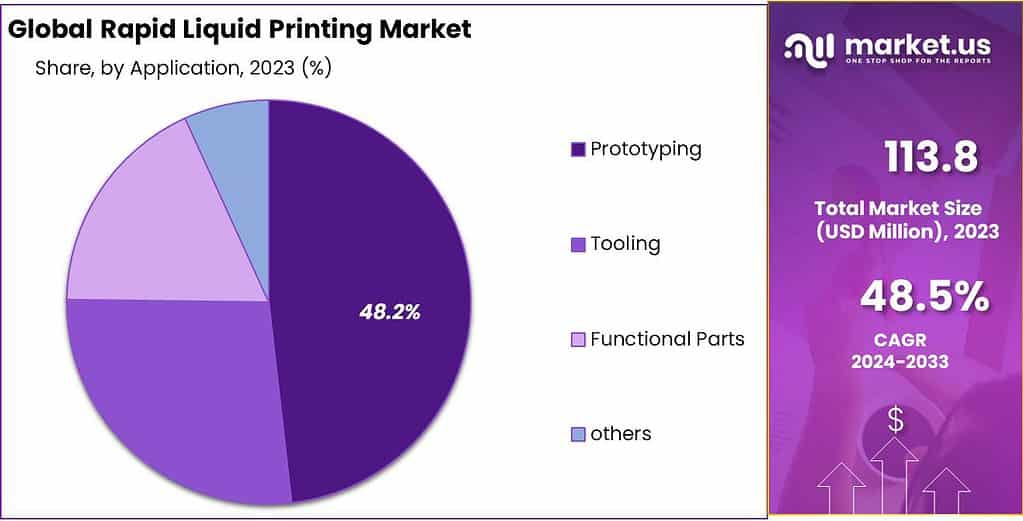

- Prototyping Leadership: Prototyping held a dominant position with a share of over 48.2% in 2023, meeting the rising demand for fast and efficient model development.

- Automotive Adoption: The automotive sector dominated with over 28.4% market share in 2023, rapidly adopting RLP for innovative manufacturing methods and reduced development times.

By Material Type

In 2023, Photopolymers held a dominant market position, capturing more than a 42.7% share in the Rapid Liquid Printing market. This segment’s popularity stems from photopolymers’ versatility and ability to cure quickly under light, making them ideal for detailed and complex structures. Their wide application range, from medical devices to consumer goods, underscores their integral role in the industry’s growth.

Thermoplastics followed closely, with their demand driven by the need for durable and flexible materials in manufacturing. Known for their recyclability and strength, thermoplastics are favored in the automotive and aerospace sectors, reflecting their critical contribution to sustainable and robust product designs.

Epoxy Resins also carved out a significant niche, prized for their exceptional mechanical properties and resistance to environmental factors. Occupying a key position in industrial applications and electronics, epoxy resins are crucial for creating high-performance parts that require precision and longevity.

By Technology

In 2023, Stereo-lithography (SLA) held a dominant market position, capturing more than a 37.4% share in the Rapid Liquid Printing market. SLA’s lead comes from its precision and ability to produce smooth finishes, making it a go-to for detailed prototypes and intricate designs. Its widespread use across dental, jewelry, and automotive industries highlights its versatility and reliability.

Following SLA, Digital Light Processing (DLP) technology also made a significant impact, renowned for its speed and efficiency. DLP’s advantage lies in its use of a digital light projector to cure photopolymer resins, enabling faster production times compared to SLA. This technology is particularly favored in the consumer goods sector for its ability to rapidly produce high-quality parts.

Continuous Liquid Interface Production (CLIP) stands out for its innovative approach to 3D printing, offering even faster production speeds by harnessing oxygen-permeable optics. Although newer to the market, CLIP is gaining traction for its potential to revolutionize manufacturing with its continuous printing process, particularly in industries requiring high-volume, end-use products.

By Application

In 2023, Prototyping held a dominant market position in the Rapid Liquid Printing market, capturing more than a 48.2% share. This segment’s prominence is attributed to the increasing demand for fast and efficient development of models across industries like automotive, healthcare, and consumer electronics. Prototyping’s lead underscores its role in reducing design to production time, enabling quicker market entry for new products.

Tooling followed as a significant application, benefiting from Rapid Liquid Printing’s ability to produce custom, complex tools swiftly. This technology’s adaptability in creating bespoke tooling solutions without the constraints of traditional manufacturing processes marks its importance in sectors aiming for innovation and efficiency in production.

Functional Parts also saw considerable interest, driven by the technology’s capability to produce ready-to-use components with comparable strength and durability to those made through conventional methods. Industries such as aerospace and defense particularly value this for their critical need for precision and reliability.

By End-User Industry

In 2023, Automotive held a dominant market position in the Rapid Liquid Printing market, capturing more than a 28.4% share. This sector’s leadership is due to its rapid adoption of innovative manufacturing methods to produce complex parts and prototypes, reducing development times and costs.

Aerospace & Defense followed closely, with its stringent requirements for precision and lightweight materials driving the adoption of Rapid Liquid Printing. This technology’s ability to create parts that meet high standards of strength and durability makes it indispensable in this sector.

Healthcare emerged as another key user, utilizing Rapid Liquid Printing for customized medical devices and prosthetics. The technology’s precision and adaptability make it ideal for producing patient-specific solutions and enhancing treatment outcomes.

Consumer Goods industries also embraced Rapid Liquid Printing to innovate and speed up the production of everyday items. From wearable technology to home goods, the technology allows for the creation of unique, customized products.

Construction and Architecture sectors are leveraging Rapid Liquid Printing for models and functional components, showcasing its potential in creating complex structures and intricate designs that were previously challenging to achieve.

Education and Research institutions increasingly incorporate Rapid Liquid Printing into their curricula and projects, recognizing its value in fostering innovation and learning in engineering, design, and technology fields.

Electronics manufacturers benefit from Rapid Liquid Printing by producing components with precision, speed, and efficiency, enabling the rapid prototyping of devices and parts with intricate details.

Market Key Segmentation

By Material Type

- Photopolymers

- Thermoplastics

- Epoxy Resins

- Others

By Technology

- Stereo-lithography (SLA)

- Digital Light Processing (DLP)

- Continuous Liquid Interface Production (CLIP)

By Application

- Prototyping

- Tooling

- Functional Parts

- others

By End-User Industry

- Automotive

- Aerospace & Defense

- Healthcare

- Consumer Goods

- Construction and Architecture

- Education and Research

- Electronics

- Others

Market Drivers

Innovation in Manufacturing Processes:

A significant driver of the Rapid Liquid Printing (RLP) market is the continual innovation in manufacturing processes. Traditional manufacturing methods often limit design complexity and require lengthy production times. RLP, however, allows for the creation of intricate designs with high precision in significantly reduced time frames. This capability to rapidly prototype and produce complex structures directly from digital designs without the need for molds or cutting tools is revolutionizing industries. It enables companies to accelerate product development cycles, leading to quicker market entries and enhanced competitiveness.

Demand for Customized and Complex Products:

The growing consumer demand for personalized and complex products across various sectors, including healthcare, automotive, and consumer goods, is driving the adoption of RLP technologies. In healthcare, for instance, RLP facilitates the production of custom-fit prosthetics and implants, significantly improving patient outcomes. In the automotive industry, it allows for the creation of complex parts that meet specific performance criteria, contributing to lighter, more efficient vehicles. The ability of RLP to meet these demands for customization and complexity head-on is a key factor propelling its market growth.

Market Restraints

High Initial Investment and Operating Costs:

The initial setup cost for RLP technologies can be high, including the expenses for advanced printing equipment and specialized materials. Additionally, operating costs related to maintenance and skilled personnel can pose financial challenges, especially for small and medium-sized enterprises (SMEs). These financial barriers can restrain the adoption of RLP, limiting its market growth to larger organizations with the necessary capital.

Technical Limitations and Material Challenges:

Despite its advantages, RLP faces technical limitations, such as the range of materials that can be used effectively. While ongoing research is expanding this range, the current limitations on material properties, such as durability under various conditions and compatibility with different chemicals, can restrict the applicability of RLP in certain industries. Overcoming these material challenges remains a significant hurdle for broader adoption.

Opportunities

Expansion into New Industries:

RLP presents significant opportunities for expansion into new industries beyond traditional manufacturing. Fields such as architecture, fashion, and even food are beginning to explore the possibilities offered by RLP.

For instance, in architecture, RLP can be used to create models and structural components with unique designs that are difficult to achieve with conventional methods. In fashion, it offers the potential for creating customized clothing and accessories on demand.

Advancements in Material Science:

The ongoing advancements in material science offer tremendous opportunities for the RLP market. Developing new materials with enhanced properties, such as increased strength, flexibility, or biocompatibility, can open up new applications for RLP.

For example, materials that are more resistant to environmental conditions can make RLP suitable for outdoor applications, while biocompatible materials can expand their use in medical implants and devices. These advancements in materials are critical for broadening the scope and appeal of RLP technologies and driving future market growth.

Market Trends

Integration with Digital Technologies:

A prevailing trend in the RLP market is the integration of digital technologies, such as artificial intelligence (AI) and machine learning (ML). These technologies enhance the capabilities of RLP by optimizing printing processes, improving material properties prediction, and enabling more intricate designs.

The integration facilitates smarter manufacturing processes, where adjustments can be made in real time, and outcomes can be more accurately predicted, leading to higher-quality products and reduced waste.

Sustainability and Eco-Friendliness:

Another significant trend is the increasing focus on sustainability and eco-friendly manufacturing processes. RLP technologies are being developed to use materials that are biodegradable or derived from renewable resources.

This trend is driven by growing environmental concerns and regulatory pressures, making RLP an attractive option for companies aiming to reduce their environmental impact. The ability to print only the necessary material also minimizes waste, further enhancing the sustainability aspect of RLP.

Regional Analysis

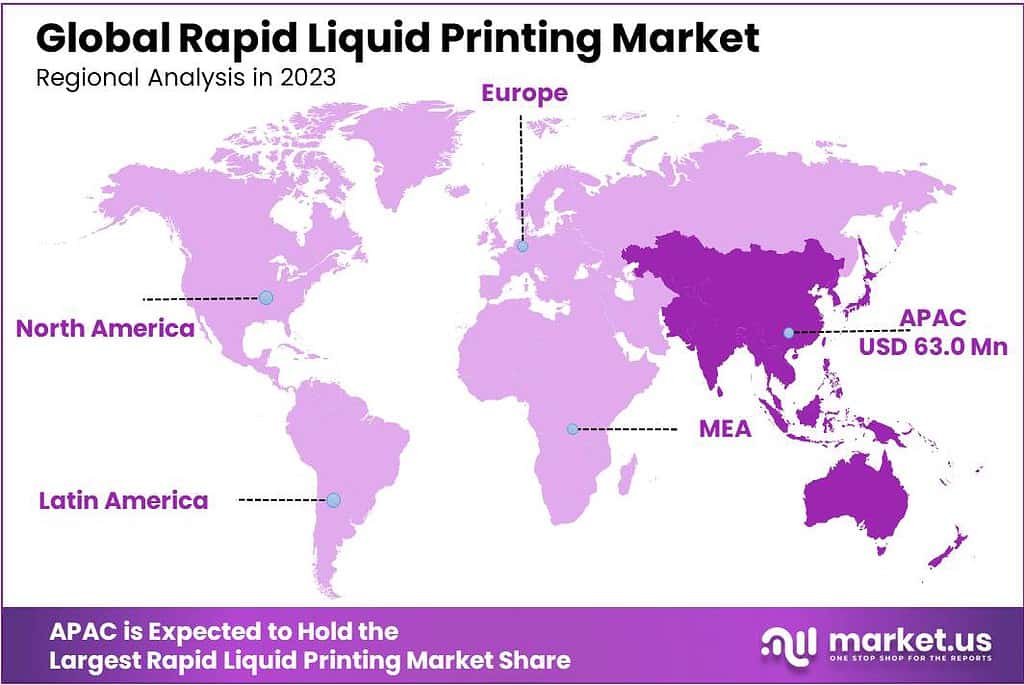

In 2023, the Asia Pacific (APAC) region took the lead in the Rapid Liquid Printing market, capturing a significant revenue share of over 55.4%. This leadership stems from strong regulatory support for innovation and technology adoption, which is notably strong in the context of the US and Canada’s renewable energy initiatives.

Such government incentives and policies have spurred the use of Rapid Liquid Printing technologies, making them a favored choice among manufacturers and end-users for their efficiency and advanced capabilities.

North America demonstrated its prowess in technological advancements within the sector, achieving record highs in clean energy projects. The commitment to sustainable practices was highlighted by the signing of nearly 20 GW of clean power Purchase Power Agreements (PPAs) in 2022, emphasizing the region’s dedication to sustainable energy solutions.

Meanwhile, Europe showed the fastest growth in adopting Rapid Liquid Printing technologies, with an impressive Compound Annual Growth Rate (CAGR) of 36.6%. This growth is anticipated to continue, driven by strict environmental regulations and the ambitious renewable energy goals set by the European Union. The year 2023 was a landmark for the European market, with renewable power contracts exceeding 16.2 GW, showcasing a significant shift towards sustainability.

Predictions for 2024 suggest an even stronger market, with expectations to surpass 20 GW in renewable PPAs. This trend towards renewable energy in Europe mirrors the increasing corporate commitment to reducing carbon footprints and fostering a sustainable future, directly impacting the demand and growth of the Rapid Liquid Printing market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

The Rapid Liquid Printing (RLP) market is characterized by a dynamic and innovative landscape, with several key players driving advancements and adoption across various industries. These companies are at the forefront of developing RLP technologies, materials, and applications, contributing significantly to the market’s growth and evolution. Here’s an analysis of some of the key players in the RLP market:

Market Key Players

- 3D Systems, Inc.

- Autodesk, Inc.

- Bayerische Motoren Werke AG (BMW)

- Dassault Systèmes

- Block.one.

- ExOne

- Materialise

- Native Shoes

- Steelcase Inc.

- Stratasys Direct, Inc.

- Stratasys Ltd

- Native Canada Footwear

Recent Developments

2023 3D Systems: Announced “MultiJet Studio Liquid 3D Printing System,” their first commercial RLP offering, targeting medical and other applications.

2023 Autodesk: Invested in Desktop Metal, a company developing metal RLP technology.

Report Scope

Report Features Description Market Value (2023) US$ 1013.8 Mn Forecast Revenue (2033) US$ 5934.8 Mn CAGR (2024-2033) 48.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type(Photopolymers, Thermoplastics, Epoxy Resins, Others), By Technology(Stereolithography (SLA), Digital Light Processing (DLP), Continuous Liquid Interface Production (CLIP)), By Application(Prototyping, Tooling, Functional Parts, others), By End-User Industry(Automotive, Aerospace & Defense, Healthcare, Consumer Goods, Construction and Architecture, Education and Research, Electronics, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape 3D Systems, Inc., Autodesk, Inc., Bayerische Motoren Werke AG (BMW), Dassault Systèmes, Block.one., ExOne, Materialise, Native Shoes, Steelcase Inc., Stratasys Direct, Inc., Stratasys Ltd, Native Canada Footwear Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Rapid Liquid Printing Market?Rapid Liquid Printing Market size is expected to be worth around USD 5934.8 Million by 2033, from USD 1013.8 Million in 2023

What is the Rapid Liquid Printing Market growth?The global Rapid Liquid Printing Market is expected to grow at a compound annual growth rate of 48.5%. From 2024 To 2033Name the major industry players in the Rapid Liquid Printing Market?3D Systems, Inc., Autodesk, Inc., Bayerische Motoren Werke AG (BMW), Dassault Systèmes, Block.one., ExOne, Materialise, Native Shoes, Steelcase Inc., Stratasys Direct, Inc., Stratasys Ltd, Native Canada Footwear

Rapid Liquid Printing MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Rapid Liquid Printing MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3D Systems, Inc.

- Autodesk, Inc.

- Bayerische Motoren Werke AG (BMW)

- Dassault Systèmes

- Block.one.

- ExOne

- Materialise

- Native Shoes

- Steelcase Inc.

- Stratasys Direct, Inc.

- Stratasys Ltd

- Native Canada Footwear