Global Precision Components and Tooling Systems Market Size, Share, Growth Analysis By Type (Stainless Steel & Titanium Components, Hardened Punches & Dies, WC Co Components & Tools, Orthopaedic & Dental Implants, Grippers & Scissors, Others), By Application (Defence & Aerospace, Medical, Electronics & Communications, Automotive Industry, Mining Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 160551

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

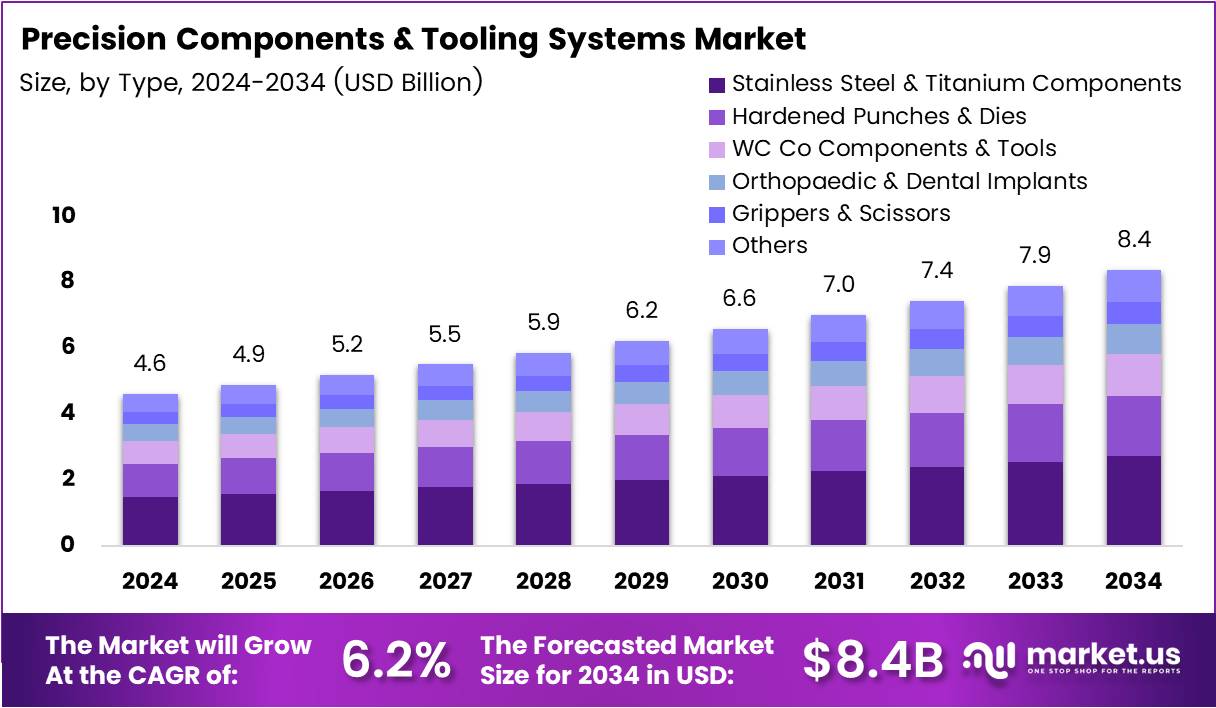

The Global Precision Components and Tooling Systems Market size is expected to be worth around USD 8.4 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The Precision Components and Tooling Systems Market represents a critical backbone for advanced manufacturing and engineering industries. It encompasses high-accuracy parts, fixtures, molds, and dies used in automotive, aerospace, electronics, and energy sectors. With rising adoption of automation and CNC machining, demand for precision tooling is rapidly accelerating across global production networks.

In recent years, the market has grown steadily due to increasing industrial automation and digital manufacturing. The integration of Industry 4.0 technologies has enhanced design accuracy, reduced production time, and minimized material wastage. As manufacturers strive for tighter tolerances and improved efficiency, precision tooling systems have become essential in maintaining consistent quality in high-volume production.

Moreover, global industries are investing heavily in ultra-precision machining and multi-axis tools to meet complex design requirements. The market benefits from growth in aerospace and defense, medical device manufacturing, and electric vehicle components, where micro-level accuracy is critical. This shift toward miniaturization and high-performance parts is boosting adoption of advanced cutting tools, molds, and dies globally.

Government initiatives promoting domestic manufacturing are further strengthening market expansion. Programs like the U.S. CHIPS Act and Europe’s Industrial Strategy encourage investment in precision engineering facilities. Similarly, tax incentives for capital equipment modernization have stimulated small and mid-sized enterprises to upgrade tooling systems, enhancing overall productivity and export competitiveness.

Opportunities are emerging from the transition to smart factories and digital twins, where real-time data enables predictive maintenance and tool optimization. Integration of IoT-enabled tooling systems ensures higher uptime and improved process control, offering cost savings and sustainable operations. This technological convergence is reshaping traditional manufacturing workflows into intelligent, connected ecosystems.

Additionally, stringent quality standards in aerospace, semiconductor, and medical sectors are driving demand for precision measurement and calibration systems. Regulatory compliance with ISO and AS9100 certifications compels manufacturers to adopt advanced tooling to ensure precision consistency. This regulatory environment not only supports innovation but also fosters long-term trust and international trade competitiveness.

Key Takeaways

- The Global Precision Components and Tooling Systems Market is projected to reach USD 8.4 Billion by 2034, up from USD 4.6 Billion in 2024.

- The market is expected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, Stainless Steel & Titanium Components dominated the By Type segment with a 32.3% share.

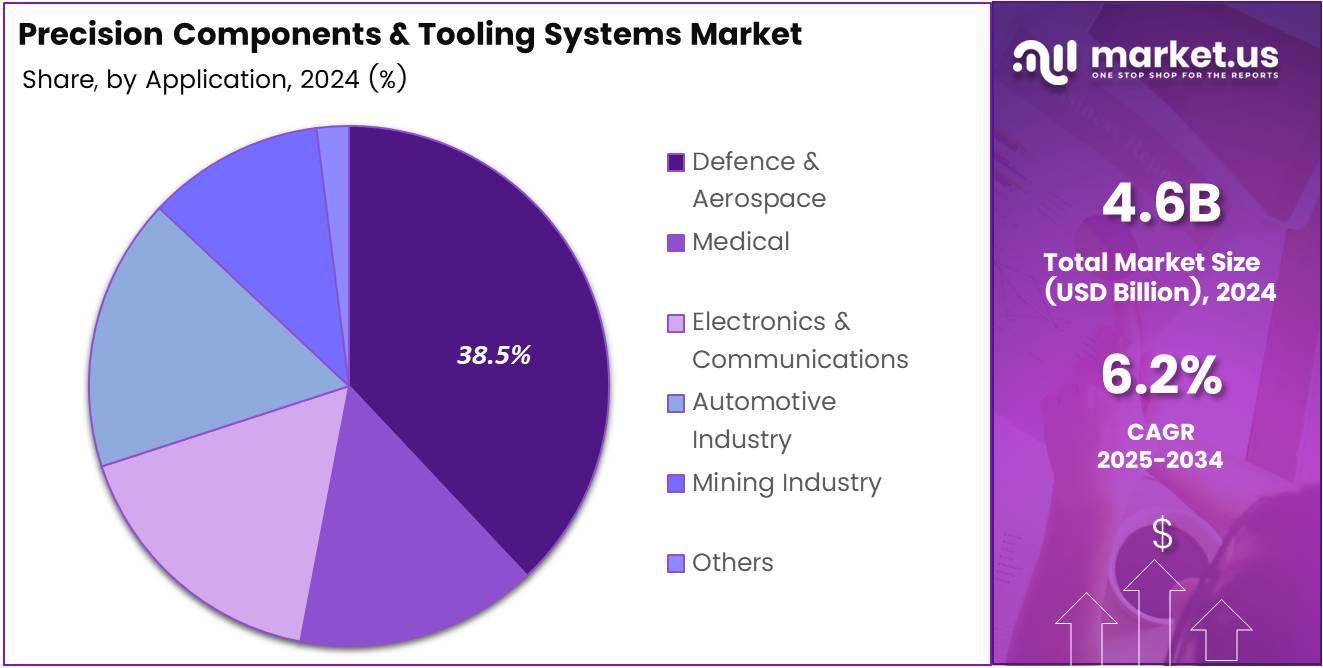

- In 2024, Defence & Aerospace led the By Application segment with a 38.5% share.

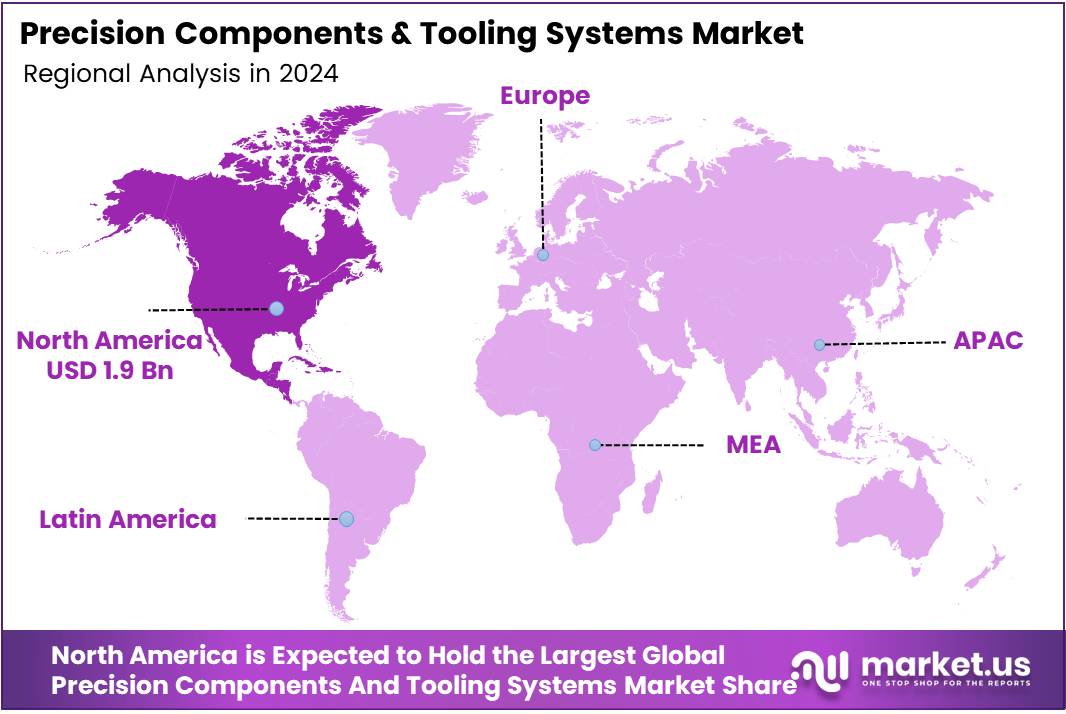

- North America held the largest regional share at 42.6%, valued at USD 1.9 Billion in 2024.

By Type Analysis

Stainless Steel & Titanium Components dominate with 32.3% due to their exceptional durability, corrosion resistance, and wide applicability.

In 2024, Stainless Steel & Titanium Components held a dominant market position in the By Type Analysis segment of the Precision Components and Tooling Systems Market, with a 32.3% share. Their superior strength, lightweight properties, and resistance to harsh environments make them indispensable across aerospace, medical, and industrial sectors, driving consistent demand globally.

Hardened Punches & Dies continue to gain traction due to their robust performance in manufacturing precision parts. They provide long service life and high wear resistance, making them ideal for mass production processes. Growing automation in machining and metalworking industries is further supporting the adoption of these durable tooling solutions.

WC Co Components & Tools are valued for their extreme hardness and cutting efficiency. Their integration in high-precision machining and heavy-duty operations enhances production accuracy and reduces tool wear. As industries move toward complex material processing, these components are becoming increasingly vital to achieving consistent output quality.

Orthopaedic & Dental Implants represent a growing niche, driven by rising healthcare expenditures and technological advancements in medical-grade precision components. Their demand is expanding with aging populations and increasing surgical procedures, emphasizing biocompatibility and reliability in design and manufacturing.

Grippers & Scissors are witnessing moderate growth due to their use in robotic handling systems and precision cutting tools. Their role in automation, medical applications, and assembly lines supports operational efficiency and precision, aligning with growing industrial modernization trends.

Others include specialized precision parts serving niche industrial applications. These components cater to custom requirements across emerging sectors, offering flexibility and innovation. As customization and specialized engineering rise, this segment supports diverse end-use demands with tailored, high-performance solutions.

By Application Analysis

Defence & Aerospace dominate with 38.5% due to stringent performance standards and continuous investment in high-precision systems.

In 2024, Defence & Aerospace held a dominant market position in the By Application Analysis segment of the Precision Components and Tooling Systems Market, with a 38.5% share. Increasing defense budgets and expanding aerospace projects demand precision-engineered parts for safety, reliability, and performance under extreme conditions, boosting market share.

Medical applications are witnessing significant growth driven by advancements in surgical tools, implants, and diagnostic devices. The increasing adoption of precision-engineered components in healthcare ensures higher accuracy, biocompatibility, and patient safety, supporting innovation in minimally invasive and robotic-assisted medical procedures.

Electronics & Communications rely heavily on micro-precision tooling and components to achieve compact designs and high-performance functionality. The rise of 5G technology and smart devices drives demand for reliable, finely machined parts ensuring stable connectivity and improved device longevity across consumer and industrial electronics.

Automotive Industry applications are expanding with the shift toward electric and autonomous vehicles. Precision components enhance performance, reduce energy consumption, and ensure safety compliance. Advanced tooling systems enable high-accuracy manufacturing, meeting the sector’s growing demand for lightweight and efficient parts.

Mining Industry continues to adopt precision components for improved operational efficiency and equipment durability. High-strength tooling systems support drilling, extraction, and processing operations under harsh conditions, minimizing downtime and extending machinery lifespan across mining operations worldwide.

Others encompass sectors such as energy, marine, and industrial automation. These industries leverage precision tooling and components for customized, high-performance solutions that ensure process accuracy, reliability, and sustainability, aligning with global industrial modernization efforts.

Key Market Segments

By Type

- Stainless Steel & Titanium Components

- Hardened Punches & Dies

- WC Co Components & Tools

- Orthopaedic & Dental Implants

- Grippers & Scissors

- Others

By Application

- Defence & Aerospace

- Medical

- Electronics & Communications

- Automotive Industry

- Mining Industry

- Others

Drivers

Rising Adoption of High-Precision Machining in Aerospace and Automotive Sectors Drives Market Growth

The precision components and tooling systems market is witnessing strong growth due to the rising use of high-precision machining across the aerospace and automotive industries. These sectors demand components with tight tolerances and superior quality to ensure performance, safety, and efficiency. As manufacturers aim to reduce errors and enhance productivity, they are increasingly turning to precision tools and advanced machining technologies.

The demand for advanced cutting tools in CNC manufacturing is another key factor boosting market expansion. Modern CNC machines require tools capable of handling complex geometries and hard-to-machine materials. As industries push for faster production and higher accuracy, the need for durable, high-performance cutting tools continues to rise.

Furthermore, the integration of automation and IoT in tooling operations is improving real-time monitoring, predictive maintenance, and production efficiency. Smart tooling systems help reduce downtime and extend tool life, supporting manufacturers in achieving consistent quality and cost savings.

Additionally, the growing use of lightweight materials such as composites and titanium in aerospace and automotive manufacturing has increased the need for specialized tooling solutions. These materials require tools with unique coatings and geometries, driving innovation in the tooling industry. Overall, these factors are creating a favorable environment for sustained market growth.

Restraints

High Initial Investment Costs for Precision Manufacturing Equipment Restrains Market Growth

One of the major restraints for the precision components and tooling systems market is the high initial investment required for setting up precision manufacturing facilities. Advanced machining centers, inspection equipment, and automation systems demand significant capital, which can limit adoption among small and medium-sized enterprises.

Another challenge lies in the limited availability of skilled professionals capable of operating and maintaining complex tooling systems. Precision manufacturing requires deep technical expertise, and the shortage of trained workers often slows down production efficiency and innovation.

Volatility in raw material prices, particularly steel, tungsten, and carbide, also impacts the profitability of tool manufacturers. Sudden price fluctuations increase production costs, making it difficult for companies to maintain consistent pricing strategies and margins.

Moreover, maintaining tight tolerances for ultra-precision components presents ongoing technical challenges. As industries demand components with micron-level accuracy, manufacturers must invest in continuous process improvements and quality control, further raising operational costs. These restraints collectively pose barriers to faster market growth.

Growth Factors

Expansion of Additive Manufacturing and Hybrid Machining Applications Creates New Growth Opportunities

The growing adoption of additive manufacturing and hybrid machining is opening new growth avenues for the precision components and tooling systems market. These advanced technologies enable faster prototyping, complex geometries, and material efficiency, making them ideal for industries seeking innovation and flexibility.

Rising demand for custom tooling solutions in the medical and electronics sectors is another promising opportunity. These industries require small, intricate, and high-precision tools to produce specialized components like implants, connectors, and sensors, driving the need for tailored tooling systems.

Additionally, the development of sustainable tooling materials with extended lifespans is gaining traction. Manufacturers are focusing on eco-friendly materials and coatings that reduce wear, energy use, and waste, aligning with global sustainability goals and reducing operational costs over time.

Government support for domestic precision manufacturing is also fueling market expansion. Policies promoting local production, technology upgradation, and skill development are encouraging investment in precision tooling infrastructure. Together, these factors present strong opportunities for market players to innovate and expand their presence.

Emerging Trends

Shift Toward Micro-Tooling and Nano-Fabrication Technologies Shapes Market Trends

A key trend shaping the precision components and tooling systems market is the growing shift toward micro-tooling and nano-fabrication technologies. As industries like electronics, optics, and healthcare demand miniature components, manufacturers are investing in ultra-precise tooling solutions to meet these requirements.

The adoption of digital twins and simulation tools in tool design is also transforming production processes. By using virtual models, companies can optimize tool performance, predict wear, and reduce development time, leading to better efficiency and cost control.

Modular tooling systems are gaining popularity for their flexibility in modern manufacturing. These systems allow quick tool changes and easy customization, helping manufacturers adapt rapidly to different production needs and smaller batch sizes.

Furthermore, advancements in coating technologies are improving tool durability and performance. Enhanced coatings such as PVD and CVD provide superior resistance to heat, wear, and corrosion, extending tool life and supporting high-speed machining. Together, these trends are driving innovation and shaping the future of precision tooling.

Regional Analysis

North America Dominates the Precision Components and Tooling Systems Market with a Market Share of 42.6%, Valued at USD 1.9 Billion

North America holds a commanding position in the Precision Components and Tooling Systems Market with a Market Share of 42.6%, Valued at USD 1.9 Billion, driven by advanced manufacturing capabilities, widespread adoption of automation, and strong presence of aerospace and automotive industries. The region benefits from high investment in industrial modernization and precision engineering technologies. Additionally, robust R&D initiatives and a focus on high-quality production standards continue to strengthen its market dominance.

Europe Precision Components and Tooling Systems Market Trends

Europe represents a mature and technologically advanced market, supported by a strong industrial base and adoption of Industry 4.0 practices. The region’s focus on innovation, precision manufacturing, and sustainability drives continuous growth. Demand is particularly influenced by developments in automotive engineering, aerospace, and energy sectors, where high-performance tooling solutions are critical.

Asia Pacific Precision Components and Tooling Systems Market Trends

Asia Pacific is emerging as one of the fastest-growing regions, fueled by rapid industrialization, expanding manufacturing infrastructure, and increasing investments in high-precision machining. Countries like China, Japan, and India are playing pivotal roles in driving regional demand. The rise in local production and export-oriented manufacturing is also supporting market expansion across diverse industries.

Middle East and Africa Precision Components and Tooling Systems Market Trends

The Middle East and Africa region is gradually gaining traction, supported by growing diversification efforts and investment in manufacturing and industrial automation. The demand for precision components is rising with infrastructure development and expansion of energy and oilfield projects. Increasing adoption of modern machining solutions is further expected to enhance the region’s market potential.

Latin America Precision Components and Tooling Systems Market Trends

Latin America shows steady progress in the market, driven by industrial development in sectors such as automotive, aerospace, and heavy machinery. The region is witnessing increasing adoption of advanced manufacturing technologies to enhance production quality and efficiency. Government initiatives to boost local manufacturing and improve industrial competitiveness are likely to create new growth avenues.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Precision Components and Tooling Systems Company Insights

The global Precision Components and Tooling Systems Market in 2024 is witnessing steady growth, driven by rising demand for high-performance manufacturing tools, automation, and precision engineering across industries such as automotive, aerospace, and electronics. Key players are focusing on innovation, advanced materials, and digital integration to strengthen their market presence.

Robert Bosch Tool Corporation continues to lead with its strong focus on innovation and quality. The company leverages advanced manufacturing technologies and smart solutions, ensuring high precision, durability, and efficiency in its tooling systems. Its global footprint and commitment to R&D position it as a dominant force in the market.

Agathon AG stands out for its expertise in ultra-precision tooling and grinding technology. The company emphasizes technological excellence, offering high-end components tailored for micro-precision manufacturing. Its customer-centric approach and investment in automation keep it competitive in high-value sectors.

BENZ GmbH Werkzeugsysteme has strengthened its market position through cutting-edge tooling systems and modular solutions. With a focus on dynamic toolholding and driven tools, BENZ addresses the evolving needs of CNC machining and automated production lines, enhancing productivity and flexibility for its customers.

botek Przisionsbohrtechnik GmbH is renowned for its specialization in precision drilling technology. The company’s innovative solutions cater to complex machining requirements, especially in deep-hole drilling. By integrating precision engineering with sustainable manufacturing practices, botek continues to expand its influence in both domestic and international markets.

Collectively, these leading players are driving technological advancement, efficiency, and quality standards across the global precision tooling landscape.

Top Key Players in the Market

- Robert Bosch Tool Corporation

- Agathon AG

- BENZ GmbH Werkzeugsysteme

- botek Przisionsbohrtechnik GmbH

- Nepean

- Makino

- ARCH Cutting Tools

- Ensinger Precision Components

- FRAISA SA

- UMEC SL

Recent Developments

- In Apr 2024, Sandvik announced it will increase its ownership stake to 72.4% (from 12.4%) through a strategic deal valued at €189 million. This move enhances Sandvik’s control and supports its long-term growth strategy in precision engineering and tooling segments.

- In May 2024, Precision Aerospace (Dallas) acquired Owens (Lewisville, TX), a specialist in complex parts, tooling, and prototypes. The acquisition expands Precision Aerospace’s machining capabilities across the aerospace and defense sectors in the U.S.

- In Jul 2024, JK Tool, part of the Weiss-Aug Group, acquired Precise Tool & Die (Leechburg, PA, USA). The deal strengthens JK Tool’s precision manufacturing footprint and supports integration of advanced die-making solutions.

- In Jul 2024, OSG Corporation completed the acquisition of Precision Tools Holding B.V. (Contour / Technodiamant). This acquisition enhances OSG’s global tooling portfolio and expands its reach in high-precision diamond tool solutions.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Billion Forecast Revenue (2034) USD 8.4 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Stainless Steel & Titanium Components, Hardened Punches & Dies, WC Co Components & Tools, Orthopaedic & Dental Implants, Grippers & Scissors, Others), By Application (Defence & Aerospace, Medical, Electronics & Communications, Automotive Industry, Mining Industry, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Robert Bosch Tool Corporation, Agathon AG, BENZ GmbH Werkzeugsysteme, botek Przisionsbohrtechnik GmbH, Nepean, Makino, ARCH Cutting Tools, Ensinger Precision Components, FRAISA SA, UMEC SL Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Precision Components and Tooling Systems MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Precision Components and Tooling Systems MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch Tool Corporation

- Agathon AG

- BENZ GmbH Werkzeugsysteme

- botek Przisionsbohrtechnik GmbH

- Nepean

- Makino

- ARCH Cutting Tools

- Ensinger Precision Components

- FRAISA SA

- UMEC SL