Global Predictive AI In Supply Chain Market Size, Share Analysis Report By Component (Software, Services), By Deployment Mode (On-Premise, Cloud-based), By Application (Demand Forecasting, Inventory Management, Procurement & Sourcing, Risk Management, Others), By End Use Industry (Retail, Automotive, Manufacturing, Food and Beverages, Healthcare, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145113

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Application Analysis

- End Use Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

The Global Predictive AI In Supply Chain Market size is expected to be worth around USD 8.1 Billion By 2034, from USD 2.0 billion in 2024, growing at a CAGR of 15.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.6% share, holding USD 0.79 Billion revenue. The U.S. Predictive AI in Supply Chain market was valued at USD 0.64 billion in 2024 and is expected to grow at a CAGR of 14.6%.

Predictive AI in the supply chain encompasses the application of artificial intelligence technologies to forecast events within the supply chain operations. By analyzing historical and real-time data, AI predictive analytics can anticipate future trends and disruptions, allowing businesses to proactively adjust their strategies. This application of AI enhances decision-making processes, optimizes inventory, reduces costs, and improves overall supply chain efficiency.

The market for predictive AI in the supply chain is expanding as more businesses recognize the need to improve accuracy in forecasting and decision-making processes. This market segment includes various solutions such as demand forecasting, inventory optimization, and predictive maintenance tools that are increasingly being integrated into supply chain management systems.

Several key factors are driving the adoption of predictive AI in supply chains. These include the need for enhanced supply chain visibility, improved risk management, and the ability to respond more swiftly to market changes and disruptions. Companies are increasingly investing in AI technologies to stay competitive and manage the complexities of modern supply chains effectively.

According to Market.us, The Global Predictive AI Market is projected to reach approximately USD 108 billion by 2033, rising from USD 14.9 billion in 2023. This growth is expected to occur at a CAGR of 21.9% from 2024 to 2033. The expansion can be attributed to rising demand for data-driven insights, increasing adoption of AI across industries, and the growing need for automation in decision-making processes.

The demand for predictive AI in supply chains is growing as companies recognize its potential to enhance forecasting accuracy and operational resilience. Industries such as retail, manufacturing, and logistics are particularly keen on integrating these technologies to improve their responsiveness to market dynamics and supply chain risks

Organizations are increasingly adopting technologies such as machine learning, advanced analytics, and Internet of Things (IoT) solutions to empower their supply chain operations. These technologies facilitate real-time data analysis and greater transparency across the supply chain, leading to improved operational efficiencies and decision-making.

The primary reasons for adopting predictive AI technologies in supply chains include the ability to forecast demand more accurately, optimize inventory levels, and identify potential supply chain disruptions before they occur. This proactive approach not only enhances operational efficiency but also significantly reduces costs and improves customer satisfaction.

Key Takeaways

- The global market for predictive AI in supply chain management is poised for significant growth, projected to increase from USD 2.0 billion in 2024 to USD 8.1 billion by 2034. This growth trajectory represents a compound annual growth rate (CAGR) of 15.3%.

- In 2024, North America emerged as a leader in the market, securing a 39.6% share, translating to revenue of USD 0.79 billion. The robust market position underscores the region’s pioneering role in adopting advanced predictive AI technologies.

- The U.S. stands out within the North American market, with the predictive AI in supply chain sector valued at USD 646.1 billion in 2024. The market is expected to continue its upward trend, growing at a CAGR of 14.6%.

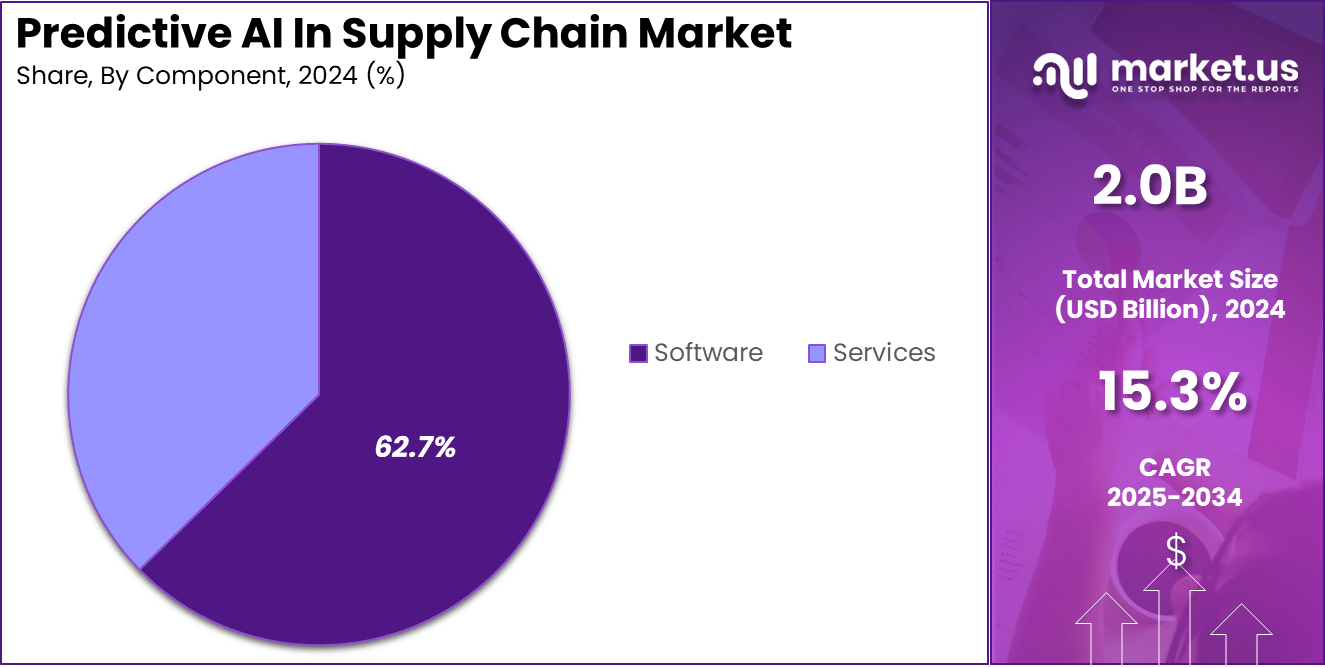

- The software segment notably dominated the predictive AI landscape, holding a 62.7% share in 2024. This dominance indicates a strong reliance on sophisticated AI-driven software solutions to enhance supply chain operations.

- Cloud-based solutions have established a stronghold in the sector, accounting for a 61.8% market share in 2024. The shift towards cloud platforms reflects the industry’s preference for scalable and flexible AI applications.

- Demand forecasting is a critical application within this market, with a dominant 35.3% share in 2024. The focus on demand forecasting highlights the industry’s need to leverage AI for more accurate and timely predictions to optimize supply chain efficiency.

- The retail sector significantly utilizes predictive AI technologies, representing 23.4% of the market in 2024. This indicates the sector’s strategic implementation of AI to streamline operations and enhance supply chain responsiveness.

Analysts’ Viewpoint

The rapid growth of the predictive AI market presents significant investment opportunities, especially in developing technologies that enhance supply chain analytics, risk assessment, and inventory management. Investors are particularly interested in startups and technologies that offer innovative solutions for complex supply chain challenges.

Key trends in the predictive AI in supply chain market include the integration of AI with other digital technologies like blockchain for enhanced transparency, the adoption of cloud-based platforms for scalability, and the emphasis on sustainability through optimized logistics operations.

Major factors impacting the market include technological advancements, the increasing complexity of supply chains, and regulatory changes affecting trade and logistics. Additionally, economic fluctuations and geopolitical events also play critical roles in shaping market dynamics.

Businesses leveraging predictive AI in their supply chains enjoy numerous benefits, such as improved accuracy in demand forecasting, reduced lead times, and enhanced customer service. This not only leads to cost savings but also boosts overall business resilience and adaptability in a volatile market environment.

U.S. Market Size

The US Predictive AI In Supply Chain Market is valued at approximately USD 0.6 Billion in 2024 and is predicted to increase from USD 0.7 Billion in 2025 to approximately USD 2.0 Billion by 2034, projected at a CAGR of 14.6% from 2025 to 2034.

The United States is projected to lead the Predictive AI in Supply Chain market due to several core factors that drive innovation and adoption in the sector. These factors include a robust technological infrastructure, significant investments in AI and machine learning, and a strong presence of leading tech companies that are pioneering AI developments.

The U.S. market benefits from advanced data analytics capabilities and extensive integration of IoT devices across supply chain operations, providing rich data sets that enhance predictive accuracy. American companies have also been early adopters of AI technologies, applying them across various components of the supply chain including logistics optimization, inventory management, and demand forecasting.

In 2024, North America held a dominant market position in the Predictive AI in Supply Chain sector, capturing more than a 39.6% share with a revenue of USD 0.79 Billion. This leadership can be attributed to several key factors that uniquely position North America at the forefront of the predictive AI advancements in supply chain management.

Firstly, North America benefits from a highly developed technological infrastructure, which is crucial for the sophisticated data processing required by predictive AI systems. The region’s advanced IT and communications network facilitates the seamless collection, transmission, and analysis of large data sets that are critical for effective predictive modeling and AI integration.

Secondly, the presence of major technology giants and innovative startups in North America drives continuous advancements in AI technology and its applications in supply chains. Companies in the U.S. and Canada are pioneers in developing and implementing AI solutions, contributing significantly to the region’s leading position.

These companies not only invest heavily in AI research and development but also apply these innovations to streamline supply chain operations, reduce costs, and improve service delivery, setting a high standard of operational efficiency that is emulated globally.

Component Analysis

In 2024, the Software segment held a dominant market position within the predictive AI in supply chain market, capturing more than a 62.7% share. This significant market share can be attributed to several key factors that underscore the critical role software plays in enhancing predictive capabilities and operational efficiencies in supply chains.

Firstly, the prevalence of software in this sector is driven by its ability to integrate complex algorithms that analyze vast amounts of data to forecast future demand and supply conditions. These predictive analytics software systems enable companies to optimize inventory levels, reduce waste, and enhance just-in-time delivery models, which are essential for maintaining competitiveness in fast-paced markets.

Additionally, the software segment benefits from continuous advancements in machine learning and artificial intelligence technologies. These innovations enhance the accuracy of predictive models and allow for real-time decision-making, which is crucial in managing the dynamic nature of supply chains.

The ability to quickly adapt to market changes and predict potential disruptions before they occur helps companies mitigate risks and maintain continuous operations, further solidifying the importance of software solutions in this field.

Moreover, the rise of cloud-based solutions has expanded access to predictive AI technologies, enabling even small and medium-sized enterprises to leverage advanced analytics without the need for substantial upfront investments in IT infrastructure. This democratization of technology has not only expanded the market size but also intensified the demand for software solutions, driving further growth in this segment.

Deployment Mode Analysis

In 2024, the cloud-based deployment segment established a dominant market position in the predictive AI in supply chain sector, capturing a significant 61.8% market share. This leadership is primarily due to the segment’s ability to offer superior flexibility and scalability compared to on-premise solutions.

Cloud-based AI deployments provide businesses with the advantage of low entry costs and reduced need for in-house IT infrastructure, which are compelling for organizations aiming to integrate AI into their operations without significant initial investments.

Additionally, the cloud-based model excels in facilitating enhanced collaboration and data sharing across geographically dispersed supply chain partners. This capability is crucial in modern supply chains, where real-time data exchange and visibility are essential for effective decision-making and responsiveness to market changes.

The increasing adoption of cloud-based AI solutions by small and medium-sized enterprises further underscores its growing appeal, as these organizations seek technology solutions that are both cost-effective and capable of driving significant operational improvements.

Application Analysis

In 2024, the Demand Forecasting segment within the predictive AI in supply chain market held a dominant position, capturing more than a 35.3% share. This prominence is attributed to the increasing necessity for precision in predicting consumer demand, which is essential for optimizing inventory and production strategies in today’s dynamic market environments.

AI-enhanced demand forecasting utilizes advanced algorithms and machine learning models to analyze vast amounts of data, including sales history, seasonal trends, and market conditions, which allows businesses to anticipate consumer needs with unprecedented accuracy.

The rapid evolution of consumer behavior, especially highlighted during the COVID-19 pandemic, has underscored the limitations of traditional forecasting methods that primarily relied on historical sales data. Modern AI tools in demand forecasting integrate diverse data inputs such as weather patterns, social media trends, and global economic conditions, enabling companies to adapt to market fluctuations more effectively.

Moreover, the strategic application of AI in demand forecasting facilitates enhanced operational efficiency across the supply chain. It supports critical activities such as procurement planning and production scheduling, ensuring that resources are allocated efficiently to meet anticipated demand without excess expenditure.

End Use Industry Analysis

In 2024, the Retail segment within the predictive AI in supply chain market held a dominant market position, capturing more than a 23.4% share. This significant market share can be attributed primarily to the rapid expansion of e-commerce and the increasing consumer demand for faster and more reliable delivery services.

Retailers are leveraging AI to enhance various aspects of the supply chain, including inventory management, demand forecasting, and customer service, to meet these expectations effectively. The growth of the Retail segment is further fueled by the digital transformation of the industry.

As consumer preferences continue to shift towards online shopping, retailers are adopting AI-driven technologies to gain real-time insights into customer behavior and inventory levels, ensuring optimal stock availability without the risk of overstocking or stockouts. This adoption not only improves operational efficiency but also enhances the customer shopping experience by ensuring product availability and timely delivery.

Moreover, the integration of AI in retail supply chains is crucial for adapting to the dynamic retail landscape where speed, accuracy, and efficiency are key competitive advantages. AI technologies enable retailers to predict market trends more accurately and respond more swiftly to changes in consumer demand, thereby reducing wasted inventory and increasing profitability.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-Premise

- Cloud-based

By Application

- Demand Forecasting

- Inventory Management

- Procurement & Sourcing

- Risk Management

- Others

By End Use Industry

- Retail

- Automotive

- Manufacturing

- Food and Beverages

- Healthcare

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Operational Efficiency and Cost Savings

Predictive AI in the supply chain primarily drives enhanced operational efficiency and cost savings. By leveraging AI-driven predictive analytics, organizations can significantly improve demand forecasting, optimize inventory levels, and streamline production scheduling.

These capabilities allow companies to reduce excess inventory and minimize storage costs, while also ensuring product availability to meet consumer demand without delay. Predictive models analyze various data inputs, including historical sales, market trends, and seasonal fluctuations, enabling precise demand forecasts that align production and distribution effectively.

Restraint

Complexity and Integration Challenges

A major restraint for predictive AI in the supply chain is the complexity of integration into existing systems. Many companies face significant challenges when attempting to embed AI technologies into their legacy supply chain management systems. The integration often requires substantial upfront investment in technology upgrades and skilled personnel.

Furthermore, predictive analytics relies on the quality and completeness of data. Inconsistent data formats and the presence of data silos across different departments can hinder the effective implementation of AI solutions, leading to unreliable forecasts and suboptimal decision-making.

Opportunity

Real-Time Decision Making and Risk Mitigation

The opportunity presented by predictive AI in supply chain management lies in its ability to facilitate real-time decision-making and enhance risk mitigation. AI tools can process vast arrays of data in real-time, providing businesses with the ability to react quickly to supply chain disruptions or changes in demand.

Moreover, predictive analytics can foresee potential disruptions by analyzing indicators such as weather conditions, political instability, or supplier performance, allowing companies to proactively adjust their strategies and mitigate risks before they impact the supply chain.

Challenge

Data Quality and Management

The primary challenge associated with predictive AI in supply chains is ensuring data quality and effective data management. Predictive analytics depends heavily on the availability of high-quality, comprehensive data sets. Many organizations struggle with data that is incomplete, outdated, or siloed, which can severely compromise the accuracy of AI-driven predictions.

Additionally, the management of such data requires robust IT infrastructure and skilled personnel to handle data integration, cleansing, and analysis processes, posing significant operational and financial challenges for many companies.

Growth Factors

Accelerating Efficiency and Innovation

Predictive AI in the supply chain is primarily driven by its capacity to enhance operational efficiency and foster innovation. The integration of AI technologies enables businesses to handle large volumes of data in real-time, optimizing logistics and improving decision-making processes.

This real-time data handling capability allows companies to make immediate adjustments in their operations, significantly reducing waste and saving both time and money. Furthermore, predictive AI supports advanced analytics that can forecast future trends and behaviors, thereby allowing companies to align their strategies proactively with predicted market demands.

Emerging Trends

Towards Cognitive and Connected Supply Chains

The landscape of supply chain management is evolving towards more connected and cognitive ecosystems. This shift is characterized by the increasing adoption of AI-driven tools that not only automate processes but also enable companies to predict and respond to potential disruptions before they occur.

The trend towards cognitive supply chains is facilitated by technologies such as machine learning and deep learning, which enhance the precision of logistics planning and operations. These advancements are not just about automating existing tasks but redefining them to make supply chains more resilient and adaptable to changing market conditions.

Business Benefits

Cost Reduction and Enhanced Decision Making

The deployment of predictive AI in supply chains brings substantial business benefits, including significant cost reductions and enhanced decision-making capabilities. By improving forecasting accuracy, AI allows companies to reduce the costs associated with overstocking and understocking, which in turn minimizes capital tied up in inventory and reduces storage costs.

Moreover, AI’s ability to analyze data from various sources – ranging from market trends to weather patterns – enables businesses to make informed decisions quickly. This agility is crucial for maintaining competitive advantage in dynamic markets.

For instance, companies like Walmart and Amazon have successfully used AI to optimize inventory and respond promptly to fluctuating demand patterns, demonstrating AI’s role in enhancing operational efficiency and customer satisfaction.

Key Player Analysis

The predictive AI in supply chain market is being shaped by a group of powerful technology firms and innovative supply chain solution providers. Each player brings a unique strength to the table – whether it’s cloud computing, data analytics, or AI-driven automation.

IBM Corporation and Microsoft Corporation continue to lead with their advanced cloud platforms and AI capabilities, helping businesses gain deeper insights into demand forecasting and logistics. SAP SE and Oracle Corporation have integrated AI into their supply chain suites, focusing on real-time visibility and smarter planning decisions.

Amazon Web Services (AWS) leverages its global infrastructure and machine learning tools to simplify complex supply chain tasks. Blue Yonder Group and Kinaxis Inc. are known for their specialized AI solutions that target inventory optimization and end-to-end supply planning.

Meanwhile, Infor, SAS Institute, and Llamasoft (now part of Coupa Software) offer data-driven tools that help businesses respond quickly to disruptions. Hardware and automation specialists like Zebra Technologies and industrial giants such as Siemens AG are also pushing boundaries, bringing AI into warehouse management, production lines, and predictive maintenance

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Blue Yonder Group, Inc.

- SAS Institute Inc.

- Kinaxis Inc.

- Infor (US), Inc.

- Llamasoft, Inc.

- Amazon Web Services, Inc.

- Zebra Technologies Corporation

- Siemens AG

- Other Major Players

Recent Developments

- Oracle Corporation: In January 2025, Oracle embedded new role-based AI agents within its Fusion Cloud Supply Chain Management platform. These agents are designed to automate routine tasks, enhancing productivity and fostering growth across supply chain operations.

- Blue Yonder Group, Inc.: In January 2025, Blue Yonder announced updates to its AI-powered platform, focusing on cognitive planning and execution. These enhancements aim to improve agility, support global expansion, and help businesses achieve their objectives.

- Kinaxis Inc.: In March 2025, Kinaxis unveiled plans to introduce agentic and generative AI capabilities in its Maestro platform. These innovations are intended to simplify AI adoption and deliver critical business insights more rapidly.

- Amazon Web Services (AWS): In March 2025, AWS launched “Nova Act,” an AI agent capable of performing tasks within web browsers. Developed by the Amazon AGI SF Lab, Nova Act positions AWS competitively in the AI agent market.

- Siemens AG: In March 2025, Siemens expanded its Industrial Copilot with new generative AI-powered maintenance solutions. This enhancement aims to support various stages of the maintenance cycle, from repair to predictive maintenance.

- SAP SE: In April 2024, SAP introduced AI-driven enhancements to its supply chain solutions, aiming to boost productivity and precision in manufacturing. These advancements provide real-time insights to optimize decision-making across supply chains.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Bn Forecast Revenue (2034) USD 8.1 Bn CAGR (2025-2034) 15.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premise, Cloud-based), By Application (Demand Forecasting, Inventory Management, Procurement & Sourcing, Risk Management, Others), By End Use Industry (Retail, Automotive, Manufacturing, Food and Beverages, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, Blue Yonder Group, Inc., SAS Institute Inc., Kinaxis Inc., Infor (US), Inc., Llamasoft, Inc., Amazon Web Services, Inc., Zebra Technologies Corporation, Siemens AG, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Predictive AI In Supply Chain MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Predictive AI In Supply Chain MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Blue Yonder Group, Inc.

- SAS Institute Inc.

- Kinaxis Inc.

- Infor (US), Inc.

- Llamasoft, Inc.

- Amazon Web Services, Inc.

- Zebra Technologies Corporation

- Siemens AG

- Other Major Players