Global Premium Electric Motorcycle Market Size, Share, Growth Analysis By Types (Electric Motorcycle, Electric Scooter), By Product (Sport, Off-road, Others), By Battery Capacity (Below 10 kWh, 10-15 kWh, 15-20 kWh, Above 21 kWh), By Application (Personal, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158512

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

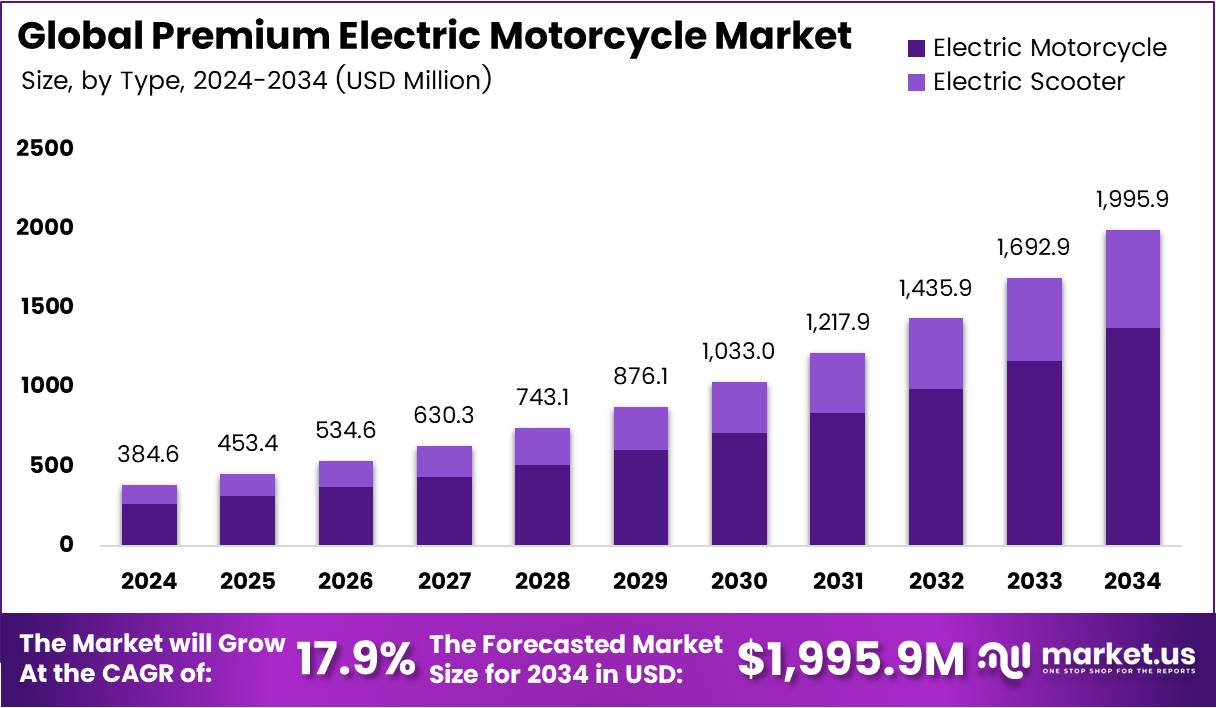

The Global Premium Electric Motorcycle Market size is expected to be worth around USD 1995.9 Million by 2034, from USD 384.6 Million in 2024, growing at a CAGR of 17.9% during the forecast period from 2025 to 2034.

The Premium Electric Motorcycle Market has been experiencing significant growth due to the rising demand for sustainable transportation and technological advancements. Consumers are shifting towards electric vehicles (EVs), drawn by their environmental benefits and lower operating costs. The increasing emphasis on reducing carbon emissions and the appeal of electric motorcycles as an alternative to traditional gasoline-powered models have contributed to the market’s expansion.

Additionally, the growing availability of high-performance premium electric motorcycles is a key factor. These motorcycles offer enhanced features like longer battery life, faster charging times, and superior performance compared to their conventional counterparts. The trend towards innovation in battery technology and design improvements continues to drive market interest and demand for premium options.

Government investment and regulatory support are also playing a pivotal role in accelerating market growth. Countries around the world are introducing policies that encourage the adoption of electric vehicles, including motorcycles. Incentives such as tax credits, rebates, and reduced registration fees for electric motorcycles are fueling consumer interest. This governmental backing is enhancing the overall market environment for electric motorcycles.

Furthermore, the market is benefiting from technological advancements in both infrastructure and production. The development of fast-charging networks and improvements in battery storage are making it more convenient for consumers to own and operate premium electric motorcycles. As the infrastructure improves, so too does consumer confidence in electric motorcycles, boosting demand.

According to Tradeimex, China takes the lead as the top motorcycle exporter globally, with a total export value of $14.53 billion in 2024. This dominance in the motorcycle export sector strengthens the growth prospects for premium electric motorcycles as China continues to lead in both production and technological innovation.

Additionally, Evreporter notes that in 2023, global electric motorcycle sales exceeded 10 million units, highlighting the increasing adoption of electric motorcycles worldwide. This trend is expected to further fuel growth in the premium segment of the market, as consumers seek higher-end, performance-oriented electric motorcycles.

Key Takeaways

- The Global Premium Electric Motorcycle Market is projected to reach USD 1995.9 Million by 2034, from USD 384.6 Million in 2024, growing at a CAGR of 17.9% during the forecast period from 2025 to 2034.

- Electric motorcycles dominate with 68.9% of the market share, offering superior torque, advanced battery technology, and enhanced stability.

- Sport motorcycles lead the premium market with 57.3% market share, driven by high-performance demand and advanced aerodynamics.

- The 10-15 kWh battery segment holds 39.2% of the market share, offering a balanced combination of performance, range, and cost.

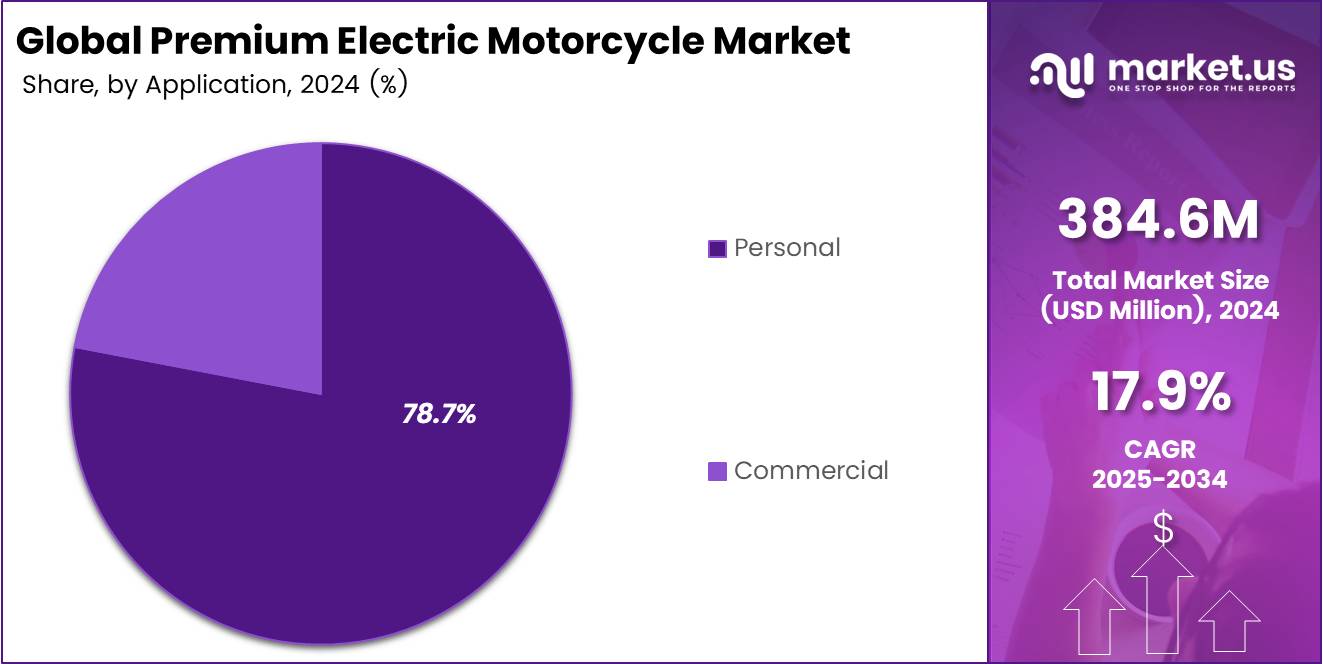

- Personal use applications account for 78.7% of the premium electric motorcycle market, reflecting growing adoption for commuting and recreational purposes.

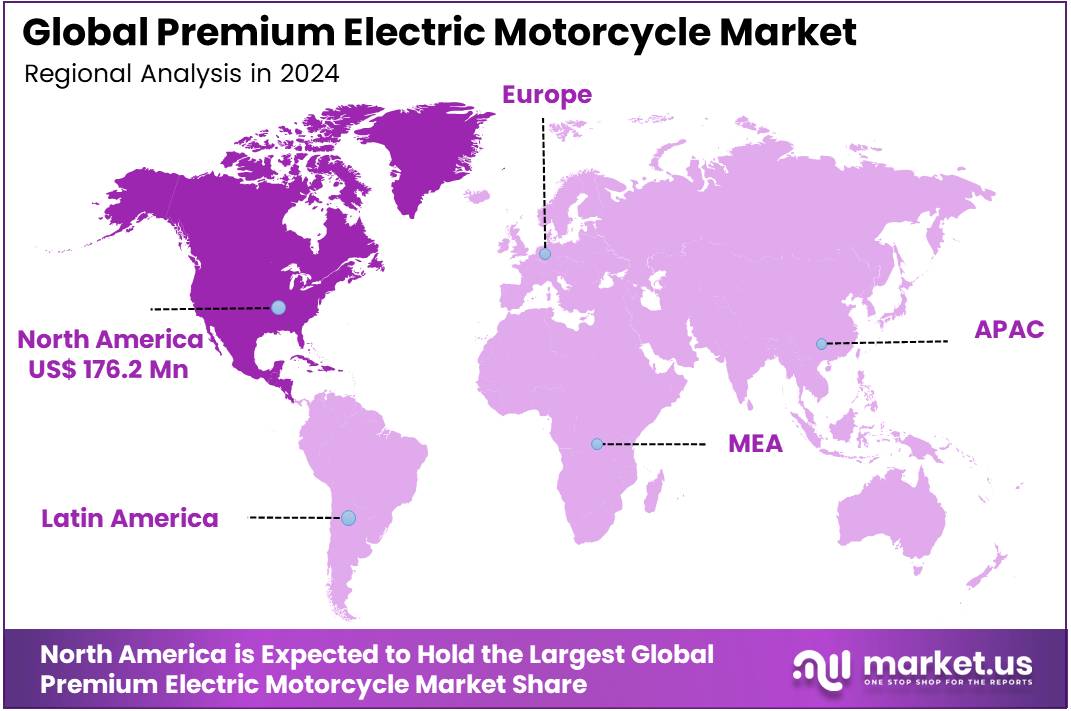

- North America leads the market with 45.9% market share, valued at USD 176.2 Million, due to strong demand for sustainable transportation and government incentives.

Types Analysis

Electric Motorcycle dominates with 68.9% due to its superior performance and longer range capabilities.

Electric motorcycles have emerged as the preferred choice among premium consumers, capturing 68.9% of the market share. These vehicles offer exceptional torque delivery, advanced battery technology, and sophisticated design elements that appeal to performance-oriented riders. Furthermore, electric motorcycles provide enhanced stability and superior handling characteristics compared to their scooter counterparts.

Electric scooters represent the remaining market segment, focusing primarily on urban mobility solutions. These vehicles emphasize convenience, compact design, and ease of use for daily commuting needs. Additionally, electric scooters cater to consumers seeking affordable entry points into premium electric mobility, though they maintain lower market penetration than motorcycles.

The dominance of electric motorcycles reflects consumer preference for premium features, advanced technology integration, and enhanced performance capabilities. Moreover, manufacturers continue investing heavily in motorcycle development, driving innovation in battery efficiency, motor power, and smart connectivity features that distinguish premium offerings from standard market alternatives.

Product Analysis

Sport segment dominates with 57.3% due to its high-performance appeal and advanced technological features.

Sport motorcycles command 57.3% of the premium electric motorcycle market, driven by consumer demand for high-performance vehicles. These models feature advanced aerodynamics, powerful electric motors, and sophisticated suspension systems that deliver exceptional riding experiences. Additionally, sport motorcycles incorporate cutting-edge battery technology and regenerative braking systems that enhance overall performance efficiency.

Off-road motorcycles serve adventure enthusiasts and recreational riders seeking robust, terrain-capable vehicles. These motorcycles feature reinforced frames, enhanced ground clearance, and specialized tire configurations designed for challenging environments. Furthermore, off-road models incorporate weather-resistant components and extended battery life to support longer adventure rides.

Other product categories encompass touring, cruiser, and hybrid motorcycle designs that cater to diverse consumer preferences. These segments focus on comfort, versatility, and specialized features that address specific riding requirements. Moreover, manufacturers continue expanding product portfolios to capture emerging market opportunities and satisfy evolving consumer demands across various riding applications.

Battery Capacity Analysis

10-15 kWh segment dominates with 39.2% due to its optimal balance between performance and affordability.

The 10-15 kWh battery segment captures 39.2% market share, representing the optimal balance between performance, range, and cost considerations. These batteries provide sufficient power for daily commuting while supporting moderate highway speeds and extended riding sessions. Furthermore, this capacity range offers reasonable charging times and battery longevity that satisfy mainstream consumer expectations.

Below 10 kWh batteries serve entry-level premium motorcycles, focusing on urban commuting and short-distance travel applications. These batteries offer cost-effective solutions while maintaining acceptable performance levels for city riding. Additionally, smaller capacity batteries reduce vehicle weight and manufacturing costs, making premium electric motorcycles more accessible to broader consumer segments.

15-20 kWh batteries cater to performance-oriented riders requiring extended range and higher power output capabilities. These batteries support longer touring applications and sustained high-speed riding. Moreover, 20+ kWh batteries serve premium performance motorcycles, offering maximum range and power for enthusiasts demanding ultimate performance capabilities and extended riding experiences.

Application Analysis

Personal use dominates with 78.7% due to growing consumer adoption and lifestyle preferences.

Personal use applications command 78.7% of the premium electric motorcycle market, reflecting strong consumer adoption trends and changing transportation preferences. Individual consumers increasingly embrace electric motorcycles for daily commuting, recreational riding, and lifestyle expression. Additionally, personal users appreciate the environmental benefits, reduced operating costs, and advanced technology features that premium electric motorcycles provide.

Commercial applications encompass delivery services, rental businesses, and fleet operations utilizing premium electric motorcycles for business purposes. These applications benefit from lower operating costs, reduced maintenance requirements, and enhanced brand image associated with sustainable transportation solutions. Furthermore, commercial users increasingly recognize the operational advantages and cost efficiencies that electric motorcycles offer over traditional internal combustion engine alternatives.

The dominance of personal use reflects broader consumer trends toward sustainable transportation, technological innovation, and premium lifestyle choices. Moreover, government incentives, environmental regulations, and charging infrastructure development continue supporting personal adoption rates, while commercial applications gradually expand as businesses recognize long-term operational benefits and environmental responsibility advantages.

Key Market Segments

By Types

- Electric Motorcycle

- Electric Scooter

By Product

- Sport

- Off-road

- Others

By Battery Capacity

- Below 10 kWh

- 10-15 kWh

- 15-20 kWh

- Above 21 kWh

By Application

- Personal

- Commercial

Drivers

Increasing Demand for Sustainable Transportation Solutions Drives Market Growth

The premium electric motorcycle market is experiencing strong momentum due to rising consumer interest in eco-friendly transportation options. More people are choosing electric bikes to reduce their carbon footprint and contribute to cleaner air in cities. This shift reflects growing environmental awareness among consumers who want alternatives to gas-powered vehicles.

Government support plays a crucial role in market expansion. Many countries offer tax breaks, rebates, and subsidies to encourage electric vehicle purchases. These incentives make premium electric motorcycles more affordable for buyers, reducing the initial cost barrier that often prevents adoption.

Battery technology improvements are revolutionizing the industry. New batteries store more energy in smaller spaces, allowing motorcycles to travel longer distances on single charges. These advances address one of the main concerns buyers have about electric vehicles – limited range.

Rising fuel prices and environmental worries are pushing more consumers toward electric alternatives. As gasoline costs increase, the economic benefits of electric motorcycles become more attractive. Combined with growing concerns about air pollution and climate change, these factors create strong demand for sustainable transportation solutions.

Restraints

Limited Charging Infrastructure Creates Market Barriers

The premium electric motorcycle market faces significant challenges from inadequate charging networks, especially in rural areas. Many regions lack sufficient charging stations, making it difficult for riders to find convenient places to recharge their vehicles during long trips. This infrastructure gap limits market expansion beyond urban centers.

Range anxiety remains a major concern for potential buyers. Many consumers worry about running out of battery power during rides, particularly on longer journeys. Long charging times compound this problem, as riders may need to wait hours for full battery restoration, unlike the quick refueling possible with traditional motorcycles.

Consumer doubts about electric motorcycle reliability and durability slow market adoption. Many buyers question whether electric bikes can match the performance and longevity of conventional motorcycles. This skepticism stems from limited long-term data on electric vehicle performance and concerns about expensive battery replacements.

The combination of these restraints creates hesitation among potential customers, limiting market growth despite the environmental and economic benefits electric motorcycles offer.

Growth Factors

Expansion into Emerging Markets Creates Significant Growth Opportunities

The premium electric motorcycle market shows promising expansion potential in developing countries where urbanization is accelerating rapidly. These markets offer large customer bases seeking affordable, efficient transportation solutions. As infrastructure develops and purchasing power increases, demand for premium electric motorcycles is expected to grow substantially.

Fast-charging technology development presents major market opportunities. Companies investing in quick-charge solutions can address range anxiety concerns effectively. New charging technologies that reduce charging times to minutes rather than hours will make electric motorcycles more practical for daily use and long-distance travel.

Strategic partnerships between electric vehicle manufacturers and energy companies are creating new business models. These collaborations help expand charging networks, develop renewable energy solutions, and create integrated services that make electric motorcycle ownership more convenient and cost-effective.

Urban areas are increasingly embracing electric motorcycles due to their environmental benefits and lower operating costs. Cities implementing strict emission regulations and offering dedicated lanes for electric vehicles create favorable conditions for market growth. The growing trend of urban mobility solutions positions electric motorcycles as ideal transportation for congested city environments.

Emerging Trends

Growing Interest in Eco-Friendly Products Shapes Market Trends

Environmental consciousness is driving consumer preferences toward energy-efficient transportation solutions. More buyers prioritize products that reduce environmental impact, creating strong demand for electric motorcycles. This trend reflects broader societal shifts toward sustainability and responsible consumption patterns that influence purchasing decisions across demographics.

The last-mile delivery sector is rapidly adopting electric motorcycles for commercial operations. E-commerce growth has increased demand for efficient, cost-effective delivery solutions. Electric motorcycles offer lower operating costs, reduced noise pollution, and environmental benefits that align with corporate sustainability goals, making them attractive for delivery services.

Electric motorcycle racing and entertainment segments are gaining popularity, creating new market opportunities. Racing events showcase electric motorcycle performance capabilities and generate consumer excitement about the technology. These entertainment applications help change public perceptions and demonstrate that electric motorcycles can deliver thrilling experiences comparable to traditional bikes.

The convergence of these trending factors creates a positive market environment where consumer preferences, commercial applications, and entertainment value align to support premium electric motorcycle adoption across multiple segments.

Regional Analysis

North America Dominates the Premium Electric Motorcycle Market with a Market Share of 45.9%, Valued at USD 176.2 Million

North America held the dominant position in the Premium Electric Motorcycle market, accounting for 45.9% of the global share, with a market value of USD 176.2 Million. The region’s leadership can be attributed to the growing demand for sustainable transportation solutions, strong government incentives, and advancements in electric motorcycle technology. Increased awareness of environmental issues and higher fuel costs have further fueled the shift toward electric motorcycles in this region.

Europe Premium Electric Motorcycle Market Trends

Europe follows as a significant market for Premium Electric Motorcycles, driven by robust regulatory frameworks supporting eco-friendly transportation. The region’s adoption of electric vehicles (EVs) is further enhanced by policies encouraging zero-emission transportation. With the presence of several key players and rising consumer demand for high-performance electric motorcycles, Europe is anticipated to witness steady growth in the coming years.

Asia Pacific Premium Electric Motorcycle Market Trends

Asia Pacific is expected to experience substantial growth in the Premium Electric Motorcycle market, supported by increasing consumer interest in electric mobility solutions. Countries like China and Japan are leading the charge in electric vehicle adoption due to government subsidies and the rapid development of charging infrastructure. The expansion of domestic manufacturers and advancements in battery technology are set to accelerate the market’s expansion in this region.

Middle East and Africa Premium Electric Motorcycle Market Trends

The Middle East and Africa region is still in the early stages of adopting premium electric motorcycles but is expected to grow gradually. Increased urbanization and government-backed initiatives to reduce carbon emissions are propelling demand for sustainable transportation options. However, the market faces challenges related to limited charging infrastructure and high initial investment costs, which may slow growth in the short term.

Latin America Premium Electric Motorcycle Market Trends

Latin America presents a growing market for Premium Electric Motorcycles, driven by the rising need for cost-effective and environmentally friendly transport options. While the region is still developing its electric vehicle infrastructure, government incentives and increasing consumer awareness of the environmental benefits of electric vehicles are expected to foster growth. However, adoption rates remain low due to financial constraints and underdeveloped charging networks.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Premium Electric Motorcycle Company Insights

In 2024, BMW Motorrad remains a leading player in the global Premium Electric Motorcycle Market, known for its innovation in electric mobility. The company’s commitment to sustainability and cutting-edge technology has positioned it as a key competitor, with its electric motorcycle lineup focusing on performance, design, and environmental efficiency.

Ducati Motor Holding S.p.A, another significant market player, is leveraging its strong brand presence to capture the growing demand for electric motorcycles. Ducati’s electric motorcycle offerings combine high-performance engineering with sleek designs, appealing to both existing and new customers looking for premium electric solutions in the two-wheeler segment.

Energica Motor Company continues to push the boundaries of electric motorcycles with its high-performance models. Energica’s focus on electric racing technology and integration of advanced electric drivetrains has helped the company maintain its strong position in the premium segment. The company’s electric motorcycles cater to performance enthusiasts, offering an eco-friendly alternative without compromising on speed or power.

LiveWire, a subsidiary of Harley-Davidson, is carving a niche in the electric motorcycle market by targeting eco-conscious riders who seek performance alongside sustainability. LiveWire’s aggressive marketing and distinctive designs have helped the brand attract attention, making it a noteworthy competitor in the premium electric motorcycle market in 2024. Its focus on quality, performance, and sustainable mobility is expected to drive its market share further.

Top Key Players in the Market

- BMW Motorrad

- Ducati Motor Holding S.p.A

- Energica Motor Company

- LiveWire

- KTM AG

- Verge Motorcycles

- Zero Motorcycles

- Yadea

- AIMA

- Lvyuan

Recent Developments

- In August 2025, Electric Motorcycle Company Ultraviolette raised $21 million in a funding round led by TDK Ventures. The investment will help scale up its electric vehicle production and expand its operations.

- In January 2025, Oben Electric secured INR 50 Crore in Series A funding, taking its total funding to INR 150 Crore. This capital will drive the company’s pan-India expansion and enhance its product offerings.

- In September 2025, Maeving raised $15 million in funding to strengthen its presence in the US market. The investment aims to expand its electric motorcycle operations and enhance its product distribution.

- In July 2024, E-Bike maker Matter secured USD 35 million in Series B funding led by Helena. This funding will accelerate its growth in the electric mobility space and support new product developments.

- In July 2024, Harley-Davidson announced a $89 million investment to expand its plant dedicated to manufacturing electric motorcycles. The funding will enable Harley-Davidson to ramp up production of its electric bike models.

Report Scope

Report Features Description Market Value (2024) USD 384.6 Million Forecast Revenue (2034) USD 1995.9 Million CAGR (2025-2034) 17.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (Electric Motorcycle, Electric Scooter), By Product (Sport, Off-road, Others), By Battery Capacity (Below 10 kWh, 10-15 kWh, 15-20 kWh, Above 21 kWh), By Application (Personal, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BMW Motorrad, Ducati Motor Holding S.p.A, Energica Motor Company, LiveWire, KTM AG, Verge Motorcycles, Zero Motorcycles, Yadea, AIMA, Lvyuan Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Premium Electric Motorcycle MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Premium Electric Motorcycle MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BMW Motorrad

- Ducati Motor Holding S.p.A

- Energica Motor Company

- LiveWire

- KTM AG

- Verge Motorcycles

- Zero Motorcycles

- Yadea

- AIMA

- Lvyuan