Global Raising Agents Market By Product Type (Baking Powder, Baking Soda, Cream of Tartar, Organic Agents, Others), By Form (Powder, Liquid, Granules, Others), By Application (Bakery Products, Confectionery Products, Biscuits and Crackers, Packaged Food Products, Fried Food Products, Others), By End User (Household, Foodservice Providers, Confectioneries, Others), By Distribution Channel (Direct Sales and Wholesalers, Modern Grocery Retailers, Independent Grocery Retailer, Non-Store Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132254

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

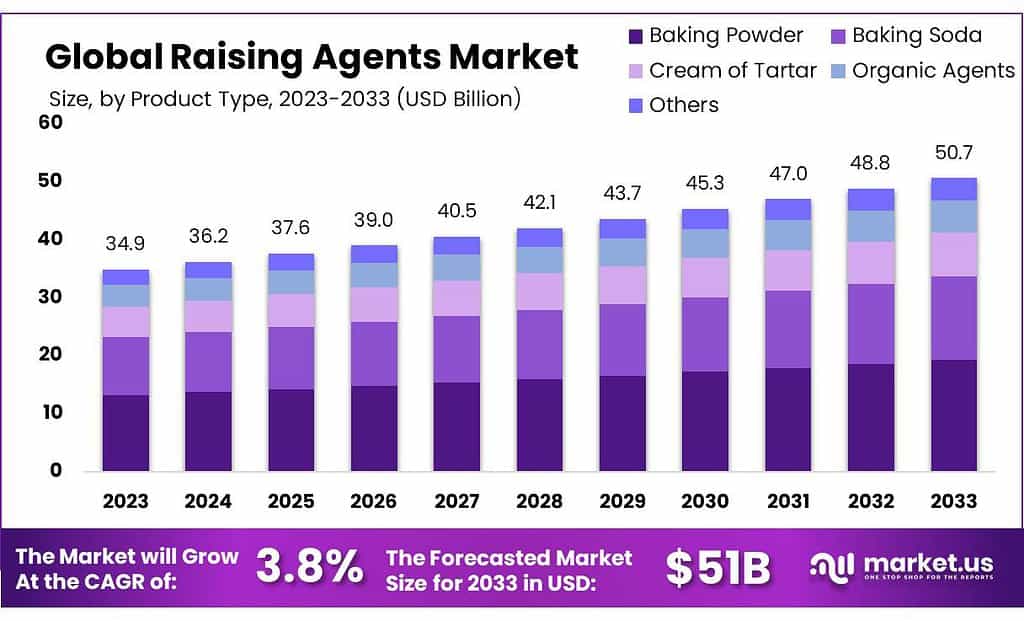

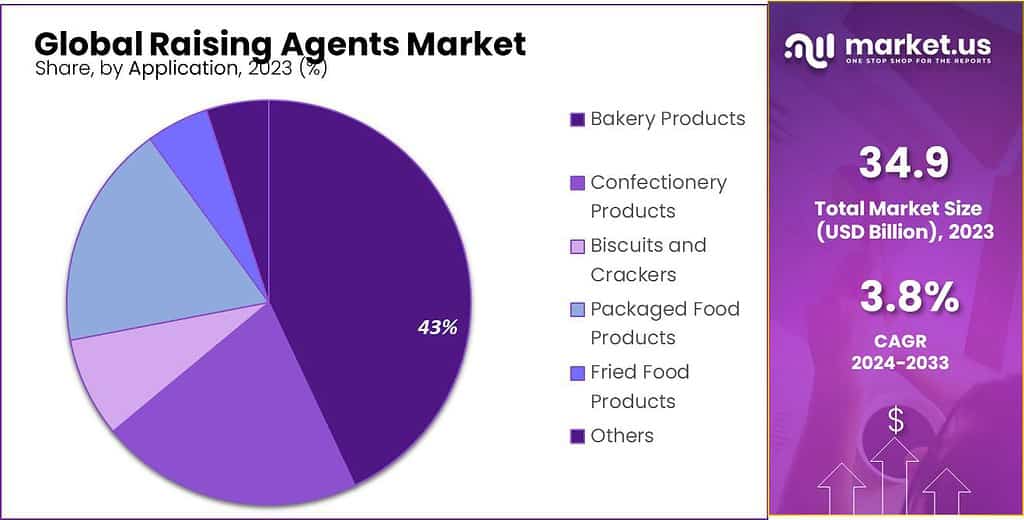

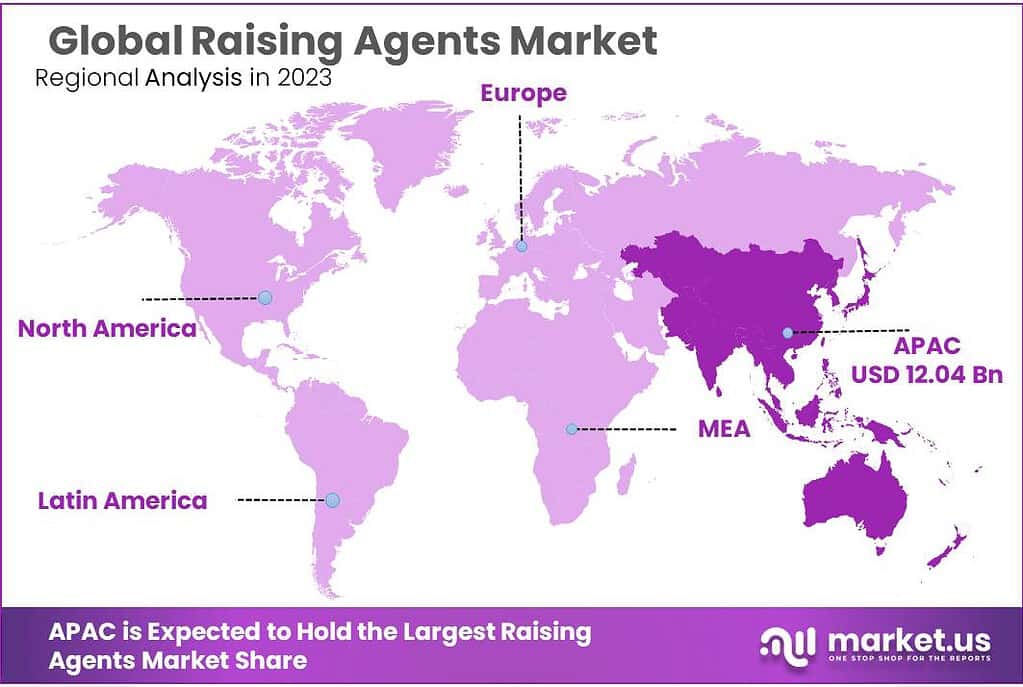

The Global Raising Agents Market size is expected to be worth around USD 50.7 Bn by 2033, from USD 34.9 Bn in 2023, growing at a CAGR of 3.8% during the forecast period from 2024 to 2033.

-

-

- ACH Food

- Angel Yeast

- Associated British Foods plc

- Blue Bird Foods India Pvt. Ltd.

- Caravan Ingredients

- Clabber Girl Corporation

- Corbionnv

- Foodchem International Corporation

- Lesaffre

- McCormick & Company

- Newseed Chemical

- Shandong SunKeen Biological Engineering Co., Ltd.

- Solvay S.A.

- Tartaros Gonzalo Castello, S.L.

- The Kraft Heinz Company

- Ward McKenzie Pty Ltd

- Weikfield Products

Our Clients

✖

Request a Sample Report

We'll get back to you as quickly as possible