Global Protein Expression Market By Expression System (Prokaryotic Expression Systems, Yeast Expression Systems, Insect Cell Expression Systems, Mammalian Cell Expression Systems, Cell-Free Protein Expression Systems and Plant-Based and Algal Expression Systems), By Product Type (Reagents and Kits, Expression Vectors and Plasmids, Competent Cells and Cell Lines, Instruments and Services), By Workflow Stage (Gene Cloning and Vector Design, Host Cell Transformation or Transfection, Protein Expression and Induction, Protein Purification and Characterization), By Application (Therapeutic Protein Development, Research Applications, Diagnostic Applications and Industrial and Enzyme Applications), By End-User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutions, CROs & CDMOs and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172914

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Expression System Analysis

- Product Type Analysis

- Workflow Stage Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

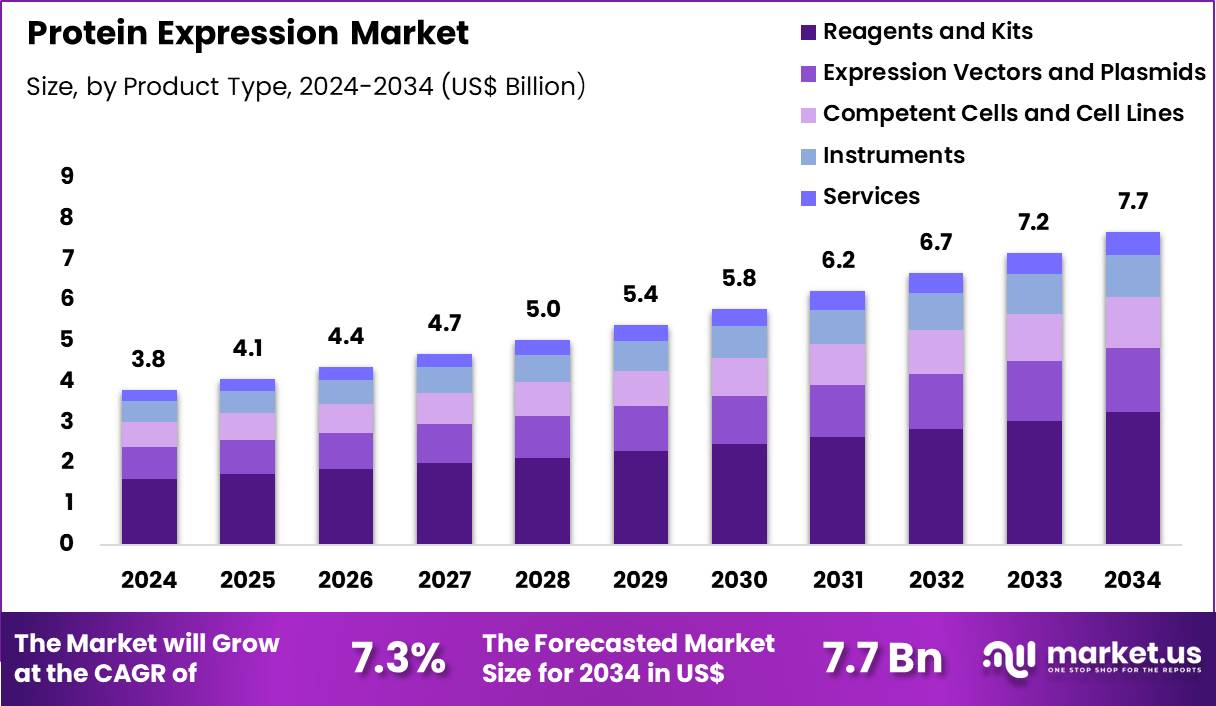

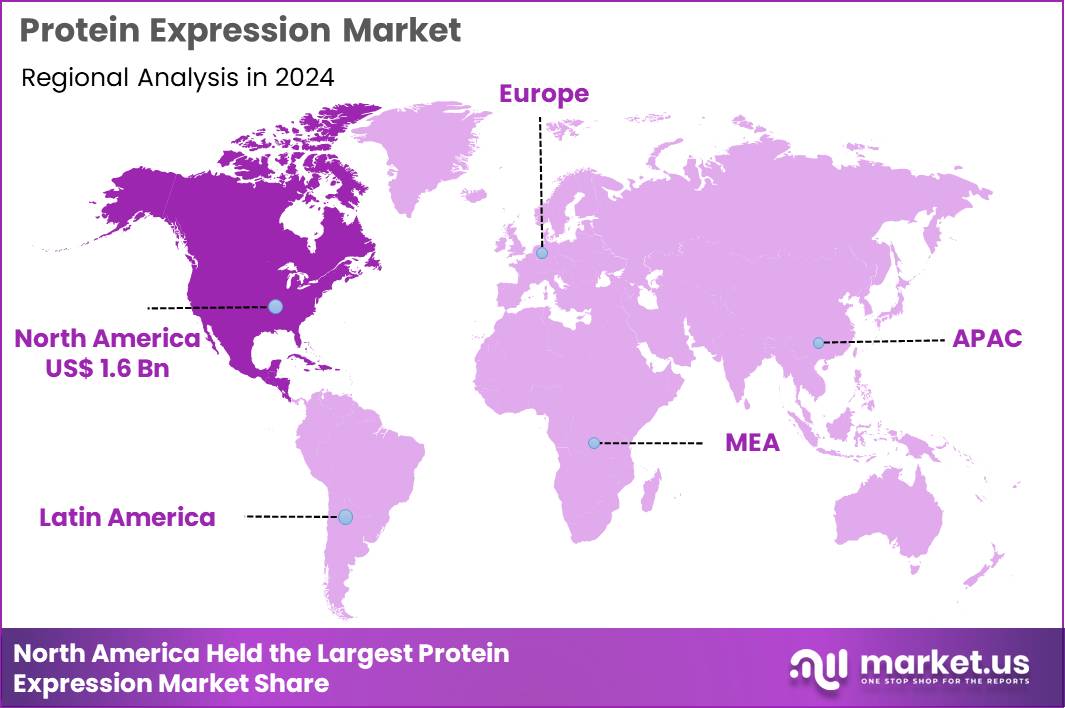

The Global Protein Expression Market size is expected to be worth around US$ 7.7 Billion by 2034 from US$ 3.8 Billion in 2024, growing at a CAGR of 7.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.7% share with a revenue of US$ 1.6 Billion.

Growing demand for recombinant proteins in therapeutic development accelerates advancements in protein expression systems that deliver high-yield and properly folded biologics for clinical applications. Biopharmaceutical companies increasingly utilize mammalian cell lines like CHO cells to produce complex glycoproteins, ensuring appropriate post-translational modifications essential for monoclonal antibody efficacy in oncology treatments.

These platforms support vaccine antigen production by expressing viral surface proteins, facilitating rapid response to emerging infectious threats through scalable fermentation processes. Researchers employ bacterial systems such as E. coli for rapid prototyping of enzymes and cytokines, enabling cost-effective generation of research-grade reagents for structural biology studies. Insect cell-baculovirus expression vectors facilitate production of multiprotein complexes, aiding virology research into virus-like particles for subunit vaccines.

In April 2025, Lonza Group implemented a new organizational structure under its One Lonza operating model. The change brings greater alignment across its protein expression and contract development and manufacturing activities, enabling more consistent deployment of technologies such as the GS Xceed gene expression platform across its global manufacturing network.

Biotechnology firms capitalize on opportunities to integrate cell-free expression systems that bypass cellular limitations, accelerating synthesis of toxic or membrane proteins for drug target validation in high-throughput screening. Developers engineer yeast-based platforms to balance glycosylation control with high productivity, expanding utility in biosimilar antibody production and enzyme replacement therapies. These technologies open pathways for transient expression in HEK293 cells, supporting rapid generation of viral vectors for gene therapy clinical trials.

Opportunities expand in plant-based systems that offer low-cost, scalable production of oral therapeutics like edible vaccines against gastrointestinal pathogens. Companies advance microfluidic devices for miniaturized expression optimization, streamlining parameter testing in personalized protein therapeutic design. Enterprises pursue hybrid systems combining prokaryotic speed with eukaryotic folding machinery, enhancing applications in diagnostic reagent manufacturing for immunoassay development.

Industry innovators deploy CRISPR-mediated genome editing to create stable producer cell lines with enhanced productivity, refining expression in bispecific antibody and fusion protein pipelines. Developers incorporate perfusion culture modes in bioreactors, sustaining long-term expression for labile proteins in continuous manufacturing processes.

Market participants refine chemically defined media formulations that eliminate animal-derived components, ensuring consistency in therapeutic protein production for regenerative medicine scaffolds. Companies prioritize inducible promoters for tight control in metabolic engineering, optimizing yields of secondary metabolites and bioactive peptides.

Innovators embed real-time monitoring sensors to adjust expression dynamics, improving quality attributes in vaccine subunit and hormone replacement therapies. Ongoing advancements emphasize multi-host platforms that flexibly switch between systems, accommodating diverse requirements in antibody-drug conjugate and cytokine therapeutic development.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.8 Billion, with a CAGR of 7.3%, and is expected to reach US$ 7.7 Billion by the year 2034.

- The expression system segment is divided into prokaryotic expression systems, yeast expression systems, insect cell expression systems, mammalian cell expression systems, cell-free protein expression systems and plant-based and algal expression systems, with mammalian cell expression systems taking the lead in 2023 with a market share of 38.0%.

- Considering product type, the market is divided into reagents and kits, expression vectors and plasmids, competent cells and cell lines, instruments and services. Among these, reagents and kits held a significant share of 42.5%.

- Furthermore, concerning the workflow stage segment, the market is segregated into gene cloning and vector design, host cell transformation or transfection, protein expression and induction, protein purification and characterization. The protein expression and induction sector stands out as the dominant player, holding the largest revenue share of 36.6% in the market.

- The application segment is segregated into therapeutic protein development, research applications, diagnostic applications and industrial and enzyme applications, with the therapeutic protein development segment leading the market, holding a revenue share of 45.1%.

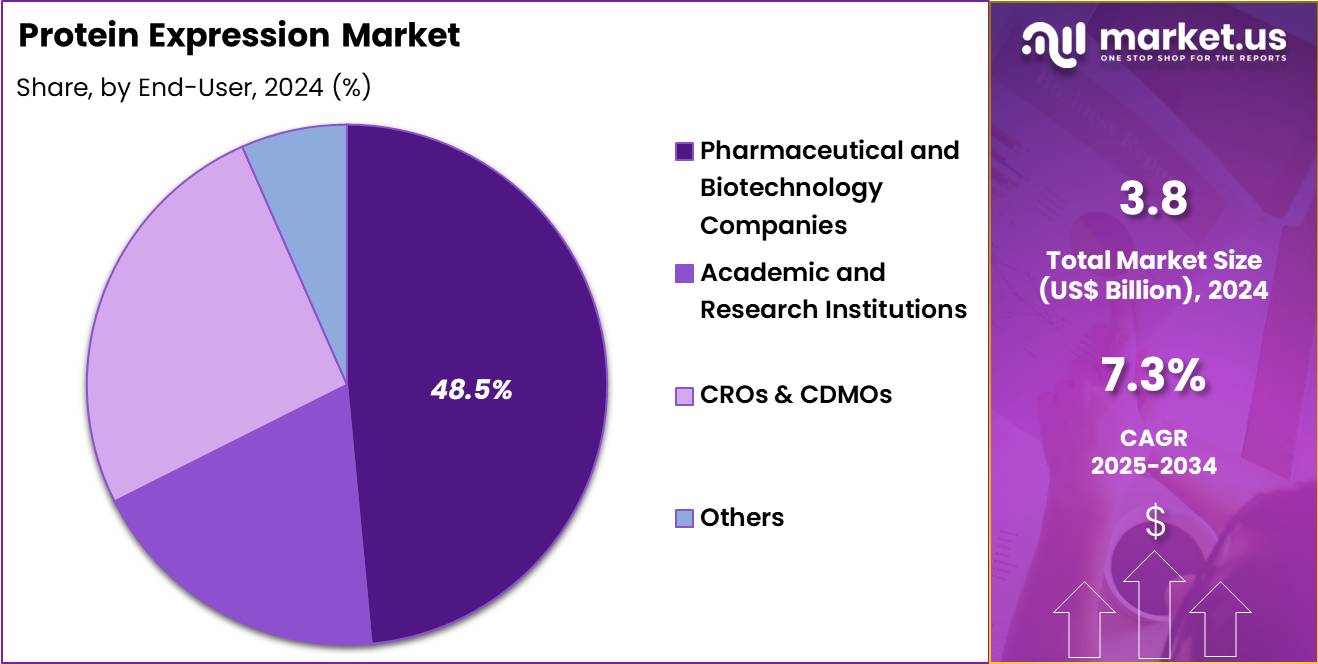

- Considering end-user, the market is divided into pharmaceutical and biotechnology companies, academic and research institutions, CROs & CDMOs and others. Among these, pharmaceutical and biotechnology companies held a significant share of 48.5%.

- North America led the market by securing a market share of 41.7% in 2024.

Expression System Analysis

Mammalian cell expression systems accounted for 38.0% of the protein expression market in 2024, reflecting their unmatched suitability for producing structurally complex and clinically relevant proteins. Biopharmaceutical developers rely on these systems to achieve correct folding, glycosylation, and post translational modifications required for therapeutic efficacy. Rising development of monoclonal antibodies, fusion proteins, and recombinant hormones directly supports demand.

Regulatory familiarity with CHO and HEK based platforms improves confidence during clinical and commercial production. Continuous cell line engineering enhances productivity and expression stability. Scalable suspension culture systems strengthen manufacturing flexibility. Growing biologics pipelines increase dependence on mammalian platforms.

Media optimization improves cost efficiency and yield consistency. Contract manufacturing alignment further accelerates adoption. This segment is projected to grow steadily due to biologics driven innovation and regulatory alignment.

Product Type Analysis

Reagents and kits held a significant share of 42.5% of the protein expression market, driven by their essential role across experimental and production workflows. Researchers depend on ready to use reagents to reduce variability and improve reproducibility. Growing demand for standardized workflows accelerates adoption in academic and industrial laboratories.

Kits simplify complex protocols, which improves productivity and reduces technical errors. Expansion of high throughput screening increases reagent consumption volumes. Continuous product innovation enhances expression efficiency and compatibility with multiple systems.

Time sensitive research environments favor off the shelf solutions. Cost predictability supports procurement planning for large scale users. Strong supplier portfolios reinforce customer loyalty. This segment is anticipated to remain dominant due to workflow standardization and recurring consumption patterns.

Workflow Stage Analysis

Protein expression and induction accounted for 36.6% of the protein expression market, reflecting its central influence on yield, functionality, and process economics. Developers focus heavily on optimizing induction parameters to maximize expression output. Advances in promoter systems and induction chemistry improve control and scalability.

Automation integration enhances reproducibility across batches and experiments. Faster development timelines increase emphasis on efficient expression stages. High yield expression reduces downstream purification complexity and costs. Industrial scale production depends on reliable induction strategies.

Technology providers continue refining induction reagents and protocols. Expression optimization supports both research and commercial objectives. This workflow stage is likely to sustain leadership due to its direct impact on productivity and scalability.

Application Analysis

Therapeutic protein development represented 45.1% of the protein expression market, supported by sustained growth in biologics and advanced therapies. Pharmaceutical pipelines increasingly prioritize antibodies, enzymes, and cytokines for chronic and rare diseases. Strong clinical outcomes reinforce investment in protein based drugs.

Precision medicine strategies require consistent and high quality protein expression. Regulatory approvals for biologics encourage continued pipeline expansion. Improvements in expression platforms shorten development timelines. Manufacturing scalability supports global commercialization.

High unmet medical needs strengthen therapeutic demand. Long product lifecycles improve return on investment. This application segment is expected to maintain dominance due to robust biologics innovation and clinical demand.

End-User Analysis

Pharmaceutical and biotechnology companies held a significant share of 48.5% of the protein expression market, reflecting their central role in drug discovery and development. These organizations operate extensive pipelines that require continuous protein production. Strategic investments in expression technologies improve internal efficiency and speed.

Portfolio diversification across biologics increases expression complexity and volume. Regulatory compliance requirements favor advanced and validated expression systems. Capital availability supports adoption of premium platforms and reagents. Integration with downstream manufacturing strengthens end to end workflows.

Competitive pressure accelerates technology upgrades. Long term outsourcing partnerships complement in house capabilities. This end user segment is projected to remain dominant due to sustained R and D intensity and commercial scale requirements.

Key Market Segments

By Expression System

- Prokaryotic Expression Systems

- Yeast Expression Systems

- Insect Cell Expression Systems

- Mammalian Cell Expression Systems

- Cell-Free Protein Expression Systems

- Plant-Based and Algal Expression Systems

By Product Type

- Reagents and Kits

- Expression Vectors and Plasmids

- Competent Cells and Cell Lines

- Instruments

- Services

By Workflow Stage

- Gene Cloning and Vector Design

- Host Cell Transformation or Transfection

- Protein Expression and Induction

- Protein Purification and Characterization

By Application

- Therapeutic Protein Development

- Research Applications

- Diagnostic Applications

- Industrial and Enzyme Applications

By End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- CROs & CDMOs

- Others

Drivers

Increasing approvals of biologic therapies is driving the market

The protein expression market is significantly driven by the increasing approvals of biologic therapies, which rely heavily on advanced expression systems to produce complex recombinant proteins for clinical use. Biopharmaceutical companies expand production capacities to meet the demands of newly approved monoclonal antibodies and fusion proteins. Expression platforms, including mammalian and microbial hosts, enable scalable manufacturing essential for therapeutic supply chains.

Regulatory pathways prioritize biologics, accelerating the need for optimized expression technologies in development pipelines. Healthcare providers integrate these therapies into treatment protocols for oncology and autoimmune disorders, sustaining market momentum. Research institutions collaborate on expression optimizations to support translational efforts from bench to bedside. Global initiatives address chronic disease burdens through biologic interventions, further elevating expression requirements.

Pharmaceutical investments focus on high-yield systems to reduce costs associated with biologic production. The U.S. Food and Drug Administration approved 50 novel drugs in 2024, including a substantial portion of biologics requiring recombinant protein expression. This approval volume reinforces the critical role of expression technologies in delivering innovative treatments to patients.

Restraints

High costs of mammalian expression systems are restraining the market

The protein expression market encounters restraints from the high costs associated with mammalian expression systems, which demand expensive media, bioreactors, and downstream processing for proper glycosylation. Smaller biotechnology firms face barriers to entry due to substantial capital requirements for establishing compliant facilities.

Maintenance of cell lines and viral safety testing add recurring expenditures that strain research budgets. Regulatory validation for mammalian-derived products extends timelines and amplifies financial commitments. Academic laboratories often opt for less costly alternatives, limiting adoption of premium systems. Global supply chain vulnerabilities for specialized reagents contribute to price instability.

Intellectual property licensing for proprietary cell lines imposes additional fees on users. Operational complexities in scaling mammalian cultures deter rapid prototyping in early discovery phases. Economic pressures on healthcare funding indirectly affect investment in high-end expression platforms. These cost-related factors collectively moderate market growth and favor alternative systems in resource-constrained environments.

Opportunities

Advancements in gene therapy vectors is creating growth opportunities

The protein expression market harbors opportunities through advancements in gene therapy vectors, which require efficient expression of therapeutic proteins in viral capsids or non-viral delivery systems. Developers leverage optimized promoters and codon usage to enhance transgene expression in target tissues. Clinical pipelines expand with vectors encoding corrective proteins for genetic disorders, driving demand for robust production platforms.

Regulatory designations for orphan indications facilitate accelerated development of expression-optimized therapies. Partnerships between vector manufacturers and biotechs streamline scalable expression processes. Research focuses on inducible systems to control protein levels post-administration, improving safety profiles.

Global health priorities for rare diseases support investment in specialized expression technologies. Patient registries provide data to refine vector expression for better therapeutic outcomes. Emerging modalities like in vivo editing benefit from precise protein delivery via advanced vectors. These developments diversify applications and position expression systems as enablers of next-generation gene therapies.

Impact of Macroeconomic / Geopolitical Factors

Strong biopharmaceutical growth and increasing demand for recombinant proteins in therapeutics drive the protein expression market, encouraging labs and manufacturers to deploy advanced mammalian, bacterial, and cell-free systems for higher yields and scalability. Prominent suppliers actively introduce optimized vectors and media formulations, meeting the surge in monoclonal antibody and vaccine development needs across expanding research hubs globally.

Elevated inflation rates, however, raise prices for culture media, plasmids, and purification resins, causing research institutions to curb spending and postpone system expansions during periods of restrained funding. Ongoing geopolitical rivalries, including U.S.-China trade barriers and supply restrictions in key reagent-producing nations, frequently hinder deliveries of expression kits and host cells, prompting delays and added complexities for operations dependent on worldwide sourcing.

Current U.S. tariffs maintain Section 301 duties up to 25 percent on Chinese-origin laboratory reagents and equipment as of late 2025, alongside a 10 percent baseline on broader imports, elevating overall costs for U.S. buyers and tightening margins in the supply network. These duties additionally provoke retaliatory steps from international counterparts, curbing American exports of specialized expression technologies and straining cross-border alliances.

Nonetheless, the tariff dynamics motivate focused initiatives in domestic bioprocessing capacity and regional supplier diversification, laying groundwork for greater self-reliance, enhanced technological advances, and sustained market vitality in the coming years.

Latest Trends

Growing adoption of cell-free protein expression systems is a recent trend

In 2024, the protein expression market has witnessed a growing adoption of cell-free systems, offering rapid prototyping and incorporation of non-natural amino acids for diverse applications. These platforms bypass cellular constraints, enabling direct control over reaction conditions for toxic or membrane proteins. Researchers favor cell-free approaches for high-throughput screening in synthetic biology projects.

Developers integrate lyophilized extracts to enhance stability and portability in point-of-need production. Clinical evaluations explore cell-free expressed antigens for personalized vaccines. Regulatory discussions address quality attributes unique to open-system synthesis. Academic publications highlight yields comparable to traditional hosts with reduced timelines.

Industry collaborations standardize kits for reproducible cell-free workflows. Ethical frameworks guide deployment in therapeutic protein engineering. Advancements in continuous-exchange formats extend reaction durations, boosting complex protein folding in 2024 studies.

Regional Analysis

North America is leading the Protein Expression Market

In 2024, North America secured a 41.7% share of the global protein expression market, advanced by robust investments in biotechnology research and the escalating production of recombinant therapeutics for oncology and rare disorders. Biopharmaceutical enterprises increasingly utilize mammalian cell lines, such as CHO systems, to generate complex glycoproteins with human-like post-translational modifications, essential for monoclonal antibody efficacy in targeted cancer treatments.

Federal support through agencies like the National Institutes of Health facilitates high-throughput screening platforms, enabling rapid optimization of expression vectors for vaccine antigens and enzyme replacements. Contract research organizations expand transient transfection services to accommodate surging demands from startups developing cell and gene therapies, streamlining early-stage scalability.

Demographic trends toward personalized medicine amplify requirements for customized protein variants, prompting integrations of CRISPR-based editing for enhanced yield stability. Academic centers pioneer insect cell baculovirus methodologies for structural biology, supporting drug design initiatives amid competitive funding landscapes.

Supply enhancements ensure availability of serum-free media formulations, aligning with sustainable manufacturing imperatives. The Food and Drug Administration approved 50 novel drugs in 2024, including 16 protein-based therapies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project substantial advancement in protein expression technologies across Asia Pacific throughout the forecast period, as governments escalate funding for domestic biomanufacturing to address prevalent chronic conditions. Research institutes deploy prokaryotic and yeast systems to produce affordable insulin analogs, catering to diabetes epidemics in high-burden nations like India and Indonesia. Pharmaceutical manufacturers invest in perfusion bioreactors, optimizing continuous harvesting for biosimilar antibodies against autoimmune markers.

Regulatory agencies harmonize guidelines for transient plant-based platforms, accelerating viral vector outputs for regional vaccine stockpiles. Biotech hubs cultivate algal and fungal hosts, tailoring glycosylation profiles to ethnic pharmacogenetic variations in metabolic therapeutics. International consortia facilitate technology transfers for microfluidic cell-free synthesis, empowering remote laboratories to prototype orphan enzyme therapies.

Policy incentives promote hybrid expression suites, bridging gaps in rare hematological disorder interventions. The World Health Organization estimates that the Western Pacific Region bears a significant portion of global diabetes cases, compelling scaled recombinant hormone production.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Protein Expression market drive growth by expanding versatile expression platforms across mammalian, microbial, insect, and cell-free systems to meet diverse research and biomanufacturing needs. Companies strengthen differentiation by improving yield, scalability, and speed through optimized vectors, host-cell engineering, and automation-ready workflows.

Commercial strategies emphasize bundled solutions that combine reagents, instruments, and technical support, enabling customers to standardize expression pipelines with lower risk. Market leaders also invest in partnerships with biopharma firms and academic institutes to co-develop application-specific systems for biologics, vaccines, and enzymes.

Geographic expansion focuses on regions building biologics manufacturing capacity and translational research infrastructure. Thermo Fisher Scientific exemplifies leadership by offering a broad portfolio of expression systems and services, supported by global manufacturing, deep application expertise, and strong customer relationships across research and industrial biotechnology.

Top Key Players

- Agilent Technologies, Inc.

- QIAGEN

- Bio-Rad Laboratories

- Merck

- Promega Corporation

- Thermo Fisher Scientific, Inc.

- Lucigen Corporation

- New England BioLabs, Inc.

- Oxford Expression Technologies

- Takara Bio, Inc.

- Danaher Corporation

- GenScript Biotech

- Lonza Group

- Sartorius

- Sino Biological

- Bioneer Corporation

- Jena Bioscience

- Charles River Laboratories

Recent Developments

- In June 2024, LenioBio entered into a collaboration with Labscoop to broaden the availability of its cell-free protein production technologies across North America. Through this arrangement, Labscoop began offering LenioBio’s solutions, including the ALiCE cell-free expression platform, via its online marketplace. The partnership improves visibility and access to scalable, cell-free protein synthesis tools for both research-focused and commercial laboratories in the region.

- In April 2024, Expression Systems partnered with Thomson to demonstrate a combined workflow for improved protein expression. The collaboration highlighted the use of ESF AdvanCD cell culture medium alongside Optimum Growth flasks, showing stable cell performance and strong protein output across multiple culture formats. The results underscored the suitability of this integrated approach for scalable and reproducible protein production.

Report Scope

Report Features Description Market Value (2024) US$ 3.8 Billion Forecast Revenue (2034) US$ 7.7 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Expression System (Prokaryotic Expression Systems, Yeast Expression Systems, Insect Cell Expression Systems, Mammalian Cell Expression Systems, Cell-Free Protein Expression Systems and Plant-Based and Algal Expression Systems), By Product Type (Reagents and Kits, Expression Vectors and Plasmids, Competent Cells and Cell Lines, Instruments and Services), By Workflow Stage (Gene Cloning and Vector Design, Host Cell Transformation or Transfection, Protein Expression and Induction, Protein Purification and Characterization), By Application (Therapeutic Protein Development, Research Applications, Diagnostic Applications and Industrial and Enzyme Applications), By End-User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutions, CROs & CDMOs and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agilent Technologies, Inc., QIAGEN, Bio-Rad Laboratories, Merck, Promega Corporation, Thermo Fisher Scientific, Inc., Lucigen Corporation, New England BioLabs, Inc., Oxford Expression Technologies, Takara Bio, Inc., Danaher Corporation, GenScript Biotech, Lonza Group, Sartorius, Sino Biological, Bioneer Corporation, Jena Bioscience, Charles River Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agilent Technologies, Inc.

- QIAGEN

- Bio-Rad Laboratories

- Merck

- Promega Corporation

- Thermo Fisher Scientific, Inc.

- Lucigen Corporation

- New England BioLabs, Inc.

- Oxford Expression Technologies

- Takara Bio, Inc.

- Danaher Corporation

- GenScript Biotech

- Lonza Group

- Sartorius

- Sino Biological

- Bioneer Corporation

- Jena Bioscience

- Charles River Laboratories