Global Printing Ink Market By Process (Gravure, Flexographic, and Other Processes), By Formulation (Oil Based, Solvent Based, Water Based, and UV- Cured Based), and by End-User (Packaging, Commercial Publication, Textiles, and Other End-User) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 13038

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

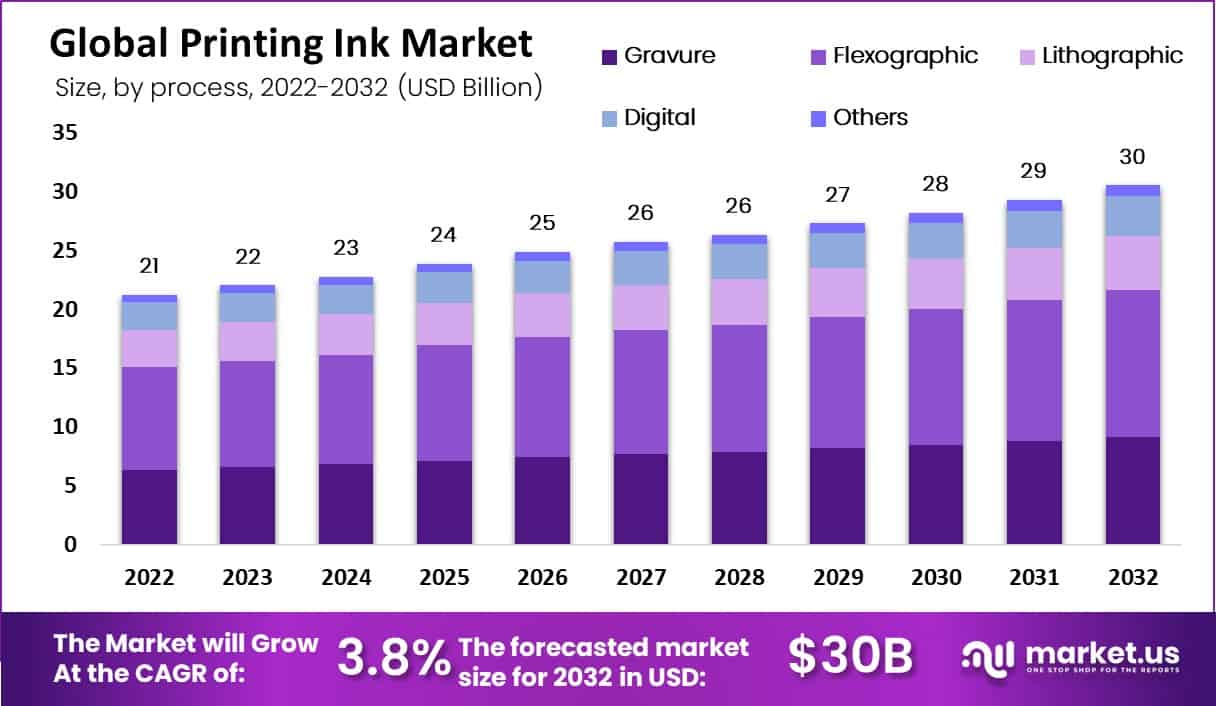

In 2022, the global printing ink market size was valued at USD 21.2 billion and is expected to grow to around USD 30 billion by 2032 between 2023 and 2032, this market is estimated to register the highest CAGR of 3.8%.

Using printing inks, individuals can make images, text, and designs. They contain dyes or pigments. They are frequently utilized in lithographic and letterpress printing. A pigment or pigments of the required color are combined with varnish or oil to make printing inks.

Carbon black, for instance, is mixed with thick linseed oil or similar oil, frequently rosin oil, which is then coated with rosin varnish. Inkjet inks are made up of a base carrier like water, oil, or a solvent, colorants like dyes or pigments, and a few chemical additives to give them some special qualities.

Key Takeaways

- Market Size and Growth Projection: The printing ink market was valued at USD 21.2 billion in 2022. It is expected to grow to approximately USD 30 billion by 2032. The market is projected to register a Compound Annual Growth Rate (CAGR) of 3.8% between 2023 and 2032.

- Printing Ink Composition: Printing inks are used for creating images, text, and designs, and they contain dyes or pigments. They are commonly used in lithographic and letterpress printing. Inks are made by mixing pigments of the desired color with varnish or oil.

- Types of Printing Inks: Carbon black is often mixed with linseed oil or similar oils for traditional printing inks. Inkjet inks are composed of a base carrier (water, oil, or solvent), colorants (dyes or pigments), and chemical additives for special qualities.

- Drivers for Market Growth: The packaging and label segment is a major driver of the printing ink market. Printing inks are increasingly used in packaging materials to enhance product appeal and marketability. Flexible packaging, especially in the food and beverage industry, contributes to market growth.

- Challenges and Restraints: Stringent regulations exist regarding toxic solvents, particularly in technical printing inks. Legal compliance, environmental impact, and safety evaluation are regulated by national and international bodies.

- Printing Processes: Lithographic printing dominates the market due to its versatility in various applications. Gravure printing inks are used for printing photographs on various materials. Flexographic inks, known for their cost-effectiveness and eco-friendliness, are expected to grow rapidly.

- Ink Formulations: Oil-based printing ink is the dominant product category in the market. Demand for water-based printing inks is expected to grow steadily due to environmental concerns.

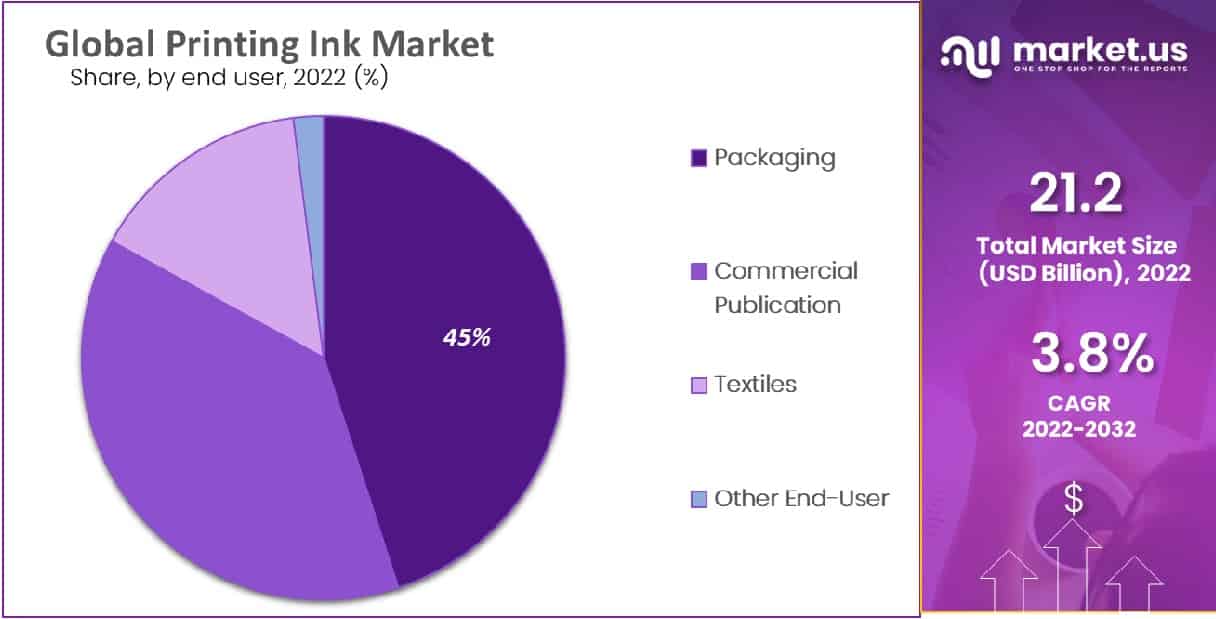

- End-User Analysis: Packaging is anticipated to dominate the market in terms of value during the forecast period. Printing inks are used on a variety of materials, including paper, plastics, and multilayered materials.

- Opportunities and Trends: Rising demand for printing ink in the commercial printing and publishing sector due to technological advancements. Customized packaging is made easier with flexible packaging, driven by the food and beverage industry’s growth.

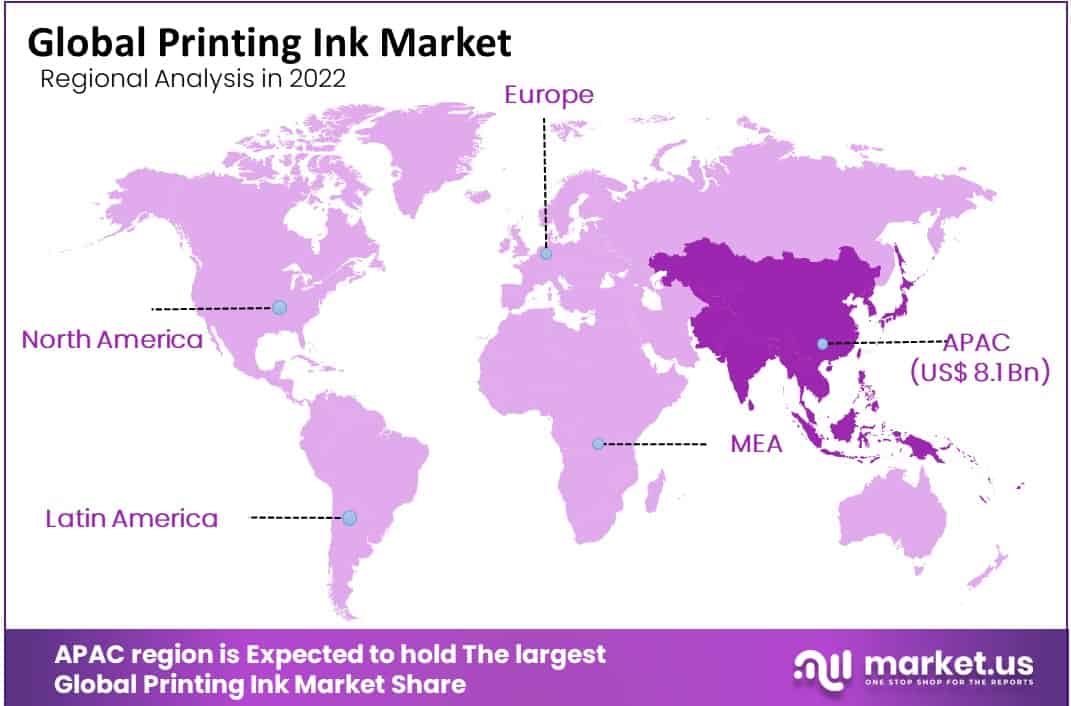

- Regional Market Analysis: Asia Pacific held the highest revenue share (38.0%) in the printing ink market in 2022. Market growth is positively impacted by the consumption of packaged food items and the labeling industry in the region.

- Key Players in the Market: Prominent companies in the printing ink market include DIC Corporation, Flint Group, Toyo Ink SC HOLDINGS CO., LTD., and others. The industry is competitive, with key players focusing on expansion, research, and development.

Drivers

Rise in Adoption from Packaging Industry

The major application segments of the global market for printing inks are packaging and labels. In 2022, the packaging and label segment accounted for nearly half of the total global printing ink market share in terms of volume. The high share is due to the rising demand for UV-blocking packaging inks, nano graphic printing inks, flexographic inks, gravure inks, and gravure inks for flexible packaging and paper packaging printing.

Printing inks were initially mostly used to print publications like newspapers, magazines, and journals. However, the packaging industry now outnumbers commercial printing and publication as a result of rapid urbanization and consumers’ increasingly digitalized needs. Printing inks are used to print on packaging materials in the packaging industry to make the packaging more appealing to customers. This is one of the most effective ways to promote and market products.

Custom packaging options are expanded with flexible packaging. The food and beverage industry is the driving force behind the demand for flexible packaging, which is supported by the strong printing ink market growth in the snacks and confectionery category.

Restraints

Stringent Regulations Regarding Toxic Solvents

Volatile organic compounds (VOCs) must be faced with a number of statutory regulations and laws. There are a number of state and federal regulations that aim to control VOC emissions and reduce human exposure to these chemicals. These compounds are frequently used in technical printing inks.

VOCs’ legal conformity in new application areas, their environmental relevance, and the safety evaluation of raw materials based on ecotoxicological and toxicological data are all regulated by national and international bodies.

Process Analysis

Increase in Demand for Lithographic Printing in Various Applications

The lithographic printing sector dominated the global market for printing inks based on the process. This can primarily be attributed to the rise in demand for lithographic printing in a variety of applications, including publication, commercial printing, industrial, and other fields.

Photographs are typically printed with gravure printing inks; They can be applied to thin papers, films, metal foils, paper cups, and other materials. “Liquid inks” are utilized in this process. These print processes are able to cover a variety of applications in food packaging, tobacco products, and cosmetics on a variety of substrates, including cardboard, papers, labels, foils, and plastics, thanks to the adaptability of this ink technology.

On a variety of substrates, including paper, laminates, corrugated boards, films, and foils, flexographic inks can be used. Due to their low cost and eco-friendly nature, these inks are expected to grow rapidly over the forecast period.

Formulation Analysis

Oil-based Printing Ink Product Segment Dominates the Global Printing Inks Market

The oil-based printing ink category dominated the global printing ink market in terms of product. This can primarily be attributed to the rise in demand for oil-based printing inks in a variety of applications, such as packaging and commercial and publication printing.

Due to rising environmental concerns, businesses in the North American printing ink market are attempting to concentrate on the production of bio-based inks. The price of crude oil directly affects demand for these printing inks. As a result, the global crude oil price fluctuation has a significant impact on the overall growth of the North American market.

Demand for UV-cured ink, an increase in the number of customers, and an increase in consumers’ spending and economic power are also driving overall market expansion.

Only a few applications call for solvent-based printing inks. As a result, the market for water-based printing ink is expected to grow steadily over the forecast period.

End-User Analysis

Packaging Segment is Anticipated to Dominate the Market

During the forecast period, it is anticipated that the packaging segment will dominate the global printing ink market in terms of value. The segment is anticipated to be propelled in the near future by an increase in demand for printing inks in packaging, publication and commercial printing, industrial, and other applications.

Printing inks are utilized in a wide variety of materials, including paper and carton boards, plastics, and multilayered materials.

Printing inks on food packaging materials are utilized for both marketing and consumer information. There are numerous packaging materials that can benefit from inks. Direct printing is possible on cork, paper, cork, plastic, and board. When printing ink come into contact with food, offset migration can cause them to migrate onto the internal surface.

Key Market Segments

Based on Process

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

Based on Formulation

- Oil Based

- Solvent Based

- Water Based

- UV- Cured Based

Based on End-User

- Packaging

- Commercial Publication

- Textiles

- Other End-User

Opportunity

Rising Printing Industry Demand and Technological Spread.

It is anticipated that the global demand for printing ink in the commercial printing/publishing sector will rise as a result of technological spread and rising printing ink industry demand.

In addition, the printing industry’s demand for short-run production of printed resources like direct mail, books, and brochures is thriving commercially.

Printing ink is expected to be in high demand as a result of rising retail, food, and beverage industry demand for promotional materials. The retail sector is included as print advertising and a part of the marketing strategy because numerous promotional events, including print advertising, are determining the commercial printing/publishing application segment.

Trends

Customized Packaging is made Easier with Flexible Packaging

Printing inks were initially used on a large scale to print newspapers, magazines, and journals. However, the packaging industry now outnumbers commercial printing and publication as a result of rapid urbanization and consumers’ increasingly digitalized needs. In the packaging industry, printing ink is used to make packaging materials more appealing to customers and is a powerful marketing tool.

Customized packaging is made easier with flexible packaging. The food and beverage industry is the main driver of demand for flexible packaging, which is supported by the strong growth in the snacks and confectionery category. In addition, one of the primary trends that are boosting the expansion of the flexible packaging industry is the rising demand for food as a result of the expanding global population. The printing ink market is anticipated to benefit significantly from the expanding flexible packaging sector.

Regional Analysis

Asia Pacific Held the Highest Revenue Share with Rising Consumption of Packaged Food Items and the Labeling Industry

In 2022, Asia Pacific held the highest revenue share 38.0% in the printing ink market. In 2022, Asia-Pacific held a commanding lead in the global market for printing inks and is anticipated to maintain this position throughout the forecast period.

Market growth in the region has been positively impacted by the rising consumption of packaged food items and the labeling industry as a result of the emergence of various businesses, such as the healthcare sector, the food and beverage industry, consumer goods, and e-commerce. Due to the flourishing packaging industry, the printing ink market is anticipated to expand significantly in North America. In addition, the region’s printing ink market is expected to expand in the coming years due to the ease with which resin can be obtained.

Due to the region’s rapid economic growth, it is anticipated that the Central and South American printing ink market will expand significantly during the forecast period. Based on the dynamics of the end-use industry in developed and developing nations, the Middle East and African printing ink market is diverse and varies country by country.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Several printing ink market companies are concentrating on expanding their existing operations and R&D facilities.

Due to the presence of vertically integrated key players with technologically advanced solutions, equipment, and procurement and distribution channels, the global ink industry is highly competitive. The industry has experienced a period of strong consolidation in various regions, including mergers, acquisitions, and expansions. This has made the industry extremely competitive.

Market Key Players

- DIC Corporation

- Flint Group

- Toyo Ink SC HOLDINGS CO., LTD.

- Huber Group Deutschland GmbH

- SAKATA INX CORPORATION

- ALTANA AG

- Wikoff Color Corporation

- Sun Chemical

- Tokyo Printing Ink MFG CO., LTD

- Other Key Players

Recent Developments

- Encres DUBUIT purchased POLY-INK in January 2022, expanding its product line with conductive inks. Through this acquisition, the company has merged application engineering capabilities with expertise in nanomaterial science.

- SAPICI was acquired by Sun Chemical in January 2022. strengthening the company’s capabilities to develop and manufacture brand-new polymers for the entire range of inks, and laminating adhesives it sells

Report Scope

Report Features Description Market Value (2022) US$ 21.2 Bn Forecast Revenue (2032) US$ 30.5 Bn CAGR (2023-2032) 3.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Process –Gravure, Flexographic, Lithographic, Digital, and Other Processes; By Formulation – Oil Based, Solvent Based, Water Based, UV- Cured Based; By End-User – Packaging, Commercial Publication, Textiles, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DIC Corporation, Flint Group, Toyo Ink SC HOLDINGS CO., LTD., Huber Group Deutschland GmbH, SAKATA INX CORPORATION, ALTANA AG, Wikoff Color Corporation, Sun Chemical, Tokyo Printing Ink MFG CO., LTD, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the printing ink market in 2022?The Healthy Snack Market size was estimated to be USD 21.2 billion in 2022.

What is the projected CAGR at which the printing ink market is expected to grow at?The printing ink market is expected to grow at a CAGR of 3.8% (2023-2032).

List the key industry players of the printing ink market?DIC Corporation, Flint Group, Toyo Ink SC HOLDINGS CO.LTD., Huber Group Deutschland GmbH, SAKATA INX CORPORATION, ALTANA AG, Wikoff Color Corporation, Sun Chemical, Tokyo Printing Ink MFG CO.LTD, Other Key Players engaged in the printing ink market.

Which region is more appealing for vendors employed in the printing ink market?In 2022, Asia Pacific held the highest revenue share 38.0% in the printing ink market. In 2022, Asia-Pacific held a commanding lead in the global market for printing inks and is anticipated to maintain this position throughout the forecast period.

-

-

- DIC Corporation

- Flint Group

- Toyo Ink SC HOLDINGS CO., LTD.

- Huber Group Deutschland GmbH

- SAKATA INX CORPORATION

- ALTANA AG

- Wikoff Color Corporation

- Sun Chemical

- Tokyo Printing Ink MFG CO., LTD

- Other Key Players