Global Precision Aquaculture Market Size, Share and Report Analysis By Offering (Hardware, Software, Services), By System Type (Smart Feeding Systems, Monitoring And Control Systems, Underwater Remotely Operated Vehicle Systems, Others), By Application (Feed Optimization, Monitoring And Surveillance, Yield Analysis), By Farm Type (Open Aquaculture Farm, RAS Farm), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178511

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

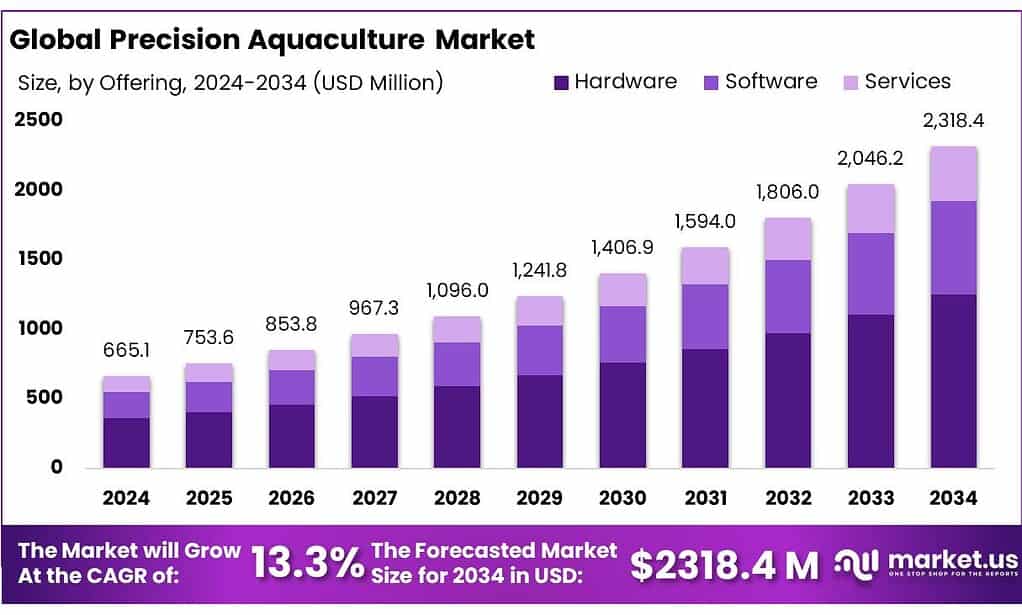

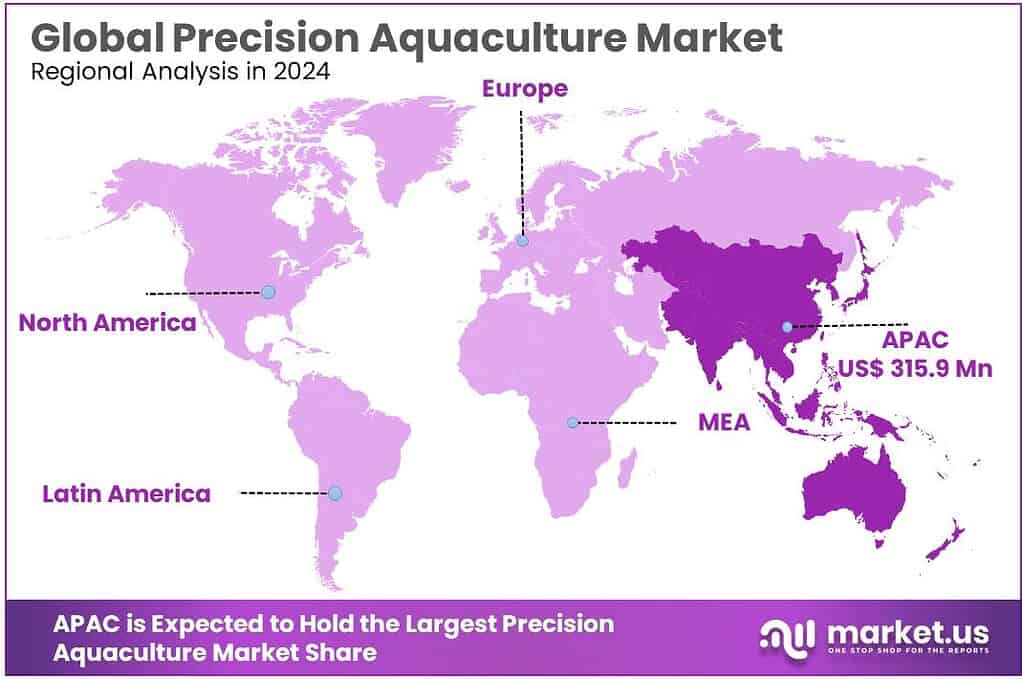

Global Precision Aquaculture Market size is expected to be worth around USD 2318.4 Million by 2034, from USD 665.1 Million in 2024, growing at a CAGR of 13.3% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 47.5% share, holding USD 315.9 Million in revenue.

Precision aquaculture refers to the use of connected sensors, automation, analytics, and decision-support tools to run fish and shrimp farms with tighter control over feeding, water quality, animal health, and environmental impact. The timing is strong: global fisheries and aquaculture production hit a record USD 472 billion in 2022, and world aquaculture output reached 130.9 million tonnes, valued at USD 312.8 billion—a scale that pushes farms to professionalize operations and reduce biological and operational volatility.

- First, demand is rising: global per-capita seafood consumption reached 20.7 kg in 2022, and aquatic animal foods supplied 15% of animal proteins and 6% of total proteins in 2021; for 3.2 billion people, aquatic foods contributed at least 20% of their per-capita animal protein supply.

Second, supply concentration remains high—FAO highlights that a small set of countries account for a very large share of farmed aquatic animal production—so technology diffusion beyond today’s leaders is increasingly viewed as the next growth lever. Third, the value chain is under pressure to cut waste and improve transparency: FAO-linked research cited in recent coverage estimates 25–35 million tonnes of fish are wasted globally each year due to infrastructure and handling inefficiencies, reinforcing the business case for monitoring, cold-chain digitization, and traceable logistics.

Key growth drivers are economic and regulatory. Feed remains the single biggest controllable cost in many systems; FAO technical work has long noted aquafeeds can represent 50–70% of production costs, making precision feeding and appetite-based automation high-ROI levers. At the same time, governments and multilaterals are putting capital behind modernization and sustainability. In India, PMMSY has been implemented with a funding outlay commonly cited at ₹20,050 crore, with official updates also referencing ₹20,750 crore for holistic fisheries-sector development and cluster-based infrastructure approaches.

- In the EU, the European Maritime, Fisheries and Aquaculture Fund (EMFAF) provides €6.108 billion (2021–2027) to support sustainable fisheries and aquaculture. Globally, the World Bank reports its blue economy portfolio exceeded $10.5 billion in active projects as of FY24, including sustainable fisheries and aquaculture.

Government and public funding frameworks are also accelerating uptake. In India, the Pradhan Mantri Matsya Sampada Yojana (PMMSY) is positioned as a flagship fisheries scheme with a stated total investment of ₹20,050 crore, supporting modernization and capacity building that can include farm-level technology upgrades.

Key Takeaways

- Precision Aquaculture Market size is expected to be worth around USD 2318.4 Million by 2034, from USD 665.1 Million in 2024, growing at a CAGR of 13.3%.

- Hardware held a dominant market position, capturing more than a 54.8% share.

- Smart Feeding Systems held a dominant market position, capturing more than a 42.6% share.

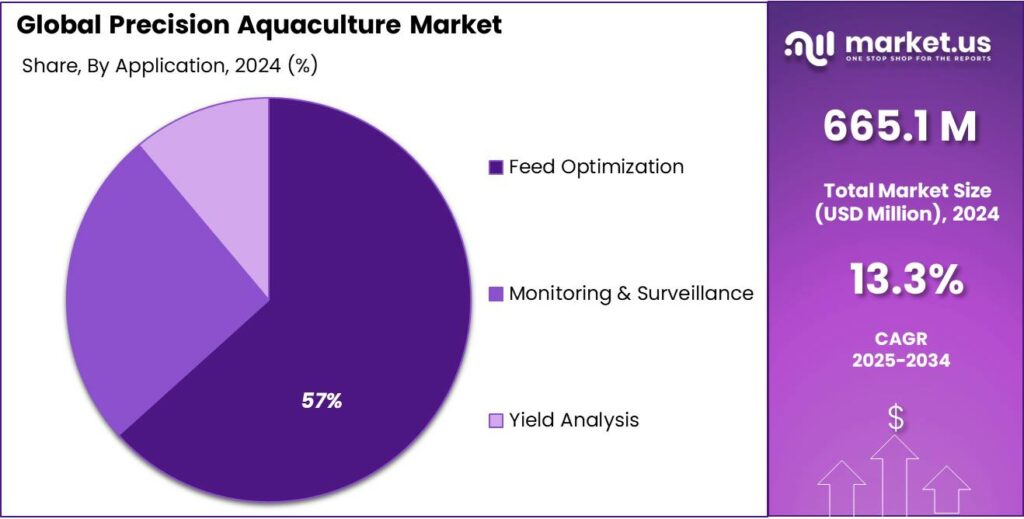

- Feed Optimization held a dominant market position, capturing more than a 57.9% share.

- Open Aquaculture Farm held a dominant market position, capturing more than a 67.2% share.

- Asia Pacific remained the dominating region in the Precision Aquaculture market, accounting for 47.5% share and reaching 315.9 Mn.

By Offering Analysis

Hardware dominates with 54.8% driven by strong demand for farm monitoring systems

In 2024, Hardware held a dominant market position, capturing more than a 54.8% share. This leadership was mainly supported by the growing use of physical monitoring and control equipment across fish and shrimp farms. Farmers increasingly invested in water quality sensors, dissolved oxygen meters, automatic feeders, underwater cameras, control panels, and aeration systems to improve survival rates and feed efficiency. Hardware remains the backbone of precision aquaculture because real-time data collection starts with on-site devices. In 2024, many medium and large-scale farms upgraded from manual observation methods to sensor-based systems to reduce human error and improve daily performance tracking.

By System Type Analysis

Smart Feeding Systems lead with 42.6% as farms focus on feed efficiency

In 2024, Smart Feeding Systems held a dominant market position, capturing more than a 42.6% share. Their strong position was largely driven by the rising need to control feed costs and reduce wastage in commercial aquaculture farms. Feed accounts for a major portion of farm expenses, and producers are increasingly shifting toward automated and sensor-based feeding systems that adjust feed delivery based on fish behavior, appetite signals, and environmental conditions. During 2024, many intensive fish and shrimp farms adopted programmable feeders and camera-assisted feeding platforms to improve feed conversion and minimize overfeeding. This helped reduce water contamination and improved overall farm productivity.

By Application Analysis

Feed Optimization leads with 57.9% as farms aim to cut feed waste

In 2024, Feed Optimization held a dominant market position, capturing more than a 57.9% share. This strong share was mainly driven by the need to manage feed expenses more efficiently, as feed remains one of the largest operational costs in aquaculture. Farm operators increasingly focused on improving feed conversion ratios, reducing overfeeding, and minimizing nutrient discharge into water bodies. During 2024, many producers adopted sensor-based monitoring, biomass tracking, and automated feeding controls to match feed delivery with real-time fish behavior and growth patterns. These tools helped improve survival rates and maintain better water quality.

By Farm Type Analysis

Open Aquaculture Farms lead with 67.2% as traditional systems remain widely used

In 2024, Open Aquaculture Farm held a dominant market position, capturing more than a 67.2% share. This strong presence was largely due to the continued reliance on ponds, cages, and coastal farming systems across major aquaculture-producing regions. Open farms are widely preferred because of their lower initial setup cost compared to fully enclosed systems and their suitability for large-scale production of fish and shrimp. During 2024, many producers operating in coastal and inland water bodies adopted precision tools such as water quality sensors, smart aerators, and automated feeders to improve performance within open environments.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By System Type

- Smart Feeding Systems

- Monitoring & Control Systems

- Underwater Remotely Operated Vehicle Systems

- Others

By Application

- Feed Optimization

- Monitoring & Surveillance

- Yield Analysis

By Farm Type

- Open Aquaculture Farm

- RAS Farm

Emerging Trends

AI + digital twin farm control is moving from pilots to daily operations

In 2024 and 2025, one clear trend in precision aquaculture is the shift from “monitoring only” to AI-guided control, where farms use connected sensors, cameras, and models to recommend (and sometimes automate) feeding, oxygen management, and routine decisions. This shift is happening because aquaculture is now operating at a scale where small errors become expensive, and farms want more predictable results. Global fisheries and aquaculture production reached 223.2 million tonnes in 2022, including 185.4 million tonnes of aquatic animals and 37.8 million tonnes of algae. Aquaculture alone reached 130.9 million tonnes in 2022, and farmed aquatic animals hit 94.4 million tonnes, which was 51% of total aquatic animal production—a key signal that farm management quality is now a major food-system issue, not a niche topic.

The economics behind the trend are also straightforward. FAO technical work has highlighted that aquafeeds can account for 50–70% of production costs, which is why farms are most eager to adopt “decision tools” around feeding and biomass estimation first. When seafood demand is also rising—global apparent consumption is estimated at 20.7 kg per capita in 2022—farms feel pressure to produce more reliably while keeping unit costs under control.

Government and institutional support is helping this trend move faster by funding modernization and innovation. For example, the EU’s fisheries and aquaculture funding framework (EMFAF) runs 2021–2027 and is positioned to support sustainable and competitive aquaculture. Public descriptions of the fund reference a total budget of €6.108 billion for the period, showing real policy weight behind technology-enabled upgrades.

Drivers

Feed-cost pressure pushes farms toward smarter feeding

Precision aquaculture is being pulled forward by one very practical reality: feed is expensive, and it decides profitability. As aquaculture scales up to meet food demand, producers feel constant pressure to convert every kilo of feed into healthy biomass with minimal waste. This matters because aquaculture is no longer a small add-on to wild catch. In 2022, global aquaculture output reached 130.9 million tonnes, including 94.4 million tonnes of aquatic animals, and it accounted for 51% of total aquatic animal production.

Feed sits at the center of this efficiency story because it dominates day-to-day operating costs in many commercial systems. FAO technical work has highlighted that aquafeeds account for 50–70% of production costs in aquaculture, meaning feed management is often the quickest lever to protect margins when prices rise or yields fluctuate. In plain terms: when feed costs are that high, overfeeding becomes a direct cash leak, and underfeeding slows growth and delays harvest. Precision aquaculture tools—especially smart feeding systems and feed optimization software—address this by making feeding decisions less dependent on guesswork.

- Government support is reinforcing this shift by funding modernization and productivity improvements in fisheries and aquaculture. In India, the Pradhan Mantri Matsya Sampada Yojana (PMMSY) has been framed as a holistic sector push with a total investment of ₹20,050 crore for development and welfare-related measures. In Europe, the European Maritime, Fisheries and Aquaculture Fund (EMFAF) carries a budget of €6.108 billion for 2021–2027, supporting sustainable fisheries and aquaculture and encouraging innovation.

Restraints

High Infrastructure Cost and Technology Access Limits Adoption

One of the biggest restraining factors slowing down the wider adoption of precision aquaculture is the high cost and limited access to the required infrastructure and digital technology, especially for small and medium-size farmers. Precision aquaculture relies on sensors, continuous connectivity, automated feeding systems, data platforms, and often cloud or edge computing. These technologies can deliver great benefits in feed optimization, water quality management, and overall operational efficiency, but their upfront cost and ongoing maintenance requirements are often beyond what many aquaculture producers can comfortably manage.

Farmers in more established industrial operations might afford this technology, yet a large portion of global aquaculture still depends on traditional systems where every extra dollar invested must be justified through clear returns—a comparison that sometimes makes advanced tech hard to justify.

The reality becomes clearer when we look at how global aquaculture has expanded. In 2022, global aquaculture production reached a record 130.9 million tonnes, with 94.4 million tonnes of aquatic animals, making up 51% of total aquatic animal production as capture fisheries plateaued. This massive scale shows not only how central aquaculture is to food systems, but also why, in principle, precision tools could add huge value. Yet, despite this growth, only a relatively small share of producers—often in well-funded regions—have the financial capacity to fully adopt connected and automated technologies.

Public programs and policy initiatives can help address some of these barriers, but they also highlight the gap between ambition and reality. The FAO’s Blue Transformation roadmap, for example, sets out a vision for aquatic food systems to increase their contribution to nutrition, livelihoods, and sustainability by 2030. Yet realizing this vision depends on narrowing technological divides and building local capacity.

Governments and international agencies are increasingly aware of this: some provide grants, subsidies, or rural infrastructure funds aimed at enhancing digital uptake, power reliability, and training. However, the current pace of such investments still falls short of what many farmers need to adopt precision systems at scale.

Opportunity

Scaling precision tools into mainstream farming through public “blue economy” funding

A major growth opportunity for precision aquaculture is the next wave of farm modernization funded and encouraged by government and multilateral “blue economy” programs. Aquaculture is no longer a niche food source—it is already a core part of global supply. In 2022, global aquaculture production reached 130.9 million tonnes, including 94.4 million tonnes of aquatic animals, and aquaculture accounted for 51% of total aquatic animal production.

What makes the opportunity bigger now is that many farms still operate with limited monitoring and manual decision-making, especially outside a few highly industrialized clusters. That gap is where public investment and policy support can change the speed of adoption. The World Bank notes that, as of FY24, its blue economy portfolio exceeded $10.5 billion in active projects, including work related to sustainable fisheries and aquaculture.

Government-led schemes add another strong layer to this opportunity. In India, the Pradhan Mantri Matsya Sampada Yojana (PMMSY) is described in official material as a flagship program with a total investment of ₹20,050 crore for holistic development of the fisheries sector. This kind of structured support matters because it can push modernization beyond a small set of early adopters. In practice, it can expand demand for farm equipment and systems that make precision aquaculture practical—water-quality monitoring, aeration control, and feeding management—while also supporting hatcheries, cold chain, and logistics that make technology benefits easier to capture on the ground.

A similar pattern is visible in Europe through the European Maritime, Fisheries and Aquaculture Fund (EMFAF), which has a total budget of €6.108 billion for 2021–2027. When public funding is tied to sustainability, efficiency, and competitiveness, farms have a clearer reason to invest in monitoring and automation, because technology becomes part of compliance, traceability expectations, and performance improvement—not just an optional upgrade. Over 2024 and 2025, this creates a practical growth runway for solution providers: farms are more likely to buy precision systems when there is policy backing, financing support, and technical capacity-building, rather than relying only on farm cash flow.

Regional Insights

Asia Pacific dominates with 47.5% share, valued at 315.9 Mn, backed by the region’s aquaculture scale.

In 2024, Asia Pacific remained the dominating region in the Precision Aquaculture market, accounting for 47.5% share and reaching 315.9 Mn. This leadership is strongly supported by the region’s unmatched aquaculture base and day-to-day farming intensity, which naturally creates demand for sensors, smart feeding, water-quality monitoring, and farm automation. FAO data shows that Asian countries produced about 70% of all aquatic animals in 2022, underlining why technology adoption tends to scale faster here than in other regions.

From a demand angle, Asia’s consumption strength adds another push. FAO’s Asia-Pacific summary notes that Asia’s apparent aquatic food consumption reached 116.1 million tonnes, with per-capita consumption at 24.7 kg, which is higher than the global average—keeping pressure on farms to improve yields and consistency. In 2025, growth expectations remain linked to modernization needs: farms are increasingly prioritizing better feed control and real-time pond management to protect margins, while reducing avoidable losses across supply chains—an issue highlighted by recent FAO-linked findings on large fish losses from infrastructure gaps.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Thai Union is a global seafood and petcare producer that supports precision aquaculture through large-scale sourcing, quality systems, and traceability needs. For FY2024, it reported sales of THB 138.4 billion and net profit of THB 5.0 billion, with EPS of THB 1.08. These scale numbers show why Thai Union pushes tighter farm controls and supplier compliance—data capture, feed tracking, and health monitoring—so upstream production stays consistent and auditable.

Blue Ridge Aquaculture runs indoor recirculating aquaculture (RAS) for tilapia, where precision tools are essential for oxygen, water quality, and feeding control. The company says it produces over 4 million pounds/year and ships 10,000–20,000 pounds/day of live tilapia. A 2024 industry report also cited production “around 5 million pounds/year,” reflecting steady-state, tech-driven output. This type of RAS model typically depends on continuous sensing, automation, and biosecurity discipline to hold performance.

Kaiko Yukinoya operates land-based shrimp farming using closed-loop systems where monitoring and control are core. Its official company page lists established: October 2020 and capital: JPY 10,000,000. Industry reporting described a planned 16,000 m² facility in Iwata, Shizuoka, with six 12×40 m grow-out lanes plus four nursery tanks, and noted corporate capital was planned to rise to JPY 1 billion as the project scaled.

Top Key Players Outlook

- Thai Union Group PCL

- Blue Ridge Aquaculture, Inc.

- Kaiko Yukinoya Co. Ltd.

- Avanti Feeds Limited

- Mowi ASA

- Grieg Aqua AS

- Nippon Suisan Kaisha Ltd

- Tassal Group Ltd.

- Maruha Nichiro Corporation

- Stolt Sea Farm

Recent Industry Developments

In 2024, Thai Union reported sales of THB 138.4 billion, net profit of THB 5.0 billion, EBITDA of THB 13.4 billion, gross profit margin of 18.5%, and EPS of THB 1.08, showing the scale at which better farm controls matter commercially.

In 2024, Blue Ridge Aquaculture positioned itself around consistent, high-volume output—its own materials state it produces over 4 million pounds/year and ships 10,000–20,000 pounds/day of live tilapia, supported by an indoor facility sized at about 100,000 square feet in Martinsville, Virginia, and a fully integrated setup.

Report Scope

Report Features Description Market Value (2024) USD 665.1 Mn Forecast Revenue (2034) USD 2318.4 Mn CAGR (2025-2034) 13.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, Services), By System Type (Smart Feeding Systems, Monitoring And Control Systems, Underwater Remotely Operated Vehicle Systems, Others), By Application (Feed Optimization, Monitoring And Surveillance, Yield Analysis), By Farm Type (Open Aquaculture Farm, RAS Farm) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Thai Union Group PCL, Blue Ridge Aquaculture, Inc., Kaiko Yukinoya Co. Ltd., Avanti Feeds Limited, Mowi ASA, Grieg Aqua AS, Nippon Suisan Kaisha Ltd, Tassal Group Ltd., Maruha Nichiro Corporation, Stolt Sea Farm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Precision Aquaculture MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Precision Aquaculture MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Thai Union Group PCL

- Blue Ridge Aquaculture, Inc.

- Kaiko Yukinoya Co. Ltd.

- Avanti Feeds Limited

- Mowi ASA

- Grieg Aqua AS

- Nippon Suisan Kaisha Ltd

- Tassal Group Ltd.

- Maruha Nichiro Corporation

- Stolt Sea Farm