Global Pulsed Field Ablation Market By Product Type (Catheters and Generators), By Indication (Atrial fibrillation and Non-atrial fibrillation), By End-Use (Inpatient facilities and Outpatient facilities), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177178

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

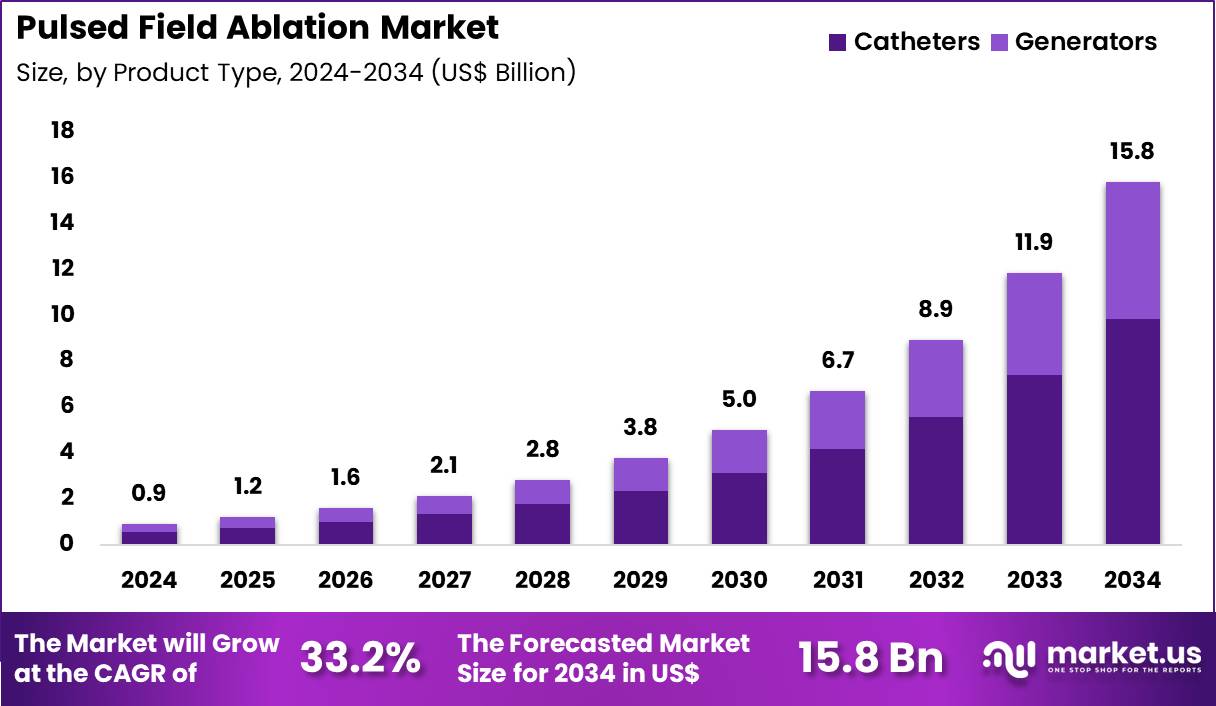

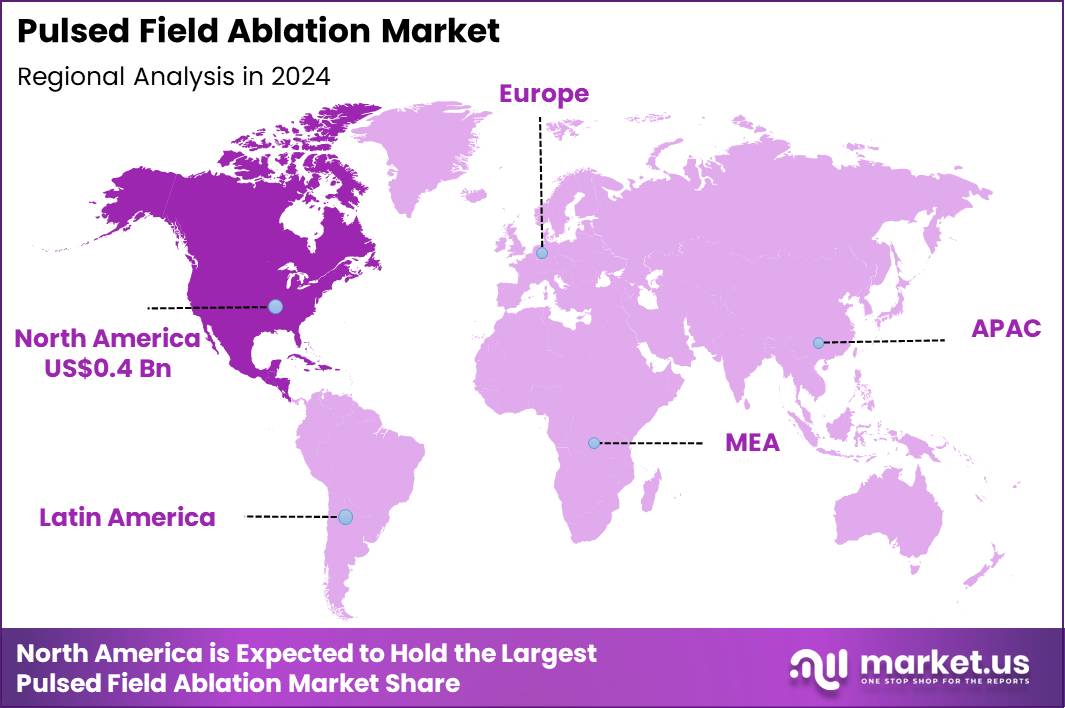

Global Pulsed Field Ablation Market size is expected to be worth around US$ 15.8 Billion by 2034 from US$ 0.9 Billion in 2024, growing at a CAGR of 33.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.1% share with a revenue of US$ 0.4 Billion.

Increasing prevalence of atrial fibrillation and other cardiac arrhythmias drives the pulsed field ablation market as electrophysiologists seek non-thermal techniques that selectively target myocardial tissue while preserving surrounding structures.

Clinicians increasingly apply pulsed field ablation catheters for pulmonary vein isolation in paroxysmal atrial fibrillation, delivering high-voltage electric pulses that create irreversible electroporation and restore sinus rhythm with minimal collateral damage. These systems support ventricular arrhythmia management by ablating scar-related substrates in post-infarction patients, reducing recurrence rates through precise lesion formation.

Interventional cardiologists utilize the technology in persistent atrial fibrillation cases, where multi-electrode configurations enable broad-area mapping and ablation in a single procedure. Pulsed field ablation also finds applications in treating atrial flutter, where operators isolate the cavotricuspid isthmus to interrupt reentrant circuits efficiently. Hybrid approaches combine the method with cryoablation for complex substrates, optimizing outcomes in patients with structural heart disease.

Manufacturers pursue opportunities to develop steerable, multi-polar catheters that enhance navigation and energy delivery, expanding applications in pediatric arrhythmias and congenital heart defects. Developers advance integration with real-time imaging modalities like intracardiac echocardiography, broadening utility in valve-related ablations where precision avoids conduction system injury.

These innovations facilitate outpatient procedures with reduced recovery times, appealing to high-volume centers managing rhythm disorders. Opportunities emerge in oncology adaptations where pulsed field ablation targets solid tumors through percutaneous access, minimizing thermal necrosis risks.

Companies invest in biocompatible electrode materials that improve durability and reduce thrombus formation during prolonged sessions. Recent trends emphasize AI-assisted mapping algorithms that predict optimal pulse parameters, positioning the market for enhanced procedural efficiency and patient safety across diverse arrhythmia therapies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.9 Billion, with a CAGR of 33.2%, and is expected to reach US$ 15.8 Billion by the year 2034.

- The product type segment is divided into catheters and generators, with catheters taking the lead with a market share of 62.4%.

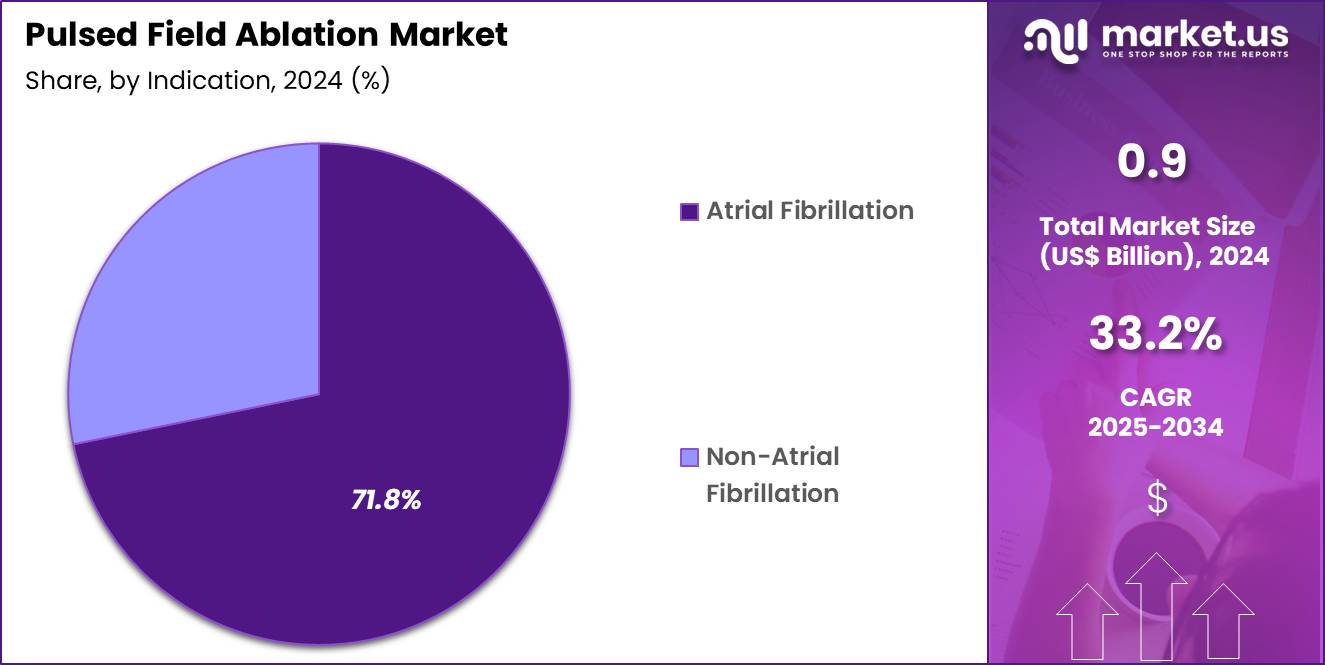

- Considering indication, the market is divided into atrial fibrillation and non-atrial fibrillation. Among these, atrial fibrillation held a significant share of 71.8%.

- Furthermore, concerning the end-use segment, the market is segregated into inpatient facilities and outpatient facilities. The inpatient facilities sector stands out as the dominant player, holding the largest revenue share of 66.1% in the market.

- North America led the market by securing a market share of 42.1%.

Product Type Analysis

Catheters contributed 62.4% of growth within product type and led the pulsed field ablation market due to their direct procedural use and single-use replacement cycle in ablation therapies. Electrophysiologists rely on advanced catheter designs to deliver precise pulsed electric fields to cardiac tissue while minimizing collateral damage.

Rising procedural volumes increase per-case catheter demand, which strengthens repeat purchasing. Innovations in catheter flexibility, mapping integration, and lesion consistency improve procedural confidence and adoption across electrophysiology labs.

Growth strengthens as hospitals standardize pulsed field ablation workflows that require dedicated catheter platforms. Training programs emphasize catheter handling and positioning, which reinforces device-specific usage.

Expanding clinical evidence supporting safety advantages over thermal ablation further accelerates uptake. Inventory stocking practices also increase unit consumption. The segment is expected to remain dominant as procedural expansion directly translates into higher catheter utilization.

Indication Analysis

Atrial fibrillation generated 71.8% of growth within indication and emerged as the leading segment due to the high global prevalence of arrhythmia and increasing demand for safer ablation techniques. Pulsed field ablation addresses atrial fibrillation by selectively targeting myocardial tissue while preserving surrounding structures, which improves safety outcomes. Physicians increasingly prefer this approach for pulmonary vein isolation procedures. Rising diagnosis rates and earlier intervention strategies expand the eligible patient population.

Growth accelerates as clinical guidelines evolve toward rhythm control strategies. Aging populations contribute to higher atrial fibrillation incidence, which increases procedure referrals. Reduced complication risk supports broader patient selection. Hospital adoption increases as outcome data matures. The segment is anticipated to maintain dominance as atrial fibrillation remains the primary clinical focus of pulsed field ablation innovation.

End-Use Analysis

Inpatient facilities accounted for 66.1% of growth within end-use and dominated the pulsed field ablation market due to their role in managing complex electrophysiology procedures. Hospitals provide comprehensive monitoring, anesthesia support, and post-procedural care that support early adoption of advanced ablation technologies. Most initial pulsed field ablation procedures occur in inpatient settings to ensure clinical oversight. High case complexity concentrates usage within hospital-based electrophysiology labs.

Growth continues as hospitals expand arrhythmia management programs and invest in next-generation ablation platforms. Reimbursement alignment favors inpatient procedural pathways during early adoption phases.

Teaching hospitals further increase utilization through training and clinical studies. Centralized referral patterns reinforce inpatient dominance. The segment is projected to remain the primary growth driver as hospitals continue to anchor advanced cardiac ablation services.

Key Market Segments

By Product Type

- Catheters

- Generators

By Indication

- Atrial fibrillation

- Non-atrial fibrillation

By End-Use

- Inpatient facilities

- Outpatient facilities

Drivers

Increasing prevalence of atrial fibrillation is driving the market.

The growing incidence of atrial fibrillation worldwide has substantially elevated the requirement for innovative treatments, including pulsed field ablation, to restore normal heart rhythm and reduce stroke risks in patients. Greater clinical awareness and improved electrocardiogram screening have led to more frequent diagnoses, expanding the patient pool eligible for ablation procedures.

Healthcare institutions are prioritizing these therapies to address the escalating burden on cardiovascular services. According to a study published in the Journal of the American College of Cardiology Advances, the overall prevalence of atrial fibrillation was 3.89% among U.S. adults from 2019 to 2023, based on data from 124,247,691 patients. This figure highlights the significant population affected and the corresponding demand for effective, tissue-selective ablation technologies.

Pulsed field ablation offers a non-thermal approach that minimizes collateral damage compared to traditional methods, appealing to electrophysiologists managing complex cases. The association between aging demographics and higher atrial fibrillation rates further intensifies the need for scalable interventional solutions.

Public health campaigns emphasize rhythm control strategies to mitigate long-term complications like heart failure. Leading developers are accelerating research to refine pulsed field systems for this expanding indication. This driver sustains investments in electrophysiology labs equipped for advanced arrhythmia management.

Restraints

High cost of pulsed field ablation systems is restraining the market.

The considerable pricing of pulsed field ablation consoles and catheters poses a barrier to adoption in healthcare settings with limited capital allocations. Intricate design elements for energy delivery and safety features contribute to substantial production expenditures. Smaller electrophysiology centers often encounter difficulties in justifying investments amid competing procedural priorities.

Certification processes for device reliability add layers of expense to implementation frameworks. Within communal health structures, resource distributions favor fundamental provisions over cutting-edge apparatuses. Operators might postpone integrations due to the notable initial and servicing disbursements entailed. This restraint influences dissemination, notably in nascent territories with sparse provisions.

Sector endeavors to engineer economical prototypes strive to counteract these impediments stepwise. Notwithstanding functional merits, fiscal elements obstruct inclusive rollout. Ameliorating procurement via incentives proves vital to surmounting this market encumbrance.

Opportunities

Strong growth in pulsed field ablation revenues is creating growth opportunities.

The notable increase in revenues from pulsed field ablation products indicates potential for broader utilization in arrhythmia management across clinical environments. Enhanced financial outcomes enable allocations toward refining device functionalities for diverse patient profiles.

Boston Scientific reported that it surpassed $1 billion in FARAPULSE revenue in 2024, treating over 200,000 patients with the device. This achievement reflects robust clinician acceptance and procedural volumes in electrophysiology practices. Cooperative ventures with care providers expedite the positioning of integrated systems in prolific centers.

The extensive operational foundation in progressed economies heightens vistas for apparatus augmentations. Modifications in therapeutic compensation fortify structural evolutions. Paramount entities are embarking on territorial proliferations to exploit financial rebounds. This prospect synchronizes with undertakings to exalt criteria in minimally intrusive examinations. Directed methodologies can engender conspicuous headways in particularized realms.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions shape the pulsed field ablation market through hospital capital discipline, electrophysiology lab utilization, and reimbursement visibility that leaders assess carefully. Inflation and elevated interest rates raise financing costs for new platforms and catheters, which slows rollout decisions in some cardiac centers.

Geopolitical tensions disrupt supplies of generators, semiconductors, and precision components, increasing lead times and operational risk. Current US tariffs on imported electronics and device subassemblies add cost pressure for manufacturers and distributors, which compresses margins and complicates pricing discussions. These factors can delay adoption among budget constrained hospitals and emerging programs.

On the positive side, trade friction accelerates domestic sourcing, local assembly, and supplier diversification for critical components. Strong clinical momentum for safer, non thermal ablation in atrial fibrillation sustains procedural demand. With focused investment, manufacturing resilience, and clear clinical value, the market continues to advance on a confident growth path.

Latest Trends

Regulatory approvals of novel pulsed field ablation systems is a recent trend in the market.

In 2024, the authorization of innovative pulsed field ablation platforms has broadened therapeutic options for managing persistent atrial fibrillation. These systems feature enhanced mapping capabilities to improve lesion creation precision during procedures.

Medtronic received U.S. Food and Drug Administration approval in October 2024 for its Affera Mapping and Ablation System with Sphere-9 Catheter. This all-in-one device supports both pulsed field and radiofrequency energy delivery for versatile arrhythmia treatment.

Fabricators are emphasizing hybrid functionalities to address varied clinical scenarios effectively. Evaluations confirmed safety profiles suitable for high-risk patient groups. The inclination responds to demands for efficient workflows in busy electrophysiology labs.

Supervisory pathways have adapted to expedite reviews for these complex technologies. Sector synergies concentrate on optimizing navigation for superior outcomes. These evolutions target reduced recurrence rates in challenging cases.

Regional Analysis

North America is leading the Pulsed Field Ablation Market

North America holds a 42.1% share of the global Pulsed Field Ablation market, manifesting impressive expansion in 2024 propelled by swift regulatory endorsements and heightened procedural volumes for atrial fibrillation management, emphasizing non-thermal energy delivery that spares adjacent tissues.

Renowned entities like Boston Scientific and Medtronic have accelerated deployments of their FARAPULSE and PulseSelect systems following FDA clearances, enabling electrophysiologists to perform quicker ablations with lower complication rates in high-risk patients.

The continent’s advanced cardiac centers have embraced these technologies to address escalating arrhythmia burdens, supported by comprehensive training programs that ensure proficient usage across urban and suburban facilities. Health policies advocating for outpatient shifts have spurred investments in versatile catheters and generators, optimizing cost-effectiveness amid reimbursement adjustments.

A proliferation of multicenter trials has demonstrated superior lesion durability, influencing guideline updates from cardiology associations. Strategic acquisitions and partnerships have enriched product pipelines, incorporating mapping integrations for precise energy applications.

Moreover, public health initiatives targeting cardiovascular prevention have indirectly boosted demand by identifying more candidates for early intervention. According to the Centers for Disease Control and Prevention, more than 454,000 hospitalizations with atrial fibrillation as the primary diagnosis occur each year in the United States.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts envision notable progression in the non-thermal cardiac therapy arena across Asia Pacific throughout the forecast period, since administrations prioritize expansions of specialized arrhythmia clinics to accommodate aging demographics vulnerable to irregular heart rhythms.

Corporations in Japan and South Korea pioneer adaptable catheter designs that align with varied anatomical profiles, while practitioners in India refine energy protocols to enhance durability in persistent cases. Healthcare networks in Vietnam secure international collaborations that introduce generator upgrades, facilitating precise treatments for paroxysmal episodes in expanding urban populations.

Financiers in Indonesia channel resources into device localization efforts that lower acquisition barriers, enabling tier-two hospitals to adopt innovative tools for ventricular applications. Policymakers in Thailand establish certification frameworks that validate system safety, attracting clinical investments for broader procedural access.

Clinicians in Malaysia leverage digital simulations to train teams on waveform optimizations, improving outcomes amid humid environmental challenges. Manufacturers in Australia customize balloon configurations that support hybrid approaches, gaining momentum in coastal medical hubs. Japan’s Ministry of Internal Affairs and Communications reported that the number of seniors aged 65 and older rose by 60,000 in September 2022, reaching a record 36.27 million.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the pulsed field ablation market grow by advancing next-generation energy delivery platforms and refining catheter designs that improve procedural precision, reduce collateral tissue damage, and shorten procedure times for electrophysiologists. They also expand clinical evidence through robust trials and real-world studies that demonstrate safety and efficacy, which supports stronger adoption among cardiology specialists.

Firms strengthen their commercial presence by establishing training programs, comprehensive sales support, and post-market services that reinforce customer confidence and long-term utilization. Strategic partnerships with leading cardiac centers and key opinion leaders help embed solutions into clinical practice and accelerate preference among high-volume ablation sites.

Boston Scientific exemplifies a leading medical technology company with a broad electrophysiology portfolio, expansive global distribution, and coordinated engagement with the cardiovascular community to translate emerging procedural needs into product innovation.

The company advances its growth agenda through disciplined investment in research, targeted alliance building, and a customer-centric commercialization strategy that aligns technological enhancements with evolving clinical expectations.

Top Key Players

- Boston Scientific

- Medtronic

- Johnson and Johnson MedTech

- Abbott

- Biosense Webster

- Farapulse

- Kardium

- Galaxy Medical

- Adagio Medical

- Acutus Medical

Recent Developments

- In November 2024, the FDA approved the VARIPULSE Platform from Johnson & Johnson MedTech for the treatment of drug-refractory paroxysmal atrial fibrillation. The platform combines pulsed field ablation therapy with integration into the CARTO 3 System, enabling advanced three-dimensional electroanatomical mapping to support precise cardiac ablation procedures.

- In October 2024, Boston Scientific Corporation received FDA clearance for the FARAWAVE NAV Ablation Catheter for use in paroxysmal atrial fibrillation treatment. The approval also covers the FARAVIEW Software, which improves visualization during ablation when paired with the FARAPULSE Pulsed Field Ablation System and the OPAL HDx Mapping System, supporting enhanced procedural guidance.

Report Scope

Report Features Description Market Value (2024) US$ 0.9 Billion Forecast Revenue (2034) US$ 15.8 Billion CAGR (2025-2034) 33.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Catheters and Generators), By Indication (Atrial fibrillation and Non-atrial fibrillation), By End-Use (Inpatient facilities and Outpatient facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Boston Scientific, Medtronic, Johnson and Johnson MedTech, Abbott, Biosense Webster, Farapulse, Kardium, Galaxy Medical, Adagio Medical, Acutus Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pulsed Field Ablation MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Pulsed Field Ablation MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Boston Scientific

- Medtronic

- Johnson and Johnson MedTech

- Abbott

- Biosense Webster

- Farapulse

- Kardium

- Galaxy Medical

- Adagio Medical

- Acutus Medical