Global Port Cranes Market Size, Share, Growth Analysis By Type (Ship-to-Shore Cranes (STS), Gantry Cranes, Mobile Cranes, Offshore Cranes, Rail-Mounted Cranes (RMG), Other), By Application (Shipbuilding Industry, Port Loading and Unloading, Auto Industry, Aerospace, Construction, Manufacturing, Warehousing), By Load Capacity (Below 50 Tons, 50 to 200 Tons, 200 to 500 Tons, Above 500 Tons), By Power Source (Electric, Diesel, Hybrid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141256

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

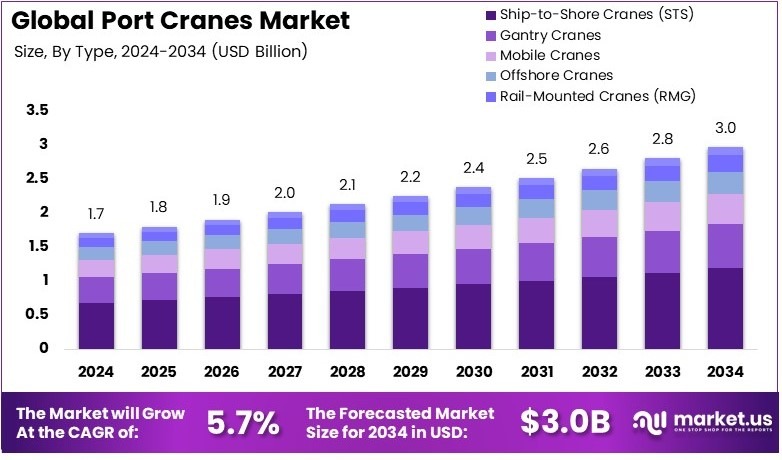

The Global Port Cranes Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Port cranes are large machines used at ports to load and unload cargo from ships. They are essential for moving containers, bulk materials, and heavy cargo. These cranes come in various types, such as gantry cranes and ship-to-shore cranes, depending on the port’s specific needs.

The port cranes market refers to the global demand for these machines in the shipping and logistics sectors. It includes manufacturers, suppliers, and distributors involved in port crane production and sales. The market is driven by the growing need for efficient cargo handling in busy port environments worldwide.

According to the Port of Los Angeles statistics, in 2023, the total container volume handled was 8.6 million TEUs. This highlights the vital role of port cranes in managing global trade flows. Even though the volume was lower than the previous year, port cranes remain critical for the smooth functioning of international trade and shipping logistics.

The port cranes market is influenced by increasing global trade and infrastructure investments. Countries with busy ports, like the U.S., China, and Germany, continue to invest in upgrading port facilities. For example, the U.S. government recently announced a $20 billion initiative to enhance maritime infrastructure. This investment includes improving crane production and port facilities, benefiting both domestic and global trade.

The market is highly competitive, with a few major exporters dominating the global supply. China, Germany, and Japan are the top exporters of port cranes. According to global trade data, 235,152 shipments of cranes were imported between March 2023 and February 2024, reflecting the growing demand for these machines worldwide.

Government investments are also playing a key role in the growth of the port cranes market. For example, the Canadian government announced an investment of up to $25 million for the Halifax Port Authority. This investment aims to increase capacity and improve efficiency, further boosting the demand for modern port cranes.

Key Takeaways

- The Port Cranes Market was valued at USD 1.7 Billion in 2024 and is expected to reach USD 3.0 Billion by 2034, with a CAGR of 5.7%.

- In 2024, Ship-to-Shore Cranes (STS) held the highest market share with 40.3%, owing to increased global maritime trade.

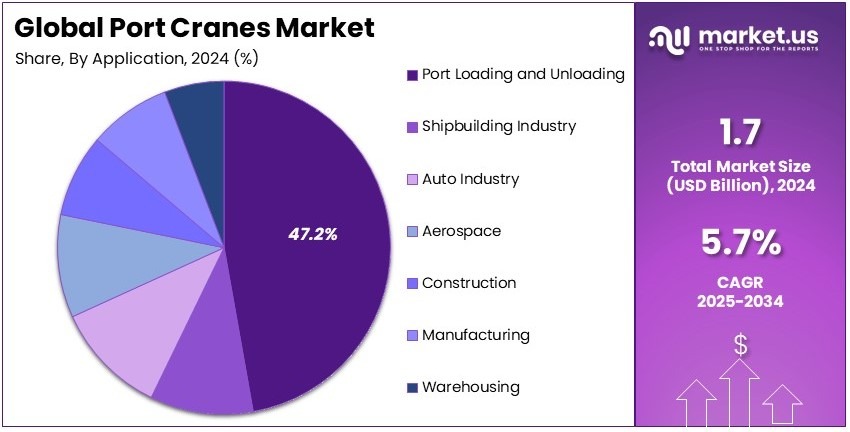

- In 2024, Port Loading and Unloading dominated with 47.2%, driven by growing container traffic and port automation trends.

- In 2024, Above 500 Tons capacity cranes led the load capacity segment with 35.6%, due to rising demand for heavy-duty cargo handling.

- In 2024, Electric Cranes accounted for 50.8%, reflecting the industry’s shift toward sustainable and energy-efficient port operations.

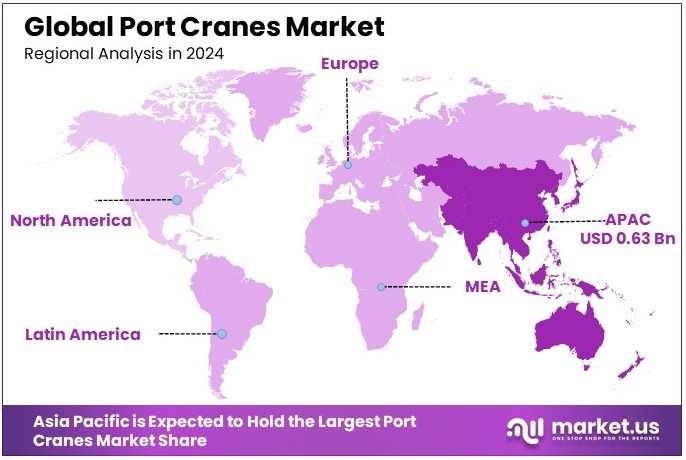

- In 2024, APAC led the market with 37.2% + USD 0.63 Bn, supported by port infrastructure modernization and trade expansion.

Type Analysis

Ship-to-Shore Cranes (STS) dominate with 40.3% due to their critical role in port operations.

Ship-to-Shore Cranes (STS) are the dominant sub-segment in the port cranes market, holding a 40.3% share. These cranes are essential for loading and unloading containers directly from ships at the docks. Their high reach, large capacity, and ability to handle large containers make them a vital part of port operations.

As global trade grows and ports expand to accommodate larger vessels, the demand for STS cranes continues to rise. These cranes are particularly important in major ports around the world, including those in the U.S., China, and Europe, where trade volumes are high. The growing trend towards automation in ports is also increasing the adoption of advanced STS cranes that can be operated remotely and efficiently.

Other types of cranes, such as Gantry Cranes and Mobile Cranes, although important, have smaller market shares. Gantry cranes are widely used in rail and yard operations, where they transport containers over short distances. They are often used for loading and unloading goods in storage areas or rail terminals, but their market share is smaller compared to STS cranes.

Mobile cranes, though more versatile and widely used in various industries, are not as specialized for port operations. Offshore cranes, used for offshore drilling platforms, and Rail-Mounted Cranes (RMG), used mainly in container yards, together form a smaller portion of the market but continue to grow in specific applications.

Application Analysis

Port Loading and Unloading dominate with 47.2% due to the growing need for container handling.

Port Loading and Unloading is the dominant application for port cranes, capturing 47.2% of the market share. This sector is driven by the increasing global demand for goods and the expansion of shipping routes. With the rise in international trade and containerized shipping, efficient and effective loading and unloading processes are crucial for keeping ports running smoothly.

Cranes used in this application are highly specialized, with large capacities and high speeds to handle a large number of containers in a short period. The expansion of major ports in Asia, Europe, and North America is pushing the demand for these cranes even further. In addition, ports are investing in automated cranes that improve efficiency and reduce operating costs.

Other applications, such as the shipbuilding industry and aerospace, account for smaller shares but are important in specific contexts. The shipbuilding industry, with its need for heavy lifting during construction, uses specialized cranes that can handle large and heavy components. This segment holds a smaller share.

Similarly, the aerospace industry relies on port cranes for the transport of aircraft components, although this application remains a niche market. The construction industry and manufacturing sectors also require port cranes for material handling, but they do not contribute as significantly to the market share compared to port loading and unloading operations.

Load Capacity Analysis

Above 500 Tons dominates with 35.6% due to the need for heavy-duty lifting in port operations.

Port cranes with a load capacity above 500 tons dominate the market, accounting for 35.6% of the share. These cranes are used for the heaviest loads, such as large container ships, industrial equipment, and heavy cargo handling. The demand for high-capacity cranes has increased as global shipping companies use larger vessels that require more robust lifting solutions.

These cranes are primarily used in major ports and terminals that handle large shipments. The expansion of ports to accommodate these larger vessels further drives demand for cranes with higher load capacities. As a result, cranes with above 500 tons capacity remain a key segment in the port cranes market.

Other load capacities, including below 50 tons and between 50 to 200 tons, account for smaller shares. Cranes with lower load capacities, such as those below 50 tons, are often used for lighter cargo and smaller vessels. These cranes play an important role in smaller ports and terminals but are not as critical for large-scale operations, which is why they hold a smaller share.

Similarly, cranes with a capacity between 50 to 200 tons are used in mid-sized ports and industrial applications, but their role in the market is less significant compared to the larger cranes. Despite this, these sub-segments continue to grow due to the need for versatility and cost-effectiveness in various port activities.

Power Source Analysis

Electric cranes dominate with 50.8% due to growing environmental concerns and operational efficiency.

Electric port cranes dominate the market with a 50.8% share. The shift towards electric cranes is driven by the increasing focus on sustainability and environmental regulations. Electric cranes produce fewer emissions compared to diesel-powered cranes, making them more suitable for use in urban environments and eco-friendly ports.

They are also more energy-efficient and cost-effective in the long term. This has made them the preferred choice in many regions, especially as governments and industries move towards greener technologies. Electric cranes are often seen in ports that prioritize sustainability and those in regions with strict emission standards, such as Europe and North America.

Diesel cranes, though still common, represent a smaller share. Diesel cranes are preferred in locations where electric infrastructure is limited or where high mobility is required, such as in offshore applications. Diesel-powered cranes offer flexibility and can operate in remote locations without relying on a fixed power grid.

Hybrid cranes, which combine both electric and diesel power sources, account for the remaining share. These cranes offer the advantages of both power sources, providing operational flexibility while reducing fuel consumption and emissions.

Key Market Segments

By Type

- Ship-to-Shore Cranes (STS)

- Gantry Cranes

- Mobile Cranes

- Offshore Cranes

- Rail-Mounted Cranes (RMG)

- Other

By Application

- Shipbuilding Industry

- Port Loading and Unloading

- Auto Industry

- Aerospace

- Construction

- Manufacturing

- Warehousing

By Load Capacity

- Below 50 Tons

- 50 to 200 Tons

- 200 to 500 Tons

- Above 500 Tons

By Power Source

- Electric

- Diesel

- Hybrid

Driving Factors

Global Trade Growth and Port Capacity Drive Market Growth

The expansion of global trade and port capacity upgrades are key driving factors behind the growth of the Port Cranes market. As international trade volumes continue to rise, ports are under pressure to increase their throughput capabilities. This has led to significant investments in upgrading port infrastructure, including the purchase of advanced port cranes.

Additionally, technological advancements in automation and remote control have greatly enhanced the performance of port cranes. Automation allows for faster and more accurate loading and unloading, while remote control capabilities improve safety and reduce the need for manual intervention.

Growing demand for increased efficiency in container handling also drives the market. The need for faster turnaround times and reduced congestion in ports requires the adoption of more sophisticated and efficient crane systems.

Moreover, investments in port infrastructure development in emerging economies further support the demand for advanced port cranes. These regions are increasingly modernizing their ports to handle the growing volume of international trade, creating a significant opportunity for crane manufacturers to expand their presence in these markets.

Restraining Factors

Economic and Environmental Constraints Limit Growth

Despite the potential for growth, several factors are restraining the Port Cranes market. One of the main challenges is the high capital investment and maintenance costs associated with port cranes. These machines require significant financial resources to purchase and maintain, which can be a barrier for smaller ports or those operating on tight budgets.

The vulnerability of ports to economic downturns and trade disruptions also poses a risk. During periods of economic uncertainty or global trade slowdowns, port operations can be negatively impacted, reducing the demand for new cranes or upgrades.

In addition, stringent environmental regulations on crane emissions are pushing manufacturers to invest in cleaner technologies, which can increase costs. Ports are under increasing pressure to meet sustainability standards, which may require them to upgrade or replace older, less efficient cranes.

Lastly, limited space for crane expansion in congested ports presents another challenge. Many major ports are already operating at full capacity, and expanding or upgrading crane systems within these confined spaces can be difficult and costly.

Growth Opportunities

Technological Advancements and Sustainability Open New Opportunities

There are several growth opportunities within the Port Cranes market, particularly in the integration of smart crane technologies and IoT solutions. These innovations allow for improved monitoring, predictive maintenance, and optimized operations. By integrating IoT systems, port cranes can provide real-time data that helps operators make more informed decisions and reduce downtime.

The increasing demand for eco-friendly, hybrid, and electric cranes is another significant opportunity. As ports face increasing pressure to reduce their carbon footprints, there is a growing demand for cranes that are more energy-efficient and environmentally responsible. This trend opens the door for manufacturers to develop and market cranes that utilize hybrid or electric power sources.

Expansion of port operations in developing countries offers additional growth prospects. As trade continues to grow in these regions, there is a need for modern, efficient port cranes to handle the increased volume.

The development of floating and mobile crane solutions is also an emerging opportunity. These cranes provide flexibility in handling cargo in ports that may have space limitations or need to manage special cargo types, contributing to more versatile port operations.

Emerging Trends

Emerging Trends in Port Crane Operations

Several trends are shaping the future of the Port Cranes market. The adoption of Automated Guided Vehicles (AGVs) in crane operations is one such trend. AGVs are being increasingly integrated with port cranes to improve the efficiency of container transport between the crane and storage areas. This integration allows for seamless automation, reducing labor costs and improving operational speed.

There is also a growing focus on safety enhancements and worker protection technologies. With port cranes operating in high-risk environments, the implementation of safety features such as collision avoidance systems and advanced monitoring tools is becoming increasingly important to protect workers and prevent accidents.

The shift toward energy-efficient and low-carbon port operations is another key trend. As sustainability becomes a more pressing concern, ports are seeking solutions that reduce energy consumption and carbon emissions. This trend is driving the development of more energy-efficient port cranes.

Lastly, advancements in hybrid and electric cranes for sustainable operations are leading the way in reducing the environmental impact of port operations. These innovations are not only environmentally friendly but also offer long-term cost savings in terms of fuel and maintenance, making them an attractive investment for modern ports looking to reduce their carbon footprint.

Regional Analysis

Asia Pacific Dominates with 37.2% Market Share

Asia Pacific dominates the Port Cranes Market with a 37.2% share, valued at USD 0.63 billion. The region’s growth can be attributed to rapid industrialization, urbanization, and an expanding logistics sector. Countries like China, Japan, and India are investing heavily in ports and cargo handling infrastructure, which drives the demand for advanced port cranes.

Key factors contributing to the region’s dominance include a strong industrial base, the expansion of international trade, and the strategic importance of ports in the region. The need to handle increasingly larger volumes of cargo, especially in major trade hubs like Shanghai, Singapore, and Busan, pushes the demand for advanced and efficient port cranes. Additionally, the region benefits from substantial government investments in upgrading port facilities and enhancing logistics capabilities.

Asia Pacific’s market share is likely to continue growing due to ongoing infrastructure investments and the rise of trade activities in emerging economies. The region’s focus on enhancing port operations to handle bigger vessels and increased cargo volumes will drive the demand for more sophisticated cranes and other port equipment in the future.

Regional Mentions:

- North America: North America maintains a significant presence in the Port Cranes Market, with the U.S. leading in port infrastructure investments. With major ports like Los Angeles and New York, the region’s market growth is supported by the need for automation and improved cargo handling efficiency in the face of growing trade volumes.

- Europe: Europe’s Port Cranes Market is supported by its established ports and advanced maritime infrastructure. Key markets like the Netherlands and Germany are investing in modern port technologies to increase efficiency and accommodate larger vessels, driving growth in the region’s market share.

- Middle East & Africa: The Middle East and Africa are seeing strong demand for port cranes due to the region’s strategic geographic location. Ports like Dubai and Suez are modernizing their facilities to handle larger container ships, increasing the demand for advanced crane systems.

- Latin America: Latin America’s Port Cranes Market is growing steadily, driven by infrastructure upgrades in countries like Brazil and Mexico. The region is enhancing its port capabilities to boost international trade, with new investments supporting the demand for advanced port cranes and equipment.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Port Cranes Market is dominated by a few key players known for their strong technological capabilities and industry leadership. The top four companies in this market are Konecranes, Liebherr Group, ZPMC (Zhenhua Port Machinery Company), and SANY Group.

Konecranes is a global leader in crane manufacturing, with a focus on automation, reliability, and sustainability. The company offers a wide range of port cranes, including ship-to-shore and yard cranes. Konecranes’ reputation for advanced technology, particularly in automation, has positioned it as a key player in the port crane market.

Liebherr Group is another prominent player in the port crane market. Liebherr’s cranes are known for their durability, energy efficiency, and innovative technology. The company offers a wide range of port cranes, including mobile harbor cranes and container cranes. Liebherr’s focus on precision engineering and continuous innovation makes it a trusted choice for ports worldwide, contributing to its strong market presence.

ZPMC (Zhenhua Port Machinery Company) is one of the largest manufacturers of port cranes, particularly known for its large-scale ship-to-shore cranes. The company has a strong footprint in the global market and is recognized for its ability to deliver high-performance cranes with advanced automation capabilities. ZPMC’s presence in major ports worldwide, especially in China, gives it a significant advantage in the market.

SANY Group is a key player in the port crane sector, particularly in Asia. The company has expanded its product portfolio to include high-quality port cranes designed for efficiency and performance. SANY’s cranes are known for their cost-effectiveness and reliable technology, making them a popular choice among emerging markets.

These companies shape the Port Cranes Market through continuous technological advancements, strong customer relations, and global presence.

Major Companies in the Market

- Konecranes

- Liebherr Group

- ZPMC (Zhenhua Port Machinery Company)

- SANY Group

- Terex Corporation

- Cargotec Corporation

- Kalmar (part of Cargotec)

- Mitsui Engineering & Shipbuilding Co.

- Hyundai Heavy Industries

- ABB Ltd.

- Toshiba Corporation

- Anupam Industries

- STS Crane Solutions

Recent Developments

- Adani Gangavaram Port: On December 2024, the Adani Gangavaram Port announced the launch of two state-of-the-art Economic Grab Ship Cranes, marking a milestone as the first of their kind in India. This advancement is aimed at improving cargo handling efficiency and sustainability, reinforcing the port’s leadership in India’s logistics sector.

- Hutchison Ports Thailand: On January 2025, Hutchison Ports Thailand announced the acquisition of advanced remote-controlled, electric-powered cranes for Terminal D at Laem Chabang Port. This includes four quay cranes and eight rubber-tyred gantry cranes, expected to enhance operational efficiency, reduce emissions, and support a capacity of 3.4 million TEUs annually upon expansion completion.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 3.0 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ship-to-Shore Cranes (STS), Gantry Cranes, Mobile Cranes, Offshore Cranes, Rail-Mounted Cranes (RMG), Other), By Application (Shipbuilding Industry, Port Loading and Unloading, Auto Industry, Aerospace, Construction, Manufacturing, Warehousing), By Load Capacity (Below 50 Tons, 50 to 200 Tons, 200 to 500 Tons, Above 500 Tons), By Power Source (Electric, Diesel, Hybrid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Konecranes, Liebherr Group, ZPMC (Zhenhua Port Machinery Company), SANY Group, Terex Corporation, Cargotec Corporation, Kalmar (part of Cargotec), Mitsui Engineering & Shipbuilding Co., Hyundai Heavy Industries, ABB Ltd., Toshiba Corporation, Anupam Industries, STS Crane Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Konecranes

- Liebherr Group

- ZPMC (Zhenhua Port Machinery Company)

- SANY Group

- Terex Corporation

- Cargotec Corporation

- Kalmar (part of Cargotec)

- Mitsui Engineering & Shipbuilding Co.

- Hyundai Heavy Industries

- ABB Ltd.

- Toshiba Corporation

- Anupam Industries

- STS Crane Solutions