Global Programmatic DOOH Platform Market Size, Share Report By Component (Software, Services), By Application (Billboards, Transit, Street Furniture, Retail, Others), By End-User (Retail, Automotive, Entertainment, BFSI, Healthcare, Others), By Deployment Mode (Cloud-Based, On-Premises), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169641

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Programmatic DOOH Platform Statistics

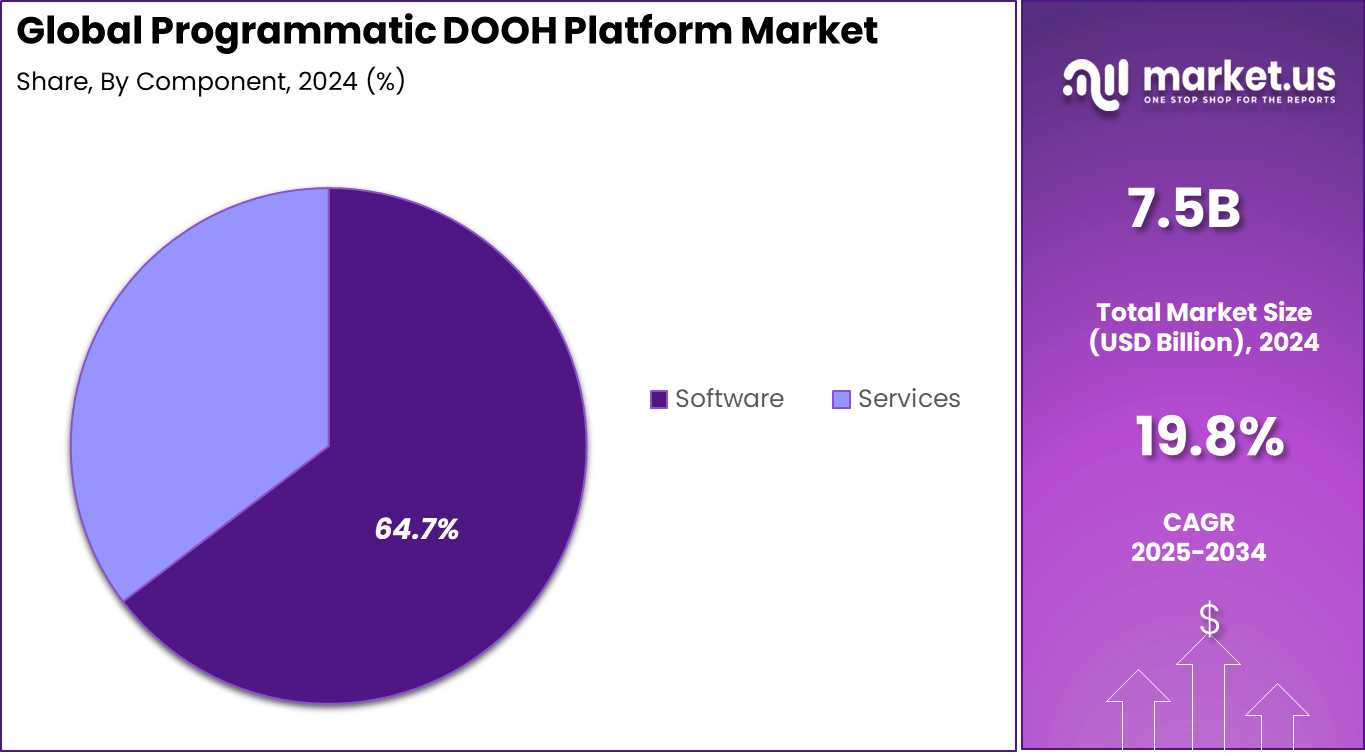

- By Component: Software (64.7%)

- By Application: Billboards (45.5%)

- By End User: Retail (38.5%)

- By Deployment Mode: Cloud Based (60.2%)

- By Region

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

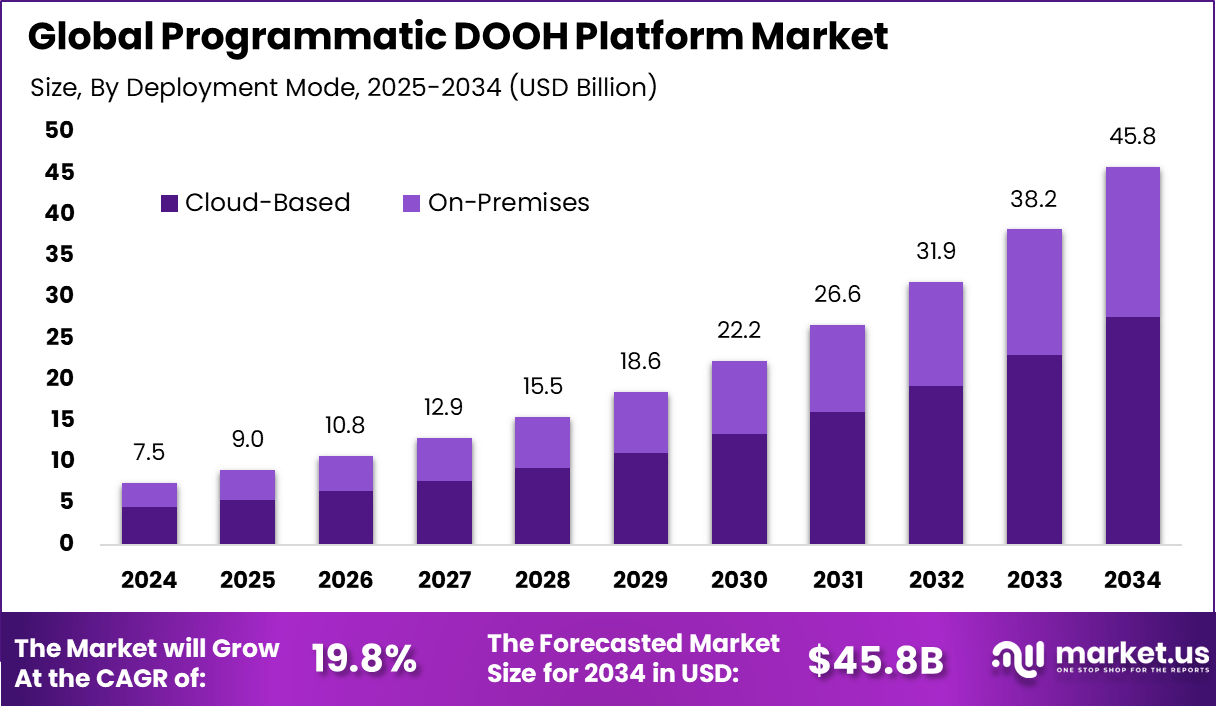

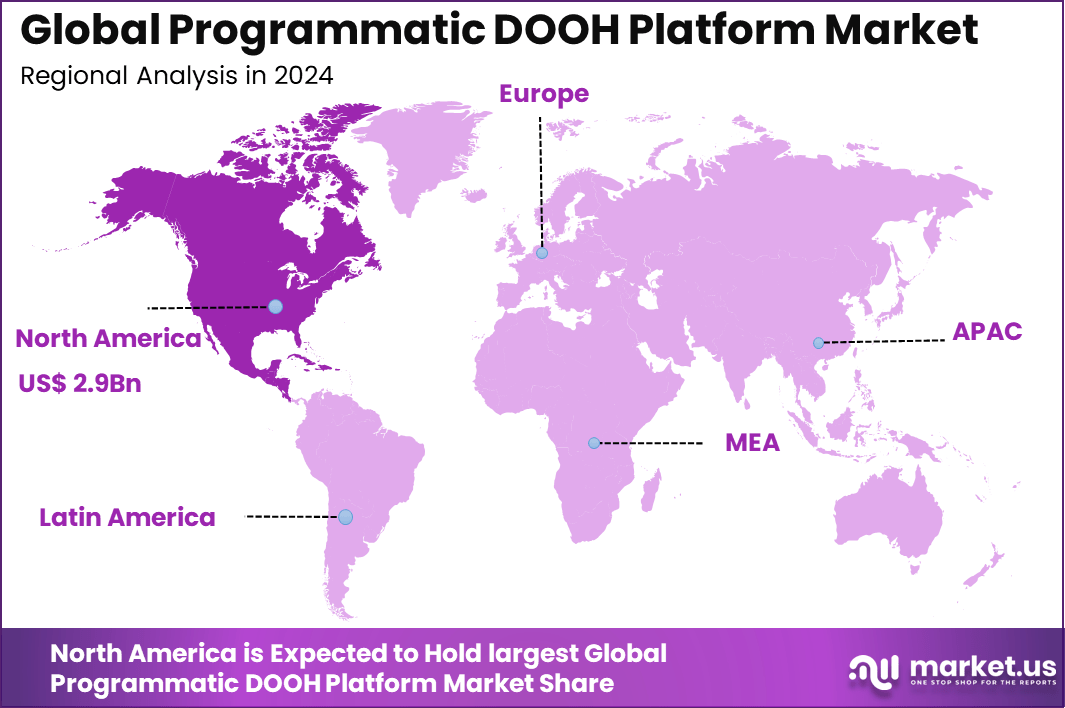

The Global Programmatic DOOH Platform Market generated USD 7.5 billion in 2024 and is predicted to register growth from USD 9.0 billion in 2025 to about USD 45.8 billion by 2034, recording a CAGR of 19.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.3% share, holding USD 2.9 Billion revenue.

The programmatic DOOH platform market has grown as advertisers move digital media buying into outdoor environments such as roadsides, malls, transit stations and public venues. Growth is linked to rising demand for automated ad placement, real time content delivery and improved audience targeting in physical locations. These platforms manage digital screens through software that controls ad scheduling, content timing and performance tracking.

The growth of the market can be attributed to rising demand for data led outdoor advertising, wider deployment of digital display networks and the need for flexible ad buying models. Advertisers prefer automated platforms that allow quick campaign changes based on time, location and audience movement. Growth in smart city projects and public digital infrastructure also supports wider adoption.

According to StackAdapt, programmatic DOOH ad spending is expected to rise by 22.6% in 2025 and reach USD 1.22 billion in 2026. A survey shows that 59% of marketers still rely on direct deals for OOH buying, indicating that adoption remains slower than interest.

The US market continues to lead, with DOOH ad spending projected to reach USD 4.40 billion in 2025. In China, DOOH spending is forecasted to reach USD 4.84 billion in 2025 and could grow at a 6.57% CAGR to reach USD 6.65 billion by 2030, supported by strong urban development and ongoing digital infrastructure investments.

Top Market Takeaways

- Software led the market with 64.7%, showing strong demand for automated ad buying, real-time bidding, and campaign optimization tools.

- Billboards captured 45.5%, confirming their continued dominance as the primary format for large-scale programmatic DOOH advertising.

- The retail sector held 38.5%, driven by location-based promotions, hyperlocal targeting, and in-store traffic conversion strategies.

- Cloud-based deployment accounted for 60.2%, reflecting the need for scalable platforms that support real-time ad delivery and analytics.

- North America recorded 39.3%, supported by high digital signage density and advanced ad-tech infrastructure.

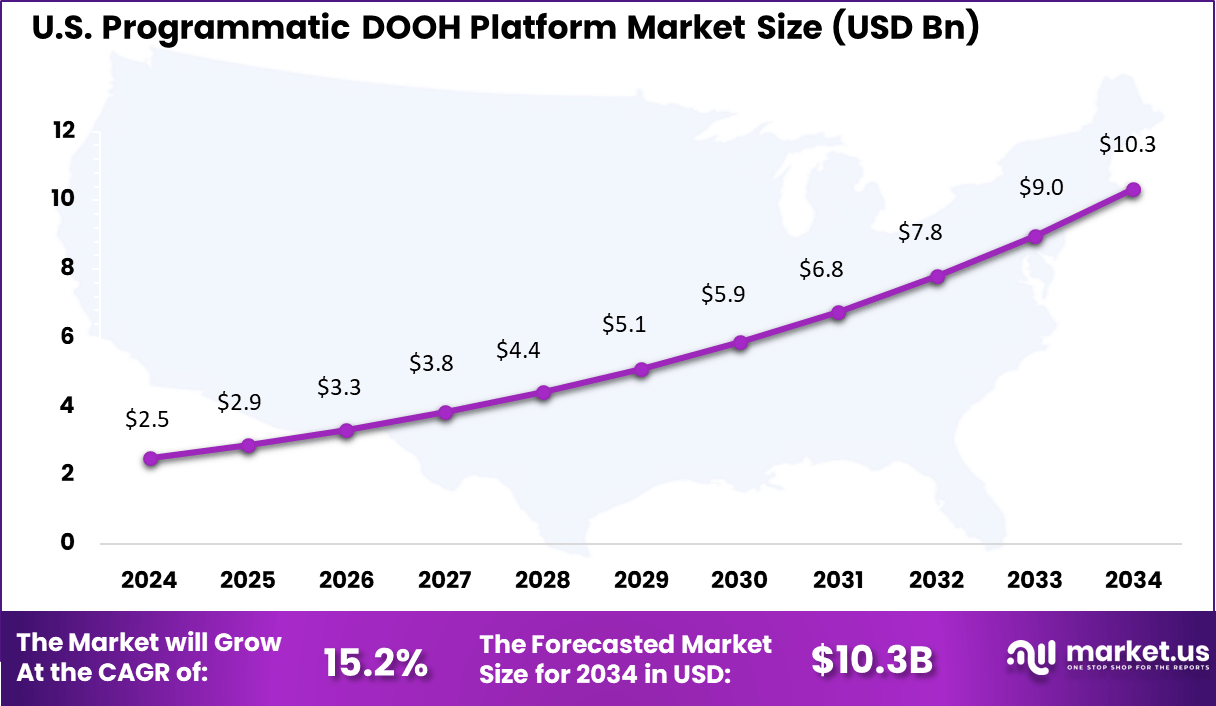

- The U.S. market reached USD 2.51 billion with a strong 15.2% CAGR, indicating rapid expansion of automated outdoor advertising across urban and commercial zones.

Programmatic DOOH Platform Statistics

- Based on data from viooh, Media professionals expect a 28% rise in programmatic DOOH investment over the next 18 months, showing strong confidence in automated outdoor advertising.

- Programmatic DOOH adoption is projected to grow from 27% to 35% within the next 18 months, reflecting fast market maturity.

- For the first time, 50% of all DOOH campaigns in the past year were bought partly or fully through programmatic channels.

- When prDOOH is managed by digital teams, 81% of budgets shift from other digital channels, while 79% are redirected from traditional media.

- Use of Dynamic Creative Optimisation is expected to increase, as its impact on campaign performance is now widely recognized.

- About 60% of marketers now view sustainability as an important factor when investing in programmatic DOOH campaigns.

By Component: Software (64.7%)

The software segment holds a leading share of 64.7%, showing that platform capabilities are the core of programmatic DOOH operations. Software tools manage ad bidding, campaign scheduling, audience targeting, real time analytics, and content delivery across digital screens.

The high share of software reflects the need for automation and control across large advertising networks. Advertisers depend on software platforms to manage multiple campaigns at scale while maintaining targeting accuracy and reporting clarity.

By Application: Billboards (45.5%)

Billboards account for 45.5% of total programmatic DOOH usage. Digital billboards remain the most visible and high impact format across highways, city centers, transport corridors, and commercial districts.

This segment remains strong due to its ability to reach large audiences in short time frames. Programmatic buying improves billboard efficiency by enabling dynamic pricing, time based targeting, and real time content adjustments based on location and traffic flow.

By End User: Retail (38.5%)

The retail sector represents 38.5% of total demand for programmatic DOOH platforms. Retailers use digital screens for store promotions, brand campaigns, seasonal offers, and customer engagement in both outdoor and indoor environments.

Retail adoption is driven by the need to attract foot traffic and influence buying decisions near the point of sale. Programmatic platforms allow retailers to run location specific ads and adjust content based on time of day, weather, and shopper movement.

By Deployment Mode: Cloud Based (60.2%)

Cloud based deployment dominates with a 60.2% share. Cloud platforms allow advertisers, agencies, and media owners to manage campaigns from remote locations with centralized control.

This deployment model supports quick setup, easier expansion, and stable system performance. Cloud hosting also improves data integration, reporting speed, and platform accessibility across regional and national advertising networks.

By Region

North America (39.3%)

North America holds a 39.3% share of the global market, reflecting its advanced digital advertising infrastructure and strong advertiser spending. The region benefits from wide digital screen coverage across transport hubs, retail areas, and urban centers.

U.S. Base at 2.51 Bn with 15.2% CAGR

The U.S. base stands at 2.51 Bn, supported by strong adoption from retail, entertainment, and outdoor media owners. A 15.2% CAGR indicates steady expansion driven by data driven advertising, smart city development, and rising adoption of automated media buying.

Key Market Segments

By Component

- Software

- Services

By Application

- Billboards

- Transit

- Street Furniture

- Retail

- Others

By End-User

- Retail

- Automotive

- Entertainment

- BFSI

- Healthcare

- Others

By Deployment Mode

- Cloud-Based

- On-Premises

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A major driver in the programmatic DOOH platform market is the rapid shift from static outdoor advertising to digital screens in public places. Shopping centers, airports, transit hubs, and retail locations now use digital displays that can show updated content throughout the day.

Advertisers prefer these screens because they allow flexible scheduling and quick message changes. As more locations adopt digital signage, the need for programmatic platforms that manage this inventory grows steadily. Another driver comes from the desire for easier campaign management.

Programmatic DOOH platforms allow advertisers to buy space across many screens through a single system. This reduces manual work and helps advertisers plan campaigns more efficiently. Reports also show that a large share of revenue in this category comes from demand side platforms, indicating strong adoption among advertisers who value simpler and more organized buying processes.

Restraint Analysis

A key restraint is the presence of varying local rules that govern outdoor advertising. Many regions have restrictions on screen placement, brightness, content type, or timing. Advertisers and platform providers must comply with these rules for each location, which slows expansion and increases operational effort. Another restraint relates to the technical needs of large digital screen networks.

Maintaining displays, ensuring constant connectivity, and managing content across different sites require investment and expertise. Smaller companies may find these requirements difficult to support. In addition, measuring audience reach for outdoor screens is not as straightforward as measuring digital ads on personal devices, which may make some advertisers cautious.

Opportunity Analysis

There is strong opportunity in fast growing cities across Asia Pacific, South America, and the Middle East. These regions are investing heavily in transport networks, commercial centers, and public infrastructure that often include digital signage. Programmatic DOOH providers can expand their reach by supporting these new networks and offering visibility to advertisers targeting urban audiences.

Another opportunity lies in combining DOOH with location information and contextual data. Advertisers increasingly prefer campaigns that deliver relevant content at specific times or places. Programmatic platforms that help align messages with real time conditions such as weather, traffic, or nearby activity can attract brands seeking more precise public outreach.

Challenge Analysis

A major challenge is measuring campaign impact in a reliable way. DOOH screens reach broad public audiences, and this makes it difficult to determine how many people viewed an ad or acted on it. Without strong measurement tools, some advertisers may limit their spending.

Another challenge concerns the upkeep of digital infrastructure. Screens require maintenance, network reliability, and consistent content delivery. If any of these break down, the value of the platform decreases. Ensuring smooth performance across many locations can be costly and places pressure on service providers to maintain high standards.

Competitive Analysis

Vistar Media, Broadsign, and Hivestack lead the programmatic DOOH platform market with strong supply-side and demand-side integrations for real-time digital billboard buying. Their platforms enable automated ad placement, audience targeting, and dynamic creative delivery. These companies focus on data-driven activation, inventory transparency, and high-fill rate optimization. Growing adoption of automated outdoor advertising continues to reinforce their leadership across urban and transit environments.

Clear Channel Outdoor, JCDecaux, Lamar Advertising Company, and Outfront Media strengthen the market through large-format digital networks and direct programmatic enablement. Their assets span highways, airports, shopping districts, and public transit hubs. These operators focus on premium locations, high audience reach, and measurable campaign performance. Rising demand for omnichannel brand visibility continues to expand their programmatic DOOH presence.

Adomni, Place Exchange, Magnite, The Trade Desk, Yahoo DSP, Firefly, Quividi, Ocean Outdoor, Intersection, Ströer, Zeta Global, Moving Walls, and Blip Billboards broaden the ecosystem with DSP connectivity, audience analytics, and small-business access to DOOH buying. Their platforms emphasize campaign flexibility, real-time reporting, and geo-based targeting. Increasing adoption by local advertisers and retail brands continues to accelerate growth in the programmatic DOOH market.

Top Key Players in the Market

- Vistar Media

- Broadsign

- Hivestack

- Clear Channel Outdoor

- JCDecaux

- Lamar Advertising Company

- Outfront Media

- Adomni

- Place Exchange

- Magnite

- The Trade Desk

- Verizon Media (Yahoo DSP)

- Firefly

- Quividi

- Ocean Outdoor

- Intersection

- Ströer SE & Co. KGaA

- Zeta Global

- Moving Walls

- Blip Billboards

- Others

Recent Developments

- In May 2024, Broadsign International acquired OutMoove, enabling Broadsign to integrate OutMoove’s DOOH DSP technology while OutMoove focuses on growing its specialist OOH agency workflows and global support services.

- In February 2024, JCDecaux Group introduced the first global airport pDOOH offer, allowing brands to run targeted and dynamic advertising campaigns across programmatic-enabled airports through the VIOOH SSP and more than 30 DSPs.

Report Scope

Report Features Description Market Value (2024) USD 7.5 Bn Forecast Revenue (2034) USD 45.8 Bn CAGR(2025-2034) 19.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Application (Billboards, Transit, Street Furniture, Retail, Others), By End-User (Retail, Automotive, Entertainment, BFSI, Healthcare, Others), By Deployment Mode (Cloud-Based, On-Premises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vistar Media, Broadsign, Hivestack, Clear Channel Outdoor, JCDecaux, Lamar Advertising Company, Outfront Media, Adomni, Place Exchange, Magnite, The Trade Desk, Verizon Media (Yahoo DSP), Firefly, Quividi, Ocean Outdoor, Intersection, Ströer SE & Co. KGaA, Zeta Global, Moving Walls, Blip Billboards, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Programmatic DOOH Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Programmatic DOOH Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vistar Media

- Broadsign

- Hivestack

- Clear Channel Outdoor

- JCDecaux

- Lamar Advertising Company

- Outfront Media

- Adomni

- Place Exchange

- Magnite

- The Trade Desk

- Verizon Media (Yahoo DSP)

- Firefly

- Quividi

- Ocean Outdoor

- Intersection

- Ströer SE & Co. KGaA

- Zeta Global

- Moving Walls

- Blip Billboards

- Others