Global Procurement Software Market Size, Share, Statistics Analysis Report By Deployment (Cloud, On-Premise), By End-User Industry (Retail & e-Commerce, Healthcare, Automotive, BFSI, IT & Telecom, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134692

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Impact of AI on Procurement Software

- 5 Best Procurement Software

- Deployment Analysis

- End-User Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

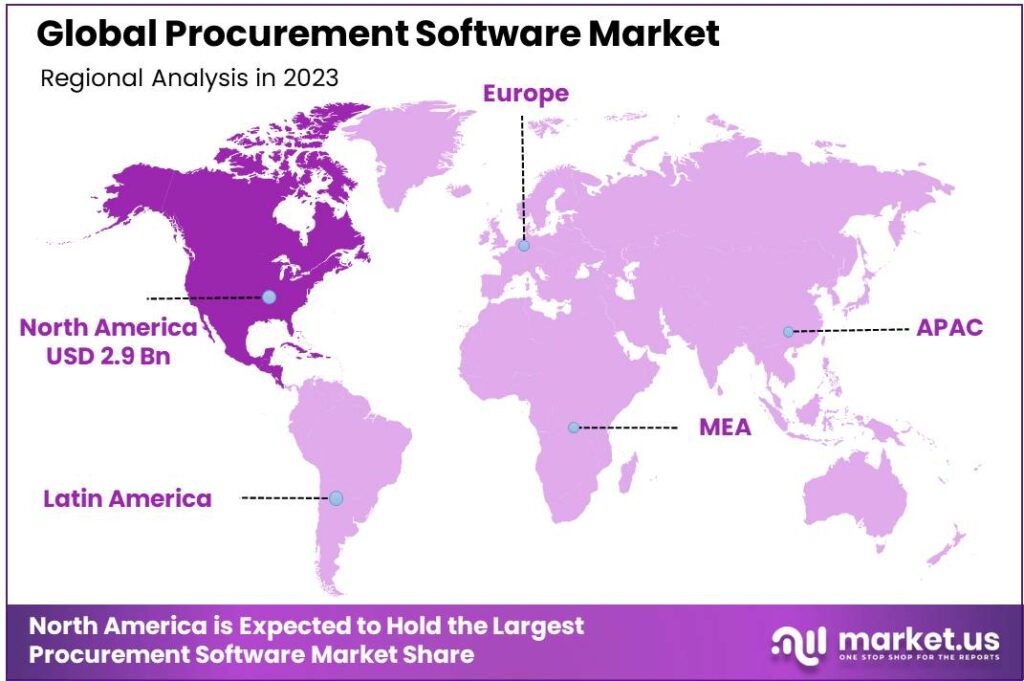

The Global Procurement Software Market size is expected to be worth around USD 19.9 Billion By 2033, from USD 7.8 Billion in 2023, growing at a CAGR of 9.80% during the forecast period from 2024 to 2033. In 2023, North America captured over 38.1% of the global procurement software market share, which equated to approximately USD 2.9 billion in revenue, securing a dominant position in the market.

Procurement software is a digital tool designed to streamline the purchasing processes within an organization. It automates the key tasks involved in acquiring goods and services, from the initial request to the final payment. This software aids in managing purchase orders, executing online procurement processes, maintaining contracts, and analyzing spending patterns within the company.

Procurement software improves efficiency, transparency, and compliance in the procurement cycle, helping businesses save costs and enhance supply chain operations. The procurement software market is experiencing significant growth, driven by the increasing need for streamlined purchasing operations and enhanced supply chain visibility. As businesses expand and regulatory requirements become more stringent, the demand for efficient and reliable procurement solutions is rising.

This market includes a range of software solutions from cloud-based platforms to on-premise installations, catering to diverse business needs and scales, from small enterprises to large corporations. Market demand for procurement software is bolstered by the increasing importance of strategic sourcing and the need for efficient vendor and contract management in businesses.

Organizations are looking for solutions that not only automate purchasing tasks but also provide analytics to drive smarter spending decisions and improve supplier relationships. This demand is further amplified by the global push towards digital operations, where procurement solutions play a critical role in ensuring continuous supply chain and operational resilience. There are significant opportunities in the procurement software market related to the integration of emerging technologies like AI, machine learning, and blockchain.

For instance, In January 2024, Relish, a leading name in B2B application and platform development, launched its revolutionary AI-powered Procurement Assistant. This innovative tool, built on advanced natural language processing, is designed to simplify complex enterprise workflows. It streamlines procurement tasks across diverse industries, offering businesses actionable insights and greater efficiency.

These technologies can enhance the capabilities of procurement systems in areas such as predictive analytics, risk management, and transactional integrity. Additionally, the growing need for mobile solutions and remote access to procurement functions presents opportunities for the development of mobile apps and cloud-based platforms that cater to the needs of a distributed workforce.

The procurement software market is set for global expansion as businesses increasingly recognize the benefits of streamlined, automated systems. Expansion is likely to be particularly strong in regions that are currently undergoing rapid industrialization and in sectors that are just beginning to embrace digital procurement solutions. This ongoing expansion not only supports business growth but also drives innovation within the market.

Technological advancements in procurement software focus on enhancing the functionalities related to electronic data interchange, real-time tracking, and automated workflows. Features like electronic purchase orders, automated invoice processing, and advanced analytics for spend analysis are becoming standard. Moreover, the adoption of AI and machine learning is enabling more predictive capabilities, helping organizations anticipate market trends and make informed procurement decisions.

Key Takeaways

- The Global Procurement Software Market is projected to reach USD 19.9 Billion by 2033, up from USD 7.8 Billion in 2023, reflecting a CAGR of 9.80% during the forecast period from 2024 to 2033.

- In 2023, the cloud segment of the procurement software market led the industry, commanding more than 70% of the total market share.

- The Retail & e-Commerce segment dominated the procurement software market in 2023, accounting for over 24.6% of the share. This growth is driven by the expanding online shopping sector, which demands efficient procurement systems to handle complex inventory and supply chain operations.

- North America held the largest share of the global procurement software market in 2023, representing over 38.1%, equating to approximately USD 2.9 billion in revenue.

Impact of AI on Procurement Software

The impact of artificial intelligence (AI) on procurement software is transforming the landscape of procurement processes, offering significant enhancements in efficiency, decision-making, and risk management.

- Enhancing Efficiency: AI significantly automates routine and repetitive tasks within procurement, such as data entry, invoice processing, and purchase order creation. This automation speeds up processes and reduces the potential for human error. AI’s ability to process and analyze large volumes of data rapidly also supports more efficient supply chain operations, helping organizations manage inventory more effectively and optimize supply levels.

- Improving Decision-making: AI enhances decision-making in procurement by providing comprehensive analytics that synthesize data from various sources, including market trends, supplier performance, and risk factors. These insights enable procurement teams to make informed decisions about supplier selection, contract negotiations, and spend management. For instance, AI can analyze historical data to predict future demand, ensuring optimal stocking and purchasing decisions.

- Risk Mitigation: AI’s predictive capabilities are crucial for identifying and mitigating potential risks before they impact the business. By monitoring various data sources, AI tools can detect early warning signs of supply chain disruptions, such as geopolitical changes or natural disasters, and alert teams to develop contingency plans. Additionally, AI ensures compliance by continuously scanning contracts and supplier interactions to flag any deviations from regulatory standards.

- Challenges and Considerations: Despite its benefits, integrating AI into procurement processes comes with challenges. These include ensuring the quality of data fed into AI systems, managing changes within organizations, and addressing any ethical concerns related to automated decision-making. It’s crucial for organizations to establish robust data governance frameworks to ensure data integrity and to train employees on new AI tools and procedures to facilitate smooth transitions.

5 Best Procurement Software

- Coupa: Best known for its comprehensive visibility and compliance tracking features, Coupa offers a cloud-native Business Spend Management platform that supports a wide range of processes from procurement to finance. Although it is robust, the platform can be complex and requires regular updates, which may pose a learning curve for new users.

- Gatekeeper: This cloud-based platform excels in vendor and contract lifecycle management, providing tools for automating workflows and enhancing compliance monitoring. It is particularly beneficial for companies that prioritize strong vendor relationship management and comprehensive contract oversight.

- Precoro: Ideal for businesses seeking user-friendly, cloud-based procurement solutions, Precoro offers excellent spend management capabilities, with intuitive design and real-time analytics to help monitor and control spending. It supports a three-way matching system that ensures payment accuracy and integrates seamlessly with major accounting software like QuickBooks and NetSuite.

- Procurify: Geared towards small to mid-sized businesses, Procurify excels in providing real-time visibility into procurement processes, excellent budget control, and robust supplier management tools. It’s noted for its user-friendly interface and ability to streamline procurement activities.

- SAP Ariba: This platform is suited for large organizations that require a robust procurement solution with extensive features for automating manual processes and enhancing supplier collaboration. While SAP Ariba offers excellent end-to-end visibility and data privacy, it is also known for its complexity and high cost.

Deployment Analysis

In 2023, the cloud segment of the procurement software market held a dominant position, capturing more than a 70% share. This segment’s leadership is largely attributed to the flexibility and scalability that cloud-based solutions offer. Organizations, especially those with fluctuating procurement needs, benefit from the ability to scale their solutions up or down without significant capital expenditure.

Moreover, the operational advantages of cloud deployment, such as reduced IT maintenance costs and lower initial setup investments, have contributed to its dominance. Businesses are able to outsource much of the technical support and maintenance to the software provider, significantly reducing the burden on in-house IT teams.

Another driving factor for the cloud segment’s growth is the enhanced accessibility it offers. Cloud-based procurement software can be accessed from anywhere at any time, provided there is internet connectivity. This has proven particularly advantageous in the modern work environment, where remote working and flexible office hours are becoming more common.

The continuous updates and improvements provided by cloud-based platforms ensure that businesses can always access the most advanced tools and features. These platforms typically offer regular updates without requiring significant downtime, ensuring that organizations are always at the forefront of procurement technology.

End-User Industry Analysis

In 2023, the Retail & e-Commerce segment held a dominant position in the procurement software market, capturing more than a 24.6% share. This segment’s leadership is primarily due to the expansive growth of online shopping, which necessitates robust procurement systems to manage the complex inventory and supply chain operations.

The driving force behind the Retail & e-Commerce segment’s prominence is the digital transformation sweeping through the sector. As consumer preferences shift towards online shopping, retailers must adapt to a more dynamic market environment where speed, efficiency, and accuracy in procurement operations are critical.

The integration of artificial intelligence and analytics in procurement software offers Retail & e-Commerce businesses critical insights into consumer behavior and trends. This capability enables them to make informed purchasing decisions, tailor inventory to predicted changes in consumer preferences, and manage logistical challenges more effectively.

Looking ahead, the Retail & e-Commerce segment is expected to maintain its lead due to the continuous innovations in online retailing and the increasing complexity of global supply chains. The need for sophisticated procurement solutions will only grow as e-commerce businesses expand their reach and face more competition.

Key Market Segments

By Deployment

- Cloud

- On-Premise

By End-User Industry

- Retail & e-Commerce

- Healthcare

- Automotive

- BFSI

- IT & Telecom

- Others

Driver

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The incorporation of AI and ML into procurement software is revolutionizing how companies manage their procurement activities. These technologies enable the automation of complex procurement processes, leading to improved decision-making and operational efficiency.

For instance, AI-driven analytics can predict purchasing trends, optimize supplier selection, and identify cost-saving opportunities. Machine learning algorithms can assess vast amounts of data to forecast demand accurately, helping businesses maintain optimal inventory levels and reduce wastage.

By leveraging AI and ML, procurement software not only enhances process efficiency but also provides strategic insights that contribute to a company’s competitive advantage.

Restraint

High Initial Implementation Costs

Despite its benefits, the adoption of procurement software often entails significant upfront expenses. These costs encompass software licensing fees, implementation charges, employee training, and potential hardware upgrades. For small and medium-sized enterprises (SMEs), such financial commitments can be particularly burdensome, potentially outweighing the anticipated benefits.

Additionally, concerns related to data security and privacy may deter organizations from fully embracing digital procurement solutions. Ensuring robust cybersecurity measures and compliance with data protection regulations adds to the complexity and cost of implementation.

Opportunity

Digital Transformation and Process Optimization

The global shift towards digitalization presents a significant opportunity for procurement functions to modernize and optimize their operations. By adopting e-procurement systems, organizations can achieve greater transparency, better competition, and easier communication with suppliers.

Digital procurement platforms facilitate electronic tendering, e-auctions, and streamlined supplier management, leading to reduced transaction costs and improved efficiency. Moreover, digital tools enable better data analytics, providing insights that drive strategic decision-making and enhance overall procurement performance.

Challenge

Managing Global Supply Chain Disruptions

In today’s interconnected world, procurement functions are increasingly vulnerable to global supply chain disruptions caused by natural disasters, geopolitical tensions, and pandemics. Such events can lead to severe interruptions, affecting the timely delivery of goods and services.

To mitigate these risks, procurement teams must diversify their supplier base, develop contingency plans, and invest in supply chain resilience measures. Building strong relationships with multiple suppliers across different regions and implementing robust risk management strategies are crucial to ensuring continuity and minimizing the impact of unforeseen disruptions.

Emerging Trends

Procurement software is evolving rapidly, embracing new technologies to enhance efficiency and adaptability. A significant trend is the integration of artificial intelligence (AI) and machine learning (ML). These technologies automate routine tasks, analyze spending patterns, and provide insights for better decision-making.

Another emerging trend is the adoption of cloud-based solutions. Cloud procurement platforms offer scalability and flexibility, allowing businesses to access procurement data anytime, anywhere. This accessibility facilitates real-time collaboration among teams and suppliers, streamlining the procurement process.

Sustainability is also becoming a focal point in procurement strategies. Companies are increasingly using procurement software to assess and report on sustainability metrics, such as carbon emissions and ethical sourcing practices. This shift reflects a growing commitment to environmental responsibility and compliance with regulations.

Moreover, mobile procurement solutions are gaining traction. They enable procurement activities through mobile devices, enhancing convenience and responsiveness. This mobility ensures that procurement processes continue seamlessly, even when team members are on the move.

Business Benefits

Implementing procurement software offers numerous business benefits. One of the primary advantages is enhanced efficiency by streamlining workflows. Features like electronic purchase orders and automated approvals expedite the procurement cycle, allowing teams to focus on strategic tasks rather than administrative duties.

Improved supplier management is another key benefit. The software provides a centralized platform to track supplier performance, manage contracts, and maintain communication, fostering stronger supplier relationships and ensuring compliance with agreements.

Additionally, procurement software offers better spend visibility. Comprehensive analytics and reporting tools enable businesses to monitor spending patterns, identify cost-saving opportunities, and make informed purchasing decisions.

Furthermore, the software supports compliance and risk management by maintaining records of procurement activities and ensuring adherence to company policies and regulatory requirements. This oversight reduces the risk of fraud and legal issues.

Regional Analysis

In 2023, North America held a dominant position in the procurement software market, capturing over 38.1% of the global share, which translated to approximately USD 2.9 billion in revenue. This leadership is attributed to several key factors.

The region’s advanced technological infrastructure has been pivotal in adopting sophisticated procurement solutions. Organizations across various industries have integrated procurement software to streamline operations and enhance efficiency. The strong presence of major procurement software providers in North America has further facilitated widespread adoption.

Moreover, the emphasis on automation and digital transformation has driven businesses to invest in procurement software. The need to optimize supply chains, reduce operational costs, and improve decision-making processes has made procurement software indispensable for many North American companies.

Additionally, regulatory frameworks and compliance requirements in the region have compelled organizations to adopt procurement solutions that ensure adherence to standards and mitigate risks. This necessity has spurred the demand for comprehensive procurement software capable of managing complex procurement activities.

Overall, North America’s leading position in the procurement software market in 2023 is a result of its robust technological infrastructure, focus on automation, presence of key industry players, and stringent regulatory requirements. These factors collectively have fostered an environment conducive to the widespread adoption and growth of procurement software.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the procurement software market, several key players offer distinct solutions tailored to various business needs.

SAP SE is a global leader in enterprise application software, providing comprehensive procurement solutions through its SAP Ariba platform. This platform facilitates end-to-end procurement processes, including sourcing, procurement, and supplier management, enabling organizations to streamline operations and achieve greater efficiency.

Proactis Holdings PLC specializes in spend management and procurement solutions aimed at enhancing cost savings and operational efficiency. Their software suite covers procurement, supplier management, and spend analysis, catering primarily to mid-market organizations seeking to optimize their procurement functions.

Ginesys, also known as Ginni Systems Limited, focuses on retail-specific procurement software. Their solutions integrate procurement with retail operations, offering modules for inventory management, point of sale, and supply chain management, thereby addressing the unique procurement challenges faced by retailers.

Top Key Players in the Market

- SAP SE

- Proactis Holdings PLC

- Ginesys

- Coupa Software Inc.

- Zycus Inc.

- Ivalua Inc.

- Microsoft Corporation

- Oracle Corporation

- Basware AS

- GEP Corporation

- Jaggaer Inc.

- Other Key Players

Top Opportunities Awaiting for Players

The procurement software market is ripe with opportunities for industry players, bolstered by several emerging trends and technological innovations.

- Cloud-based Solutions: The shift towards cloud-based procurement software continues to dominate, offering scalability, flexibility, and real-time collaboration capabilities. These cloud solutions are especially attractive because they reduce the need for substantial upfront infrastructure investment and facilitate quicker deployment.

- Sustainable Procurement: There’s a growing emphasis on sustainability within supply chain practices. Companies are increasingly looking for procurement solutions that can help assess supplier sustainability credentials and ensure ethical sourcing. This trend is not only driven by corporate responsibility but also by regulatory pressures and consumer demand for transparency.

- Globalization: As businesses expand globally, there is a heightened need for procurement solutions that manage international supplier relationships and comply with cross-border regulatory requirements. Software that supports multi-currency transactions and international compliance standards is therefore in high demand.

- Automation and AI Integration: Automation and artificial intelligence (AI) are becoming integral to procurement software, simplifying processes such as vendor selection, procurement operations, and transaction management. These technologies help improve efficiency, reduce errors, and cut operational costs, making them essential features for modern procurement systems.

- Regulatory Compliance: Compliance with increasing government regulations around data privacy, anti-corruption, and trade is another area where procurement software is proving invaluable. Software providers that can offer robust compliance features are likely to have a competitive edge.

Recent Developments

- In October 2023, Maximus UK is entering a new era of procurement with Atamis’ cutting-edge software, designed to streamline their sourcing processes and drive efficiency. By leveraging Atamis’ solutions, Maximus aims to enhance operations and achieve significant cost savings.

- In December 2024, Cleo has released an update to its Cleo Integration Cloud, introducing new procurement automation solutions that streamline supply chains from procurement to invoicing, offering customers full end-to-end visibility and control to ensure seamless delivery on commitments.

Report Scope

Report Features Description Market Value (2023) USD 7.8 Bn Forecast Revenue (2033) USD 19.9 Bn CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment (Cloud, On-Premise), By End-User Industry (Retail & e-Commerce, Healthcare, Automotive, BFSI, IT & Telecom, Others), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAP SE, Proactis Holdings PLC, Ginesys, Coupa Software Inc., Zycus Inc., Ivalua Inc., Microsoft Corporation, Oracle Corporation, Basware AS, GEP Corporation, Jaggaer Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Procurement Software MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Procurement Software MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- Proactis Holdings PLC

- Ginesys

- Coupa Software Inc.

- Zycus Inc.

- Ivalua Inc.

- Microsoft Corporation

- Oracle Corporation

- Basware AS

- GEP Corporation

- Jaggaer Inc.

- Other Key Players