Global Portable Generator Market By Fuel(Gasoline, Diesel, Natural Gas, Others), By Power(Below 5 kW, 5–10 kW, 10–20 kW), By Phase(Single Phase, Three Phase), By Application(Temporary Power, Primary Power), By End-Use(Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121823

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

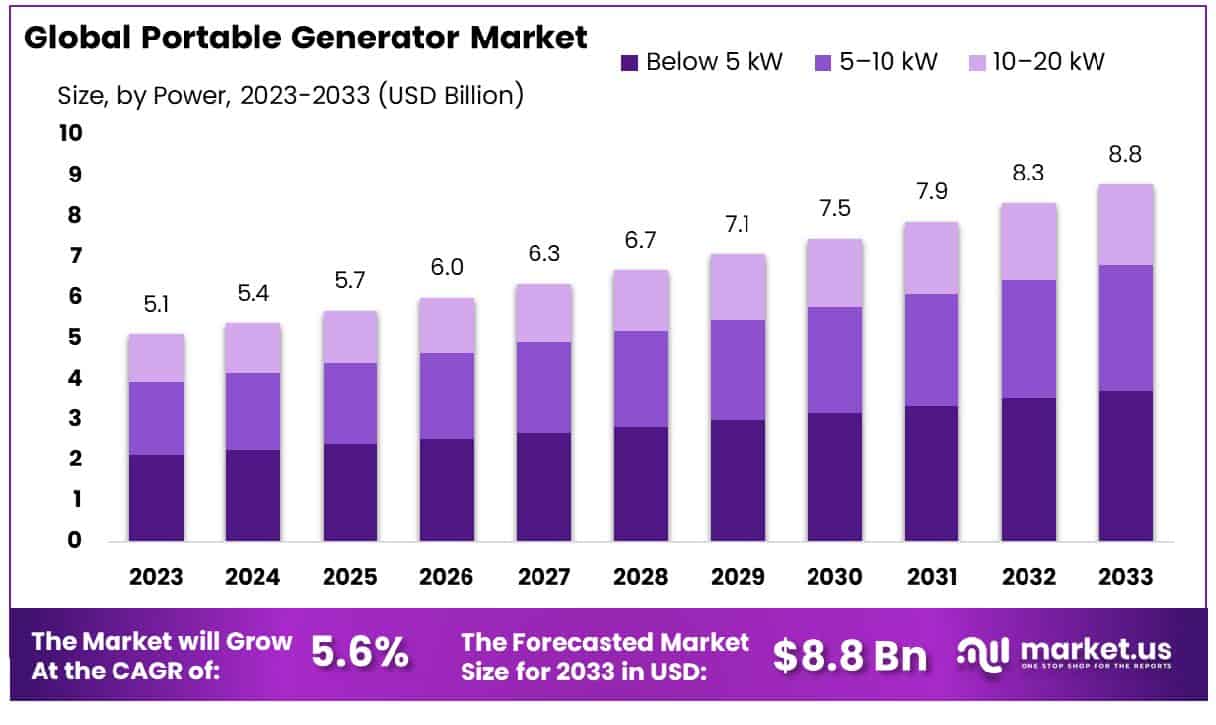

The Global Portable Generator Market size is expected to be worth around USD 8.8 Billion by 2033, From USD 5.1 Billion by 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

The Portable Generator Market comprises a range of mobile power generation units designed for temporary or emergency power supply. These generators are utilized across residential, commercial, and industrial sectors for applications requiring reliable electricity away from fixed power sources. Key features include fuel efficiency, ease of transport, and varying power outputs to suit specific needs.

The market’s growth is driven by frequent power outages, construction activities, and outdoor events, making portable generators indispensable for business continuity and operational efficiency. This market is crucial for decision-makers planning risk management and operational strategies in power-sensitive environments.

The Portable Generator Market is poised to encounter significant transitions, reflecting broader shifts in global energy consumption and production dynamics. As the world grapples with increasing electricity demands, which rose by 694 TWh to 28,510 TWh in 2022—a continuation of the decade’s average growth rate of 2.6%—portable generators are becoming an increasingly vital solution for bridging energy gaps, particularly in remote or disaster-impacted areas.

This market’s relevance is underscored by the overarching energy trend where renewable sources like wind and solar accounted for 80% of the new electricity demand last year, indicating a shift towards more sustainable energy solutions. Despite the surge in renewables, which met 92% of the new demand, there remains a robust demand for portable generators due to their reliability and immediacy in power provision.

Interestingly, while coal generation marked a 1.1% increase in 2022, reaching a record high, the slight decline in gas power generation and a 5% decrease in nuclear generation highlight the fluctuating reliance on traditional energy sources. This backdrop sets a complex stage for portable generators, as they are essential in scenarios where renewable infrastructure either isn’t feasible or insufficiently responsive to immediate demand.

Looking forward to 2023, the expected surpassing of clean power growth over electricity demand might initiate a reduction in fossil generation, signaling potential peak emissions in the power sector. For market players, this environment spells a strategic pivot to adapt portable generator offerings to be more environmentally compliant, while still capitalizing on their unique value proposition of mobility and reliability.

Supporting Data: Global electricity demand increased by 2.5% in 2022, reaching 28,510 TWh, similar to the decade’s average growth. Most of the increase in demand was met by renewables, particularly wind and solar, which contributed to 80% of it. Despite a small decline in fossil generation projected for 2023, the role of portable generators remains critical, especially in regions with unstable power supply or non-existent renewable infrastructure.

Key Takeaways

- Market Growth: The Global Portable Generator Market size is expected to be worth around USD 8.8 Billion by 2033, From USD 5.1 Billion by 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

- Regional Dominance: The Asia Pacific Portable Generator Market holds a 36.4% share, valued at USD 1.8 billion.

- Segmentation Insights:

- By Fuel: Gasoline fuels 42.6% of the market, dominating other energy sources.

- By Power: Power generators below 5 kW claim 42.4% of the market share.

- By Phase: Single-phase generators hold a significant majority at 64.3% of sales.

- By Application: Temporary power applications constitute 64.3% of the generator market demand.

- By End-Use: In the residential sector, generator usage reaches a high of 70.4%.

- Growth Opportunities: In 2023, the Portable Generator Market growth opportunities lie in expanding into emerging markets and developing generators with higher fuel efficiency and lower emissions.

Driving Factors

Increased Frequency of Power Outages Fueling Demand

The escalating frequency of power outages, primarily due to extreme weather conditions such as hurricanes, floods, and blizzards, is a critical driver for the Portable Generator Market. These events disrupt the regular supply of electricity, leading consumers and businesses to seek reliable backup power solutions.

Portable generators offer a convenient and immediate source of power during emergencies, enhancing their appeal. This reliance is evidenced by the surge in sales of portable generators following significant weather-related disruptions, reflecting a direct correlation between increased power outages and market growth.

Construction and Infrastructure Developments Boosting Generator Usage

The expansion in construction and infrastructure projects worldwide provides a substantial impetus for the growth of the Portable Generator Market. These projects often require power in remote or newly developed areas where grid electricity is either unavailable or unreliable.

Portable generators serve as a crucial power source for running tools, lighting, and essential machinery on construction sites, driving their adoption. The market growth in this sector is supported by the ongoing global urbanization and industrialization, which necessitates extensive construction activities.

Portable Energy Solutions Gaining Popularity in Outdoor Activities

There is a growing trend towards engaging in outdoor recreational activities such as camping, tailgating, and outdoor events, which has spurred the demand for portable energy solutions. Portable generators cater to this need by providing an accessible and flexible power source, enabling the use of electrical appliances, lighting, and entertainment systems in off-grid locations.

This trend is particularly pronounced in regions with a robust culture of outdoor leisure activities, contributing significantly to the market expansion. The increasing consumer investment in recreational and leisure activities further underscores the rising market potential for portable generators.

Restraining Factors

Stringent Environmental Regulations Impacting Market Dynamics

Stringent environmental regulations focused on reducing emissions present significant challenges to the growth of the Portable Generator Market. These regulations, which aim to curtail the environmental impact of fossil fuel-based generators, compel manufacturers to invest in cleaner, more efficient technologies.

While this drives innovation, it also increases production costs and the final market price of generators, potentially limiting their appeal to cost-sensitive consumers. For example, in areas with strict air quality standards, the sale and use of traditional portable generators may be heavily regulated, pushing consumers towards greener alternatives.

Rising Adoption of Alternative Energy Sources Restraining Growth

The increasing availability and adoption of alternative energy sources, such as solar panels and battery storage systems, also restrain the growth of the Portable Generator Market. These alternatives offer several advantages over conventional generators, including quieter operation, no emissions, and lower operating costs over time. As the cost of renewable energy technology continues to decrease and its efficiency improves, more consumers and businesses opt for these sustainable solutions.

This shift is particularly evident in residential sectors and among environmentally conscious consumers, who prioritize sustainability over convenience and initial costs. The combined impact of these factors is creating a competitive environment that challenges the traditional dominance of portable generators in the backup power market.

By Fuel Analysis

The gasoline fuel segment dominates with a substantial 42.6% share in the generator market.

In 2023, Gasoline held a dominant market position in the by-fuel segment of the Portable Generator Market, capturing more than a 42.6% share. Its prominence is attributed to the widespread availability and economic efficiency of gasoline as a fuel source. Following closely, Diesel accounted for a significant portion of the market, favored for its energy density and prolonged running times, making it ideal for longer power outages and industrial applications.

Natural Gas generators emerged as a cleaner alternative, appealing to markets with stringent emissions regulations, though its share was smaller due to infrastructure constraints. The ‘Others’ category, which includes fuels like propane and biodiesel, also marked its presence, driven by the rising demand for sustainable and environmentally friendly alternatives.

The gasoline segment’s lead can be traced to its convenience and cost-effectiveness for average consumers and small businesses, ensuring a steady demand in residential and commercial settings. Diesel generators, while more costly upfront, are preferred in settings where uninterrupted power supply is critical, such as hospitals and construction sites. Natural Gas generators are gaining traction in residential sectors due to their lower operational costs and minimal storage requirements, aligning with the shift towards more sustainable energy solutions.

This fuel-based segmentation in the portable generator market reflects diverse consumer preferences influenced by availability, cost, and environmental considerations. As the market evolves, the shift towards more sustainable options could reshape the competitive dynamics, potentially increasing the market share of Natural Gas and other alternative fuels.

By Power Analysis

Generators with power ratings below 5 kW are preferred, accounting for 42.4% of the market.

In 2023, Below 5 kW held a dominant market position in the By Power segment of the Portable Generator Market, capturing more than a 42.4% share. This segment is predominantly favored by residential users for emergency power solutions, owing to its adequacy for powering essential household appliances during outages.

The 5–10 kW range followed, serving both residential and small commercial needs, ideal for supporting a broader array of appliances and small tools. The 10–20 kW generators are preferred in more demanding environments such as small industrial applications and larger residential properties, where higher power output is necessary.

The popularity of the Below 5 kW category is driven by its affordability, ease of use, and portability, making it a first choice for average consumers looking for backup power solutions. Generators in the 5–10 kW bracket are versatile, balancing cost with capability, making them suitable for a wide range of uses from emergency household power to running small workshops. The 10–20 kW generators, although less common in the residential sector, are essential in settings that require sustained high power output, such as during large events or in commercial setups that need to maintain operational continuity during power failures.

This segmentation underscores the diverse applications of portable generators across different power needs, reflecting the market’s adaptation to varied consumer requirements. As technology advances and consumer preferences shift towards more robust and environmentally friendly options, the dynamics within these segments are expected to evolve, potentially increasing the demand for higher power ranges.

By Phase Analysis

Single-phase generators lead the sector, comprising 64.3% of total generator sales worldwide.

In 2023, Single Phase held a dominant market position in the By Phase segment of the Portable Generator Market, capturing more than a 64.3% share. This type is predominantly utilized in residential settings and small businesses where the electrical loads are lower and less complex. The Three-phase generators, although less common in the segment, are essential for applications requiring higher power output and more efficient energy distribution, such as in industrial or large commercial settings.

The predominance of Single Phase generators can be attributed to their simplicity, cost-effectiveness, and suitability for the majority of residential applications, where typical energy requirements include lighting, heating, and small appliances. These generators are easier to handle, install, and maintain, making them an attractive option for households and small businesses seeking emergency power solutions or portable energy for recreational activities.

On the other hand, Three Phase generators, which account for the remainder of the market share, are preferred in settings where heavy machinery operates or where power needs are substantially higher. These generators provide a more stable power supply and are capable of handling larger operational loads, making them ideal for construction sites, large venues, and extensive agricultural operations.

This segmentation within the portable generator market highlights the diverse application environments and the tailored power solutions provided to meet specific customer needs. As advancements in generator technology continue, there is potential for growth in the Three Phase segment, particularly in emerging markets and areas undergoing industrial expansion.

By Application Analysis

Generators for temporary power solutions hold a significant market share, also at 64.3%.

In 2023, Temporary Power held a dominant market position in the By Application segment of the Portable Generator Market, capturing more than a 64.3% share. This segment is particularly significant in scenarios where power needs are intermittent or for short-term usage, such as during construction projects, outdoor events, or emergency power during utility outages. The Primary Power segment, while smaller, is crucial for locations where generators serve as the main power source due to the absence or unreliability of grid electricity.

The substantial share of the Temporary Power segment is driven by its widespread applicability across various industries, including construction, entertainment, and disaster recovery operations where portable and immediate power solutions are necessary. These generators are valued for their flexibility and ease of deployment, allowing users to manage power requirements during planned and unplanned outages.

Primary Power generators, on the other hand, are essential in remote or underdeveloped regions where grid connectivity is poor or non-existent. These units are typically larger and have a more robust build, designed to provide continuous operation. They are commonly found in agricultural, mining, and remote industrial applications.

The distinction between these segments underscores the versatility of portable generators and their adaptation to meet specific user requirements across a broad spectrum of applications. As global economic activities expand and infrastructure projects increase in remote areas, the demand for both temporary and primary power solutions is expected to rise, potentially shifting market dynamics further in favor of versatile and reliable generator models.

By End-Use Analysis

The residential sector emerges as the primary end-user of generators, capturing 70.4% of the market.

In 2023, Residential held a dominant market position in the By End-Use segment of the Portable Generator Market, capturing more than a 70.4% share. This segment includes homeowners utilizing generators for emergency power during outages, as well as for recreational usage in activities such as camping and tailgating.

The Commercial sector, which includes businesses and service providers requiring backup power to prevent operational disruptions, also represents a significant portion of the market. Meanwhile, the Industrial sector, though smaller, relies on portable generators for powering equipment on construction sites, in mining operations, and during manufacturing processes when permanent power solutions are not feasible.

The high market share of the Residential segment is attributed to the increasing frequency of extreme weather events causing power outages, coupled with a growing consumer awareness of emergency preparedness. Additionally, the affordability and availability of portable generators have made them a viable option for a broad spectrum of households.

Commercial users value portable generators for their ability to maintain continuity in services and operations, particularly in sectors like retail, hospitality, and healthcare. In the Industrial sector, portable generators are critical for ensuring that high-power machinery and power tools operate without interruption, essential in maintaining productivity and safety standards.

The diversity in applications across these segments highlights the integral role portable generators play in modern energy management and emergency preparedness strategies. As the technology behind portable generators evolves, offering more efficient and environmentally friendly options, their adoption across residential, commercial, and industrial sectors is likely to increase, reinforcing their market dominance.

Key Market Segments

By Fuel

- Gasoline

- Diesel

- Natural Gas

- Others

By Power

- Below 5 kW

- 5–10 kW

- 10–20 kW

By Phase

- Single Phase

- Three Phase

By Application

- Temporary Power

- Primary Power

By End-Use

- Residential

- Commercial

- Industrial

Growth Opportunities

Expansion into Emerging Markets

The global Portable Generator Market is poised for significant growth opportunities in 2023 by targeting emerging markets. These regions present a fertile ground for expansion due to increasing industrial activities, rising power outages, and the burgeoning demand for backup power solutions in both residential and commercial sectors.

The economic development in countries such as India, Brazil, and parts of Africa correlates with heightened construction activities and infrastructural developments, which directly fuel the demand for portable generators. By penetrating these markets, manufacturers can tap into new customer bases that are increasingly aware of the need for energy solutions that can guarantee continuity in power supply, thereby driving the market growth.

Development of Generators with Lower Emissions and Higher Fuel Efficiency

Another significant growth opportunity for the Portable Generator Market in 2023 lies in the development of generators that are both fuel-efficient and produce lower emissions. Environmental regulations are becoming stricter globally, pushing manufacturers to innovate and develop cleaner energy solutions. Portable generators that utilize advanced technologies to reduce emissions and increase fuel efficiency are likely to see a rise in demand from environmentally conscious consumers and industries.

Additionally, the integration of hybrid models that combine traditional fuel with renewable sources like solar power could redefine market standards, offering eco-friendly alternatives to traditional options. This shift not only aligns with global sustainability goals but also meets the evolving regulatory landscapes, providing a competitive edge to those who innovate early in this space.

Latest Trends

Adoption of Smart Connected Portable Generators

The 2023 landscape for the global Portable Generator Market is significantly shaped by the adoption of smart connected generators. This trend marks a shift towards more intelligent and user-friendly energy solutions. Smart-connected portable generators offer enhanced features such as automatic start/stop, fuel monitoring, and maintenance alerts, all accessible via smartphones or other devices.

This integration of connectivity not only improves user convenience but also enhances the operational efficiency of generators, reducing downtime and operational costs. The adoption of these advanced features is likely to attract a tech-savvy customer base and set new standards in the portable generator industry, emphasizing ease of use, efficiency, and data-driven management.

Increase in the Integration of IoT Technology for Remote Monitoring and Control

Another pivotal trend in the global Portable Generator Market in 2023 is the increased integration of Internet of Things (IoT) technology. IoT allows for remote monitoring and control of portable generators, providing real-time data on performance metrics such as power output, fuel levels, and efficiency. This capability is essential for critical applications in sectors like healthcare, where power reliability is crucial.

Moreover, IoT technology facilitates predictive maintenance, alerting users to potential issues before they lead to failures, thus minimizing repair costs and extending the equipment’s lifespan. This trend not only enhances the functionality and reliability of portable generators but also supports a move towards more automated, user-centric power solutions.

Regional Analysis

The Asia Pacific Portable Generator Market holds a 36.4% share, valued at USD 1.8 billion.

The portable generator market exhibits varied growth dynamics across different geographical regions, each influenced by regional economic conditions, industrial activities, and infrastructural developments.

In North America, the portable generator market is driven by frequent power outages due to extreme weather conditions and an increasing number of outdoor recreational activities. The U.S. and Canada show significant adoption rates, primarily for dual-fuel and gasoline-powered generators, catering to both residential and commercial sectors. The market is expected to grow steadily, supported by advances in fuel-efficient and low-emission technologies.

Europe’s market, while mature, continues to evolve with a strong emphasis on energy-efficient and environmentally friendly generators, reflecting the region’s stringent environmental regulations. Countries like Germany, the UK, and France lead in adoption, leveraging portable generators for emergency backup and event hosting. The market sees moderate growth with a gradual shift towards more sustainable alternatives such as solar-powered and battery-operated units.

Asia Pacific is the dominant region in the global portable generator market, holding a 36.4% share and valued at USD 1.8 billion. The region’s growth is propelled by rapid industrialization, extensive construction activities, and the increasing severity of power outages, particularly in emerging economies such as China, India, and Southeast Asia. The demand is robust for both residential and commercial applications, with local manufacturers playing a crucial role in supplying cost-effective and reliable solutions.

The Middle East & Africa (MEA) region shows promising growth potential, primarily driven by infrastructural developments and the oil & gas sector, which requires reliable power supply solutions. Portable generators are extensively used in remote construction sites, oil fields, and military operations within the region. The market is expected to expand as economic diversification progresses, especially in GCC countries.

Lastly, Latin America experiences moderate growth influenced by the development of the construction industry and rural electrification projects. Countries like Brazil, Mexico, and Argentina see a steady demand for portable generators due to unreliable grid infrastructure and growing energy demand from the residential sector. The market benefits from the availability of a wide range of products tailored to various user needs, from small-scale residential units to larger, more robust models for industrial use.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

The Global Portable Generator Market in 2023 features a prominent array of key players, each contributing distinct technological advancements and market strategies that enhance their competitive edge. Generac Holdings Inc. continues to lead with its robust product offerings tailored for both residential and commercial use, reflecting a strong market presence in North America. Caterpillar Inc., known for its reliability and high-power range, caters extensively to construction and mining sectors, reinforcing its footprint globally.

Honda Siel Power Products Limited stands out with its focus on fuel efficiency and low-emission technologies, aligning with global environmental standards and appealing to a diverse consumer base. Similarly, Briggs & Stratton Corporation emphasizes innovation in compact and lightweight designs, enhancing portability which is critically valued in the residential sector.

Kohler Power Systems and Cummins Inc. both maintain their market positions through high-performance products that are integral to industrial applications. Their commitment to technological integration and IoT-based monitoring systems is setting new standards for operational efficiency.

Atlas Copco AB, with its dual focus on construction and event applications, along with Kirloskar Oil Engines Ltd., which dominates the Asian market with robust diesel generators, showcases regional strengths that underscore their global strategies. Siemens AG continues to leverage its engineering excellence to deliver high-quality generators, while Skyline Power Solutions is gaining recognition for its cost-effective and reliable solutions in emerging markets.

Other notable companies such as Yamaha Motor Co. Ltd., Wacker Neuson SE, Yanmar Holdings Co. Ltd., Himoinsa, and Altas Copco are expanding their market share by focusing on specific niches like portable generators for recreational use and small-scale industries, thereby enhancing their visibility and operational footprints across varied market segments. This dynamic competition underscores a market driven by innovation, regional penetration, and adaptability to consumer needs and environmental standards.

Market Key Players

- Generac Holdings Inc.

- Caterpillar Inc.

- Honda Siel Power Products Limited

- Briggs & Stratton Corporation

- Kohler Power Systems

- Yamaha Motor Co. Ltd.

- Cummins Inc.

- Atlas Copco AB

- Kirloskar Oil Engines Ltd.

- Siemens AG

- Skyline Power Solutions

- Wacker Neuson SE

- Yanmar Holdings Co. Ltd.

- Himoinsa

- Altas Copco

Recent Development

- In April 2024, EcoFlow unveils Delta Pro Ultra, a portable home battery resembling a suitcase. With a 6kWh capacity, 7200W output, and solar compatibility, it offers versatile power solutions for homes and outdoor adventures.

- In April 2024, University of Queensland researchers developed a nanogenerator that absorbs CO2 to produce electricity. The technology, from the Dow Centre for Sustainable Engineering Innovation, could power devices or integrate with industrial CO2 capture processes.

- In January 2024, BLUETTI unveils a waterproof AC240 power generator and industry-first Multi-cooler fridge bundle at CES 2024. AC240 offers 2,400W power; MultiCooler features an LFP-powered fridge with an ice maker. Available for crowdfunding.

Report Scope

Report Features Description Market Value (2023) USD 5.1 Billion Forecast Revenue (2033) USD 8.8 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel(Gasoline, Diesel, Natural Gas, Others), By Power(Below 5 kW, 5–10 kW, 10–20 kW), By Phase(Single Phase, Three Phase), By Application(Temporary Power, Primary Power), By End-Use(Residential, Commercial, Industrial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Generac Holdings Inc., Caterpillar Inc., Honda Siel Power Products Limited, Briggs & Stratton Corporation, Kohler Power Systems, Yamaha Motor Co. Ltd., Cummins Inc., Atlas Copco AB, Kirloskar Oil Engines Ltd., Siemens AG, Skyline Power Solutions, Wacker Neuson SE, Yanmar Holdings Co. Ltd., Himoinsa, Altas Copco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Portable Generator Market Size in 2023?The Global Portable Generator Market Size is USD 5.1 Billion in 2023.

What is the projected CAGR at which the Global Portable Generator Market is expected to grow at?The Global Portable Generator Market is expected to grow at a CAGR of 5.6% (2024-2033).

List the segments encompassed in this report on the Global Portable Generator Market?Market.US has segmented the Global Portable Generator Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Fuel(Gasoline, Diesel, Natural Gas, Others), By Power(Below 5 kW, 5–10 kW, 10–20 kW), By Phase(Single Phase, Three Phase), By Application(Temporary Power, Primary Power), By End-Use(Residential, Commercial, Industrial)

List the key industry players of the Global Portable Generator Market?Generac Holdings Inc., Caterpillar Inc., Honda Siel Power Products Limited, Briggs & Stratton Corporation, Kohler Power Systems, Yamaha Motor Co. Ltd., Cummins Inc., Atlas Copco AB, Kirloskar Oil Engines Ltd., Siemens AG, Skyline Power Solutions, Wacker Neuson SE, Yanmar Holdings Co. Ltd., Himoinsa, Altas Copco

Name the key areas of business for Global Portable Generator Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Portable Generator Market

- Market Growth: The Global Portable Generator Market size is expected to be worth around USD 8.8 Billion by 2033, From USD 5.1 Billion by 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

-

-

- Generac Holdings Inc.

- Caterpillar Inc.

- Honda Siel Power Products Limited

- Briggs & Stratton Corporation

- Kohler Power Systems

- Yamaha Motor Co. Ltd.

- Cummins Inc.

- Atlas Copco AB

- Kirloskar Oil Engines Ltd.

- Siemens AG

- Skyline Power Solutions

- Wacker Neuson SE

- Yanmar Holdings Co. Ltd.

- Himoinsa

- Altas Copco