Global PU Films Market Size, Share, And Industry Analysis Report By Form (Monolayer PU Films, Multilayer PU Films, PU Laminates), By Application (Surface Protection Films, Technical Membrane Films, Medical and Hygiene Films), By End-Use (Automotive and Transportation, Medical and Healthcare, Textiles, Outdoor and Footwear, Electronics and Consumer, Offshore and Marine Structures), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175065

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

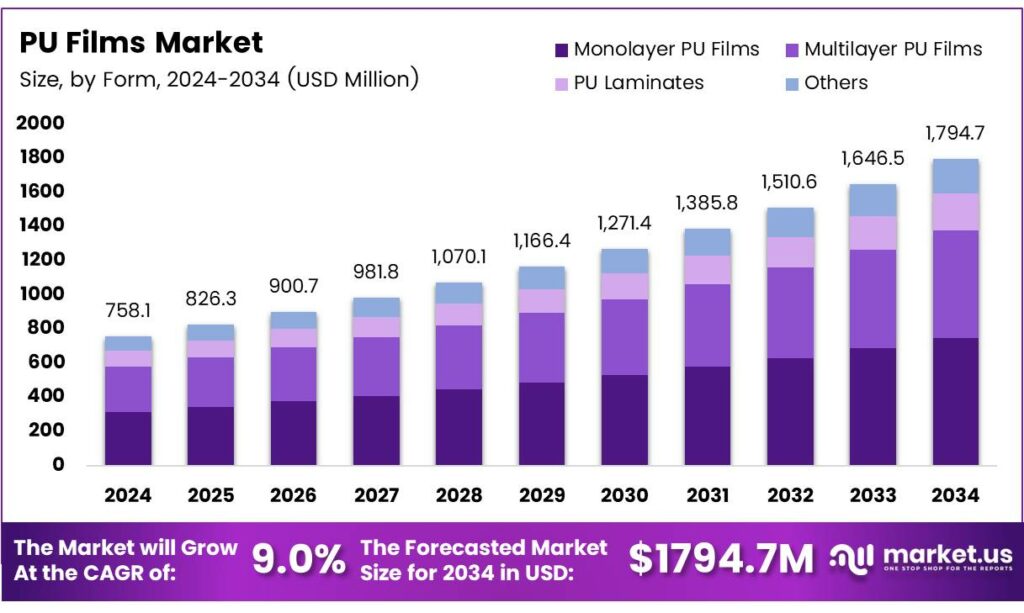

The Global PU Films Market size is expected to be worth around USD 1794.7 million by 2034, from USD 758.1 million in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034.

The PU Films Market refers to the global industry producing polyurethane-based films known for flexibility, durability, and high-performance barrier strength. These films are widely used across automotive, medical, textiles, electronics, and packaging sectors due to their superior abrasion resistance, elasticity, and chemical stability. A growing sustainability focus is reshaping product innovation.

The PU Films industry continues to gain traction as manufacturers adopt lightweight, durable materials to meet evolving performance and regulatory needs. Increasing demand for medical-grade films, breathable films for textiles, and high-strength protective films strengthens long-term opportunities. Governments encouraging cleaner manufacturing further accelerate PU Films Market expansion worldwide.

- Polyurethane film below 25 μm maintains corrosion resistance without stressing stent structures. Further, straining films to 225% and applying plasma treatment enhanced biocompatibility without altering mechanical performance. Another study by Mazumder et al. revealed corrosion rates improving from 275 μm/year uncoated to below 13 μm/year with a 30 g/m polyurethane layer.

Toward the scientific front, several studies reveal polyurethane’s biodegradation potential, shaping material innovation. The strain survived solely on polyether polyurethane for 30 days. Moreover, Alternaria sp. PURDK2 research showed 27% degradation in one week, while C. Pseudocladosporioides T1.PL.1 achieved 80% degradation in two weeks. The market progresses as sectors modernize their material selection to enhance efficiency, product lifespan, and environmental compliance.

Healthcare infrastructure and high-performance industrial coatings continue to generate steady demand. PU film suppliers benefit from policies supporting import substitution and eco-friendly polymer manufacturing, creating favourable project pipelines. Microelectronics, flexible wearables, and protective automotive components open additional growth avenues. Businesses are prioritizing recyclable and solvent-free polyurethane films to align with global sustainability frameworks.

Key Takeaways

- The Global PU Films Market is projected to reach USD 1794.7 million by 2034 from USD 758.1 million in 2024, at a strong CAGR of 9.0% during 2025–2034.

- Monolayer PU Films lead the By Form segment with a dominant share of 38.4%.

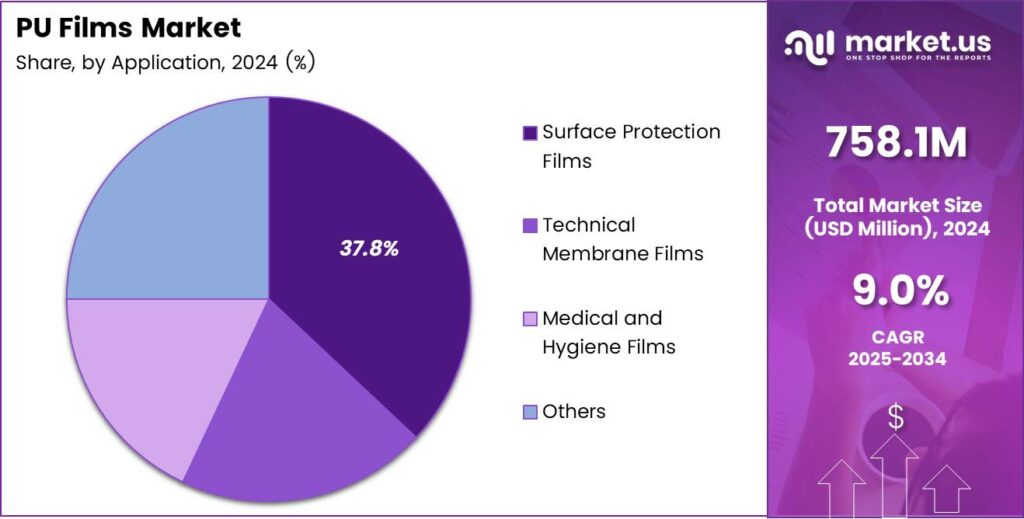

- Surface Protection Films hold the highest share in the By Application segment at 37.8%.

- Automotive and Transportation is the top end-use segment, capturing 29.6% of the market.

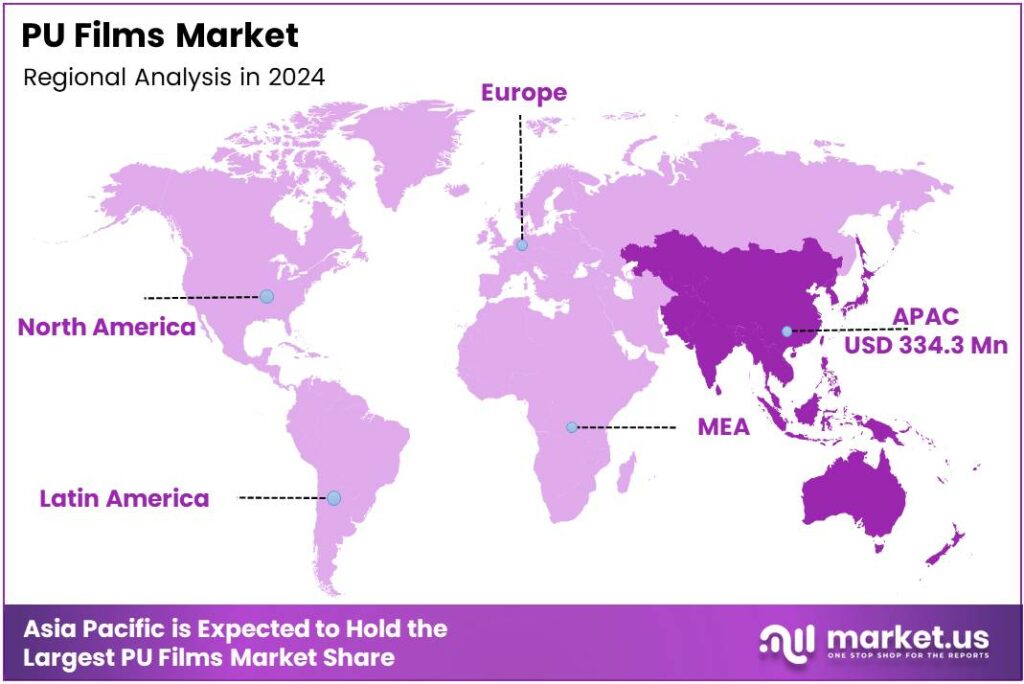

- Asia Pacific dominates the global PU Films Market with a share of 44.1%, valued at USD 334.3 million.

By Form Analysis

Monolayer PU films dominate with 38.4% due to their balanced performance and material efficiency.

In 2025, Monolayer PU Films held a dominant market position in the By Form Analysis segment of the PU Films Market, with a 38.4% share. These films gained traction as they provide reliable strength, flexibility, and clarity. Their cost-effectiveness further supports adoption across industries.

Multilayer PU Films continued expanding as industries sought enhanced durability and barrier properties. These films deliver stronger protection and improved functional layers, making them suitable for demanding applications. Their growing use in automotive, medical, and industrial settings strengthens long-term market penetration.

PU Laminates advanced steadily, driven by the need for improved adhesion, structural integrity, and processing ease. They enable better bonding with textiles and technical substrates, supporting their broad application in footwear, medical goods, and protective clothing.

Others in the form segment included specialized and emerging PU film types. These alternatives gained attention where customization, performance variation, or niche requirements were essential. Their adoption improved as manufacturers diversified solutions for unique industrial uses.

By Application Analysis

Surface Protection Films dominates with 37.8%, driven by rising demand for product safety and durability.

In 2025, Surface Protection Films held a dominant market position in the By Application Analysis segment of the PU Films Market, with a 37.8% share. These films ensured scratch resistance, environmental shielding, and long-term surface quality, making them essential across electronics, automotive, and industrial goods.

Technical Membrane Films expanded steadily as their advanced filtration, moisture control, and breathability supported applications in outdoor gear, infrastructure, and high-performance textiles. Their reliability in harsh environments contributed to wider adoption.

Medical and Hygiene Films grew due to rising needs for sterile packaging, wearable medical devices, and protective healthcare materials. Their biocompatibility and skin-comfort properties made them suitable for safe and hygienic medical usage. Others in applications covered specialty uses that required tailored performance.

By End-Use Analysis

Automotive and transportation dominate with 29.6%, supported by the rising use of lightweight and durable materials.

In 2025, Automotive and Transportation held a dominant market position in the By End-Use Analysis segment of the PU Films Market, with a 29.6% share. These films enhanced vehicle interiors, protection layers, and lightweight components, aligning with manufacturers’ efficiency and design goals.

Medical and Healthcare continued progressing as PU films offered safe, flexible, and biocompatible solutions for medical devices, wound dressings, and hygiene products. Their performance and skin comfort supported expanding applications. Textiles, Outdoor, and Footwear grew consistently, driven by rising demand for water-resistant, breathable, and durable materials.

PU films enhance comfort, protection, and product longevity across lifestyle and performance apparel. Electronics and Consumer relied increasingly on PU films for protective films, flexible components, and device durability. Their clarity and mechanical strength supported growth in modern consumer electronics.

Offshore and Marine Structures utilized PU films for corrosion resistance and structural protection in harsh environments. Their robustness supported long-term material stability. Others included specialized industrial uses requiring tailored film characteristics. These applications broadened PU film adoption across niche sectors.

Key Market Segments

By Form

- Monolayer PU Films

- Multilayer PU Films

- PU Laminates

- Others

By Application

- Surface Protection Films

- Technical Membrane Films

- Medical and Hygiene Films

- Others

By End-Use

- Automotive and Transportation

- Medical and Healthcare

- Textiles, Outdoor, and Footwear

- Electronics and Consumer

- Offshore and Marine Structures

- Others

Emerging Trends

Growing Adoption of Sustainable and High-Performance PU Films Shapes Market Trends

The PU Films Market is experiencing notable trends that are reshaping the competitive landscape. A major trend is the rapid move toward sustainable and bio-based PU films as industries seek materials with lower environmental impact. Companies are investing in research to create recyclable and biodegradable options that match the performance standards of traditional PU.

- Electric car sales topped 17 million in 2024, rising by more than 25% versus the year before. The IEA also notes that EVs reached more than 20% of global car sales in 2024, with China alone selling over 11 million electric cars that year. For PU film producers and downstream users, this creates friction: onboarding new staff takes longer, audits become more frequent, and procurement may shift toward simpler-to-handle alternatives where possible.

The expansion of PU usage in advanced textiles, outdoor gear, and sportswear. The demand for breathable, waterproof, and lightweight materials continues to rise, especially in premium and technical clothing lines. The growth of flexible electronics and smart wearables has increased interest in PU films due to their strong mechanical and electrical properties.

Drivers

Rising Use of PU Films in Protective Applications Drives Growth

The PU Films Market is growing steadily as industries increasingly look for materials that offer flexibility, strong resistance, and safe performance. One of the key drivers is the increasing demand for PU films in protective applications, including surface protection, medical films, and technical membranes.

- These films offer excellent durability and transparency, making them suitable for applications where both strength and appearance are important. The shift toward lightweight and high-performance materials across automotive, medical, and electronics sectors. The EU generated 35.3 kg of plastic packaging waste per person, and only 14.8 kg per person was recycled.

Manufacturers prefer PU films because they are easy to process, offer strong bonding properties, and enhance product lifespan. The market also benefits from the rising awareness of sustainable and recyclable materials, as polyurethane films align with ongoing innovation in eco-friendly material development. These factors collectively contribute to strong and sustained market expansion.

Restraints

High Production Costs of PU Films Limit Wider Adoption

The PU Films Market faces certain restraints that slow down its growth, despite strong industrial demand. One of the key challenges is the comparatively higher cost of polyurethane films when compared to PVC or PE alternatives.

This makes it difficult for budget-sensitive industries to shift completely toward PU-based products, especially in large-scale applications. The sensitivity of PU films to specific environmental conditions, such as moisture and high heat, may impact performance in some settings.

The need for specialized processing technology further adds to operational complexity, discouraging smaller manufacturers from entering the market. Fluctuating raw material prices linked to petrochemical feedstocks can create uncertainty for producers. These factors collectively create hurdles that restrict the market’s full potential.

Growth Factors

Rising Demand for Medical and Hygiene Films Creates Strong Opportunities

The PU Films Market is witnessing promising growth opportunities, especially with the expanding use of PU films in medical and hygiene applications. These films offer breathability, softness, and skin-friendly properties, making them suitable for wound dressings, surgical drapes, and wearable medical devices.

As healthcare systems modernize worldwide, demand for premium-quality medical materials is expected to rise sharply. There is also a growing opportunity in the automotive and textile industries, where PU films are used for lightweight interiors, laminates, and waterproof fabrics.

The shift toward high-performance wearable technology further opens new application areas. In addition, advancements in biodegradable PU film formulations are creating opportunities for companies focusing on sustainability. These innovations allow manufacturers to develop environmentally friendly alternatives and tap into emerging green material markets.

Regional Analysis

Asia Pacific Dominates the PU Films Market with a Market Share of 44.1%, Valued at USD 334.3 Million

The Asia Pacific region leads the global PU Films Market, driven by strong manufacturing bases, expanding automotive production, and rapid growth in medical and hygiene applications. The region’s dominance, with a share of 44.1% worth USD 334.3 million, is supported by rising investments in high-performance polymer materials and increased demand for protective and technical films.

North America shows steady adoption of PU films, supported by technological advancements and a rising shift toward durable, high-quality materials in automotive, healthcare, and consumer applications. Regulatory support for sustainable and high-performance polymer films also contributes to regional growth. Demand is additionally strengthened by increased utilization of PU films in medical devices, protective garments, and specialty packaging.

Europe maintains strong market relevance due to its mature industrial ecosystem and emphasis on environmentally responsible materials. Growing interest in lightweight automotive components, technical textiles, and medical films continues to support PU film usage. Strict sustainability and safety standards further encourage the adoption of advanced polyurethane-based solutions across key industries.

The U.S. market benefits from robust demand across healthcare, defense, automotive, and electronics applications. Innovation in bio-based and high-durability PU films is strengthening the country’s adoption patterns. The presence of strong research activity and a strong focus on premium performance materials continues to push the market forward.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global PU Films Market in 2025 reflects strong advancements in high-performance materials, and leading companies are shaping innovation through sustainability, product diversification, and application-driven upgrades.

Covestro AG continues to strengthen its role by advancing TPU- and PU-based specialty films that support automotive, medical, and consumer industries. The company’s focus on circular material solutions positions it at the center of premium-grade film adoption.

BASF maintains a solid presence by leveraging its polyurethane systems expertise, enabling PU films with enhanced mechanical strength, durability, and environmental resistance. Its integrated chemical platforms support tailored solutions across healthcare, textiles, and protective applications, reinforcing customer-specific developments in 2025.

Lubrizol builds on its strong TPU portfolio, emphasizing performance films designed for breathable, flexible, and chemical-resistant applications. Its innovations continue to move toward lightweight, high-function films for medical, sports, and electronics markets, ensuring consistency in specialty-grade material supply.

SWM International Corp. remains influential through engineered films that meet stringent industry requirements for precision, clarity, and function. Its PU-based films cater to filtration, industrial, and protective segments, supported by a strategy that aligns material science with end-user performance needs.

Top Key Players in the Market

- Covestro AG

- BASF

- Lubrizol

- SWM International Corp.

- 3M

- AMERICAN POLYFILM, INC.

- AVERY DENNISON CORPORATION

- Permali Gloucester Ltd.

- Coveris

- DingZing Advanced Materials Inc.

Recent Developments

- In 2025, Covestro will focus on advancing thermoplastic polyurethane (TPU) films for medical, electronics, textiles, and automotive applications. Covestro highlighted materials for healthcare at MD&M West, including Dureflex MA5000 TPU film on paper carrier for high-performance medical applications, and Platilon TPU flexible films for durable wearable devices and wound care.

- In 2025, BASF will emphasize sustainable TPU films and PU solutions in footwear, recycling, and battery applications. BASF collaborated with San Fang and Nichetech on GRS-certified TPU films for the footwear industry, advancing circular economy goals toward net-zero.

Report Scope

Report Features Description Market Value (2024) USD 758.1 Million Forecast Revenue (2034) USD 1794.7 Million CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Monolayer PU Films, Multilayer PU Films, PU Laminates, Others), By Application (Surface Protection Films, Technical Membrane Films, Medical and Hygiene Films, Others), By End-Use (Automotive and Transportation, Medical and Healthcare, Textiles, Outdoor and Footwear, Electronics and Consumer, Offshore and Marine Structures, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Covestro AG, BASF, Lubrizol, SWM International Corp., 3M, AMERICAN POLYFILM, INC., AVERY DENNISON CORPORATION, Permali Gloucester Ltd., Coveris, DingZing Advanced Materials Inc. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Covestro AG

- BASF

- Lubrizol

- SWM International Corp.

- 3M

- AMERICAN POLYFILM, INC.

- AVERY DENNISON CORPORATION

- Permali Gloucester Ltd.

- Coveris

- DingZing Advanced Materials Inc.