Global Prepared Flour Mixes Market By Product (Bread Mix, Pastry Mix, and Batter Mix), By Application (Household, Bakery Shop, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 29192

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

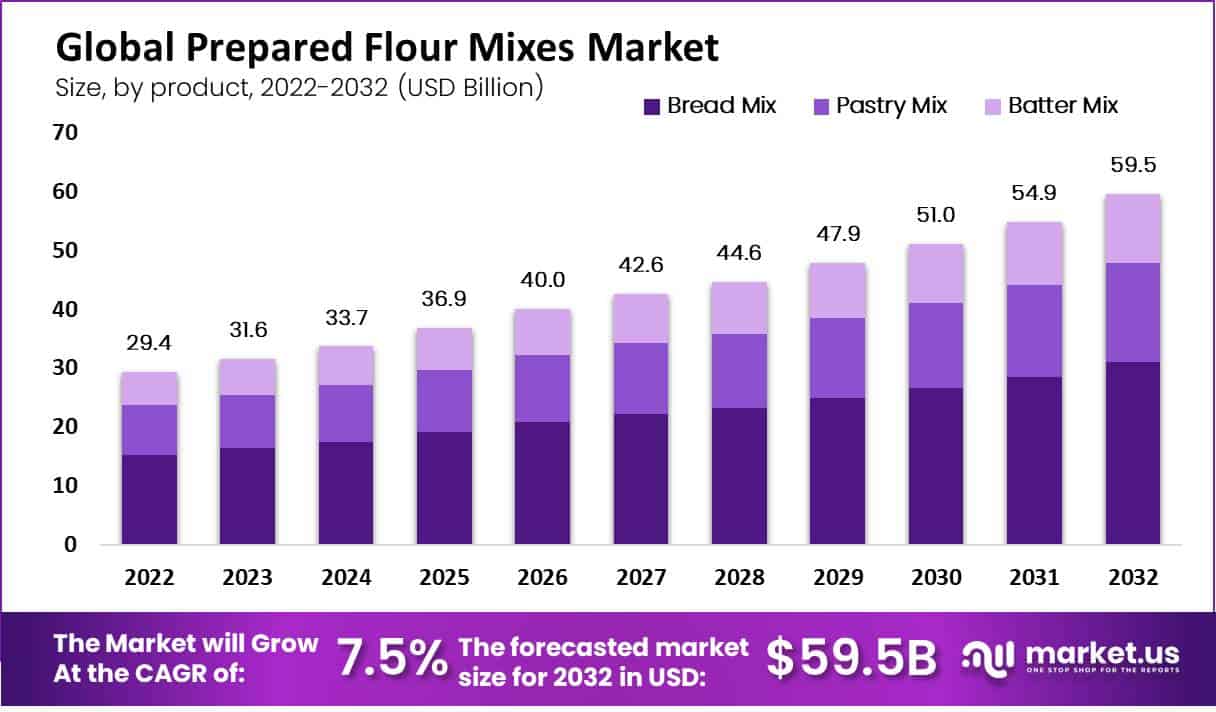

In 2022, the global prepared flour mixes market was valued at USD 29.4 billion and is expected to reach USD 59.5 billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 7.5%.

The market for products made from a combination of various flours, starches, also other components that are pre-mixed and packed for use in a variety of food applications is referred to as the “globally prepared flour mixes market.” These mixtures are constantly used in the making of pasta, pizza crusts, tortillas, and baked goods like bread, cakes, cookies, and pastries.

The market for prepared flour mixes has expanded in recent years as a result of a number of factors, including rising consumer demand for quick-to-prepare foods as well as the expansion of the food service sector. Prepared flour mixes are a desirable alternative for producers because they can also reduce waste and increase consistency in food production.

The product’s advantages over conventional formulae, such as simplicity of use, quick preparation, uniformity of results also longer shelf life, are fostering its expansion on a global scale. The demand for ready-to-cook flour mixes is increasing as a result of the lengthening workdays because they reduce time spent in the kitchen.

Key Takeaways

- Market Growth: In 2022, the prepared flour mixes market was valued at USD 29.4 billion and is projected to grow at a CAGR of 7.5% to reach USD 59.5 billion by 2032.

- Definition: The prepared flour mixes market consists of products that combine various flours, starches, and other components, pre-mixed and packed for use in various food applications, including pasta, pizza crusts, tortillas, and baked goods like bread, cakes, cookies, and pastries.

- Factors Driving Growth: Convenience Prepared flour mixes offer simplicity, quick preparation, and consistency, reducing the need to measure and combine individual ingredients. Time-saving As workdays lengthen, the demand for ready-to-cook flour mixes has increased, saving time in the kitchen. Health-consciousness The market is expanding due to consumer interest in healthier options, including whole grains, plant-based proteins, and superfoods.

- Factors Restraining Growth: Competitive Market The market is highly competitive, which may lead to lower pricing and reduced profit margins for manufacturers. Changing Consumer Preferences The market for natural and organic products is expanding, which may require costly and time-consuming product development. Health Concerns Some customers perceive prepared flour mixes with preservatives and additives as unhealthy, limiting market expansion.

- Product Analysis: Bread Mix Dominance The bread mix segment holds a 52% market share in the globally prepared flour mixes market. It includes various products like multigrain bread mix, white bread mix, wheat bread mix, and others. Health-Driven Demand Whole wheat and multigrain bread mix products are gaining popularity due to increased health awareness.

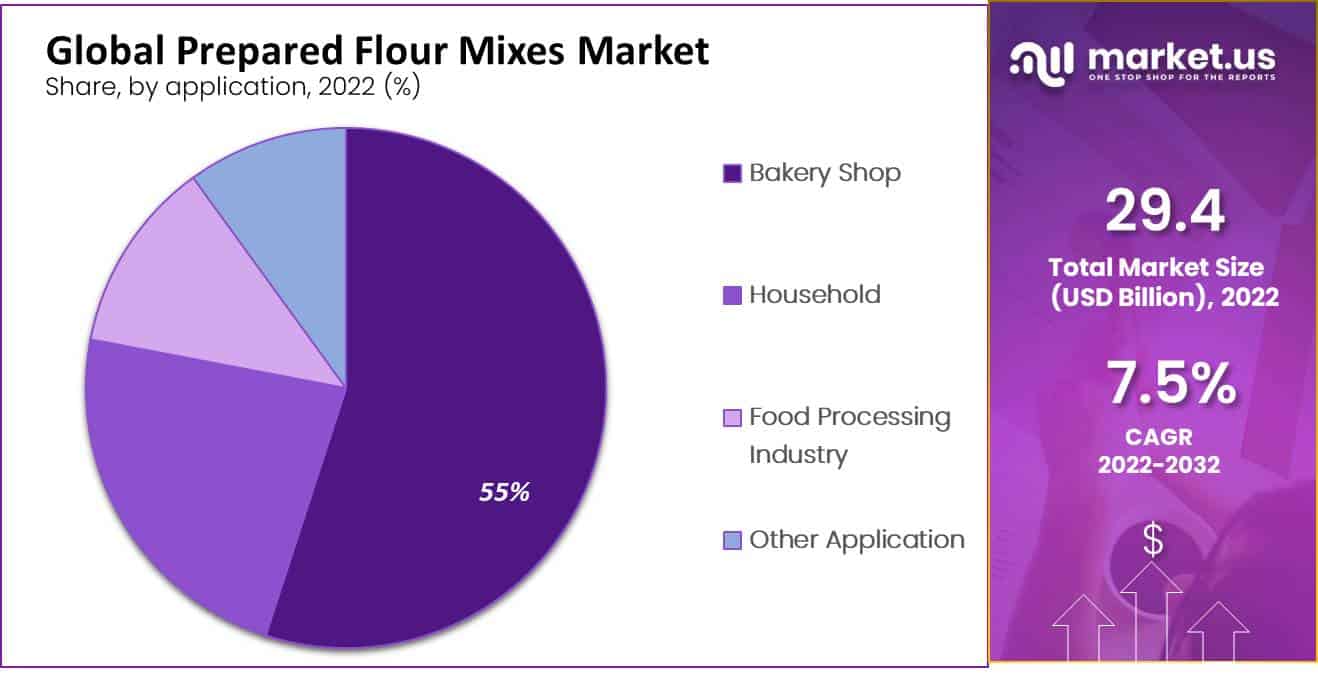

- Application Analysis: Bakery Shop Dominance The bakery shop application leads the market with a 55% market share, driven by the increasing demand for bakery products with a variety of flavors. Home Baking Growth The household segment is expected to witness significant growth, as more people prefer baking products at home, especially during pandemic seasons.

- Growth Opportunities: The prepared flour mixes market is poised for significant growth due to consumer preference for ready-to-eat foods and convenience. The increasing demand for gluten-free and allergen-free products is also a key growth factor.

- Latest Trends: Gluten-Free Demand There is a growing demand for gluten-free flour mixes to cater to individuals with celiac disease and gluten intolerance. Expanding into Emerging Markets Prepared flour mix manufacturers are looking to expand into emerging markets, such as Asia-Pacific and Latin America, as consumer eating habits change.

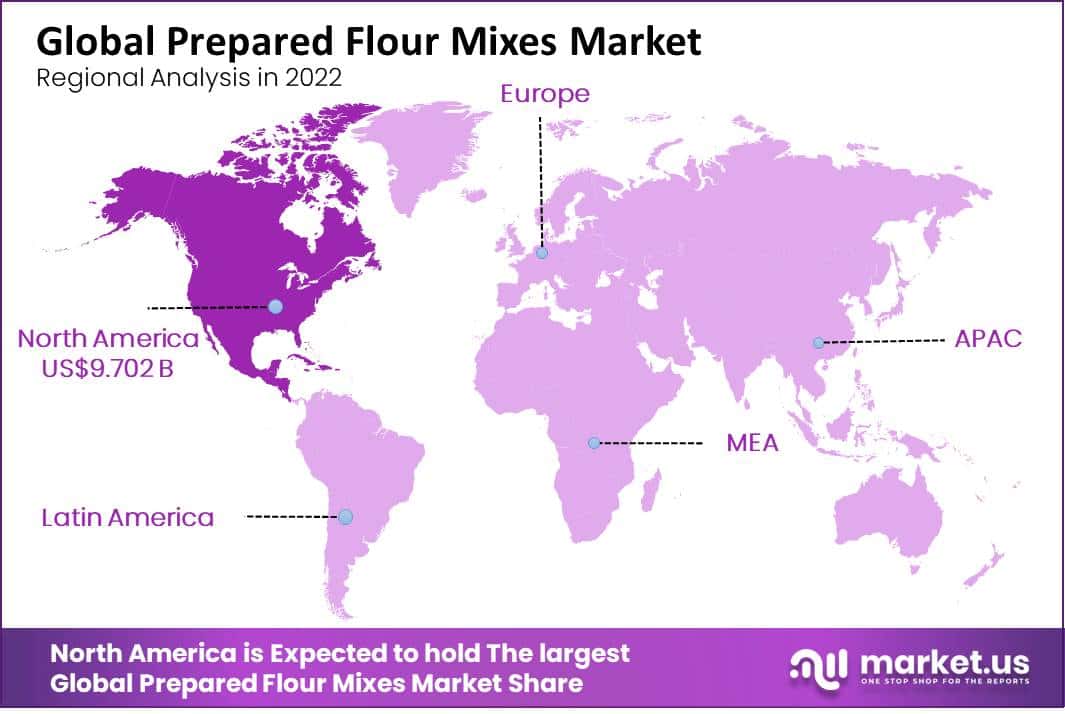

- Regional Analysis: North America leads the market with a 33% market share, driven by the demand for bakery products and ready-to-eat food. Europe is expected to experience significant growth, with a focus on gluten-free and organic flour mixes.

- Key Players: Major players in the prepared flour mixes market include ADM, Lesaffre, Bakels Group, PURATOS, Associated British Foods plc, and others.

Driving Factors

By removing the need to measure and combine flours and additives, prepared flour mixes are providing consumer convinces. This option makes them the popular choice for busy customer who wants to prepare meals fast and easily. Compared to buying individual flours and ingredients, prepared flours are mostly less expensive.

This is especially true for home cooks and small-scale bakers who don’t need large components. The demand has increased as a result of the rising illness and gluten intolerance. This demand has extended to prepared flour mixes. The global demand for prepared flour mixes has been increasing as baked products like cakes, bread, and cookies.

The food industry is growing rapidly with new products and brands, This industry offers opportunities for companies to introduce innovative products to the market Consumers are growing more health-conscious and seeking healthier food options. More people are growing interested in prepared flour that includes healthier components including whole grains plant-based proteins and superfoods are becoming more popular.

Restraining Factors

The global prepared flour mixes market is highly competitive with many big players operating in the market. There may be more competition, which might result in lower pricing and smaller manufacturer profit margins. Consumer preferences are always changing and the market for natural and organic goods is expanding.

It may be necessary for the manufacturers to maintain consumer preferences and need to provide products, which can be expensive and time-consuming. Consumers are aware of health-related issues, the preservatives and additives used in prepared flour mixes are frequently viewed as unhealthy products. As a result, customers would be hesitant to buy this product, which could restrict their market expansion.

By Product Analysis

Based on product, the bread mix segment dominates the globally prepared flour mixes market with a 52% market share. The bread mix segment is one of the major categories in this prepared flour mixes market, which includes a variety of products like multigrain bread mix, white bread mix, wheat bread mix, and others.

The growing popularity of home baking as well as the rising demand for prepared foods are the two factors that have contributed to the expansion of the bread mix market.

Products made from bread mixes are favored by customers who want to experience freshly baked bread without the inconvenience of creating it from scratch, because they are easy to use and also require little work for baking. The demand for whole wheat and multigrain bread mix products is being driven by the rising concern for health and wellness.

By Application Analysis

By application analysis, the bakery shop application was dominating the globally prepared flour mixes market with 55% market share due to the increasing demand for bakery products, like bread, muffins, cakes, and pastries are being boosted by the huge variety of flavors available in the market.

The household segment is expected to witness significant growth during the forecasting period. Due to in pandemic season, people become more health-conscious they prefer baking such types of products at home.

Key Market Segments

Based on Product

- Bread Mix

- Pastry Mix

- Batter Mix

Based on Application

- Household

- Bakery Shop

- Food Processing Industry

- Other Application

Growth Opportunity

The global prepared flour mixes market is expected to experience significant growth in the coming year. This growth can be attributed to some factors like consumer preference, increasing popularity of ready-to-eat foods also increasing demand for convenience food.

For consumers who wish to produce baked goods like bread, cakes, and pastries without having to measure and combine individual ingredients, prepared flour mixes offer a straightforward and time-saving solution. For customers who appreciate convenience also dependability, these mixes also provide consistency in taste as well as quality, which is vital.

Another factor in the growth of the global prepared flour mix market is the increasing demand for gluten-free and allergen-free products. The availability of prepared flour mixtures made especially for those people with dietary restrictions such as nut-free mixes and gluten-free is likely to increase demand for these goods

Latest Trends

With the growing incidence of celiac disease as well as gluten intolerance, there is a growing demand for gluten-free flour mixes. Manufacturers are responding to this demand by offering a wide range of gluten-free options, including mixes made from corn flour, rice flour, and other alternative grains.

The prepared flour mix market is no longer limited to developed countries. As more consumers in emerging markets adopt Western eating habits, there is an opportunity for prepared flour mixes manufacturers to expand into new regions. Industries are increasingly focusing on regions like Asia-Pacific and Latin America, where there is a growing middle class and also increasing demand for convenience foods.

To stay competitive, prepared flour mix manufacturers are constantly innovating and introducing new products. Some key players are focused on organic also non-GMO ingredients, while others are developing mixes that cater to the specific dietary needs of the customer, such as vegan, keto, and paleo diets.

Regional Analysis

North America dominates the global prepared flour mixes market with a 33% market share. The demand for the wholesale industry is growing fast due to the rising consumption of bakery products in this region. The busy lifestyle of customers prefers ready-to-eat food which is a driving factor of the prepared flour mixes market.

The European market is expected to have significant growth due to the gluten-free as well as organic flour mixes also increasing in this region. presence of major players such as Cargill and Nestle have boosted the market growth in this region

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

To obtain an advantage over rivals, important players are using a range of strategies, including mergers and acquisitions. In addition, a lot of businesses are developing and launching new products to increase their capacity and solidify their position in the market.

Custom-formulated flour solutions are available from manufacturers for customers in the premium segment. In order to profit from the aforementioned trend, important corporations are also focusing on narrow consumer bases.

Key Players

- ADM

- Lesaffre

- Bakels Group

- PURATOS

- Associated British Foods plc

- Allied Pinnacle Pty. Ltd.

- Intermix

- Rich Products Corp.

- Nisshin Seifun Group Inc.

- Yihai Kerry

- Nitto-fuji International Vietnam Co., Ltd.

- Pondan (PPMI)

- Interflour Group Pte. Ltd.

- Other Key Players

Recent Developments

- In July 2021, Bakels announced the acquisition of Innovative Bakery Resources (IBR), a leading bakery ingredient supplier based in California, USA. The acquisition expands Bakels’ presence in the North American market and strengthens its position as a global supplier of bakery ingredients.

- In May 2021, Bakels opened a new production facility in Shanghai, China, to meet the growing demand for bakery ingredients in the region. The new facility is equipped with state-of-the-art technology and will enable Bakels to better serve its customers in China and the Asia-Pacific region.

Report Scope

Report Features Description Market Value (2022) USD 29.4 Bn Forecast Revenue (2032) USD 59.5 Bn CAGR (2023-2032) 7.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product, By Application Regional Analysis North America – The US, Canada,&Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, &Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, &Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, &Rest of MEA Competitive Landscape Lesaffre, Bakels Group, Associated British Foods plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Prepared Flour Mixes Market in 2032?In 2032, the Prepared Flour Mixes Market will reach USD 59.5 billion.

What CAGR is projected for the Prepared Flour Mixes Market?The Prepared Flour Mixes Market is expected to grow at 7.5% CAGR (2023-2032).

List the segments encompassed in this report on the Prepared Flour Mixes Market?Market.US has segmented the Prepared Flour Mixes Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Product, market has been segmented into Bread Mix, Pastry Mix and Batter Mix. By Application, the market has been further divided into Household, Bakery Shop, Food Processing Industry and Other Application.

Which segment dominate the Prepared Flour Mixes industry?With respect to the Prepared Flour Mixes industry, vendors can expect to leverage greater prospective business opportunities through the Bread Mix segment, as this dominate this industry.

Name the major industry players in the Prepared Flour Mixes Market.ADM, Lesaffre, Bakels Group, PURATOS, Associated British Foods plc, Allied Pinnacle Pty. Ltd., Intermix and Other Key Players are the main vendors in this market.

Prepared Flour Mixes MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Prepared Flour Mixes MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Lesaffre

- Bakels Group

- PURATOS

- Associated British Foods plc

- Allied Pinnacle Pty. Ltd.

- Intermix

- Rich Products Corp.

- Nisshin Seifun Group Inc.

- Yihai Kerry

- Nitto-fuji International Vietnam Co., Ltd.

- Pondan (PPMI)

- Interflour Group Pte. Ltd.

- Other Key Players