Global Quantum Dot (QD) Display Market Report By Type (QDEF, QLED), By Material (Cadmium-containing, Cadmium-free), By Application (Consumer Electronics, Healthcare, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 128876

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

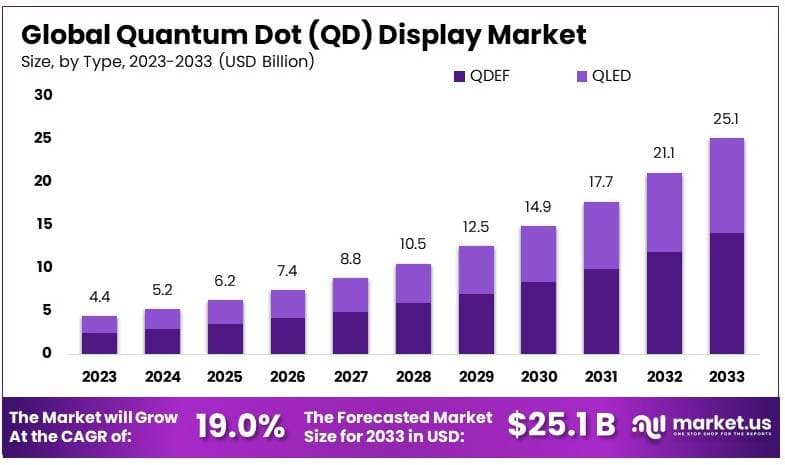

The Global Quantum Dot (QD) Display Market size is expected to be worth around USD 25.1 Billion by 2033, from USD 4.4 Billion in 2023, growing at a CAGR of 19.0% during the forecast period from 2024 to 2033.

A Quantum Dot (QD) display is a type of screen technology that uses quantum dots, which are tiny semiconductor particles, only a few nanometers in size. When these particles are hit by light, they emit their own colored light. The main advantage of quantum dot displays is their vivid colors and high brightness. This technology is often used in TV screens and monitors to enhance the viewing experience by providing more intense and accurate colors compared to traditional displays.

The market for Quantum Dot (QD) displays has been expanding as more consumers and industries recognize the superior color quality these displays offer. Television manufacturers are major users of this technology, driving its adoption due to the demand for high-quality display screens. As technology improves and costs come down, other applications such as smartphones and gaming monitors are starting to adopt quantum dot displays. This growth is supported by continual advancements in nano-technology and the increasing affordability of quantum dot materials, making them more accessible for various electronic devices.

The demand for Quantum Dot (QD) displays is primarily driven by the consumer electronics sector, where there is a high demand for devices with superior display quality. Televisions, monitors, and smartphones equipped with QD displays offer enhanced color accuracy and vibrancy, which appeal to consumers seeking premium visual experiences. Additionally, as digital content becomes more sophisticated with higher resolution and color quality, the demand for QD displays is expected to increase to meet these advanced standards.

Several factors contribute to the growth of the Quantum Dot (QD) display market. Technological advancements in nanomaterials have made QD displays more efficient and vibrant. The increasing penetration of high-definition viewing technology in emerging markets also plays a crucial role.

Moreover, the ongoing innovation in display technology, coupled with the reduction in manufacturing costs of quantum dots, enables broader adoption across various consumer electronics. Environmental regulations pushing for the use of non-toxic materials in display manufacturing also favor the growth of safer quantum dot technologies.

The Quantum Dot (QD) display market presents significant opportunities in various sectors beyond just consumer electronics. For instance, the automotive industry is increasingly integrating QD technology into vehicle displays to enhance dashboard functionality and safety. There is also potential in sectors like healthcare for high-precision medical imaging.

Furthermore, as the technology matures, there are opportunities in wearable devices and augmented reality systems, where enhanced color and brightness can significantly improve user experience. The scalability of quantum dot production methods also opens up avenues for cost reduction and innovation, further expanding market opportunities.

This technology has allowed displays to achieve up to 90% of the Rec.2020 color gamut, outperforming OLED and LCD displays that typically cover 70-75%. For example, Samsung’s QD-OLED panels provide more vibrant reds and greens, significantly improving color reproduction.

QD displays are also essential in the development of 4K and 8K resolution panels, which deliver higher picture quality and clarity. Leading manufacturers such as Samsung and Sony are integrating QD technology into their product lines. Samsung’s investment of $10.8 billion to convert LCD production to QD-OLED by 2025 highlights the industry’s confidence in the future of this technology.

The growth of the Quantum Dot display sector is driven by increasing consumer demand for high-quality viewing experiences. The shift towards 4K and 8K resolution in televisions and monitors is a key driver for the adoption of QD displays.

In 2022, more than 768 million 4K TVs were installed globally, and by 2024, 233 million 4K units are expected to be shipped. These high-resolution displays, coupled with the superior color accuracy of QD technology, offer a competitive edge in the market.

Despite slower adoption rates, 8K technology is expected to grow as content availability increases and production costs decline. In 2021, global sales of 8K TVs reached 550,000 units, and this figure is expected to rise to 1 million units annually in the near future. QD technology will be central to the development of these ultra-high-definition displays, offering better brightness and color depth for high-end products.

Government support plays a key role in the advancement of display technologies, including Quantum Dot. In some regions, governments have provided incentives for research and development in advanced display manufacturing.

Additionally, regulations aimed at promoting energy-efficient technologies have accelerated the shift towards Quantum Dot displays, which consume less power compared to traditional backlit LCD screens. This makes them an attractive option for both manufacturers and consumers looking for sustainable products.

Key Takeaways

- The Quantum Dot (QD) Display Market was valued at USD 4.4 billion in 2023 and is expected to reach USD 25.1 billion by 2033, with a CAGR of 19%.

- In 2023, QDEF dominated the type segment with 56%, as it enhances display color performance.

- In 2023, Cadmium-free Quantum Dots led the material segment with 71%, driven by environmental concerns.

- In 2023, Consumer Electronics dominated the application segment with 80%, owing to the growing demand for high-quality displays.

- In 2023, North America accounted for 35.6% of the market, fueled by strong demand for advanced display technologies.

Type Analysis

QDEF dominates with 56% due to its superior color display capabilities and efficiency in production.

The Quantum Dot (QD) Display market is segmented by type into QDEF (Quantum Dot Enhancement Film) and QLED (Quantum Dot Light Emitting Diode). QDEF holds the dominant position, capturing 56% of the market share.

This dominance is primarily because QDEF technology significantly enhances the color quality of smart displays by providing a wide color gamut and high color purity. These features are especially valued in high-definition consumer electronics like TVs and monitors, where visual quality is a critical selling point.

QDEF’s popularity is also driven by its compatibility with existing LCD technologies, making it a cost-effective upgrade that improves performance without the need for entirely new manufacturing processes. This compatibility allows display manufacturers to integrate QDEF into their current production lines, facilitating a smoother transition to enhanced display technologies without substantial upfront investment.

In contrast, QLED, while it represents a smaller portion of the market, is gaining traction for its potential in next-generation display technologies. QLED displays offer benefits such as improved brightness and energy efficiency over traditional LCD and OLED displays.

However, the higher cost of QLED production and the early stage of technology development compared to QDEF are factors that currently limit its market share. Despite this, QLED’s development is crucial for the future of displays, especially as consumers and industries continue to demand higher-quality visuals and energy-efficient solutions.

Material Analysis

Cadmium-free Quantum Dots lead with 71% due to environmental concerns and regulatory compliance.

The Quantum Dot market is further categorized by the material composition, particularly focusing on cadmium-containing and cadmium-free quantum dots. Cadmium-free quantum dots have become increasingly dominant, currently holding a 71% market share.

This shift is largely driven by growing environmental and health concerns associated with cadmium, a toxic heavy metal that poses significant disposal and health risks. Consequently, there is a strong regulatory push worldwide to reduce or eliminate the use of hazardous substances in consumer electronics, favoring cadmium-free alternatives.

Cadmium-free quantum dots are particularly appealing because they align with global environmental regulations and offer fewer health hazards, making them more sustainable in the long run. Additionally, they are capable of achieving high color purity and stability, which are essential for the performance of high-quality displays in devices like smartphones and televisions.

While cadmium-containing quantum dots are noted for their high efficiency and color quality, the environmental and health issues they present make their future use uncertain. The market’s shift towards cadmium-free materials reflects not only compliance with regulations but also a commitment to environmental sustainability and consumer safety, factors that are becoming increasingly important to customers and industry stakeholders.

Application Analysis

Consumer Electronics dominates with 80% due to high demand for advanced display technologies in devices.

The application segments of the Quantum Dot Display market include consumer electronics, healthcare, automotive, and others. Consumer electronics is by far the dominant segment, capturing 80% of the market.

This overwhelming dominance is due to the high demand for superior display technologies in consumer devices such as TVs, monitors, smartphones, and tablets. Quantum dots enhance the visual performance of these devices with brighter colors and deeper blacks, significantly improving the user experience.

The role of quantum dots in consumer electronics is critical not only for enhancing product appeal but also for driving the development of new applications within the sector. As device manufacturers continue to innovate, quantum dot technologies are increasingly integral for staying competitive in a market where visual quality is a key differentiator.

Meanwhile, other application areas like healthcare and automotive are emerging as important growth sectors for quantum dots. In healthcare, quantum dots are used in imaging and diagnostic equipment to improve the accuracy and clarity of medical imaging.

In the automotive sector, they enhance display readability and performance under various lighting conditions, crucial for dashboards and in-vehicle displays. These segments, though smaller in market share, highlight the versatility of quantum dots and their expanding role across different industries, underscoring their importance in the broader technological landscape.

Key Market Segments

By Type

- QDEF

- QLED

By Material

- Cadmium-containing

- Cadmium-free

By Application

- Consumer Electronics

- Healthcare

- Automotive

- Others

Driver

Superior Color Performance Drives Market Growth

The Quantum Dot (QD) Display Market is driven by several key factors, with superior color performance being a primary driver. Quantum dot technology offers enhanced color accuracy and brightness, which makes QD displays ideal for high-end televisions, monitors, and other display devices.

Another important driving factor is the rising demand for energy-efficient displays. QD displays consume less power compared to other display technologies, which makes them attractive for eco-conscious consumers and manufacturers aiming to reduce energy consumption.

The growing adoption of 4K and 8K televisions is also a significant factor driving market growth. As consumers shift toward ultra-high-definition (UHD) viewing experiences, manufacturers are increasingly integrating QD technology into their products to meet the demand for sharper, more detailed images.

Additionally, the rising consumer preference for advanced display technologies, driven by the desire for better image quality and immersive experiences, continues to support the expansion of the QD Display Market. These driving factors collectively propel the growth of the market by delivering superior performance, energy efficiency, and cutting-edge technology to consumers.

Restraint

High Manufacturing Costs Restraints Market Growth

The Quantum Dot (QD) Display Market is facing several restraining factors, with high manufacturing costs being one of the most significant barriers. The production of QD displays requires sophisticated materials and processes, leading to higher costs compared to other display technologies. These elevated costs can limit mass adoption, especially in price-sensitive markets.

Another restraint is the limited availability of raw materials needed for quantum dot production. Certain materials, such as cadmium-based quantum dots, face supply constraints, making it challenging for manufacturers to scale production and meet growing demand.

Competition from alternative display technologies, such as OLED and MicroLED displays, also hampers the growth of the QD display market. These technologies offer similar or superior performance in some applications, drawing consumers and manufacturers away from QD solutions.

Additionally, environmental concerns related to quantum dot materials, particularly cadmium, are restraining market growth. Regulatory restrictions and the need for eco-friendly alternatives add complexity to the production and adoption of QD displays.

Opportunity

Expansion of Quantum Dot Applications in Healthcare Provides Opportunities

The Quantum Dot (QD) Display Market offers numerous growth opportunities, particularly through the expansion of quantum dot applications in the healthcare sector. Quantum dots are being explored for use in medical imaging displays and diagnostics due to their precision in color representation and brightness, which can enhance the accuracy of medical imaging technologies.

Another opportunity lies in the integration of quantum dots with wearable technology. As wearable technology gains popularity in fitness, health monitoring, and entertainment, the need for high-performance, energy-efficient displays is growing. Quantum dot displays are well-positioned to meet this demand, providing vibrant displays for smartwatches and fitness trackers.

The growing adoption of QD displays in the automotive industry is another potential growth area. Automakers are increasingly incorporating advanced display technologies into dashboards and infotainment systems, and QD displays offer the brightness, clarity, and durability required for automotive environments.

The increasing use of QD displays in smart devices, including smartphones and tablets, provides further growth opportunities. As consumer demand for high-quality displays in mobile devices rises, quantum dot technology offers an attractive solution for manufacturers seeking to enhance visual performance.

Challenge

Rapid Technological Advancements Challenges Market Growth

The Quantum Dot (QD) Display Market faces several challenges, with rapid technological advancements presenting a major obstacle. The fast-paced development of display technologies means that QD manufacturers must continuously innovate to keep up with emerging trends and competing technologies such as OLED and MicroLED.

Another challenge is the difficulty in scaling quantum dot production. While QD technology offers many advantages, scaling production to meet growing global demand remains a technical and logistical challenge. Ensuring consistent quality and performance across large-scale manufacturing processes adds further complexity.

Regulatory issues concerning quantum dot materials also pose challenges for market growth. Some quantum dots, particularly cadmium-based ones, face regulatory restrictions due to their environmental impact. Manufacturers must navigate these regulatory landscapes while exploring more eco-friendly alternatives, which can slow product development and market entry.

Additionally, consumer preference for cost-effective display solutions is a persistent challenge for QD displays. Despite their superior performance, the higher cost of QD displays compared to other technologies can deter price-sensitive consumers.

Growth Factors

Advancements in Quantum Dot Material Engineering Are Growth Factors

The Quantum Dot (QD) Display Market is witnessing growth due to several key factors, with advancements in quantum dot material engineering being a significant contributor. Continuous improvements in the development of quantum dot materials have enhanced their performance, allowing for brighter displays, better color accuracy, and lower energy consumption.

Another growth factor is the expansion of quantum dots in High Dynamic Range (HDR) displays. The increasing demand for HDR technology, which delivers superior contrast and vibrant colors, is fueling the integration of quantum dots in televisions, monitors, and other display devices. This enhances the viewing experience, particularly in the entertainment and gaming sectors.

The growing use of quantum dot displays in medical imaging is also contributing to market growth. Quantum dots offer precise color reproduction and brightness, making them ideal for advanced imaging technologies used in medical diagnostics and monitoring.

Additionally, the rising demand for quantum dot displays in consumer electronics, including smartphones, tablets, and wearable devices, is further supporting market growth. As consumers continue to seek high-quality, energy-efficient displays in their everyday devices, quantum dots provide a compelling solution that meets these expectations.

Emerging Trends

Shift Toward Eco-Friendly Quantum Dot Materials Is Latest Trending Factor

The Quantum Dot (QD) Display Market is witnessing several emerging trends, with a notable shift toward eco-friendly quantum dot materials leading the way. Manufacturers are increasingly focusing on developing cadmium-free quantum dots that offer the same superior color performance without the environmental concerns.

Another key trend is the growing demand for flexible and foldable displays. Quantum dot technology’s compatibility with flexible substrates is driving its adoption in next-generation foldable devices, including smartphones and tablets.

The increased focus on quantum dot displays for gaming is also shaping the market. Gamers demand high-resolution, high-performance displays for an immersive experience, and QD technology offers the vibrant colors and sharp contrasts needed for gaming monitors and televisions.

Additionally, the integration of quantum dot displays in smart TVs is becoming a prominent trend. As consumer demand for high-quality home entertainment continues to grow, quantum dot technology is being increasingly adopted in smart TV models, offering enhanced viewing experiences with better brightness and color accuracy.

Regional Analysis

North America Dominates with 35.6% Market Share

North America leads the Quantum Dot (QD) Display Market with a 35.6% market share, valued at USD 1.57 billion. This strong market presence is driven by high consumer demand for advanced display technologies, especially in televisions and monitors. The region’s established tech industry, major electronics manufacturers, and continuous innovation in display technologies further boost its dominance.

North America’s advanced R&D capabilities, along with early adoption of new technologies, significantly impact the performance of the QD Display Market. The region benefits from a well-developed supply chain, including key players in the electronics industry, which supports the rapid growth of QD displays in consumer electronics and commercial applications.

North America’s leadership in the Quantum Dot Display Market is expected to grow. Increasing demand for high-resolution displays in entertainment, gaming, and professional applications will drive further market expansion, keeping the region at the forefront of display technology innovation.

Regional Mentions:

- Europe: Europe is growing steadily in the QD Display Market, driven by increasing demand for energy-efficient displays and stringent environmental regulations pushing sustainable technologies.

- Asia Pacific: Asia Pacific is rapidly expanding, fueled by rising consumer electronics demand, particularly in countries like China, South Korea, and Japan, where innovation in display technology is advancing quickly.

- Middle East & Africa: The region is emerging, with growing investments in advanced display technologies for high-end consumer electronics and commercial displays, aiming to enhance entertainment and retail experiences.

- Latin America: Latin America is adopting QD display technologies, focusing on improving display quality in consumer electronics and entertainment sectors, with a focus on affordability and innovation in digital displays.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Quantum Dot (QD) Display Market, Samsung Electronics Co., Ltd., Sony Corporation, and Nanosys are the leading companies driving innovation and market growth. These top players maintain strong market positions through advanced technology, strategic partnerships, and widespread global influence.

Samsung Electronics Co., Ltd. leads the market with its pioneering QLED technology, offering superior color performance and brightness in consumer electronics like televisions. Samsung’s strong brand presence and investment in research and development keep it at the forefront of quantum dot innovations, making it a dominant player in the market.

Sony Corporation is another key player, known for integrating quantum dot displays in its high-end television products. Sony’s focus on delivering premium picture quality and immersive viewing experiences positions it as a leader in the high-definition display market, particularly in home entertainment.

Nanosys plays a crucial role as a supplier of quantum dot technology to various display manufacturers. Nanosys’s expertise in material science and innovation in quantum dot applications help drive the development of new display technologies. Its strategic partnerships with major electronics brands amplify its influence in the market.

These companies are shaping the Quantum Dot Display Market through their focus on delivering superior display performance, innovation in technology, and partnerships across the electronics industry. Their ongoing advancements in quantum dot technology continue to push the boundaries of visual display capabilities, contributing to market growth and consumer demand.

Top Key Players in the Market

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Nanosys

- QD Vision

- Nanoco Group

- Invisage Technologies

- QD Laser

- Qlight Nanotech

- Ocean Nanotech

- NN Crystal U.S Corporation

- Other Key Players

Recent Developments

- Samsung: In May 2024, Samsung unveiled its world-first QD-LED display technology at the SID 2024 Expo, marking a significant advancement in display technology. Unlike traditional OLED panels, QD-LED panels use semiconductor materials instead of organic ones, eliminating the issue of burn-in and providing enhanced durability and stability.

- Mojo Vision: In January 2024, Mojo Vision announced a breakthrough in single-panel RGB Micro-LED technology using its proprietary Quantum Dot technology. This development integrates red, green, and blue sub-pixels into a single panel, making it highly suitable for augmented reality (AR) devices due to its durability and brightness.

- Scrona and Avantama: In January 2024, Scrona and Avantama announced a collaboration to enhance quantum dot (QD) processing using electrohydrodynamic (EHD) inkjet printing to produce more efficient and cost-effective MicroLED displays. The partnership combines Scrona’s EHD technology, which enables fine pattern printing, with Avantama’s perovskite QDs, offering high absorption and improved color purity.

- Nanosys: In April 2023, Nanosys highlighted several milestones in its quantum dot technology, declaring 2023 the “Year of the Quantum Dot.” These advancements included expanded partnerships and increased adoption of QD technologies in consumer electronics. Nanosys continues to improve color accuracy, brightness, and energy efficiency, positioning its quantum dot technology as a leading solution for next-generation displays.

Report Scope

Report Features Description Market Value (2023) USD 4.4 Billion Forecast Revenue (2033) USD 25.1 Billion CAGR (2024-2033) 19% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (QDEF, QLED), By Material (Cadmium-containing, Cadmium-free), By Application (Consumer Electronics, Healthcare, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co., Ltd., Sony Corporation, Nanosys, QD Vision, Nanoco Group, Invisage Technologies, QD Laser, Qlight Nanotech, Ocean Nanotech, NN Crystal U.S Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Quantum Dot (QD) Display MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Quantum Dot (QD) Display MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Nanosys

- QD Vision

- Nanoco Group

- Invisage Technologies

- QD Laser

- Qlight Nanotech

- Ocean Nanotech

- NN Crystal U.S Corporation

- Other Key Players