Global Protein Ingredients Market; By Product Type (Microbe-Based Proteins, Animal Proteins, Plant Proteins, and Insect Proteins); By Application (Infant Formulations, Animal Feed, Food & Beverages); By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2023-2033

- Published date: Nov 2023

- Report ID: 20358

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

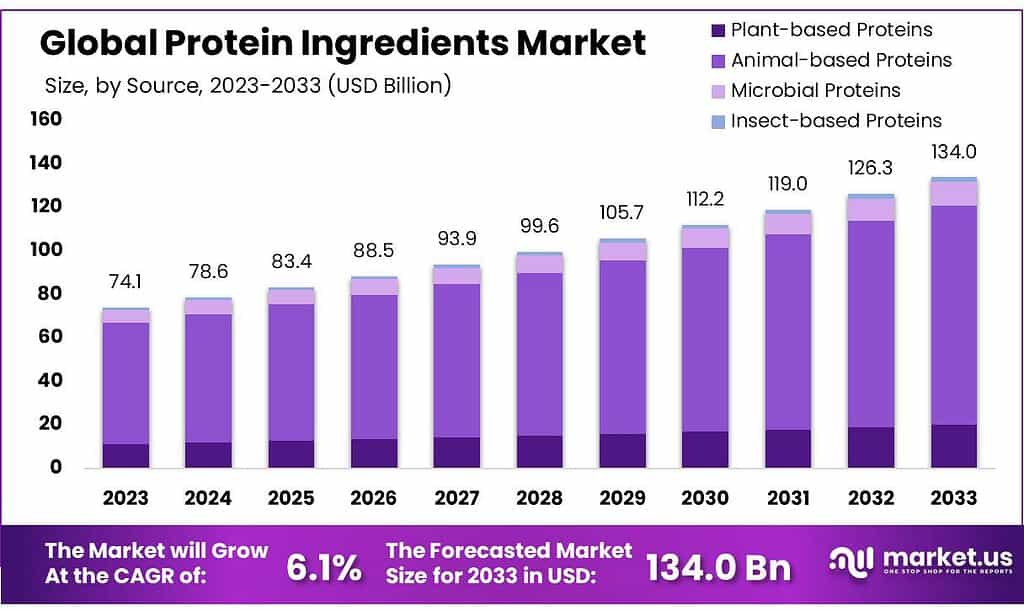

The global Protein Ingredients market size is expected to be worth around USD 134.0 billion by 2033, from USD 74.1 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

Demand for protein ingredients market is on the rise, and there is high demand for food products such as margarine and cold cuts. The market growth is rising due to the changing consumption patterns of these products by both the elderly and health-conscious consumers. Clean eating and a healthy lifestyle are the key trends leading to a considerable increase in awareness of health and functional ingredients.

Moreover, this market is also expected to benefit from tremendous growth opportunities due to the increased innovation of proteins from different manufacturers. These proteins are a wide range of amino acids for serving specific functions such as weight loss, muscle repair, energy balance, and satiety.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth and Projection: The protein ingredients market is anticipated to reach USD 134.0 billion by 2033, growing from USD 74.1 billion in 2023, with a CAGR of 6.1%. This growth is driven by changing consumption patterns and increased awareness of health and functional ingredients.

- Animal-based proteins dominated the market in 2023, capturing over 75.4% of the liquid biopsy market, offering recognized health benefits. Whey, in particular, has shown benefits in enhancing nutrition and immunity.

- Plant proteins, with lower costs than animal-derived counterparts, are gaining traction, especially in regions embracing veganism. Soy, wheat, and pea proteins are prominent choices, with pea protein showing a projected revenue-based CAGR of 12.9%.

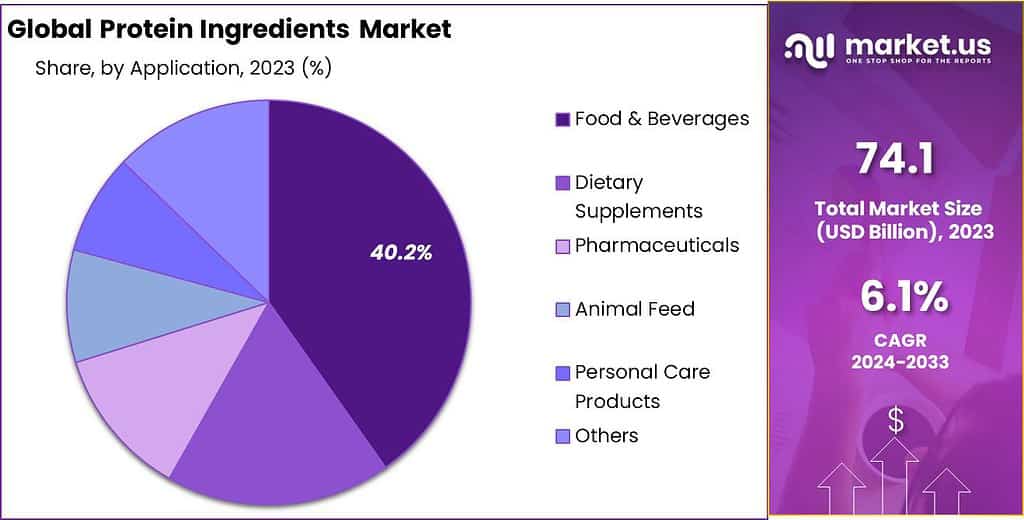

- Application Trends: Food and beverages accounted for 40.2% of the market share in 2023, showcasing a surge in the consumption of protein-enriched products. Infant Formulations are expected to witness significant growth, catering to the nutrition needs of infants.

- Market Drivers: The aftermath of COVID-19 propelled a heightened focus on health and nutrition, escalating protein consumption for a stronger immune system.

- Market Restraints: Restrictions based on religious and dietary rules against consuming animal-derived products, such as gelatin from pork, limit market growth in certain regions.

- Opportunities: Dairy and plant-based proteins are poised for growth, tapping into the demand for functional and healthier food products. Plant proteins are gaining popularity due to sustainability concerns and cultural preferences in various regions.

- Challenges: Concerns over genetically modified (GM) ingredients used in plant-based foods raise worries about food safety, posing challenges to consumer acceptance.

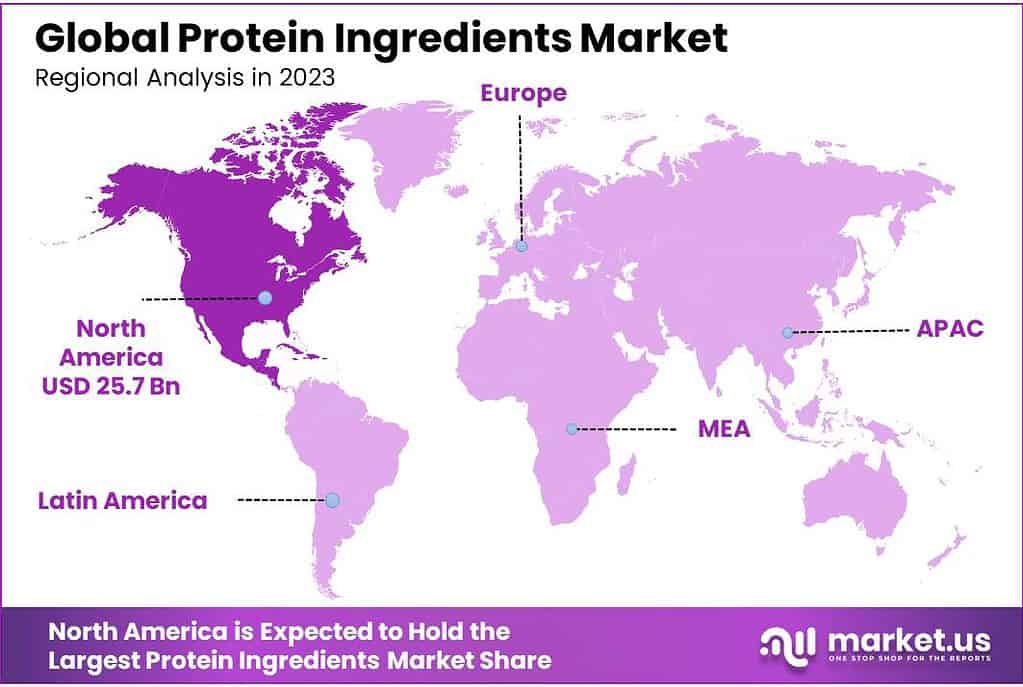

- Regional Insights: North America holds a significant market share, driven by increased consumption of protein-rich foods. Europe, specifically Germany, sees high demand for medical and geriatric nutrition products. The Asia Pacific region is forecasted to experience rapid growth, with China leading in animal- and plant-based protein ingredients.

- Key Players and Developments: Major players in the market include DuPont, Cargill, ADM, Kerry Group plc, among others. Recent developments, like Roquette’s food innovation center and IFF’s launch of soy-based plant protein, indicate industry advancements.

By Source

In 2023, Animal-based Proteins were the top choice in the Liquid Biopsy market, grabbing over 75.4% of the spotlight. These proteins, gathered from animals, are crucial for liquid biopsy tests that detect diseases like cancer by analyzing blood samples.

Animal protein ingredients offer many health benefits that have been confirmed by scientific evidence and are recognized by government food regulatory agencies. This is expected to continue to drive segment growth and future trends, owing to the high demand for animal by-products.

Whey, for example, increases glutathione levels and improves nutrition and immunity in patients who are undergoing chemotherapy.

The cost of plant proteins is much lower than animal-derived versions, which is also expected to fuel segment growth. In North America and Europe, veganism is a key trend that encourages the use and consumption of plant-based ingredients.

Soy and wheat products are being increasingly adopted because they are perceived as healthier than their animal-based counterparts. Although pea protein is less popular than soy protein and wheat protein, its revenue-based CAGR is projected to be 12.9% over the forecast period.

Because of their use in personal care and cosmetics, the demand for cereal-based ingredients is slated to continue to grow. Corn-based ingredients are used in hair and skin care products as a pacifying, skin conditioning, and hair conditioning agent. This is set to rise the demand for plant protein in the near future.

The growing acceptance of legumes as a protein source is driving the segment for legume-based proteins. This is leading to an expansion of plant protein as a nutritional supplement.

The protein ingredients market size is expected to be influenced by the growing consumption of legume-based snacks. Consumers are increasingly accepting healthy food due to increasing incidences of obesity, digestive problems, and diabetes.

It is clear that legumes are able to prevent or reduce the onset and progression of several health disorders, such as cell damage and high blood pressure. This is proliferating the demand for nutritious food products.

The growth in animal feed applications has led to an increase in the demand for micro-based protein products. The growing use of microbe-based protein in aquaculture feed is one of the key factors driving this segment’s growth. This is due to the increase in fish farming worldwide, which accounts for half of the world’s fish supplies for food applications.

This number will continue to increase over the next few decades, which will lead to a surge in microbe-based protein segments. It is a key ingredient that supplies aquaculture with nutritive value as well as high-quality amino acids.

Application Analysis

In 2023, Food & Beverages were at the top in the Protein Ingredients market, grabbing over 40.2% of the market share. These ingredients are widely used in foods and drinks to add extra protein.

The quality of whey products has improved due to technological advances and process design. To make functional food and beverage products and give them a more nutritional profile, these advances have allowed for the increased use of protein ingredients.

Beverages that contain protein ingredients can be used to make liquid form. Ready-to-drink, protein-rich beverages are gaining popularity among fitness-conscious consumers. This is slated to increase the consumption of healthy food as well as expand the beverages segment in the future.

These ingredients can also be used in beverages to enhance textural properties and increase their particulate levels. These are key driving factors to increase the value of other beverages and improve overall consistency.

As protein is an important component of infant diets, the application segment for Infant Formulations is expected to grow significantly in the coming years. Premixes can contain animal, plant, or egg protein. For infant nutrition, formulas that contain milk protein concentrates or isolates are popular. It is available in dry form, ready-to-eat, and liquid concentrate forms.

There are many products made from cow milk, including partially hydrolyzed and concentrated whey protein, a combination of casein, and non-fat milk. This is giving rise to a wide variety of dairy applications across various business segments.

The biopharmaceutical sector has registered a spike in the number of products containing protein ingredients due to the increasing research and development endeavors in protein-based products. These form of protein ingredients are in high demand due to the increasing awareness of nutrition deficiencies and health consciousness and is responsible for the growth of protein ingredients market size.

Note: Actual Numbers Might Vary In the Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Source

- Microbe-Based Proteins

- Animal/Diary Proteins

- Plant Proteins

- Insect Proteins

By Application

- Food & Beverages

- Protein Bars

- Protein Beverages

- Meat Alternatives

- Dairy Products

- Dietary Supplements

- Pharmaceuticals

- Animal Feed

- Personal Care Products

- Others

Drivers

After the chaos of COVID-19, people started paying more attention to their health. A study in 2022 showed that folks who ate healthier felt more secure and focused on staying safe. This whole experience made everyone think about keeping their immune system strong to avoid getting sick easily.

Today, due to this, there is an increase in protein consumption within our diets, as people seek ways to stay healthier and prevent illness through eating better. This means more folks are looking for food with extra protein to boost their immune systems.

COVID-19 changed how we think about staying healthy, and now, more than ever, people are into foods with protein to help them stay strong. This is making the demand for protein ingredients go way up worldwide.

Restraints

Gelatin is used in lots of food and medicine stuff, but here’s the thing: it’s made from animal parts like bones, hides, and hooves. For some people, especially those with religious or dietary rules against eating animal stuff, gelatin is a no-go.

For example, in Muslim and Middle Eastern communities, pork and anything from pigs are a strict no-no. They prefer products made from cows that are certified as halal.

Because of this, the market for gelatin from pork skin is pretty much zero in these areas. This limits the growth of gelatin products in regions where cultural or religious rules restrict using animal-derived stuff.

Opportunities

The future looks bright for protein ingredients, especially dairy and plant-based ones. Dairy suppliers can tap into the trend for more functional products and people’s interest in healthier foods.

Plant-based proteins are on the rise too, thanks to more folks going vegan. People are concerned about sustainability and animal treatment, pushing them toward plant sources. In places like Islamic nations where animal proteins, especially from pork, are a no-go, and in countries like India and Nepal where beef-based proteins are avoided due to cultural and religious reasons, plant proteins are gaining popularity.

The growing interest in dairy and plant proteins presents companies in this market with an incredible opportunity for expansion. There’s great promise in these dynamic industries that offer plenty of growth potential.

Challenges

One major cause for concern in food and drinks is the widespread use of genetically modified (GM) ingredients like soy, wheat, and peas. They’re often made in factories using hexane-based processes which may pose health risks when taken in large doses by consumers.

This has made folks globally concerned about plant-based foods made from these GM ingredients.

In places like Asia Pacific and Europe, regulators now demand that food labels tell us if the ingredients are GM or not. These GM ingredients might cause allergies and could have residues from weed killers. This creates problems for the plant-based protein market.

Take the Impossible Burgers in the US, for example. They used soybeans made from GMOs and got some side-eye from consumers because of the inorganic bits and weed killers in them.

Overall, using GM ingredients in plant-based foods raises worries about food quality and safety. It’s a challenge for the market as people become more cautious about what’s in their food.

Regional Analysis

North America held the largest share of the regional market, accounting for over 34.7% of global revenues in 2023. A growing number of people are now eating more protein-rich foods such as snacks, egg protein, and cold cereals.

Companies in North America such as Mead Johnson, and Cargill Inc., for example, have introduced new products, including Enfamil Human Milk Fortifier Liquid High Protein, to meet consumer demand for low-sodium and cholesterol-free beverages.

Germany was Europe’s largest revenue earner in 2020. Medical and geriatric nutrition products that aid in maintaining bone and muscle health have been in high demand due to the surge in German geriatric populations. These ingredients have been in high demand in recent years. This market has also been positively affected by the inclusion of protein ingredients to treat Alzheimer’s disease.

The Asia Pacific will experience the fastest revenue growth over the forecast period, due to emerging markets in India and China. China is one of the major players in animal- and plant protein ingredient market products due to its easy access to raw materials.

In Asia Pacific, China is a big consumer of soy protein. Soy was responsible for over 91% of the plant-based protein market. In the coming years, South Korea, Malaysia, and Indonesia will be reliant on the packaged foods and beverages industry, which is expected to drive protein ingredients market growth in China, Indonesia, South Korea, and India.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Saudi Arabia

- Rest of MEA

Key Players Analysis

The market for protein ingredients is extremely competitive. Global market manufacturers are using innovative strategies to increase their product offerings and brand recognition. Innovative strategies like creating a plant-based product line, and expanding their product reach by acquisitions, etc are adopted.

The prominent players who have the largest market share dominate the industry. However, the main strategies of companies in the protein ingredients industry are geographic expansion, product innovation, mergers and acquisitions, and joint ventures.

Industry participants in the competitive landscape are likely to be successful over the next few decades by incorporating protein powders into different products. They are also expanding their range of protein derivatives in key countries. Bunge Limited, for example, expanded its clean-label ingredients portfolio by adding functional flour made from lentils. These new products are high in protein and can be used as a replacement for modified starches.

Кеу Маrkеt Рlауеrѕ

- DuPont

- Fonterra Co-operative Group Limited

- Cargill, Incorporated

- ADM

- Kerry Group plc

- Arla Foods amba

- BRF Global

- International Flavors & Fragrances Inc.

- Royal FrieslandCampina NV

- Glanbia plc

- Solae LLC

- Axiom Food Inc.

- Davisco Foods International, Inc.

- Roquette Freres S.A.

- FrieslandCampina DMV B.V

Recent Developments

In June 2023, Roquette unveiled the new food innovation center, in Lestrem, France. This center will include a sensory analysis laboratory, a demonstration kitchen, and collaborative labs for pilot-scale testing of various plant-based ingredients.

In November 2022, International Flavors & Fragrances Inc., which merged with DuPont’s Nutrition & Biosciences business segment, launched Supro Tex, a soy-based plant protein ingredient. The ingredient has 80% protein content which gives it a protein profile comparable to animal meat. It is the newest addition to IFF’s Reimagine-Protein Program commenced in 2017. The launch will help DuPont expand its product portfolio in the plant-based protein ingredients category.

Report Scope

Report Features Description Market Value (2023) USD 74.1 Billion Forecast Revenue (2033) USD 134 Billion CAGR (2023-2032) 6.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Microbe-Based Proteins, Animal Proteins, Plant Proteins, and Insect Proteins); By Application (Infant Formulations, Animal Feed, Food & Beverages) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DuPont, Cargill, Incorporated, ADM, Kerry Group plc, Arla Foods amba, BRF Global, Fonterra Co-operative Group Limited, International Flavors & Fragrances Inc., Royal FrieslandCampina NV, Glanbia plc, Solae LLC, Axiom Food Inc., Davisco Foods International, Inc., Roquette Freres S.A., FrieslandCampina DMV B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are protein ingredients?Protein ingredients are compounds derived from various sources, such as plants (soy, pea, rice), animals (whey, casein, egg), or microorganisms (such as algae or yeast), that are rich in protein content.

What are the primary applications of protein ingredients?Protein ingredients are used in a wide range of applications including food and beverages, dietary supplements, animal feed, pharmaceuticals, and cosmetics.

Are plant-based protein ingredients gaining more popularity?Yes, plant-based protein ingredients are experiencing significant growth due to factors like environmental concerns, health consciousness, ethical reasons, and the increasing variety and quality of plant-based protein sources.

What are the geographical trends in the protein ingredients market?The market growth varies across regions due to differing dietary habits, economic factors, and consumer preferences. However, regions like North America and Europe have shown significant growth in the consumption of protein ingredients.

-

-

- DuPont

- Fonterra Co-operative Group Limited

- Cargill, Incorporated

- ADM

- Kerry Group plc

- Arla Foods amba

- BRF Global

- International Flavors & Fragrances Inc.

- Royal FrieslandCampina NV

- Glanbia plc

- Solae LLC

- Axiom Food Inc.

- Davisco Foods International, Inc.

- Roquette Freres S.A.

- FrieslandCampina DMV B.V