Precision Medicine Market By Product Type (Bioinformatics, Gene Sequencing, Drug Discovery, Big Data Analytics, Companion Diagnostics, and Others), By Technology (Sequencing by Synthesis, Single Molecule Real Time Sequencing, Sequencing by Ligation, Pyrosequencing, Nanopore Sequencing, Ion Semiconductor Sequencing, and Chain Termination Sequencing), By Application (Oncology, Respiratory, Immunology, CNS and Others), By End-user (Pharmaceutical Companies, Homecare, Healthcare IT companies, Diagnostic Companies and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 16592

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

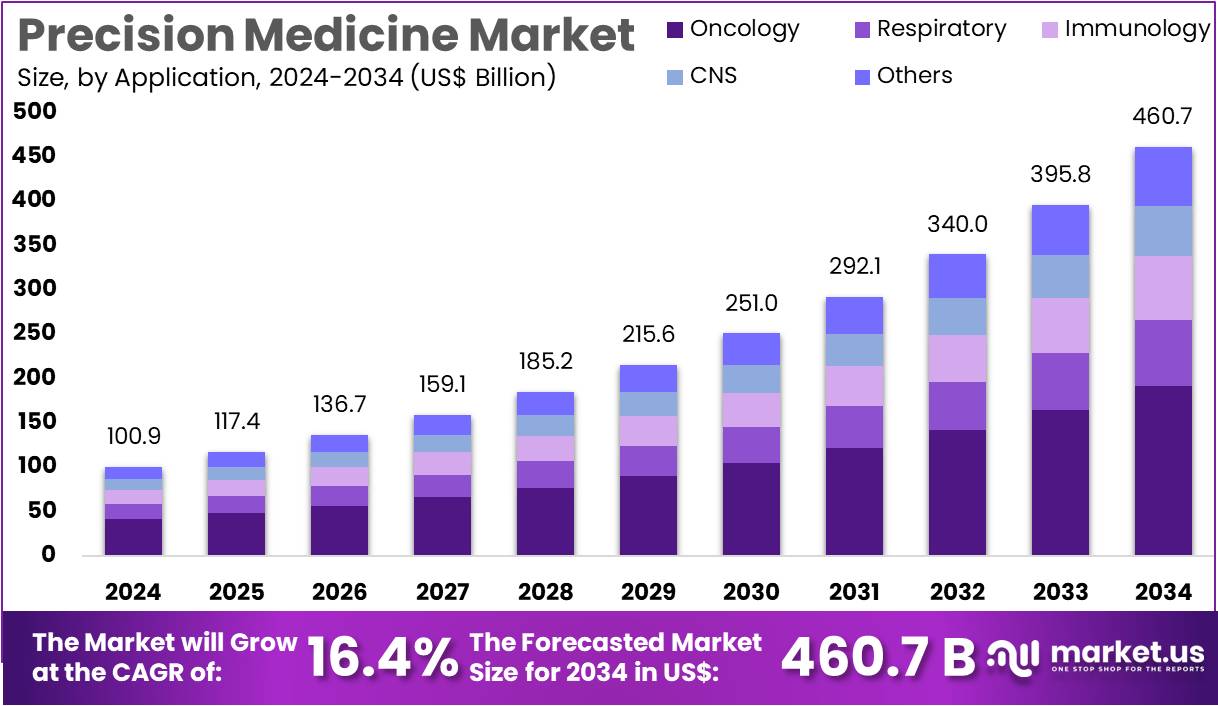

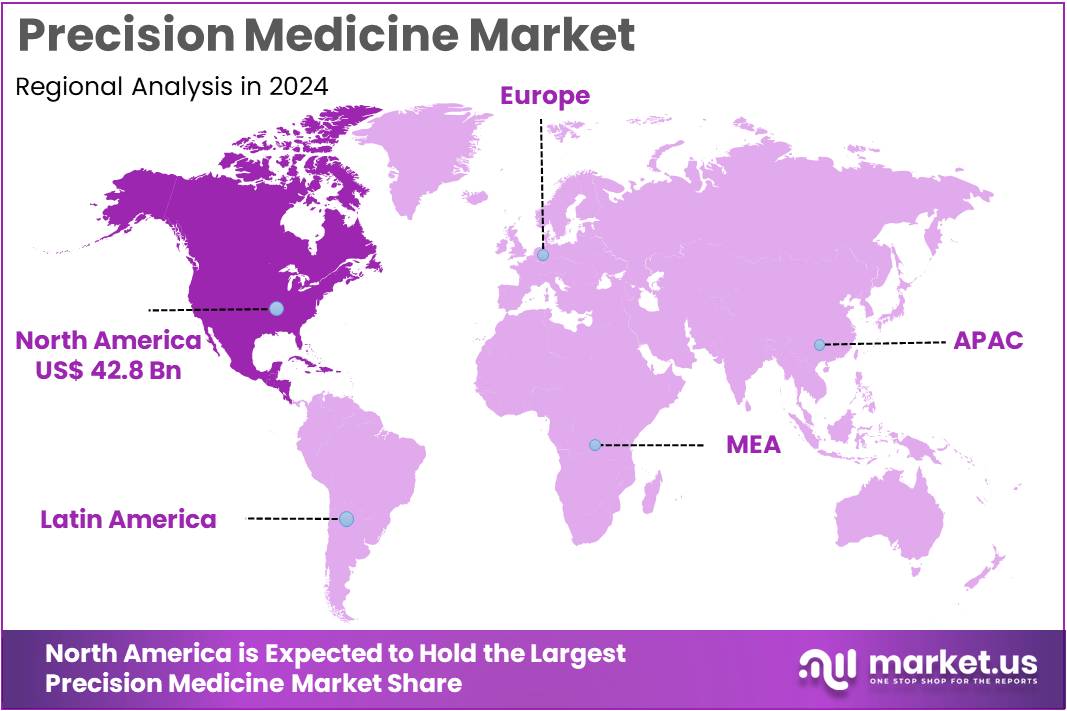

The Precision Medicine Market size is expected to be worth around US$ 460.7 billion by 2034 from US$ 100.9 billion in 2024, growing at a CAGR of 16.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 49.5% share and holds US$ 42.8 Billion market value for the year.

Rising prevalence of complex neurological and oncological conditions is a primary driver of the precision medicine market. This approach customizes healthcare by leveraging individual variability in genes, environment, and lifestyle for disease treatment and prevention. The American Cancer Society estimates that over 1.9 million new cancer cases will be diagnosed in the US in 2024, and precision medicine is crucial for tailoring therapies based on a patient’s unique molecular profile. This data highlights the immense and growing patient population that can benefit from targeted therapies and diagnostics, which offer a more effective alternative to traditional, one-size-fits-all treatments.

Growing technological advancements and strategic global collaborations are key trends shaping the market. Companies are leveraging artificial intelligence and advanced analytics to profile tumors and immune systems, improving diagnostic accuracy and treatment planning. For example, in August 2023, BostonGene, a leader in AI-powered molecular and immune profiling, teamed up with NEC Corporation and Japan Industrial Partners to establish BostonGene Japan Inc. This Tokyo-based joint venture aims to accelerate the adoption of precision medicine, ultimately improving patient outcomes. This type of collaboration demonstrates a significant industry-wide focus on democratizing access to cutting-edge technology through international partnerships.

Increasing investment from government bodies and a greater emphasis on personalized treatments are creating significant opportunities for market expansion. The FDA’s Center for Drug Evaluation and Research reported that over half of its 2024 novel drug approvals were therapies with orphan drug designations, many of which are targeted therapies for rare diseases. This trend underscores a strong regulatory environment that supports the development of precision medicine. Furthermore, large-scale initiatives like the NIH’s All of Us Research Program, which aims to collect health data from over one million participants, are generating massive datasets that fuel the discovery of new biomarkers and therapeutic targets across a wide range of diseases.

Key Takeaways

- In 2024, the market generated a revenue of US$ 100.9 billion, with a CAGR of 16.4%, and is expected to reach US$ 460.7 billion by the year 2034.

- The product type segment is divided into bioinformatics, gene sequencing, drug discovery, big data analytics, companion diagnostics, and others, with bioinformatics taking the lead in 2023 with a market share of 32.5%.

- Considering technology, the market is divided into sequencing by synthesis, single molecule real time sequencing, sequencing by ligation, pyrosequencing, nanopore sequencing, ion semiconductor sequencing and chain termination sequencing. Among these, sequencing by synthesis held a significant share of 38.0%.

- Furthermore, concerning the application segment, the market is segregated into oncology, respiratory, immunology, CNS and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 41.7% in the market.

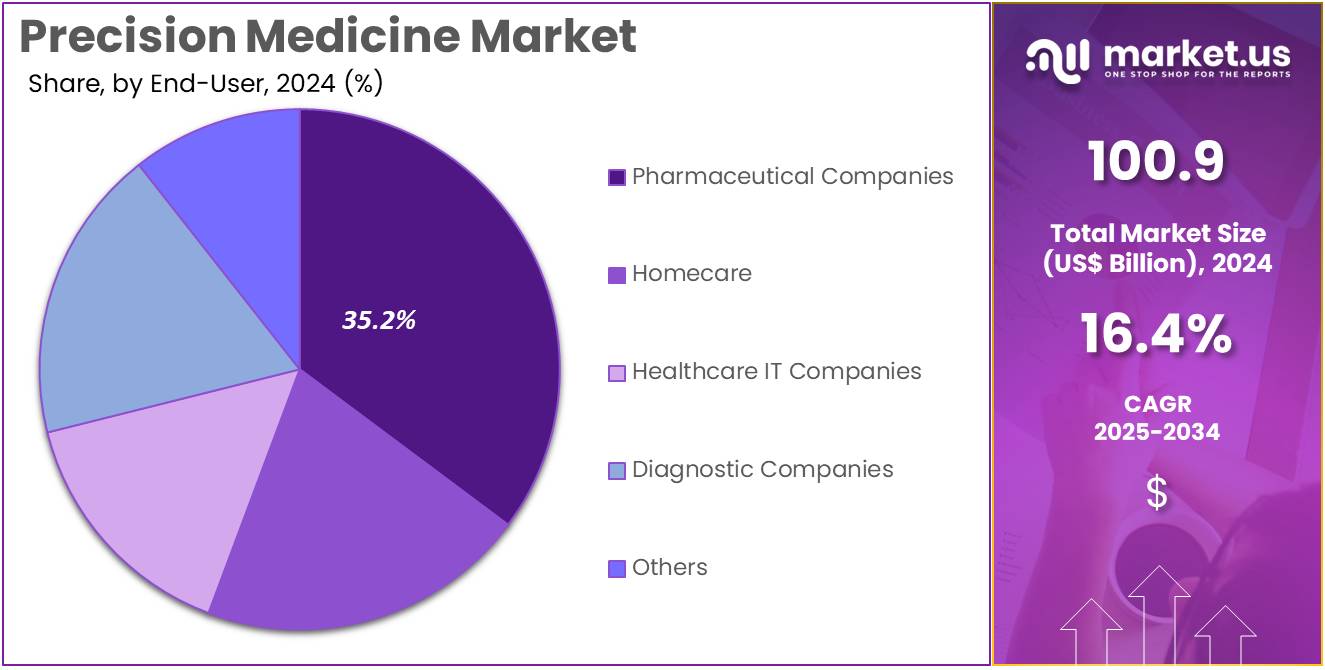

- The end-user segment is segregated into pharmaceutical companies, homecare, healthcare IT companies, diagnostic companies and others, with the pharmaceutical companies segment leading the market, holding a revenue share of 35.2%.

- North America led the market by securing a market share of 49.5% in 2023.

Product Type Analysis

Bioinformatics holds the largest share of 32.5% in the precision medicine market. This growth is expected to continue as advancements in genetic sequencing technologies increase the volume of genetic data generated by healthcare providers and research institutions. The integration of bioinformatics into personalized medicine allows for more accurate and efficient analysis of genetic information, leading to the development of targeted therapies.

As pharmaceutical companies and research organizations seek more precise and cost-effective ways to design personalized treatments, the need for bioinformatics tools will rise. The ability to analyze large sets of genetic data efficiently is anticipated to drive growth in this segment, alongside increasing demand for software and computational models designed for drug discovery, diagnostics, and disease prevention.

Technology Analysis

Sequencing by synthesis accounts for 38.0% of the technology segment in the precision medicine market. This method has become a cornerstone of modern genomics due to its accuracy, speed, and cost-effectiveness. Sequencing by synthesis technology allows for high-throughput sequencing, which is integral in identifying genetic mutations and understanding genetic disorders.

As sequencing costs continue to fall, this technology is expected to expand its presence in clinical settings, particularly for applications in oncology, rare genetic diseases, and personalized medicine. Moreover, sequencing by synthesis allows for the analysis of vast amounts of genomic data, which is essential for developing targeted therapies that address specific genetic variations in patients. These advancements are anticipated to drive significant growth in this segment over the coming years.

Application Analysis

Oncology holds 41.7% of the application segment in the precision medicine market. The use of precision medicine in cancer treatment has transformed the way oncologists approach patient care by enabling treatments tailored to the genetic makeup of individual tumors. This segment’s growth is largely driven by the increasing understanding of genetic mutations in cancer cells and the ability to design therapies that target these specific mutations. With the expansion of genomic databases and the continuous development of targeted cancer therapies, oncology is expected to remain a dominant application of precision medicine.

Additionally, advancements in liquid biopsy techniques and companion diagnostics are further driving innovation in oncology, making precision medicine a key player in cancer care. As more cancer types are analyzed at the genetic level, the demand for precision oncology treatments is projected to increase significantly.

End-User Analysis

Pharmaceutical companies represent 35.2% of the end-user segment in the precision medicine market. This growth is expected to continue as pharmaceutical companies incorporate genetic and molecular insights into their drug discovery and development processes. By utilizing precision medicine, these companies can design drugs that are more effective for specific patient populations, improving both efficacy and safety. The ongoing integration of precision medicine into clinical trials allows for more targeted patient selection, enhancing the likelihood of successful outcomes.

Furthermore, regulatory support for the development of personalized therapies, including faster approval pathways and incentives, is likely to accelerate the adoption of precision medicine by pharmaceutical companies. As the focus on personalized healthcare increases, pharmaceutical companies are expected to continue driving growth in the precision medicine market.

Key Market Segments

By Product Type

- Bioinformatics

- Gene Sequencing

- Drug Discovery

- Big Data Analytics

- Companion Diagnostics

- Others

By Technology

- Sequencing by Synthesis

- Single Molecule Real Time Sequencing

- Sequencing by Ligation

- Pyrosequencing

- Nanopore Sequencing

- Ion Semiconductor Sequencing

- Chain Termination Sequencing

By Application

- Oncology

- Respiratory

- Immunology

- CNS

- Others

By End-user

- Pharmaceutical Companies

- Homecare

- Healthcare IT companies

- Diagnostic Companies

- Others

Drivers

The increasing prevalence of complex diseases is driving the market

The market for precision medicine is experiencing significant growth, primarily driven by the rising global incidence of complex, life-threatening diseases, particularly cancer. The traditional “one-size-fits-all” approach to treatment is often ineffective, leading to a strong demand for more targeted and personalized therapies.

Precision medicine, which tailors treatment to an individual’s unique genetic makeup and lifestyle, offers a more effective path to combatting these diseases, increasing both efficacy and patient survival rates. This shift is particularly evident in oncology, where genomic analysis of tumors is becoming a standard practice.

According to data from the American Cancer Society, in 2023, there were an estimated 1,958,310 new cancer cases and 609,820 cancer deaths projected to occur in the United States. This vast and growing patient population represents a strong and continuous demand for the targeted diagnostics and therapies that are the core of the precision medicine market.

Restraints

The lack of data interoperability is restraining the market

A significant restraint on the precision medicine market is the complex and pervasive challenge of data interoperability. Genomic data, electronic health records (EHRs), and patient-reported outcomes often exist in siloed systems, using disparate formats and standards. This fragmentation makes it incredibly difficult for healthcare providers to access and integrate a patient’s complete health profile, which is essential for making informed, personalized treatment decisions. The absence of a uniform data-sharing infrastructure hinders the ability to leverage large-scale datasets for research and drug discovery, thereby slowing down innovation.

While some hospitals have made progress, a survey highlighted that 68% of healthcare professionals identify technical limitations as the primary barrier to accessing data for decision-making. Furthermore, a report from the Journal of Clinical Oncology in 2024 highlighted that, when comparing data transfer methodologies for genomic ordering, the traditional system required an average of 53% more complexity than a new, standardized approach. This lack of data standardization and the resulting technical barriers create a major headwind for market growth, preventing the seamless flow of information necessary to deliver truly personalized care at scale.

Opportunities

The advancement of Next-Generation Sequencing (NGS) is creating growth opportunities

A key growth opportunity for the precision medicine market lies in the rapid technological advancements in Next-Generation Sequencing (NGS). These technologies have revolutionized the field of genomics by making it possible to sequence an individual’s entire genome or exome in a matter of hours or days, at a fraction of the cost of previous methods. This scalability and efficiency have made genomic data more accessible for both research and clinical applications.

NGS platforms are now capable of analyzing massive amounts of genetic data simultaneously, which enables the discovery of new biomarkers and therapeutic targets. The US Food and Drug Administration (FDA) has been actively approving new devices to support this growth. As of August 27, 2024, the FDA approved Illumina’s TruSight Oncology Comprehensive test, which profiles over 500 genes to help match cancer patients to targeted therapies. This regulatory approval of a comprehensive, multi-gene test signals strong institutional support for the widespread adoption of NGS-based diagnostics, creating a clear pathway for commercial growth.

Impact of Macroeconomic / Geopolitical Factors

The precision medicine market is heavily influenced by a combination of macroeconomic and geopolitical factors. High development costs for personalized treatments, coupled with high inflation and potential economic downturns, can strain healthcare budgets and deter both private and public payers from investing in these cutting-edge but expensive technologies. This market is also highly vulnerable to geopolitical tensions, which can disrupt a complex supply chain reliant on a global network of manufacturers for advanced diagnostic equipment, genetic sequencing technologies, and specialized reagents.

Current US trade policies have introduced significant cost pressures. A universal baseline tariff of 10% now applies to most imported medical devices and components regardless of origin, while certain imports from key trading partners face much higher duties. For instance, medical devices from Mexico that do not meet USMCA requirements are subject to a 25% tariff, and imports from the EU now face a 20% duty, which is a substantial increase from previous near-zero rates. These tariffs raise the overall cost for healthcare providers, compelling them to absorb the expenses or pass them on to patients, which could ultimately slow the adoption of these innovative therapies.

Latest Trends

The integration of artificial intelligence for predictive analytics is a recent trend

A defining trend in 2024 is the accelerated integration of artificial intelligence (AI) and machine learning to analyze vast amounts of genomic and clinical data. This innovation is transforming how precision medicine is applied by moving beyond static diagnostics and into predictive analytics.

AI algorithms can identify subtle patterns in a patient’s genetic profile and health records to predict disease risk, forecast a patient’s response to a specific drug, or even design novel therapeutic compounds. This capability makes treatments more proactive, efficient, and personalized than ever before. This trend is strongly supported by intellectual property trends.

A report analyzing patent filings in 2024 found that medical-related patents saw a significant increase, with AI-driven drug discovery and diagnostic applications leading the surge. The US Patent and Trademark Office (USPTO)’s data reflects this, with major companies in the healthcare and biotech sectors filing and being granted numerous patents for AI-powered solutions that analyze patient data for personalized treatment recommendations, as evidenced by an increased focus on AI-enabled inventions.

Regional Analysis

North America is leading the Precision Medicine Market

Percentage share of north America in the market is 49.5%. The market’s significant growth in North America has been fueled by a combination of robust government initiatives, increasing regulatory support, and a high prevalence of complex diseases.

The US National Institutes of Health (NIH) has continued to invest heavily in foundational research and large-scale projects, with significant funding being channeled into next-generation programs. For example, in 2024, the NIH awarded US$27 million to establish a new network of genomics-enabled learning health systems (gLHS). This funding supports the integration of genomic information into hospital systems, aiming to directly translate research findings into improved patient care.

Concurrently, the US Food and Drug Administration (FDA) is accelerating the approval of companion diagnostics and novel therapies. For example, the FDA’s Center for Drug Evaluation and Research (CDER) approved 50 new drugs in 2024, many of which are personalized treatments targeting specific genetic mutations or biomarkers. These regulatory actions create a clear pathway for innovative products to reach the market.

The region also saw a collaboration in May 2024 between Canada’s Drug Agency and its partners to improve the reimbursement review process for companion diagnostics. This proactive approach from regulatory bodies and the pharmaceutical industry, alongside ongoing research funding, is solidifying the region’s dominant position.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is expected to emerge as a powerhouse for personalized medical solutions in the coming years. This growth is projected to be driven by supportive government policies, increasing healthcare spending, and a vast, diverse patient population. Governments in countries like Japan and China are actively promoting large-scale genomic initiatives.

For instance, the Genome India Project has sequenced 10,000 representative genomes, providing a critical reference allele dataset to improve diagnostic accuracy for South Asian populations. In China, the BGI Genomics organization is scaling up colorectal cancer screening to roughly 800,000 individuals in Harbin, demonstrating a capacity for large-scale, population-wide interventions.

Japan’s universal health insurance system is also estimated to provide a unique advantage, as it is likely to facilitate unprecedented access to real-world health data from a large number of citizens. This data is anticipated to fuel research and the development of new treatments.

The rising burden of chronic illnesses, particularly cancer, is also compelling regional healthcare systems to adopt more precise diagnostic and therapeutic tools. With government support and continuous investments, the region’s scientific and medical communities are poised to make significant strides in moving towards more patient-centered care.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the precision medicine market are driving growth by leveraging technological advancements in genomics and data analytics, particularly through the use of AI to analyze vast datasets and inform treatment decisions. They are also actively engaged in strategic partnerships and collaborations with pharmaceutical companies and healthcare providers to integrate their platforms and expand their services into new therapeutic areas.

Companies further focus on developing comprehensive, end-to-end solutions that combine diagnostics with targeted therapies, offering a holistic approach to patient care. This combination of scientific innovation and strategic business development is crucial for maintaining a competitive edge.

Hoffmann-La Roche Ltd., a global pioneer in pharmaceuticals and diagnostics, has established a dominant position in this sector. The company’s business model is centered on its unique, integrated approach that combines its pharmaceuticals and diagnostics divisions under one roof, allowing it to develop companion diagnostics alongside targeted therapies.

Roche’s strategy involves continuously investing in its R&D pipeline to identify novel biomarkers and genetic targets while also acquiring companies that complement its portfolio, such as Foundation Medicine. The company’s focus on creating integrated solutions has solidified its role as a foundational partner for advancing personalized healthcare globally.

Top Key Players in the Precision Medicine Market

- Siemens

- Quest Diagnostics Incorporated

- QIAGEN

- NeoDiagnostix

- Myriad Genetics

- Medtronic

- Janssen Global Services, LLC

- Illumina, Inc

- GE Healthcare

- Abbott

Recent Developments

- In May 2024: Atara Biotherapeutics filed a Biologics License Application (BLA) with the US FDA for tabelecleucel (tab-cel), proposing it as a treatment for Epstein-Barr Virus-Positive Post-Transplant Lymphoproliferative Disease (EBV+ PTLD) in adults and children aged 2 years and older, who have undergone at least one prior therapy. For solid organ transplant recipients, prior treatments typically include chemotherapy, when deemed appropriate. This filing is particularly significant, as no FDA-approved therapies currently exist for this condition.

- In May 2024: Dragonfly Therapeutics, Inc. announced a clinical collaboration with Merck (MSD outside the US and Canada) to evaluate DF9001, an EGFR-targeting immune engager, in combination with Merck’s anti-PD-1 therapy, KEYTRUDA (pembrolizumab). The collaboration aims to investigate the efficacy of this combination in treating patients with advanced solid tumors expressing EGFR.

- In February 2023: Roche expanded its collaboration with Janssen Biotech Inc. (Janssen) to advance the development of companion diagnostics for targeted therapies. This extension underscores Roche’s commitment to driving innovation and advancing research in precision medicine.

Report Scope

Report Features Description Market Value (2024) US$ 100.9 billion Forecast Revenue (2034) US$ 460.7 billion CAGR (2025-2034) 16.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bioinformatics, Gene Sequencing, Drug Discovery, Big Data Analytics, Companion Diagnostics, and Others), By Technology (Sequencing by Synthesis, Single Molecule Real Time Sequencing, Sequencing by Ligation, Pyrosequencing, Nanopore Sequencing, Ion Semiconductor Sequencing, and Chain Termination Sequencing), By Application (Oncology, Respiratory, Immunology, CNS and Others), By End-user (Pharmaceutical Companies, Homecare, Healthcare IT companies, Diagnostic Companies and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens, Quest Diagnostics Incorporated, QIAGEN, NeoDiagnostix, Myriad Genetics, Medtronic, Janssen Global Services, LLC, Illumina, Inc, GE Healthcare, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens

- Quest Diagnostics Incorporated

- QIAGEN

- NeoDiagnostix

- Myriad Genetics

- Medtronic

- Janssen Global Services, LLC

- Illumina, Inc

- GE Healthcare

- Abbott