Global Print Management Software Market Size, Share, Industry Analysis Report By Type (Standalone, Integrated), By Deployment (On-Premises, Cloud-based), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By End-User (BFSI (Banking, Financial Services, and Insurance), Healthcare, Government & Public Sector, Education, Legal, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156397

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

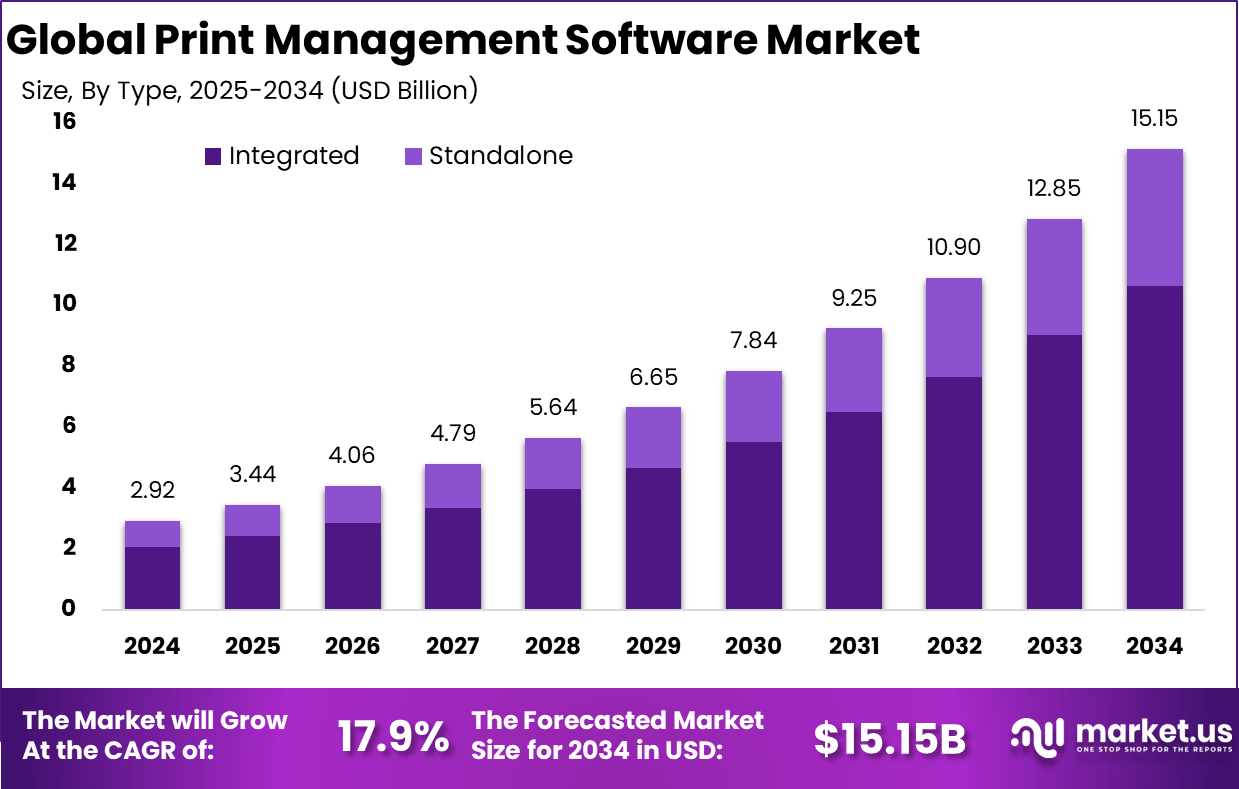

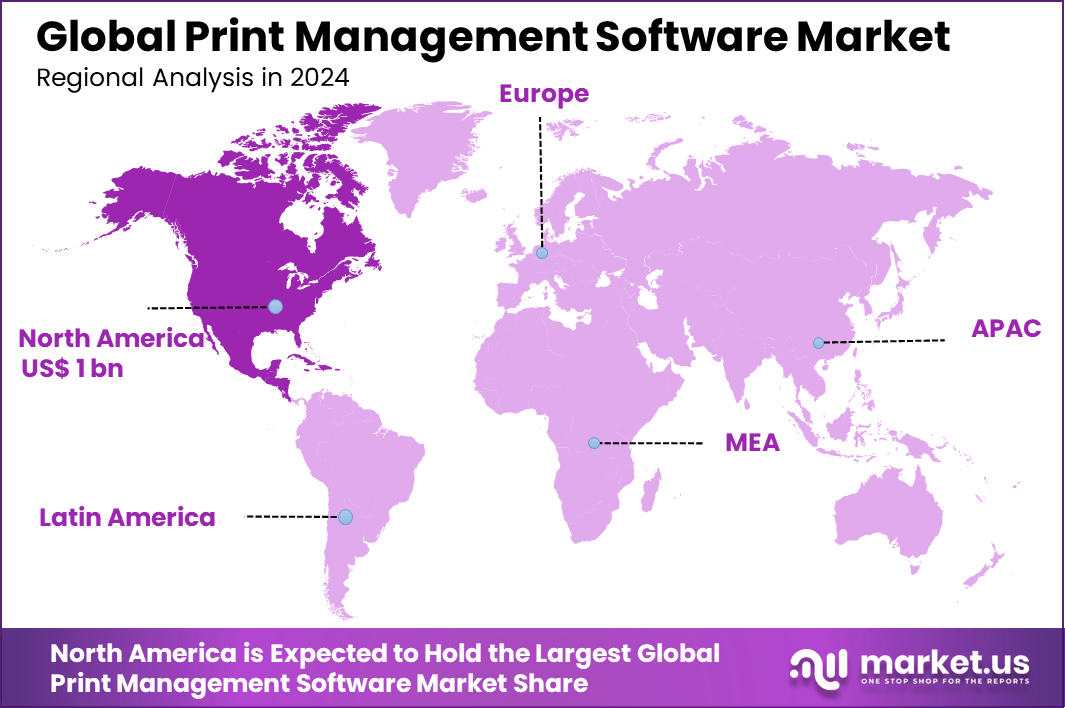

The Global Print Management Software Market size is expected to be worth around USD 15.15 billion by 2034, from USD 2.92 billion in 2024, growing at a CAGR of 17.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.5% share, holding USD 1.0 billion in revenue.

The Print Management Software Market focuses on software solutions that help organizations efficiently manage their printing operations. This software centralizes the control of printing devices, monitors usage, enforces print policies, and tracks costs to optimize resource utilization. It also supports mobile and cloud printing, allowing users to print securely from various devices while reducing waste and improving operational efficiency.

Top driving factors include the normalization of hybrid work, the hardening of endpoint print security, the migration of infrastructure to cloud, and the modernization of operating system print stacks. Cloud print management is already in use at 69% of organizations, with 74% running hybrid environments. Security remains the top barrier but has eased to 32%, as functionality and cost concerns are evaluated alongside benefits from centralized control.

Full-time in-office work fell by 6% in 2024, while hybrid and remote models expanded, shifting print to home offices and mobile contexts. At the same time, print-related data loss was reported by 67% of organizations, and employee-owned printers were cited as a key risk by 33%, which raises the priority of authenticated release and audit trails. A large installed base of over 120 million standards-certified printers enables rapid enablement without bespoke drivers, which supports broader rollout

For instance, in August 2025, PrintIQ unveiled its Version 49 software update, introducing a range of enhancements designed to improve workflow automation and user experience in print management. The update includes expanded integrations, improved job tracking, and advanced reporting features, helping print service providers streamline operations and optimize efficiency.

Key Takeaway

- By Type, Integrated solutions dominated with a 70.3% share, reflecting demand for end-to-end print management platforms.

- By Deployment, Cloud-based systems led with a 58.8% share, driven by scalability, remote access, and cost efficiency.

- By Organization Size, Large Enterprises accounted for a 57.4% share, supported by complex document workflows and compliance needs.

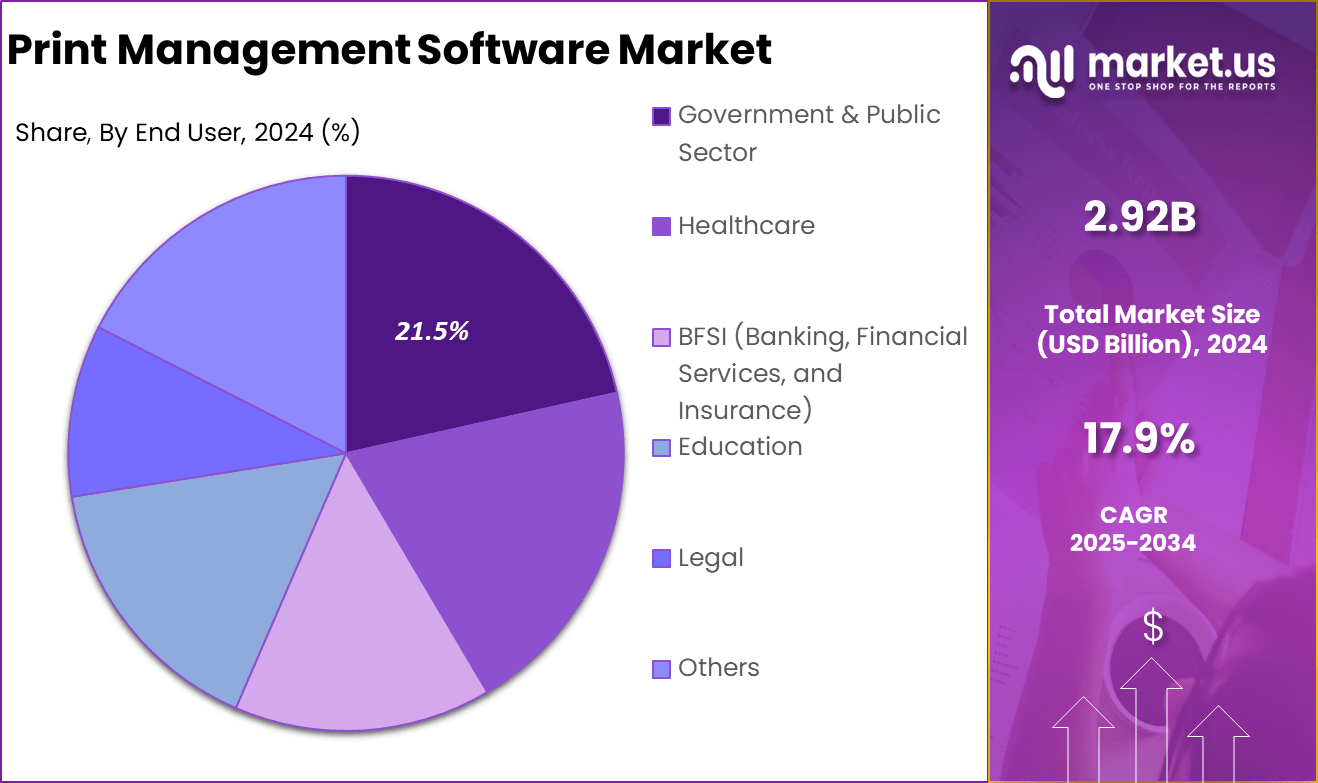

- By End-User, the Government & Public Sector captured a 21.5% share, reflecting their reliance on secure and regulated print operations.

- By Region, North America held 34.5% share of the global market.

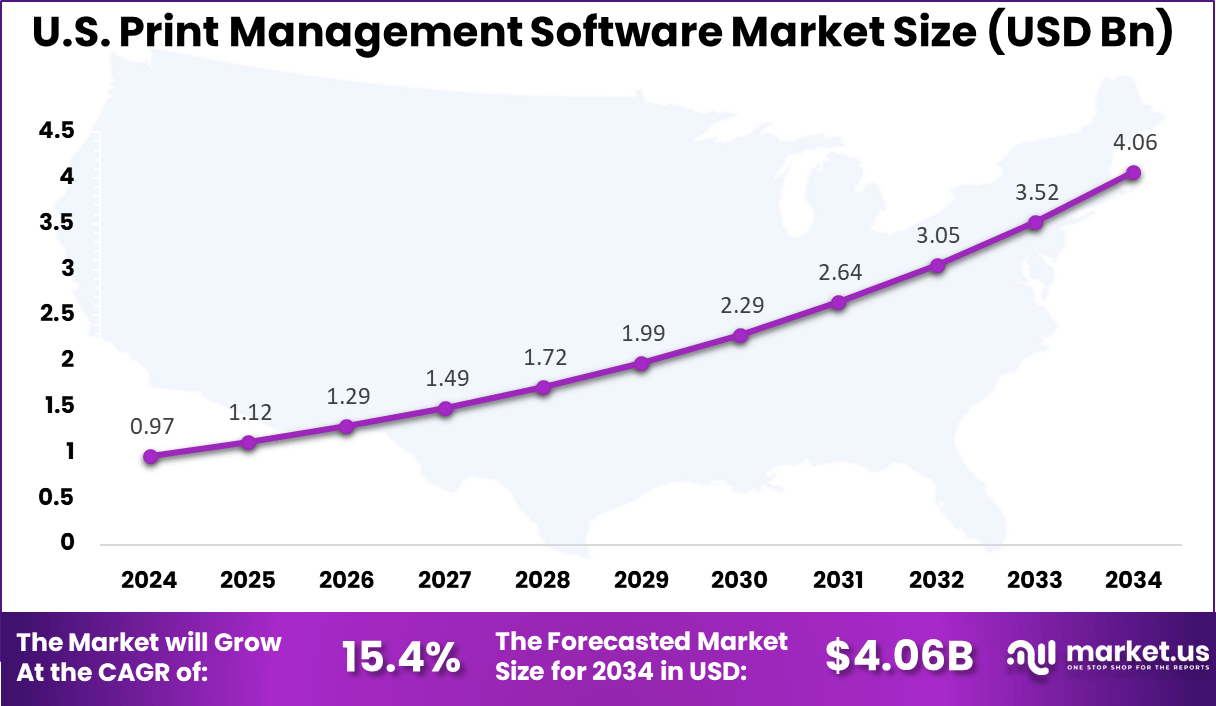

- The U.S. market was valued at USD 0.97 Billion in 2024, with a strong CAGR of 15.4%, highlighting rapid adoption of cloud and integrated printing solutions.

Investment and Benefits

The primary reasons for adopting print management software revolve around cost savings, improved security, increased operational control, and environmental responsibility. Organizations benefit from reduced print waste and printer maintenance costs while safeguarding sensitive information through controlled print access. Enhanced visibility into print usage helps identify inefficiencies and enable informed decision-making.

Investment opportunities lie in developing cloud-based SaaS offerings, AI-driven print optimization tools, and advanced security modules. Growing demand for integrated solutions that combine print management with document workflow automation presents avenues for innovation. Additionally, businesses focused on enhancing mobile and remote printing experiences are positioned well to attract investment.

Business benefits of print management software include streamlined print environments, reduced operational expenses, enhanced data security, and improved compliance adherence. Automation minimizes manual intervention, freeing IT resources and accelerating job throughput. These solutions also enable organizations to meet regulatory requirements more effectively by maintaining detailed audit trails.

U.S. Market Size

The market for Print Management Software within the U.S. is growing tremendously and is currently valued at USD 0.97 billion, the market has a projected CAGR of 15.4%. The market is growing due to rapid digital transformation, showing cybersecurity concerns and stricter regulatory compliance across sectors.

With the shift toward hybrid and remote work, U.S. organizations are prioritizing cloud-based print management to ensure secure, centralized control. At the same time, growing ESG initiatives are driving the adoption of eco-friendly printing practices. Businesses are also leveraging AI and automation to streamline workflows, enhance efficiency, and lower operational costs, making it a strategic priority in the enterprise landscape.

For instance, in September 2024, HP introduced new AI-driven innovations in its print solutions, reinforcing the U.S. leadership position in the global Print Management Software market. These advancements focus on predictive analytics, workflow automation, and enhanced security features, enabling enterprises to improve efficiency and sustainability.

In 2024, North America held a dominant market position in the Global Print Management Software Market, capturing more than a 34.5% share, holding USD 1 billion in revenue. The dominance is due to North America’s robust IT infrastructure, proactive cloud adoption, and emphasis on cybersecurity and compliance.

Its well-established enterprise sector, coupled with rising ESG priorities, has fueled the need for sustainable, streamlined print management solutions. The rapid integration of AI and automation across operations has further driven adoption. Additionally, the presence of major players such as HP, Xerox, and Canon, along with the expansion of hybrid work models, has significantly reinforced its leadership.

For instance, in April 2024, Xerox expanded access for its channel partners to its workplace and production print portfolio across North America, strengthening the region’s leadership in the global print management software market. This move enabled enterprises to adopt advanced solutions for secure printing, workflow automation, and cost optimization.

Economic Impact

Impact Details Cost Savings Up to 30% reduction in print-related expenses Productivity Gains Minimized downtime and streamlined print workflows Sustainability Benefits Reduced paper and energy consumption, supporting green initiatives ROI Rapid return on investment with efficient print resource management Type Analysis

In 2024, the Integrated segment held a dominant market position, capturing a 70.3% share of the Global Print Management Software Market. This dominance is due to rising demand for unified platforms that consolidate print tracking, security, and workflow management.

Integrated systems offer seamless compatibility with existing IT environments and enable centralized control in large multi-site organizations. These systems enhance security through encryption and user authentication, support cloud-enabled remote printing, and enable cost control via print quotas and detailed usage analytics. Their scalability, enhanced user experience, and support for hybrid work models have made them the preferred choice across industries.

For Instance, in July 2025, Bambu Lab introduced its new Local Print Farm Manager, a solution designed to centralize control and streamline operations across multiple 3D printers. While focused on additive manufacturing, the platform reflects the same principles driving adoption of integrated print management software, combining workflow optimization, real-time monitoring, and resource efficiency within a unified system.

Deployment Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 58.8% share of the Global Print Management Software Market. The dominance is due to the rise of remote and hybrid workforces, necessitating adaptable, scalable, and easily accessible print solutions.

Cloud-based platforms support centralized control, lower infrastructure costs, and provide real-time visibility and updates. Their seamless integration with enterprise cloud systems, along with enhanced security and ease of deployment, has accelerated adoption. Furthermore, growing integration of AI, mobile printing capabilities, and IoT connectivity is accelerating adoption, making it essential for modern, distributed workplaces.

For instance, in February 2024, Microsoft showcased the evolution of Universal Print, its cloud-based print management solution designed to deliver seamless and secure printing experiences. The platform enables centralized management without the need for on-premises print servers, making it especially valuable for hybrid and remote work environments.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 57.4% share of the Global Print Management Software Market. This dominance is due to the complex print infrastructure and higher security requirements typical of large organizations.

These enterprises prioritize centralized control, cost efficiency, and regulatory compliance, driving demand for advanced print management solutions. With larger budgets and dedicated IT teams, they are more likely to adopt integrated, AI-driven platforms that support scalability, sustainability, and seamless integration across global operations.

For Instance, in August 2024, eProductivity Software announced its acquisition of EPMS, strengthening its portfolio of enterprise print management solutions. This move reflects the growing demand among large enterprises for scalable, integrated platforms capable of handling complex workflows, high-volume printing, and strict compliance requirements.

End-User Analysis

In 2024, the Government & Public Sector segment held a dominant market position, capturing a 21.5% share of the Global Print Management Software Market. This dominance is due to the sector’s high demand for secure, compliant, and cost-efficient document management.

With extensive printing needs across departments, government institutions prioritize centralized control, data protection, and auditability. With growing emphasis on digital transformation, sustainability, and accountability, government bodies are increasingly adopting advanced, centralized print solutions to modernize operations and meet regulatory standards.

For Instance, in July 2025, Microsoft advanced its Universal Print offering within U.S. government environments, making it available across GCC and GCC High cloud environments with FedRAMP certification. This government-tailored solution allows agencies to manage printers securely without relying on on-premises print servers, aligning with Zero Trust principles.

Emerging Trends

Trend Details AI-Driven Insights Predictive maintenance and usage pattern analytics Cloud Integration Flexible, scalable print management across distributed sites Sustainability Focus Eco-friendly printing initiatives and resource optimization Hybrid Print Environments Combination of cloud and on-premise print management solutions Enhanced Security Features Multi-factor authentication, secure release printing Customer Insights

Insight Observations Increased Demand for Security Secure print management critical in healthcare, finance, government Preference for Cloud & Hybrid Models Flexibility in managing remote and distributed printing Sustainability & Cost Saving Primary drivers for adoption across industries Integration Challenges Seamless integration with existing IT infrastructure is key Key Market Segments

By Type

- Standalone

- Integrated

By Deployment

- On-Premises

- Cloud-based

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End-User

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Government & Public Sector

- Education

- Legal

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increased Focus on Sustainability

Growing environmental awareness and rising ESG commitments are prompting organizations to adopt sustainable practices. Print management software enables paper-saving features such as duplex printing, digital workflows, and usage tracking.

These solutions support green initiatives and also offer cost efficiencies. As environmental accountability becomes a business imperative, companies are increasingly turning to print management tools to drive both sustainability and operational performance.

For instance, in March 2023, HP unveiled a suite of its most sustainable printing solutions to date, reinforcing the industry’s shift toward environmentally responsible print management. These solutions integrate advanced print management software with features like automated duplex printing, toner efficiency, and analytics dashboards to track environmental impact.

Restraint

High Initial Implementation Costs

Despite its long-term benefits, the adoption of print management software often faces resistance due to high upfront costs. Licensing fees, infrastructure upgrades, and employee training costs can seem discouraging, especially for SMEs operating with tight IT budgets.

Additionally, organizations may hesitate to replace or upgrade existing hardware, further delaying adoption. These cost concerns can delay adoption, limiting market growth, particularly in cost-sensitive or resource-constrained business environments.

For instance, in May 2024, Strategic Technology Partners of Texas outlined the financial barriers surrounding print management software, particularly emphasizing the high initial implementation costs. For many SMEs, these upfront costs can be a significant deterrent, despite the long-term operational and cost-saving benefits.

Opportunities

Sector-Specific Solutions

Industry-specific print management solutions present a compelling growth opportunity. In sectors like healthcare, legal, and education, where documentation is both extensive and sensitive, tailored features such as secure printing, audit trails, and compliance reporting can offer significant value.

Vendors that understand and address the unique workflows and regulatory requirements of these industries can differentiate themselves in a competitive market. This focused approach not only enhances product relevance but also fosters stronger client relationships and long-term retention.

For instance, in June 2025, Ricoh launched its “Ricoh 3D for Healthcare” business, marking a significant expansion into the medical technology sector. The initiative focuses on leveraging additive manufacturing to deliver patient-specific solutions such as anatomical models, surgical guides, and custom implants.

Challenges

Security Concerns

As more organizations shift to cloud-based printing, concerns around data privacy and cybersecurity have become a growing challenge. For sectors handling sensitive information, such as finance and healthcare, unauthorized access or breaches during the print process can lead to significant legal and reputational risks.

While print management vendors offer security features like user authentication and encryption, many IT leaders remain cautious. Addressing these concerns transparently and robustly is critical for broader adoption, particularly in highly regulated environments.

For instance, in February 2025, Lexmark issued a critical security advisory warning customers about serious vulnerabilities in its printer software. These flaws, if exploited, could allow unauthorized access to networked devices, exposing sensitive data and compromising enterprise print environments. The company urged immediate firmware updates and reinforced secure configuration practices.

Key Players Analysis

The Print Management Software Market is characterized by the presence of established multinational corporations and strong technology providers. Companies such as Hewlett-Packard, Canon, Kyocera, Ricoh, Epson Print Admin, Konica Minolta, and Xerox have built significant portfolios that combine hardware strength with advanced software platforms.

Specialized software providers also contribute significantly to market development. Companies like Nuance, KOFAX, EFI, Levi Ray & Shoup, Y Soft, PaperCut Software, and Pharos Systems focus on software-only solutions tailored for businesses with diverse infrastructure. Their platforms integrate with multifunction devices and cloud environments, offering secure print release, detailed reporting, and policy enforcement.

The competitive environment also includes niche innovators such as ThinPrint GmbH, Process Fusion, PrinterLogic, Ringdale UK Ltd., Uniprint, Sepialine, PrintManager, Printix.net, and United Carlton. These companies emphasize flexibility, cost-effectiveness, and integration with digital workplaces. Many target small to mid-sized businesses seeking affordable solutions without heavy infrastructure investments.

Top Key Players in the Market

- The Hewlett-Packard Company

- Canon Inc.

- Kyocera

- Ricoh Company Ltd.

- Epson Print Admin

- Konica Minolta

- Xerox Corporation

- Brother International Corporation

- Nuance

- KOFAX INC.

- EFI (Electronics for Imaging Inc.)

- Levi Ray & Shoup Inc.

- Y Soft Corporation

- PaperCut Software International Pty Ltd.

- Pharos Systems

- ThinPrint GmbH

- Process Fusion

- PrinterLogic

- Ringdale UK Ltd.

- Uniprint

- Sepialine Inc.

- PrintManager

- Printix.net

- United Carlton

- Other Key Players

Recent Developments

- In May 2025, HP unveiled HP Nio, an AI-driven assistant integrated with PrintOS. It delivers real-time production insights, predictive analytics, and smart workflow suggestions via a chatbot interface, streamlining print operations.

- In April 2025, Print ePS expanded its partnership with PlanProphet to strengthen CRM integration within its ecosystem. This collaboration extends Salesforce-powered CRM capabilities to a wider base of Print ePS users, including those utilizing the Midmarket Print Suite powered by ePS Pace.

- In February 2025, Konica Minolta announced support for Windows Protected Print (WPP) in its Workplace Pure, YSoft SAFEQ Cloud, and SAFEQ print solutions, enhancing print security by transitioning to Microsoft’s modern, driver-independent print framework.

- In January 2025, OnPrintShop introduced version 12.0 of its platform, incorporating AI-driven web-to-print (W2P) capabilities. The update enhances personalization for large-format prints and textile products while adding advanced features such as AI-based website language translation, automated image generation, and smart text translation.

Report Scope

Report Features Description Market Value (2024) USD 2.92 Bn Forecast Revenue (2034) USD 15.15 Bn CAGR(2025-2034) 17.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Standalone, Integrated), By Deployment (On-Premises, Cloud-based), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By End-User (BFSI (Banking, Financial Services, and Insurance), Healthcare, Government & Public Sector, Education, Legal, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Hewlett-Packard Company, Canon Inc., Kyocera, Ricoh Company Ltd., Epson Print Admin, Konica Minolta, Xerox Corporation, Brother International Corporation, Nuance, KOFAX INC., EFI (Electronics for Imaging Inc.), Levi Ray & Shoup Inc., Y Soft Corporation, PaperCut Software International Pty Ltd., Pharos Systems, ThinPrint GmbH, Process Fusion, PrinterLogic, Ringdale UK Ltd., Uniprint, Sepialine Inc., PrintManager, Printix.net, United Carlton, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Print Management Software MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Print Management Software MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Hewlett-Packard Company

- Canon Inc.

- Kyocera

- Ricoh Company Ltd.

- Epson Print Admin

- Konica Minolta

- Xerox Corporation

- Brother International Corporation

- Nuance

- KOFAX INC.

- EFI (Electronics for Imaging Inc.)

- Levi Ray & Shoup Inc.

- Y Soft Corporation

- PaperCut Software International Pty Ltd.

- Pharos Systems

- ThinPrint GmbH

- Process Fusion

- PrinterLogic

- Ringdale UK Ltd.

- Uniprint

- Sepialine Inc.

- PrintManager

- Printix.net

- United Carlton

- Other Key Players