Global Quantum Cryptography Market By Component (Hardware, Software), By Application (Network Security, Database Encryption, Application Security), By End-User (Government and Defense, BFSI, Healthcare, IT and Telecommunication, Aerospace and Defense, Other End-users), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 115764

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

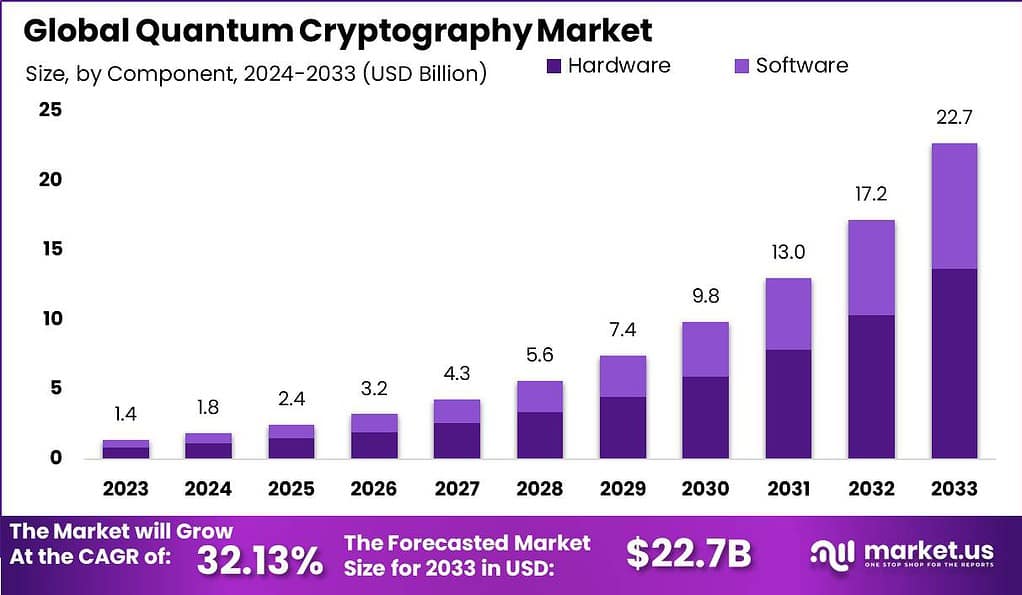

The Global Quantum Cryptography Market size is expected to be worth around USD 22.7 Billion by 2033, from USD 1.4 Billion in 2023, growing at a CAGR of 32.13% during the forecast period from 2024 to 2033.

Quantum cryptography, also known as quantum key distribution (QKD), is a cutting-edge technology that leverages the principles of quantum mechanics to provide secure communication channels. Unlike classical cryptographic methods that rely on mathematical algorithms, quantum cryptography utilizes the fundamental properties of quantum physics to ensure the confidentiality and integrity of transmitted data.

The quantum cryptography market is witnessing rapid growth as organizations recognize the need for advanced security measures to protect sensitive data. The market encompasses various solutions and services, including quantum key distribution systems, quantum encryption algorithms, and quantum-resistant cryptographic protocols. Additionally, the integration of quantum cryptography with existing network infrastructures and communication systems is a crucial aspect of the market.

The market for quantum cryptography is driven by factors such as the increasing adoption of cloud computing, the growing volume of digital transactions, and the rising concerns over data breaches and cyberattacks. Industries that handle sensitive information, such as finance, government, healthcare, and defense, are particularly interested in quantum cryptography to enhance their data protection capabilities.

According to a 2022 survey conducted by the Cloud Security Alliance, it is projected that 66% of organizations will adopt quantum-safe cryptography by 2030 to safeguard against the threats posed by quantum computing. This indicates a growing recognition of the need for robust encryption solutions that can withstand the advancements in quantum technologies.

Arqit, a company specializing in quantum encryption solutions through a satellite-based network, went public in 2021 following a SPAC merger. As of April 14, 2022, Arqit has achieved a market capitalization of approximately $1.7 billion. This successful entry into the market signifies the demand and investor confidence in quantum encryption technologies.

China currently leads in quantum cryptography patents, with over 4,000 applications reported by the World Intellectual Property Organization (WIPO). Other countries such as the United States, Japan, the United Kingdom, South Korea, and Canada are also actively involved in quantum cryptography research and development. This global participation reflects the widespread interest and recognition of the potential for quantum encryption in enhancing data security.

The significance of quantum-safe cryptography is underscored by an Entrust report, which reveals that 81% of organizations believe there would be a medium to high business impact if their current encryption and security solutions are compromised by quantum computers. This awareness is driving the increased interest in adopting quantum-safe encryption to mitigate potential risks.

In support of the advancement of quantum network technologies, the U.S. Department of Energy granted $74 million in 2022 to accelerate the commercialization of Quantum Key Distribution (QKD) and other quantum networking technologies. This government support highlights the importance placed on quantum-safe solutions and their potential impact on enhancing cybersecurity.

A Thales report indicates that 53% of cybersecurity professionals believe that quantum computers will be capable of breaking current public key cryptography within the next 10 years. This perception of an impending threat is creating a sense of urgency among organizations to invest in and implement quantum-safe security measures.

Key Takeaways

- The global quantum cryptography market is forecasted to reach a substantial value of USD 22.7 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 32.13% during the forecast period from 2024 to 2033.

- Government support, such as the $74 million grant from the U.S. Department of Energy in 2022, highlights the importance placed on quantum-safe solutions and their potential impact on enhancing cybersecurity, emphasizing the significance of quantum-safe encryption measures.

- Hardware Component: The hardware segment, particularly quantum key distribution (QKD) systems, held a dominant market position in 2023, capturing over 60.3% share, indicating the critical role of hardware in ensuring secure transmission of information.

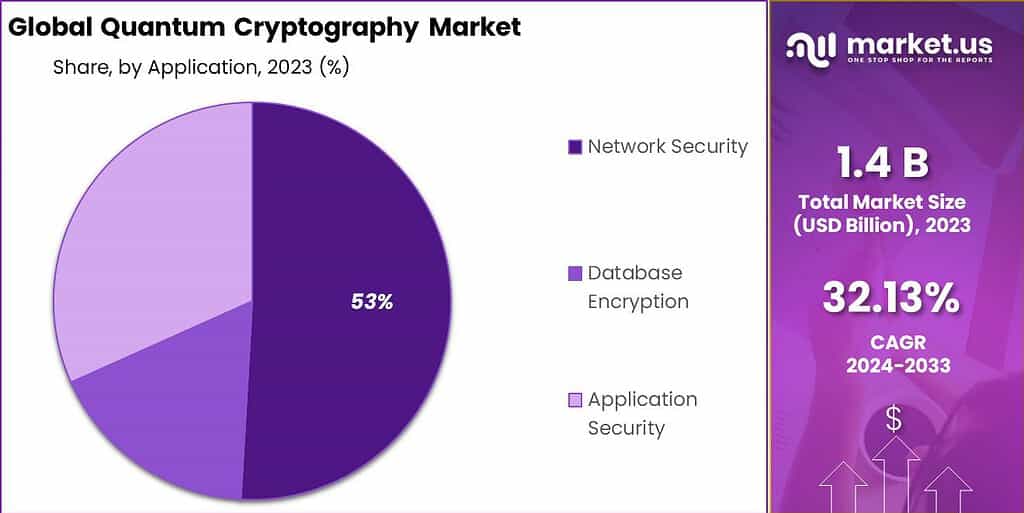

- Network Security Application: Network security emerged as the dominant application segment, accounting for more than 53% share in 2023, driven by escalating threats to data transmission and increasing demand for secure communication channels in various sectors.

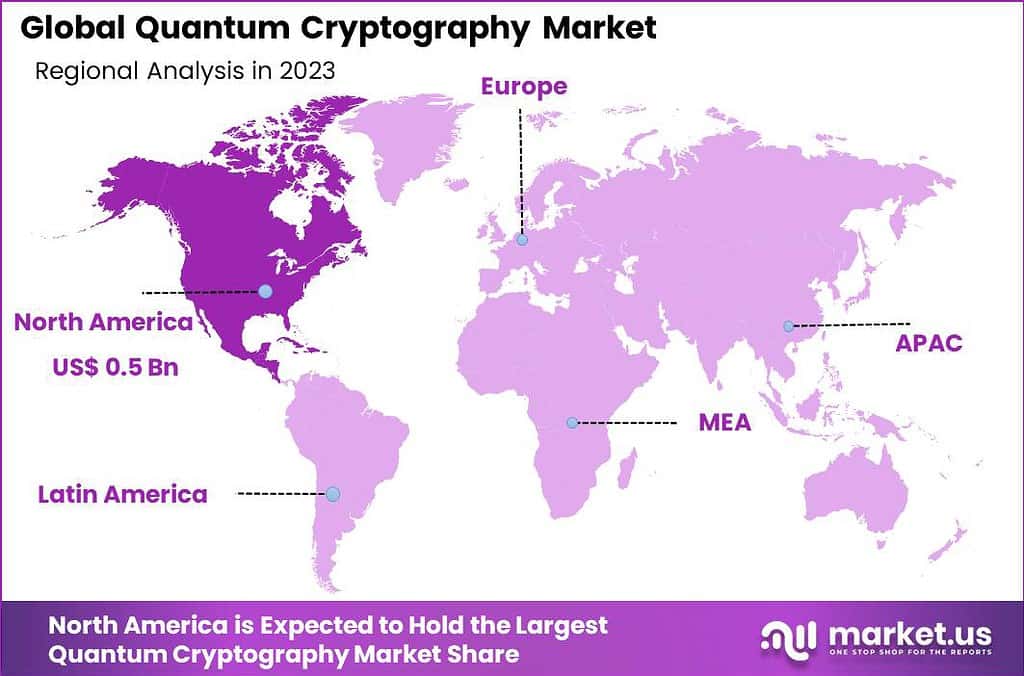

- North America leads the quantum cryptography market, holding over 31.6% share in 2023, driven by robust technological infrastructure, research and development activities, stringent regulatory landscape, and collaborations between academia, government, and private sectors.

Component Analysis

In 2023, the Hardware segment held a dominant market position in the Quantum Cryptography market, capturing more than a 60.3% share. This significant market share can be attributed to the critical role that quantum cryptographic hardware plays in the secure transmission of information.

Hardware components, such as quantum key distribution (QKD) systems, are essential for implementing quantum cryptography, providing the physical means to generate and distribute quantum keys securely. These systems leverage the principles of quantum mechanics to offer security that is theoretically immune to computational vulnerabilities, making them highly sought after in industries where data security is paramount, including government, finance, and healthcare sectors.

The leading status of the Hardware segment is further reinforced by the substantial investments in research and development, aimed at enhancing the efficiency and reliability of quantum cryptographic systems. With advancements in quantum computing threatening traditional encryption methods, the demand for quantum-safe hardware solutions has surged. This demand is driven by the need to protect critical infrastructure and sensitive information against increasingly sophisticated cyber threats.

Furthermore, the development of compact, user-friendly quantum cryptographic hardware devices has lowered entry barriers, enabling wider adoption across various sectors. The integration of quantum cryptographic hardware with existing communication infrastructure poses a significant challenge, yet it represents a crucial step toward practical and widespread implementation of quantum-safe security measures.

Application Analysis

In 2023, the Network Security segment held a dominant market position in the Quantum Cryptography market, capturing more than a 53% share. This significant market share can be attributed to the escalating threats to data transmitted across networks and the increasing need for secure communication channels. With the advent of quantum computing, traditional encryption methods are becoming increasingly vulnerable, making quantum cryptography a crucial technology for enhancing network security.

Organizations and governments worldwide are prioritizing the protection of their data transmission processes, thereby driving demand for quantum cryptography solutions that offer unbreakable encryption. The dominance of the Network Security segment is further bolstered by the growing complexity and volume of cyberattacks. As hackers become more sophisticated in their methods, the need for robust security solutions that can offer protection against a wide range of threats has never been more critical.

Quantum cryptography, with its ability to provide secure communication based on the principles of quantum mechanics, presents a solution that is theoretically immune to hacking attempts. This has led to its increased adoption in securing network infrastructures, especially in sectors where data security is paramount, such as financial services, government, and healthcare.

Moreover, the ongoing digital transformation initiatives across industries are contributing to the expansion of network perimeters and the proliferation of IoT devices, further complicating the security landscape. In response, organizations are investing in quantum cryptography to safeguard their networks against potential quantum-computing-based attacks.

The Network Security segment’s dominance is also reflected in the substantial investments in research and development activities aimed at making quantum cryptography more accessible and cost-effective for a broader range of applications. This focus on innovation is expected to sustain the segment’s growth and its leading position in the quantum cryptography market.

End-User Analysis

In 2023, the Government and Defense segment held a dominant market position in the quantum cryptography market, capturing more than a 36% share. This significant market share can be attributed to the escalating demand for advanced security solutions against the backdrop of increasing cyber threats and espionage activities targeting sensitive government and military communications.

Quantum cryptography offers a pioneering approach to secure communication, leveraging the principles of quantum mechanics to ensure that any attempt at interception or eavesdropping can be detected instantly. This has made it an indispensable tool for government and defense agencies worldwide, seeking to safeguard national security interests and classified information.

The robust growth of this segment is further propelled by substantial investments from governments in quantum technologies, aiming to achieve quantum supremacy. The prioritization of secure communication channels, especially for defense operations and national infrastructure, has led to the integration of quantum cryptography in various government initiatives and projects.

Additionally, the increasing collaboration between governments and technology providers to develop quantum-resistant communication systems underscores the strategic importance of this segment. Furthermore, the Government and Defense sector’s dominance in the quantum cryptography market is underpinned by the need to stay ahead of rapidly advancing cyber threats.

As adversaries become more sophisticated in their methods, the adoption of quantum cryptography is seen as a critical step in ensuring a future-proof defense mechanism. This is particularly relevant in scenarios where traditional encryption methods are increasingly vulnerable to quantum computing attacks. The deployment of quantum cryptography not only enhances the security of communications but also plays a pivotal role in the strategic defense capabilities of nations, thereby solidifying the Government and Defense segment’s leading position in the market.

Key Market Segments

By Component

- Hardware

- Software

By Application

- Network Security

- Database Encryption

- Application Security

By End-User

- Government and Defense

- BFSI

- Healthcare

- IT and Telecommunication

- Aerospace and Defense

- Other End-users

Driver

Rising Cyberattacks in the Digitalization Era

In the era of digitalization, the increase in cyberattacks has become a significant driver for the quantum cryptography market. As businesses and governments digitalize their operations, the amount of sensitive data stored and transmitted online has surged, presenting lucrative targets for cybercriminals. This uptick in digital information has led to a corresponding rise in cyber threats, ranging from data breaches to sophisticated state-sponsored attacks.

Traditional encryption methods are increasingly vulnerable, highlighting the need for more secure technologies. Quantum cryptography, with its promise of theoretically unbreakable encryption, offers a compelling solution to this challenge. Its ability to secure data against the computational power of future quantum computers positions it as an essential tool in the arsenal against cyber threats. This growing necessity for advanced security measures in the face of escalating cyberattacks drives the quantum cryptography market forward.

Restraint

High Implementation Cost

The quantum cryptography market faces a significant restraint in the form of high implementation costs. Deploying quantum cryptography systems involves sophisticated technology and infrastructure, which can be prohibitively expensive for many organizations. The need for specialized hardware, such as quantum key distribution (QKD) devices, and the ongoing maintenance and updates required, contribute to the overall financial burden.

This cost barrier is particularly daunting for smaller entities and emerging markets, which may not have the capital to invest in such advanced security measures. Moreover, the complexity of integrating quantum cryptography into existing network infrastructures adds to the cost, making it a less viable option for widespread adoption. This high cost of entry limits the market’s growth potential, restricting access to entities with substantial resources.

Opportunity

Spur in Demand for Security Solutions Across Industry Verticals

The quantum cryptography market is poised to benefit from a spur in demand for security solutions across various industry verticals. As digital transformation deepens, sectors such as finance, healthcare, government, and IT are increasingly prioritizing data security to protect against evolving cyber threats. The unique proposition of quantum cryptography, offering a level of security that is theoretically immune to future advancements in computing power, makes it an attractive option for industries handling sensitive information.

This growing awareness and concern for advanced data protection mechanisms are driving organizations to explore quantum cryptography as a part of their security infrastructure. The expanding digital economy, coupled with the urgent need for impenetrable data encryption, presents a significant opportunity for growth in the quantum cryptography market.

Challenge

Commercialization of Quantum Cryptography

A critical challenge in the quantum cryptography market is its commercialization. While the technology holds promise for revolutionizing data security, translating theoretical advantages into practical, widely available solutions has been slow. Several factors contribute to this challenge, including the technological complexity of quantum cryptography, the need for specialized infrastructure, and the current lack of standardization in the field.

These hurdles impede the seamless integration of quantum cryptography into existing IT systems and networks. Furthermore, there’s a gap between the technology’s potential and the market’s readiness to adopt such advanced solutions, partly due to the high costs and the limited understanding of quantum cryptography’s practical applications. Overcoming these barriers to commercialize quantum cryptography is essential for its widespread adoption and the realization of its full market potential.

Regional Analysis

In 2023, North America held a dominant market position in the quantum cryptography sector, capturing more than a 31.6% share of the global market. This significant market share can be attributed to several key factors that underscore the region’s leading position. Firstly, the presence of a robust technological infrastructure and a strong emphasis on research and development activities have fostered innovation in quantum cryptography.

North American companies, backed by substantial investment in cybersecurity technologies, are at the forefront of developing advanced quantum cryptography solutions. Moreover, the region’s stringent regulatory landscape concerning data protection and privacy has necessitated the adoption of secure communication channels, further propelling the demand for quantum cryptography.

Furthermore, the collaboration between academic institutions, government agencies, and private sectors in North America has been instrumental in advancing quantum cryptography technologies. Initiatives aimed at enhancing national security measures and protecting critical infrastructure from cyber threats have led to increased investment in quantum-safe encryption methods.

The U.S. and Canada, in particular, have seen a surge in startups focused on quantum computing and cryptography, supported by favorable government policies and funding opportunities. This ecosystem not only contributes to the region’s dominance but also positions North America as a global leader in shaping the future direction of quantum cryptographic technologies.

Europe follows North America in the quantum cryptography market share, driven by its commitment to cybersecurity and data protection. The region’s focus on adhering to General Data Protection Regulation (GDPR) standards has spurred the integration of quantum cryptography to safeguard sensitive information. Europe’s investment in quantum technology research, coupled with collaborative projects across EU member states, aims at developing a secure quantum communication infrastructure.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The quantum cryptography market is witnessing substantial growth, driven by the increasing demand for secure communication methods in the face of rising cyber threats. Among the key players, ID Quantique, QuintessenceLabs, and MagiQ Technologies (now part of Raytheon Technologies Corporation) have established themselves as pioneers, offering advanced quantum key distribution (QKD) solutions to enhance data security across various industries.

Toshiba Corporation and Qubitekk have also made significant contributions, developing innovative quantum encryption technologies that promise to revolutionize secure communication. QuantumCTek Co., Ltd., a notable player from China, is gaining international attention for its state-of-the-art QKD systems, indicating the global nature of the quantum cryptography market.

Top Market Leaders

- ID Quantique

- QuintessenceLabs

- MagiQ Technologies (acquired by Raytheon Technologies Corporation)

- Toshiba Corporation

- Qubitekk

- QuantumCTek Co., Ltd.

- PQ Solutions

- Infineon Technologies AG

- Anhui Qasky Quantum Technology Co. Ltd.

- NEC Corp.

- Microsoft Corp.

- Other Key Players

Recent Developments

- In June 2023: QuintessenceLabs: Announced a partnership with NEC Corporation to develop and commercialize quantum cryptography solutions for the Japanese market. This collaboration focuses on integrating QuintessenceLabs’ QKD technology with NEC’s existing network infrastructure.

- In May 2023, ID Quantique: Launched its latest quantum key distribution (QKD) solution, “Quantum-Safe Bridge,” in May 2023. This solution aims to bridge the gap between existing classical networks and future quantum-resistant communication infrastructure.

- In February 2023 – During MWC23, ID Quantique, KCS, and SK Telecom introduced advanced quantum-enhanced cryptography hardware. This innovative technology integrates IDQ’s quantum random number generator (QRNG) and KCS’ cryptographic communication semiconductor technology into a unified security chipset.

Report Scope

Report Features Description Market Value (2023) US$ 1.4 Bn Forecast Revenue (2033) US$ 22.7 Bn CAGR (2024-2033) 32.13% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Hardware, Software), By Application (Network Security, Database Encryption, Application Security), By End-User (Government and Defense, BFSI, Healthcare, IT and Telecommunication, Aerospace and Defense, Other End-users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ID Quantique, QuintessenceLabs, MagiQ Technologies (acquired by Raytheon Technologies Corporation), Toshiba Corporation, Qubitekk, QuantumCTek Co. Ltd., PQ Solutions, Infineon Technologies AG, Anhui Qasky Quantum Technology Co. Ltd., NEC Corp., Microsoft Corp., Other Key Players, , Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Quantum Cryptography?Quantum cryptography is a field of study that focuses on developing cryptographic systems that leverage the principles of quantum mechanics to provide secure communication. Unlike traditional cryptographic methods, which rely on mathematical complexity, quantum cryptography uses the properties of quantum particles to ensure the security of communication channels.

How big is Quantum Cryptography Market?The Global Quantum Cryptography Market size is expected to be worth around USD 5.0 Billion by 2033, from USD 1.4 Billion in 2023, growing at a CAGR of 32.13% during the forecast period from 2024 to 2033.

Who are the major players in the quantum cryptography market?The top key player in quantum cryptography market include ID Quantique, QuintessenceLabs, MagiQ Technologies (acquired by Raytheon Technologies Corporation), Toshiba Corporation, Qubitekk, QuantumCTek Co. Ltd., PQ Solutions, Infineon Technologies AG, Anhui Qasky Quantum Technology Co. Ltd., NEC Corp., Microsoft Corp., Other Key Players, ,

Which region has the biggest share in Quantum Cryptography Market?In 2023, North America held a dominant market position in the quantum cryptography sector, capturing more than a 31.6% share of the global market.

What are the challenges of Quantum Cryptography?Despite its advantages, quantum cryptography also faces several challenges. One of the main challenges is the practical implementation of quantum cryptographic systems. While the principles of quantum mechanics are well understood, building practical quantum cryptographic systems that can be deployed in real-world scenarios is still a significant challenge.

What are the key drivers of growth in the quantum cryptography market?The key drivers of growth in the quantum cryptography market include increasing cybersecurity threats, the need for secure communication in various industries (such as finance, healthcare, and government), and advancements in quantum technologies.

Quantum Cryptography MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Quantum Cryptography MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ID Quantique

- QuintessenceLabs

- MagiQ Technologies (acquired by Raytheon Technologies Corporation)

- Toshiba Corporation

- Qubitekk

- QuantumCTek Co., Ltd.

- PQ Solutions

- Infineon Technologies AG

- Anhui Qasky Quantum Technology Co. Ltd.

- NEC Corp.

- Microsoft Corp.

- Other Key Players